Insurance Analytics Market by Component (Tools and Services), Application (Claims Management, Risk Management, Customer Management and Personalization, Process Optimization), Deployment Mode, Organization Size, End User, and Region - Global Forecast to 2026

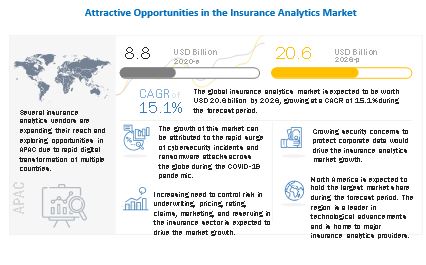

The estimated size of the global insurance analytics market in 2020 was USD 8.8 billion, and it is anticipated to grow to USD 20.6 billion by 2026, at a CAGR of 15.1% over the forecast period.

Increasing focus on enhancing customer experience and the growing trend of digitalization would drive the market growth. However, rising cyberattacks and its threats is expected to restrain the market growth. Factors such as, need for cloud-based digital solutions by the insurer and COVID-19 accelerated organizations to new customer engagement through digital experiences would create opportunities.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 Impact

Several insurance providers are accelerating investments in digitization and closing gaps in business continuity models. The integration of third-party data to mitigate risk is increasing in urgency. Throughout this time, customers are reminded of how significant the role of insurance is in their lives. For example, health coverage assists with drug and treatment plans for the ill, employment insurance helps those impacted by the economic turmoil, and business interruption coverage supports businesses unable to operate. Companies must continue investing and enabling access for customers while ensuring underwriters are well-informed of upcoming risks. Emergencies, such as COVID-19, highlight the need for insurers to seamlessly integrate reliable data sources, actionable insights, and responsive control measures to help navigate the uncertain landscape. By leveraging data and investing in digitization and analytics, insurers can navigate this challenging period and move the industry forward.

Market Dynamics

Drivers: Rising need for big data and predictive modeling capability during the COVID-19 pandemic drives the adoption of insurance analytics tools

Data is one of the most valuable assets an insurer can have, and predictive analytics has been helping businesses make the most of that data. The COVID-19 crisis has shown insurers that the ability to predict change is invaluable, and predictive modeling is a great tool for carriers that know they need to make changes but want to ensure they are doing it accurately. The capability of predictive modeling in insurance software can help define and deliver rate changes and new products more efficiently. Predictive analytics and big data together enable insurers with valuable insights such as forecasting customer behavior and supporting underwriting processes.

Predictive analytics tools can collect data from a variety of sources from both internal and external, to better understand and predict the behavior of insureds. Property and Casualty (P&C) insurance companies are collecting data from telematics, agent interactions, customer interactions, smart homes, and even social media to better understand and manage their relationships, claims, and underwriting. Insurers can quickly and accurately consolidate data and generate new insights that paint a complete picture of a customer. What are their buying habits? What is their risk profile? How apt are they to buy new or expanded coverage? Before predictive analytics, insurers could estimate or take guesses at these questions, but now they are able to accurately and effectively service customers, which ultimately results in happier customers and increased revenues. This helps insurers provide a personalized experience to consumers.

Restraint: Rising cyberattacks and their threats

P&C insurance companies are always battling various instances of frauds and often are not as successful as they expect. As other sectors, such as banking, become more secure, hackers are turning their attention toward more vulnerable target insurance companies. Insurers maintain a huge database of Personally Identifiable Information (PII) related to policyholders that make an appealing target for identity thieves, including names, birthdates, social security numbers, street, and email addresses, health data, and employment data, such as income. Information related to policyholders’ personal property, including homes and cars, can also be a target.

Over the years, various insurers have invested in security tools that offer a false sense of security. In reality, attackers are advancing faster than traditional cybersecurity tools such as firewalls and antivirus software and are now leveraging encryption and other advanced attack techniques that can evade detection. In fact, according to the KPMG Global CEO Outlook survey, only 43% of insurance executives said their organization was prepared for a cyberattack on their insurance company. This is a dangerous risk as attacks on insurance firms can result in significant financial damages such as fines and lawsuits, as well as reputational damage and loss of trust, a factor that will negatively impact an insurer’s brand and market value.

Opportunity: COVID-19 accelerated organizations to new customer engagement through digital experiences

Digital channel usage has seen a spike during the pandemic. Corporate investments in digital experiences will need to mirror new ways of living and working. As customers continue to ‘go’ and ‘stay’ digital, post-crisis expectations for digital experience will continue to rise. Organizations are witnessing stunning shifts in customer interaction volumes, types, and transactions. The timeline for developing relationships with customers is now significantly compressed. During their prolonged time at home, consumers have become more willing and are able to use digital methods of engagement. Already digital-savvy consumers are increasing their use, while individuals who once resisted digital interactions such as eCommerce, mobile finance, and video calls are emerging as digitally engaged customers. The emergence of new digital customer profiles is expected to continue and will require ongoing analysis to maintain the right customer sales and service channel mix.

Both during and post-COVID-19 situations, companies should focus customer engagement on reassurance- and confidence-building to continuously reinforce the value of products, services, and the organization itself. Data and feedback collected from social media, smart devices, and interactions between claims specialists and customers are straight from the source. Data that is not harvested through outside channels (such as the typical demographic material used in the past, including criminal records and credit history) is more direct and can provide valuable insights for P&C insurers. The innovation demonstrates that digital capabilities created during the pandemic can become a permanent engagement strategy. As a result, the foundation has been set for organizations to think more holistically related to the flexibility of their workforce across customer engagement touchpoints. This, in turn, will drive significant changes in customer sales and support operating models as well as the workforce skills required to succeed.

Challenge: Data security and privacy concerns

Security threats are projected to grow even further in the future. In the past four years, the financial impact of cybercrimes increased by nearly 78%, and the time it takes to resolve cyberattacks has increasingly doubled. The increase in data from various sources is becoming cumbersome for several IT teams. The inefficiency of managing exabytes and petabytes of data has led to an increase in the chances of security breaches and data loss. It may seem as if insurance analytics is a threat to data privacy. However, the actual threat is poorly managed data. Before buying data, organizations should do their research and ensure they are receiving data from a reputable provider that offers accurate data. As data consists of customer demographic information, organizations may develop algorithms that penalize individuals based on their age, gender, or ethnicity. Organizations should always have a detailed and precise representation of customers, account for biases, and offer fairness above analytics.

Data privacy concerns related to how critical enterprise data or personal information to be used or misused is a barrier to the adoption of cyber insurance. The global spread of COVID-19 has generated a lot of questions related to data protection, privacy, security, and compliance. Owing to COVID-19, companies, and organizations are reviewing their existing privacy policies to ensure the appropriate disclosure of Personally Identifiable Information (PII) to government agencies and cyber insurers to ensure the privacy of data. Some enterprises hesitate in revealing reliable information related to risk exposures in their environment, making it burdensome for insurers to provide guidance on an effective cyber insurance policy. Insureds are reluctant to share information with insurers due to the fear of disclosure risks. Enterprises are wary when it comes to revealing cyber incident data as they feel that the exposed data could further intensify attacks and expose it to regulatory fines or legal fees.

Tools segment to constitute a larger market size during the forecast period

Insurance analytics tools are widely adopted by various end users, such as insurance companies, third-party administrators, agents, and brokers, to gain a competitive advantage over others by using data as a strategic asset. The growing emphasis on compliance as well as government regulations across the insurance sector has also fueled the adoption of insurance analytics solutions, especially in highly regulated regions such as North America and Europe. The emerging regulations, such as GDPR, are expected to further propel the demand for insurance analytics solutions during the forecast period. In addition to the strict governance and compliance policies, insurance analytics solutions also help enterprises avert risks through fraud and risk management applications and optimize their daily operations, leading to a reduced operational cost.

Risk management segment to hold the largest market size during the forecast period

Insurers are widely using analytics solutions to understand the potential risks and deploy countermeasures to mitigate losses, or at least screen, pre-empt, and assess the cost of risks in the underwriting process. Risk management involves the identification, assessment, and management of potential risks, incorporating analytics to support decision-making by clearly stating business goals and objectives, and facilitating precise information management with a better understanding of the trade-offs between risks and rewards. Risk management provides insurers with the risk capacity to maintain specific credit ratings, manage capital, and reduce earnings volatility across insurance companies.

Cloud deployment model to grow at a higher CAGR during the forecast period

The cloud deployment model is expected to grow at a higher CAGR during the forecast period. Cloud-based solutions are gaining a firm hold in the market due to various benefits, such as cost control, resource pooling, and less implementation time. Cloud deployment offers flexibility, scalability, and cost-effectiveness benefits. It also enables an enterprise to have more control over the server, infrastructure, and systems that can be configured as per the business requirements

APAC region to grow at the highest CAGR during the forecast period

The global insurance analytics market by region covers five major geographic regions: North America, Asia Pacific (APAC), Europe, Middle East & Africa (MEA), and Latin America. APAC is expected to grow at the highest CAGR during the forecast period. APAC constitutes major countries, such as China, Japan, South Korea, Australia, and the rest of APAC, which are increasingly contributing toward the development of data analytics solutions in the insurance analytics market. Various end users such as insurance companies and government agencies are leading the race in terms of cloud adoption in the APAC region.

Key Market Players

The insurance analytics market comprises major solution providers, such as IBM(US), Salesforce(US), Oracle(US), Microsoft(US), Sapiens (Israel), OpenText (Canada), SAP (Germany), Verisk Analytics (US), SAS Institute (US), Vertafore (US), TIBCO (US), Qlik (US), Board International (Switzerland), BRIDGEi2i (US), MicroStrategy (US), Guidewire Software (US), LexisNexis Risk Solutions (US), WNS (India), Hexaware Technologies (India), Pegasystems (US), Applied Systems (US), InsuredMine (US), ReFocus AI (US), RiskVille (Ireland), Pentation Analytics (US), Habit Analytics (US), Artivatic.ai (India), CyberCube (US), and Arceo.ai (US). The study includes an in-depth competitive analysis of these key players in the insurance analytics market with their company profiles, recent developments, and key market strategies.

Scope of the report

|

Report Metric |

Details |

|

Market size value in 2020 |

USD 8.8 Billion |

|

Market size value in 2026 |

USD 20.6 Billion |

|

Growth rate |

CAGR of 15.1% |

|

Market Size Available for years |

2016-2026 |

|

Base year considered |

2019 |

|

Forecast Period |

2020-2026 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Application, Component, Organization Size, Deployment Mode, End User, and Region |

|

Geographies covered |

North America, APAC, Europe, MEA, and Latin America |

|

Companies covered |

The major market players include IBM(US), Salesforce(US), Oracle(US), Microsoft(US), Sapiens (Israel), OpenText (Canada), SAP (Germany), Verisk Analytics (US), SAS Institute (US), Vertafore (US), TIBCO (US), Qlik (US), Board International (Switzerland), BRIDGEi2i (US), MicroStrategy (US), Guidewire Software (US), LexisNexis Risk Solutions (US), WNS (India), Hexaware Technologies (India), Pegasystems (US), Applied Systems (US), InsuredMine (US), ReFocus AI (US), RiskVille (Ireland), Pentation Analytics (US), Habit Analytics (US), Artivatic.ai (India), CyberCube (US), and Arceo.ai (US). |

The study categorizes the insurance analytics market based on component, deployment mode, organization size, application, end user are at the regional and global level.

On the basis of component, the insurance analytics market has been segmented as follows:

- Tools

- Services

On the basis of application, the market has been segmented as follows:

- Claims Management

- Risk Management

- Customer Management and Personalization

- Process Optimization

- Others (workforce management and fraud detection)

On the basis of organization size, the insurance analytics market has been segmented as follows:

- Large Enterprises

- SMEs

On the basis of deployment modes, the market has been segmented as follows:

- Cloud

- On-premises

On the basis of end user, the insurance analytics market has been segmented as follows:

- Insurance Companies

- Government Agencies

- Third-party Administrators, Brokers and Consultancies

On the basis of regions, the market has been segmented as follows:

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

APAC

- Japan

- China

- Australia

- South Korea

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia (KSA)

- United Arab Emirates (UAE)

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In September 2020, IBM launched a new risk-based service IBM Risk Analytics. IBM Risk Analytics is designed to help organizations apply the same analytics used for traditional business decisions to cybersecurity spending priorities.

- In August 2020, WNS launched EXPIRIUS, AI, and analytics-driven customer experience solution.

- In June 2020, Microsoft announced a new global skills initiative required for the COVID-19 scenario. The objective of the initiative is to provide extensive access to digital skills in improving economic recovery, particularly for the people hardest hit by job losses.

- In March 2020, Board International released the latest version of its leading Board decision-making platform – Board 11.2. Already making business reporting, planning, and forecasting more effective with its unified approach, the Board platform is now even faster and more flexible. One of the most significant enhancements in the new version is the DeepLocker function, which enables users to lock data values at the cell or aggregate level along any hierarchy and across any dimension.

- In February 2020, Oracle and Microsoft expanded their cloud collaboration with a new cloud interconnect location in Amsterdam, Netherlands. The new interconnect will enable these businesses to share data across applications running in Microsoft Azure and Oracle Cloud.

Frequently Asked Questions (FAQ):

What are the future insurance analytics market trends?

Below are some of the insurance analytics market market trends:

- Predictive and Prescriptive Analytics

- Artificial Intelligence (AI) and Machine Learning (ML)

- Internet of Things (IoT)

- Cloud-based Analytics

- Customer-Centricity

- Blockchain

- Digital Transformation

How big is the insurance analytics market?

What is the growth rate estimated for insurance analytics market?

What is insurance analytics?

What are the top vendors in insurance analytics market?

Which end users are covered in insurance analytics market study?

Which are the analytics applications covered in insurance analytics market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 6 INSURANCE ANALYTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE FROM TOOLS/SERVICES OF THE INSURANCE ANALYTICS MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL TOOLS/SERVICES OF THE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL TOOLS/SERVICES OF THE MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND SIDE): SHARE OF INSURANCE ANALYTICS THROUGH OVERALL INSURANCE ANALYTICS SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 13 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 14 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

2.9 IMPLICATIONS OF COVID-19 ON THE MARKET

FIGURE 15 QUARTERLY IMPACT OF COVID-19 DURING 2020–2021

3 EXECUTIVE SUMMARY (Page No. - 58)

TABLE 4 GLOBAL INSURANCE ANALYTICS MARKET SIZE AND GROWTH RATE, 2016–2019 (USD MILLION, Y-O-Y%)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2020–2026 (USD MILLION, Y-O-Y%)

FIGURE 16 TOOLS SEGMENT TO HOLD A LARGER MARKET SIZE IN 2020

FIGURE 17 RISK MANAGEMENT SEGMENT TO HOLD THE LARGEST MARKET SHARE IN 2020

FIGURE 18 MANAGED SERVICES SEGMENT TO HOLD A LARGER MARKET SIZE IN 2020

FIGURE 19 ON-PREMISES SEGMENT TO HOLD A LARGER MARKET SHARE IN 2020

FIGURE 20 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SHARE IN 2020

FIGURE 21 INSURANCE COMPANIES SEGMENT TO HOLD THE LARGEST MARKET SHARE IN 2020

FIGURE 22 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 63)

4.1 ATTRACTIVE OPPORTUNITIES IN THE INSURANCE ANALYTICS MARKET

FIGURE 23 RAPID ADOPTION OF DATA-DRIVEN DECISION-MAKING AND THE INCREASING ADOPTION OF ADVANCED ANALYTICS TECHNIQUES DRIVE THE MARKET GROWTH

4.2 MARKET: TOP THREE END USERS

FIGURE 24 CUSTOMER MANAGEMENT AND PERSONALIZATION SEGMENT TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2026

4.3 MARKET, BY REGION

FIGURE 25 NORTH AMERICA ACCOUNTED FOR THE LARGEST SHARE IN THE MARKET IN 2020

4.4 NORTH AMERICAN MARKET, BY COMPONENT AND END USER

FIGURE 26 TOOLS AND INSURANCE COMPANIES SEGMENTS ACCOUNTED FOR LARGE MARKET SHARES IN 2020

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 65)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: INSURANCE ANALYTICS MARKET

5.2.1 DRIVERS

5.2.1.1 Rising need of big data and predictive modeling capability during the COVID-19 pandemic drives the adoption of insurance analytics solutions

5.2.1.2 Rise in adoption of IoT products

5.2.2 RESTRAINTS

5.2.2.1 Rising cyberattacks and their threats

5.2.2.2 Difficulty to integrate insurance platforms with legacy systems

5.2.3 OPPORTUNITIES

5.2.3.1 COVID-19 accelerated organizations to new customer engagement through digital experiences

5.2.3.2 Need for cloud-based digital solutions by insurer to obtain higher scalability

5.2.4 CHALLENGES

5.2.4.1 Data security and privacy concerns

5.2.5 CUMULATIVE GROWTH ANALYSIS

5.3 INSURANCE ANALYTICS MARKET: ECOSYSTEM

FIGURE 28 MARKET: ECOSYSTEM

5.4 CASE STUDY ANALYSIS

5.4.1 CNSEG AND FENSEG USES SAS INSURANCE ANALYTICS TO ELIMINATE INSURANCE FRAUD AND BOOST ACCURACY

5.4.2 FARMERS INSURANCE GROUP USES SALESFORCE EINSTEIN ANALYTICS TO STREAMLINE PROCESSES

5.4.3 DIE MOBILIER INSURANCE ACCELERATES OPERATIONAL DATA ANALYTICS WITH ORACLE DATABASE IN-MEMORY

5.4.4 GREAT AMERICAN INSURANCE GROUP EMBRACED PEGA CUSTOMER SERVICE TO ELIMINATE COMPLEXITIES AND DELIVER EXCEPTIONAL CUSTOMER EXPERIENCE

5.4.5 PROMUTUEL INSURANCE EMBRACED GUIDEWIRE TO TRANSFORM ITS CLAIMS BUSINESS

5.4.6 YDROGIOS INSURANCE CHOOSE SAS DETECTION AND INVESTIGATION OF INSURANCE TO REDUCE COSTS

5.5 INSURANCE ANALYTICS MARKET: COVID-19 IMPACT

FIGURE 29 MARKET TO WITNESS A SLOWDOWN IN 2020

5.6 PATENT ANALYSIS

5.6.1 METHODOLOGY

5.6.2 DOCUMENT TYPE

TABLE 6 PATENTS FILED

5.6.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 30 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2009–2019

5.6.3.1 Top applicants

FIGURE 31 TOP 10 COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2010–2020

5.7 VALUE CHAIN ANALYSIS

FIGURE 32 INSURANCE ANALYTICS MARKET: VALUE CHAIN ANALYSIS

5.8 TECHNOLOGY ANALYSIS

5.8.1 5G AND INSURANCE ANALYTICS

5.8.2 AI AND INSURANCE ANALYTICS

5.8.3 IOT AND INSURANCE ANALYTICS

5.9 PORTER’S FIVE FORCE ANALYSIS

FIGURE 33 PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

6 INSURANCE ANALYTICS MARKET, BY COMPONENT (Page No. - 80)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 34 TOOLS SEGMENT TO HAVE A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 7 MARKET SIZE, BY COMPONENT,2016–2019 (USD MILLION)

TABLE 8 MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

6.2 TOOLS

6.3 SERVICES

FIGURE 35 PROFESSIONAL SERVICES SEGMENT TO HAVE A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 9 SERVICES: INSURANCE ANALYTICS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 10 SERVICES: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

6.3.1 MANAGED SERVICES

6.3.2 PROFESSIONAL SERVICES

6.3.2.1 Consulting

6.3.2.2 Support and maintenance

6.3.2.3 Deployment and integration

7 INSURANCE ANALYTICS MARKET, APPLICATION (Page No. - 86)

7.1 INTRODUCTION

7.1.1 APPLICATIONS: MARKET DRIVERS

7.1.2 APPLICATIONS: COVID-19 IMPACT

FIGURE 36 RISK MANAGEMENT SEGMENT TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 11 APPLICATIONS: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 12 APPLICATIONS: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

7.2 CLAIMS MANAGEMENT

7.3 RISK MANAGEMENT

7.4 CUSTOMER MANAGEMENT AND PERSONALIZATION

7.5 PROCESS OPTIMIZATION

7.6 OTHERS

8 INSURANCE ANALYTICS MARKET, BY DEPLOYMENT MODE (Page No. - 91)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODES: MARKET DRIVERS

8.1.2 DEPLOYMENT MODES: COVID-19 IMPACT

FIGURE 37 ON-PREMISES SEGMENT TO HAVE A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 13 MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 14 MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

8.2 ON-PREMISES

8.3 CLOUD

9 INSURANCE ANALYTICS MARKET, BY ORGANIZATION SIZE (Page No. - 96)

9.1 INTRODUCTION

9.1.1 ORGANIZATION SIZE: MARKET DRIVERS

9.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 38 LARGE ENTERPRISES SEGMENT TO HAVE A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 15 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 16 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9.2 LARGE ENTERPRISES

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

10 INSURANCE ANALYTICS MARKET, BY END USER (Page No. - 100)

10.1 INTRODUCTION

10.1.1 END USERS: MARKET DRIVERS

10.1.2 END USERS: COVID-19 IMPACT

FIGURE 39 INSURANCE COMPANIES SEGMENT TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 17 MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 18 MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

10.2 INSURANCE COMPANIES

10.3 GOVERNMENT AGENCIES

10.4 THIRD-PARTY ADMINISTRATORS, BROKERS, AND CONSULTANCIES

11 INSURANCE ANALYTICS MARKET, BY REGION (Page No. - 105)

11.1 INTRODUCTION

FIGURE 40 INDIA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 41 ASIA PACIFIC TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 19 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 NORTH AMERICA: REGULATIONS

11.2.3.1 Health Insurance Portability and Accountability Act of 1996

11.2.3.2 California Consumer Privacy Act

11.2.3.3 Gramm–Leach–Bliley Act

11.2.3.4 Health Information Technology for Economic and Clinical Health Act

11.2.3.5 Sarbanes-Oxley Act

11.2.3.6 Federal Information Security Management Act

11.2.3.7 Payment Card Industry Data Security Standard

11.2.3.8 Federal Information Processing Standards

FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

TABLE 21 NORTH AMERICA: INSURANCE ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 22 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 23 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 24 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 25 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 26 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 27 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

11.2.4 UNITED STATES

11.2.5 CANADA

11.3 EUROPE

11.3.1 EUROPE: INSURANCE ANALYTICS MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

11.3.3 EUROPE: REGULATIONS

11.3.3.1 General Data Protection Regulation

11.3.3.2 European Committee for Standardization

11.3.3.3 European Technical Standards Institute

TABLE 35 EUROPE: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 36 EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 37 EUROPE: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 38 EUROPE: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 39 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 40 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 41 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 42 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 43 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 44 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 45 EUROPE: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 46 EUROPE: MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 47 EUROPE: INSURANCE ANALYTICS SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 48 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

11.3.4 UNITED KINGDOM

11.3.5 GERMANY

11.3.6 FRANCE

11.3.7 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: INSURANCE ANALYTICS MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

11.4.3 ASIA PACIFIC: REGULATIONS

11.4.3.1 Privacy Commissioner for Personal Data

11.4.3.2 Act on the Protection of Personal Information

11.4.3.3 Critical Information Infrastructure

11.4.3.4 Privacy Amendment (Notifiable Data Breaches) Act

11.4.3.5 International Organization for Standardization 27001

11.4.3.6 Personal Data Protection Act

FIGURE 43 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 49 ASIA PACIFIC: INSURANCE ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 50 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 51 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 52 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 53 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 54 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 55 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 56 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 57 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 58 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 60 ASIA PACIFIC: MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 61 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 62 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

11.4.4 CHINA

11.4.5 JAPAN

11.4.6 AUSTRALIA

11.4.7 SOUTH KOREA

11.4.8 REST OF ASIA PACIFIC

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: INSURANCE ANALYTICS MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

11.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

11.5.3.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

11.5.3.2 Cloud Computing Framework

11.5.3.3 GDPR Applicability in the Kingdom of Saudi Arabia

11.5.3.4 Protection of Personal Information Act

11.5.3.5 Other Regulations

TABLE 63 MIDDLE EAST AND AFRICA: INSURANCE ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 68 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 69 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 70 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 71 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 74 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 75 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 76 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

11.5.4 KINGDOM OF SAUDI ARABIA

11.5.5 UNITED ARAB EMIRATES

11.5.6 SOUTH AFRICA

11.5.7 REST OF MIDDLE EAST AND AFRICA

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: INSURANCE ANALYTICS MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

11.6.3 LATIN AMERICA: REGULATIONS

11.6.3.1 Brazil Data Protection Law

11.6.3.2 Argentina Personal Data Protection Law No. 25.326

11.6.3.3 Chile’s Law 19.628/2011

TABLE 77 LATIN AMERICA: INSURANCE ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 78 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 79 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 80 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 81 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 82 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 83 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 84 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 85 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 86 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 87 LATIN AMERICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 88 LATIN AMERICA: MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 89 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 90 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

11.6.4 BRAZIL

11.6.5 MEXICO

11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 157)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 44 MARKET EVALUATION FRAMEWORK

12.3 MARKET SHARE, 2020

FIGURE 45 MICROSOFT TO LEAD THE INSURANCE ANALYTICS MARKET IN 2020

12.4 HISTORICAL REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 46 REVENUE ANALYSIS OF KEY MARKET PLAYERS

12.5 RANKING OF KEY MARKET PLAYERS IN MARKET, 2020

FIGURE 47 RANKING OF KEY PLAYERS, 2020

12.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 91 COMPANY PRODUCT FOOTPRINT

12.7 COMPETITIVE SCENARIO

12.7.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 92 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2018–2021

12.7.2 BUSINESS EXPANSIONS

TABLE 93 BUSINESS EXPANSIONS, 2019–2020

12.7.3 MERGERS AND ACQUISITIONS

TABLE 94 MERGERS AND ACQUISITIONS, 2018–2021

12.7.4 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS

TABLE 95 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS, 2018–2021

12.8 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

12.8.1 STAR

12.8.2 EMERGING LEADERS

12.8.3 PERVASIVE

12.8.4 PARTICIPANTS

FIGURE 48 INSURANCE ANALYTICS MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

12.8.5 STRENGTH OF PRODUCT PORTFOLIO (GLOBAL)

FIGURE 49 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MARKET

12.8.6 BUSINESS STRATEGY EXCELLENCE (GLOBAL)

FIGURE 50 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MARKET

12.9 STARTUP/SME EVALUATION MATRIX, 2020

12.9.1 PROGRESSIVE COMPANIES

12.9.2 RESPONSIVE COMPANIES

12.9.3 DYNAMIC COMPANIES

12.9.4 STARTING BLOCKS

FIGURE 51 INSURANCE ANALYTICS MARKET (GLOBAL): STARTUP/SME EVALUATION MATRIX, 2020

12.9.5 STRENGTH OF PRODUCT PORTFOLIO (STARTUP/SME)

FIGURE 52 PRODUCT PORTFOLIO ANALYSIS OF TOP STARTUPS IN THE MARKET

12.9.6 BUSINESS STRATEGY EXCELLENCE (STARTUP/SME)

FIGURE 53 BUSINESS STRATEGY EXCELLENCE OF TOP STARTUPS IN THE MARKET

13 COMPANY PROFILES (Page No. - 182)

13.1 INTRODUCTION

(Business and Financial Overview, Platforms and Services Offered, and Recent Developments)*

13.2 IBM

TABLE 96 IBM: BUSINESS OVERVIEW

FIGURE 54 IBM: COMPANY SNAPSHOT

TABLE 97 IBM: PLATFORM OFFERED

TABLE 98 IBM: RECENT DEVELOPMENTS

TABLE 99 IBM: DEALS

TABLE 100 IBM: OTHERS

13.3 SALESFORCE

TABLE 101 SALESFORCE: BUSINESS OVERVIEW

FIGURE 55 SALESFORCE: COMPANY SNAPSHOT

TABLE 102 SALESFORCE: SOLUTIONS OFFERED

TABLE 103 SALESFORCE: RECENT DEVELOPMENTS

TABLE 104 SALESFORCE: DEALS

13.4 ORACLE

TABLE 105 ORACLE: BUSINESS OVERVIEW

FIGURE 56 ORACLE: COMPANY SNAPSHOT

TABLE 106 ORACLE: SOLUTIONS OFFERED

TABLE 107 ORACLE: RECENT DEVELOPMENTS

TABLE 108 ORACLE: DEALS

TABLE 109 ORACLE: OTHERS

13.5 MICROSOFT

TABLE 110 MICROSOFT: BUSINESS OVERVIEW

FIGURE 57 MICROSOFT: COMPANY SNAPSHOT

TABLE 111 MICROSOFT: SOLUTIONS OFFERED

TABLE 112 MICROSOFT: RECENT DEVELOPMENTS

TABLE 113 MICROSOFT: DEALS

TABLE 114 MICROSOFT: OTHERS

13.6 OPENTEXT

TABLE 115 OPENTEXT: BUSINESS OVERVIEW

FIGURE 58 OPENTEXT: COMPANY SNAPSHOT

TABLE 116 OPENTEXT: SOLUTIONS OFFERED

TABLE 117 OPENTEXT: RECENT DEVELOPMENTS

TABLE 118 OPENTEXT: DEALS

13.7 SAP

TABLE 119 SAP: BUSINESS OVERVIEW

FIGURE 59 SAP: COMPANY SNAPSHOT

TABLE 120 SAP: SOLUTIONS OFFERED

TABLE 121 SAP: RECENT DEVELOPMENTS

TABLE 122 SAP: OTHERS

13.8 VERISK ANALYTICS

TABLE 123 VERISK ANALYTICS: BUSINESS OVERVIEW

FIGURE 60 VERISK ANALYTICS: COMPANY SNAPSHOT

TABLE 124 VERISK ANALYTICS: SOLUTIONS OFFERED

TABLE 125 VERISK ANALYTICS: SERVICES OFFERED

TABLE 126 VERISK ANALYTICS: RECENT DEVELOPMENTS

13.9 SAS INSTITUTE

TABLE 127 SAS INSTITUTE: BUSINESS OVERVIEW

FIGURE 61 SAS INSTITUTE: COMPANY SNAPSHOT

TABLE 128 SAS INSTITUTE: SOLUTIONS OFFERED

TABLE 129 SAS INSTITUTE: SERVICES OFFERED

TABLE 130 SAS INSTITUTE: RECENT DEVELOPMENTS

TABLE 131 SAS INSTITUTE: OTHERS

TABLE 132 SAS INSTITUTE: DEALS

13.10 VERTAFORE

TABLE 133 VERTAFORE: SOLUTIONS OFFERED

TABLE 134 VERTAFORE: RECENT DEVELOPMENTS

13.11 TIBCO

TABLE 135 TIBCO: PLATFORMS OFFERED

TABLE 136 TIBCO: RECENT DEVELOPMENTS

TABLE 137 TIBCO: DEALS

13.12 QLIK

TABLE 138 QLIK: PLATFORMS OFFERED

TABLE 139 QLIK: RECENT DEVELOPMENTS

TABLE 140 QLIK: DEALS

13.13 SAPIENS

TABLE 141 SAPIENS: BUSINESS OVERVIEW

FIGURE 62 SAPIENS: COMPANY SNAPSHOT

TABLE 142 SAPIENS: PLATFORMS OFFERED

TABLE 143 SAPIENS: DEALS

13.14 BOARD INTERNATIONAL

TABLE 144 BOARD INTERNATIONAL: SOLUTIONS OFFERED

TABLE 145 BOARD INTERNATIONAL: RECENT DEVELOPMENTS

TABLE 146 BOARD INTERNATIONAL: OTHERS

TABLE 147 BOARD INTERNATIONAL: DEALS

13.15 BRIDGEI2I

TABLE 148 BRIDGEI2I: SOLUTIONS OFFERED

TABLE 149 BRIDGEI2I: RECENT DEVELOPMENTS

13.16 MICROSTRATEGY

TABLE 150 MICROSTRATEGY: BUSINESS OVERVIEW

FIGURE 63 MICROSTRATEGY: COMPANY SNAPSHOT

TABLE 151 MICROSTRATEGY: SOLUTIONS OFFERED

TABLE 152 MICROSTRATEGY: RECENT DEVELOPMENTS

13.17 GUIDEWIRE SOFTWARE

TABLE 153 GUIDEWIRE SOFTWARE: BUSINESS OVERVIEW

FIGURE 64 GUIDEWIRE SOFTWARE: COMPANY SNAPSHOT

TABLE 154 GUIDEWIRE SOFTWARE: SOLUTIONS OFFERED

TABLE 155 GUIDEWIRE SOFTWARE: RECENT DEVELOPMENTS

TABLE 156 GUIDEWIRE SOFTWARE: DEALS

13.18 LEXISNEXIS RISK SOLUTIONS

TABLE 157 LEXISNEXIS RISK SOLUTIONS: BUSINESS OVERVIEW

TABLE 158 LEXISNEXIS RISK SOLUTIONS: SOLUTIONS OFFERED

TABLE 159 LEXISNEXIS RISK SOLUTIONS: RECENT DEVELOPMENTS

TABLE 160 LEXISNEXIS RISK SOLUTIONS: DEALS

13.19 WNS

TABLE 161 WNS: BUSINESS OVERVIEW

FIGURE 65 WNS: COMPANY SNAPSHOT

TABLE 162 WNS: SOLUTIONS OFFERED

TABLE 163 WNS: RECENT DEVELOPMENTS

TABLE 164 WNS: DEALS

13.20 HEXAWARE TECHNOLOGIES

TABLE 165 HEXAWARE TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 66 HEXAWARE TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 166 HEXAWARE TECHNOLOGIES: PLATFORM/SOLUTIONS OFFERED

TABLE 167 HEXAWARE TECHNOLOGIES: RECENT DEVELOPMENTS

13.21 PEGASYSTEMS

TABLE 168 PEGASYSTEMS: BUSINESS OVERVIEW

FIGURE 67 PEGASYSTEMS: COMPANY SNAPSHOT

TABLE 169 PEGASYSTEMS: SOLUTIONS OFFERED

TABLE 170 PEGASYSTEMS: SERVICES OFFERED

TABLE 171 PEGASYSTEMS: RECENT DEVELOPMENTS

13.22 APPLIED SYSTEMS

TABLE 172 APPLIED SYSTEMS: SOLUTIONS OFFERED

TABLE 173 APPLIED SYSTEMS: RECENT DEVELOPMENTS

TABLE 174 APPLIED SYSTEMS: DEALS

13.23 INSUREDMINE

13.24 REFOCUS AI

13.25 RISKVILLE

13.26 PENTATION ANALYTICS

13.27 HABIT ANALYTICS

13.28 ARTIVATIC.AI

13.29 CYBERCUBE

13.30 ARCEO.AI

*Details on Business and Financial Overview, Platforms and Services Offered, and Recent Developments might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 250)

14.1 INTRODUCTION

14.2 DIGITAL INSURANCE MARKET - GLOBAL FORECAST TO 2021

14.2.1 MARKET DEFINITION

14.2.2 MARKET OVERVIEW

14.2.2.1 Digital Insurance market, by component

TABLE 175 DIGITAL INSURANCE PLATFORM MARKET SIZE, BY COMPONENT, 2016–2023 (USD BILLION)

14.2.2.2 Digital insurance market, by service

TABLE 176 DIGITAL INSURANCE PLATFORM MARKET SIZE, BY SERVICE, 2016–2023 (USD BILLION)

14.2.2.3 Digital insurance market, by end user

TABLE 177 DIGITAL INSURANCE PLATFORM MARKET SIZE, BY END USER, 2016–2023 (USD BILLION)

14.2.2.4 Digital insurance market, by insurance application

TABLE 178 DIGITAL INSURANCE PLATFORM MARKET SIZE, BY INSURANCE APPLICATION, 2016–2023 (USD BILLION)

14.2.2.5 Digital insurance market, by deployment mode

TABLE 179 DIGITAL INSURANCE PLATFORM MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2023 (USD BILLION)

14.2.2.6 Digital insurance market, by organization size

TABLE 180 DIGITAL INSURANCE PLATFORM MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD BILLION)

14.2.2.7 Digital insurance market, by region

TABLE 181 DIGITAL INSURANCE PLATFORM MARKET SIZE, BY REGION, 2016–2023 (USD BILLION)

14.3 AI IN FINTECH MARKET - GLOBAL FORECAST TO 2025

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.3.2.1 AI in FinTech market, by solution

TABLE 182 AI IN FINTECH MARKET SIZE, BY COMPONENT, 2015–2022 (USD MILLION)

14.3.2.2 AI in FinTech market, by service

TABLE 183 AI IN FINTECH MARKET SIZE, BY DEPLOYMENT MODE, 2015–2022 (USD MILLION)

14.3.2.3 AI in FinTech market, by deployment mode

TABLE 184 GLOBAL MOBILE UC&C SOLUTION MARKET SIZE, BY DEPLOYMENT TYPE, 2012–2019 (USD MILLION)

14.3.2.4 Mobile UC&C market, by application area

TABLE 185 AI IN FINTECH MARKET SIZE, BY APPLICATION AREA,2015–2022 (USD MILLION)

14.3.2.5 AI in FinTech market, by region

TABLE 186 AI IN FINTECH MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

15 APPENDIX (Page No. - 257)

15.1 INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

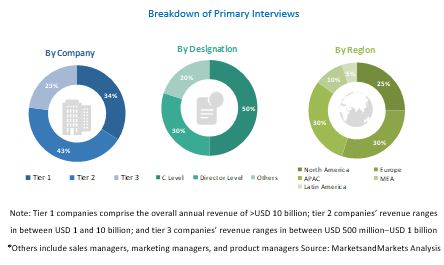

The study involved four major activities in estimating the current market size of the insurance analytics market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the insurance analytics market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers and Bloomberg BusinessWeek, Dun Bradstreet, and Factiva, have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, certified publications and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from insurance analytics solution vendors, system integrators, service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the insurance analytics market.

- In this approach, the overall insurance analytics market size for each organization size has been considered at a country and regional level.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various insurance analytics platform types used in the key end users.

- Several primary interviews have been conducted with key opinion leaders related to insurance analytics providers, including key OEMs and Tier I suppliers

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global insurance analytics Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, segment, and project the global market size of the insurance analytics market

- To understand the structure of the insurance analytics market by identifying its various subsegments

- To provide detailed information about the key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze micromarkets concerning individual growth trends, prospects, and contributions to the overall market

- To analyze the market by component, applications, organization size, deployment mode, end user, and region

- To project the size of the market and its submarkets, in terms of value, for North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify significant growth strategies adopted by players across key regions

- To analyze competitive developments, such as expansions and funding, new product launches, mergers and acquisitions, strategic partnerships, and agreements, in the insurance analytics market

- To analyze the impact of COVID-19 pandemic on insurance analytics market

Insurance Data Analytics Market & Its impact on Insurance Analytics Market:

The Insurance Analytics Market refers to the use of data analytics tools and techniques by insurance companies to gain insights into their business operations, improve their decision-making processes, and better understand their customers. This can include a wide range of activities, such as data mining, predictive modeling, and risk analysis. The Insurance Data Analytics Market, on the other hand, specifically refers to the market for products and services that support insurance companies in their data analytics efforts. This can include software tools for data visualization and analysis, consulting services for implementing analytics solutions, and data providers who specialize in collecting and aggregating insurance-related data.

The Insurance Data Analytics Market has a significant impact on the Insurance Analytics Market, as it provides the technology, tools, and expertise required to implement and utilize data analytics in the insurance industry.

As the Insurance Data Analytics Market grows, it is driving innovation and competition within the Insurance Analytics Market. Insurance companies are increasingly looking for ways to differentiate themselves through the use of data analytics, and the availability of new and advanced analytics tools is enabling them to do so.

In addition, the Insurance Data Analytics Market is helping to break down barriers to entry for new players in the insurance industry. Smaller insurance companies and insurtech startups can leverage data analytics tools to compete with larger, more established insurers by offering more personalized products, better pricing, and improved customer experiences.

Futuristic growth use-cases of Insurance Data Analytics Market:

- Predictive underwriting: Insurance companies are using predictive analytics to assess risk more accurately and efficiently. By analysing vast amounts of data on past claims, customer behaviour, and other factors, insurers can better predict the likelihood of a claim and price policies more accurately.

- Usage-based insurance: Insurance companies are using telematics and other data sources to offer usage-based insurance policies. These policies are priced based on factors like driving behaviour, miles driven, and other usage patterns, allowing insurers to offer more personalized and cost-effective coverage.

- Fraud detection: Data analytics can help insurers detect fraudulent claims by analysing patterns in claims data and identifying anomalies. This can help insurers reduce losses due to fraud and improve the accuracy of claims processing.

- Customer experience: Insurance companies are using data analytics to improve customer experiences by providing personalized recommendations, faster claims processing, and more convenient services.

- Cyber insurance: With the increasing risk of cyber attacks, insurance companies are using data analytics to assess cyber risk and price cyber insurance policies more accurately. This includes analyzing data on past cyber-attacks, assessing the security posture of potential policyholders, and identifying vulnerabilities in their systems.

Overall, the growth of the Insurance Data Analytics Market is expected to drive innovation and transformation in the insurance industry, enabling insurers to offer more personalized, efficient, and effective products and services to customers.

Some of the top companies in the Insurance Data Analytics Market are Verisk Analytics, IBM, Oracle, Allstate, SAS, Munich Re, Swiss Re, Aon, Guidewire, LexisNexis Risk Solutions, Accenture

Industries Getting Impacted in the future by Insurance Data Analytics Market:

- Insurance: The most obvious industry that will be impacted by the Insurance Data Analytics Market is the insurance industry itself. Insurers are using data analytics to improve their risk assessment, underwriting, claims processing, fraud detection, and customer engagement capabilities.

- Healthcare: Healthcare providers and insurers are using data analytics to improve patient outcomes, reduce costs, and manage risk. By analyzing patient data and clinical outcomes, healthcare providers can identify trends and patterns that can help them improve their services and provide more personalized care.

- Finance: Financial services companies are using data analytics to identify fraud, manage risk, and personalize their offerings. Banks and credit card companies, for example, are using data analytics to identify fraudulent transactions and assess credit risk.

- Retail: Retailers are using data analytics to personalize their marketing and sales efforts, improve customer engagement, and manage supply chain risk. By analyzing customer data, retailers can identify buying patterns and preferences, and offer targeted promotions and recommendations.

- Automotive: The automotive industry is using data analytics to develop more personalized and efficient products and services. For example, telematics data is being used to offer usage-based insurance policies and to develop more efficient and personalized driving experiences.

- Energy: The energy industry is using data analytics to manage risk, optimize operations, and reduce costs. By analysing data on energy consumption and production, companies can identify areas where they can improve their efficiency and reduce their environmental impact.

Available customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of insurance analytics market

- Profiling of additional market players (total up to 15)

- Country-level analysis of main 3 segments such as componentapplications, organization size, deployment mode, end user

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Insurance Analytics Market

Scope of SaaS in insurance sector

Interested in insurance data from UK and US

This report will give you a 360 analysis of Insurance Analytics Market landscape with deep-dive data market sizing, growth projections, adoptions rates for platform, services and various application segments across various buyer segments. The report will also cover top vendor developments, regional analysis for North America, Europe, APAC, Latin America and MEA along with country level data and how this market will shape in the coming years. This Insurance Analytics Market report will cover the following quantitative and qualitative data:

Market strategy and growth in insurance industry