The study involved analyzing the recent developments, trends, and performance of the players and the EV battery testing market in 2024, along with the projections for 2033. The analysis was based on the production volume of the EV batteries around the world. The study also analyzes the primary targets for EVs, market adoption, advancement in battery technologies, and government electrification goals—exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with the industry experts. The top-down approache were employed to estimate the market size in battery testing for the segments considered.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study on the EV battery testing market. The secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles from recognized authors, directories, and databases; and articles from recognized associations and government publishing sources.

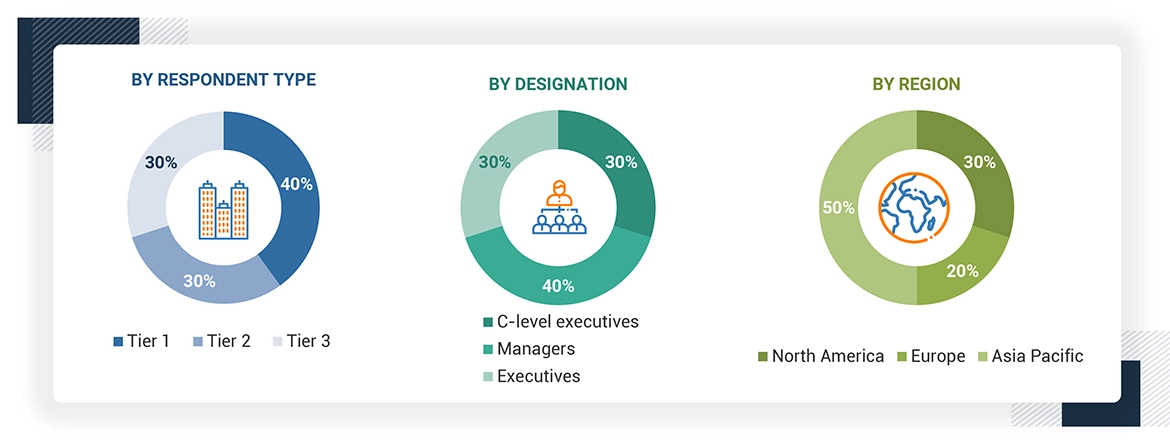

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the size of the EV battery testing market and other dependent submarkets, as mentioned below:

-

Key players in the EV battery testing market were identified through secondary research, and their global market share was determined through primary and secondary research.

-

The research methodology included the study of the automotive testing spending by the Tier-1 companies and estimates on outsourcing of different applications to testing service providers.

-

The research methodology included the study of the annual and quarterly financial reports and regulatory filings of major market players, as well as interviews with industry experts for detailed market insights.

-

All major penetration rates, percentage shares, splits, and breakdowns for the applications & services of the EV battery testing market were determined by using secondary sources and verified through primary sources.

-

All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

-

The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

EV Battery Testing Market : Top-Down and Bottom-Up Approach

Market Definition

EV battery testing involves a systematic evaluation of electric vehicle batteries to ensure their safety, performance, reliability, and compliance with industry standards. This process includes assessing battery capacity, charging efficiency, thermal stability, lifecycle durability, and response under varying environmental and operational conditions. Through rigorous testing, manufacturers verify that batteries meet required specifications and can perform safely and efficiently over the intended lifespan of the vehicle.

Stakeholders

-

Raw Material Suppliers

-

Testing Equipment Supplier

-

Research Organizations

-

Original Equipment Manufacturers (OEMs)

-

Technology Standards Organizations, Forums, Alliances, and Associations

-

Technology Investors

-

Analysts and Strategic Business Planners

-

Government Bodies, Venture Capitalists, and Private Equity Firms

-

Original Equipment Manufacturers

-

End Users curious to know more about EV battery testing services and the latest standards in the EV battery testing market

Report Objectives

-

To analyze the EV battery testing market performance till 2033

-

To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

-

Identify the technological trends likely to impact the market during the forecast period.

-

To analyze opportunities for stakeholders and the competitive landscape for market leaders

-

To project the EV Battery testing market revenue from 2024 to 2033

-

To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), product developments, and other activities carried out by key industry participants.

Growth opportunities and latent adjacency in EV Battery Testing Market