The research study involved 4 major activities in estimating the size of the electronic shelf lables market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the supply chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s supply chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

In the electronic shelf lables market report, the global market size has been estimated using both the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

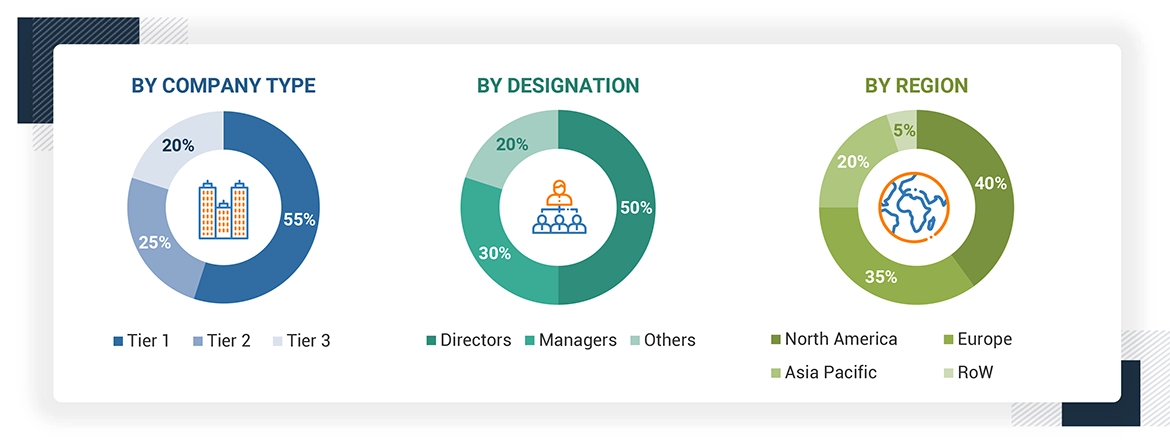

Extensive primary research has been conducted after understanding the electronic shelf lables market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions— North America, Europe, Asia Pacific, and the Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, have been used to estimate and validate the size of the electronic shelf labels and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

-

Identifying different stakeholders in the electronic shelf labels market that influence the entire market, along participants across the value chain.

-

Analyzing major manufacturers of electronic shelf labels (OEMs) as well as studying their product portfolios

-

Analyzing trends related to the adoption of electronic shelf labels based on application

-

Tracking the recent and upcoming developments in the market that include investments, R&D activities, product launches, collaborations, mergers & acquisitions, and partnerships as well as forecasting the market size based on these developments and other critical parameters

-

Carrying out multiple discussions with key opinion leaders to identify the adoption trends of electronic shelf labels

-

Segmenting the overall market into various other market segments

-

Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Electronic Shelf Labels Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the electronic shelf lables market.

Market Definition

Electronic Shelf Labels (ESLs) are digital price tags that replace traditional paper labels in retail environments. They are fixed on the shelves and it is possible to post different information on them as price for products, motives for a sale, quantity in stock, and barcode numbers. The core of ESLs is based on e-paper technology, which facilitates proper information illumination and does not require additional external light sources. They provide instant information using wireless technologies whereby retailers can change prices, promotional campaigns and stock details of the whole store from one location. That minimizes the amount of handling required, increases the accuracy of the prices charged, and optimizes the processing functionality. Also, ESLs play a role in helping the sustainability causes through elimination of papers helps to cut paper usage and hence be more environmentally friendly as compared to paper based tag.

Key Stakeholders

-

Original equipment manufacturers (OEMs)

-

Raw material suppliers

-

System integrators

-

Product assembly and packaging vendors

-

Electronic shelf label software solution providers

-

Distributors

-

Research organizations

-

Market research and consulting firms

-

End Users

Report Objectives

-

To define, describe, segment, and forecast the electronic shelf lables market, by component, product type, communication technology, display size, end-user in terms of value

-

To forecast the market for display sizes, in terms of volume

-

To describe and forecast the market for various segments, with respect to four main regions: North America, Europe, Asia Pacific, RoW along with their respective countries, in terms of value

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the electronic shelf lables market

-

To provide a detailed overview of the electronic shelf labels market’s supply chain, along with the ecosystem, technology trends, use cases, regulatory environment, and Porter’s five forces analysis

-

To analyze industry trends, pricing data, patents and innovations, and trade data (export and import data) related to the electronic shelf labels

-

To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies

-

To analyze opportunities for stakeholders and provide a detailed competitive landscape of the market

-

To analyze competitive developments, such as product launches/developments, collaborations, partnerships, acquisitions, and research & development (R&D) activities carried out by players in the electronic shelf lables market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players (up to 5)

User

Sep, 2019

The increasing use of electronic shelf labels in hypermarkets, supermarkets, and specialty stores is gaining traction day by day. I would like to understand the growth rate and product type preferred in these stores. I would like to know the deciding factors for the selection of these particular product types in these stores. .

User

Sep, 2019

I am interested in understanding the market penetration of electronic shelf label's in North America, especially in the US and Canada. Does your report cover the companies based out in this region and their market share w.r.t to the other companies ? .

User

Sep, 2019

I would like to know about the major communication technologies in ESL and their market share as well. Has this information been included in your report? I am also interested in knowing the competitive landscape for this market..

User

Dec, 2021

we need cheaper solutions.