TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 48)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 MARKETS COVERED

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 USD EXCHANGE RATES

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 53)

2.1 RESEARCH DATA

2.1.1 RESEARCH FLOW

FIGURE 2 RESEARCH DESIGN

2.2 RESEARCH DATA

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Key industry insights

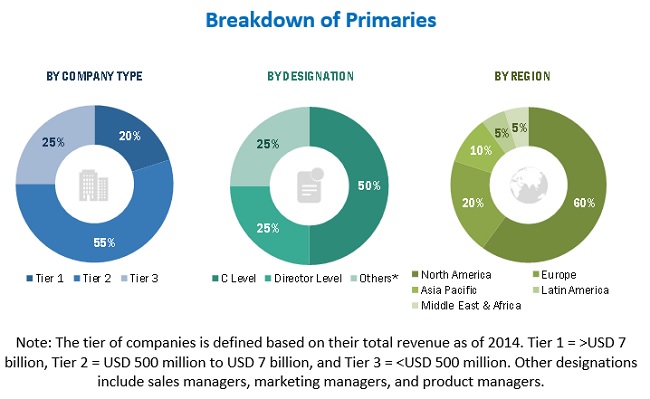

2.2.2.3 Breakdown of primaries

2.3 FACTOR ANALYSIS

2.3.1 INTRODUCTION

2.3.2 DEMAND-SIDE ANALYSIS

2.3.2.1 Increasing demand for situational awareness in vessels

2.3.3 SUPPLY-SIDE ANALYSIS

2.3.3.1 Increasing software development

2.3.3.2 Development of next-generation autonomous ships

2.4 MARKET DEFINITION & SCOPE

2.5 SEGMENTS AND SUBSEGMENTS

2.6 MARKET-SIZE ESTIMATION

2.6.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.6.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.7 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.8 GROWTH RATE ASSUMPTIONS

2.9 RESEARCH ASSUMPTIONS & LIMITATIONS

2.9.1 ASSUMPTIONS

2.9.2 RISKS

2.10 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 65)

FIGURE 6 PARTIAL AUTOMATION SEGMENT EXPECTED TO LEAD INTEGRATED MARINE AUTOMATION SYSTEM MARKET FROM 2020 TO 2025

FIGURE 7 COMMERCIAL SEGMENT LED INTEGRATED MARINE AUTOMATION SYSTEMS MARKET IN 2020

FIGURE 8 VESSEL MANAGEMENT SYSTEM SEGMENT PROJECTED TO LEAD INTEGRATED MARINE AUTOMATION SYSTEMS MARKET DURING FORECAST PERIOD

FIGURE 9 ASIA PACIFIC ACCOUNTED FOR THE LARGEST SHARE OF INTEGRATED MARINE AUTOMATION SYSTEMS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 68)

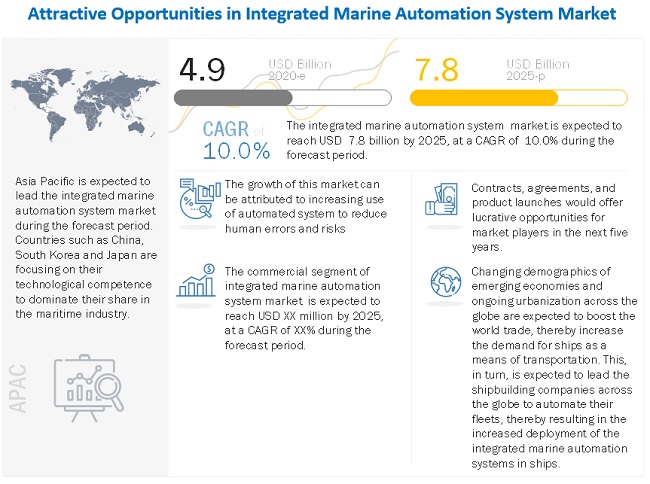

4.1 ATTRACTIVE OPPORTUNITIES IN INTEGRATED MARINE AUTOMATION SYSTEM MARKET

FIGURE 10 INCREASING INVESTMENTS DRIVE THE INTEGRATED MARINE AUTOMATION SYSTEMS MARKET

4.2 INTEGRATED MARINE AUTOMATION SYSTEM MARKET, BY SHIP TYPE

FIGURE 11 COMMERCIAL SEGMENT PROJECTED TO DOMINATE INTEGRATED MARINE AUTOMATION SYSTEMS MARKET DURING FORECAST PERIOD

4.3 INTEGRATED MARINE AUTOMATION SYSTEMS MARKET, BY END USER

FIGURE 12 OEM SEGMENT EXPECTED TO LEAD INTEGRATED MARINE AUTOMATION SYSTEMS MARKET DURING FORECAST PERIOD

4.4 INTEGRATED MARINE AUTOMATION SYSTEMS MARKET, BY COUNTRY

FIGURE 13 INTEGRATED MARINE AUTOMATION SYSTEM MARKET IN FRANCE EXPECTED TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 71)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 INTEGRATED MARINE AUTOMATION SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Adoption of the internet of things (IoT) for real-time decision making

5.2.1.2 Increasing software development

5.2.1.3 Increasing use of automated systems to reduce human errors and risks

5.2.1.4 Increased budgets of shipping companies for the incorporation of ICT in vessels

5.2.1.5 Increasing demand for situational awareness in vessels

5.2.2 RESTRAINTS

5.2.2.1 Vulnerability associated with cyber threats

FIGURE 15 POTENTIAL CYBERATTACK ROUTES FOR MARINE VESSELS

5.2.3 OPPORTUNITIES

5.2.3.1 Development of new port cities in emerging economies

5.2.3.2 Initiatives for the development of autonomous ships

TABLE 2 TIMELINE AND DESIGN DEVELOPMENT TARGETS FOR AUTONOMOUS SHIPS

5.2.3.3 Revision and formulation of marine safety regulations in several countries

5.2.3.4 Advancement in sensor technologies for improved navigation systems in vessels

5.2.3.5 Development of propulsion systems

5.2.4 CHALLENGES

5.2.4.1 Cost-intensive customization of marine automation systems

5.2.4.2 Lack of skilled personnel to handle and operate marine automation systems

5.2.4.3 Lack of common standards for data generated from different subsystems in a ship

5.3 RANGE/SCENARIOS

FIGURE 16 IMPACT OF COVID-19 ON INTEGRATED MARINE AUTOMATION SYSTEM MARKET: GLOBAL SCENARIOS

5.4 COVID-19 IMPACT ON INTEGRATED MARINE AUTOMATION SYSTEMS MARKET

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR INTEGRATED MARINE AUTOMATION SYSTEM MARKET

FIGURE 17 REVENUE SHIFT IN INTEGRATED MARINE AUTOMATION SYSTEMS MARKET

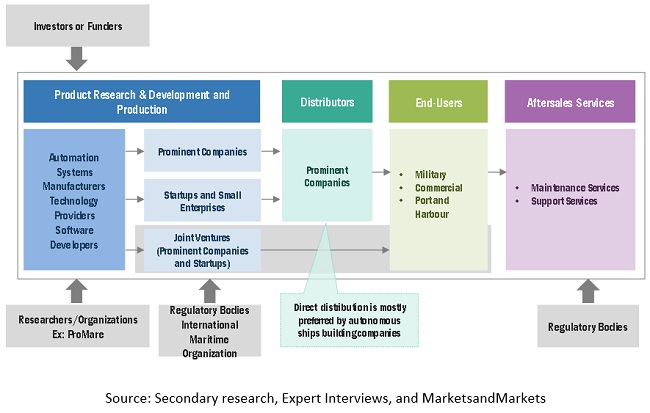

5.6 MARKET ECOSYSTEM

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 END USERS

FIGURE 18 MARKET ECOSYSTEM MAP: INTEGRATED MARINE AUTOMATION SYSTEM MARKET

5.7 PRICING ANALYSIS

FIGURE 19 PRICING ANALYSIS– BY SHIP TYPE

5.8 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS: INTEGRATED MARINE AUTOMATION SYSTEM MARKET

5.9 TARIFF REGULATORY LANDSCAPE FOR AUTOMATION IN MARINE INDUSTRY

5.10 TRADE DATA

5.10.1 INTERNATIONAL MARITIME TRADE DATA, 2010-2019

FIGURE 21 DEVELOPMENT OF INTERNATIONAL MARITIME TRADE, (2010–2019)

5.10.2 WORLD SEA-BORNE TRADE, 2015-2019

TABLE 3 WORLD SEABORNE TRADE, 2015-2019

5.11 PORTER’S FIVE FORCES MODEL

5.12 TECHNOLOGY ANALYSIS

5.12.1 BIG DATA

5.12.2 INTEGRATED AUTOMATION SYSTEM

5.12.3 PREDICTIVE MAINTENANCE

5.12.4 COLLISION AVOIDANCE TOOL

5.13 USE CASES

5.13.1 AUTONOMOUS CONTROL AND REMOTE COMMAND SYSTEMS

5.13.2 LNG POWERED OPEN SEA FERRY

5.13.3 AI-BASED SYSTEMS OF ROLLS-ROYCE

5.14 OPERATIONAL DATA

TABLE 4 GLOBAL SHIP ORDERS COMPLETION, 2015-2020

TABLE 5 SHIP ORDERS COMPLETION, BY JAPAN, 2015-2020

TABLE 6 SHIP ORDERS COMPLETION, BY SOUTH KOREA, 2015-2020

TABLE 7 SHIP ORDERS COMPLETION, BY CHINA, 2015-2020

TABLE 8 SHIP ORDERS COMPLETION, BY EUROPE, 2015-2020

6 INDUSTRY TRENDS (Page No. - 91)

6.1 INTRODUCTION

6.2 TECHNOLOGY ROADMAP

FIGURE 22 TECHNOLOGY ROADMAP

6.3 TECHNOLOGICAL ADVANCEMENTS IN THE MARINE INDUSTRY

6.3.1 ARTIFICIAL INTELLIGENCE

6.3.2 BIG DATA ANALYTICS

6.3.3 INTERNET OF THINGS (IOT)

6.3.4 AUGMENTED REALITY

6.3.5 PREDICTIVE MAINTENANCE

6.4 TECHNOLOGY TRENDS

6.4.1 DIGITAL MARINE AUTOMATION SYSTEM (DBS)

6.4.1.1 Conning system

6.4.1.2 Autopilot

6.4.1.3 Mooring control and monitoring system

6.4.1.4 Automated radar plotting aid/navigation radar servers (NRS)

6.4.1.5 Electronic chart display and information system (ECDIS)

6.4.1.6 Communication system

6.4.1.7 Voyage data recorder

6.4.1.8 Decision support system

6.4.2 SENSOR FUSION SOLUTIONS

6.4.3 CONTROL ALGORITHMS

6.5 INNOVATIONS AND PATENT REGISTRATIONS, 2012-2020

TABLE 9 INNOVATIONS AND PATENT REGISTRATIONS

7 INTEGRATED MARINE AUTOMATION SYSTEM MARKET, BY AUTONOMY (Page No. - 98)

7.1 INTRODUCTION

FIGURE 23 INTEGRATED MARINE AUTOMATION SYSTEM MARKET, BY AUTONOMY, 2020 & 2025 (USD MILLION)

TABLE 10 MARKET SIZE, BY AUTONOMY, 2016-2019 (USD MILLION)

TABLE 11 MARKET SIZE, BY AUTONOMY, 2020-2025 (USD MILLION)

7.2 PARTIAL AUTOMATION

7.2.1 INCREASING DEMAND FOR ONBOARD AUTOMATION SYSTEMS IS EXPECTED TO DRIVE THIS SEGMENT

TABLE 12 PARTIALLY AUTOMATED INTEGRATED MARINE SYSTEM MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 13 PARTIALLY AUTOMATED INTEGRATED MARINE SYSTEM MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

7.3 REMOTELY- OPERATED

7.3.1 INCREASING INVESTMENTS IN REMOTELY-OPERATED SHIPS IS EXPECTED TO DRIVE THIS SEGMENT

TABLE 14 REMOTELY-OPERATED INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 15 REMOTELY-OPERATED MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

7.4 AUTONOMOUS

7.4.1 INCREASING INVESTMENTS ON DEVELOPING AUTONOMOUS SHIPS IS EXPECTED TO FUEL THIS SEGMENT

TABLE 16 AUTONOMOUS INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY REGION,2016-2019 (USD MILLION)

TABLE 17 AUTONOMOUS MARKET SIZE, BY REGION,2020-2025 (USD MILLION)

8 INTEGRATED MARINE AUTOMATION SYSTEM MARKET, BY SOLUTION (Page No. - 103)

8.1 INTRODUCTION

FIGURE 24 INTEGRATED MARINE AUTOMATION SYSTEM MARKET, BY SOLUTION, 2020 & 2025

TABLE 18 MARKET SIZE, BY SOLUTION, 2016-2019 (USD MILLION)

TABLE 19 MARKET SIZE, BY SOLUTION, 2020-2025 (USD MILLION)

8.2 PRODUCTS

8.2.1 INCREASING INVESTMENT IN AUTOMATED PROCESS IS DRIVING THE GROWTH OF THE SEGMENT

TABLE 20 INTEGRATED MARINE AUTOMATION PRODUCTS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 21 INTEGRATED MARINE AUTOMATION PRODUCTS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 22 INTEGRATED MARINE AUTOMATION PRODUCTS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 23 INTEGRATED MARINE AUTOMATION PRODUCTS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

8.2.1.1 Hardware

8.2.1.1.1 Displays

8.2.1.1.2 Control unit

8.2.1.1.3 Data storage devices

8.2.1.1.4 Sensors

8.2.1.1.5 Alarms

8.2.1.1.6 Others

TABLE 24 HARDWARE: INTEGRATED MARINE AUTOMATION PRODUCTS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 25 HARDWARE: INTEGRATED MARINE AUTOMATION PRODUCTS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

8.2.1.2 Software

8.2.1.2.1 Analytical software

8.2.1.2.2 Monitoring software

TABLE 26 SOFTWARE: INTEGRATED MARINE AUTOMATION PRODUCTS MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 27 SOFTWARE: INTEGRATED MARINE AUTOMATION PRODUCTS MARKET, BY TYPE, 2020-2025 (USD MILLION)

8.2.1.3 Datalink & connectivity

8.2.1.3.1 Open platform communications (OPC)

8.2.1.3.2 Open database connectivity (ODBC)

8.2.1.3.3 Controller area network (CAN)

8.2.1.3.4 Process field bus (PROFIBUS)

8.2.1.3.5 Modular digital controller (MODCON)

8.3 SERVICES

8.3.1 SERVICES ARE ESSENTIAL FOR SMOOTH FUNCTIONING OF SYSTEM

TABLE 28 INTEGRATED MARINE AUTOMATION SERVICES MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 29 INTEGRATED MARINE AUTOMATION SERVICES MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

8.3.1.1 Maintenance services

8.3.1.2 Support services

9 INTEGRATED MARINE AUTOMATION SYSTEM MARKET, BY SHIP TYPE (Page No. - 111)

9.1 INTRODUCTION

9.1.1 IMPACT OF COVID-19 ON SHIP TYPE

9.1.1.1 Most impacted segment, By ship type

9.1.1.2 Least impacted segment, By ship type

FIGURE 25 INTEGRATED MARINE AUTOMATION SYSTEMS MARKET, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 30 MARKET, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 31 MARKET, BY SHIP TYPE, 2020–2025 (USD MILLION)

9.2 COMMERCIAL

TABLE 32 INTEGRATED MARINE AUTOMATION SYSTEM MARKET FOR COMMERCIAL SHIPS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 33 MARKET FOR COMMERCIAL SHIPS, BY TYPE, 2020–2025 (USD MILLION)

9.2.1 CARGO VESSELS

TABLE 34 MARKET FOR CARGO VESSELS, BY TYPE, 2016-2019 (USD MILLION)

TABLE 35 MARKET FOR CARGO VESSELS, BY TYPE, 2020–2025 (USD MILLION)

9.2.1.1 Bulk carriers

9.2.1.1.1 China is expected to witness demand for integrated marine automation systems

9.2.1.2 Dry Cargo

9.2.1.2.1 Increasing growth of dry cargo ships is expected to fuel the market

9.2.1.3 Tankers

9.2.1.3.1 Rising demand for oil tankers to transport LNG is expected to drive the demand for tankers

9.2.1.4 Gas tankers

9.2.1.4.1 Increasing transportation of LPG and LNG tankers expected to fuel the growth of the market

9.2.2 PASSENGER VESSELS

TABLE 36 INTEGRATED MARINE AUTOMATION SYSTEM MARKET FOR PASSENGER VESSELS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 37 MARKET FOR PASSENGER VESSELS, BY TYPE, 2020–2025 (USD MILLION)

9.2.2.1 Yachts

9.2.2.1.1 Growing demand for automation systems in yachts is expected to drive the growth of the market

9.2.2.2 Ferries

9.2.2.2.1 Rapid advancements in automation would lead to increase the need for retrofitting ferries

9.2.2.3 Cruises

9.2.2.3.1 Increased automation in cruise ships expected to drive the adoption of integrated marine automation systems

9.2.3 OTHERS

TABLE 38 INTEGRATED MARINE AUTOMATION SYSTEM MARKET FOR OTHER COMMERCIAL SHIPS, BY TYPE, 2016-2019 (USD MILLION)

TABLE 39 MARKET FOR OTHER COMMERCIAL SHIPS, BY TYPE, 2020-2025 (USD MILLION)

9.2.3.1 Fishing vessels

9.2.3.1.1 Rising demand for next-generation fishing vessels expected to have a positive impact on the growth of the market

9.2.3.2 Dredgers

9.2.3.2.1 Dredgers are increasingly used to remove contamination from the seabed

9.2.3.3 Research vessels

9.2.3.3.1 Wide applications drive the demand for research vessels

9.3 DEFENSE

TABLE 40 INTEGRATED MARINE AUTOMATION SYSTEM MARKET FOR DEFENSE SHIPS, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 41 MARKET FOR DEFENSE SHIPS, BY SHIP TYPE, 2020–2025 (USD MILLION)

9.3.1 Destroyers

9.3.1.1 Increasing procurement of destroyers by countries such as the US and China expected to drive this segment

9.3.2 Frigates

9.3.1.2 Rising demand for construction and maintenance of frigates in coming years is fueling the market

9.3.3 Corvettes

9.3.1.3 Increasing focus of China on strengthening naval security by induction of advanced corvettes by 2030 will drive this segment

9.3.4 Submarines

9.3.1.4 China, the US, and India are working to develop advanced submarines, and this will drive the demand for integrated marine automated systems

9.3.5 Aircraft carriers

9.3.1.5 Countries such as India, the US, and China are constructing advanced aircraft carriers for strengthening their naval fleet

9.3.6 Amphibious ships

9.3.1.6 Increase in the orders of amphibious ships is expected to fuel the growth of the market

9.4 UNMANNED

TABLE 42 INTEGRATED MARINE AUTOMATION SYSTEM MARKET FOR UNMANNED VEHICLES, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 MARKET FOR UNMANNED VEHICLES, BY REGION, 2020–2025 (USD MILLION)

9.4.1 Unmanned underwater vehicles (UUV)

9.4.1.1 Remotely-operated vehicle (ROV)

9.4.1.2 Remotely-operated vehicle (ROV)

9.4.1.3 Autonomous underwater vehicle (AUV)

9.4.2 Unmanned surface vehicle (USV)

9.4.2.1 Remotely-operated surface vehicle (RSV)

9.4.2.2 Autonomous surface vehicles (ASV)

10 INTEGRATED MARINE AUTOMATION SYSTEM MARKET, BY END USER (Page No. - 124)

10.1 INTRODUCTION

10.1.1 IMPACT OF COVID-19 ON END USER

10.1.1.1 MOST IMPACTED END USER

10.1.1.2 LEAST IMPACTED END USER

FIGURE 26 INTEGRATED MARINE AUTOMATION SYSTEM MARKET, BY END USER, 2020 & 2025

TABLE 44 MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 45 MARKET SIZE, BY END USER, 2020-2025 (USD MILLION)

10.2 OEM

10.2.1 INCREASING INSTALLATION OF ADVANCED AUTOMATION SYSTEMS IN SHIPS IS EXPECTED TO DRIVE THE MARKET

TABLE 46 INTEGRATED MARINE AUTOMATION SYSTEM OEM MARKET, BY REGION, 2016-2019 (USD MILLION)

TABLE 47 INTEGRATED MARINE AUTOMATION SYSTEM OEM MARKET, BY REGION, 2020-2025 (USD MILLION)

10.3 AFTERMARKET

10.3.1 MAINTENANCE AND REPAIR SERVICES OF SYSTEMS IS EXPECTED TO DRIVE THE GROWTH OF THIS SEGMENT

TABLE 48 INTEGRATED MARINE AUTOMATION SYSTEM AFTERMARKET, BY REGION, 2016-2019 (USD MILLION)

TABLE 49 INTEGRATED MARINE AUTOMATION SYSTEM AFTERMARKET, BY REGION, 2020-2025 (USD MILLION)

11 INTEGRATED MARINE AUTOMATION SYSTEM MARKET, BY SYSTEM (Page No. - 129)

11.1 INTRODUCTION

FIGURE 27 MARKET, BY SYSTEM, 2020-2025

TABLE 50 MARKET SIZE, BY SYSTEM, 2016-2019 (USD MILLION)

TABLE 51 MARKET SIZE, BY SYSTEM, 2020-2025 (USD MILLION)

11.2 POWER MANAGEMENT SYSTEM

11.2.1 POWER MANAGEMENT SYSTEM IS RESPONSIBLE FOR CONTROLLING THE PERFORMANCE OF VESSELS ENGINES

11.2.1.1 Engine monitoring and control system

11.2.1.2 Power distribution management

11.2.1.3 Diesel generator monitoring (DGMS)

TABLE 52 INTEGRATED MARINE AUTOMATION POWER MANAGEMENT SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 53 INTEGRATED MARINE AUTOMATION POWER MANAGEMENT SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

11.3 VESSEL MANAGEMENT SYSTEM

11.3.1 USE OF ADVANCED TECHNOLOGICAL EQUIPMENT TO MONITOR THE VESSELS

11.3.1.1 Machinery management system

11.3.1.2 Alarm monitoring system

11.3.1.3 Ballast water management system

11.3.1.4 Propulsion control system

11.3.1.5 Remote monitoring system

11.3.1.6 Dynamic positioning system

11.3.1.7 Security management system

11.3.1.8 Thrust control system

11.3.1.9 Information management system

TABLE 54 INTEGRATED MARINE AUTOMATION VESSEL MANAGEMENT SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 55 INTEGRATED MARINE AUTOMATION VESSEL MANAGEMENT SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

11.4 PROCESS CONTROL SYSTEM

11.4.1 COMMUNICATION IS ENABLE DUE TO PROCESS CONTROL SYSTEM

11.4.1.1 HVAC control

11.4.1.2 Drilling driver control system

TABLE 56 INTEGRATED MARINE AUTOMATION PROCESS CONTROL SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 57 INTEGRATED MARINE AUTOMATION PROCESS CONTROL SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

11.5 SAFETY SYSTEM

11.5.1 SAFETY SYSTEM ENSURE SAFETY OF THE SHIP AND MARINE ENVIRONMENT

11.5.1.1 Fire protection system

11.5.1.2 Emergency shutdown system

TABLE 58 INTEGRATED MARINE AUTOMATION SAFETY SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 59 INTEGRATED MARINE AUTOMATION SAFETY SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

12 REGIONAL ANALYSIS (Page No. - 137)

12.1 INTRODUCTION

12.2 GLOBAL SCENARIOS OF INTEGRATED MARINE AUTOMATION SYSTEM MARKET

FIGURE 28 GLOBAL SCENARIOS OF INTEGRATED MARINE AUTOMATION SYSTEMS MARKET

FIGURE 29 ASIA PACIFIC ACCOUNTED FOR THE LARGEST SHARE OF THE INTEGRATED MARINE AUTOMATION SYSTEMS MARKET IN 2020

TABLE 60 INTEGRATED MARINE AUTOMATION SYSTEMS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 61 INTEGRATED MARITIME AUTOMATION SYSTEM MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

12.3 NORTH AMERICA

12.3.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 30 NORTH AMERICA INTEGRATED MARINE AUTOMATION SYSTEM MARKET SNAPSHOT

TABLE 62 NORTH AMERICA MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY AUTONOMY, 2016–2019 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY AUTONOMY, 2020–2025 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 68 NORTH AMERICA: INTEGRATED MARINE AUTOMATION PRODUCTS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 69 NORTH AMERICA: INTEGRATED MARINE AUTOMATION PRODUCTS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 70 NORTH AMERICA: INTEGRATED MARINE AUTOMATION HARDWARE PRODUCTS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 71 NORTH AMERICA: INTEGRATED MARINE AUTOMATION HARDWARE PRODUCTS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 72 NORTH AMERICA: INTEGRATED MARINE AUTOMATION SOFTWARE PRODUCTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 73 NORTH AMERICA: INTEGRATED MARINE AUTOMATION SOFTWARE PRODUCTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 75 NORTH AMERICA: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 78 NORTH AMERICA: POWER MANAGEMENT SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 79 NORTH AMERICA: POWER MANAGEMENT SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 80 NORTH AMERICA: VESSEL MANAGEMENT SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 81 NORTH AMERICA: VESSEL MANAGEMENT SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 82 NORTH AMERICA: PROCESS CONTROL SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 83 NORTH AMERICA: PROCESS CONTROL SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 84 NORTH AMERICA: SAFETY SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 85 NORTH AMERICA: SAFETY SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 87 NORTH AMERICA: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

12.3.1.1 US

12.3.1.1.1 Increase in naval shipbuilding in the country is driving the growth of the market

TABLE 88 US: INTEGRATED MARINE AUTOMATION SYSTEMS MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 89 US: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 90 US: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 91 US: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 92 US: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 93 US: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

12.3.1.2 Canada

12.3.1.2.1 Increased international maritime trade expected to drive the market in this country

TABLE 94 CANADA: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 95 CANADA: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 96 CANADA: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 97 CANADA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 98 CANADA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 99 CANADA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

12.4 EUROPE

12.4.1 PESTLE ANALYSIS: EUROPE

FIGURE 31 EUROPE INTEGRATED MARINE AUTOMATION SYSTEM MARKET SNAPSHOT

TABLE 100 EUROPE: MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY AUTONOMY, 2016–2019 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY AUTONOMY, 2020–2025 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 106 EUROPE: INTEGRATED MARINE AUTOMATION PRODUCTS MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 107 EUROPE: INTEGRATED MARINE AUTOMATION PRODUCTS MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 108 EUROPE: INTEGRATED MARINE AUTOMATION HARDWARE PRODUCTS MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 109 EUROPE: INTEGRATED MARINE AUTOMATION HARDWARE PRODUCTS MARKET, 2020-2025 (USD MILLION)

TABLE 110 EUROPE: INTEGRATED MARINE AUTOMATION SOFTWARE PRODUCTS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 111 EUROPE: INTEGRATED MARINE AUTOMATION SOFTWARE PRODUCTS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 112 EUROPE: INTEGRATED MARINE AUTOMATION SYSTEMS MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 116 EUROPE: POWER MANAGEMENT SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 117 EUROPE: POWER MANAGEMENT SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 118 EUROPE: VESSEL MANAGEMENT SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 119 EUROPE: VESSEL MANAGEMENT SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 120 EUROPE: PROCESS CONTROL SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 121 EUROPE: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY PROCESS CONTROL SYSTEM, 2020-2025 (USD MILLION)

TABLE 122 EUROPE: SAFETY SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 123 EUROPE: SAFETY SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2030 (USD MILLION)

12.4.1.1 UK

12.4.1.1.1 Increasing investment in the upgradation of marine systems is expected to drive the market in the UK

TABLE 126 UK: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 127 UK: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 128 UK: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 129 UK: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 130 UK: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 131 UK: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

12.4.1.2 Germany

12.4.1.2.1 Upgradation of the system will boost the demand for integrated marine automation systems in Germany

TABLE 132 GERMANY: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 133 GERMANY: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 134 GERMANY: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 135 GERMANY: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 136 GERMANY: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 137 GERMANY: MARKET SIZE, BY USER, 2020–2025 (USD MILLION)

12.4.1.3 France

12.4.1.3.1 Increasing requirement of naval vessels is expected to drive the market in France

TABLE 138 FRANCE: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 139 FRANCE: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 140 FRANCE: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 141 FRANCE: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 142 FRANCE: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 143 FRANCE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

12.4.1.4 Russia

12.4.1.4.1 Introduction of automation technologies in naval ships will boost the demand for the market in Russia

TABLE 144 RUSSIA: INTEGRATED MARINE AUTOMATION SYSTEMS MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 145 RUSSIA: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 146 RUSSIA: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 147 RUSSIA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 148 RUSSIA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 149 RUSSIA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

12.4.1.5 Italy

12.4.1.5.1 Retrofitting of advanced technologies in vessels is driving the growth of the market in Italy

TABLE 150 ITALY: INTEGRATED MARINE AUTOMATION SYSTEMS MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 151 ITALY: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 152 ITALY: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 153 ITALY: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 154 ITALY: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 155 ITALY: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

12.4.1.6 Turkey

12.4.1.6.1 Increasing demand for merchant & naval ships is driving the demand for integrated marine automation system in Turkey

TABLE 156 TURKEY: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 157 TURKEY: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 158 TURKEY: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 159 TURKEY: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 160 TURKEY: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 161 TURKEY: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

12.4.1.7 Rest of Europe

12.4.1.7.1 Increasing investment in automation systems in European countries would drive the market

TABLE 162 REST OF EUROPE: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 163 REST OF EUROPE: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 164 REST OF EUROPE: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 165 REST OF EUROPE: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 166 REST OF EUROPE: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 167 REST OF EUROPE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

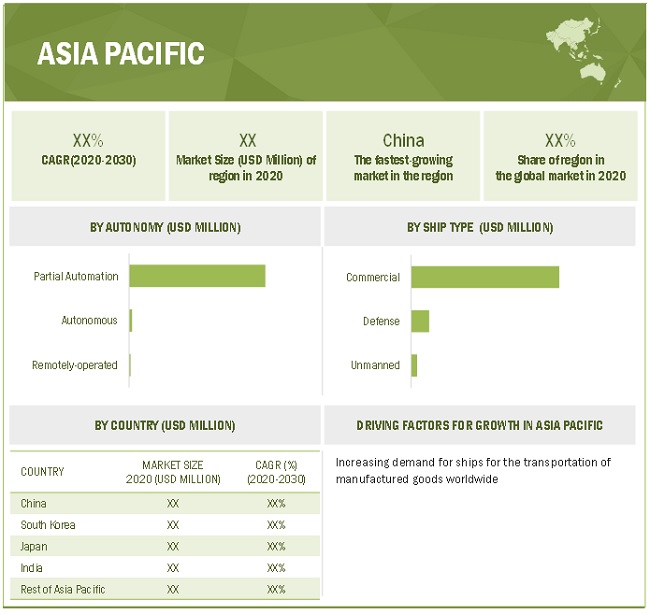

12.5 ASIA PACIFIC

12.5.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 32 ASIA PACIFIC INTEGRATED MARINE AUTOMATION SYSTEMS MARKET SNAPSHOT

TABLE 168 ASIA PACIFIC: MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 169 ASIA PACIFIC: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 170 ASIA PACIFIC: MARKET SIZE, BY AUTONOMY, 2016–2019 (USD MILLION)

TABLE 171 ASIA PACIFIC: MARKET SIZE, BY AUTONOMY, 2020–2025 (USD MILLION)

TABLE 172 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 173 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 174 ASIA PACIFIC: INTEGRATED MARINE AUTOMATION PRODUCTS MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 175 ASIA PACIFIC: INTEGRATED MARINE AUTOMATION PRODUCTS MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 176 ASIA PACIFIC: INTEGRATED MARINE AUTOMATION HARDWARE PRODUCTS MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 177 ASIA PACIFIC: INTEGRATED MARINE AUTOMATION HARDWARE PRODUCTS MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 178 ASIA PACIFIC: INTEGRATED MARINE AUTOMATION SOFTWARE PRODUCTS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 179 ASIA PACIFIC: INTEGRATED MARINE AUTOMATION SOFTWARE PRODUCTS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 180 ASIA PACIFIC: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 181 ASIA PACIFIC: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 182 ASIA PACIFIC: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 183 ASIA PACIFIC: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 184 ASIA PACIFIC: POWER MANAGEMENT SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 185 ASIA PACIFIC: POWER MANAGEMENT SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 186 ASIA PACIFIC: VESSEL MANAGEMENT SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 187 ASIA PACIFIC: VESSEL MANAGEMENT SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 188 ASIA PACIFIC: PROCESS CONTROL SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 189 ASIA PACIFIC: PROCESS CONTROL SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 190 ASIA PACIFIC: SAFETY SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 191 ASIA PACIFIC: SAFETY SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 192 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 193 ASIA PACIFIC: INTEGRATED MARINE AUTOMATION SYSTEMS MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

12.5.1.1 China

12.5.1.1.1 Increase in naval spending and rise in domestic ship production is expected to drive the market in China

TABLE 194 CHINA: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 195 CHINA: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 196 CHINA: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 197 CHINA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 198 CHINA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 199 CHINA: MARKET SIZE, BY END USER 2020–2030 (USD MILLION)

12.5.1.2 South Korea

12.5.1.2.1 Integration of automation systems by various shipbuilding players to drive the market in South Korea

TABLE 200 SOUTH KOREA: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 201 SOUTH KOREA: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 202 SOUTH KOREA: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 203 SOUTH KOREA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 204 SOUTH KOREA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 205 SOUTH KOREA: MARKET SIZE, BY END USER 2020–2025 (USD MILLION)

12.5.1.3 Japan

12.5.1.3.1 Increasing delivery of commercial ships is fueling the growth of the integrated marine automation system market in Japan

TABLE 206 JAPAN: MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 207 JAPAN: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 208 JAPAN: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 209 JAPAN: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 210 JAPAN: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 211 JAPAN: MARKET SIZE, BY END USER 2020–2025 (USD MILLION)

12.5.1.4 India

12.5.1.4.1 Upgradation of old ships with new systems is expected to drive the integrated marine automation system market in India

TABLE 212 INDIA: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 213 INDIA: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 214 INDIA: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 215 INDIA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 216 INDIA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 217 INDIA: MARKET SIZE, BY END USER 2020–2025 (USD MILLION)

12.5.1.5 Rest of Asia Pacific

12.5.1.5.1 Focus of countries to enhance coastal security drive this market in this region

TABLE 218 REST OF ASIA PACIFIC: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 219 REST OF ASIA PACIFIC: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 220 REST OF ASIA PACIFIC: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 221 REST OF ASIA PACIFIC: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 222 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 223 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER 2020–2025 (USD MILLION)

12.6 MIDDLE EAST & AFRICA

12.6.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

TABLE 224 MIDDLE EAST & AFRICA: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 225 MIDDLE EAST & AFRICA: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 226 MIDDLE EAST & AFRICA: MARKET SIZE, BY AUTONOMY, 2016–2019 (USD MILLION)

TABLE 227 MIDDLE EAST & AFRICA: MARKET SIZE, BY AUTONOMY, 2020–2025 (USD MILLION)

TABLE 228 MIDDLE EAST & AFRICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 229 MIDDLE EAST & AFRICA: MARKET SIZE, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 230 MIDDLE EAST & AFRICA: INTEGRATED MARINE AUTOMATION PRODUCTS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 231 MIDDLE EAST & AFRICA: INTEGRATED MARINE AUTOMATION PRODUCTS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 232 MIDDLE EAST & AFRICA: INTEGRATED MARINE AUTOMATION HARDWARE PRODUCTS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 233 MIDDLE EAST & AFRICA: INTEGRATED MARINE AUTOMATION HARDWARE PRODUCTS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 234 MIDDLE EAST & AFRICA: INTEGRATED MARINE AUTOMATION SOFTWARE PRODUCTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 235 MIDDLE EAST & AFRICA: INTEGRATED MARINE AUTOMATION SOFTWARE PRODUCTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 236 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 237 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 238 MIDDLE EAST & AFRICA: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 239 MIDDLE EAST & AFRICA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 240 MIDDLE EAST & AFRICA: POWER MANAGEMENT SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 241 MIDDLE EAST & AFRICA: POWER MANAGEMENT SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 242 MIDDLE EAST & AFRICA: VESSEL MANAGEMENT SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 243 MIDDLE EAST & AFRICA: VESSEL MANAGEMENT SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 244 MIDDLE EAST & AFRICA: PROCESS CONTROL SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 245 MIDDLE EAST & AFRICA: PROCESS CONTROL SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 246 MIDDLE EAST & AFRICA: SAFETY SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 247 MIDDLE EAST & AFRICA: SAFETY SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 248 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 249 MIDDLE EAST & AFRICA: INTEGRATED MARINE AUTOMATION SYSTEMS MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

12.6.1.1 UAE

12.6.1.1.1 Increasing number of shipbuilding activities is expected to drive the market in UAE

TABLE 250 UAE: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 251 UAE: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 252 UAE: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 253 UAE: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 254 UAE: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 255 UAE: MARKET SIZE, BY END USER 2020–2030 (USD MILLION)

12.6.1.2 Saudi Arabia

12.6.1.2.1 Increasing number of ships is expected to drive the integrated marine automation system market in Saudi Arabia

TABLE 256 SAUDI ARABIA: MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 257 SAUDI ARABIA: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 258 SAUDI ARABIA: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 259 SAUDI ARABIA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 260 SAUDI ARABIA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 261 SAUDI ARABIA: MARKET SIZE, BY END USER 2020–2030 (USD MILLION)

12.6.1.3 South Africa

12.6.1.3.1 Increasing intercontinental trade is expected to drive the integrated marine automation system market in South Africa

TABLE 262 SOUTH AFRICA: MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 263 SOUTH AFRICA: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 264 SOUTH AFRICA: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 265 SOUTH AFRICA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 266 SOUTH AFRICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 267 SOUTH AFRICA: INTEGRATED MARINE AUTOMATION SYSTEMS MARKET SIZE, BY END USER 2020–2030 (USD MILLION)

12.6.1.4 Rest of Middle East & Africa

12.6.1.4.1 Focus on shipbuilding activities is expected to drive the integrated marine automation system market in India

TABLE 268 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 269 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 270 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 271 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 272 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 273 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER 2020–2030 (USD MILLION)

12.7 LATIN AMERICA

12.7.1 PESTLE ANALYSIS: LATIN AMERICA

TABLE 274 LATIN AMERICA: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 275 LATIN AMERICA: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 276 LATIN AMERICA: MARKET SIZE, BY AUTONOMY, 2016–2019 (USD MILLION)

TABLE 277 LATIN AMERICA: MARKET SIZE, BY AUTONOMY, 2020–2025 (USD MILLION)

TABLE 278 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 279 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2020–2025 (USD MILLION)

TABLE 280 LATIN AMERICA: INTEGRATED MARINE AUTOMATION PRODUCTS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 281 LATIN AMERICA: INTEGRATED MARINE AUTOMATION PRODUCTS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 282 LATIN AMERICA: INTEGRATED MARINE AUTOMATION HARDWARE PRODUCTS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 283 LATIN AMERICA: INTEGRATED MARINE AUTOMATION HARDWARE PRODUCTS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 284 LATIN AMERICA: INTEGRATED MARINE AUTOMATION SOFTWARE PRODUCTS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 285 LATIN AMERICA: INTEGRATED MARINE AUTOMATION SOFTWARE PRODUCTS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 286 LATIN AMERICA: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 287 LATIN AMERICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 288 LATIN AMERICA: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 289 LATIN AMERICA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 290 LATIN AMERICA: POWER MANAGEMENT SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 291 LATIN AMERICA: POWER MANAGEMENT SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 292 LATIN AMERICA: VESSEL MANAGEMENT SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 293 LATIN AMERICA: VESSEL MANAGEMENT SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 294 LATIN AMERICA: PROCESS CONTROL SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 295 LATIN AMERICA: PROCESS CONTROL SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 296 LATIN AMERICA: SAFETY SYSTEM MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 297 LATIN AMERICA: SAFETY SYSTEM MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 298 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 299 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

12.7.1.1 Brazil

12.7.1.1.1 Increasing offshore production of oil & gas is expected to drive the growth of automation system in Brazil

TABLE 300 BRAZIL: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 301 BRAZIL: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 302 BRAZIL: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 303 BRAZIL: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 304 BRAZIL: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 305 BRAZIL: MARKET SIZE, BY END USER 2020–2030 (USD MILLION)

12.7.1.2 Argentina

12.7.1.2.1 Increasing investments in shipbuilding are expected to drive the growth of the market

TABLE 306 ARGENTINA: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 307 ARGENTINA: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 308 ARGENTINA: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 309 ARGENTINA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 310 ARGENTINA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 311 ARGENTINA: MARKET SIZE, BY END USER 2020–2030 (USD MILLION)

12.7.1.3 Rest of Latin America

12.7.1.3.1 Increasing investments in automation systems drive the market in Latin America

TABLE 312 REST OF LATIN AMERICA: INTEGRATED MARINE AUTOMATION SYSTEM MARKET SIZE, BY SHIP TYPE, 2016–2019 (USD MILLION)

TABLE 313 REST OF LATIN AMERICA: MARKET SIZE, BY SHIP TYPE, 2020–2025 (USD MILLION)

TABLE 314 REST OF LATIN AMERICA: MARKET SIZE, BY SYSTEM, 2016–2019 (USD MILLION)

TABLE 315 REST OF LATIN AMERICA: MARKET SIZE, BY SYSTEM, 2020–2025 (USD MILLION)

TABLE 316 REST OF LATIN AMERICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 317 REST OF LATIN AMERICA: MARKET SIZE, BY END USER 2020–2030 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 223)

13.1 INTRODUCTION

13.2 RANKING OF LEADING PLAYERS, 2019

FIGURE 33 MARKET RANKING OF LEADING PLAYERS IN THE INTEGRATED MARINE AUTOMATION SYSTEM MARKET, 2019

13.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2019

FIGURE 34 MARKET SHARE ANALYSIS OF LEADING PLAYERS IN THE INTEGRATED MARINE AUTOMATION SYSTEM MARKET, 2019

13.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2019

FIGURE 35 REVENUE ANALYSIS OF LEADING PLAYERS IN THE INTEGRATED MARINE AUTOMATION SYSTEM MARKET, 2019

13.5 COMPETITIVE OVERVIEW

TABLE 318 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE INTEGRATED MARINE AUTOMATION SYSTEM MARKET BETWEEN 2016 AND 2020

13.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 319 COMPANY PRODUCT FOOTPRINT

TABLE 320 COMPANY APPLICATION FOOTPRINT

TABLE 321 COMPANY INDUSTRY FOOTPRINT

TABLE 322 COMPANY REGION FOOTPRINT

13.7 COMPANY EVALUATION QUADRANT

13.7.1 STAR

13.7.2 EMERGING LEADER

13.7.3 PERVASIVE

13.7.4 PARTICIPANT

FIGURE 36 INTEGRATED MARINE AUTOMATION SYSTEM MARKET COMPETITIVE LEADERSHIP MAPPING, 2019

13.8 INTEGRATED MARINE AUTOMATION SYSTEMS MARKET COMPETITIVE LEADERSHIP MAPPING (STARTUPS)

13.8.1 PROGRESSIVE COMPANIES

13.8.2 RESPONSIVE COMPANIES

13.8.3 DYNAMIC COMPANIES

13.8.4 STARTING BLOCKS

FIGURE 37 INTEGRATED MARINE AUTOMATION SYSTEM MARKET (STARTUPS) COMPETITIVE LEADERSHIP MAPPING, 2019

13.9 COMPETITIVE SCENARIO

13.9.1 DEALS

TABLE 323 DEALS, 2017-2020

13.9.2 PRODUCT LAUNCHES

TABLE 324 PRODUCT LAUNCHES, 2017-2020

14 COMPANY PROFILES (Page No. - 241)

14.1 INTRODUCTION

14.2 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

14.2.1 ABB

FIGURE 38 ABB: COMPANY SNAPSHOT

14.2.2 HONEYWELL INTERNATIONAL INC

FIGURE 39 HONEYWELL INTERNATIONAL INC: COMPANY SNAPSHOT

14.2.3 ROLLS-ROYCE PLC

FIGURE 40 ROLLS-ROYCE PLC: COMPANY SNAPSHOT

14.2.4 WARTSILA

FIGURE 41 WARTSILA: COMPANY SNAPSHOT

14.2.5 KONGSBERG

FIGURE 42 KONGSBERG: COMPANY SNAPSHOT

14.2.6 SIEMENS

FIGURE 43 SIEMENS: COMPANY SNAPSHOT

14.2.7 HYUNDAI HEAVY INDUSTRIES

14.2.8 GENERAL ELECTRIC

FIGURE 44 GENERAL ELECTRIC: COMPANY SNAPSHOT

14.2.9 NORTHROP GRUMMAN CORPORATION

FIGURE 45 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

14.2.10 TOKYO KEIKI

FIGURE 46 TOKYO KEIKI: COMPANY SNAPSHOT

14.2.11 CONSILIUM

14.2.12 FINCANTIERI S.P.A

FIGURE 47 FINCANTIERI S.P.A: COMPANY SNAPSHOT

14.2.13 ROCKWELL AUTOMATION, INC

FIGURE 48 ROCKWELL AUTOMATION, INC: COMPANY SNAPSHOT

14.2.14 JASON MARINE GROUP

FIGURE 49 JASON MARINE GROUP: COMPANY SNAPSHOT

14.2.15 THALES GROUP

FIGURE 50 THALES GROUP: COMPANY SNAPSHOT

14.2.16 MARINE TECHNOLOGIES LLC

14.2.17 PRAXIS AUTOMATION & TECHNOLOGY B.V.

14.2.18 L3HARRIS ASV

14.2.19 MITSUI E&S HOLDINGS CO., LTD

FIGURE 51 MITSUI E&S HOLDINGS CO., LTD: COMPANY SNAPSHOT

14.2.20 DNV GL

FIGURE 52 DNV GL: COMPANY SNAPSHOT

14.2.21 FUGRO

FIGURE 53 FUGRO: COMPANY SNAPSHOT

14.2.22 VALMET

FIGURE 54 VALMET: COMPANY SNAPSHOT

14.2.23 ASELSAN A.S.

FIGURE 55 ASELSAN A.S.: COMPANY SNAPSHOT

14.2.24 SAMSUNG HEAVY INDUSTRIES CO., LTD

FIGURE 56 SAMSUNG HEAVY INDUSTRIES CO., LTD: COMPANY SNAPSHOT

14.2.25 ULSTEIN

14.3 OTHER PLAYERS

14.3.1 API MARINE, INC

14.3.2 RH MARINE

14.3.3 MTU FRIEDRICHSHAFEN

14.3.4 MARLINK

14.3.5 SMEC AUTOMATION PVT. LTD.

14.3.6 LOGIMATIC

14.3.7 SEDNI MARINE SYSTEMS

14.3.8 SEA MACHINES ROBOTICS, INC

14.3.9 SHONE, AUTOMATION INC

14.3.10 BUFFALO AUTOMATION

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 298)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATION

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Integrated Marine Automation System Market