Electric Traction Motor Market by Type (AC and DC), Power Rating (Below 200 kW, 200-400 kW, and Above 400 kW), Application (Railways, Electric Vehicles, Elevators, Conveyors, and Industrial Machinery) and Region - Global Forecast to 2027

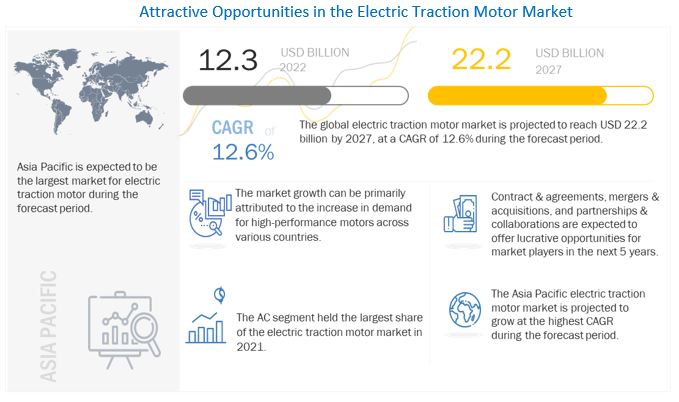

[190 Pages Report] The global electric traction motor market is projected to reach USD 22.2 billion by 2027 from an estimated market size of USD 12.3 billion in 2022, at a CAGR of 12.6% during the forecast period. The increase in demand for high-performance motors, favorable government policies and subsidies, and the rise in investments in the railway sector are likely to drive the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The electric traction motor market was severely affected by COVID-19. The most significant near-term impact on electric traction motors that are already contracted or in the manufacturing process will be felt through supply chains, by 2023. Industry executives are anticipating delivery and construction slowdowns, either because nations have shuttered industries to slow the spread of coronavirus or because the workers have tested positive. Many components and parts for manufacturing electric traction motors come from China, US, and some parts of Europe.

Electric traction motor Market Dynamics

Driver: Increasing stringency of emission regulations to push OEMs to manufacture and sell electric and hybrid vehicles

Growing concerns about the harmful effects of various means of transportation on the environment, such as air pollution, are increasing day by day. The rising concerns about environmental pollution have forced automotive manufacturers to develop vehicles that comply with regional regulatory standards. According to the International Energy Agency (IEA), in 2020, the worldwide electric car fleet grew to 10 million vehicles, with battery electric vehicles (BEVs) accounting for two-thirds of the total. In 2020, Europe saw the highest gain, with registrations doubling to 1.4 million (10% sales share), making it the world's leading electric car market for the first time. China came in second with 1.2 million registrations (5.7% of total sales), and the US came in third with 295,000 registrations (2% sales share). The demand for electric and hybrid vehicles has increased due to various reasons. Government incentives, zero emissions, advancements in battery technology, and enhanced user experience have contributed to the growth of electric and hybrid vehicles. The increasing stringency of emission norms has resulted in the increased sales of electric vehicles such as BEVs, HEVs, and PHEVs.

The electrification of vehicles has resulted in the replacement of mechanical linkages with automated systems. For example, the increasing usage of 48-volt electrical systems in cars has accentuated the need for high-performing electric traction motors to adhere to the power requirements. The increased number of electric vehicles has directly influenced the motor industry, which, in turn, augurs the growth of the electric traction motor market.

Restraint: High initial deployment cost of electric traction motors in rail industry

The initial cost involved in deploying railways such as locomotives, metros, trams, and others is very high. It requires substantial initial investments to set up field-level devices and equipment with updated technologies. An additional cost is also needed for setting up the advanced infrastructure for arranging transmission networks and managing new and existing systems. The post-deployment high operational and maintenance costs are also a huge concern for railway authorities. Railway Budget constraint acts as a restraining factor for deploying advanced railway technologies and solutions by the government as well as private players. Therefore, the high initial cost of deploying railways with advanced systems and solutions such as electric traction motors is expected to hamper the growth of the electric traction motor market in the coming years.

Opportunities: Increasing demand for electric vehicles

The number of electric and hybrid vehicles is rapidly growing due to fluctuating fuel prices and the rising need to minimize CO2 emissions. According to the Automotive Fuel Economy Survey, nearly 40% of American car owners identified fuel economy as a top aspect in making their vehicles more efficient. According to the International Energy Agency (IEA), around 10 million electric cars were sold worldwide in 2020, an increase of 63% from the previous year. China accounts for over 95% of the global electric 2/3-wheeler stock. According to the World Health Organization (WHO), China is taking significant steps to deal with air pollution, which is responsible for approximately 1 million deaths per year. The country is focusing on controlling air pollution and reducing carbon emissions by making necessary changes in its automotive sector to meet the air quality standards set by the government. Apart from China holding a major share of electric cars on the road, the demand for electric vehicles is on the rise in most countries across the globe.

Traction motors are the key components used in hybrid and fully electric vehicles for converting electrical energy into mechanical energy. Electric traction motors are installed in electric vehicles for initial propulsion and for providing rotational torque to the vehicle. Developments in hybrid vehicle technologies have led to a considerable increase in the demand for traction motors. Electric traction motors, such as permanent magnet synchronous motors, are widely used in electric vehicles due to their compact size and lower weight than induction motors. The rising awareness about the harmful effects of carbon emissions by vehicles is another major factor supporting the growth of the electric traction motor market. According to the IEA, globally, 82,000 new electric buses were registered in 2020, up 10% from the previous year, for a total stock of 600,000. Although electric buses are rapidly being purchased in Europe, India, and Latin America, China accounts for 98% of electric bus stock. Therefore, the rising demand for electric vehicles is expected to drive the growth of the electric traction motor market in the coming years.

Challenges: Motor failure due to overheating

Excessive heat due to overheating can result in motor failure by weakening the winding insulation in electric motors. Overheating occurs due to overload, poor power conditions, highly effective service factors, frequent turning on-off of the motor, and lack of air circulation around the motor. Electric motors also tend to overheat in high-temperature environments. Around 30% of all motor failures occur due to insulation failure, and approximately 60% happen due to overheating. Permanent magnet motors are challenged with significant reliability issues; these motors lose their magnetism if exposed to high temperatures. The permanent magnets of these motors get demagnetized, resulting in decreased torque performance. Thus, electric motors need to operate in ideal conditions to overcome this challenge. Hence, proper cooling and ventilation systems must be installed in areas where electric motors are operational.

Market Ecosystem

The AC segment is expected to be the largest market, by type, during the forecast period

By type electric traction motor market is segmented into AC and DC. The AC segment is expected to be the largest segment by type for electric traction motors market, during the forecast period. These motors are widely used in rail industries, electric vehicles, and industrial machinery for their propulsion. AC motors are easier to control and more efficient as compared to DC motors,.

The 200–400 kW segment is expected to be the second largest market, by power rating during the forecast period

By power rating electric traction motor market is segmented into 200 kW, 200-400 kW, and above 400 kW. The 200-400 kW segment is expected to be the second largest segment by power rating of the electric traction motor market, during the forecast period. The wide array of applications in metro systems, high-speed trains, and subway trains employing these electric traction motors is one of the major driving factors for this segment.

The railways segment is projected to be the fastest growing segment by application for electric traction motor market, during the forecast period

By application electric traction motor market is classified into railways, electric vehicles, and others. Others include conveyor belts, elevators, and industrial machinery. The electric vehicle segment is expected to be the fastest growing segment, during the forecast period. The increasing number of electric vehicles worldwide is leading to a higher demand for efficient traction motors. Major end users of traction motors are Mercedes, Tesla, BMW, Jaguar Land Rover, Daimler, and Toyota.

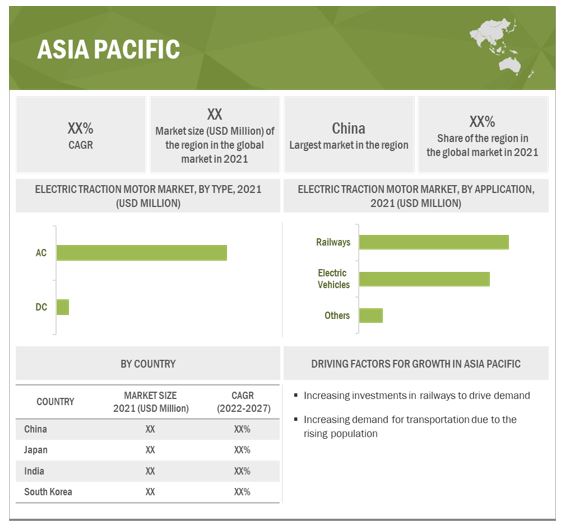

Asia Pacific is projected to be the fastest growing region for electric traction motor market during the forecast period

The global electric traction motor market has been segmented by region into North America, South America, Europe, Asia Pacific, and Middle East & Africa. Asia Pacific is projected to be the fastest growing market for electric traction motors from 2022 to 2027. The rising population within the region has led to a significant increase in the demand for transportation connectivity, which has correspondingly driven investments in the railway sector and is likely to further increase the demand for the electric traction motor market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the electric traction motor market are ABB (Switzerland), Mitsubishi (Japan), TOSHIBA CORPORATION (Japan), General Electric (US), and Siemens (Germany). Between 2017 and 2021, the companies adopted growth strategies such as contracts & agreements, investments & expansions, partnerships, collaborations, alliances & joint ventures to capture a larger share of the electric traction motor market.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, power rating, application, and region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies covered |

ABB (Switzerland), CG Power and Industrial Solutions (India), CRRC (China), General Electric (US), Mitsubishi (Japan), TOSHIBA CORPORATION (Japan), and Siemens (Germany) |

This research report categorizes the electric traction motor market by type, power rating, application, and region.

On the basis of by type, the electric traction motor market has been segmented as follows:

- AC

- DC

On the basis of by power rating, the electric traction motor market has been segmented as follows:

- Below 200 kW

- 200-400 kW

- Above 400 kW

On the basis of by application, the electric traction motor market has been segmented as follows:

- Railways

- Electric Vehicle

- Others

On the basis of region, the electric traction motor market has been segmented as follows:

- North America

- South America

- Europe

- Asia Pacific

- Middle East & Africa

Recent Developments

- In February 2020, NIDEC CORPORATION launched two new traction motor systems: the 200 kW Ni200Ex and 50 kW Ni50Ex based on the company’s original 150 kW E-Axle (fully integrated traction motor system with electric motor, reduction gearbox and inverter)

- In February 2020, ABB will supply traction equipment worth USD 26 million to Chittaranjan Locomotives Works (India)

- In February 2020, NIDEC CORPORATION expanded its footprints by inaugurating three new manufacturing plants in China, Poland, and Mexico. These plants would supply millions of electric motors at significantly reduced prices.

Frequently Asked Questions (FAQs):

What is the current size of the electric traction motor market?

The current market size of global electric traction motor market is USD 11.6 billion in 2021.

What is the major drivers for the electric traction motor market?

The factors driving the growth for electric traction motor market are increasing stringency of emission regulations to push OEMs to manufacture and sell electric and hybrid vehicles, favorable government policies and subsidies.

Which is the fastest-growing region during the forecasted period in electric traction motor market?

Asia Pacific region is expected to grow at the highest CAGR during the forecast period, driven mainly by rising investments in electric vehicles and the growing metro rail network in the region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 MARKET, BY TYPE: INCLUSIONS AND EXCLUSIONS

1.3.2 MARKET, BY POWER RATING: INCLUSIONS & EXCLUSIONS

1.3.3 MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONAL SCOPE

1.5 YEARS CONSIDERED

1.6 CURRENCY

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

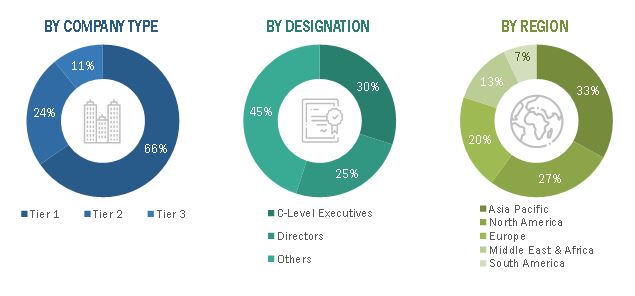

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

2.3 SCOPE

FIGURE 4 MAIN METRICS CONSIDERED TO CONSTRUCT AND ASSESS DEMAND FOR MARKET

2.4 MARKET SIZE ESTIMATION

2.4.1 DEMAND-SIDE ANALYSIS

FIGURE 5 MARKET: INDUSTRY-/COUNTRY-WISE ANALYSIS

2.4.1.1 Calculations

2.4.1.2 Assumptions

2.4.2 SUPPLY-SIDE ANALYSIS

FIGURE 6 MARKET: SUPPLY-SIDE ANALYSIS

2.4.2.1 Calculations

FIGURE 7 MARKET: MARKET SHARES

2.4.2.2 Assumptions

2.4.3 FORECASTS

3 EXECUTIVE SUMMARY (Page No. - 46)

TABLE 1 ELECTRIC TRACTION MOTOR MARKET SNAPSHOT

FIGURE 8 ASIA PACIFIC DOMINATED MARKET IN 2021

FIGURE 9 AC SEGMENT TO HOLD LARGEST MARKET SHARE, BY TYPE, 2022–2027

FIGURE 10 BELOW 200 KW SEGMENT TO LEAD MARKET, BY POWER RATING, 2022–2027

FIGURE 11 RAILWAYS SEGMENT TO HAVE HIGHEST MARKET SHARE, BY APPLICATION, 2022–2027

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 12 INCREASE IN DEMAND FOR HIGH-PERFORMANCE MOTORS AND FAVORABLE GOVERNMENT POLICIES AND SUBSIDIES TO BOOST MARKET GROWTH FROM 2022 TO 2027

4.2 MARKET, BY REGION

FIGURE 13 ASIA PACIFIC MARKET TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

4.3 ASIA PACIFIC MARKET, BY APPLICATION AND COUNTRY

FIGURE 14 RAILWAY APPLICATION AND CHINA HELD LARGEST SHARES OF MARKET IN ASIA PACIFIC IN 2021

4.4 MARKET, BY TYPE

FIGURE 15 AC ELECTRIC TRACTION MOTOR TO ACCOUNT FOR LARGEST MARKET SHARE, BY TYPE, IN 2027

4.5 MARKET, BY APPLICATION

FIGURE 16 RAILWAYS SEGMENT TO ACQUIRE LARGEST MARKET SHARE, BY APPLICATION, IN 2027

4.6 MARKET, BY POWER RATING

FIGURE 17 BELOW 200 KW SEGMENT TO DOMINATE MARKET, BY POWER RATING, IN 2027

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 ELECTRIC TRACTION MOTOR MARKET: MARKET DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing stringency of emission regulations to push OEMs to manufacture and sell electric and hybrid vehicles

TABLE 2 KEY COUNTRIES: OVERVIEW OF CAR EMISSION REGULATIONS, BY FUEL TYPE, 2016–2021

5.2.1.2 Increased demand for high-performance motors

5.2.1.3 Favorable government policies and subsidies

5.2.1.4 Increasing investments in railway sector

5.2.2 RESTRAINTS

5.2.2.1 High initial deployment cost of electric traction motors in rail industry

5.2.2.2 Volatility of raw material prices, especially copper

FIGURE 19 COPPER (LME) PRICE TREND (IN USD PER METRIC TON), JANUARY 2018–APRIL 2022

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for electric vehicles

FIGURE 20 ELECTRIC CAR STOCK IN SELECTED REGIONS, 2017–2020

5.2.4 CHALLENGES

5.2.4.1 High cost of electric vehicles compared to ICE vehicles

5.2.4.2 Motor failure due to overheating

5.3 IMPACT OF COVID-19

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN MARKET

FIGURE 21 REVENUE SHIFT OF ELECTRIC TRACTION MOTOR PROVIDERS

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 22 MARKET: SUPPLY CHAIN ANALYSIS

5.5.1 RAW MATERIAL SUPPLIERS

5.5.2 ORIGINAL EQUIPMENT MANUFACTURERS

5.5.3 ASSEMBLERS/MANUFACTURERS

5.5.4 DISTRIBUTORS

5.5.5 END USERS

5.6 MARKET MAP

FIGURE 23 ELECTRIC TRACTION MOTOR: MARKET MAP

5.7 INNOVATIONS AND PATENT REGISTRATION

TABLE 3 ELECTRIC TRACTION MOTOR MARKET: INNOVATIONS AND PATENT REGISTRATIONS

6 ELECTRIC TRACTION MOTOR MARKET, BY TYPE (Page No. - 63)

6.1 INTRODUCTION

FIGURE 24 MARKET, BY TYPE, 2021

TABLE 4 MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 5 MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.2 AC

6.2.1 HIGH EFFICIENCY AND LOW MANUFACTURING COST EXPECTED TO FUEL DEMAND FOR AC MOTORS

TABLE 6 AC: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 7 AC: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 DC

6.3.1 OPERATIONAL BENEFITS SUCH AS LOW NOISE AND LESS MAINTENANCE TO RAISE DEMAND FOR DC MOTORS

TABLE 8 DC: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 9 DC: MARKET, BY REGION, 2020–2027 (USD MILLION)

7 ELECTRIC TRACTION MOTOR MARKET, BY POWER RATING (Page No. - 67)

7.1 INTRODUCTION

FIGURE 25 MARKET, BY POWER RATING, 2021

TABLE 10 MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 11 MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

7.2 BELOW 200 KW

7.2.1 DEMAND FROM ELECTRIC VEHICLES, ELEVATORS, AND LIGHT RAIL TRANSIT SYSTEMS TO AMPLIFY SEGMENT DEMAND

TABLE 12 BELOW 200 KW: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 13 BELOW 200 KW: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 200–400 KW

7.3.1 DEMAND FROM METRO SYSTEMS, HIGH-SPEED TRAINS, AND SUBWAY TRAINS TO BOOST SEGMENT GROWTH

TABLE 14 200–400 KW: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 15 200–400 KW: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.4 ABOVE 400 KW

7.4.1 INCREASING RATE OF URBANIZATION AND GROWING POPULATION TO RAISE DEMAND FOR ABOVE 400 KW MOTORS

TABLE 16 ABOVE 400 KW: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 ABOVE 400 KW: MARKET, BY REGION, 2020–2027 (USD MILLION)

8 ELECTRIC TRACTION MOTOR MARKET, BY APPLICATION (Page No. - 73)

8.1 INTRODUCTION

FIGURE 26 MARKET, BY APPLICATION, 2021

TABLE 18 MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 19 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 RAILWAYS

8.2.1 INCREASED RELIANCE OF RAILWAY INDUSTRY ON ELECTRIC TRACTION MOTORS FOR HIGH EFFICIENCY AND LOW MAINTENANCE COST TO DRIVE MARKET

8.2.1.1 Locomotives

8.2.1.1.1 Diesel locomotives

8.2.1.1.2 Electric locomotives

8.2.1.1.3 Diesel-electric locomotives

8.2.1.2 Rapid transit vehicles

8.2.1.2.1 Diesel multiple units

8.2.1.2.2 Electric multiple units

8.2.1.2.3 Light rail vehicles

8.2.1.2.4 Metro and subway trains

8.2.1.3 Railroad cars

8.2.1.3.1 Passenger coaches

8.2.1.3.2 Freight wagons

TABLE 20 RAILWAYS: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 RAILWAYS: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 ELECTRIC VEHICLES

8.3.1 INCREASING NUMBER OF ELECTRIC VEHICLES WORLDWIDE TO LEAD TO HIGHER DEMAND FOR EFFICIENT TRACTION MOTORS

8.3.1.1 Hybrid Electric Vehicles (HEVs)

8.3.1.2 Battery Electric Vehicles (BEVs)

8.3.1.3 Plug-in Hybrid Electric Vehicles (PHEVs)

TABLE 22 ELECTRIC VEHICLES: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 ELECTRIC VEHICLES: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.4 OTHERS

TABLE 24 OTHERS: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

9 ELECTRIC TRACTION MOTOR MARKET, BY REGION (Page No. - 80)

9.1 INTRODUCTION

FIGURE 27 ASIA PACIFIC TO DOMINATE ELECTRIC TRACTION MOTOR MARKET DURING FORECAST PERIOD

FIGURE 28 MARKET SHARE (VALUE), BY REGION, 2021

TABLE 26 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC: REGIONAL SNAPSHOT

9.2.1 BY TYPE

TABLE 28 ASIA PACIFIC: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 29 ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.2.2 BY POWER RATING

TABLE 30 ASIA PACIFIC: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 31 ASIA PACIFIC: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

9.2.3 BY APPLICATION

TABLE 32 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 33 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.4 BY COUNTRY

TABLE 34 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 35 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.2.4.1 China

9.2.4.1.1 Increasing investments in electric vehicles to meet air quality standards to contribute to market growth

TABLE 36 CHINA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 37 CHINA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 38 CHINA: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 39 CHINA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 40 CHINA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 41 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.4.2 Japan

9.2.4.2.1 Government initiatives for reinforcing transportation efficiency to create lucrative opportunities for electric traction motor market

TABLE 42 JAPAN: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 43 JAPAN: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 44 JAPAN: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 45 JAPAN: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 46 JAPAN: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 47 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.4.3 India

9.2.4.3.1 Government initiatives to upgrade existing diesel locomotives with electric models to boost electric traction motor market

TABLE 48 INDIA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 49 INDIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 50 INDIA: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 51 INDIA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 52 INDIA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 53 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.4.4 South Korea

9.2.4.4.1 Increasing investments in electric vehicles and railway projects to propel demand for electric traction motors

TABLE 54 SOUTH KOREA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 55 SOUTH KOREA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 56 SOUTH KOREA: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 57 SOUTH KOREA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 58 SOUTH KOREA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 59 SOUTH KOREA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2.4.5 Rest of Asia Pacific

TABLE 60 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 61 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 62 REST OF ASIA PACIFIC: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 63 REST OF ASIA PACIFIC: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 64 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 65 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3 EUROPE

FIGURE 30 EUROPE: REGIONAL SNAPSHOT

9.3.1 BY TYPE

TABLE 66 EUROPE: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.3.2 BY POWER RATING

TABLE 68 EUROPE: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 69 EUROPE: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

9.3.3 BY APPLICATION

TABLE 70 EUROPE: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 71 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.4 BY COUNTRY

TABLE 72 EUROPE: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.4.1 UK

TABLE 74 UK: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 75 UK: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 76 UK: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 77 UK: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 78 UK: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 79 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.4.2 Germany

9.3.4.2.1 Renewable energy capacity developments in electric vehicles to drive market

TABLE 80 GERMANY: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 81 GERMANY: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 82 GERMANY: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 83 GERMANY: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 84 GERMANY: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 85 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.4.3 Italy

9.3.4.3.1 Developments in electric car industry to drive market in Italy

TABLE 86 ITALY: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 87 ITALY: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 ITALY: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 89 ITALY: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 90 ITALY: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 91 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.4.4 France

9.3.4.4.1 Increasing investments in electric vehicle charging infrastructure to positively influence demand for electric traction motors in France

TABLE 92 FRANCE: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 93 FRANCE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 94 FRANCE: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 95 FRANCE: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 96 FRANCE: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 97 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.3.4.5 Rest of Europe

TABLE 98 REST OF EUROPE: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 99 REST OF EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 REST OF EUROPE: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 101 REST OF EUROPE: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 102 REST OF EUROPE: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 103 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4 NORTH AMERICA

9.4.1 BY TYPE

TABLE 104 NORTH AMERICA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.4.2 BY POWER RATING

TABLE 106 NORTH AMERICA: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

9.4.3 BY APPLICATION

TABLE 108 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.4 BY COUNTRY

TABLE 110 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.4.4.1 US

9.4.4.1.1 Electric vehicles segment to drive demand in US market

TABLE 112 US: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 113 US: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 114 US: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 115 US: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 116 US: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 117 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.4.2 Canada

9.4.4.2.1 Investment in electric vehicles and fuel-efficient locomotives to benefit Canadian market

TABLE 118 CANADA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 119 CANADA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 120 CANADA: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 121 CANADA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 122 CANADA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 123 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.4.4.3 Mexico

9.4.4.3.1 Rising focus on decarbonization of transport sector to support market growth in Mexico

TABLE 124 MEXICO: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 125 MEXICO: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 126 MEXICO: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 127 MEXICO: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 128 MEXICO: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 129 MEXICO: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

9.5.1 BY TYPE

TABLE 130 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 131 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.5.2 BY POWER RATING

TABLE 132 MIDDLE EAST & AFRICA: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 133 MIDDLE EAST & AFRICA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

9.5.3 BY APPLICATION

TABLE 134 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 135 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.5.4 BY COUNTRY

TABLE 136 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 137 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.5.4.1 Saudi Arabia

9.5.4.1.1 Increasing rate of traffic congestion and rising demand for better transport facilities to drive market in Saudi Arabia

TABLE 138 SAUDI ARABIA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 139 SAUDI ARABIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 140 SAUDI ARABIA: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 141 SAUDI ARABIA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 142 SAUDI ARABIA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 143 SAUDI ARABIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.5.4.2 UAE

9.5.4.2.1 Government initiatives to reduce greenhouse emissions to aid market growth in UAE

TABLE 144 UAE: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 145 UAE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 146 UAE: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 147 UAE: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 148 UAE: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 149 UAE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.5.4.3 South Africa

9.5.4.3.1 Increasing investment in railway sector to help grow market in South Africa

TABLE 150 SOUTH AFRICA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 151 SOUTH AFRICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 152 SOUTH AFRICA: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 153 SOUTH AFRICA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 154 SOUTH AFRICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 155 SOUTH AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.5.4.4 Rest of Middle East & Africa

TABLE 156 REST OF MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 157 REST OF MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 158 REST OF MIDDLE EAST & AFRICA: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 159 REST OF MIDDLE EAST & AFRICA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 160 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 161 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.6 SOUTH AMERICA

9.6.1 BY TYPE

TABLE 162 SOUTH AMERICA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 163 SOUTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.6.2 BY POWER RATING

TABLE 164 SOUTH AMERICA: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 165 SOUTH AMERICA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

9.6.3 BY APPLICATION

TABLE 166 SOUTH AMERICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 167 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.6.4 BY COUNTRY

TABLE 168 SOUTH AMERICA: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 169 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.6.4.1 Brazil

9.6.4.1.1 Robust development of transportation sector and increased demand for electric traction motors to boost Brazilian market

TABLE 170 BRAZIL: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 171 BRAZIL: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 172 BRAZIL: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 173 BRAZIL: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 174 BRAZIL: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 175 BRAZIL: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.6.4.2 Rest of South America

TABLE 176 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 177 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 178 REST OF SOUTH AMERICA: MARKET, BY POWER RATING, 2016–2019 (USD MILLION)

TABLE 179 REST OF SOUTH AMERICA: MARKET, BY POWER RATING, 2020–2027 (USD MILLION)

TABLE 180 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 181 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 134)

10.1 OVERVIEW

FIGURE 31 KEY DEVELOPMENTS IN MARKET, 2018 TO 2022

10.2 SHARE ANALYSIS OF KEY PLAYERS, 2021

TABLE 182 MARKET: DEGREE OF COMPETITION

FIGURE 32 SHARE ANALYSIS OF TOP PLAYERS IN MARKET, 2021

10.3 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 33 SEGMENTAL REVENUE ANALYSIS, 2018–2021

10.4 RECENT DEVELOPMENTS

10.4.1 DEALS

10.4.1.1 market: Deals, 2018–2022

10.4.2 OTHERS

10.4.2.1 market: Others, 2018–2022

10.5 COMPETITIVE LEADERSHIP MAPPING

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 34 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

11 COMPANY PROFILES (Page No. - 140)

11.1 KEY COMPANIES

(Business and financial overview, Products/solutions/services offered, Recent Developments, MNM view)*

11.1.1 TOSHIBA CORPORATION

TABLE 183 TOSHIBA CORPORATION: BUSINESS OVERVIEW

FIGURE 35 TOSHIBA CORPORATION: COMPANY SNAPSHOT

11.1.2 GENERAL ELECTRIC

TABLE 184 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 36 GENERAL ELECTRIC: COMPANY SNAPSHOT

11.1.3 SIEMENS

TABLE 185 SIEMENS: BUSINESS OVERVIEW

FIGURE 37 SIEMENS: COMPANY SNAPSHOT

11.1.4 AMETEK, INC.

TABLE 186 AMETEK, INC.: BUSINESS OVERVIEW

FIGURE 38 AMETEK, INC.: COMPANY SNAPSHOT

11.1.5 ABB

TABLE 187 ABB: BUSINESS OVERVIEW

FIGURE 39 ABB: COMPANY SNAPSHOT

11.1.6 EATON

TABLE 188 EATON: BUSINESS OVERVIEW

FIGURE 40 EATON: COMPANY SNAPSHOT

11.1.7 VOITH GMBH & CO. KGAA

TABLE 189 VOITH GMBH & CO. KGAA: BUSINESS OVERVIEW

FIGURE 41 VOITH GMBH & CO. KGAA: COMPANY SNAPSHOT

11.1.8 KAWASAKI HEAVY INDUSTRIES

TABLE 190 KAWASAKI HEAVY INDUSTRIES: BUSINESS OVERVIEW

FIGURE 42 KAWASAKI HEAVY INDUSTRIES: COMPANY SNAPSHOT

11.1.9 TRAKTIONSSYSTEME AUSTRIA GMBH

TABLE 191 TRAKTIONSSYSTEME AUSTRIA GMBH: BUSINESS OVERVIEW

11.1.10 MITSUBISHI ELECTRIC CORPORATION

TABLE 192 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 43 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

11.1.11 CG POWER AND INDUSTRIAL SOLUTIONS LIMITED

TABLE 193 CG POWER AND INDUSTRIAL SOLUTIONS LIMITED: BUSINESS OVERVIEW

FIGURE 44 CG POWER AND INDUSTRIAL SOLUTIONS LIMITED: COMPANY SNAPSHOT

11.1.12 CRRC CORPORATION LIMITED

TABLE 194 CRRC CORPORATION LIMITED: BUSINESS OVERVIEW

FIGURE 45 CRRC CORPORATION LIMITED: COMPANY SNAPSHOT

11.1.13 ROBERT BOSCH GMBH

TABLE 195 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 46 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

11.1.14 NIDEC CORPORATION

TABLE 196 NIDEC CORPORATION: BUSINESS OVERVIEW

FIGURE 47 NIDEC CORPORATION: COMPANY SNAPSHOT

11.1.15 WEG

TABLE 197 WEG: BUSINESS OVERVIEW

FIGURE 48 WEG: COMPANY SNAPSHOT

*Details on Business and financial overview, Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 AMERICAN TRACTION SYSTEMS

11.2.2 HITACHI INDUSTRIAL PRODUCTS, LTD.

11.2.3 HYUNDAI ROTEM

11.2.4 ŠKODA TRANSPORTATION A.S.

11.2.5 VEM GROUP

12 APPENDIX (Page No. - 182)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the electric traction motor market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as power data, industry publications, several newspaper articles, Statista Industry Journal, Factiva, and electric traction motor journal to identify and collect information useful for a technical, market-oriented, and commercial study of the electric traction motor market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The electric traction motor market comprises several stakeholders such as companies related to the industry, consulting companies in the power sector, power companies, government & research organizations, organizations, forums, alliances & associations, electric traction motor service providers, state & national energy authorities, dealers & suppliers, and vendors. The demand side of the market is characterized by the electric traction motor expenditure across regions, investments by key power companies, and maturing of the renewable energy sector. The demand is also driven by a change in rules and regulations, and active participation from environmental bodies have pushed the electric traction motor market. The supply side is characterized by the contracts & agreements, new product launches, investments & expansions, and partnerships & collaborations among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global electric traction motor market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and demand have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The application’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources..

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in electric traction motor activities.

Objectives of the Study

- To forecast and describe the electric traction motor market size, by type, power rating, application, and region, in terms of value

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To estimate the size of the market in terms of value

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, future expansions, and contributions to the overall market

- To provide post-pandemic estimation for the market and analyze the impact of the pandemic on the overall market and value chain

- To forecast the growth of the market with respect to five major regions, namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

- To analyze market opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their respective market shares and core competencies

- To analyze competitive developments such as investments & expansions, mergers & acquisitions, product launches, contracts & agreements, and joint ventures & collaborations in the electric traction motor market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Company Information

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the regions and country-specific analysis

- Further country-specific breakdown of electric vehicle subsegment in the hybrid electric vehicle, battery electric vehicle, plug-in-hybrid electric vehicle, fuel cell vehicle

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electric Traction Motor Market