COVID-19 Impact on Critical Care Device Market by Device (High-Impact Products (Ventilators, Patient Monitors, Infusion Pumps, Hyperbaric Oxygen Therapy Devices and Sleep Apnea Devices) and Low-Impact Products (Anesthesia Machines, Defibrillators and Blood Warmers)) and Region - Global Forecast to 2021

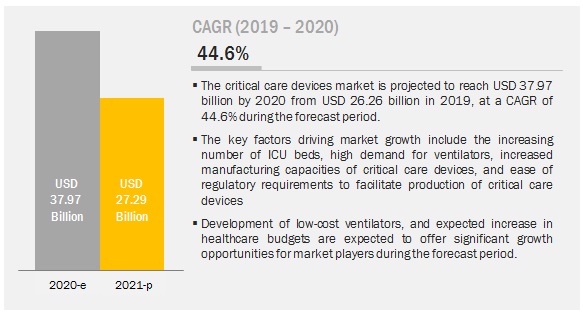

[ Pages Report] The global critical care devices market size is expected to reach USD 27.29 billion by 2021 from an estimated value of USD 37.97 billion in 2020. The critical care devices market is expected to witness a growth of 44.1% from 2019 to 2020. The market for critical care devices is driven primarily by the increasing number of ICU beds owing to the continuously rising COVID-19 cases, increasing demand for ventilators for effective management of critical COVID-19 patients, and ease of regulatory requirements to facilitate the production of critical care devices. In addition, the development of low-cost ventilators and the expected increase in healthcare budgets offer significant growth opportunities for players operating in the critical care devices market. However, disruption of supply chain & logistics due to the rapid spread of coronavirus is likely to challenge the growth of this market.

The ventilators segment is projected to grow at the highest CAGR during the forecast period

Based on products, the critical care devices market is segmented into ventilators & supplies, sleep apnea devices, patient monitors, hyperbaric oxygen therapy devices, infusion pumps, defibrillators, anesthesia machines, blood warmers, and other critical care devices supplies. The ventilators segment is expected to grow at the highest rate during the forecast period. This can be attributed to owing to rapid manufacturing of emergency ventilators, worldwide, and the development of low-cost ventilators.

In 2019, the hospitals & clinics segment accounted for the largest share of the market

Based on end-users, the critical care devices market has been segmented into hospitals, home care settings, ambulatory care settings, and emergency medical services. The hospitals & clinics segment accounted for the largest share of the critical care devices industry in 2019. The large share of this segment is attributed to the strong financial capabilities of hospitals for purchasing high-priced critical care devices, the large patient pool treated at hospitals, and the availability of trained professionals to operate these critical care devices.

North America accounted for the largest share of the critical care devices industry in 2019

The critical care devices market is segmented into five major regions, namely, North America, Europe, the Asia Pacific (APAC), Latin America, and the Middle East & Africa. In 2019, North America accounted for the largest share of the critical care devices industry. The large share of this region can primarily be attributed to the high adoption of specialty infusion pumps, the high number of positive COVID-19 cases & deaths in the US, a strong healthcare system, and the presence of many large hospitals in the region. Moreover, a large number of major global players are based in the US, owing to which the US can easily manufacture these devices.

Key Market Players

The key players in the global critical care devices market are Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany), Baxter International Inc. (US), Fresenius Kabi (Germany), Medtronic plc (Ireland), ResMed (US), Koninklijke Philips (Netherlands), and Fisher & Paykel Healthcare (New Zealand), among others.

Critical questions the report answers:

- Where will these developments take the industry in the mid-to-long term?

- What are the recent trends in the critical care devices market?

- What are the major market dynamics and their impact on overall market growth?

- What is the global scenario of the critical care devices market?

- What initiatives are players undertaking to sustain post the pandemic?

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

20182021 |

|

Base year considered |

2019 |

|

Forecast period |

20202021 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product, End User, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

|

Companies covered |

Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany), Baxter International Inc. (US), Fresenius Kabi (Germany), Medtronic plc (Ireland), ResMed (US), Koninklijke Philips (Netherlands), and Fisher & Paykel Healthcare (New Zealand), Medtronic, Masimo Corporation, among others |

The critical care devices market research report categorizes the market into the following segments and subsegments:

By Product

- High-Impact Products

- Ventilators and Supplies

- Patient Monitors

- Infusion Pumps

- Hyperbaric Oxygen Therapy Devices

- Sleep Apnea Devices

- Low-Impact Products

- Anesthesia Machines

- Defibrillators

- Blood Warmers

- Other Critical Care devices and supplies

By End User

- Hospitals and Clinics

- Home Care Settings

- Ambulatory Care Settings

- Emergency Medical Services

By Region

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

- Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America

- Middle East & Africa

Recent Developments

- On 29th April 2020, Medtronic has ramped up the production of its high-performance ventilators by more than 40%. In addition, the company is working with third-parties to explore other non-traditional mechanisms to increase the production of ventilators, including providing its intellectual property and ventilator designs to the public for third-party ventilator production

- Getinge has seen an increased global demand for advanced ventilators, extracorporeal life support (ECLS) equipment, and advanced monitoring for intensive care units since the outbreak of the COVID-19 pandemic. To meet the global demand, Getinge will temporarily increase its production of advanced ICU-ventilators by 160% in 2020, to 26,000 ventilators in total. In 2019, Getinge produced approximately 10,000 advanced ICU-ventilators at its production site in Solna, Sweden.

- Medtronics ventilator portfolio primarily includes the PB980, PB840, PB560, and HT70 models. Medtronic ships more than 300 ventilators per week to customers in the highest risk, highest need locations in the world. By the end of April, Medtronic expects to manufacture more than 400 ventilators per week. By the end of May, the company is planning to manufacture more than 700 ventilators per week, and it is targeting more than 1,000 ventilators per week by the end of June, representing an approximately five-fold increase in production versus pre-pandemic levels. This production ramp-up is expected to generate over 25,000 ventilators across all platforms over the next six months.

- In March 2020, Medtronic launched the MCMS COVID-19 virtual care evaluation and monitoring system. This system is now available to US health systems, plans, and employers. It follows the companys launch of a respiratory infectious disease health check to its existing MCMS customers. Medtronic designed the new stand-alone coronavirus evaluation and monitoring system to use a virtual assistant to evaluate patients through a Centers for Disease Control and Prevention (CDC) guideline-based survey for COVID-19 symptoms.

- In April 2020, The FDA issued Emergency Use Authorization for B. Brauns Perfusor Space Syringe Infusion Pump, Infusomat Space Volumetric Infusion Pump, and Outlook ES Pump systems to deliver nebulized meds into a nebulizer to treat COVID-19 patients.

- To help ensure the continuity of supply, BD has placed all BD and Alaris infusion sets on manual inventory allocation until further notice. As a part of the supply continuity plan, the company is also reducing the number of available product SKUs of Alaris system pump sets.

- In October 2019, B. Braun Medical Inc. (US) collaborated with STANLEY Healthcare (US) to integrate and deploy B. Brauns Space Infusion Pump Systems along with DoseTrac Infusion Management Software with STANLEY Healthcares MobileView software, Aeroscout RTLS MobileView, at Saratoga Hospital, located in New York, US, to provide real-time pump status data.

- In April 2019, Smiths Medical (US) partnered with HCA Capital Division (US) to integrate the Medfusion 4000 system with PharmGuard Software with HCAs electronic medical records system (EMR), to provide better patient outcomes by reducing medication errors.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 11)

1.1 COVID-19 HEALTH ASSESSMENT

1.2 COVID-19 ECONOMIC ASSESSMENT

1.2.1 COVID-19 IMPACT ON THE ECONOMYSCENARIO ASSESSMENT

2 RESEARCH METHODOLOGY (Page No. - 17)

2.1 RESEARCH APPROACH

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.2 MARKET SIZE ESTIMATION

2.3 MARKET RANKING ANALYSIS

2.4 ASSUMPTIONS FOR THE STUDY

3 IMPACT OF COVID-19 OUTBREAK ON THE CRITICAL CARE DEVICES MARKET OVERVIEW (Page No. - 25)

3.1 INTRODUCTION

3.2 DRIVERS

3.2.1 INCREASE IN THE NUMBER OF ICU BEDS IN COUNTRIES WITH A HIGH PREVALENCE OF COVID-19

3.2.2 INCREASING DEMAND FOR VENTILATORS FOR THE EFFECTIVE MANAGEMENT OF CRITICAL COVID-19 PATIENTS

3.2.3 LESS-STRINGENT REGULATORY REQUIREMENTS TO FACILITATE THE PRODUCTION OF CRITICAL CARE DEVICES

3.3 CHALLENGES

3.3.1 IMPACT ON SUPPLY CHAIN AND LOGISTICS

3.4 OPPORTUNITIES

3.4.1 EXPECTED INCREASE IN PUBLIC HEALTHCARE INVESTMENTS GLOBALLY

3.4.2 DEVELOPMENT OF LOW-COST VENTILATORS

3.5 BURNING ISSUES

3.5.1 REVENUE SHIFT FROM OTHER MEDICAL DEVICES

4 IMPACT OF COVID-19 OUTBREAK ON THE CRITICAL CARE DEVICES MARKET (Page No. - 29)

4.1 INTRODUCTION

4.1.1 MOST-ATTRACTIVE MARKETS

4.1.1.1 Ventilators

4.1.1.2 Sleep apnea devices

4.1.1.3 Respiratory monitoring devices

4.1.1.4 Hyperbaric oxygen therapy devices

4.1.1.5 Infusion pumps

4.1.2 LESS-AFFECTED MARKETS

4.1.2.1 Defibrillators

4.1.2.2 Anesthesia monitors & machines

4.1.2.3 Blood warmer devices

5 IMPACT OF COVID-19 OUTBREAK ON THE CRITICAL CARE DEVICES MARKET, BY END USER (Page No. - 45)

5.1 INTRODUCTION

5.2 HOSPITALS & CLINICS

5.3 AMBULATORY CARE CENTERS

5.4 EMERGENCY MEDICAL SERVICES

5.5 HOME CARE SETTINGS

6 CRITICAL CARE EQUIPMENT MARKET, BY REGION (Page No. - 50)

6.1 US

6.2 CANADA

6.3 EUROPE

6.3.1 ITALY

6.3.2 SPAIN

6.3.3 GERMANY

6.3.4 FRANCE

6.3.5 UK

6.3.6 ROE

6.4 ASIA PACIFIC

6.4.1 CHINA

6.4.2 INDIA

6.4.3 JAPAN

6.4.4 REST OF ASIA PACIFIC

6.5 LATIN AMERICA

6.6 MIDDLE EAST AND AFRICA

7 COMPETITIVE LANDSCAPE (Page No. - 86)

7.1 INTRODUCTION

7.2 VENTILATORS

7.2.1 KEY COMPANIES

7.2.2 KEY DEVELOPMENTS

7.2.3 SHORT-TERM STRATEGIES

7.3 SLEEP APNEA DEVICES

7.3.1 KEY COMPANIES

7.3.2 KEY DEVELOPMENTS

7.3.3 SHORT-TERM STRATEGIES

7.4 RESPIRATORY CARE MONITORING DEVICES

7.4.1 KEY COMPANIES

7.4.2 KEY DEVELOPMENTS

7.4.3 SHORT-TERM STRATEGIES

7.5 INFUSION PUMPS

7.5.1 KEY COMPANIES

7.5.2 KEY DEVELOPMENTS

7.5.3 SHORT-TERM STRATEGIES

LIST OF TABLES (85 Tables)

TABLE 1 CRITICAL CARE DEVICES MARKET, BY PRODUCT, 20182021 (USD MILLION)

TABLE 2 CRITICAL CARE DEVICES MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 3 MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 4 MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 5 VENTILATORS MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 6 SLEEP APNEA DEVICES MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 7 RESPIRATORY MONITORING DEVICES MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 8 HYPERBARIC OXYGEN THERAPY DEVICES MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 9 INFUSION PUMP DEVICES MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 10 LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 11 LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 12 DEFIBRILLATORS MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 13 ANESTHESIA MONITORS & MACHINES MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 14 BLOOD WARMER DEVICES MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 15 CRITICAL CARE DEVICES MARKET, BY END USER, 20182021 (USD MILLION)

TABLE 16 CRITICAL CARE DEVICES MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 20182021 (USD MILLION)

TABLE 17 CRITICAL CARE DEVICES MARKET FOR AMBULATORY CARE CENTERS, BY COUNTRY, 20182021 (USD MILLION)

TABLE 18 CRITICAL CARE DEVICES MARKET FOR EMERGENCY MEDICAL SERVICES, BY COUNTRY, 20182021 (USD MILLION)

TABLE 19 CRITICAL CARE DEVICES MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 20182021 (USD MILLION)

TABLE 20 US: CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 21 US: MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 22 US: LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 23 US: CRITICAL CARE DEVICES MARKET, BY END USER, 20182021 (USD MILLION)

TABLE 24 CANADA: CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 25 CANADA: MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 26 CANADA: LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 27 CANADA: CRITICAL CARE DEVICES MARKET, BY END USER, 20182021 (USD MILLION)

TABLE 28 EUROPE: CRITICAL CARE DEVICES MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 29 EUROPE: CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 30 EUROPE: MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 31 EUROPE: LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 32 EUROPE: CRITICAL CARE DEVICES MARKET, BY END USER, 20182021 (USD MILLION)

TABLE 33 ITALY: CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 34 ITALY: MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 35 ITALY: LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 36 ITALY: CRITICAL CARE DEVICES MARKET, BY END USER, 20182021 (USD MILLION)

TABLE 37 SPAIN: CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 38 SPAIN: MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 39 SPAIN: LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 40 SPAIN: CRITICAL CARE DEVICES MARKET, BY END USER, 20182021 (USD MILLION)

TABLE 41 GERMANY: CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 42 GERMANY: MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 43 GERMANY: LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 44 GERMANY: CRITICAL CARE DEVICES MARKET, BY END USER, 20182021 (USD MILLION)

TABLE 45 FRANCE: CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 46 FRANCE: MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 47 FRANCE: LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 48 FRANCE: CRITICAL CARE DEVICES MARKET, BY END USER, 20182021 (USD MILLION)

TABLE 49 UK: CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 50 UK: MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 51 UK: LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 52 UK: CRITICAL CARE DEVICES MARKET, BY END USER, 20182021 (USD MILLION)

TABLE 53 ROE: CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 54 ROE: MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 55 ROE: LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 56 ROE: CRITICAL CARE DEVICES MARKET, BY END USER, 20182021 (USD MILLION)

TABLE 57 ASIA PACIFIC: CRITICAL CARE DEVICES MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 58 ASIA PACIFIC: CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 59 ASIA PACIFIC: MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 60 ASIA PACIFIC: LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 61 ASIA PACIFIC: CRITICAL CARE DEVICES MARKET, BY END USER, 20182021 (USD MILLION)

TABLE 62 CHINA: CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 63 CHINA: MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 64 CHINA: LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 65 CHINA: CRITICAL CARE DEVICES MARKET, BY END USER, 20182021 (USD MILLION)

TABLE 66 INDIA: CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 67 INDIA: MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 68 INDIA: LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 69 INDIA: CRITICAL CARE DEVICES MARKET, BY END USER, 20182021 (USD MILLION)

TABLE 70 JAPAN: CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 71 JAPAN: MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 72 JAPAN: LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 73 JAPAN: CRITICAL CARE DEVICES MARKET, BY END USER, 20182021 (USD MILLION)

TABLE 74 ROA: CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 75 ROA: MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 76 ROA: LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 77 ROA: CRITICAL CARE DEVICES MARKET, BY END USER, 20182021 (USD MILLION)

TABLE 78 LATIN AMERICA: CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 79 LATIN AMERICA: MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 80 LATIN AMERICA: LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 81 LATIN AMERICA: CRITICAL CARE DEVICES MARKET, BY END USER, 20182021 (USD MILLION)

TABLE 82 MEA: CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 83 MEA: MOST-ATTRACTIVE CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 84 MEA: LESS-AFFECTED CRITICAL CARE DEVICES MARKET, BY TYPE, 20182021 (USD MILLION)

TABLE 85 MEA: CRITICAL CARE DEVICES MARKET, BY END USER, 20182021 (USD MILLION)

LIST OF FIGURES (24 Figures)

FIGURE 1 COVID-19 THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

FIGURE 3 COUNTRIES BEGIN WITH SIMILAR TRAJECTORIES BUT CURVES DEVIATE BASED ON MEASURES TAKEN

FIGURE 4 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 5 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 6 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

FIGURE 7 RESEARCH DESIGN

FIGURE 8 PRIMARY SOURCES

FIGURE 9 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 10 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 11 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 12 BOTTOM-UP APPROACH

FIGURE 13 VENTILATORS MARKET, 20182021 (USD BILLION)

FIGURE 14 SLEEP APNEA DEVICES MARKET, 20182021 (USD BILLION)

FIGURE 15 RESPIRATORY MONITORING DEVICES MARKET, 20182021 (USD BILLION)

FIGURE 16 HYPERBARIC OXYGEN THERAPY DEVICES MARKET, 20182021 (USD BILLION)

FIGURE 17 INFUSION PUMPS MARKET, 20182021 (USD BILLION)

FIGURE 18 DEFIBRILLATORS MARKET, 20182021 (USD BILLION)

FIGURE 19 ANESTHESIA MONITORS & MACHINES MARKET, 20182021 (USD BILLION)

FIGURE 20 BLOOD WARMER DEVICES MARKET, 20182021 (USD MILLION)

FIGURE 21 US: NUMBER OF OUTPATIENT FACILITIES, 2005 VS. 2016

FIGURE 22 EUROPE: NUMBER OF CRITICAL BEDS PER 100,000 POPULATION

FIGURE 23 NUMBER OF ACTIVE CASES IN ITALY

FIGURE 24 APAC: NUMBER OF CRITICAL BEDS PER 100,000 PEOPLE

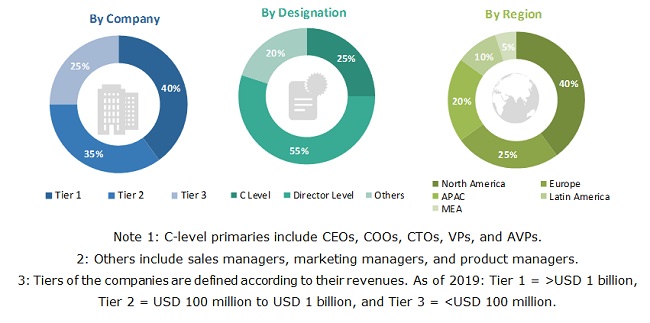

The study on the global critical care devices market study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the critical care devices market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, industry experts from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Industry experts from the supply side include CEOs, vice presidents, marketing and sales directors, product managers, business development managers, technology and innovation directors of companies providing critical care devices, key opinion leaders, and suppliers and distributors. The industry experts from the demand side include hospitals, ambulatory care settings, and clinics.

Following the breakdown of primary respondents

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends, by product, end user, and region).

Data Triangulation

After arriving at the market size, the total critical care devices market was divided into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, and forecast the global critical care devices market by product, end user, and region

- To provide detailed information about the factors influencing the market growth (drivers, opportunities, challenges, burning issues)

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall critical care devices market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the critical care devices market in five regions (along with major countries)North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa.

- To asses short-term strategies of players in the critical care devices market and analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions; new product launches; collaborations, partnerships, and agreements; of the leading players in the global critical care devices market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the critical care devices market report:

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific market into Australia, South Korea, and other countries

- Further breakdown of the Rest of Europe market into Belgium, Russia, Switzerland, and other countries

- Further breakdown of the Latin America market into Brazil, Mexico, Argentina, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in COVID-19 Impact on Critical Care Device Market