ECMO Machine Market Size, Growth, Share & Trends Analysis

ECMO Machines Market by Product [ECMO Machines, Components (Oxygenators, Pumps, Controllers)], Modality (Venovenous and Arteriovenous ECMO), Patient Type (Adults, Neonates), Application (Respiratory, Cardiac), End User (Hospitals) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

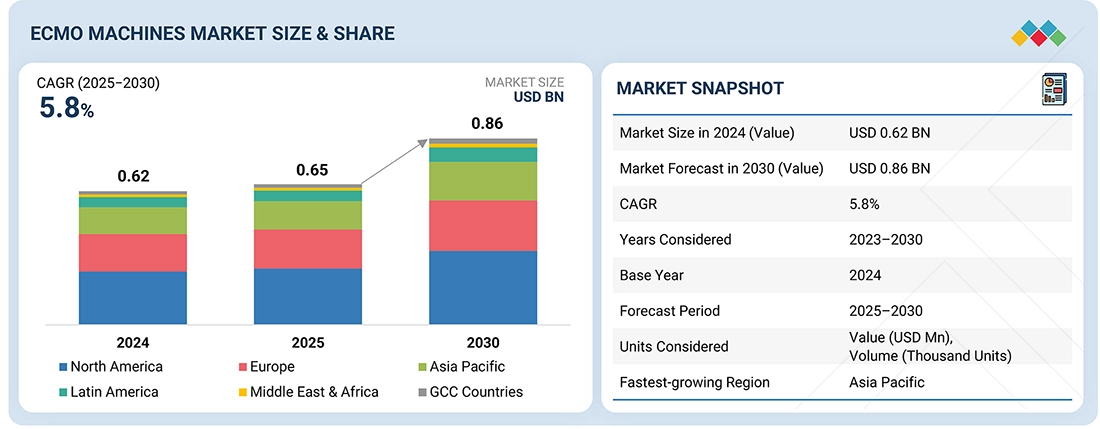

The ECMO machines market is primarily driven by the increasing prevalence of cardiovascular and respiratory diseases, growing adoption of ECMO in lung transplantation procedures, growth in the number of ECMO centers, and technological advancements. However, the high cost of ECMO procedures and associated complications act as restraints. On the other hand, increasing survival rates with ECMO present substantial opportunities for future expansion.

KEY TAKEAWAYS

-

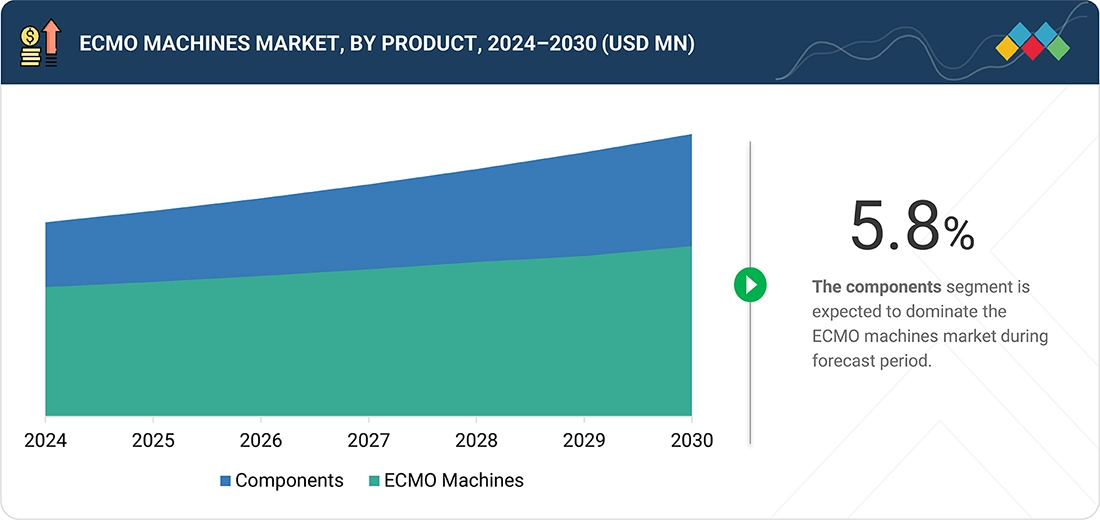

BY PRODUCTThe ECMO machines market is divided into components and ECMO machines based on product. In 2024, the components segment held the largest share of the global ECMO machine market. Long-term ECMO support in cases of lung transplant bridging or chronic heart failure requires durable pumps and frequent replacement of oxygenators and accessories.

-

BY MODALITYBased on modality, the market of ECMO machines is divided into venovenous ECMO, venoarterial ECMO, and arteriovenous ECMO. In 2024, the venovenous ECMO segment held the largest share of the global ECMO machines market. Acute Respiratory Distress Syndrome (ARDS), often triggered by pneumonia, influenza, and sepsis, continues to rise globally. VV ECMO is the primary support option for ARDS patients unresponsive to mechanical ventilation, making it the dominant ECMO modality.

-

BY PATIENT TYPEBased on patient type, the ECMO market has been categorized into adults, pediatrics, and neonates. In 2024, adults held the largest market share in the ECMO machines market. Globally, aging populations and higher disease burdens are leading to more adult patients in intensive care units, where ECMO is increasingly deployed.

-

BY APPLICATIONBased on application, the ECMO market has been categorized into respiratory, cardiac, and extracorporeal cardiopulmonary resuscitation (ECPR). Chronic Obstructive Pulmonary Disease (COPD) is highly prevalent among adults due to smoking and environmental pollution. Advanced COPD cases often escalate to acute respiratory failure requiring ECMO intervention. The rising global COPD burden strengthened demand in the respiratory ECMO segment.

-

BY END USERThe ECMO machines market has been categorized by end user into hospitals, academic and research institutions, and specialty clinics. Hospitals house advanced ICUs, operating rooms, and cardiac units essential for ECMO deployment. Their integrated facilities and availability of trained intensivists make them the primary centers for ECMO treatment, ensuring hospitals dominate usage compared to ambulatory or standalone care settings.

-

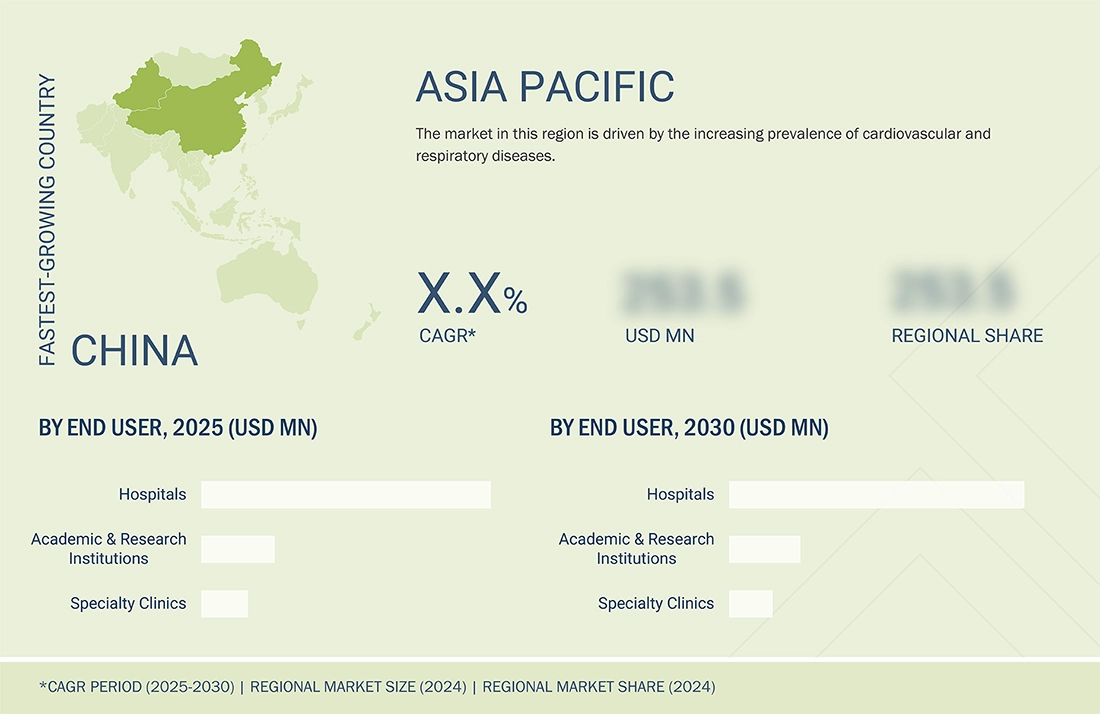

BY REGIONDuring the forecast period, the Asia Pacific region is projected to record the highest growth rate in the ECMO machines market. The surge is driven by rapidly expanding healthcare infrastructure, rising government investments in hospital modernization, and increasing prevalence of respiratory, cardiac, and COPD diseases.

-

COMPETITIVE LANDSCAPEThe major market players have adopted organic and inorganic strategies, including partnerships, collaborations, and approvals. For instance, Xenios AG, a subsidiary of Fresenius Medical Care, received approval from the National Medical Products Administration (NMPA) in China for the use of its Xenios Console and patient kits in ECMO therapy. This approval comes following the successful registration of two patient kits in China.

The growing adoption of ECMO in pediatric and neonatal care, along with expanding applications in emergency and transport settings, is broadening market potential. Technological innovations such as compact, portable systems and improved oxygenators enhance usability and efficiency, further supporting adoption. Favorable reimbursement policies, especially in developed regions, and ongoing clinical research into new applications are expected to create sustained opportunities for ECMO machine manufacturers worldwide.

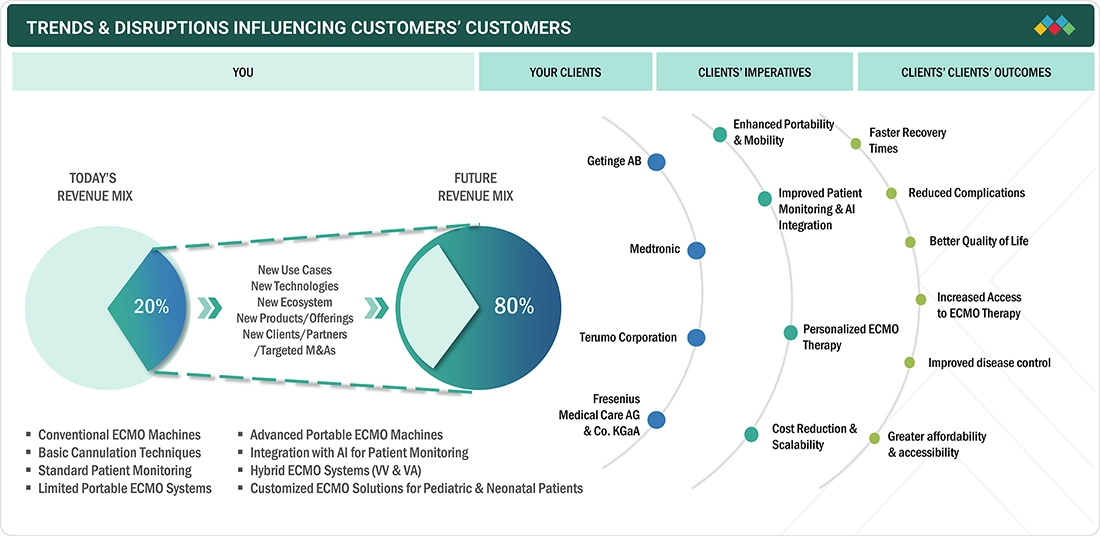

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Traditionally, revenue sources were driven by ECMO machines and their core components. However, the focus is shifting toward new revenue streams, particularly advanced consumables and accessories such as oxygenators, pumps, controllers, and cannulas. These innovations represent high-growth opportunities, as they enhance clinical outcomes and increase recurring demand compared to one-time equipment purchases. End users such as hospitals, specialty clinics, academic institutes, and research organizations are playing a pivotal role in this transition, driving the adoption of these advanced products to meet the rising demand for critical care and cardiopulmonary support. This shift reflects a broader industry trend where manufacturers are diversifying portfolios and capitalizing on consumable-driven business models, ensuring sustained revenue growth while addressing evolving healthcare needs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing prevalence of cardiovascular and respiratory diseases

-

Growing adoption of ECMO in lung transplantation procedures

Level

-

Complications associated with ECMO

-

High cost of ECMO procedures

Level

-

Increasing survival rates with ECMO

Level

-

Shortage of skilled professionals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing prevalence of cardiovascular and respiratory diseases

The rising prevalence of cardiovascular and respiratory diseases is a key driver of the ECMO machines market. Conditions such as Chronic Obstructive Pulmonary Disease (COPD), asthma, Acute Respiratory Distress Syndrome (ARDS), and heart failure are becoming more common due to lifestyle changes, pollution, and an aging global population. These diseases often progress to critical stages where conventional treatments such as mechanical ventilation or drug therapies are insufficient, creating demand for advanced life-support systems. ECMO provides temporary support by oxygenating blood and supporting circulation when the heart or lungs fail, thereby improving survival chances. The surge in COVID-19 cases further accelerated ECMO adoption, highlighting its role in managing severe respiratory distress. As global healthcare systems increasingly encounter complex critical care cases, the demand for ECMO is expected to rise steadily. This makes the growing burden of cardiovascular and respiratory diseases a pivotal driver of the ECMO machines market worldwide.

Restraint: Complications associated with ECMO

Despite its life-saving potential, ECMO therapy is associated with significant complications that limit wider adoption. Patients on ECMO face risks such as bleeding, blood clot formation, infection, hemolysis, and neurological issues due to prolonged extracorporeal circulation. The requirement of systemic anticoagulation to prevent clotting further increases the risk of hemorrhage, particularly in vulnerable patients. Prolonged ECMO usage can lead to organ dysfunction and long-term rehabilitation challenges, which pose barriers to clinical outcomes. The complexity of ECMO management also means that even minor errors can result in life-threatening consequences. These risks make clinicians cautious about initiating ECMO, restricting its use to carefully selected cases. High treatment costs associated with managing complications also deter healthcare providers in resource-limited settings. Therefore, while ECMO remains a critical life-support tool, the clinical risks and associated complications remain major restraints impacting its broader acceptance and integration into standard critical care protocols

Opportunity: Increasing survival rates with ECMO

Advancements in ECMO technology and clinical protocols are leading to improved survival rates, creating significant opportunities for market growth. Recent studies and registry data indicate that patients with severe respiratory or cardiac failure managed with ECMO demonstrate higher chances of recovery compared to those treated with conventional methods alone. Innovations such as biocompatible oxygenators, improved circuit designs, and advanced monitoring tools reduce risks and enhance safety, making ECMO more effective. Early initiation of ECMO in critical patients, particularly those with ARDS or post-cardiac surgery complications, has shown promising outcomes. The growing evidence base demonstrating improved survival rates is encouraging more hospitals and clinicians to adopt ECMO as a standard of care in advanced critical cases. As survival outcomes continue to improve, patient confidence and institutional investment in ECMO are likely to rise, offering manufacturers and service providers a significant growth opportunity in the global market.

Challenge: Shortage of skilled professionals

One of the biggest challenges in the ECMO machines market is the shortage of skilled professionals to operate and manage these complex systems. ECMO is a highly specialized therapy that demands a multidisciplinary team of perfusionists, critical care physicians, nurses, and technicians trained in extracorporeal life support. However, many healthcare systems, especially in developing regions, lack trained personnel capable of handling the intricate setup, monitoring, and troubleshooting. This shortage often leads to underutilization of ECMO even in facilities where machines are available. The steep learning curve and high training costs further exacerbate the issue. Moreover, during critical surges such as the COVID-19 pandemic, the scarcity of skilled ECMO staff became a major bottleneck, limiting access for patients who could benefit. Without adequate training programs and workforce development initiatives, this shortage will remain a major challenge, constraining the wider adoption of ECMO and long-term market growth.

ECMO machine market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

ECMO systems and oxygenators for cardiac and respiratory support in ICUs, cardiac surgery, and emergency care | Provide life-saving support for patients with severe ARDS and cardiogenic shock, improve survival outcomes, and enable prolonged extracorporeal support with reliable performance |

|

ECMO circuits, pumps, and cannulation solutions designed for critical care and surgical environments | Ensure consistent blood flow and oxygenation, reduce complications from mechanical ventilation, and support recovery in complex surgical cases. |

|

Portable and modular ECMO systems for transport, emergency care, and long-term ICU support | Allow patient mobility and inter-hospital transfers, improve emergency responsiveness, and support extended use in critical care |

|

ECMO machines integrated with cardiopulmonary bypass technology for cardiovascular and respiratory applications | Enable dual application in surgery and intensive care, reduce the need for multiple systems, and provide cost-efficient ECMO solutions |

|

Advanced ECMO and extracorporeal CO2 removal (ECCO2R) platforms for lung support | Enhance respiratory support efficiency, reduce invasive ventilation risks, improve patient tolerance, and expand use in adult and pediatric cases |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ECMO machines market ecosystem is characterized by a well-integrated value chain involving raw material suppliers, manufacturers, distributors, and end users. Leading manufacturers such as Getinge, Fresenius Medical Care, Terumo, Livanova, and Medtronic dominate the production of ECMO systems, leveraging advanced technologies and global networks to ensure quality and innovation. Raw materials are sourced directly or through third-party suppliers to support continuous production. Sales and distribution are facilitated by specialized companies such as Soma Tech Intl, Technopals Meditech, Transonic, Tradeindia, and Elite Lifecare, which bridge the gap between manufacturers and healthcare providers by offering equipment, consumables, and after-sales services. The end-user base primarily includes top-tier hospitals and healthcare institutions such as the NHS, Apollo Hospitals, Mayo Clinic, Cleveland Clinic, and Johns Hopkins Medicine, where ECMO machines are critical for managing advanced cardiac and respiratory conditions. This interconnected ecosystem ensures innovation, accessibility, and adoption of ECMO technologies across global healthcare systems

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Oxygen Concentrator Market, By Product

The components segment is expected to hold the largest market share in the ECMO machines market, driven by the recurring need for consumables such as cannulas, oxygenators, pumps, and controllers during each ECMO procedure. Unlike the machines themselves, these components require regular replacement, ensuring continuous demand. Hospitals and specialty clinics rely heavily on high-quality disposables to maintain patient safety and treatment efficacy. Additionally, the growing number of ECMO procedures worldwide further fuels the dominance of the components segment in market share.

Oxygen Concentrator Market, By Modality

Venovenous (VV) ECMO is a type of extracorporeal membrane oxygenation primarily used to support patients with severe but potentially reversible respiratory failure. In this mode, blood is drained from a central vein, oxygenated outside the body using an oxygenator, and then returned to a central vein, bypassing the lungs while the heart continues its normal pumping function. VV-ECMO is commonly applied in conditions like acute respiratory distress syndrome (ARDS), severe pneumonia, and COVID-19-related respiratory failure, offering life-saving support until lung recovery occurs.

Oxygen Concentrator Market, By Patient Type

In the ECMO machines market, the adults segment accounts for the largest share due to the high prevalence of severe cardiac and respiratory conditions in this population. Adults are more prone to diseases such as acute respiratory distress syndrome (ARDS), cardiogenic shock, and chronic obstructive pulmonary disease (COPD), which often require ECMO support when conventional therapies fail. The rising burden of lifestyle-related illnesses, COVID-19 aftereffects, and increasing adoption of advanced life-support technologies in adult critical care are further driving the dominance of this segment.

Oxygen Concentrator Market, By Application

The respiratory segment holds the largest share of the ECMO machines market, primarily due to the increasing prevalence of acute respiratory conditions such as ARDS, severe pneumonia, and complications from COVID-19. ECMO is often used as a life-saving intervention when conventional mechanical ventilation fails to maintain adequate oxygenation. Growing awareness among healthcare providers, rising ICU admissions, and advancements in ECMO technology have further supported its adoption for respiratory support. This strong demand positions the respiratory segment as a key driver of overall market growth.

Oxygen Concentrator Market, By End User

Hospitals represent the largest end-user segment in the ECMO machines market, driven by their advanced infrastructure, availability of skilled healthcare professionals, and ability to manage critical patients. Most ECMO procedures for respiratory or cardiac support are conducted in hospital settings, particularly in intensive care units (ICUs) and specialized cardiac centers. The rising number of hospital admissions for severe respiratory and cardiac conditions, coupled with increasing investments in advanced life-support technologies, strengthens the dominance of hospitals as the primary setting for ECMO machine utilization.

REGION

Asia Pacific to be fastest-growing region in global oxygen concentrators market during forecast period

The Asia Pacific region is anticipated to register the highest CAGR in the ECMO machines market during the forecast period, driven by rapidly expanding healthcare infrastructure, rising patient awareness, and growing government investments in critical care services. Countries such as China, India, Japan, and South Korea are witnessing an increasing prevalence of respiratory and cardiovascular diseases, fueled by urbanization, pollution, and aging populations. The COVID-19 pandemic further highlighted the need for advanced life-support systems, accelerating adoption across leading hospitals. Additionally, cost-effective manufacturing hubs in China and India boost regional supply and make ECMO systems more accessible. Favorable policy support, rising healthcare expenditure, and growing medical tourism in countries like India and Thailand further contribute to regional growth. Increasing training initiatives for healthcare professionals and partnerships with global ECMO providers also foster higher adoption, making the Asia Pacific the fastest-growing market globally.

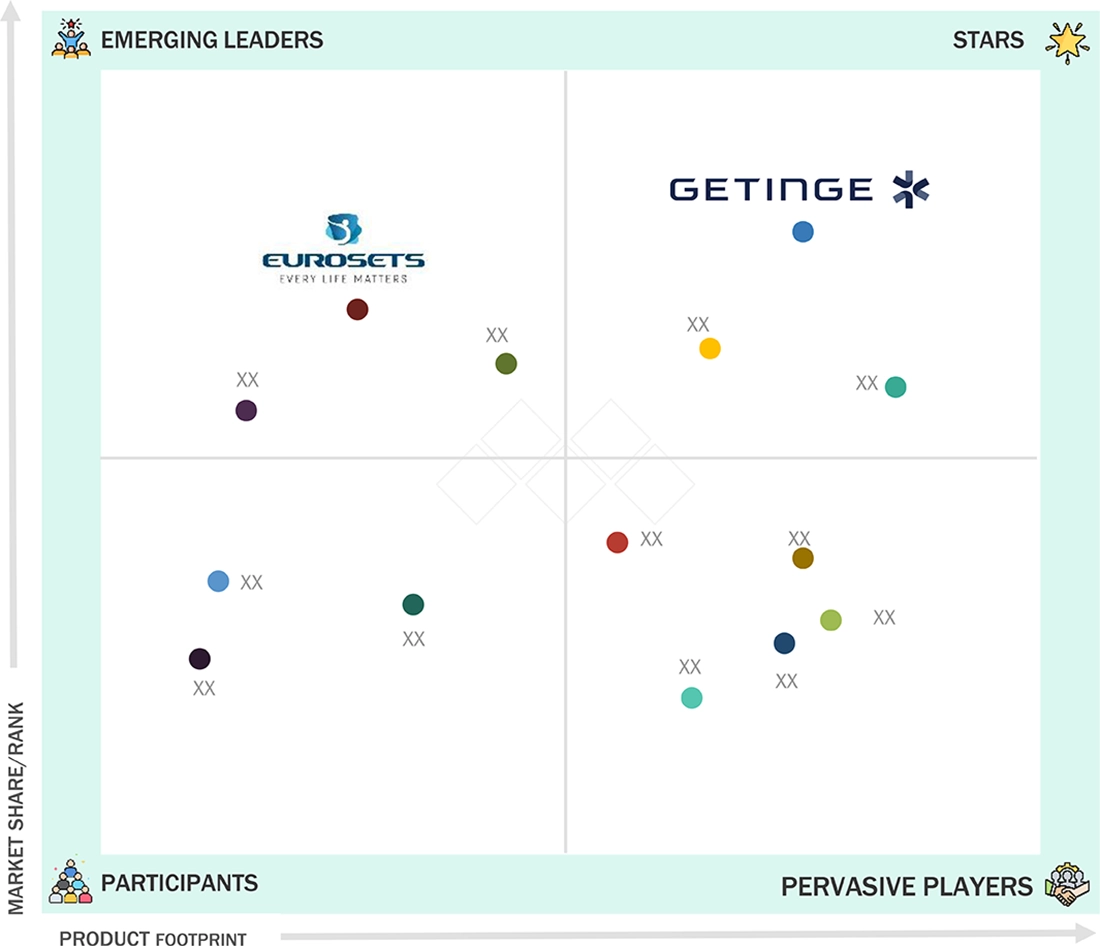

ECMO machine market: COMPANY EVALUATION MATRIX

In the ECMO machines market, Getinge AB (Star) has a strong and established product portfolio and a vast geographic presence. Eurosets S.R.L. (Emerging Leader) has substantial product innovations compared to its competitors. While they have broad product portfolios, they do not have a strong growth strategy for business development.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 (Value) | USD 0.62 BN |

| Revenue Forecast in 2030 (Value) | USD 0.86 BN |

| Growth Rate | 5.80% |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries |

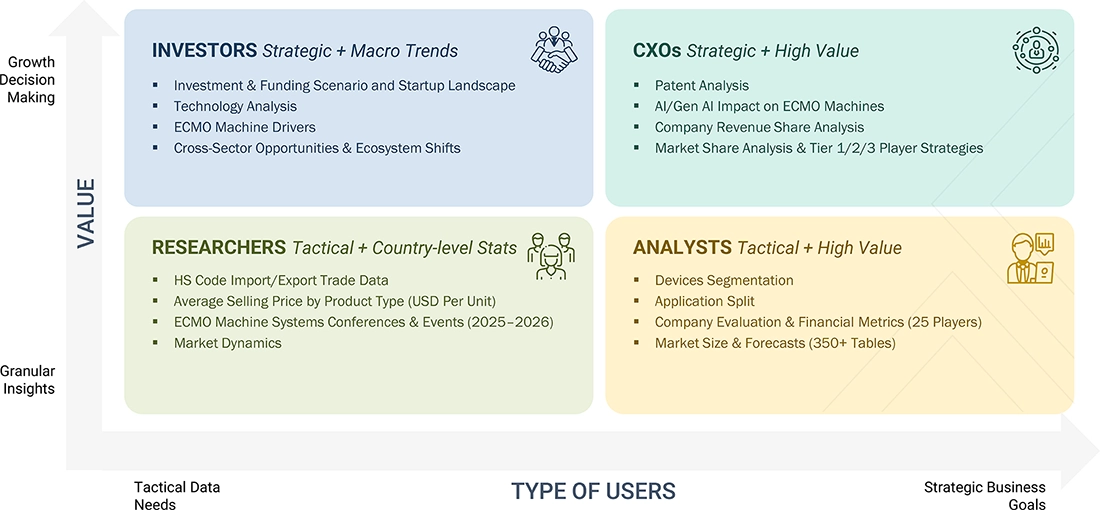

WHAT IS IN IT FOR YOU: ECMO machine market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of ECMO machines: Standalone Systems (Pumps, Oxygenators, Heat Exchangers, Controllers), Integrated Systems, and Disposables & Accessories (Cannulas, Tubing Sets, Sensors, Connectors) | Analysis of technological innovations such as portable ECMO, dual-lumen cannulas, and automated monitoring features |

| Company Information | Profiles of key ECMO players such as Getinge, Medtronic, Terumo, LivaNova, Fresenius (Xenios), Abbott, and Eurosets | Market share benchmarking of top 3–5 companies across North America, Europe, Asia Pacific, and Middle East |

| Geographic Analysis | Detailed regional analysis of North America, Europe, Asia Pacific, and emerging markets (Latin America, Middle East, and Africa) | Country-level sizing and growth forecasts for high-demand countries such as the US, Germany, Japan, China, India, and Brazil |

RECENT DEVELOPMENTS

- July 2023 : BreathMo, a state-of-the-art ECMO system, was introduced at the ASAIO Conference, representing China's homegrown innovation in medical technology. This cutting-edge maglev technology addresses the unique medical needs of patients in China, marking a notable advancement in the field.

- April 2023 : Abbott secured two new clearances from the US Food and Drug Administration (FDA) for its acclaimed life support system, particularly the CentriMag Blood Pump. The extended FDA indication allows for longer-term use in adults, depending on extracorporeal membrane oxygenation (ECMO), a vital life support method for those with heart and lung issues.

- November 2022 : LivaNova PLC announced receiving 510(k) clearance from the US Food and Drug Administration (FDA) for its next-generation advanced circulatory support system, LifeSPARC. This approval signifies that the LifeSPARC system meets the criteria set forth by the FDA and can now be used in the US market.

- July 2022 : Inspira Technologies OXY B.H.N Ltd., a pioneer in life support technology, introduced the Liby System. This advanced life support system is designed to treat patients with life-threatening heart and lung failure.

Table of Contents

Methodology

The study involved major activities in estimating the current market size of the ECMO machines market. Exhaustive secondary research was done to collect information on the ECMO market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the ECMO market.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, Factiva, whitepapers, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the ECMO market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply- and demand-side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the ECMO market. Primary sources from the demand side included hospitals, academic & research institutions, specialty clinics, researchers, lab technicians, purchase managers, and stakeholders in corporate & government bodies.

The following is a breakdown of the primary respondents:

Note 1: C-level primaries include CEOs, COOs, and CTOs.

Note 2: Others include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3=< USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the ECMO market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

The entire market was split into three segments when the market size was determined. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at precise statistics for all segments.

Approach to derive the market size and estimate market growth.

Using secondary data from paid and unpaid sources, the market rankings for the major players were determined following a thorough analysis of their sales of ECMO machines and components. Due to data restrictions, the revenue share in certain cases was determined after a thorough analysis of the product portfolio of big corporations and their individual sales performance. This information was verified at each stage by in-depth interviews with professionals in the field.

Market Definition

An ECMO machine acts as an artificial heart and lung for a patient whose heart or lungs cannot provide enough blood flow or oxygen into the blood. ECMO is used after other methods of supporting the heart and lungs do not work. The goal of ECMO is to let the heart and lungs recover while the patient is supported by the ECMO machine.

Stakeholders

- Manufacturers of ECMO Machine Products and Related Devices

- Suppliers and Distributors of ECMO Machine Devices

- Hospitals, Clinics, and Medical Colleges

- Medical Device Procurement Agencies

- Government Bodies/Municipal Corporations

- Business Research and Consulting Service Providers

- Venture Capitalists

- US Food and Drug Administration (US FDA)

- European Union (EU)

Report Objectives

- To define, describe, and forecast the oxygen concentrators market based on product, modality, patient type, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall oxygen concentrators market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the oxygen concentrators market in six regions, namely, North America (US and Canada), Europe (Germany, UK, France, Spain, Italy, and Rest of Europe), the Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa, and GCC Countries

- To strategically profile the key players in the global market and comprehensively analyze their core competencies

- To track and analyze competitive developments, such as product launches, expansions, agreements, and acquisitions, of the leading players in the market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the ECMO Machines Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in ECMO Machines Market

Adam

Mar, 2022

Can you share the detailed information on technological advancements in the ECMO Machine Market?.

Nathan

Mar, 2022

In what way COVID19 is Impacting the global growth of the ECMO Machine Market?.

Henry

Mar, 2022

Can you enlighten us about the key players operating in the global ECMO Machine Market?.