Insurance Platform Market

Insurance Platform Market by Offering (Core Insurance, Insurtech), Application (Underwriting, CRM, Data Analytics), Technology (AI, Blockchain, Cloud Computing, Analytics), Insurance Type (Health, Life, P&C, Travel), & End User - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The insurance platform market is set for significant expansion and is expected to grow from USD 116.16 billion in 2025 to USD 207.52 billion by 2030, indicating a strong CAGR of 12.3%. This increase is led, to a large extent, by investments of over USD 1.5 billion in the US in insurance platforms and Europe, following closely at over USD 1 billion. Interestingly, nearly 40% of InsurTech investment has been captured by B2B SaaS firms, which focus on innovation areas such as payment solutions, risk management, underwriting software, and claims administration. The majority of these solutions incorporate artificial intelligence (AI), with firms actively expanding their portfolios to include new AI-powered products. At the same time, changing consumer preferences are driving strategic adjustments throughout the industry, as more than 60% of insurance strategists recognize that shifting customer expectations have sped up their transformation strategies. This evolving environment highlights the increasing demand for adaptable, technology-driven solutions in the insurance sector.

KEY TAKEAWAYS

- By Region, North America accounted for largest market share of 38.20% in 2025.

- By Offering, the Insurance Technology software type segment is expected to grow at the highest CAGR of 13.4% during the forcast period.

- The AI & analytics segment is projected to have the highest growth rate among insurance platform technologies from 2025 to 2030.

- By Insurance Type, Health Insurance segment is expected to dominate the market share during the forecast period.

- By Application, the predictive modeling/extreme event forecasting segment is expected to grow at the highest CAGR of 16.5% during the forecast period.

- By End User, the third-party administrators (TPAs) segment is expected to grow at a higher CAGR during the forecast period.

- The major market players like Salesforce, Microsoft, and SAP have adopted both organic and inorganic strategies, including partnerships and investments. This dual strategy signals an arms race where scale and speed of innovation will determine leadership, reshaping the balance of power across the ecosystem.

- Companies like Coalition, OneShield, and Shift Technology among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Technological advancements are propelling the growth of insurance platforms. Insurers are increasingly utilizing predictive analytics and machine learning to optimize underwriting and claims processes, resulting in quicker and more accurate decisions. The demand for hyper-personalized customer experiences, alongside data-driven risk assessment, is driving the automation of complex workflows. The surge in embedded insurance solutions further necessitates innovative platform capabilities. To meet these demands, insurers are transitioning to flexible, cloud-based platforms that support real-time data processing, enhanced fraud detection, and proactive customer engagement, ultimately enhancing product agility and customer retention.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The insurance platform market is undergoing rapid transformation, driven by evolving customer expectations, technological advancements, and regulatory changes. As insurers, agencies, third-party administrators (TPAs), and reinsurers seek greater efficiency and improved customer experiences, the demand for digital platforms has surged. The market is characterized by increased adoption of cloud-based solutions, API-driven ecosystems, and artificial intelligence (AI) integration, enabling streamlined operations and enhanced risk assessment. Buyers are shifting from traditional legacy systems to agile platforms that offer automation, real-time data insights, and personalized services. Additionally, trends such as embedded insurance, usage-based models, and digital self-service tools are reshaping client interactions. Cybersecurity concerns and regulatory pressures further push insurers to adopt robust compliance and data protection frameworks. As customer expectations continue to evolve, insurance platform providers must deliver flexible, scalable solutions that meet the diverse needs of industry stakeholders. These disruptive trends force industry players to innovate and redefine their business models to stay competitive in this dynamic landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Digital transformation across the insurance value chain

-

Emergence of Insurtech startups disrupts traditional business models and compels established insurers to invest in flexible platforms

Level

-

Integration challenges with legacy systems

-

High implementation costs associated with modernizing insurance platforms

Level

-

Embedded insurance enables seamless coverage integration

-

Increasing adoption of usage-based and parametric insurance products creates demand for platforms with robust IoT integration and real-time data processing

Level

-

Data management and governance

-

Market fragmentation makes it challenging for insurance platform providers to offer standardized solutions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Digital transformation across the insurance value chain

Insurers are leveraging AI, ML, cloud, blockchain, and IoT to modernize underwriting, claims, policy management, and fraud detection. Cloud-native, API-driven platforms enable scalability, agility, and regulatory compliance, while automation and real-time analytics cut costs, optimize workflows, and accelerate claims processing. Rising demand for personalized products and omnichannel engagement is further driving digital-first insurance strategies.

Restraint: Integration challenges with legacy systems

Legacy IT systems remain a major barrier to adopting modern platforms. Proprietary designs, unstructured data, and long deployment cycles cause delays, cost overruns, and operational risks. Compliance requirements and limited in-house expertise often force reliance on third-party vendors, making seamless integration a critical challenge until core systems are modernized.

Opportunity: Embedded insurance enables seamless coverage integration

Embedded insurance integrates coverage into e-commerce, fintech, and mobility apps via APIs and microservices, simplifying distribution and enabling on-demand, personalized policies at the point of sale. Real-time data supports dynamic pricing, faster claims, and improved risk evaluation. Expanding digital ecosystems and InsurTech collaborations are creating new revenue streams and innovation opportunities.

Challenge: Data management and governance

Insurers handle growing volumes of structured and unstructured data from IoT, telematics, and customer interactions. Legacy infrastructure often struggles with real-time processing, affecting pricing, claims, and reporting. Ensuring data quality, compliance, and governance—especially with AI models and third-party integrations—remains a complex task. Cloud data lakes, cleansing tools, and governance frameworks help, but the absence of a unified data strategy continues to hinder efficiency and innovation.

Insurance Platform Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

AXA Business Insurance needed to boost customer satisfaction and personalization; Salesforce solved this by providing a single customer view via its Customer 360 platform for timely, personalized interactions. | The implementation resulted in a significant increase in customer satisfaction and a better experience, ultimately driving increased brand loyalty and customer retention for AXA. |

|

Aon Italy faced the challenge of harnessing its highly sensitive data (under tight governmental regulations) to improve the customer experience and develop new insurance products. IBM's solution utilized IBM Cloud Pak for Data, Watson Studio, and Watson Machine Learning to automate business processes and extract insights, thereby unlocking the value of its data. | By leveraging the power of data and analytics, Aon Italy created a more efficient and effective data management system. This allowed them to successfully improve the customer experience and develop new insurance products and services. |

|

Ping An needed to integrate its life insurance platform to improve business insights and support core business processes. Accenture provided the solution by systematically abstracting and structuring domain models to reflect business knowledge, which helped Ping An improve its insights and gain experience with Domain-Driven Design (DDD) implementation. | Ping An achieved a 25% service re-use rate and a 30% reduction in development time. This helped to significantly increase efficiency, support business processes, and further improve business insights. |

|

ARAG Group faced the challenge of its financial reporting being cumbersome and slow, preventing it from gaining rapid, group-wide insights into its finances. SAP implemented SAP Datasphere and SAP Analytics Cloud to enable faster international reporting and facilitate data-driven, proactive decision-making for managing global growth. | The SAP solution allowed ARAG Group to improve its financial transparency and gain new insights, enabling it to make better decisions and manage its global growth more effectively. It achieved faster reporting and the ability to make data-driven, forward-looking decisions. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The insurance platform market ecosystem is shaped by a mix of vendors comprised of different software types and insurance types. This segmented ecosystem works collaboratively to drive the transition toward more efficient workflows and output generation, leveraging technology and data to achieve goals.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Insurance Platform Market, By Offering

Insurance operations & management platforms are gaining traction as insurers seek to streamline workflows, reduce administrative costs, and enhance compliance. Integration of AI, automation, and cloud technologies enables real-time policy administration, efficient claims tracking, and comprehensive customer lifecycle management.

Insurance Platform Market, By Application

Predictive modeling and extreme event forecasting are expanding due to the need for more accurate risk assessment, proactive disaster management, and effective climate-related event planning. These AI-driven applications enable insurers to enhance underwriting accuracy, mitigate claims exposure, and refine their long-term risk management strategies.

Insurance Platform Market, By Technology

AI & analytics are central to innovation in insurance platforms, supporting fraud detection, personalized policy recommendations, and automated claims processing. Predictive insights and real-time decision-making allow insurers to optimize operations and deliver more tailored, efficient customer experiences.

Insurance Platform Market, By Insurance Type

Life & annuity insurance is driving demand for digital platforms as customers seek personalized financial planning, retirement solutions, and long-term coverage options. AI-powered tools enable insurers to automate underwriting, enhance customer engagement, and offer tailored investment-linked policies.

Insurance Platform Market, By End User

Third-party administrators (TPAs) are leveraging digital platforms to streamline claims management, policy servicing, and regulatory compliance. Cloud-based automation enables scalable operations, cost efficiency, and higher service quality, supporting their growing role in insurance ecosystems.

REGION

Asia Pacific to be fastest-growing region in global Insurance Platform Market during forecast period

The Asia Pacific is projected to grow at the highest CAGR due to rapid digital transformation, rising adoption of cloud-based insurance solutions, and strong government support for fintech and insurtech innovation. Countries such as China, India, and Japan are experiencing a growing demand for AI-powered claims management, digital underwriting, and customer experience platforms. The region’s large underinsured population and expanding middle class are driving insurers to deploy scalable, data-driven insurance platforms. Strategic partnerships between global providers and regional players further accelerate the adoption of technology. These factors position Asia Pacific as the fastest-growing hub for the insurance platform market.

Insurance Platform Market: COMPANY EVALUATION MATRIX

In the Insurance Platform market, Salesforce (Star) leads with its comprehensive cloud-based solutions that enable insurers to streamline policy management, enhance customer engagement, and leverage AI for personalized experiences. Its scalability and deep ecosystem integrations reinforce its dominance in digital insurance transformation. ServiceNow (Emerging Leader) is gaining traction with workflow-driven platforms that modernize claims processing, automate underwriting, and improve operational efficiency, positioning it as a fast-rising player in the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 116.17 Billion |

| Market Forecast in 2030 (Value) | USD 207.52 Billion |

| Growth Rate | CAGR of 12.3% from 2025 – 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Insurance Platform Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Insurance Platform Vendor |

|

|

| Leading Insurance Platform Vendor |

|

|

RECENT DEVELOPMENTS

- March 2025 : Accenture acquired Altus Consulting to boost its capabilities for insurance and investment clients in the UK. Altus brings expertise in advisory services, data-driven insights, and technology solutions tailored to the financial services sector. This acquisition enhances Accenture's ability to deliver end-to-end transformation projects, particularly in distribution, risk, and regulatory compliance.

- March 2025 : DXC Technology expanded its strategic partnership with ServiceNow to introduce DXC Assure BPM powered by ServiceNow. This AI-enabled platform integrates DXC's insurance expertise with ServiceNow's capabilities to modernize insurance processes, reduce operational costs, and enhance customer satisfaction by automating complex workflows across the policy lifecycle.

- February 2025 : Duck Creek Technologies announced a strategic partnership with Worldpay, a global industry leader in payments technology and solutions. Worldpay's global payments capabilities, embedded in Duck Creek Payments, provide carriers with a seamless, end-to-end payment management platform tailored to the insurance industry.

- December 2024 : Suncorp has announced a significant five-year partnership with Microsoft to revolutionize the insurance industry through the accelerated adoption of artificial intelligence (AI) technology and public cloud. Suncorp and Microsoft will extend an existing partnership to integrate AI at scale across the insurer's operations quickly. The program is designed to enhance the experience Suncorp delivers to its customers and to its own people in their day-to-day work.

- November 2024 : Guidewire announced Shift Technology as its strategic partner for insurance-based decision-making solutions. Shift's products enable AI-powered fraud detection and investigation, underwriting risk detection, and subrogation detection. The expanded partnership will deliver a joint solution that will enable the rapid integration of Shift's fraud detection technology with Guidewire's solutions, improving efficiency and claims handler productivity

Table of Contents

Methodology

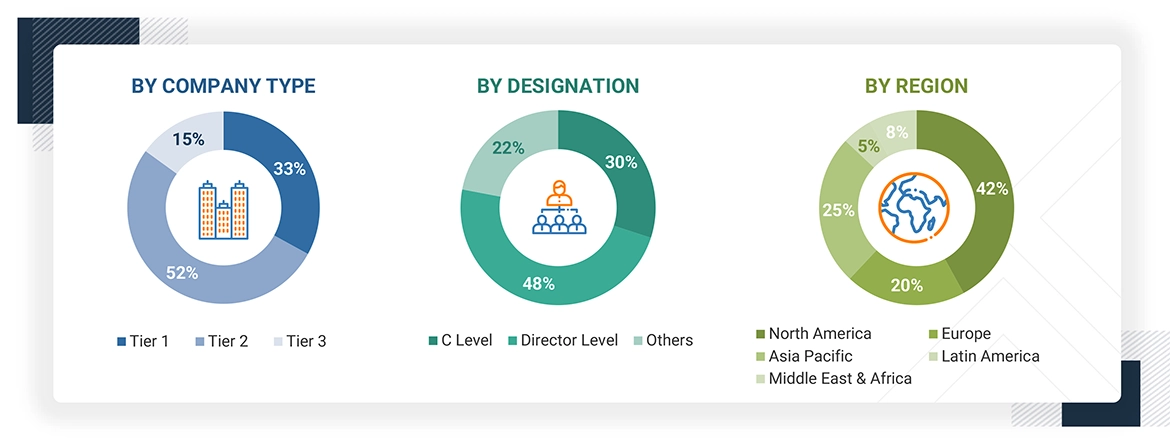

The research study for the insurance platform market involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred Insurance platform providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as AI conferences and related magazines. Additionally, the Insurance platform spending of various countries was extracted from respective sources. Secondary research was used to obtain key information about the industry’s value chain and supply chain to identify key players by solution, service, market classification, and segmentation according to the offerings of major players and industry trends related to solutions, applications, verticals, and regions, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and Insurance platform expertise; related key executives from Insurance platform solution vendors, SIs, managed service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, data types, service types, software types, verticals, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using Insurance platform solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of Insurance platform, which would impact the overall Insurance platform market.

Note: Tier 1 companies account for annual revenue of >USD 10 billion; tier 2 companies’ revenue ranges between USD 1 and 10 billion; and tier 3 companies’ revenue ranges between USD 500 million–USD 1 billion

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

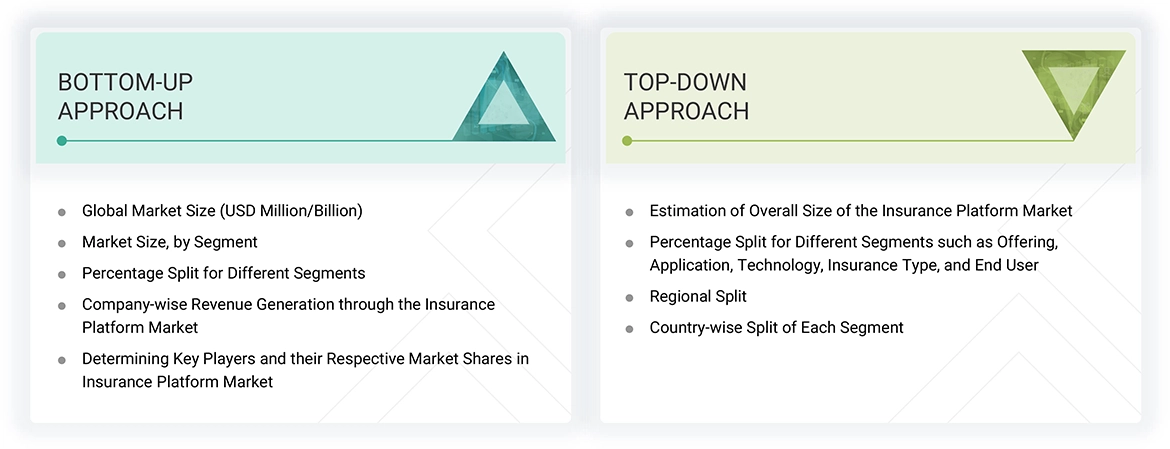

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the insurance platform market. The first approach involves estimating the market size by summating companies’ revenue generated by selling solutions and services.

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the Insurance platform market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of solutions according to software type, service type, technology, data type, vertical, and vertical. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of Insurance platform solutions and services among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of Insurance platform solutions among industries, along with different use cases with respect to their regions, was identified and extrapolated. Use cases identified in different regions were given weightage for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the Insurance platform market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major Insurance platform providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primary interviews, the exact values of the overall Insurance platform market size and segments’ size were determined and confirmed using the study.

Insurance Platform Market : Top-Down and Bottom-Up Approach

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes as explained above. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

The insurance platform market comprises digital solutions that enable insurers to manage core processes such as policy administration, underwriting, claims management, and customer engagement. These platforms leverage cloud computing, automation, and data analytics to enhance operational efficiency, improve customer experiences, and support product innovation. They cater to insurers, brokers, and third-party service providers, facilitating seamless integration with ecosystems and regulatory compliance.

Stakeholders

- Insurance platform software providers

- Insurance data providers

- Third-Party administrators

- Business analysts

- Cloud service providers

- Consulting service providers

- Enterprise end-users

- Distributors and value-added resellers (VARs)

- Government agencies

- Independent Software Vendors (ISV)

- Managed service providers

- Market research and consulting firms

- Support & maintenance service providers

- System Integrators (SIs)/migration service providers

- Technology providers

Report Objectives

- To define, describe, and forecast the Insurance platform market by offering, application, technology, insurance type, and end-user

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments, such as partnerships, product launches, and mergers and acquisitions, in the Insurance platform market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American insurance platform market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Middle Eastern & African market

- Further breakup of the Latin American insurance platform market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Insurance Platform Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Insurance Platform Market