EV Battery Recycling Market

EV Battery Recycling Market by Material Extraction (Lithium, Nickel, Cobalt, Manganese, Iron, Cobalt, Graphite, Steel, Aluminium), Battery chemistry (LFP, NMC, NCA), Vehicle Type, Recycling process & Region - Global Forecast to 2035

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

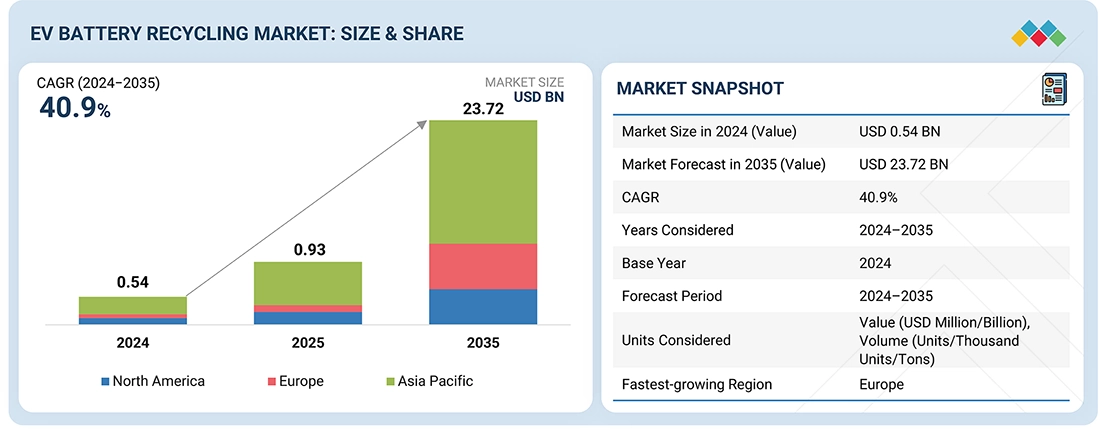

The EV Battery Recycling market is projected to reach USD 23.72 billion by 2035, from USD 0.54 billion in 2024, at a CAGR of 40.9%. The increasing adoption of electric vehicles is leading to a surge in end-of-life batteries that require sustainable disposal solutions. In response, governments across the globe are enforcing stricter regulations to minimize waste and support circular economy practices, thereby promoting battery recycling efforts. Rising demand for key materials like lithium, cobalt, and nickel is also fueling investments in recycling to lessen reliance on mining and ensure a stable raw material supply. Moreover, technological innovations in recycling methods such as hydrometallurgy and direct recycling are enhancing process efficiency and cost-effectiveness, further driving market expansion.

KEY TAKEAWAYS

-

BY VEHICLE TYPEPassenger cars dominate the EV battery recycling market due to their high production volumes and widespread adoption of electric models compared to commercial vehicles. This dominance drives increased demand for recycling infrastructure and recovery technologies tailored to lithium-ion batteries used in passenger EVs.

-

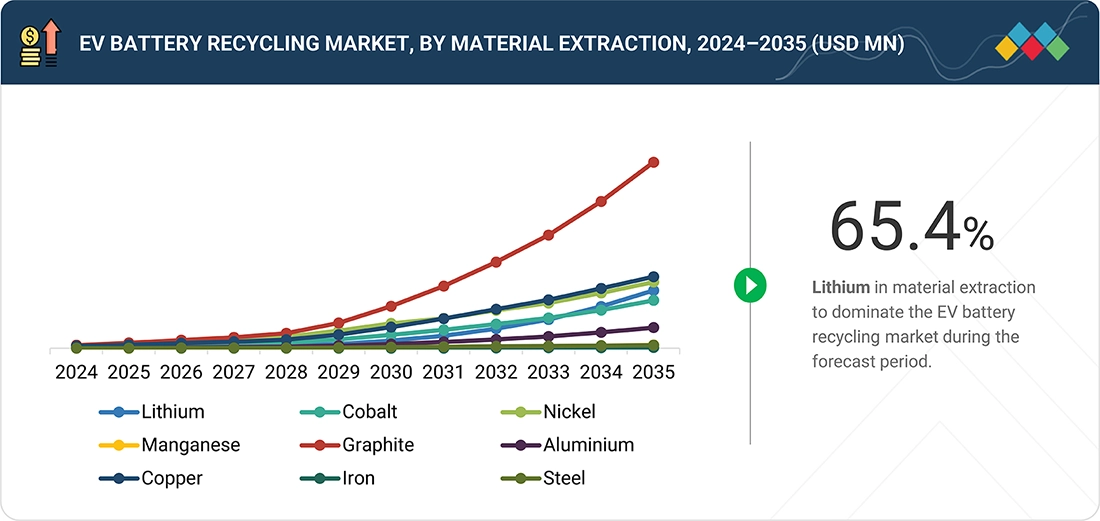

BY MATERIAL EXTRACTIONThe rising EV adoption and ongoing innovations in recycling technology will likely ensure that lithium remains a focal material for extraction and contributes to the high CAGR in the EV battery recycling market.

-

BY BATTERY CHEMISTRYWith the rapid shift toward LFP chemistry in EV batteries and increased recycling capabilities, LFP is expected to exhibit the highest CAGR in the EV battery recycling market.

-

BY RECYCLING PROCESSThe recycling of EV batteries is shifting toward more efficient and sustainable methods, with technologies like hydrometallurgy and direct recycling gaining prominence to recover critical materials such as lithium, cobalt, and nickel. Simultaneously, the industry is moving toward a circular economy approach, emphasizing material reuse, reduced environmental impact, and cost-effective processing.

-

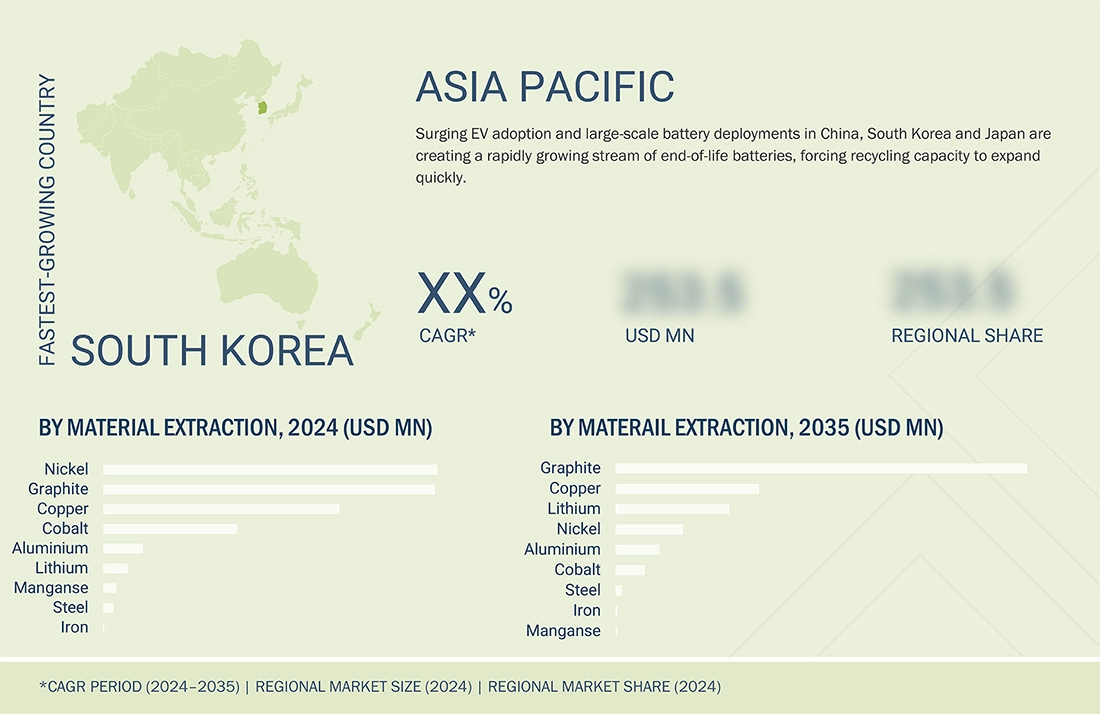

BY REGIONAsia Pacific holds the largest market share in the EV battery recycling market due to high EV adoption rates, supportive government policies, the presence of players such as CATL and GEM Co., and advancements in recycling technologies. The region’s focus on resource recovery and circular economy principles, along with its large-scale EV market, further strengthens its dominance.

-

COMPETITIVE LANDSCAPEThe EV battery recycling market is dominated by key players such as Contemporary Amperex Technology Co., Limited (China), GEM Co., Ltd. (China), Umicore (Belgium), Glencore (Switzerland), and Fortum (Finland), among others. These companies have a global distribution network across Asia Pacific, North America, and Europe. They are vital in their domestic regions and explore geographic diversification alternatives to grow their businesses. They focus on increasing their market shares through expansions, investments, joint ventures, collaboration, and partnerships.

The EV battery recycling market is also propelled by technological advancements in second-life applications, where used batteries are repurposed for energy storage, extending their economic value. Corporate sustainability initiatives and ESG mandates are motivating automakers and battery manufacturers to adopt responsible end-of-life management practices. Furthermore, volatile global supply chains for critical minerals are encouraging localized recycling solutions to ensure resource security and reduce dependency on imports.

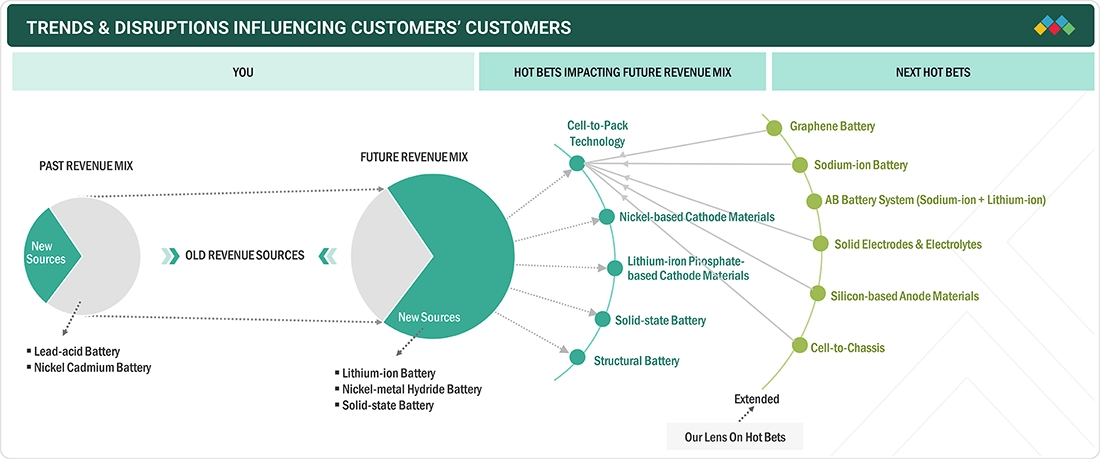

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The EV battery recycling market is witnessing rapid growth, fueled by trends such as the rising adoption of electric vehicles, stricter environmental regulations, and advancements in recycling technologies that enable efficient recovery of critical materials like lithium, cobalt, and nickel. Demand is shifting toward scalable, automated, and modular recycling solutions that optimize resource recovery and reduce processing costs. Meanwhile, supply chain pressures, raw material scarcity, and the push for circular economy practices are prompting stakeholders to rethink operations, invest in advanced recycling technologies, and explore service-based and collaborative business models to maintain competitiveness.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Creation of stable supply chains for EV battery materials

-

Stringent government initiatives for lithium-ion battery recycling

Level

-

Limited collection and recycling infrastructure

Level

-

Advent of uniform recycling procedures

-

Advancements in AI in battery recycling

Level

-

Complexity of battery chemistries

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Creation of stable supply chains for EV battery materials

The EV battery recycling market is increasingly driven by the need to secure a stable supply of critical raw materials such as lithium, cobalt, and nickel, which face fluctuating availability and high geopolitical risk. Recycling enables manufacturers to reduce dependence on mining, ensuring consistent material flow for battery production and safeguarding against supply disruptions. As EV adoption accelerates, companies are investing in advanced recycling processes to recover high-purity materials, directly strengthening the resilience of the battery supply chain.

Restraint: High initial investment costs

The EV battery recycling market faces significant barriers due to the high upfront capital required for advanced recycling facilities, including specialized equipment for processes like hydrometallurgy and direct recycling. Smaller players often struggle to enter the market, as the investment needed to ensure compliance with environmental and safety regulations can be prohibitive.

Opportunity: Digital transformation and Industry 4.0 propel innovation

The integration of Industry 4.0 technologies, such as IoT-enabled monitoring and AI-driven process optimization, allows battery recycling facilities to maximize material recovery and reduce operational inefficiencies. Advanced digital platforms enable real-time tracking of end-of-life EV batteries, ensuring safer handling and more precise sorting of critical metals like lithium and cobalt. These innovations create opportunities for scalable, data-driven recycling models that align with both sustainability goals and evolving regulatory requirements.`

Challenge: Absence of standardization in industrial communication protocols and interfaces

The EV battery recycling market faces significant hurdles due to limited collection networks, particularly in regions where consumers and businesses lack convenient drop-off points for end-of-life batteries. Inadequate recycling infrastructure leads to high transportation and logistics costs, as batteries often need to be centralized at a few specialized facilities capable of safe processing.

EV Battery Recycling Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Implements closed-loop battery recycling to recover lithium, nickel, and cobalt from end-of-life EV batteries and production scrap. | Reduces raw material dependency, lowers production costs, and improves supply chain sustainability. |

|

Provides advanced hydrometallurgical recycling of lithium-ion batteries through a spoke-and-hub model. | Achieves up to 95% material recovery, reduces environmental impact, and ensures a circular economy. |

|

Operates large-scale battery recycling plants in Europe to process end-of-life batteries and production waste. | Enables resource recovery at industrial scale and supports OEMs in meeting EU recycling mandates. |

|

Uses proprietary Hydro-to-Cathode™ technology to directly produce new cathode materials from recycled batteries. | Minimizes carbon footprint and reduces the need for virgin mining by up to 90%. |

|

Integrates collection, shredding, and refining to close the loop on EV battery materials. | Strengthens domestic supply chains and reduces costs associated with raw material imports. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The EV Battery Recycling ecosystem consists of raw material suppliers (Ganfeng, Tianqi, Albemarle, SQM, Vale, Glencore, BASF, Arcadium), battery component manufacturers (POSCO Chemical, BTR, Sumitomo Metal Mining), material collection & logistics providers (DHL Supply Chain, Veolia, Kuehne+Nagel, DB Schenker), battery recyclers (Umicore, Li-Cycle, BATX, GS Yuasa), battery manufacturers (CATL, Panasonic, LG Chem, Samsung SDI), OEMs (BMW, BYD, Tesla, Volvo, Rivian, Volkswagen). The EV battery recycling ecosystem begins with raw material suppliers providing essential metals and chemicals for battery production. Battery component and cell manufacturers convert these materials into battery packs, which are later collected and transported by logistics providers once they reach end-of-life. Recyclers then recover valuable materials through mechanical and chemical processes, returning them to the supply chain to support new battery production and promote a circular economy.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

EV Battery Recycling Market, By Material Extraction

Lithium is expected to be the fastest-growing segment in the EV battery recycling market due to increased initiatives by recyclers and OEMs to recover this material. The rising demand for lithium-ion batteries, driven by the global shift toward EVs, underscores the importance of securing a stable lithium supply. OEMs are increasingly integrating closed-loop systems and collaborating with recyclers to extract lithium from end-of-life batteries, ensuring resource sustainability while reducing reliance on mining.

EV Battery Recycling Market, By Vehicle Type

The passenger car segment is expected to dominate the EV battery recycling market over the study period. The rapid increase in electric vehicle adoption, fueled by stringent emissions regulations and a growing consumer preference for environmentally friendly transportation, has led to a significant accumulation of end-of-life batteries. The average life of a battery used in electric passenger cars typically ranges from 8 to 12 years. The increasing number of EVs leads to a surge in retired batteries, making recycling a necessity to manage the growing waste and resource demands.

EV Battery Recycling Market, By Battery Chemistry

The LFP segment is expected to grow at the highest CAGR during the forecast period, subject to the increasing adoption of LFP batteries in EVs due to their cost-effectiveness, safety, and longer life cycle than other lithium-based chemistries. As the demand for LFP-powered EVs continues to rise, the need for efficient and sustainable recycling solutions will increase, leading to advancements in LFP battery recycling technologies. Recyclers are actively developing scaling processes to recover lithium, iron, and phosphate from used LFP batteries. Many companies are also focusing on enhancing the efficiency of their recycling technologies to extract these materials while minimizing environmental impact.

EV Battery Recycling Market, By Recycling Process

Hydrometallurgical recycling holds the largest market share in the EV battery recycling market due to its high metal recovery efficiency and lower environmental impact. It enables the selective extraction of valuable metals like lithium, cobalt, and nickel with minimal energy use. This process is increasingly preferred by recyclers over pyrometallurgical methods for its sustainability and economic advantages.

REGION

Asia Pacific is expected to be the largest market for the EV battery recycling market during the forecast period

Asia Pacific holds the largest share of the EV battery recycling market, subject to the region’s dominance in EV manufacturing and battery production. China, Japan, and South Korea are home to leading battery recyclers, such as CATL (China), GEM Co., Ltd. (China), and SungEel HiTech (South Korea). These companies have advanced recycling technologies and substantial investments in circular economy initiatives. China, in particular, benefits from stringent government regulations promoting battery recycling to address environmental concerns and ensure resource security. Additionally, the region’s vast EV fleet generates a steady stream of end-of-life batteries, fueling the demand for recycling.

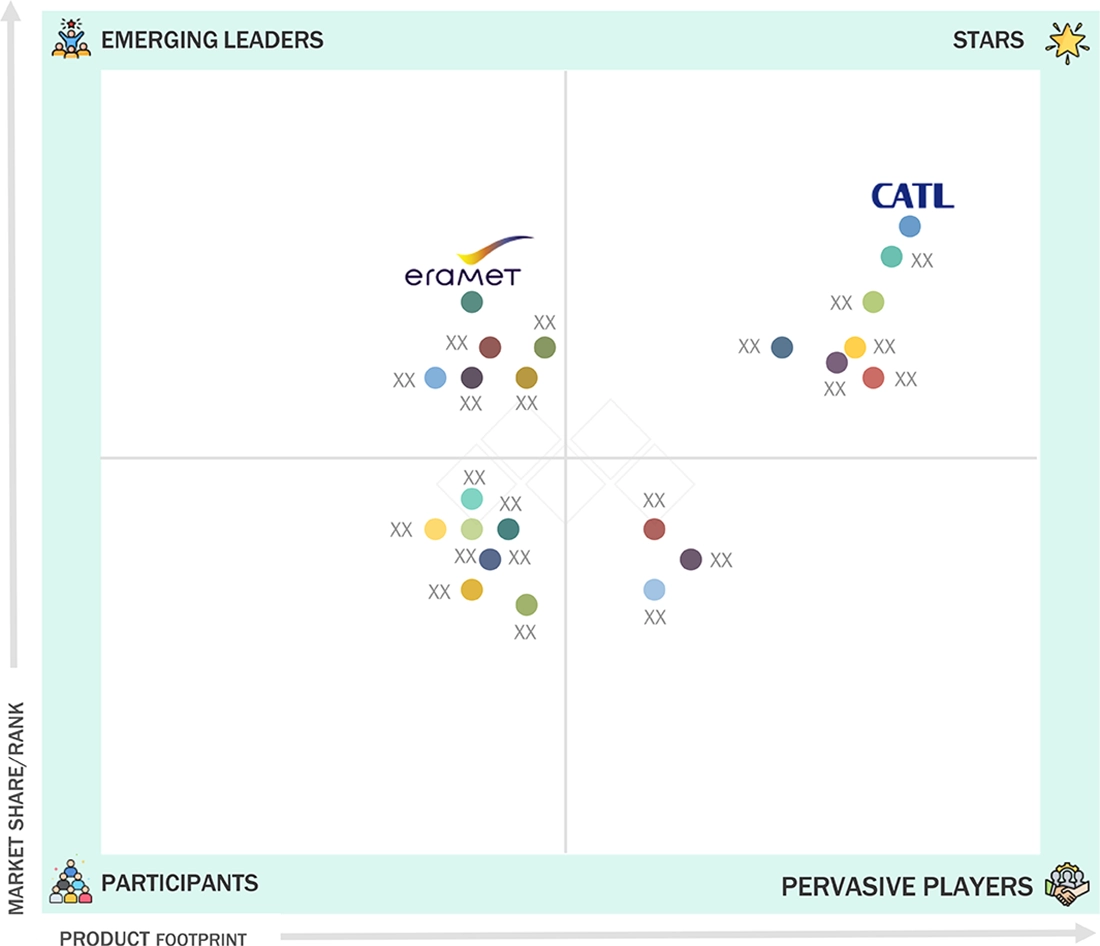

EV Battery Recycling Market: COMPANY EVALUATION MATRIX

In the EV Battery Recycling Market, CATL (Star) leads with a vertically integrated recycling ecosystem, advanced hydrometallurgical and direct recycling technologies, and strong synergies with its large-scale battery production, ensuring closed-loop material recovery for lithium, nickel, and cobalt. Its dominance is reinforced by strategic partnerships and large processing capacities supporting sustainability in global EV supply chains. ERAMET (Emerging Leader) is rapidly advancing through innovative low-carbon hydrometallurgical processes, strong R&D focus, and partnerships

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.54 Billion |

| Market Forecast in 2030 (Value) | USD 23.72 Billion |

| Growth Rate | CAGR of 40.9% from 2024-2035 |

| Years Considered | 2024-2035 |

| Base Year | 2024 |

| Forecast Period | 2024-2035 |

| Units Considered | Value (USD Million/Billion), Volume (Units/Thousand Units/Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, and Europe |

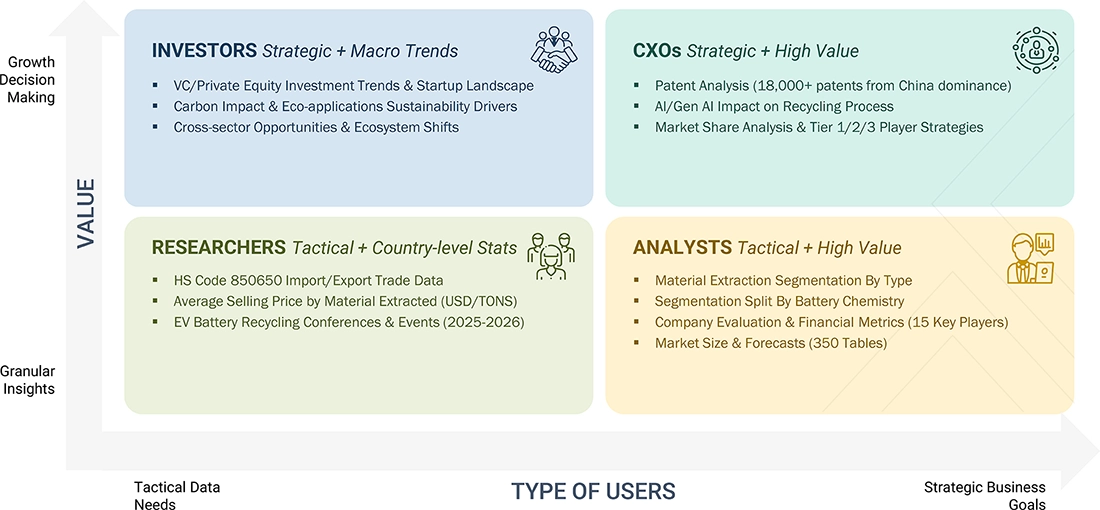

WHAT IS IN IT FOR YOU: EV Battery Recycling Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global EV Battery Recycler |

|

|

| Battery Material Processor |

|

|

RECENT DEVELOPMENTS

- December 2024 : Glencore (Switzerland) collaborated with Li-Cycle Corp. (Canada), a leading global lithium-ion battery resource recovery company, to assess the technical and economic viability of developing a new Hub facility in Portovesme, Italy, including a concept and pre-feasibility study.

- September 2024 : SK tes (Singapore) opened a lithium-ion and EV battery recycling facility in the Netherlands. The plant has been equipped to process up to 10,000 metric tons of battery materials annually.

- July 2024 : GEM Co. (China) subsidiaries, Fu’an Qingmei Energy Materials Co., Ltd. (China) (QM) and Wuhan Power Battery Recycling Technology Co., Ltd. (China) (Power Battery Recycling), signed a cooperation agreement on Joint Development and Market Advancement of Graphene Lithium (Manganese) Iron Phosphate Material Industrialization Technology with Shenzhen Eigen Equation Graphene Technology Co., Ltd.

- June 2024 : Fortum (Finland) entered into a preliminary agreement and signed an MoU with Marubeni Corporation (Japan) to jointly build a sustainable lithium-ion battery recycling chain focusing on graphite recycling.

- May 2024 : Umicore (Belgium) and STL (US), a subsidiary of Gécamines (Democratic Republic of the Congo), signed an exclusive, long-term partnership. Under this partnership, Umicore will support STL in valorizing germanium from the Big Hill2 tailings site in Lubumbashi, DRC. The company will also optimize STL’s new processing facility at the site, using its refining and recycling expertise. In return, it will get exclusive access to the processed germanium to produce material solutions for technology-adept applications.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the EV battery recycling market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized authors. Secondary research has been mainly used to obtain key information about the value chain of the industry, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market and application perspectives.

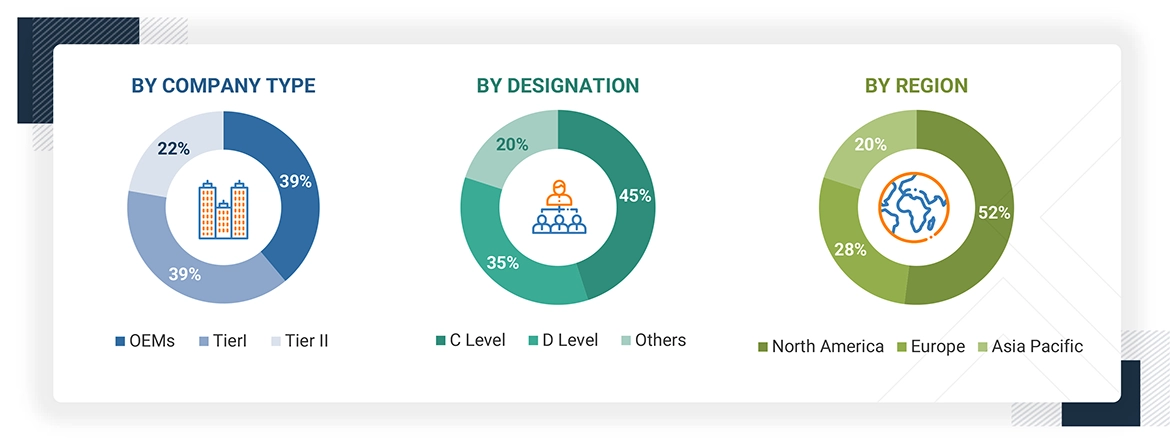

Primary Research

After understanding the EV battery recycling market scenario through secondary research, extensive primary research has been conducted. Primary interviews have been conducted with market experts from both demand- and supply-side players across North America, Europe, and Asia Pacific. Approximately 20% of interviews have been conducted from the demand side, while 80% of primary interviews have been conducted from the supply side. The primary data has been collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, various departments within organizations, such as sales and operations, have been covered to provide a holistic viewpoint in this report. Primary sources from the supply side include various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various battery recyclers, industry associations, independent consultants/industry veterans, and key opinion leaders have also been interviewed.

After interacting with industry experts, brief sessions with highly experienced independent consultants have been conducted to reinforce the findings from the primaries. This, along with the opinions of in-house subject matter experts, has led to the findings described in this report.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the web content management market. The first approach involves estimating the market size by companies’ revenue generated through the sale of WCM products.

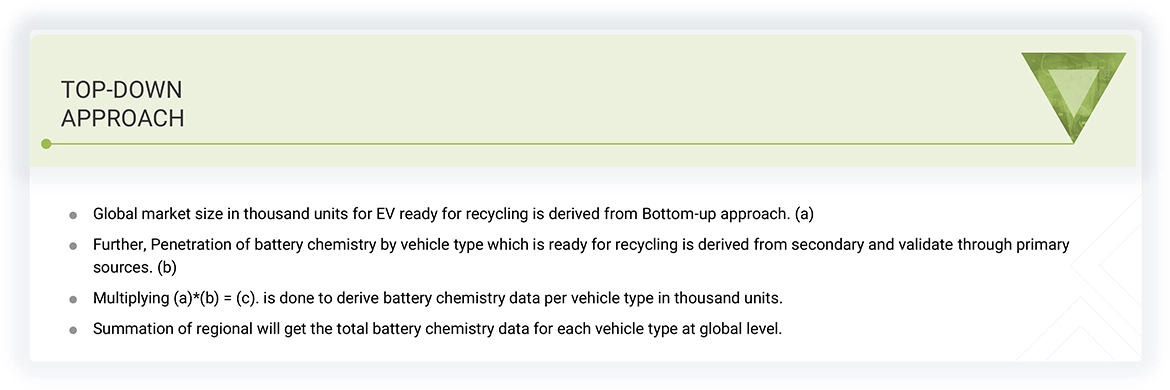

Market Size Estimation Methodology- Top-down approach

Multiple approaches were adopted for estimating and forecasting the EV battery recycling market. The first approach involved estimating the market size by summation of revenue generated through the sale of recycled EV batteries materials. The top-down and bottom-up approaches were used to estimate and validate the size of the global market and to estimate the size of various other dependent submarkets in the overall EV battery recycling market. The research methodology used to estimate the market size includes the following details. The key players in the market were identified through secondary research, and their market shares in respective regions were determined through primary and secondary research. The entire procedure included studying the annual and financial reports of top market players and extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

EV Battery Recycling Market : Top-Down Approach

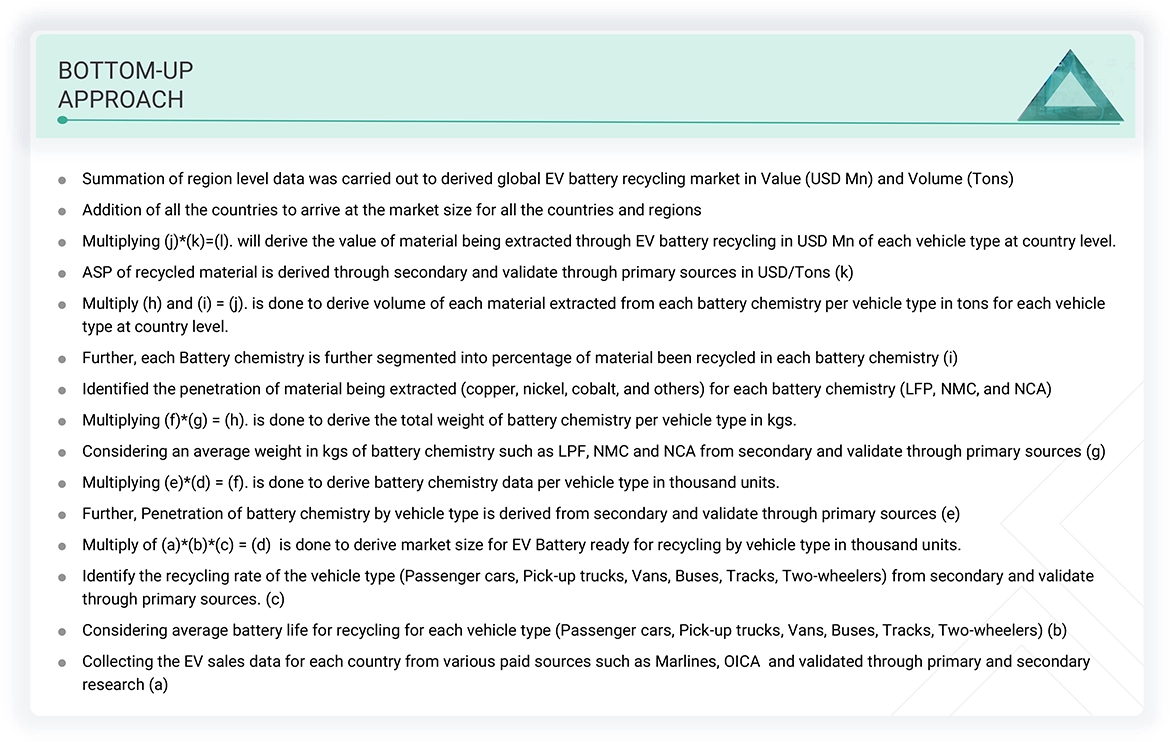

EV Battery Recycling Market : Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the global market through the abovementioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand and supply-side participants.

Market Definition

Electric vehicle battery recycling is the process of recovering and reusing materials from used electric vehicle batteries, primarily lithium-ion batteries, to minimize environmental impact and manage waste. The process involves collecting and sorting batteries, dismantling, and shredding to isolate components, and employing chemical and mechanical methods to extract valuable materials such as lithium, cobalt, and nickel. Recovered materials can be reused in the manufacturing of new batteries, contributing to resource conservation and reducing the demand for raw materials. Efficient recycling also helps manage hazardous waste disposal responsibly, fostering a more sustainable and circular approach in the electric vehicle industry.

Stakeholders

- Automobile Manufacturers

- Battery-related Service Providers

- Contract manufacturing organizations (CMOs)

- End Users

- EV Battery Casing Manufacturers

- EV Component Manufacturers

- EV Battery Manufacturing Organizations

- EV Battery Cell Manufacturing Organizations

- EV Battery Pack Manufacturing Organizations

- EV Battery Raw Material Miners and Suppliers

- EV Battery Raw Material Refinery Companies

- Electric vehicle battery recycling companies

- Manufacturers in end-use industries

- NGOs, governments, investment banks, venture capitalists, and private equity firms

- Regional manufacturers and chemical associations

- Traders, distributors, and suppliers of electric vehicle battery recycling

Report Objectives

- To define, describe, and forecast the EV battery recycling market in terms of value and volume.

-

To define, describe, and forecast the market based on battery chemistry, recycling process, vehicle type, material extraction and region

- To segment and forecast the market size, by volume, based on vehicle type (Passenger cars, Pick-up trucks, Vans, Trucks, Buses and Two-wheelers)

- To segment and forecast the market size, by volume, based on battery chemistry (LFP, NMC, NCA)

- To segment and forecast the market size, by value and volume, based on material (Lithium, Manganese, Cobalt, Nickel, Copper, Graphite, Aluminium, Steel, Iron)

- To provide qualitative insights on the market based on recycling process (Hydrometallurgical process, Pyrometallurgy process and Physical/mechanical Process)

- To forecast the size of various segments of the market based on three regions—North America, Europe, and Asia Pacific—along with their key countries

- To analyze regional markets for growth trends, prospects, and their contribution to the overall market

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

-

To study the following with respect to the market

- Supply Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- Pricing Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Key Stakeholders and Buying Criteria

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze the impact of the AI on the market

- To track and analyze competitive developments such as deals (agreements, mergers & acquisitions, partnerships, collaborations), and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with the company’s specific needs.

- Additional Company Profiles (Up to Five)

- EV Battery Recycling Market, By Material Extracted, At Country Level (For Countries Covered in The Report)

- EV Battery Recycling Market, By Battery Chemistry, At Country Level (For Countries Covered in The Report)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the EV Battery Recycling Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in EV Battery Recycling Market