Dynamic Positioning System Market Size, Share & Analysis, 2025 To 2030

Dynamic Positioning System Market by Equipment Class (Class 1, Class 2, Class 3), System (Position Reference & Tracking, Thruster & Propulsion, Power Management, DP Control, Motion & Environment Sensor), Fit, Ship Type & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

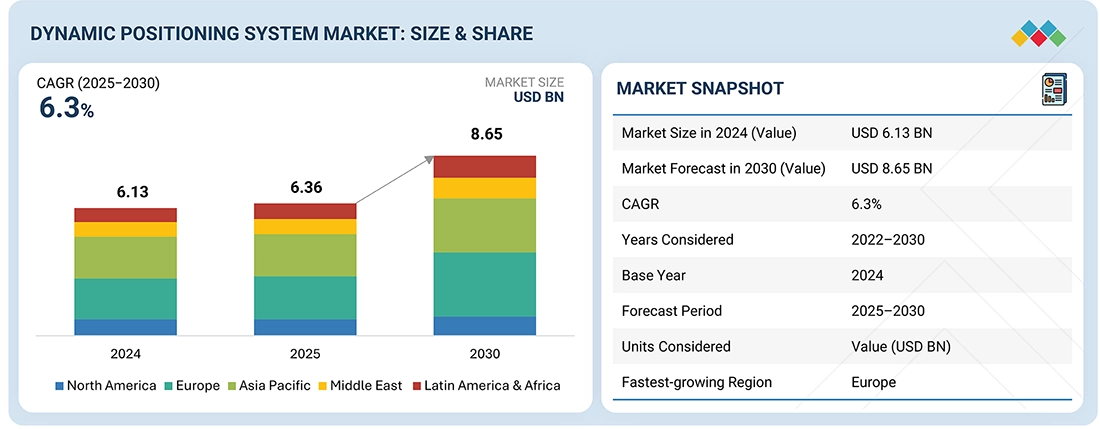

The Dynamic Positioning System Market is projected to reach USD 8.65 billion by 2030 from USD 6.36 billion in 2025, at a CAGR of 6.3% from 2025 to 2030. The growth of the dynamic positioning system market is being driven by the surge in offshore oil & gas and renewable-energy projects, which require vessels to maintain precise station-keeping under challenging deep-water and harsh-sea conditions.

KEY TAKEAWAYS

- Europe dominated the dynamic positioning system market, accounting for a 32.4% share in 2024.

- By equipment class, the class 3 segment is expected to register the highest CAGR of 8.4%.

- By system, the thruster & propulsion system segment is projected to grow at the fastest rate from 2025 to 2030.

- By fit, the retrofit segment is expected to dominate the market.

- By ship type, the military vessel segment is expected to grow at the fastest rate during the forecast period.

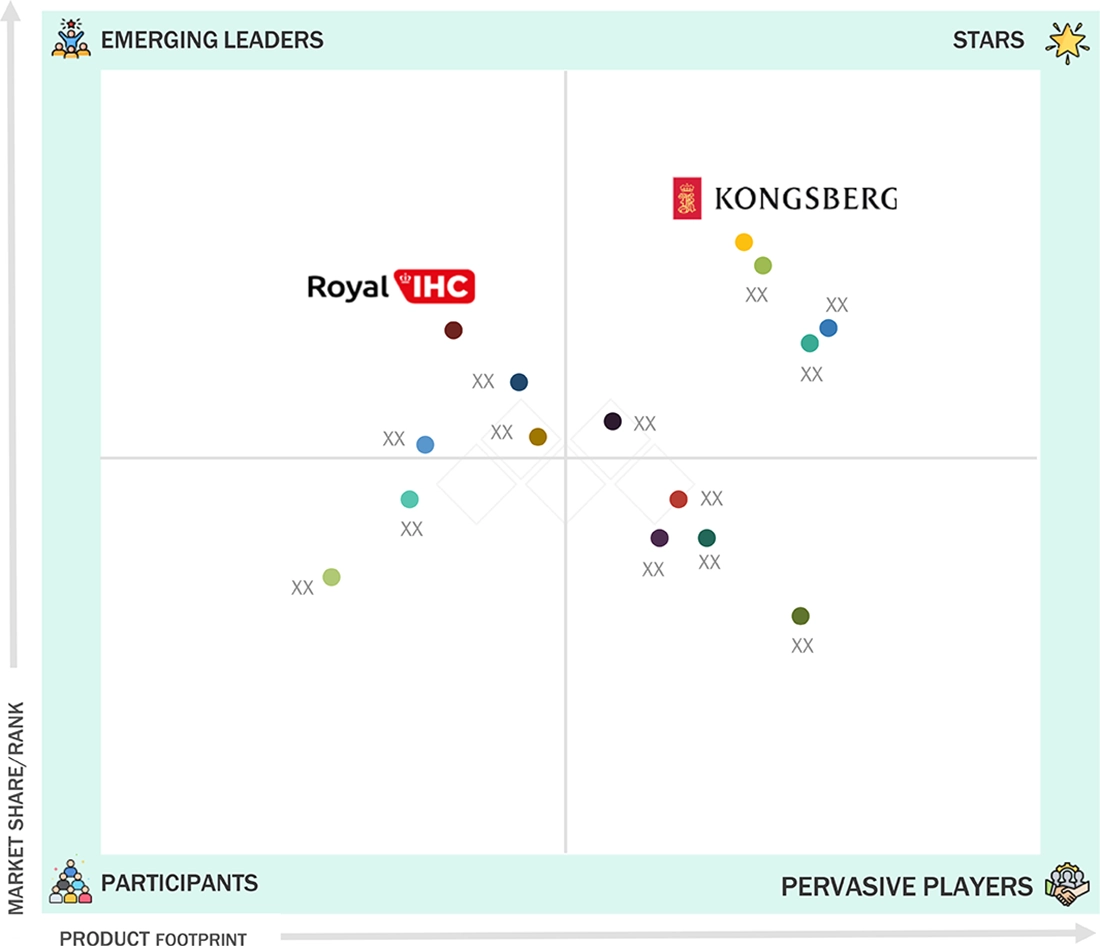

- Kongsberg Maritime, GE Vernova, and ABB were identified as star players in the dynamic positioning system market, as they have focused on innovation, offer broad industry coverage, and possess strong operational & financial strength.

- Navis Engineering, Marine Technologies LLC, and Triket Power and Automation have distinguished themselves among startups and SMEs due to their strong product portfolio and business strategy.

The Dynamic Positioning System Industry is experiencing robust expansion, fueled by the increasing deployment of offshore wind farms, autonomous surface vessels, and advanced maritime operations that demand precise station-keeping capabilities. Growing regulatory emphasis on operational safety and energy efficiency, combined with rapid advancements in AI-based control algorithms, sensor fusion, and hybrid propulsion integration, is accelerating adoption across offshore energy, defense, and research sectors. Strategic collaborations between OEMs, shipyards, and automation technology providers, alongside continuous innovations in cybersecurity and predictive maintenance, are reshaping the DP ecosystem and driving long-term market growth.

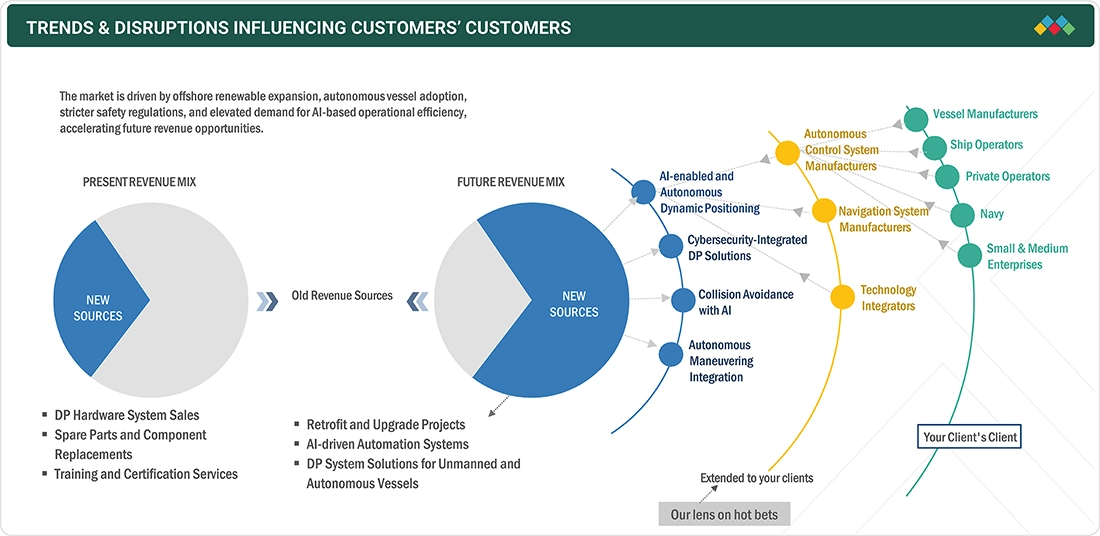

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ operations in the dynamic positioning system market is shaped by evolving offshore and maritime industry needs, increasing automation, and tightening safety and emission regulations. Offshore energy operators, marine contractors, and defense agencies are among the primary adopters of DP systems, using them to achieve precise vessel control during drilling, cabling, and research missions. The industry’s transition toward autonomous, hybrid, and energy-efficient vessels, coupled with stricter IMO compliance and digital redundancy standards, is redefining operational performance and lifecycle economics. These trends are driving sustained demand for AI-driven, cyber-secure, and energy-optimized DP solutions, reshaping both OEM strategies and end-user value creation across the global maritime ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rise of offshore oil & gas exploration and production activities

-

Expansion of offshore wind energy and renewable marine infrastructure

Level

-

High upfront cost of dynamic positioning systems

-

Regulatory compliance and periodic system audits

Level

-

Retrofitting of older vessels with modern dynamic positioning systems

-

Increased investments in coastal defense and naval modernization programs

Level

-

Interoperability across multi-vendor navigation and propulsion systems

-

Maintenance of system redundancy and fail-safe mechanisms in harsh environments

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rise of offshore oil & gas exploration and production activities

The expansion of offshore oil and gas exploration and production activities is increasing demand for advanced DP systems, enabling precise vessel positioning in deepwater and harsh environments, enhancing safety, operational efficiency, and production uptime.

Restraint: High upfront cost of dynamic positioning systems

The high upfront cost of dynamic positioning systems, driven by advanced control hardware, redundant sensors, and specialized software, poses a financial barrier for smaller operators and retrofitting projects, limiting widespread adoption across mid-tier fleets.

Opportunity: Retrofitting of older vessels with modern dynamic positioning systems

Retrofitting older vessels with modern dynamic positioning systems provides significant potential for cost-effective upgrades, extending fleet life while improving energy efficiency, automation capabilities, and compliance with evolving IMO and classification standards.

Challenge: Interoperability across multi-vendor navigation and propulsion systems

Achieving interoperability across multi-vendor navigation, propulsion, and control systems remains complex, often leading to integration issues, calibration inconsistencies, and data communication challenges during vessel upgrades or hybrid DP configurations.

Dynamic Positioning System Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Integration of digital DP control with hybrid propulsion and energy-management systems on offshore support vessels. ABB’s Ability™ Marine Pilot Control enables unified joystick-based maneuvering and automatic station-keeping through AI-based thrust allocation. | Up to 20% fuel savings via optimized load distribution. Reduced crew workload through automated control. Lower emissions and noise footprint in DP2/DP3 operations. |

|

Development of electric propulsion and power-distribution systems supporting DP redundancy standards. GE’s SeaStream™ DP integrates variable-speed drives, propulsion motors, and power-management algorithms for offshore and cruise segments. | Improved dynamic load response and power stability. Compliance with IMO DP2/DP3 redundancy. Enhanced operational reliability and lifecycle cost efficiency. |

|

Deployment of K-Pos DP systems across offshore, research, and defense vessels, integrating GNSS, gyro, MRU, and thruster control with autonomous navigation layers. Recent upgrades include AI-enabled situational awareness and remote-operation capabilities. | High-precision station-keeping (<1 m deviation). Supports autonomous and unmanned vessel control. Advanced redundancy and cybersecurity integration. |

|

Implementation of Wärtsilä NACOS Platinum DP with hybrid propulsion integration and energy-efficiency optimization. Used in offshore wind installation vessels and expedition cruise ships. | Fuel-efficient dynamic control using predictive thrust allocation. Seamless integration with voyage control and hybrid systems. Reduced emissions and operating costs. |

|

Manufacture of thruster and propulsion control systems forming the core of many DP configurations for offshore and research vessels. Brunvoll’s Integrated Propulsion & DP solutions combine tunnel, azimuth, and retractable thrusters with joystick control and redundancy management. | Superior maneuverability and precision in confined waters. Simplified integration for retrofit or newbuild projects. Improved vessel uptime and lifecycle reliability. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The dynamic positioning system market ecosystem includes OEMs such as Kongsberg, Wärtsilä, ABB, GE Vernova, and Sirehna/Naval Group that design and manufacture advanced control, propulsion, and automation systems. System integrators and shipyards like Hyundai Heavy Industries, Mitsubishi Heavy Industries, and Keppel Offshore & Marine integrate these systems into newbuild and retrofit vessels. End users including Equinor, Shell, Ørsted, and Transocean deploy DP systems to ensure precision, safety, and operational efficiency in offshore and subsea operations. Classification societies and regulators such as IMO, DNV, and ABS establish compliance and redundancy standards, fostering reliability and innovation across the global DP ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

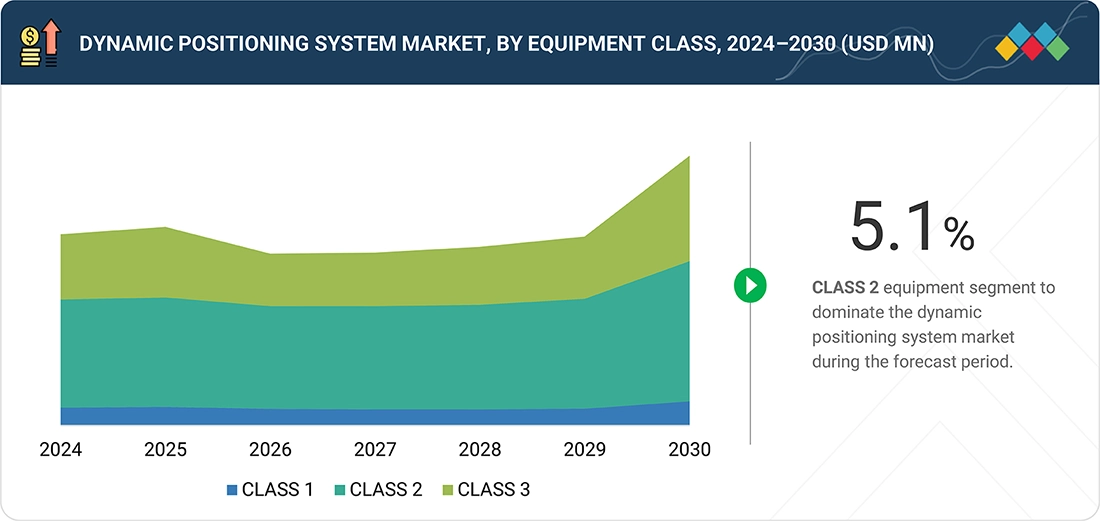

Dynamic Positioning System Market, By Equipment Class

As of 2024, class 2 held the largest share of the dynamic positioning system market and will continue leading the market through 2025 due to its widespread adoption across offshore support and subsea vessels. It offers an optimal balance between operational redundancy, cost efficiency, and compliance with IMO standards, making it the preferred choice for offshore energy, survey, and logistics applications.

Dynamic Positioning System Market, By System

As of 2024, thruster & propulsion system held the largest share of the dynamic positioning system market and will continue leading the market through 2025 due to its essential role in ensuring vessel stability, maneuverability, and precise station-keeping in harsh marine environments. Continuous advancements in hybrid thrusters and energy-efficient propulsion technology are further strengthening this segment’s dominance.

Dynamic Positioning System Market, By Fit

As of 2024, retrofit held the largest share of the dynamic positioning system market and will continue leading the market through 2025 due to increasing modernization of aging offshore and research fleets. Shipowners are prioritizing retrofitting to enhance fuel efficiency, automation, and safety compliance while reducing capital expenditure compared to newbuild DP installations.

Dynamic Positioning System Market, By Ship Type

As of 2024, commercial vessel held the largest share of the dynamic positioning system market and will continue leading the market through 2025 due to the rising use of DP systems in offshore support, cable-laying, and survey vessels. These vessels demand high precision and reliability for subsea operations, driving sustained DP integration and technological upgrades.

REGION

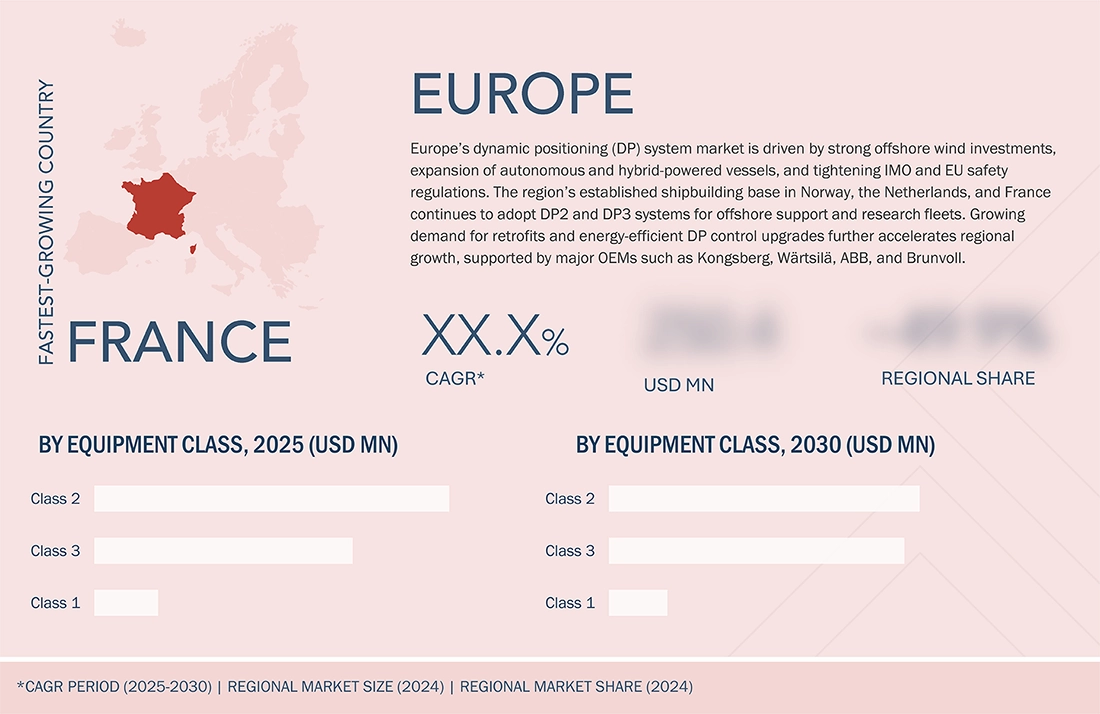

Europe to be fastest-growing region in global dynamic positioning system market during forecast period

The Europe dynamic positioning system market is expected to register the highest CAGR during the forecast period, driven by rapid offshore wind energy expansion, strong shipbuilding capabilities, and stringent IMO and EU safety regulations. Continuous investments in autonomous and hybrid vessel technologies, coupled with regional OEM leadership from Kongsberg, Wärtsilä, and ABB, are further accelerating market growth across offshore support, research, and defense segments.

Dynamic Positioning System Market: COMPANY EVALUATION MATRIX

In the dynamic positioning system market matrix, Kongsberg Maritime and Wärtsilä (Stars) lead with strong market share and broad product footprints, driven by their advanced DP automation platforms and deep integration with hybrid propulsion and energy-management systems. ABB and GE Vernova also maintain robust positions through innovations in electric propulsion, power distribution, and digital redundancy. Among emerging leaders, Royal IHC and Rolls-Royce are strengthening their positions through customized DP solutions for offshore and research applications, leveraging specialized vessel designs and automation expertise. Meanwhile, Sirehna and RH Marine exhibit strong potential to transition toward the leaders’ quadrant as their AI-driven and autonomous vessel control technologies gain wider acceptance across European and defense maritime markets.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top Dynamic Positioning System Market Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.13 Billion |

| Market Forecast in 2030 (Value) | USD 8.65 Billion |

| Growth Rate | CAGR of 6.3% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East, Latin America & Africa |

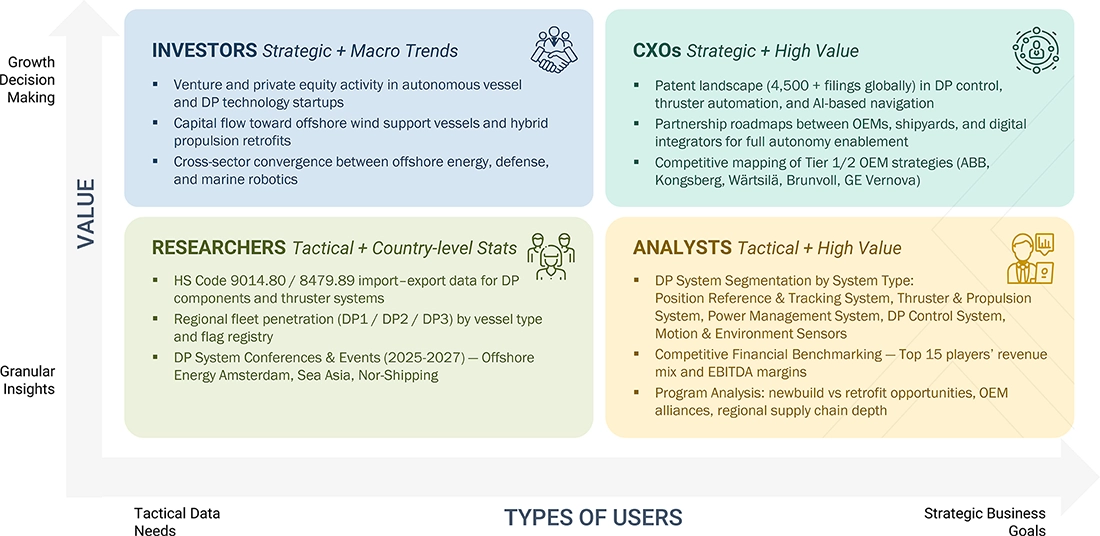

WHAT IS IN IT FOR YOU: Dynamic Positioning System Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segments covered at regional/global level to gain an understanding on market potential by each coutnry |

| Emerging Leader | Additional Company Profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for a more targeted understanding on the Total Addressable Market |

RECENT DEVELOPMENTS

- March 2025 : Furuno launched a major DP navigation-system upgrade package, delivering enhanced DP accuracy, cyber-resilience and streamlined integration geared toward offshore support and vessel operations.

- April 2025 : Kongsberg Maritime secured contract to supply an integrated equipment package—including DP-capable thrusters and hybrid power system—for a new 110 m offshore support vessel built for DOF to operate in harsh Newfoundland waters.

- October 2025 : ABB announced launch of next-generation DP control system for DP2 applications, integrating deeply into ship control architecture aimed at improving maneuvering precision and situational awareness.

Table of Contents

Methodology

The research study on the dynamic positioning system market involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, and Factiva, to identify and collect relevant information. Primary sources included industry experts from the market, as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. In-depth interviews of various primary respondents, including industry participants, subject matter experts, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the market and assess the market’s growth prospects. A deductive approach, also known as the bottom-up approach, combined with the top-down approach, was used to forecast the market size of different market segments.

Secondary Research

The share of companies in the dynamic positioning system market was determined based on secondary data made available through paid and unpaid sources and an analysis of the product portfolios of major companies. These companies were rated based on their performance and quality. These data points were further validated by primary sources. Secondary sources for this research study included corporate filings, such as annual reports, investor presentations, and financial statements from trade, business, and professional associations. The secondary data was collected and analyzed to determine the overall market size, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining critical information about the current scenario of the dynamic positioning system market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across different regions. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: Others include sales, marketing, and product managers.

The tiers of companies have been defined based on their total revenue as of 2024. Tier 1 = >USD 1 billion; tier 2 = between USD 100 million and USD 1 billion; and tier 3 = USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the dynamic positioning system market. The research methodology used to estimate the market size includes the following details.

Key players in the market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top players and extensive interviews with industry stakeholders such as CEOs, technical advisors, military experts, and subject matter experts of leading companies operating in the dynamic positioning system market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the dynamic positioning system market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Dynamic Positioning System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the dynamic positioning system market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying different factors and trends from the demand and supply sides. The dynamic positioning system market size was also validated using the top-down and bottom-up approaches.

Market Definition

The dynamic positioning system market refers to the industry focused on the development, manufacture, and integration of DP systems in various marine vessels to maintain position and heading without requiring anchors or mooring. A DP system is a computer-controlled system that uses thrusters, propulsion units, control systems, and sensor-based mechanisms to counteract external forces and maintain its navigating position.

Key Stakeholders

- System Manufacturers/OEMs

- System Integrators & Marine Engineering Firms

- Component & Sensor Suppliers

- Classification Societies & Regulatory Bodies

- Maritime Training & Certification Institutes

- Shipbuilders & Vessel Designers

- Fleet Maintenance & Retrofit Service Providers

- Maritime Cybersecurity Providers

- Vessel Operators/End Users

Report Objectives

- To define, describe, segment, and forecast the size of the dynamic positioning system market based on equipment class, system, fit, and ship type

- To forecast the sizes of various market segments within six regions: North America, Europe, Asia Pacific, the Middle East, and Latin America & Africa

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing market growth

- To provide an overview of the regulatory landscape with respect to drone detection regulations

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies

- To analyze the degree of competition in the market by identifying key growth strategies adopted by key market players, such as acquisitions, contracts, partnerships, and product launches

- To identify detailed financial positions, key products, and unique selling points of leading market players

Available Customizations

Along with the market data, MarketsandMarkets offers customizations to meet the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of market segments at the country level

Company Information

- Detailed analysis and profiling of up to five additional market players

Key Questions Addressed by the Report

- Real-time Environmental Intelligence Integration: Uses live data on weather and sea conditions to improve vessel positioning and keep it steady in changing environments.

- Multi-Sensor Fusion and Positioning Redundancy: Combines data from different sensors to make sure the vessel stays in the right position, even if one sensor fails.

- Digital Twin: Creates a virtual version of the vessel to simulate and monitor how it works, helping improve operations and predict when repairs are needed.

- Condition-Based Monitoring: Tracks the performance of important systems on the vessel to make sure maintenance is done before issues arise.

- Remote and Autonomous DP Capabilities: Lets vessels operate on their own or be controlled from a distance, making them safer and more efficient while reducing the need for crew onboard.

- Rise of offshore oil & gas exploration and production activities

- Expansion of offshore wind energy and renewable marine infrastructure

- Rapid adoption of autonomous and smart marine technologies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Dynamic Positioning System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Dynamic Positioning System Market