AI in Fintech Market by Component (Solution, Service), Application Area (Virtual Assistant, Business Analytics & Reporting, Customer Behavioral Analytics), Deployment Mode (Cloud, On-Premises), and Region - Global forecast to 2022

[122 Pages Report] The AI in Fintech market size is expected to grow from USD 959.3 Million in 2016 to USD 7,305.6 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 40.4%. The AI in Fintech market is said to have a potential scope for growth in the years to come due to the changing technology, which is improving the business processes of financial service providers. The growing internet penetration and availability of spatial data are some of the major driving factors for the market. The base year considered for this study is 2016, and the forecast period considered is between 2017 and 2022.

Request for Customization to get the global AI in Fintech market forecasts to 2025

The objective of the study has been carried out to define, describe, and forecast the global AI in Fintech market on the basis of solution (software tools and platforms), services (managed and professional), deployment modes (cloud and on-premises), application areas (virtual assistants [chatbots], business analytics and reporting, customer behavioral analytics, and others [includes market research, advertising, and marketing campaign]), and regions. The report also aims at providing detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

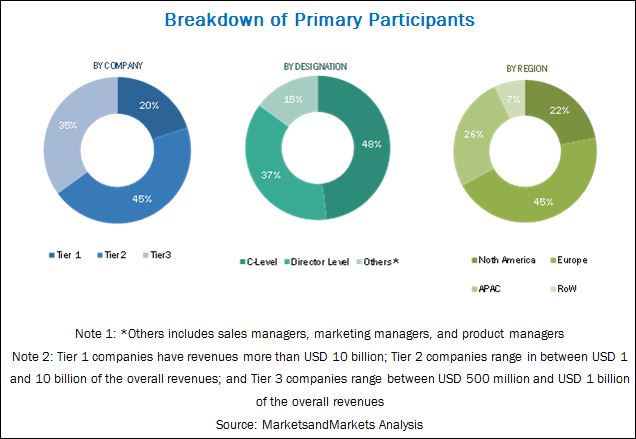

The research methodology used to estimate and forecast the global AI in Fintech market size began with the capturing of data on the key vendor revenues through secondary research, annual reports, Institute of Electrical and Electronic Engineers (IEEE), Factiva, Bloomberg, and press releases. The vendor offerings were also taken into consideration to determine the market segmentations. The bottom-up procedure was employed to arrive at the overall market size from the revenues of the key market players. After arriving at the overall market size, the total market was split into several segments and sub-segments, which were then verified through primary research by conducting extensive interviews with key individuals, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The breakdown of the profiles of the primary participants is depicted in the figure given below:

To know about the assumptions considered for the study, download the pdf brochure

The major AI in Fintech vendors are Microsoft (Washington, US), Google (California, US), Salesforce.com (California, US), IBM (New York, US), Intel (California, US), Amazon Web Services (Washington, US), Inbenta Technologies (California, US), IPsoft (New York, US), Nuance Communications (Massachusetts, US), and ComplyAdvantage.com (New York, US). These AI in Fintech solutions Vendors are rated and listed by us on the basis of product quality, reliability, and their business strategy. Please visit 360Quadrants to see the vendor listing of AI in Fintech solutions.

Key Target Audience for AI in Fintech Market

- AI in Fintech software, platform, and service providers

- IPO/VC/Angel investors

- Information security directors/managers

- BFSI organizations

- IT directors/consultants

- Government organizations

- Consultants/advisory firms

- Training and education service providers

- Managed service providers

Scope of the Report

The research report segments the AI in Fintech market into the following segments:

By Component:

- Solutions

- Software Tools

- Platforms

- Services

- Managed

- Professional

By Deployment Mode:

- Cloud

- On-premises

AI in Fintech Market By Application Area:

- Virtual Assistant (Chatbots)

- Business Analytics and Reporting

- Customer Behavioral Analytics

- Others (includes market research, advertising, and marketing campaign)

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the APAC AI in Fintech market

- Further breakdown of the North American market

- Further breakdown of the MEA market

- Further breakdown of the European market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The global AI in Fintech market is expected to grow from USD 1,337.7 Million in 2017 to USD 7,305.6 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 40.4%. The major driving factors for the market are the increasing use of data, the growing business collaborations, and improved financial operations.

In the solutions segment, the software tools solution is expected to have the largest market share, whereas platforms solution is expected to be the highest contributor during the forecast period. Software tools help in deploying AI enabled solutions in the finance sector to extract a large amount of data, as well as accurate and complete data on time.

In the services segment, the managed service is expected to grow at the highest CAGR, and is expected to be the largest contributor among all the services. The managed service is expected to be growing faster as it is beneficial for managing AI enabled applications in Fintech. The complexity involved in maintenance and support of infrastructure management is sorted by managed service providers, who enable organizations to use AI solutions at its full potential.

In the deployment mode segment, the cloud deployment mode is expected to have the largest market share and it is expected to grow at the highest CAGR during forecast period. Cloud based solutions offer wide and agile solutions to cater to AI in Fintech market.

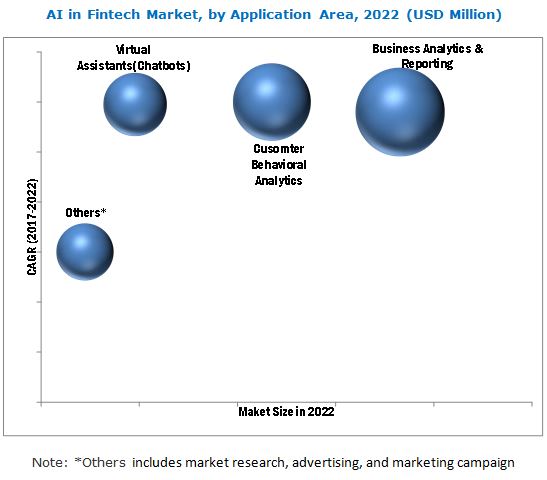

In the application area, the business analytics and reporting is expected to have the largest market share, whereas customer behavioral analytics expected to grow at the highest CAGR during the forecast period. The business analytics and reporting helps in regulatory and compliance management as well as in analysis of customer behavior.

The global AI in Fintech market has been segmented on the basis of regions into North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. North America is estimated to be the largest revenue-generating region. This is mainly because, in the developed economies of the US and Canada, there is a high focus on innovations obtained from R&D. These regions have the most competitive and rapidly changing AI technology in Fintech market in the world. The APAC region is expected to be the fastest-growing region in the market. The higher technological advancement and rapid expansion of domestic enterprises in the APAC region has led APAC to become a highly potential market.

The constantly increasing competition in the finance market, need for improved financial operations, cost reductions, and customer engagement are acting as obstacles against the growth of the AI in Fintech market. These factors account for the risk of failure to perform in the competitive business world, which necessitates the need for AI in Fintech solutions.

The major vendors that offer AI in Fintech solutions across the globe are Microsoft (Washington, US), Google (California, US), Salesforce.com (California, US), IBM (New York, US), Intel (California, US), Amazon Web Services (Washington, US), Inbenta Technologies (California, US), IPsoft (New York, US), Nuance Communications (Massachusetts, US), and ComplyAdvantage.com (New York, US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.3 Breakdown of Primaries

2.1.4 Key Industry Insights

2.2 Market Size Estimation

2.3 Bottom-Up Approach

2.4 Top-Down Approach

2.5 Microquadrant Research Methodology

2.5.1 Vendor Inclusion Criteria

2.6 Research Assumptions and Limitation

2.6.1 Research Assumptions

2.6.2 Limitations

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 26)

4.1 Attractive Market Opportunities in the AI in Fintech Market

4.2 Lifecycle Analysis, By Region, 20172022

5 Market Overview and Industry Trends (Page No. - 28)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Availability of Spatial Data

5.2.1.2 Growing Internet Penetration

5.2.2 Restraints

5.2.2.1 Lack of Skilled Consultants to Deploy AI in Fintech

5.2.3 Opportunities

5.2.3.1 Increasing Mobile Workforce Will Surge Further Innovation in the Fintech Market

5.2.3.2 Increasing Use of AI-Enabled Technological Solution in the Capital Market

5.2.4 Challenges

5.2.4.1 Difficulty to Cope With the Rapidly Expanding Scope of AI in Fintech Solution

5.2.4.2 Development of Smart Human-Aware Fintech Solution

5.3 Use Cases

5.3.1 Retail Banks

5.3.2 Insurance

5.3.3 Commercial Banks

5.3.4 Stock Market/Capital Market

5.4 Key Industry Developments

6 AI in Fintech Market Analysis, By Component (Page No. - 34)

6.1 Introduction

6.2 Solutions

6.2.1 Software Tools

6.2.1.1 Data Discovery

6.2.1.2 Data Quality and Data Governance

6.2.1.3 Data Visualization

6.2.2 Platforms

6.3 Services

6.3.1 Managed Services

6.3.2 Professional Services

7 AI in Fintech Market Analysis, By Application Area (Page No. - 42)

7.1 Introduction

7.2 Virtual Assistants (Chatbots)

7.3 Business Analytics and Reporting

7.3.1 Regulatory and Compliance Management

7.3.2 Predictive Analytics

7.4 Customer Behavioral Analytics

7.4.1 Credit Scoring

7.4.2 Asset and Portfolio Management

7.4.3 Debt Collection

7.4.4 Insurance Premium

7.5 Others

8 AI in Fintech Market Analysis, By Deployment Mode (Page No. - 51)

8.1 Introduction

8.2 Cloud

8.3 On-Premises

9 Geographic Analysis (Page No. - 54)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia Pacific

9.5 Middle East and Africa

9.6 Latin America

10 Competitive Landscape (Page No. - 75)

10.1 Microquadrant Overview

10.1.1 Visionary Leaders

10.1.2 Innovators

10.1.3 Dynamic Differentiators

10.1.4 Emerging Companies

10.2 Competitive Benchmarking

11 Company Profiles (Page No. - 79)

11.1 Microsoft

(Overview, Strength of Product Portfolio, Business Strategy Excellence, and Recent Developments)*

11.2 Google

11.3 IBM

11.4 Intel

11.5 Inbenta Technologies

11.6 Nuance Communications

11.7 Complyadvantage.Com

11.8 Salesforce.Com

11.9 Amazon Web Services

11.10 Samsung

11.11 Ipsoft

11.12 Next It Corp.

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, and Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 114)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (63 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Evaluation Criteria

Table 3 AI in Fintech Market Size, By Component, 20152022 (USD Million)

Table 4 Component: Market Size, By Solution, 20152022 (USD Million)

Table 5 Software Tools Market Size, By Type, 20152022 (USD Million)

Table 6 Data Discovery Market Size, By Application Area, 20152022 (USD Million)

Table 7 Data Quality and Data Governance Market Size, By Application Area, 20152022 (USD Million)

Table 8 Data Visualization Market Size, By Application Area, 20152022 (USD Million)

Table 9 Component: Market Size, By Service, 20152022 (USD Million)

Table 10 AI in Fintech Market Size, By Application Area, 20152022 (USD Million)

Table 11 Virtual Assistants (Chatbots): Market Size, By Region, 20152022 (USD Million)

Table 12 Virtual Assistants (Chatbots): Market Size, By Component, 20152022 (USD Million)

Table 13 Business Analytics and Reporting: Market Size, By Type, 20152022 (USD Million)

Table 14 Business Analytics and Reporting: Market Size, By Region, 20152022 (USD Million)

Table 15 Business Analytics and Reporting: Market Size, By Component, 20152022 (USD Million)

Table 16 Customer Behavioral Analytics: Market Size, By Type, 20152022 (USD Million)

Table 17 Customer Behavioral Analytics: Market Size, By Region, 20152022 (USD Million)

Table 18 Customer Behavioral Analytics: Market Size, By Component, 20152022 (USD Million)

Table 19 Others: Market Size, By Region, 20152022 (USD Million)

Table 20 AI in Fintech Market Size, By Deployment Mode, 20152022 (USD Million)

Table 21 Market Size, By Region, 20152022 (USD Million)

Table 22 North America: Market Size, By Component, 20152022 (USD Million)

Table 23 North America: Market Size, By Solution, 20152022 (USD Million)

Table 24 North America: Market Size, By Software Tool, 20152022 (USD Million)

Table 25 North America: Market Size, By Service, 20152022 (USD Million)

Table 26 North America: Market Size, By Deployment Mode, 20152022 (USD Million)

Table 27 North America: Market Size, By Application Area, 20152022 (USD Million)

Table 28 North America: Market Size, By Business Analytics and Reporting, 20152022 (USD Million)

Table 29 North America: Market Size, By Customer Behavioral Analytics, 20152022 (USD Million)

Table 30 North America: Market Size, By Country, 20152022 (USD Million)

Table 31 Europe: AI in Fintech Market Size, By Component, 20152022 (USD Million)

Table 32 Europe: Market Size, By Solution , 20152022 (USD Million)

Table 33 Europe: Market Size, By Software Tool, 20152022 (USD Million)

Table 34 Europe: Market Size, By Service, 20152022 (USD Million)

Table 35 Europe: Market Size, By Deployment Mode, 20152022 (USD Million)

Table 36 Europe: Market Size, By Application Area, 20152022 (USD Million)

Table 37 Europe: Market Size, By Business Analytics and Reporting, 20152022 (USD Million)

Table 38 Europe: Market Size, By Customer Behavioral Analytics, 20152022 (USD Million)

Table 39 Asia Pacific: AI in Fintech Market Size, By Component, 20152022 (USD Million)

Table 40 Asia Pacific: Market Size, By Solution, 20152022 (USD Million)

Table 41 Asia Pacific: Market Size, By Software Tool, 20152022 (USD Million)

Table 42 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 43 Asia Pacific: Market Size, By Deployment Mode, 20152022 (USD Million)

Table 44 Asia Pacific: Market Size, By Application Area, 20152022 (USD Million)

Table 45 Asia Pacific: Market Size, By Business Analytics and Reporting, 20152022 (USD Million)

Table 46 Asia Pacific: Market Size, By Customer Behavioral Analytics, 20152022 (USD Million)

Table 47 Middle East and Africa: AI in Fintech Market Size, By Component, 20152022 (USD Million)

Table 48 Middle East and Africa: Market Size, By Solution, 20152022 (USD Million)

Table 49 Middle East and Africa: Market Size, By Software Tool, 20152022 (USD Million)

Table 50 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 51 Middle East and Africa: Market Size, By Deployment Mode, 20152022 (USD Million)

Table 52 Middle East and Africa: Market Size, By Application Area, 20152022 (USD Million)

Table 53 Middle East and Africa: Market Size, By Business Analytics and Reporting, 20152022 (USD Million)

Table 54 Middle East and Africa: Market Size, By Customer Behavioral Analytics, 20152022 (USD Million)

Table 55 Latin America: AI in Fintech Market Size, By Component, 20152022 (USD Million)

Table 56 Latin America: Market Size, By Solution, 20152022 (USD Million)

Table 57 Latin America: Market Size, By Software Tool, 20152022 (USD Million)

Table 58 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 59 Latin America: Market Size, By Deployment Mode, 20152022 (USD Million)

Table 60 Latin America: Market Size, By Application Area, 20152022 (USD Million)

Table 61 Latin America: Market Size, By Business Analytics and Reporting, 20152022 (USD Million)

Table 62 Latin America: Market Size, By Customer Behavioral Analytics, 20152022 (USD Million)

Table 63 Market Ranking for the AI in Fintech Market, 2017

List of Figures (36 Figures)

Figure 1 Global AI in Fintech Market: Market Segmentation

Figure 2 Global Market: Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 AI in Fintech Market Snapshot, By Component (2017 vs 2022)

Figure 7 Market Snapshot, By Solution

Figure 8 Market Snapshot, By Software Tool

Figure 9 Market Snapshot, By Service

Figure 10 Market Snapshot, By Deployment Mode

Figure 11 Market Snapshot, By Application Area

Figure 12 Market Snapshot, By Region

Figure 13 Availability of Spatial Data and Growing Internet Penetration are Driving the AI in Fintech Market During the Forecast Period

Figure 14 Asia Pacific is Expected to Exhibit the Highest Growth Potential During the Forecast Period

Figure 15 Market Investment Scenario: Asia Pacific is Expected to Be the Best Opportunity Market for Investment in the Next 5 Years

Figure 16 AI in Fintech Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Solutions Component is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 18 Platforms Segment is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 19 Managed Services Segment is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 20 Virtual Assistants (Chatbots), and Customer Behavioral Analytics Application Areas are Expected to Exhibit the Highest Growth Rates During the Forecast Period

Figure 21 Cloud Deployment Mode is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 22 Asia Pacific is Expected to Have the Highest CAGR During the Forecast Period

Figure 23 Asia Pacific is Expected to Have the Highest Growth Rate During the Forecast Period

Figure 24 North America: Market Snapshot

Figure 25 Asia Pacific: Market Snapshot

Figure 26 AI in Fintech Market (Global) Competitive Leadership Mapping, 2017

Figure 27 Business Strategy Excellence Adopted in the Market

Figure 28 Strength of Product Portfolio in the Market

Figure 29 Microsoft: Company Snapshot

Figure 30 Google: Company Snapshot

Figure 31 IBM: Company Snapshot

Figure 32 Intel: Company Snapshot

Figure 33 Nuance Communications: Company Snapshot

Figure 34 Salesforce.Com: Company Snapshot

Figure 35 Amazon Web Services: Company Snapshot

Figure 36 Samsung: Company Snapshot

Growth opportunities and latent adjacency in AI in Fintech Market