Emotion AI Market

Emotion AI Market by Solutions (Emotion Recognition, Emotion AI SDKs and APIs, Emotion Analytics), Type (Text-Focused, Voice-Focused, Video & Multimodal), Technology (Machine Learning, NLP, Computer Vision) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Emotion AI market is projected to expand from USD 2.74 billion in 2024 to USD 9.01 billion by 2030, at a CAGR of 21.9% during the forecast period. The rising inclination towards emotion-driven marketing, greater emphasis on mental health and well-being, and expanding regulatory and safety applications are the major drivers of the Emotion AI market. Emotion AI is used by businesses to create emotionally charged marketing campaigns to improve customer engagement. Emotion AI is being used by mental health solutions for personalized therapeutic interventions, and regulatory sectors use it to enhance surveillance and safety protocols. The top market segments include customer experience management, which takes the lead in the emotional AI market through the application of its capabilities to generate better customer satisfaction and loyalty. Retail and E-commerce verticals foster innovation through Emotion AI as it allows personalized shopping by considering personal preferences. Machine Learning acts as the base which helps complex algorithms being developed to enhance perfect emotion recognition.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific Emotion AI market accounted for a 27.85% revenue share in 2030.

-

By OfferingBy Offering, the services segment is expected to register the highest CAGR of 22.2%.

-

By TypeBy Type, the Video & Multimodal segment is projected to grow at the fastest rate from 2024 to 2030.

-

Competitive LandscapeMicrosoft, IBM, and Google were identified as some of the star players in the Emotion AI market, given their strong market share and advanced AI ecosystems, strong cloud infrastructure, extensive research capabilities, and broad integration of emotion analytics across enterprise and consumer applications.

-

Competitive LandscapeMorphCast, Kairos, and Behavioral Signals, among others, have distinguished themselves among startups and SMEs by advancing the Emotion AI market through their specialized focus on real-time emotion detection, adaptive multimedia responses, and conversational behavioral analytics, offering agile, innovative solutions that address niche industry needs and enable highly personalized user interactions.

The growing need for hyper-personalized interactions, the rising use of AI-enabled smart devices, and significant progress in video and audio analytics are accelerating the expansion of the Emotion AI market. Increasing investments in AI startups further contribute to this momentum. In retail and e-commerce, emotion-driven personalization is reshaping customer engagement by creating more intuitive and seamless user experiences. In the automotive sector, Emotion AI enhances safety and in-vehicle comfort through advanced driver monitoring and interactive systems. Moreover, expanding biometric research is strengthening facial recognition and voice analysis capabilities, enabling more precise emotion detection and deepening emotional connectivity across diverse applications, ultimately broadening the market’s reach and potential.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Emerging trends and disruptions in the Emotion AI market are reshaping value chains by shifting revenue sources toward new use cases, advanced technologies, and ecosystem-driven offerings. As clients adopt multimodal AI, regulated safety tools, and intelligent customer-experience copilots, their priorities increasingly focus on enhancing customer retention, meeting regulatory demands, and improving outcomes across sectors such as automotive, healthcare, retail, and media. These shifts directly impact customers’ customers by enabling safer driving alerts, faster support resolution, empathetic personalization, and earlier health interventions. At the same time, strengthened privacy measures, differentiated experiences, and reduced service costs contribute to higher trust and operational efficiency, expanding the practical reach and economic potential of Emotion AI solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for customer experience enhancement

-

Advancements in Al and machine learning technologies

Level

-

Privacy and data security concerns

-

High implementation costs

Level

-

Integration with IoT and wearable devices

-

Growing demand in remote work and virtual environments

Level

-

Addressing cultural and contextual variability

-

User trust and acceptance

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Advancements in AI and Machine learning will drive Emotion AI adoption

Emotion AI is a promising future business technology that is on the rise due to the advances in machine learning, natural language processing, and computer vision. These new innovations have significantly enhanced the Emotion AI system to become more accurate and functional. By using high-quality data and powerful computing, developers are making algorithms that can better sense subtle emotional cues such as a micro expression or the slightest change in the phonetics associated with speech. Emotion AI solutions have become much more widely adopted for use in different industries due to being more reliable, scalable and economically viable. This technology has the transformative potential to support emerging use cases, such as real-time emotion tracking in wearable devices.

Restraint: High implementation costs

The implementation of Emotion AI requires a large investment, a major barrier for smaller organizations. Deploying Emotion AI offerings usually necessitates high performance and complex solutions, as well as a strong IT systems foundation, making it expensive. In addition, the cost incurred in acquiring and maintaining the talent to develop and maintain these systems is also increasing. Investments in technology can be expensive and small and medium-sized enterprises (SMEs) may not have the money to make those investments, which means smaller organizations cannot access the technology. This high cost of entry inhibits broad adoption of Emotion AI solutions in the market. The high cost of technology adoption is particularly limiting for price-sensitive markets as the return on investment (ROI) is not very well defined for new and emerging technologies.

Opportunity: Integration with IoT and Wearable Devices

When used in integration with Internet of Things (IoT) devices and wearables, Emotion AI brings new possibilities for the real-time tracking and analysis of emotion. Emotion AI can be used by wearables to monitor users’ emotional states to gain insights that can improve physical and mental wellness. A simple example is smartwatches, which can notify a user when a stress level becomes too high, inviting them to do some relaxation exercises. By integrating with Emotion AI, creators can continuously track emotions and receive personalized feedback, opening doors for the application of Emotion AI in the wellness and fitness markets.

Challenge: User Trust and Acceptance

A critical factor in Emotion AI success is user acceptance, but it isn't easy to secure, as concerns around privacy and data security stop people from participating. However, many users are uneasy about technology monitoring how they feel, a concept that uses facial expressions, voice data, or even physiological signals. Even more, trust concerns are amplified if users cannot be sure what the companies will do with their data or if they are transparent about their business. To tackle this problem, companies need to work with transparent communication, secured data processing and permission-based data collection, to drive user acceptance. For Emotion AI solutions to be adopted widely by people and organizations in healthcare, customer service and education sectors, there is a need to establish a reputation for ethical use and transparent data practices that will earn user’s trust and acceptance.

EMOTION AI MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Large-scale attention study that measured viewers’ visual attention to video ads across seven app environments (feed, short-form, stream) using participants’ front-facing cameras to map how environment influences attention quality and brand outcomes. | Enables environment-specific creative optimization, reveals when high-quality attention occurs, informs placement strategy and benchmarks, improves media efficiency and creative performance, and supports data-driven ad testing and measurement. |

|

Interactive app campaign for McDonald’s Portugal that used MorphCast’s real-time facial emotion detection to identify users’ moods and deliver mood-aligned coupons and content, driving personalized, emotionally relevant customer interactions. | Boosts engagement and completion rates, increases customer satisfaction, strengthens brand connection, delivers personalized offers at scale, generates measurable interaction metrics (330k+ camera requests, 93.53% completion), and creates memorable experiences. |

|

Joint assistive-tech solution (Lumin-i) combining Smart Eye’s eye-tracking algorithms with Smartbox’s AAC software, enabling users with complex mobility needs to communicate via eye gaze, with fast response (≈25 ms), 60 fps capture and wide tracking area. | Restores independent communication for people with disabilities, offers high accuracy and responsiveness, works outdoors, tolerates head movement (large track box), integrates with Grid Pad AAC, and expands accessibility and user autonomy. |

|

Hume’s Empathic Voice Interface powers Niantic Spatial’s location-aware AR companions (e.g., Project Jade’s Dot), delivering sub-second, emotionally adaptive speech that adjusts tone and responsiveness based on user engagement and geospatial context. | Creates natural, emotionally attuned dialogue, improves user immersion and retention, enables context-aware guidance, increases perceived companionship quality, simplifies API integration with geospatial stacks. |

|

Lunavi integrated Uniphore’s Sales Interaction Agent to analyze visual, verbal and tonal cues in video sales calls, identify key moments and buyer pain points, and auto-populate insights into CRM to improve consultative selling. | Reduced sales onboarding time by 50%, doubled sales team productivity, improved win rates and deal management, surfaced actionable call insights, enabled better coaching and scalable knowledge transfer. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Emotion AI market ecosystem is built on three interconnected layers that collectively drive its growth and responsible adoption. Solution providers develop the core emotion-recognition technologies and analytics engines that power real-time insights across industries. Service providers enable large-scale implementation by offering cloud platforms, integration capabilities, and deployment support to operationalize these solutions. Regulatory bodies establish guidelines for data privacy, biometric governance, and AI risk management, ensuring transparency, safety, and ethical use. Together, these components create a balanced ecosystem that promotes innovation while maintaining trust and compliance in Emotion AI applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Emotion AI Market, By Type

Video-based Emotion AI can capture critically important, nuanced, non-verbal signals that help us understand human emotions in real-time, for example, remote customer support, virtual learning, and mental health monitoring. By combining data from multiple modalities, Multimodal Emotion AI improves accuracy, offering a complete picture of the user’s emotions. This versatility has made it ubiquitous in the trades from entertainment, automotive, and marketing, allowing for more engaging, personalized experiences. Extensive use of video communication and surveillance systems further increases demand for Video and Multimodal types of Emotion AI.

Emotion AI Market, By Technology

Machine learning (ML) holds the largest share of the Emotion AI market due to its ability to process large volumes of data and identify complex emotional patterns with high precision. ML models interpret facial expressions, vocal characteristics, and textual sentiment, enabling accurate emotion detection and real-time responses. As these models are continuously trained on diverse datasets, they become increasingly adaptable across sectors such as retail, healthcare, and customer service. ML-driven emotion recognition is now embedded in applications including personalized marketing, virtual assistants, and mental-health monitoring, enhancing engagement and user satisfaction. Its scalability, efficiency, and capacity for ongoing improvement position ML as the leading technology driving Emotion AI’s rapid expansion and cross-industry adoption.

Emotion AI Market, By Application

As the global focus on mental health awareness and the adoption of digital health technologies have grown, mental health and well-being monitoring has become one of the fastest-growing segments in the Emotion AI market. Real-time emotion analysis through facial expressions, voice tones, and sentiment from text can provide valuable information about the emotional state of the people. Especially in the field of telehealth and virtual therapy, this technology plays an important role in better understanding patient emotions to improve the quality of care. Workplace wellness programs and even educational institutions are also taking Emotion AI on board to monitor stress, burnout and emotional health. As the demand for proactive mental health management expands, Emotion AI solutions increasingly form a part of delivering personalized and impactful interventions.

Emotion AI Market, By Industry

The Emotion AI market is experiencing its strongest momentum in healthcare, driven by its transformative impact on patient care, mental-health management, and continuous well-being monitoring. By analyzing facial expressions, vocal tones, and written sentiment, Emotion AI provides real-time insights into patients’ emotional states, enabling more personalized and empathetic care delivery. This capability is particularly valuable in telehealth, where remote emotional assessment enhances diagnosis and treatment decisions. In mental-health applications, Emotion AI supports the detection of stress, anxiety, and depression, improving therapeutic outcomes. Its integration into wearable devices further enables proactive, continuous monitoring. As demand for patient-centric solutions accelerates, healthcare providers are increasingly adopting Emotion AI to elevate care quality, enhance patient satisfaction, and address rising mental-health challenges effectively.

REGION

Asia Pacific to be fastest-growing region in global emotion AI market during forecast period.

The Asia Pacific region is projected to record the fastest growth in the Emotion AI market, driven by rapid technological advancement, strong digital adoption, and expanding use cases across multiple industries. Significant investments in AI research and development in countries such as China, Japan, and India are accelerating progress in Emotion AI specifically. Sectors including e-commerce, retail, and healthcare are increasingly leveraging emotional analytics to enhance customer experience through personalized services. The widespread adoption of mobile devices, IoT technologies, and wearables further supports real-time emotion monitoring at scale. With both governments and enterprises prioritizing AI as a strategic growth engine, Asia Pacific is well positioned to achieve substantial expansion in Emotion AI due to its combined technological, economic, and demographic advantages.

EMOTION AI MARKET: COMPANY EVALUATION MATRIX

In the Emotion AI market matrix, Microsoft (Star) leads with a strong market share and extensive product footprint, driven by its advanced cloud ecosystem, strong AI research, and seamless integration of emotion analytics across enterprise solutions, enhancing scalability, accuracy, and real-world applicability. Entropik (Emerging Leader) is gaining visibility with its strong focus on multimodal emotion analytics, innovative consumer insights platforms, and scalable solutions that enhance decision-making across marketing, product experience, and customer engagement.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- IBM (US)

- MICROSOFT (US)

- GOOGLE (US)

- AMAZON (US)

- SMART EYE (Sweden)

- ENTROPIK (India)

- UNIPHORE (US)

- AUDEERING GMBH (Germany)

- VIER GMBH (Germany)

- COGNITEC (Germany)

- SYMANTO (Germany)

- REALEYES (UK)

- CIPIA VISION (Israel)

- NOLDUS (Netherlands)

- COGITO (US)

- MORPHCAST (US)

- VOICESENSE (Israel)

- SUPERCEED (Malaysia)

- SIENA AI (US)

- OPSIS (Singapore)

- BEHAVIORAL SIGNALS (US)

- HUME (US)

- KAIROS (US)

- BEEMOTION.AI (Australia)

- INTELLIGENT VOICE (UK)

- DAVI (France)

- UTRIGG (Ukraine)

- ATTENTIONKART (India)

- VERN AI (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 2.26 Billion |

| Market Forecast in 2030 (Value) | USD 9.01 Billion |

| Growth Rate | CAGR of 21.9% from 2024-2030 |

| Years Considered | 2019-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: EMOTION AI MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| B2C Retail solution provider |

|

|

| Technology Provider |

|

|

RECENT DEVELOPMENTS

- January 2024 : At CES 2024, Smart Eye joined Forvia to present a groundbreaking Emotion AI demonstration. This partnership aims to showcase when the integration of advanced emotion detection technologies is deployed into automotive applications.

- July 2024 : The first eGates at Hazrat Shahjalal International Airport in Bangladesh were equipped with Veridos eGates and powered by face recognition technology from Cognitec. This technology allows travelers to perform self-service border control, making international checkpoints more efficient.

- August 2023 : iMotions integrated audEERING’s voice analysis technology within its biometric research platform. This collaboration will help deepen human behavioral research through voice data analysis.

- December 2023 : AItruist Technologies partnered with Uniphore to improve customer experience using AI. This collaboration works with Uniphore’s U product portfolio, comprising Emotion AI and workflow automation, to optimise processes in BPO and IT services.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

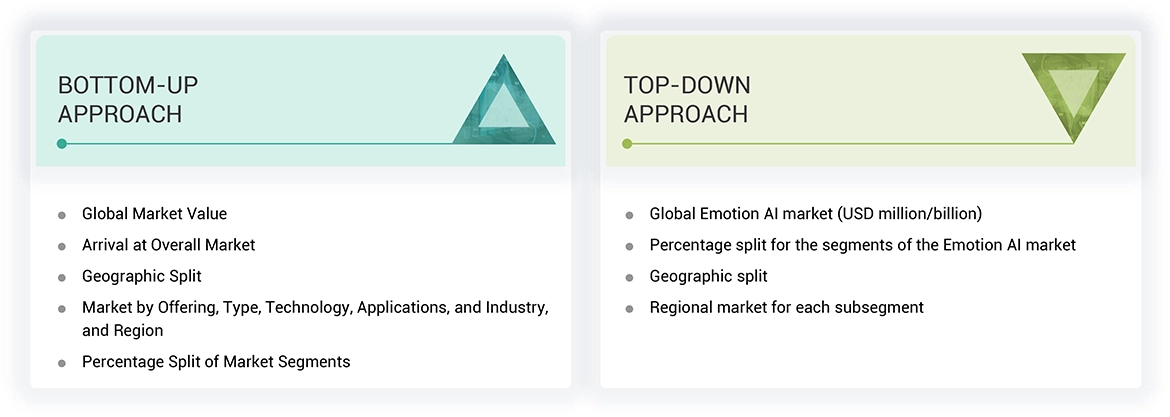

The research study involved four major activities in estimating the Emotion AI market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

The market size of the companies offering Emotion AI solutions to various end users was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

Secondary research was mainly used to obtain critical information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market-oriented and technology-oriented perspectives.

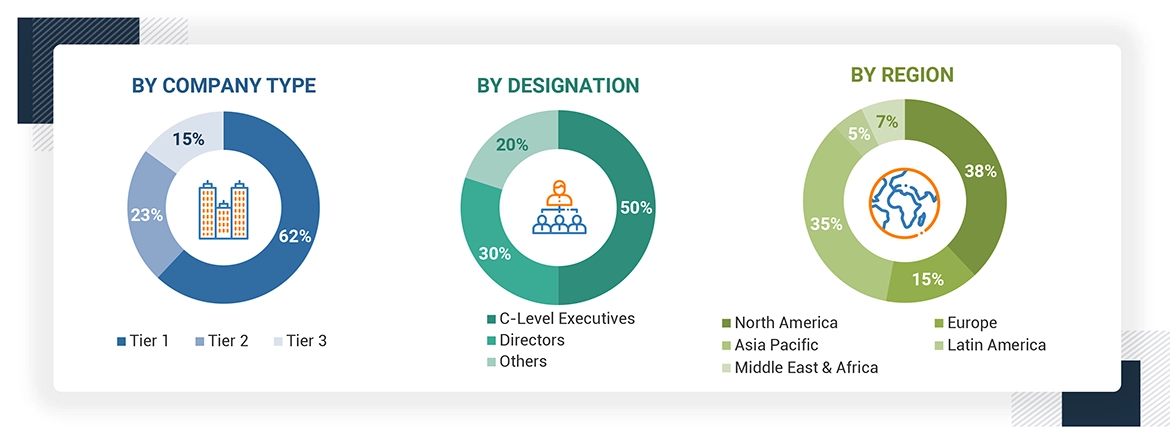

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report, Such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from Emotion AI solutions vendors, system integrators, professional and managed service providers, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from platforms and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use Emotion AI solutions, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of Emotion AI solutions which is expected to affect the overall Emotion AI market growth.

Note 1: Tier 1 companies have revenues over USD 1 billion, Tier 2 companies range between USD 500

million and 1 billion in overall revenues, and Tier 3 companies have revenues less than USD 500 million.

Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Emotion AI market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Emotion AI Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the Emotion AI market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The Emotion AI market size has been validated using top-down and bottom-up approaches.

Market Definition

Emotion Al refers to artificial intelligence that detects and interprets human emotional signals in text (using natural language processing and sentiment analysis), audio (using voice emotion Al), video (using facial movement analysis, gait analysis, and physiological signals), or combinations thereof. Emotion Al is the implementation of software that detects, interprets, and responds to human emotions. This requires the union of psychology, computer science, and Al to interpret human expressions of emotions, often through textual natural language processing (NLP), facial recognition, auditory analysis, and other physiological signals monitoring. Emotion Al seeks to achieve and surpass human-level emotional interpretation through analysis of each of these channels. This enables the technology to support more personalized and emotionally aware interactions between humans and machines, as well as support existing human-human interactions by providing keen insights and recommendations in real time to aid productive interactions. These applications promise to enable enterprises to streamline their efforts across a wide variety of both customer-facing and internal interactions.

Stakeholders

- Emotion AI Solutions and Service providers

- Technology providers

- Hardware Manufacturers

- Regulators & Policymakers

- Legal and Compliance Experts

- Consulting service providers

- Enterprise end users

- Distributors and Value-added Resellers (VARs)

- Government agencies

- Independent Software Vendors (ISV)

- Managed service providers

- Support & maintenance service providers

- System Integrators (SIs)

- Industry Associations

Report Objectives

- To determine, segment, and forecast the Emotion AI market based on offering, type, technology, application, industry, and region

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze the macro and micro-marketsmicromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the Middle East African market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Emotion AI Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Emotion AI Market