Dental Digital X-ray Market by Product (Digital, Analog), Type (Intraoral (Panoramic), Extraoral (Digital Sensor), Hybrid), Application (Diagnostic, Therapeutic), End User (Dental Hospitals, Forensic Laboratories), & Region - Global Forecasts to 2027

Market Growth Outlook Summary

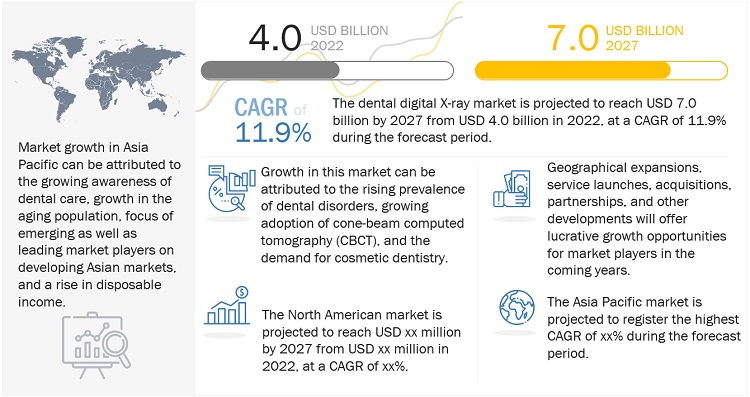

The global dental digital x-ray market, stood at US$4.0 billion in 2022 and is projected to advance at a resilient CAGR of 11.9% from 2023 to 2028, culminating in a forecasted valuation of US$7.0 billion by the end of the period. Key drivers include advancements in technology that enhance image quality and reduce diagnostic time, along with increasing adoption of CBCT in dentistry. Growing medical tourism, particularly in emerging markets, presents significant opportunities. However, high costs and radiation risks pose challenges. The dental hospitals & clinics segment is expected to grow fastest, while the US remains the largest market. Major players include Envista Holdings, VAREX Imaging, and DENTSPLY SIRONA.

Attractive Opportunities in the Dental Digital X-ray Market

To know about the assumptions considered for the study, Request for Free Sample Report

Dental digital x-ray market Dynamics

Drivers: Technological advancements

Technological innovation is one of the most important influencing factors for the growth of the market. Product innovation leads to the development of more economical, technologically advanced, and easy-to-use dental X-ray products. Conventional X-ray machines result in lead foils as a by-product, along with several other hazardous chemicals. 60% of dental offices in the US have eliminated the use of conventional X-ray materials from their practices by switching to dental digital X-ray diagnostic equipment. The frequent launch of new products is expected to increase the adoption of these devices due to the wide range of advantages they offer. This will, in turn, help the market grow.

Restraints: High cost of digital X-ray systems and potential risks associated with radiation exposure

Despite the benefits of digital systems, the high costs associated with them hinder their adoption, especially in developing countries. A digital X-ray system typically costs anywhere between USD 11,000 to USD 15,000 (excluding the cost of software, computers, and additional hardware such as servers) for a wired sensor system and between USD 20,000 to USD 50,000 (excluding the cost of maintenance and service repairs) for a wireless system. Dental CBCT systems cost anywhere between USD 150,000 to USD 300,000. Small and medium-sized hospitals cannot afford these systems due to budgetary constraints.

Also, frequent exposure to dental diagnostic X-rays, even with slight changes, increases health risks. These factors are expected to restrain the growth of the market.

Opportunities: Growing medical tourism

Countries such as India, Singapore, Thailand, Mexico, Hungary, Poland, and Turkey have emerged as the fastest-growing dental tourism destinations owing to the number of trained dental professionals and the development of strong healthcare infrastructure in these countries.

Price is another key factor influencing the growth of this market. The average cost of a dental treatment with implants in the US is around USD 4,000, whereas the same procedure costs USD 1,500 per implant in Thailand, USD 1,000 per implant in Turkey, USD 850 per implant in Mexico, and USD 750 per implant in India. Owing to such a major difference in the cost of dental services offered, patients in developed nations are increasingly opting for treatment in these emerging markets.

Challenges: Survival of new entrants

The market is capital-intensive; it demands high capital and R&D investments for players to enter the market and develop new products and technologies. Additionally, in order to survive in the market, players are required to continue making investments to update their existing product portfolios and maintain competitive positioning.

Furthermore, lack of economies of scale and high manufacturing costs, technological improvement in the R&D segments within the company are some of the other challenges faced by new players in the market, especially in the initial years.

Among end users, dental hospitals & clinics segment of dental digital x-ray market is expected to grow at the highest CAGR from 2022 to 2027.

In addition to occupying the largest share of the market, by end user, the dental hospitals & clinics segment is also expected to be the fastest growing segment during the forecast period.

Favorable reimbursement scenarios for boosting the adoption of digital dental imaging systems in developed countries such as France and the US, high demand for cosmetic dentistry, and the increasing number of people opting for dental implants are expected to drive the demand for dental radiology and imaging systems in this end-user segment.

US was the largest segment in the world for dental digital x-ray market in 2021

In 2021, the US occupied the largest share in North America and globally, in the market. This can mainly be attributed to the presence of a large population with oral/dental disorders, significant availability of technologically advanced products, and a large number of key players based in the country.

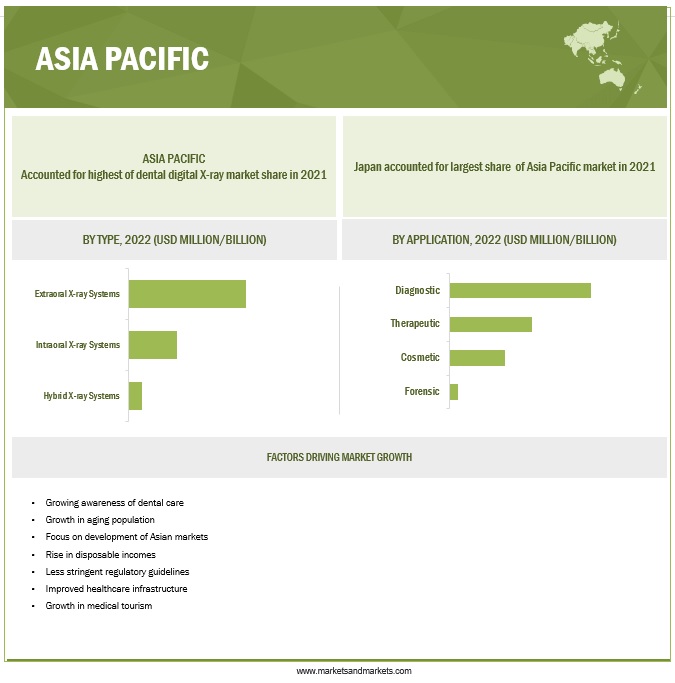

In Asia Pacific, China was expected to be the fastest growing country in the market during the forecast period. This can be attributed to the rise in disposable incomes, and an increase in the awareness about dental disorders, which has led to a significant increase in the demand for dental care services and the number of oral health clinics and dental hospitals.

To know about the assumptions considered for the study, download the pdf brochure

A few emerging and key players in the Dental digital x-ray market include Envista Holdings Corporation (US), VAREX IMAGING CORPORATION (US), Planmeca Oy (Finalnd), DENTSPLY SIRONA Inc. (US), VATECH CO. Ltd (South Korea), Acteon Group (France), Air Techniques, Inc. (US), The Yoshida Dental Mfg. Co. (Japan), and Hefei Meyer Optometric Technology Inc. (China).

These companies adopted strategies such as collaborations, product launches and enhancements, acquisitions, and partnerships, to strengthen their presence in the market.

Dental Digital X-ray Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product, Type, End User, Application, Region |

|

Geographies covered |

Asia Pacific, North America, Europe, and the Rest of the World |

The research report categorizes the dental digital x-ray market into the following segments and sub-segments:

By Product

- Digital X-ray Systems

- Analog X-ray Systems

By Type

-

Extraoral X-ray Systems

- Panoramic/Cephalometric Systems

- Cone-Beam Computed Tomography (CBCT) Systems

-

Intraoral X-ray Systems

- Digital Sensors

- Photostimulable Phosphor (PSP) Systems

- Hybrid X-ray Systems

By Application

- Diagnostic

- Therapeutic

- Cosmetic

- Forensic

By End User

- Dental Hospitals & Clinics

- Dental Academic & Research Institutes

- Forensic Laboratories

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Rest of the World

Recent Developments

- In April 2022, Envista Holdings Corporation (US) acquired Carestream Dental's Intra-Oral Scanner (US) in line with its long-term strategy to focus on its fastest-growing Specialty Products & Technologies segment to digitalize dental workflows

- In February 2022, DENTSPLY SIRONA Inc. (US) announced its collaboration with Google Cloud (US) and the launch of its medical-grade 3D printing solution to drive its leadership in Digital Dentistry.

- In September 2021, Planmeca Oy (Finland) acquired KaVo Treatment Unit & Instrument business from Envista Holdings Corporation (US) to strengthen companies' product portfolio and dental solutions.

- In March 2021, Air Techniques, Inc. (US) announced its partnership with DENTSPLY SIRONA (US)'s SICAT software. This Integration of SICAT software with ProVecta 3D Prime allows dentists to provide patients with an ideal experience.

Frequently Asked Questions (FAQ):

What is the projected market value of the global dental digital x-ray market?

The global market of dental digital x-ray is projected to reach USD 7.0 billion.

What is the estimated growth rate (CAGR) of the global dental digital x-ray market for the next five years?

The global dental digital x-ray market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.9% from 2022 to 2027.

What are the major revenue pockets in the dental digital x-ray market currently?

The dental digital x-ray market is segmented into four major regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). North America accounted for the largest share of the dental digital x-ray market in 2021. The high prevalence of dental diseases, rising healthcare expenditure, and presence of major players in the US is driving the growth of the dental digital x-ray market in the region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Technological advancements- Rapidly growing aging population- Reduced diagnosis time and improved cost savings- Increasing adoption of cone-beam computed tomography (CBCT)- Increasing number of dental disorders- Growing demand for cosmetic dentistry- Increased accessibility and data managementRESTRAINTS- High cost of digital X-ray systems and potential risks associated with radiation exposure- Lack of reimbursement for dental careOPPORTUNITIES- Growing medical tourism- Development of AI-based digital X-ray systems- Low penetration of advanced dental digital X-ray systems- Emerging marketsCHALLENGES- Management of high volumes of image data; cyberattacks; and dearth of trained professionals- Survival of new entrants

-

5.3 SAFETY MEASURES IN DENTAL RADIOLOGYINTRODUCTIONOPTIMIZATION OF RADIOGRAPHIC EXPOSURE

-

5.4 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTES

-

5.5 REGULATORY ANALYSISNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- Japan- China- India

-

5.6 CASE STUDIESCLEARTOOTH DENTAL DIGITAL X-RAY: YORK TEACHING HOSPITAL EXPEDITES DATA CAPTURE PROCESSING DURING PHASE III CLINICAL STUDYAPPLICATION OF DIGITAL TECHNOLOGIES IN CLINICAL PRACTICES FOR SMOOTH DIAGNOSTIC TREATMENTSCLEARTOOTH DIGITAL X-RAY IMAGING SUPPORTS SPECIALIZED PEDIATRIC PRACTICES

-

5.7 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCE (AI) IN DENTAL RADIOLOGYBLOCKCHAINCLOUD COMPUTING5G TECHNOLOGY

-

5.8 INDUSTRY TRENDSGROWING ADOPTION OF CLOUD SERVICESINCREASING ADOPTION OF ARTIFICIAL INTELLIGENCEIMPACT OF IOS AND AUGMENTED AND VIRTUAL REALITY ON DIGITAL DENTISTRY

- 5.9 VALUE CHAIN ANALYSIS

-

5.10 ECOSYSTEM MAP

- 5.11 KEY CONFERENCES AND EVENTS IN 2023

-

5.12 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR DENTAL DIGITAL X-RAY SYSTEMSINSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.14 PRICING ANALYSISAVERAGE SELLING PRICE, BY PRODUCT TYPEAVERAGE SELLING PRICE TREND

- 6.1 INTRODUCTION

-

6.2 DIGITAL X-RAY SYSTEMSLESS RADIATION EXPOSURE AND INSTANT HIGH-QUALITY IMAGES

-

6.3 ANALOG X-RAY SYSTEMSRAPID EMERGENCE OF DIGITAL TECHNOLOGY FOR CAPTURING INTRAORAL X-RAY IMAGES

- 7.1 INTRODUCTION

-

7.2 EXTRAORAL X-RAY SYSTEMSPANORAMIC/CEPHALOMETRIC SYSTEMS- Increasing prevalence of dental disorders and rising geriatric populationCONE-BEAM COMPUTED TOMOGRAPHY SYSTEMS- Growing dental implants market and increase in number of vendors offering CBCT

-

7.3 INTRAORAL X-RAY SYSTEMSDIGITAL SENSORS- Ease of use and cost advantage of digital sensorsPHOTOSTIMULABLE PHOSPHOR SYSTEMS- ABILITY TO SCAN MULTIPLE PLATES SIMULTANEOUSLY

- 7.4 HYBRID X-RAY SYSTEMS

- 8.1 INTRODUCTION

-

8.2 DIAGNOSTICINCREASING ORAL HEALTH AWARENESS AND RISING DISPOSABLE INCOME IN DEVELOPING ECONOMIES

-

8.3 THERAPEUTICRISE IN EDENTULISM DUE TO GROWING GERIATRIC POPULATION

-

8.4 COSMETICIMPORTANCE OF AESTHETICS AND INCREASED DISPOSABLE INCOME

-

8.5 FORENSICON-SITE INVESTIGATION CAPABILITIES AND FASTER RESULTS

- 9.1 INTRODUCTION

-

9.2 DENTAL HOSPITALS & CLINICSINCREASING NUMBER OF DENTAL CLINICS AND HOSPITALS

-

9.3 DENTAL ACADEMIC & RESEARCH INSTITUTESRISING TRAINING COLLABORATIONS BETWEEN MANUFACTURERS AND ACADEMIC INSTITUTES

-

9.4 FORENSIC LABORATORIESTECHNOLOGICAL ADVANCEMENTS IN FORENSIC DENTISTRY

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAN DENTAL DIGITAL X-RAY MARKETUSCANADA

-

10.3 EUROPEIMPACT OF RECESSION ON EUROPEAN DENTAL DIGITAL X-RAY MARKETGERMANYFRANCEUKITALYSPAINREST OF EUROPE (ROE)

-

10.4 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFIC DENTAL DIGITAL X-RAY MARKETJAPANCHINAINDIAREST OF ASIA PACIFIC (ROAPAC)

-

10.5 REST OF THE WORLD (ROW)IMPACT OF RECESSION ON DENTAL DIGITAL X-RAY MARKET IN REST OF THE WORLD

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE SHARE ANALYSIS OF KEY MARKET PLAYERS

- 11.4 MARKET RANKING ANALYSIS, 2021

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 DENTAL DIGITAL X-RAY MARKET: COMPETITIVE EVALUATION QUADRANT FOR SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 11.7 COMPETITIVE BENCHMARKING

-

11.8 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSDENTSPLY SIRONA INC.- Business overview- Products and services offered- Recent developments- MnM viewENVISTA HOLDINGS CORPORATION- Business overview- Products and services offered- Recent developments- MnM viewPLANMECA OY- Business overview- Products and services offered- Recent developments- MnM viewVATECH CO., LTD.- Business overview- Products and services offered- Recent developmentsVAREX IMAGING CORPORATION- Business overview- Products and services offered- Recent developmentsTHE YOSHIDA DENTAL MFG. CO., LTD.- Business overview- Products and services offered- Recent developmentsACTEON GROUP- Business overview- Products and services offered- Recent developmentsAIR TECHNIQUES, INC.- Business overview- Products and services offered- Recent developmentsHEFEI MEYER OPTOELECTRONIC TECHNOLOGY INC.- Business overview- Products and services offered- Recent developmentsJ. MORITA CORPORATION- Business overview- Products and services offered- Recent developmentsCEFLA SC- Business overview- Products and services offered- Recent developmentsAMANN GIRRBACH AG- Business overview- Products and services offered- Recent developmentsMIDMARK CORPORATION- Business overview- Products and services offered- Recent developmentsPLANET DDS- Business overview- Products and services offered- Recent developments

-

12.2 OTHER PLAYERSCORIX MEDICAL SYSTEMSFUSSEN TECH.OWANDY RADIOLOGYROSON MEDICAL EQUIPMENT CO., LTD.APIXIAZHENGZHOU SENMY DENTAL EQUIPMENT CO., LTDRAYTRIDENTDÜRR DENTAL SEDENFORT INTERNATIONALSOTA IMAGING

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 STANDARD CURRENCY CONVERSION RATES (USD)

- TABLE 2 RISK ASSESSMENT: DENTAL DIGITAL X-RAY MARKET

- TABLE 3 NEW PRODUCT LAUNCHES

- TABLE 4 STATISTICS ON AGING POPULATION

- TABLE 5 COST OF DENTAL TREATMENT IN DEVELOPED AND DEVELOPING COUNTRIES (USD)

- TABLE 6 SAFETY MEASURES FOR DENTAL PRACTICES TO REDUCE RADIATION EXPOSURE

- TABLE 7 DENTAL DIGITAL X-RAY MARKET: PORTER’S FIVE FORCES

- TABLE 8 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 9 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 10 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 11 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 12 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 13 CONFERENCES AND EVENTS IN 2023

- TABLE 14 DENTAL DIGITAL X-RAY: KEY PATENTS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF DENTAL DIGITAL X-RAY SYSTEMS

- TABLE 16 KEY BUYING CRITERIA FOR MEDICAL DEVICES

- TABLE 17 AVERAGE SELLING PRICE OF TOP TWO TYPES OF DENTAL DIGITAL X-RAY SYSTEMS (USD)

- TABLE 18 DENTAL X-RAY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 19 DIGITAL X-RAY SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 20 NORTH AMERICA: DIGITAL X-RAY SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 21 EUROPE: DIGITAL X-RAY SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 22 ASIA PACIFIC: DIGITAL X-RAY SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 23 ANALOG X-RAY SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 24 DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 25 EXTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 26 EXTRAORAL X-RAY SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 27 NORTH AMERICA: EXTRAORAL X-RAY SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 28 EUROPE: EXTRAORAL X-RAY SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 29 ASIA PACIFIC: EXTRAORAL X-RAY SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 30 COMMERCIALLY AVAILABLE PANORAMIC/CEPHALOMETRIC SYSTEMS

- TABLE 31 PANORAMIC/CEPHALOMETRIC SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 32 NORTH AMERICA: PANORAMIC/CEPHALOMETRIC SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 33 EUROPE: PANORAMIC/CEPHALOMETRIC SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 34 ASIA PACIFIC: PANORAMIC/CEPHALOMETRIC SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 35 COMMERCIALLY AVAILABLE CBCT SYSTEMS

- TABLE 36 CONE-BEAM COMPUTED TOMOGRAPHY SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 37 NORTH AMERICA: CONE-BEAM COMPUTED TOMOGRAPHY SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 38 EUROPE: CONE-BEAM COMPUTED TOMOGRAPHY SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 39 ASIA PACIFIC: CONE-BEAM COMPUTED TOMOGRAPHY SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 40 INTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 41 INTRAORAL X-RAY SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 42 NORTH AMERICA: INTRAORAL X-RAY SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 43 EUROPE: INTRAORAL X-RAY SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 44 ASIA PACIFIC: INTRAORAL X-RAY SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 45 COMMERCIALLY AVAILABLE DIGITAL SENSORS

- TABLE 46 DIGITAL SENSORS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 47 NORTH AMERICA: DIGITAL SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 48 EUROPE: DIGITAL SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 49 ASIA PACIFIC: DIGITAL SENSORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 50 COMMERCIALLY AVAILABLE PHOTOSTIMULABLE PHOSPHOR SYSTEMS

- TABLE 51 PHOTOSTIMULABLE PHOSPHOR SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 52 NORTH AMERICA: PHOTOSTIMULABLE PHOSPHOR SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 53 EUROPE: PHOTOSTIMULABLE PHOSPHOR SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 54 ASIA PACIFIC: PHOTOSTIMULABLE PHOSPHOR SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 55 HYBRID X-RAY SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: HYBRID X-RAY SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 57 EUROPE: HYBRID X-RAY SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 58 ASIA PACIFIC: HYBRID X-RAY SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 59 DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 60 DIAGNOSTIC APPLICATIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: DIAGNOSTIC APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 62 EUROPE: DIAGNOSTIC APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 63 ASIA PACIFIC: DIAGNOSTIC APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 64 THERAPEUTIC APPLICATIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 65 NORTH AMERICA: THERAPEUTIC APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 66 EUROPE: THERAPEUTIC APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 67 ASIA PACIFIC: THERAPEUTIC APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 68 COSMETIC APPLICATIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 69 NORTH AMERICA: COSMETIC APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 70 EUROPE: COSMETIC APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 71 ASIA PACIFIC: COSMETIC APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 72 FORENSIC APPLICATIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 73 NORTH AMERICA: FORENSIC APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 74 EUROPE: FORENSIC APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 75 ASIA PACIFIC: FORENSIC APPLICATIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 76 DENTAL DIGITAL X-RAY MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 77 DENTAL HOSPITALS & CLINICS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 78 NORTH AMERICA: DENTAL HOSPITALS & CLINICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 79 EUROPE: DENTAL HOSPITALS & CLINICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 80 ASIA PACIFIC: DENTAL HOSPITALS & CLINICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 81 DENTAL ACADEMIC & RESEARCH INSTITUTES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 82 NORTH AMERICA: DENTAL ACADEMIC & RESEARCH INSTITUTES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 83 EUROPE: DENTAL ACADEMIC & RESEARCH INSTITUTES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 84 ASIA PACIFIC: DENTAL ACADEMIC & RESEARCH INSTITUTES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 85 FORENSIC LABORATORIES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 86 NORTH AMERICA: FORENSIC LABORATORIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 87 EUROPE: FORENSIC LABORATORIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 88 ASIA PACIFIC: FORENSIC LABORATORIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 89 DENTAL DIGITAL X-RAY MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 90 NORTH AMERICA: DENTAL DIGITAL X-RAY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 91 NORTH AMERICA: DENTAL X-RAY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 92 NORTH AMERICA: DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 93 NORTH AMERICA: EXTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 94 NORTH AMERICA: INTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 95 NORTH AMERICA: DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 96 NORTH AMERICA: DENTAL DIGITAL X-RAY MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 97 US: KEY MACRO INDICATORS

- TABLE 98 US: DENTAL X-RAY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 99 US: DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 100 US: EXTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 101 US: INTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 102 US: DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 103 US: DENTAL DIGITAL X-RAY MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 104 CANADA: KEY MACRO INDICATORS

- TABLE 105 CANADA: DENTAL X-RAY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 106 CANADA: DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 107 CANADA: EXTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 108 CANADA: INTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 109 CANADA: DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 110 CANADA: DENTAL DIGITAL X-RAY MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 111 EUROPE: DENTAL DIGITAL X-RAY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 112 EUROPE: DENTAL X-RAY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 113 EUROPE: DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 114 EUROPE: EXTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 115 EUROPE: INTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 116 EUROPE: DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 117 EUROPE: DENTAL DIGITAL X-RAY MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 118 GERMANY: KEY MACRO INDICATORS

- TABLE 119 GERMANY: DENTAL X-RAY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 120 GERMANY: DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 121 GERMANY: EXTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 122 GERMANY: INTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 123 GERMANY: DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 124 GERMANY: DENTAL DIGITAL X-RAY MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 125 FRANCE: KEY MACRO INDICATORS

- TABLE 126 FRANCE: DENTAL X-RAY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 127 FRANCE: DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 128 FRANCE: EXTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 129 FRANCE: INTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 130 FRANCE: DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 131 FRANCE: DENTAL DIGITAL X-RAY MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 132 UK: KEY MACRO INDICATORS

- TABLE 133 UK: DENTAL X-RAY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 134 UK: DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 135 UK: EXTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 136 UK: INTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 137 UK: DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 138 UK: DENTAL DIGITAL X-RAY MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 139 ITALY: KEY MACRO INDICATORS

- TABLE 140 ITALY: DENTAL X-RAY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 141 ITALY: DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 142 ITALY: EXTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 143 ITALY: INTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 144 ITALY: DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 145 ITALY: DENTAL DIGITAL X-RAY MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 146 SPAIN: KEY MACRO INDICATORS

- TABLE 147 SPAIN: DENTAL X-RAY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 148 SPAIN: DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 149 SPAIN: EXTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 150 SPAIN: INTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 151 SPAIN: DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 152 SPAIN: DENTAL DIGITAL X-RAY MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 153 ROE: DENTAL X-RAY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 154 ROE: DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 155 ROE: EXTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 156 ROE: INTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 157 ROE: DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 158 ROE: DENTAL DIGITAL X-RAY MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 159 ASIA PACIFIC: DENTAL DIGITAL X-RAY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 160 ASIA PACIFIC: DENTAL X-RAY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 161 ASIA PACIFIC: DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 162 ASIA PACIFIC: EXTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 163 ASIA PACIFIC: INTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 164 ASIA PACIFIC: DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 165 ASIA PACIFIC: DENTAL DIGITAL X-RAY MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 166 JAPAN: DENTAL X-RAY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 167 JAPAN: DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 168 JAPAN: EXTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 169 JAPAN: INTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 170 JAPAN: DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 171 JAPAN: DENTAL DIGITAL X-RAY MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 172 CHINA: DENTAL X-RAY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 173 CHINA: DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 174 CHINA: EXTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 175 CHINA: INTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 176 CHINA: DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 177 CHINA: DENTAL DIGITAL X-RAY MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 178 INDIA: DENTAL X-RAY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 179 INDIA: DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 180 INDIA: EXTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 181 INDIA: INTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 182 INDIA: DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 183 INDIA: DENTAL DIGITAL X-RAY MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 184 ROAPAC: DENTAL X-RAY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 185 ROAPAC: DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 186 ROAPAC: EXTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 187 ROAPAC: INTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 188 ROAPAC: DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 189 ROAPAC: DENTAL DIGITAL X-RAY MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 190 ROW: DENTAL X-RAY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 191 ROW: DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 192 ROW: EXTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 193 ROW: INTRAORAL X-RAY SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 194 ROW: DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 195 ROW: DENTAL DIGITAL X-RAY MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 196 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 197 DENTAL DIGITAL X-RAY MARKET: TYPE FOOTPRINT

- TABLE 198 DENTAL DIGITAL X-RAY MARKET: END USER FOOTPRINT

- TABLE 199 DENTAL DIGITAL X-RAY MARKET: COMPANY REGIONAL FOOTPRINT

- TABLE 200 PRODUCT LAUNCHES, 2019–2023

- TABLE 201 DEALS, 2019–2023

- TABLE 202 DENTSPLY SIRONA INC.: BUSINESS OVERVIEW

- TABLE 203 DENTSPLY SIRONA INC.: PRODUCTS AND SERVICES OFFERED

- TABLE 204 DENTSPLY SIRONA INC.: PRODUCT LAUNCHES

- TABLE 205 DENTSPLY SIRONA INC.: DEALS

- TABLE 206 ENVISTA HOLDINGS CORPORATION: BUSINESS OVERVIEW

- TABLE 207 ENVISTA HOLDINGS CORPORATION: PRODUCTS AND SERVICES OFFERED

- TABLE 208 ENVISTA HOLDINGS CORPORATION: PRODUCT LAUNCHES

- TABLE 209 ENVISTA HOLDINGS CORPORATION: DEALS

- TABLE 210 PLANMECA OY: BUSINESS OVERVIEW

- TABLE 211 PLANMECA OY: PRODUCTS AND SERVICES OFFERED

- TABLE 212 PLANMECA OY: DEALS

- TABLE 213 PLANMECA OY: OTHER DEVELOPMENT

- TABLE 214 VATECH CO., LTD.: BUSINESS OVERVIEW

- TABLE 215 VATECH CO., LTD.: PRODUCTS AND SERVICES OFFERED

- TABLE 216 VATECH CO., LTD.: PRODUCT LAUNCHES

- TABLE 217 VAREX IMAGING CORPORATION: BUSINESS OVERVIEW

- TABLE 218 VAREX IMAGING CORPORATION: PRODUCTS AND SERVICES OFFERED

- TABLE 219 VAREX IMAGING CORPORATION: PRODUCT LAUNCHES

- TABLE 220 VAREX IMAGING CORPORATION: DEALS

- TABLE 221 THE YOSHIDA DENTAL MFG. CO., LTD.: BUSINESS OVERVIEW

- TABLE 222 THE YOSHIDA DENTAL MFG. CO., LTD.: PRODUCTS AND SERVICES OFFERED

- TABLE 223 ACTEON GROUP: BUSINESS OVERVIEW

- TABLE 224 ACTEON GROUP: PRODUCTS AND SERVICES OFFERED

- TABLE 225 ACTEON GROUP: PRODUCT LAUNCH

- TABLE 226 AIR TECHNIQUES, INC.: BUSINESS OVERVIEW

- TABLE 227 AIR TECHNIQUES, INC.: PRODUCTS AND SERVICES OFFERED

- TABLE 228 AIR TECHNIQUES, INC.: DEALS

- TABLE 229 HEFEI MEYER OPTOELECTRONIC TECHNOLOGY INC.: BUSINESS OVERVIEW

- TABLE 230 HEFEI MEYER OPTOELECTRONIC TECHNOLOGY INC.: PRODUCTS AND SERVICES OFFERED

- TABLE 231 HEFEI MEYER OPTOELECTRONIC TECHNOLOGY INC.: PRODUCT LAUNCHES

- TABLE 232 J. MORITA CORPORATION: BUSINESS OVERVIEW

- TABLE 233 J. MORITA CORPORATION: PRODUCTS AND SERVICES OFFERED

- TABLE 234 CEFLA SC: BUSINESS OVERVIEW

- TABLE 235 CEFLA SC: PRODUCTS AND SERVICES OFFERED

- TABLE 236 AMANN GIRRBACH AG: BUSINESS OVERVIEW

- TABLE 237 AMANN GIRRBACH AG: PRODUCTS AND SERVICES OFFERED

- TABLE 238 AMANN GIRRBACH AG: DEALS

- TABLE 239 MIDMARK CORPORATION: BUSINESS OVERVIEW

- TABLE 240 MIDMARK CORPORATION: PRODUCTS AND SERVICES OFFERED

- TABLE 241 MIDMARK CORPORATION: PRODUCT LAUNCHES

- TABLE 242 MIDMARK CORPORATION: DEALS

- TABLE 243 PLANET DDS: BUSINESS OVERVIEW

- TABLE 244 PLANET DDS: PRODUCTS AND SERVICES OFFERED

- TABLE 245 PLANET DDS: DEALS

- FIGURE 1 DENTAL DIGITAL X-RAY MARKET SEGMENTATION

- FIGURE 2 REGIONAL SCOPE

- FIGURE 3 DENTAL DIGITAL X-RAY MARKET: RESEARCH DESIGN

- FIGURE 4 PRIMARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS: DENTSPLY SIRONA, INC.

- FIGURE 9 REVENUE ANALYSIS OF TOP FIVE COMPANIES: DENTAL DIGITAL X-RAY MARKET (2021)

- FIGURE 10 CAGR PROJECTIONS FROM ANALYSIS OF DENTAL DIGITAL X-RAY MARKET DYNAMICS (2022–2027)

- FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 12 TOP-DOWN APPROACH

- FIGURE 13 MARKET DATA TRIANGULATION METHODOLOGY

- FIGURE 14 DIGITAL X-RAY MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

- FIGURE 15 DENTAL DIGITAL X-RAY MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 16 DENTAL DIGITAL X-RAY MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 17 DENTAL DIGITAL X-RAY MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 18 REGIONAL SNAPSHOT OF DENTAL DIGITAL X-RAY MARKET

- FIGURE 19 ADVANCEMENTS IN DENTAL X-RAY IMAGING MODALITIES TO DRIVE MARKET

- FIGURE 20 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 21 ASIA PACIFIC COUNTRIES TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 22 NORTH AMERICA TO CONTINUE TO DOMINATE MARKET

- FIGURE 23 DENTAL DIGITAL X-RAY MARKET DYNAMICS

- FIGURE 24 DENTAL DIGITAL X-RAY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 DENTAL DIGITAL X-RAY MARKET: ECOSYSTEM MAPPING (2021)

- FIGURE 26 PATENT PUBLICATION TRENDS (JANUARY 2013–FEBRUARY 2023)

- FIGURE 27 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) OF DENTAL DIGITAL X-RAY PATENTS (JANUARY 2013–FEBRUARY 2023)

- FIGURE 28 TOP 10 APPLICANT COUNTRIES/REGIONS FOR DENTAL DIGITAL X-RAY PATENTS (JANUARY 2013–FEBRUARY 2023)

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF DENTAL DIGITAL X-RAY SYSTEMS

- FIGURE 30 KEY BUYING CRITERIA FOR DENTAL DIGITAL X-RAY SYSTEMS

- FIGURE 31 AVERAGE SELLING PRICE OF TOP TWO TYPES OF DENTAL DIGITAL X-RAY SYSTEMS, BY KEY PLAYER

- FIGURE 32 DENTAL DIGITAL X-RAY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 33 NORTH AMERICA: DENTAL DIGITAL X-RAY MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: DENTAL DIGITAL X-RAY MARKET SNAPSHOT

- FIGURE 35 DENTAL DIGITAL X-RAY MARKET: KEY PLAYERS

- FIGURE 36 DENTAL DIGITAL X-RAY MARKET: COMPANY RANKING (2021)

- FIGURE 37 DENTAL DIGITAL X-RAY MARKET: COMPANY EVALUATION QUADRANT (2021)

- FIGURE 38 DENTAL DIGITAL X-RAY MARKET: COMPANY EVALUATION QUADRANT FOR SMES (2021)

- FIGURE 39 DENTAL DIGITAL X-RAY MARKET: OVERALL FOOTPRINT OF 11 COMPANIES

- FIGURE 40 DENTSPLY SIRONA INC.: COMPANY SNAPSHOT (2021)

- FIGURE 41 ENVISTA HOLDINGS CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 42 VAREX IMAGING CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 43 CEFLA SC: COMPANY SNAPSHOT (2021)

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the dental digital x-ray market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

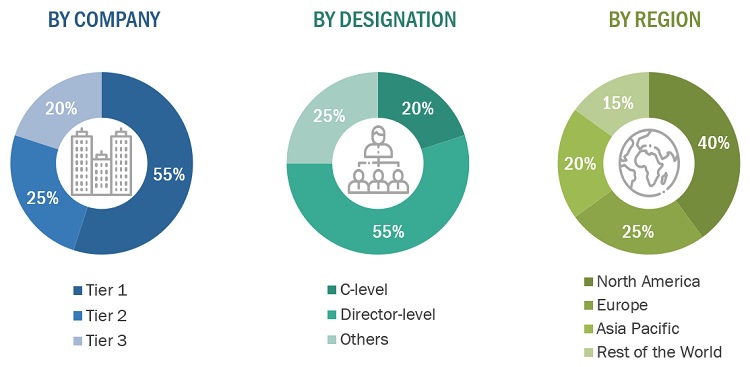

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the dental digital x-ray market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents for the dental digital x-ray market is provided below:

Tiers are defined based on a company’s total revenue. As of 2021: Tier 1= >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3= <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the dental digital x-ray market was arrived at after data triangulation as mentioned below.

Approach to calculating the revenue of different players in the ultrasound probe covers market

The size of the global dental digital x-ray market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global dental digital x-ray market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the dental digital x-ray market by application, type, product, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of the dental digital x-ray market with respect to five major regions, namely, North America, Europe, the Asia Pacific, and the Rest of the World

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile key players in the dental digital x-ray market as well as comprehensively analyze their core competencies

- To track and analyze competitive developments such as product launches and enhancements, collaborations, partnerships, and acquisitions of the leading players in the dental digital x-ray market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific dental digital x-ray market into New Zealand, South Korea, Malaysia, Singapore, Indonesia, and other countries

- Further breakdown of the Rest of Europe dental digital x-ray market into Belgium, Russia, the Netherlands, Switzerland, and other countries

- Further breakdown of the Rest of the World dental digital x-ray market into Latin America and Middle East and Africa

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Dental Digital X-ray Market