Digital Pathology Market Size, Growth, Share & Trends Analysis

Digital Pathology Market by Product (Scanner, Software, Storage System), Type (Human, Veterinary), Application (Teleconsultation, Training, Disease Diagnosis, Drug Discovery), End User (Pharma & Biotech, Academia, Hospitals) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

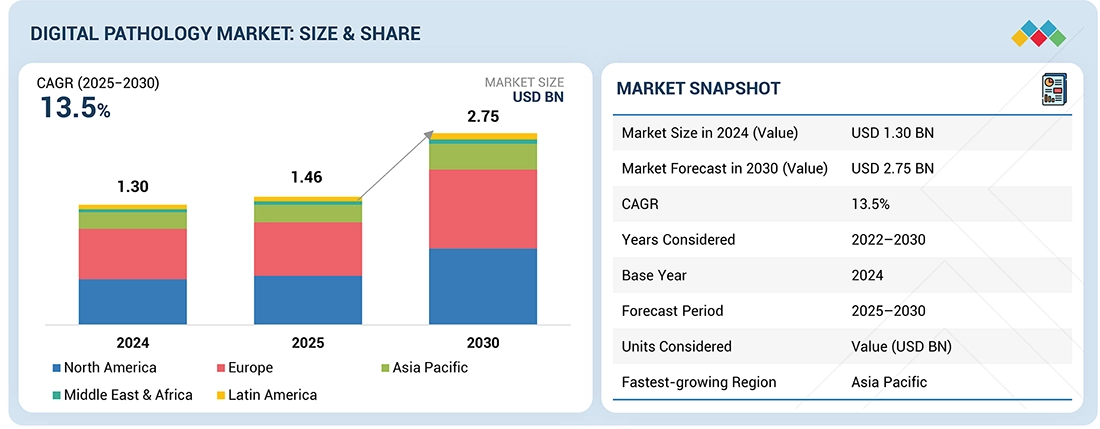

The global digital pathology market is projected to reach USD 2.75 billion by 2030 from USD 1.46 billion in 2025, at a CAGR of 13.5% during the forecast period. The global digital pathology market is witnessing robust growth driven by the accelerating adoption of AI-powered image analysis, integration with laboratory information systems (LIS), and rising demand for efficient diagnostic workflows. The market is transitioning from early-stage digitization to full-scale digital transformation, with hospitals, diagnostic labs, and research institutions increasingly embracing digital slide scanners, cloud-based pathology platforms, and image management systems to enhance diagnostic accuracy and speed. The growing volume of biopsies, coupled with the global shortage of pathologists, is compelling healthcare systems to invest in digital solutions that enable remote pathology review, collaboration, and archiving. Additionally, the integration of digital pathology with companion diagnostics and precision oncology workflows is expanding its clinical relevance beyond histopathology.

KEY TAKEAWAYS

-

BY PRODUCTThe study includes scanners, software, and storage systems. Scanners include brightfield, fluorescence scanners, and other scanners, Software, by type, includes integrated and standalone software, Standalone software includes information management software and image analysis software, Software, by deployment mode, includes on-premise model, cloud-based model, and hybrid model. Scanners account for the highest market share in digital pathology because they are the foundational technology that enables the conversion of traditional glass slides into high-resolution digital images, which is the first critical step in any digital pathology workflow.

-

BY TYPEThe study includes human pathology and veterinary pathology. Human pathology accounts for the highest market share in digital pathology because it represents the largest and most established segment of diagnostic healthcare, with widespread demand for accurate disease diagnosis, especially cancer detection.

-

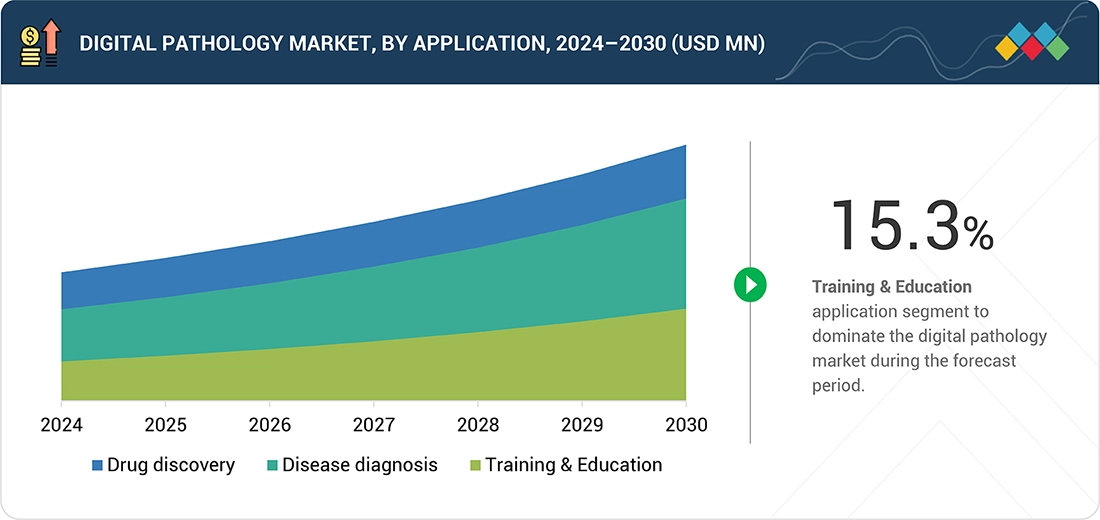

BY APPLICATIONThe study includes drug discovery, disease diagnosis, and training & education. Drug discovery accounts for the highest market share in digital pathology because it relies heavily on detailed tissue analysis to identify disease mechanisms, validate biomarkers, and evaluate drug efficacy and safety during preclinical and clinical trials.

-

BY END USERThe study includes biotechnology & pharmaceutical companies, hospitals & diagnostics laboratories, research & academic Institutes and Veterinary laboratories.Pharmaceutical and biotechnological companies account for the highest market share in the digital pathology market because they heavily depend on advanced imaging and AI-driven analytical tools to streamline drug discovery, accelerate clinical trials, and support precision medicine.

-

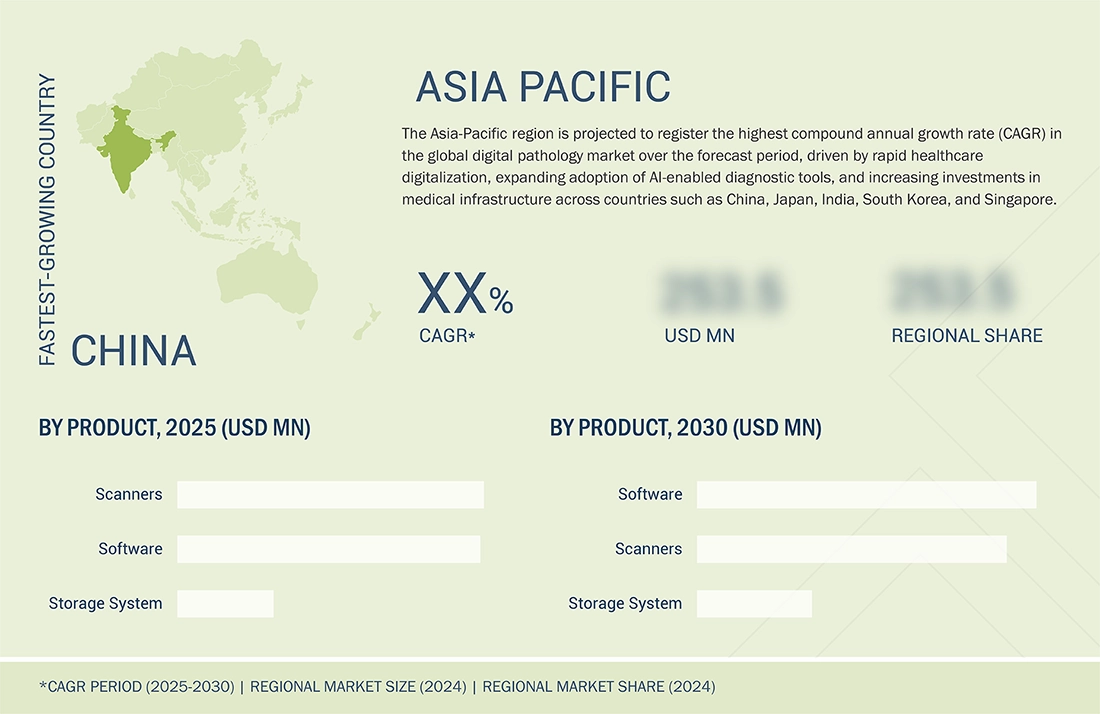

BY REGIONThe digital pathology market covers Europe, North America, Asia Pacific, Latin America, the Middle East, and Africa. The Asia-Pacific region is expected to register the highest CAGR in the digital pathology market due to several converging factors. Rapid healthcare infrastructure expansion in countries like China, India, Japan, and South Korea is increasing the adoption of advanced diagnostic technologies, including digital pathology. The region faces a rising cancer burden and prevalence of chronic diseases, creating strong demand for accurate, high-throughput diagnostic solutions.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Fujifilm Holdings Corporation (Japan), Danaher Corporation (US), Koninklijke Philips N.V. (Netherlands), KONFOONG BIOTECH INTERNATIONAL CO., LTD. (China), Glencoe Software, Inc. (US), Aiforia (Finland), Paige AI, Inc. (US), Huron Digital Pathology (Canada), Hologic, Inc. (US), Corista (US), Mikroscan Technologies, Inc. (US), have entered into a number of agreements and partnerships to cater to the growing demand for digital path across innovative applications.

Digital pathology adoption is being shaped by three major trends: AI integration, cloud-enabled interoperability, and value-based diagnostics. AI algorithms are increasingly being used for quantification of biomarkers, tumor grading, and image classification, allowing for greater consistency and throughput. Moreover, the rise of cloud-based image repositories facilitates cross-border consultations and multi-site collaborations, while vendor-neutral platforms are emerging as the new standard for interoperability. Strategic partnerships between scanner manufacturers, software developers, and AI startups—such as Philips with Paige AI or Leica with Visiopharm—are redefining the ecosystem dynamics. Furthermore, regulatory approvals of AI-based digital pathology tools in the US, Europe, and Japan are accelerating mainstream adoption.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Healthcare providers are facing a paradigm shift from volume-based to outcome-driven diagnostics, prompting investments in integrated digital pathology platforms that improve diagnostic turnaround time and patient outcomes. Pharmaceutical and CRO customers are leveraging digital pathology for AI-driven drug discovery and biomarker validation, enabling faster translational research. Meanwhile, reimbursement models are gradually evolving to recognize digital workflows, disrupting traditional business models. Disruptions such as multi-modal integration (pathology + radiology data), whole-slide image (WSI) interoperability standards, and AI-driven triage systems are pushing pathology departments toward fully automated, connected diagnostic ecosystems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

AI-enabled digital pathology improving lab throughput

-

Rising burden of cancer, diabetes, and cardiovascular diseases

Level

-

High initial cost of digital pathology systems

-

Data interoperability issues with existing lab systems

Level

-

Affordable scanner development for low-resource settings

-

Government backed digitization in emerging economies

Level

-

Shortage of skilled pathologists and technicians

-

Algorithm validation and trust in AI-based diagnostics

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: AI enabled digital pathology improving lab throughput

AI-enabled digital pathology is transforming laboratory throughput, giving automating burdensome tasks such as slide review, case anomaly detection, and image quantification. With AI algorithms cutting whole-slide image analysis time down by as much as 60% when compared with the time it takes to analyze slides manually, pathologists can get through more cases in less time. In a 2020 article published in JAMA Network Open, investigators found the AI-assisted diagnostic model increased pathologist efficiency by over 20% without impacting diagnostic accuracy and there is significant opportunity for cost, time, and efficiency improvements across the continuum of care. AI-enabled digital pathology applications that integrate with Laboratory Information Systems (LIS) allow real time data sharing and collaborate to improve workflow and laboratory turnaround times, decreasing instances of human error. Accordingly, laboratories implementing AI through digital pathology solutions are experiencing increases in daily case volumes, enhanced diagnostic consistency, and more optimal overall case management.

Restraint: High initial cost of Digital Pathology System

The major hurdle for labs realizing a digital pathology process is the high up-front costs for systems including whole-slide scanners, image management software, storage infrastructure, and AI analytics tooling. A whole-slide scanner alone can run between USD 50,000 and USD 300,000 or more depending on throughput and features. Additionally, labs must invest in IT infrastructure, data security, and staff training resources to ensure proper implementation and reliability of digital processes; all this can easily add up to an enormous utilizaiton factor which minimizes or eliminates any up-front costs. For smaller labs or labs without adequate resource support, these expenses can slow the digital transition process despite the streamlined efficiency and diagnostic advantages realized over time

Opportunity: Government backed digitization in emerging economies

Government-led initiatives for digitization in developing countries serve as an incubator for making digital pathology widespread with improved healthcare infrastructure for rural and underserved areas and increased acceptance and integration of technology. India (Ayushman Bharat Digital Mission), Brazil (Conecte SUS), and South Africa are all investing in digital health ecosystems to expand health quality and accessibility, enhance interoperability, and provide rapid, accurate diagnostics. Each program or initiative may provide funding or guidance in creating a digitized laboratory, supporting telepathology, and actionable intelligence through an AI diagnosis. These efforts will initiate a solid pathway for emerging economies to provide digital pathology that corrects existing infrastructure and greater adoption of a digital record system, specifically in the public sector, in rural or underserved areas.

Challenge: Algorithm Validation and trust in AI-based diagnostics

Algorithm validation and building trust with clinicians is an important challenge for AI-based digital pathology. AI models need to be validated and published as required, especially in diverse populations with different tissue types and staining variations, to gain the reliability and accuracy needed in a clinical setting. However, many algorithms will be trained on a relatively small population or homogenous data, which raises questions around bias, reproducibility, and routine practice or generalizability. Furthermore, some AI systems are characterized as a "black box" that is opaque to pathologists when looking to interpret and understand how decisions are made, which can slow adoption into a clinical setting. Regulatory governing bodies like the FDA and CE are increasingly requiring transparency and explainability, as well as requirement for performance in real-world settings, however, establishing widespread clinical comfort and trust in AI will require transparency and validation, peer-reviewed evidence, and demonstrable performance in the routine practice environment

Digital Pathology Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Incorporating advanced image analytics and artificial-intelligence (AI) algorithms to assist pathologists in tasks such as biomarker quantification, tumour detection/sub-typing, and measuring expression rather than relying solely on manual eyeballing. | Digital slides can be accessed remotely, shared across teams instantly, reducing delays associated with physical slide handling, couriering, storage and retrieval.. |

|

Roche uses machine-learning models to filter large sets of slides in preclinical/clinical settings — for example, they developed ML that automatically discards slides with no lesions to accelerate toxicity assessment workflows. | High-capacity scanners and digital workflows reduce turnaround time, support large caseloads, and reduce bottlenecks in slide handling. . |

|

Supporting remote review, telepathology and collaboration: sharing digital slides securely across sites, enabling second opinions, workload balancing and multi-site workflows. . | Reducing physical slide handling, transport, storage; fewer lost slides; and the ability to scale across sites without duplicating infrastructure are all potential cost benefits. For example, converting to digital allowed remote review and avoided logistics of slide shipping. |

|

Philips offers an end-to-end digital pathology workflow through its IntelliSite Pathology Solution (and related image management / scanner / software components). | With digital workflows and remote access, labs can better manage pathologist shortages or distribute work across sites and time zones |

|

Converting glass slides into digital whole-slide images with NanoZoomer scanners, integrating into pathology labs’ workflows (remote review, sharing, archiving, LIS/PACS connectivity, AI readiness) | Converting glass slides into digital whole-slide images with NanoZoomer scanners, integrating into pathology labs’ workflows (remote review, sharing, archiving, LIS/PACS connectivity, AI readiness) |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The digital pathology ecosystem comprises scanner manufacturers (Philips, Leica, Hamamatsu, 3DHISTECH), software solution providers (PathAI, Indica Labs, Visiopharm), AI algorithm developers (Paige, Aiforia, Ibex Medical Analytics), and cloud service enablers (Amazon Web Services, Microsoft Azure). Integration partners and LIS/LIMS vendors (LabVantage, CliniSys, Thermo Fisher) play a key role in connecting digital pathology with broader laboratory workflows. The ecosystem is increasingly collaborative, with partnerships between hardware and software companies to offer end-to-end digital pathology suites.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Digital Pathology Market, By Product

Scanners dominate the market by revenue share, as they serve as the foundation of digital pathology workflows. High-throughput and high-resolution scanners are increasingly being adopted by reference labs and academic institutions for large-scale digitization. The demand is further fueled by the growing use of whole-slide imaging (WSI) in primary diagnosis and research applications. Software and storage solutions are the fastest-growing segments, driven by AI integration and cloud adoption trends.

Digital Pathology Market, By Application

Disease diagnosis is the dominant application segment, driven by the shift toward digital workflows in oncology and chronic disease diagnostics. The demand for precise, AI-augmented image analysis tools in tumor grading and biomarker quantification is especially high. Meanwhile, drug discovery and development applications are expanding rapidly as biopharma companies utilize digital pathology for tissue-based biomarker studies and translational research.

Digital Pathology Market, By End User

Pharma and biotech companies account for the highest market share in the digital pathology market because they extensively use digital pathology solutions to accelerate drug discovery, enhance clinical trials, and improve biomarker research. These companies rely on advanced imaging, AI-powered analysis, and data management tools to increase accuracy, reduce time, and lower costs in pathology workflows. The growing demand for personalized medicine and the need for efficient, scalable pathology data processing further drive adoption in this sector, making pharma and biotech key revenue contributors in the digital pathology market.

REGION

Asia Pacific to be fastest-growing region in global digital pathology market during forecast period

North America dominates the market due to early regulatory approvals, high digital adoption rates, and strong presence of key players such as Philips, Leica, and Paige. The region also benefits from established reimbursement models and a robust research ecosystem. Asia-Pacific, on the other hand, is the fastest-growing region owing to increasing healthcare digitization, government investments in AI diagnostics, and expanding cancer screening programs in countries like China, Japan, South Korea, and India. Additionally, cost-effective cloud infrastructure and regional AI partnerships are accelerating adoptio

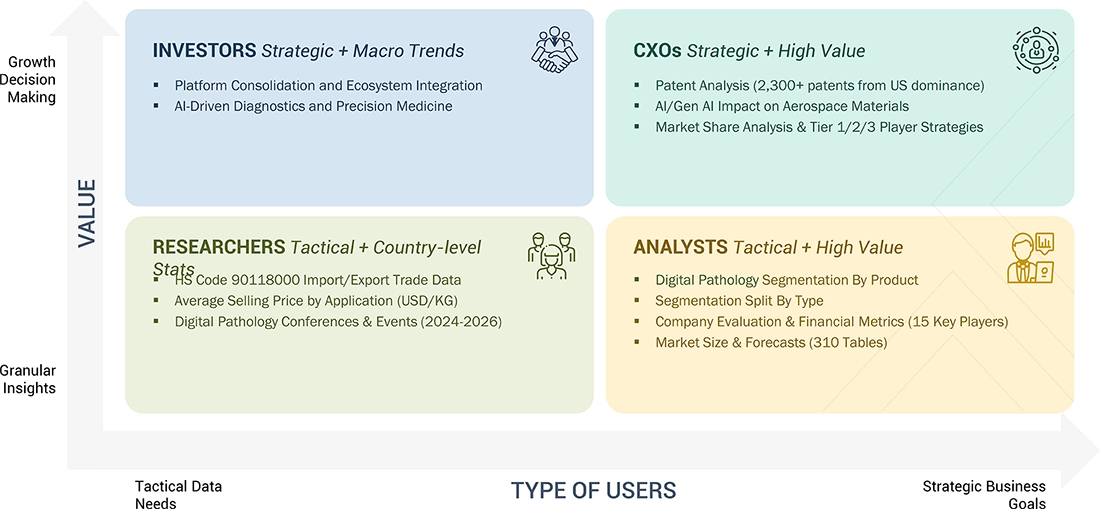

Digital Pathology Market: COMPANY EVALUATION MATRIX

The digital pathology market is moderately consolidated, with key players pursuing hybrid growth strategies that combine hardware innovation with AI-driven software integration. Leaders such as Philips Healthcare, Leica Biosystems (Danaher), Hamamatsu Photonics, and 3DHISTECH hold strong scanner portfolios and global customer networks. Emerging AI-first players like PathAI, Paige, Ibex Medical Analytics, and Aiforia Technologies are gaining traction through partnerships with hospitals and CROs. Competitive differentiation is increasingly shifting from scanner performance to workflow integration, AI accuracy, regulatory compliance, and interoperability. Vendors that offer cloud-native, vendor-neutral, and AI-augmented digital pathology ecosystems are expected to lead the next wave of market growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Fujifilm Holdings Corporation (Japan)

- Danaher Corporation (US)

- Koninklijke Philips N.V. (Netherlands)

- Mikroscan Technologies, Inc. (US)

- PathAI (US)

- Hamamatsu Photonics K.K. (Japan)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- 3DHISTECH (Hungary)

- Apollo Enterprise Imaging (US)

- XIFIN, Inc. (US)

- Proscia Inc. (US)

- KONFOONG BIOTECH INTERNATIONAL CO., LTD. (China)

- Glencoe Software, Inc. (US)

- Aiforia (Finland)

- Paige AI, Inc. (US)

- Huron Digital Pathology (Canada)

- Hologic, Inc. (US)

- Corista (US

- Indica Labs Inc. (US),

- Objective Pathology Services Limited (Canada)

- Sectra AB (Sweden)

- OptraSCAN (US)

- Akoya Biosciences, Inc. (US)

- Motic Digital Pathology (US)

- Kanteron Systems (Spain)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.30 Billion |

| Market Forecast in 2030 (Value) | USD 2.75 Billion |

| Growth Rate | CAGR of 13.5% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Product includes scanners, software, and storage systems. Scanners include brightfield, fluorescence scanners, and other scanners, Software, by type, includes integrated and standalone software, Standalone software includes information management software and image analysis software, Software, by deployment mode, includes on-premise model, cloud-based model, and hybrid model. By type includes human pathology and veterinary pathology.By application includes drug discovery, disease diagnosis, and training & education. By end user includes biotechnology & pharmaceutical companies, hospitals & diagnostics laboratories, research & academic Institutes and Veterinary laboratories. |

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Digital Pathology Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Digital Pathology Vendor |

|

|

| Hospital & Diagnostic Labs |

|

|

| AI/Software Developer |

|

|

| Pharma & Clinical Research |

|

|

RECENT DEVELOPMENTS

- March 2024 : Koninklijke Philips N.V. (Netherlands) announced an expanded collaboration with AWS to address the growing need for secure, scalable digital pathology solutions in the cloud. This collaboration will help accelerate workflow efficacy and enable seamless integration with the existing healthcare system to deliver holistic patient care.

- February 2024 : Roche announced its collaboration with Path AI to develop an AI-enabled digital pathology algorithm in the companion diagnostics space. This collaboration will allow Roche to accelerate its ability to meet the demand from biopharma companies looking to develop AI-enabled companion diagnostics and provide end-to-end solutions.

- March 2023 : Agilent Technologies partnered with Hamamatsu Photonics K.K. to incorporate the NanoZoomer range, including the S360MD Slide scanner system, into its end-to-end digital pathology solution.

Table of Contents

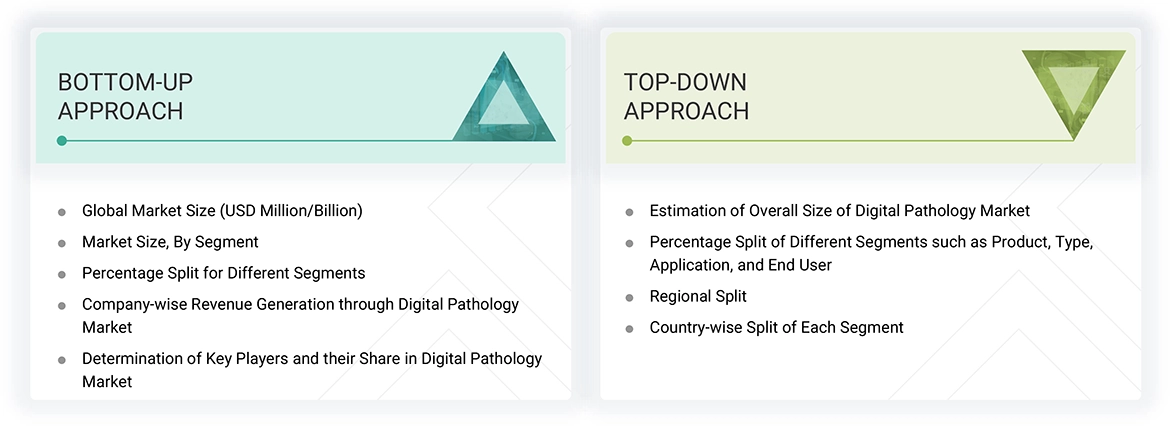

Methodology

The study involved five major activities to estimate the current size of the digital pathology market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

The market for the companies offering digital pathology solutions is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of digital pathology vendors, forums, certified publications, and white papers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global Digital Pathology market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (Hospital Directors, Hospital Vice Presidents, Department heads, and Critical care specialists ) and supply side (such as C-level and D-level executives, technology experts, product managers, marketing and sales managers, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East, and Africa. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

Note 1: Other designations include sales managers, marketing managers, and product managers.

Note 2: Tiers of companies are defined on the basis of their total revenues in 2023. Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Digital Pathology market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, using the market size estimation processes, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides in the Digital Pathology Market.

Market Definition

Digital pathology refers to the use of digital technology to capture, manage, share, and analyze pathology information, typically in the form of high-resolution digital images derived from glass slides. This technology allows pathologists to view, interpret, and manage pathology data more efficiently and accurately.

Stakeholders

- Healthcare Institutions/Providers (Hospitals, Medical Groups, Physician Practices, Diagnostic Centers, Pharmacies, Ambulatory Centers, and Outpatient Clinics)

- Digital Pathology Organizations

- Senior Management

- Finance/Procurement Department

- R&D Department

- Healthcare Data Aggregators

- Venture Capitalists

- Government Agencies

- Healthcare Startups, Consultants, and Regulators

- Academic Medical Institutes

Report Objectives

- To define, describe, and forecast the global digital pathology market based on product, type, application, end user, and region

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micro-markets concerning individual growth trends, prospects, and contributions to the overall digital pathology market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically analyze the market structure, profile the key players of the digital pathology market, and comprehensively analyze their core competencies

- To forecast the size of the market segments for five regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To track and analyze competitive developments such as product launches & enhancements, investments, partnerships, collaborations, acquisitions, expansions, agreements, sales contracts, and alliances in the digital pathology market during the forecast period

Frequently Asked Questions (FAQ)

Which are the top industry players in the digital pathology market?

Prominent players include Fujifilm Holdings Corporation (Japan), Danaher Corporation (US), Koninklijke Philips N.V. (Netherlands), KONFOONG BIOTECH INTERNATIONAL CO., LTD. (China), Glencoe Software, Inc. (US), Aiforia (Finland), Paige AI, Inc. (US), Huron Digital Pathology (Canada), Hologic, Inc. (US), Corista (US), Mikroscan Technologies, Inc. (US), PathAI (US), Hamamatsu Photonics K.K. (Japan), F. Hoffmann-La Roche Ltd. (Switzerland), 3DHISTECH (Hungary), Apollo Enterprise Imaging (US), XIFIN, Inc. (US), Proscia Inc. (US), Indica Labs Inc. (US), Objective Pathology Services Limited (Canada), Sectra AB (Sweden), OptraSCAN (US), Akoya Biosciences, Inc. (US), Motic Digital Pathology (US), and Kanteron Systems (Spain).

Which type has been included in the digital pathology market report?

Human Pathology and Veterinary Pathology.

Which geographical region is dominating in the digital pathology market?

North America is expected to hold the largest market share. The Asia Pacific region is projected to register the highest growth during the forecast period.

Which end-user segments have been included in the digital pathology market report?

Pharmaceutical & Biotechnology Companies, Hospitals, Diagnostic Labs, and Academic & Research Institutes.

What is the total CAGR expected to be recorded for the digital pathology market during the forecast period?

The market is expected to record a CAGR of 13.5% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Digital Pathology Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Digital Pathology Market

Jamie

Jul, 2022

Keen to Know about Digital Pathology Market Size, Share and Trend Analysis Report by Product (ArtificiaI Intelligence, Scanner, Software, Storage), Type (Human, Veterinary), Application (Teleconsultation, Training, Disease Diagnosis, Drug Discovery), and Pharma, Diagnostic Labs, Hospitals as well as Academia, Hospitals - Global Forecast to 2031.

Jason

Mar, 2022

Looking to gain more insights on the global Industrial Digital Pathology Market.

Jeffrey

Mar, 2022

What are the growth opportunities in Digital Pathology Market?.

Jeffrey

Mar, 2022

What are the growth opportunities in Digital Pathology Market?.

Ryan

Mar, 2022

Can you enlighten us on geographical growth analysis in Digital Pathology Market?.