The research report includes four major activities, estimating the size of the drylab photo printing market. Secondary research has been done to gather important information about the market and peer markets. To validate the findings, assumptions, and sizing with the primary research with industry experts across the supply chain is the next step. Both bottom-up and top-down approaches have been used to estimate the market size. After this, the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

Revenues of companies offering drylab photo printing across the world have been obtained based on the secondary data made available through paid and unpaid sources. They have also been derived by analyzing the product portfolios of key companies and rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the drylab photo printing market. Secondary sources considered for this research study include government sources, corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and professional associations. Secondary data has been collected and analyzed to determine the overall market size, further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of the drylab photo printing industry to identify the key players based on their products and the prevailing industry trends in the drylab photo printing market based on offering, connectivity, print width, end-user, and region. It also includes information about the key developments undertaken from both market- and technology-oriented perspectives.

Primary Research

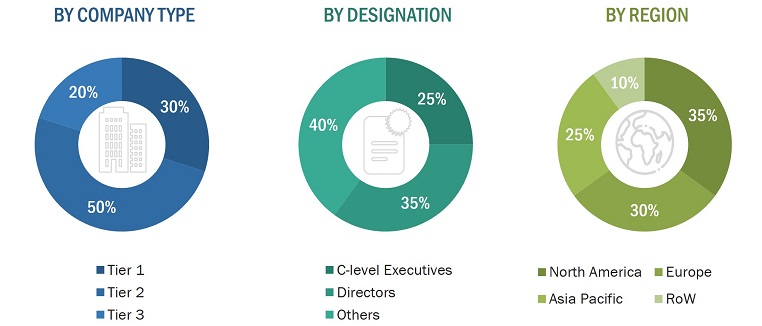

In the primary research process, various primary sources have been interviewed to obtain qualitative and quantitative information related to the market across four main regions-North America, Europe, Asia Pacific, and Row (Rest of the World). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and a few other related key executives from major companies and organizations operating in the drylab photo printing market or related markets.

After the completion of market engineering, primary research has been conducted to gather information and verify and validate critical numbers obtained from other sources. Primary research has also been conducted to identify various market segments, industry trends, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with the key strategies market players adopt. Most of the primary interviews have been conducted with the supply side of the market. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

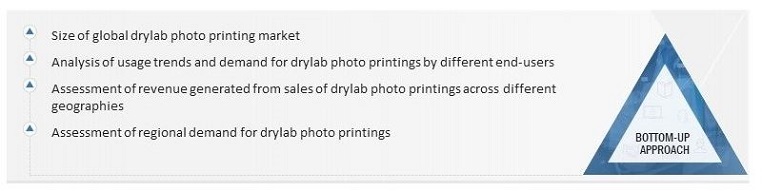

In the market engineering process, both the top-down and bottom-up approaches have been used, along with several data triangulation methods, to perform market estimation and forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed on the market engineering process to list key information/insights.

Key market players have been identified through secondary research, and their market shares have been determined through primary and secondary research. This involves studying their annual and financial reports and interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights—both quantitative and qualitative.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All possible parameters that may affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed input and analysis from MarketsandMarkets and presented in the report.

Market Size Estimation Methodology-Bottom-up Approach

A bottom-up approach has been employed to arrive at the overall size of the drylab photo printing market from the calculations based on the revenues of the key players and their shares in the market. Key players in the drylab photo printing market have been studied. The market size estimations have been carried out considering the market size of their drylab photo printing offerings

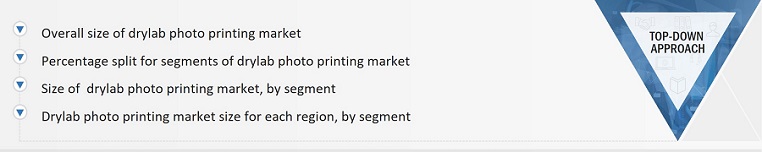

Market Size Estimation Methodology-Top Down Approach

In the top-down approach, the overall market size has been used to estimate the size of individual markets through percentage splits from secondary and primary research.

The most appropriate parent market size has been used to implement the top-down approach for the calculation of specific market segments.

The revenue shares used earlier in the bottom-up approach were verified by identifying and estimating the market share for each company. The overall parent market size and individual market sizes have been determined and confirmed in this study through the data triangulation process and data validation through the primary interviews.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been then splits into several segments and sub-segments. Data triangulation has been employed to complete the market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

A drylab photo printing system represents an advanced printing solution that employee’s thermal dye-sublimation technology, ensuring the creation of high-quality and long-lasting photo prints. Diverging from the conventional approach employed by traditional photo printers utilizing wet chemicals, drylab printing offers a range of notable advantages. These include but are not limited to, superior print quality, accelerated printing speeds, compatibility with various media types, scalability to meet varying production demands, operational efficiency, cleanliness due to the absence of wet chemicals, and a user-friendly interface that facilitates seamless functionality.

These drylab printers offer a compelling amalgamation of premium printing output, rapid production speeds, versatility in handling diverse media formats, and operational efficiency. This convergence positions them as the preferred choice for professionals and businesses seeking top-notch photo prints with the added benefit of expedited turnaround times. The comprehensive features of drylab photo printing contribute to an elevated standard in image reproduction, providing a reliable and efficient solution for those with discerning requirements in the realm of photography and print production.

Key Stakeholders

-

Original device manufacturers (ODMs)

-

Drylab photo printing hardware and solution providers

-

Component suppliers

-

Research organizations and consulting companies

-

Sub-component manufacturers

-

Technology providers

-

Drylab photo printing-related associations, organizations, forums, and alliances

-

Investors

-

Retailers

-

Photography professionals

The main objectives of this study are as follows:

-

To describe and forecast the drylab photo printing market based on offering, connectivity, print width, end user, and region in terms of value.

-

To describe and forecast the market, in terms of value, for various segments in four key regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW).

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To analyze the micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market.

-

To provide a detailed overview of the drylab photo printing supply chain and its industry trends.

-

To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market.

-

To profile the key players and comprehensively analyze their market position in terms of the market share and core competencies2, along with a detailed competitive landscape for the market leaders.

-

To analyze competitive developments such as partnerships, collaborations, acquisitions, and product launches in the drylab photo printing market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Country-wise Information for Asia Pacific

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Drylab Photo Printing Market