Four main activities were undertaken to determine the size of the drone sensor market. Initial extensive secondary research gathered data on the market, peer market, and parent market. Following this, validation of these findings, assumptions, and sizing occurred through primary research involving industry experts across the value chain. Utilizing both top-down and bottom-up approaches, the global market size was estimated. Subsequently, market breakdown and data triangulation were employed to determine the sizes of segments and subsegments within the market.

Secondary Research

Secondary sources for this research study encompass corporate filings (including annual reports, investor presentations, and financial statements), trade publications, professional associations, white papers, accredited publications, articles authored by reputable sources, directories, and databases. Secondary data was gathered and analyzed to ascertain the overall market size, subsequently corroborated through primary research.

Primary Research

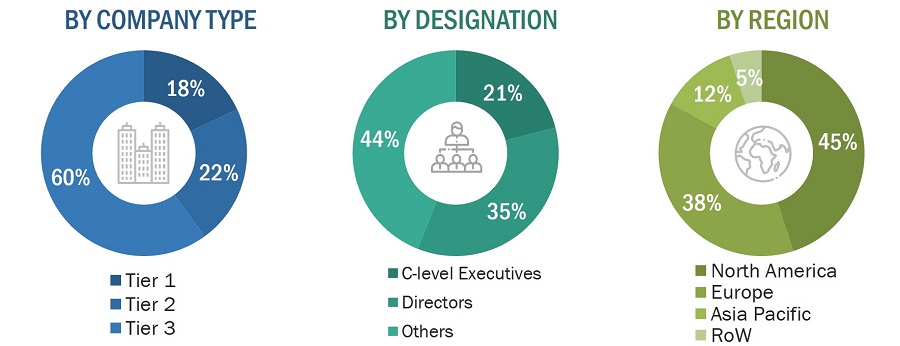

Following a comprehensive secondary research phase to comprehend and analyze the drone sensor market landscape, extensive primary research was conducted. This involved numerous interviews with key opinion leaders representing both demand- and supply-side vendors across four primary regions: North America, Asia Pacific, Europe, and RoW (comprising the GCC, Rest of Middle East & Africa, and South America). Subsequent to engaging with industry experts, concise sessions were held with seasoned independent consultants to validate the primary findings. These efforts, combined with insights from in-house subject matter experts, culminated in the findings detailed in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

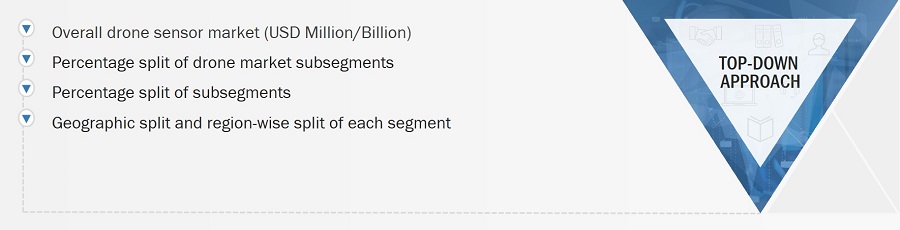

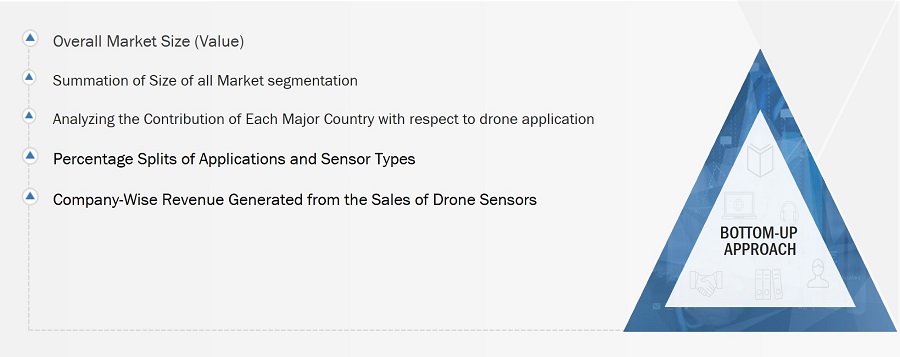

Both top-down and bottom-up methodologies have been employed to estimate and validate the overall size of the drone sensor market. These approaches were also extensively utilized to determine the sizes of various market subsegments. The research methodology utilized to estimate the market sizes encompasses the following:

Market Size Estimation Methodology-Top-Down Approach

Market Size Estimation Methodology-Bottom-up Approach

Data Triangulation

After determining the overall market size through the previously outlined market size estimation processes, the market has been subdivided into multiple segments and subsegments. Data triangulation and market breakdown procedures were used to finalize the overall market engineering process and ascertain precise statistics for each market segment and subsegment. This triangulation involved examining various factors and trends from both the demand and supply perspectives.

The market has been divided into multiple segments and subsegments following the determination of the overall market size, utilizing the market size estimation methodologies outlined previously. Data triangulation and market breakdown techniques were used to finalize the overall market engineering process and attain precise statistics for each market segment and subsegment. Triangulation of data has been achieved through an examination of diverse factors and trends from both demand and supply perspectives.

Market Definition

A sensor functions as a mechanism to identify alterations in electrical, physical, or various parameters, generating an output in response to such alterations. Typically, this output manifests as an electrical or optical signal. Drone sensors perceive modifications in their environment, enhancing their navigation capabilities and enabling them to gather vital information regarding the objects they observe.

Key Stakeholders

-

Raw material and manufacturing equipment suppliers

-

Integrated device manufacturers (IDMs)

-

Drone sensor manufacturers

-

Original device manufacturers (ODMs)

-

Original equipment manufacturers (OEMs)

-

Drone sensor-related technology providers

-

Distributors and traders

-

Research & education organizations

-

End users

Report Objectives

-

To describe and forecast the drone sensor market based on sensor type, platform type, application, and end-user industry in terms of value

-

To forecast the drone sensor market based on sensor type, platform type, and end-user industry in terms of volume

-

To forecast the size of the market for North America, Europe, Asia Pacific, and the Rest of the World (RoW) in terms of value

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the drone sensor market

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the drone sensor market

-

To describe the pricing analysis, value chain analysis, ecosystem analysis, investment and funding scenario, technology analysis, technology roadmap, patent analysis, trade analysis, the impact of megatrends, key conferences and events, case study analysis, regulatory landscape, Porter’s Five Forces analysis, and key stakeholder buying criteria

-

To analyze opportunities in the market for the stakeholders and provide a detailed competitive landscape of the drone sensor market

-

To strategically profile the key players and comprehensively analyze their market rankings and core competencies2.

-

To analyze competitive developments such as product launches, partnerships, and collaborations in the drone sensor market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of 25 market players

Growth opportunities and latent adjacency in Drone Sensor Market