The study involved four major activities in estimating the current feminine hygiene market size—exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and measures with industry experts across the value chain of feminine hygiene through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on the revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, notifications by regulatory bodies, trade directories, and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

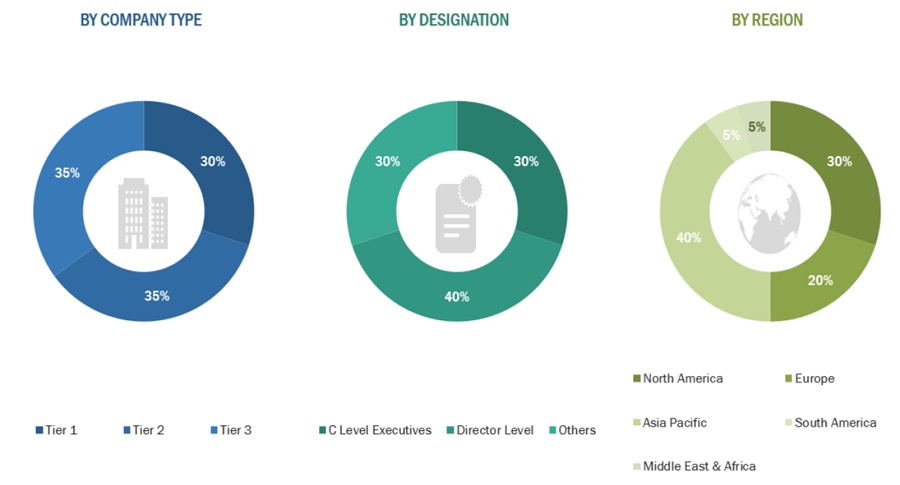

The feminine hygiene market comprises several stakeholders in the supply chain, such as manufacturers, equipment manufacturers, traders, associations, and regulatory organizations. The development of various end-use industries characterizes the demand side of this market. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

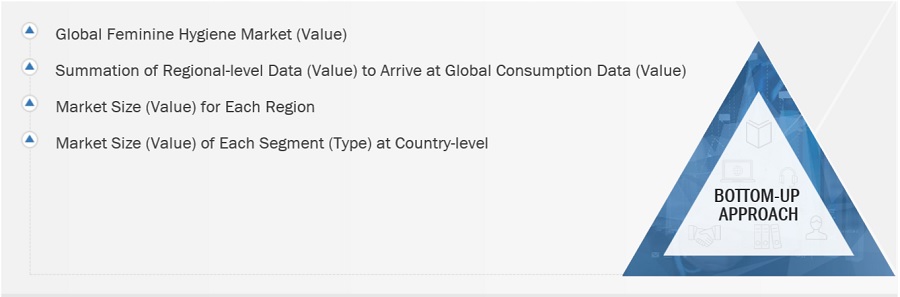

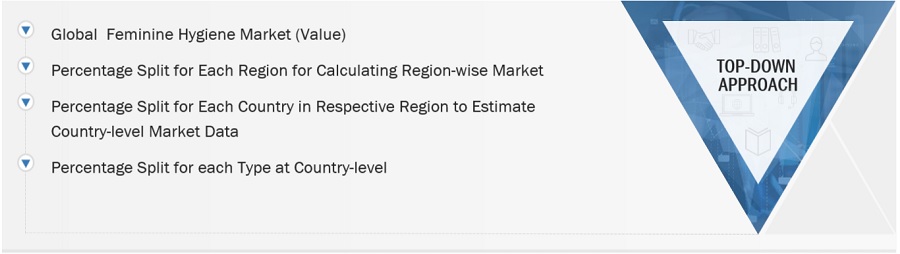

The top-down and bottom-up approaches were used to estimate and validate the total size of the feminine hygiene market. These methods were also used extensively to determine the market size of various segments. The research methodology used to estimate the market size included the following:

-

The key players were identified through extensive primary and secondary research.

-

The value chain and market size of the feminine hygiene market, in terms of value and volume, were determined through primary and secondary research.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

-

The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Feminine Hygiene Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Feminine Hygiene Market Size: Top-Down Approach

Data Triangulation

The market was split into several segments and sub-segments after arriving at the overall market size using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine each market segment’s and subsegment’s exact statistics. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

The global feminine hygiene market refers to the industry that produces and sells a wide range of products designed specifically for the personal care and hygiene needs of individuals who identify as women. These products are primarily used during menstruation, vaginal care, and general intimate hygiene. Common items in this market include sanitary pads, tampons, menstrual cups, panty liners, feminine wipes, and intimate wash products. The market is driven by changing societal norms, increased awareness of women’s health and hygiene, and product design and materials innovations.

Key Stakeholder

-

Feminine hygiene product manufacturers

-

Distributors and Suppliers of feminine hygiene goods.

-

Distributors and suppliers of raw materials suppliers.

-

Associations and Industrial Bodies such as FDA (US Food and Drug Administration), FTC (Federal Trade Commission), CDC (Centers for Disease Control and Prevention), COFEPRIS (Federal Commission for the Protection against Sanitary Risks), CONEVAL (National Council for the Evaluation of Social Development Policy), CHP Canada (Consumer Health Products Canada), Guelph-Wellington Women in Crisis, and Others

-

NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives:

-

To define, describe, and forecast the size of the global feminine hygiene market in terms of value and volume

-

To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the feminine hygiene market

-

To analyze and forecast the size of various segments (type & nature) of the feminine hygiene market based on five major regions—North America, Europe, Asia Pacific, South America, Middle East & Africa—along with key countries in each of these regions

-

To analyze recent developments and competitive strategies, such as expansions, new product developments, partnerships, and acquisitions, product launches to draw the competitive landscape of the market

-

To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

-

Additional country-level analysis of the feminine hygiene market

-

Profiling of additional market players (up to 5)

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company.

Growth opportunities and latent adjacency in Feminine Hygiene Products Market