This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study of the global electric motor market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess growth prospects of the electric motors market.

Secondary Research

Secondary sources include annual reports, press releases, and investor presentations of companies; directories and databases, which include D&B, Bloomberg, and Factiva; white papers and articles from recognized authors, and publications and databases from associations, such as the BP Statistical Review of World Energy, Energy Information Administration, and Department of Energy. Secondary research has been used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders has also been prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides have been interviewed to obtain and verify qualitative and quantitative information for this report and analyze prospects. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related executives from various leading companies and organizations operating in the electric motor market. Primary sources from the demand side include experts and key persons from the end user segment.

After the complete market engineering process (which includes calculations of market statistics, market breakdown, electric motors market size estimations, market forecasts, and data triangulation), extensive primary research has been conducted to gather information and verify and validate the critical numbers arrived at. Primary research has also been conducted to identify the segmentation, applications, Porter’s Five Forces, key players, competitive landscape, and key market dynamics such as drivers, opportunities, challenges, industry trends, and strategies adopted by key players.

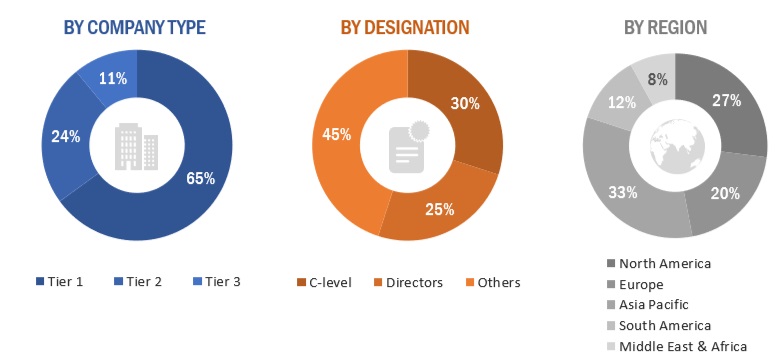

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Electric Motors Market Size Estimation

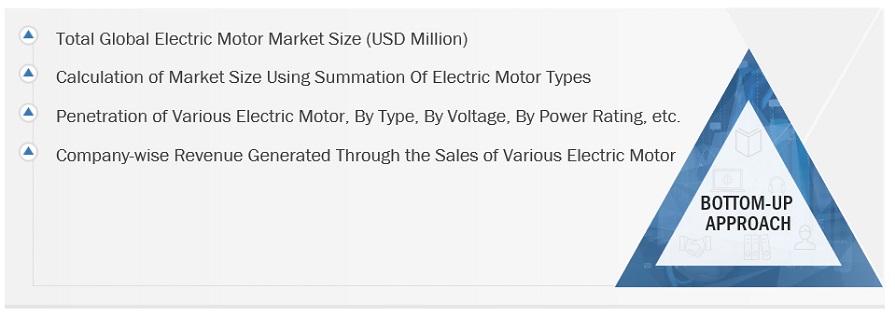

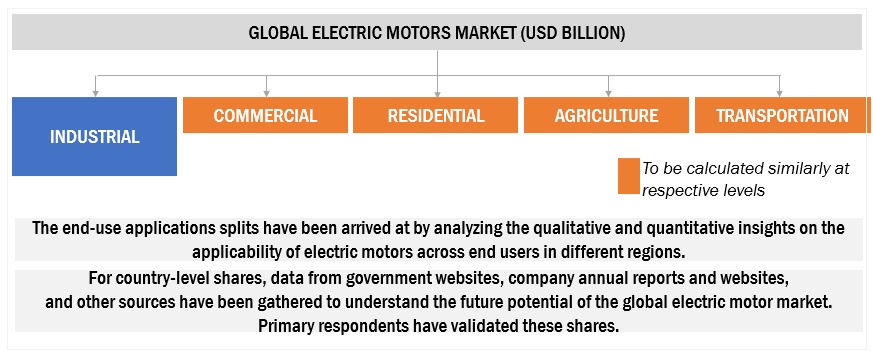

In the complete market engineering process, both top-down and bottom-up approaches have been extensively used along with several data triangulation methods to estimate and forecast the overall market segments listed in this report.

Top-down and bottom-up approaches have been used to estimate and validate the electric motors market size of electric motor for various applications in each region. The key players in the market have been identified through secondary research, and their market share in respective regions has been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the key market players and extensive interviews for insights from industry leaders such as CEOs, vice presidents, directors, and marketing executives. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Electric Motors Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Electric Motors Market Size: Top-down Approach

Data Triangulation

After arriving at the overall electric motors market size from the estimation process explained above, the total market has been split into several segments and sub-segments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and to arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has been validated using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—the top-down approach, the bottom-up approach, and expert interviews. When the values arrived at from the three points matched, the data was assumed to be correct.

Market Definition.

An electric motor is a rotating electric machine that converts electrical energy into mechanical energy. Its major components include a stator, a rotor, bearings, windings, eye bolts, brushes, poles, and conduit boxes.

-

AC Motors: These are motors driven by an alternating current (AC). AC motors are mainly of two types—synchronous AC motors and induction motors. AC motors are required where there is a need for high speed and variable torque.

-

DC Motors: These are rotatory electric motors that convert direct current (DC) into mechanical energy. DC motors are also mainly of two types—brushed DC motors and brushless DC motors (BLDC).

The electric motors market is defined as the sum of revenues generated by global companies from the sale of electric motors. These electric motors are of two types, AC and DC; they cater to various end users, such as industrial, commercial, residential, transportation, and agriculture. The regions considered for the electric motor market study include Asia Pacific, Europe, North America, the Middle East & Africa, and South America.

Key Stakeholders

-

Associations, Forums, and Alliances related to Electric Vehicle Charging Stations

-

Consulting Companies in the Energy Sector

-

Electric Motor Equipment Manufacturers

-

Environmental Associations

-

Government and Research Organizations

-

Power Companies

-

Motor Manufacturing Companies

-

Electric Motor Organizations, Forums, Alliances, and Associations

-

State and National Regulatory Authorities

Report Objectives

-

To define, describe, segment, and forecast the electric motors market on the basis of type, power rating, voltage, rotor type, output power, end user, and region

-

To provide detailed information on the major factors influencing the growth of the electric motor market (drivers, restraints, opportunities, and challenges)

-

To strategically analyze the electric motor market with respect to individual growth trends, future expansions, and the contribution of each segment to the market

-

To analyze electric motor market opportunities for stakeholders and details of the competitive landscape for market leaders

-

To forecast the growth of the electric motor market with respect to the main regions (Asia Pacific, Europe, North America, South America, and Middle East & Africa)

-

To strategically profile key players and comprehensively analyze their market rankings and core competencies*

-

To track and analyze competitive developments in the electric motor market, such as contracts and agreements, investments and expansions, new product developments, and mergers and acquisitions

Note: 1. Micromarkets are defined as the further segments and subsegments of the electric motor market included in the report.

2. Core competencies of companies are captured in terms of their key developments and product portfolios, as well as key strategies adopted to sustain their position in the electric motor market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

-

Further breakdown of the electric motor market, by country

Company Information

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Electric Motors Market