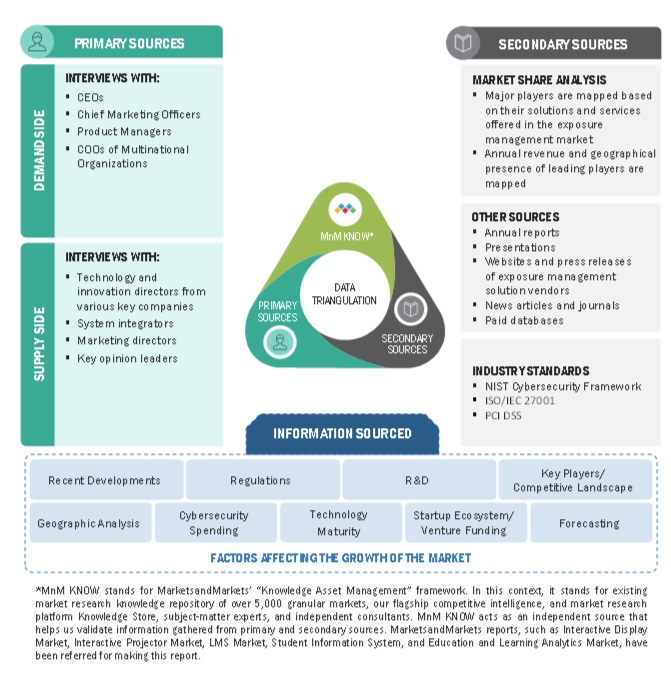

The study involved significant activities in estimating the current market size for Exposure Management. Intensive secondary research was conducted to collect information about exposure management and related ecosystems. The industry executives validated these findings, assumptions, and sizing across the value chain using a primary research process as a next step. Top-down and bottom-up market estimation approaches were used to estimate the market size globally, followed by the market breakup and data triangulation procedures to assess the market segment and sub-segments in exposure management.

Secondary Research Process:

In the secondary research process, various sources were referred to to identify and collect exposure management information. These sources include annual reports, press releases, exposure management software and service vendor investor presentations, forums, vendor-certified publications, and industry/association white papers. These secondary sources were utilized to obtain critical information about exposure management’s solutions and services supply & value chain, a list of 100+ key players and SMEs, market classification, and segmentation per the industry trends and regional markets. The secondary research also gives us insights into the key developments from market and technology perspectives, which primary respondents further validated.

The factors considered for estimating the regional market size include technological initiatives undertaken by governments of different countries, GDP growth, ICT spending, recent market developments, and market ranking analysis of primary exposure management solutions and service vendors.

Primary Research Process:

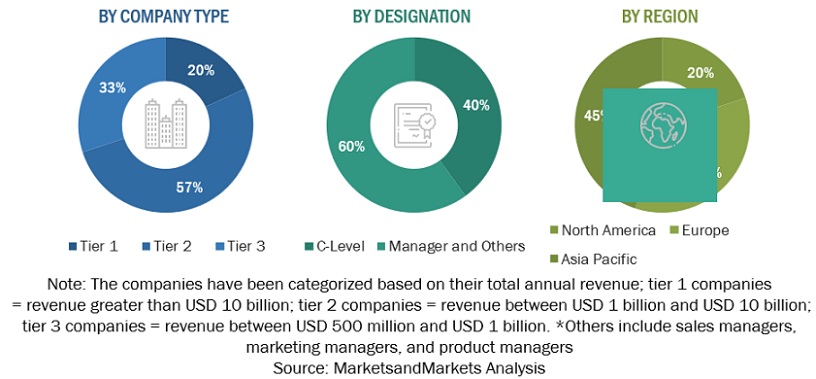

We have conducted primary research with industry executives from both the supply and demand sides. The primary sources from the supply side include chief executive officers (CEOs), vice presidents (VPs), marketing directors, and technology and innovation executives of key companies operating in the exposure management market. We have conducted primary interviews with the executives to obtain qualitative and quantitative information for exposure management.

The market engineering process implemented the top-down and bottom-up approaches and various data triangulation methods to estimate and forecast the market segments and subsegments. During the post-market engineering process, we conducted primary research to verify and validate the critical numbers we arrived at. The primary analysis was also undertaken to identify the segmentation types, industry trends, the competitive landscape of the exposure management market players, and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Following is the breakup of the primary research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation Process:

Both top-down and bottom-up approaches were implemented for market size estimation to estimate, project, and forecast the size of the global and other dependent sub-segments in the overall exposure management market.

The research methodology used to estimate the market size includes these steps:

-

The key players, SMEs, and startups were identified through secondary sources. Their revenue contributions in the market were determined through primary and secondary sources.

-

Annual and financial reports of the publicly listed market players were considered for the company’s revenue details, and,

-

Primary interviews were also conducted with industry leaders to collect information about their companies, competitors, and key players in the market.

-

All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Top-down and Bottom-up Approach-

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

Data triangulation is a crucial step in the market engineering process for exposure management. It involves utilizing multiple data sources and methodologies to validate and cross-reference findings, thereby enhancing the reliability and accuracy of the market segment and subsegment statistics. To conduct data triangulation, various factors and trends related to the exposure management market are studied from both the demand and supply sides. It includes analyzing data from diverse sources such as market research reports, industry publications, regulatory bodies, financial institutions, and technology providers. By examining data from different perspectives and sources, data triangulation helps mitigate potential biases and discrepancies. It provides a more comprehensive understanding of the market dynamics, including the size, growth rate, market trends, and customer preferences.

Furthermore, data triangulation aids in identifying any inconsistencies or outliers in the data, enabling researchers to refine their analysis and make informed decisions. It strengthens the credibility of the market engineering process by ensuring the conclusions drawn are based on robust and corroborated data. Data triangulation is a rigorous and systematic approach enhancing the reliability and validity of market segment and subsegment statistics in exposure management. It provides a solid foundation for informed decision-making and strategic planning within the industry.

Market Definition

Exposure management is a security practice used to map a company's digital attack surface and create and execute plans to mitigate these security threats. Exposure management includes identifying, assessing, and managing possible risks and vulnerabilities before attackers take advantage of them. the exposure management process involves scoping, discovery, prioritization, validation, and mobilization.

Key Stakeholders

-

Chief Technology and Data Officers

-

Certified Information Systems Auditor

-

Business Analysts

-

Information Technology (IT) Professionals

-

Government Agencies

-

Small and Medium-Sized Enterprises (SMEs) And Large Enterprises

-

Consultants/ Consultancies/ Advisory Firms

-

Managed and Professional Service Providers

Report Objectives

-

To define, describe, and forecast the exposure management market based on component, deployment mode, application, end-user industry, and region:

-

To predict and estimate the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

-

To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

-

To provide detailed information related to the primary factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

-

To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

-

To profile the key players of the market and comprehensively analyze their market size and core competencies.

-

Track and analyze competitive developments, such as new product launches, mergers and acquisitions, partnerships, agreements, and collaborations in the global exposure management market.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

-

Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

-

Further breakup of the North American market into countries contributing 75% to the regional market size

-

Further breakup of the Latin American market into countries contributing 75% to the regional market size

-

Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

-

Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Exposure Management Market