Dental 3D Printing Market: Growth, Size, Share, and Trends

Dental 3D Printing Market by Equipment (3D Scanner, Printer), Technology (VAT Photopolymerization, LCD, FDM, SLS), Material (Resins, Metal, Ceramics, Photopolymer), Application (Crown & Bridge, Dental Models, Aligner), End User - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Dental 3D printing market is projected to reach USD 10.06 billion by 2030 from USD 3.96 billion in 2025, at a CAGR of 20.5% from 2025 to 2030. The growth of the market is driven by rising demand for cosmetic dentistry, increasing prevalence of dental disorders, the growing elderly population needing prosthetics, and a significant rise in digital dentistry adoption

KEY TAKEAWAYS

- The North America 3D printing market accounted for a 37.4% revenue share in 2024

- By offering, service segment is estimated to account for a major share of the 3D printing market in 2030

- By application, the functional parts segment is expected to register the highest CAGR of 21.1%.

- By vertical, the automotive segment is projected to grow at the fastest rate from 2025 to 2030.

- Stratasys (US), EOS GmbH (Germany), and HP Development Company, L.P. (US) were identified as some of the star players in the 3D printing market (global), given their strong market share and product footprint.

- Carbon, Inc. (US), UnionTech (China) and Formlabs (US), among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The dental 3D printing market is primarily driven by factors such as the high incidence of dental caries and other dental diseases, the rising demand for cosmetic dentistry, the growing adoption of dental 3D printers in hospitals & clinics, and the rapid growth in the geriatric population.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The dental 3D printing market is being reshaped by rapid digitalization, AI-driven design tools, and advanced biocompatible materials enabling faster, patient-specific production. Growing adoption of chairside printing and automated workflows is improving efficiency but also intensifying competition and regulatory demands. These shifts are pushing customers to adopt scalable, integrated, and compliant solutions to stay agile in a transforming digital dentistry landscape

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for cosmetic dentistry and preventive dental care

-

High incidence of dental caries and other oral diseases

Level

-

High cost of Dental 3D Printing

Level

-

High growth potential of dental tourism in emerging economies

Level

-

Stringent regulatory requirements for dental 3D printing products

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Drivers: Rising demand for cosmetic dentistry and preventive dental care

Cosmetic dentistry is the leading force behind the growth of the dental 3D printing industry. This growth is driven by increasing disposable incomes, heightened awareness of aesthetics, and the influence of social media. As more individuals prioritize their appearance, there is rising demand for treatments that offer whiter teeth, straighter smiles, and natural-looking restorations. 3D printing plays a crucial role in this transformation by providing highly customized, minimally invasive cosmetic care with enhanced precision and efficiency.

High cost of Dental 3D Printing

Dental 3D printers use advanced technologies such as lasers, precise actuators, and complex software systems. The biocompatible resins and metal powders required for printing dental prosthetics are specially formulated and undergo rigorous testing for safety and regulatory compliance. This extensive testing drives up their costs compared to generic materials. Additionally, the dental market is relatively small compared to industries with mass production of 3D printers, which limits economies of scale that could lower individual unit costs. As a result, this is expected to restrain market growth.

High growth potential of dental tourism in emerging economies

The potential for dental 3D printing in emerging countries is significant, offering exciting opportunities for improved dental care access and enhanced treatment approaches. 3D printing allows for on-demand fabrication of prosthetics, bridges, and other dental restorations directly within the dental practice. This significantly reduces waiting times compared to traditional outsourcing, streamlining workflow and improving patient experience. Recognizing the potential of 3D printing, some governments in emerging countries are creating favorable policies and investing in research and development. Additionally, public-private partnerships can play a crucial role in establishing infrastructure, providing affordable equipment, and promoting wider adoption, which is expected to drive the market growth.

Stringent regulatory requirements for dental 3D printing products

Dental 3D printing materials directly interact with the human body, making biocompatibility of paramount importance. Regulatory bodies like the FDA in the US and the MHRA in the UK set strict standards for materials used in printing dental restorations, implants, and appliances to ensure they do not cause adverse reactions or pose health risks, which is expected to challenge the market growth.

Dental 3D Printing Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Advanced DENTAL 3D PRINTING solutions for orthodontic and restorative applications | High-accuracy aligner manufacturing, seamless digital workflow integration, enhanced patient customization |

|

Comprehensive DENTAL and MEDICAL 3D PRINTING platforms for prosthodontics, surgical guides, and anatomical modeling | Multi-material printing, biocompatible resins, precision modeling for clinical and educational use |

|

Chairside DENTAL 3D PRINTING systems for restorative, implant, and orthodontic applications | Compact, cost-efficient desktop printing, resin versatility, and fast turnaround for dental labs and clinics |

|

Industrial-grade DENTAL 3D PRINTING for large-scale production of dental models and custom appliances | High-speed printing, robust mechanical properties, broad material compatibility, and scalable workflows |

|

Advanced DENTAL and MEDICAL 3D PRINTING for prosthetics, implants, and anatomical models | Precision additive manufacturing, bio-compatible materials, and optimized design-to-print solutions |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

In the Dental 3D Printing market matrix, Formlabs Company (Star) leads with scale, extensive distribution, and a broad solutions portfolio. Prodway Group (Emerging Leader) is gaining momentum with innovative products and technologies. While Formlabs Company dominates through reach, Prodway Group innovation positions it for rapid growth toward the leaders’ quadrant.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Dental 3D Printing Market, By Product & Services

Based on products & services, the dental 3D printing market is categorized into equipment, materials, and services. The materials segment holds the second-largest share and is growing at the highest rate in the dental 3D printing market, driven by the tremendous demand for advanced and specialized dental materials. Dental materials consist of plastics, biocompatible resins, polymers, metals, metal alloys, ceramics, and other biomaterials, all of which are designed for specific dental applications such as crowns, bridges, aligners, surgical guides, and dentures. As a result of ongoing advances in material science, this area is expected to register the highest growth rate during the forecast period.

Dental 3D Printing Market, By Technology

By Technology, the VAT photopolymerization (VPP) segment holds the largest market share in dental 3D printing due to its high accuracy, compatibility with a wide range of resins, and extensive clinical applications. Technologies such as SLA (Stereolithography) and DLP (Digital Light Processing) offer high-resolution, precise printing for various restorations, including crowns, bridges, aligners, surgical guides, and splints.

Dental 3D Printing Market, By Application

Among applications, the models for the clear aligners segment are expected to experience the highest CAGR between 2025 and 2030. As dental models play a crucial part in today's dental practice, they are the most widely used application for dental 3D printing. Dentists employ them in order to gain a better understanding of a patient's mouth, treatment planning, and production of personalized custom dental pieces, removable models, clear aligners or bridge models. With more clinics utilizing digital technology such as CAD/CAM systems, it is quicker and cheaper to produce detailed, personalized models.

Dental 3D Printing Market, By End User

Dental laboratories hold the highest share in the dental 3D printing market, as there is growing need for high-quality products, cosmetic procedures, and better technology in dental practices. 3D printing has been applied to produce different dental items, including veneers, crowns, dentures, and prostheses, with greater precision, efficiency, and affordability. Demand is coming from greater adoption of this technology by larger chains and higher-spending labs as well as increased fabrication outsourcing to labs. In addition to enhanced accuracy, digitisation through 3D printing ensures considerable time and expense reductions. Adoption in dental labs is also spurred on by the ability to generate personalised, patient-specific solutions. Production of durable high-quality dental products will continue to increase with the advancement of technology.

REGION

Asia Pacific to be fastest-growing region in global dental 3d printing market during forecast period

The dental 3D printing market in Asia Pacific is expected to grow at the highest CAGR due to a combination of factors that highlight the region's changing healthcare landscape. Some APAC governments are promoting oral health awareness and offering subsidies for dental treatments, further stimulating market growth. The aging population in APAC is increasing the demand for dental implants and prosthetics to address tooth loss and maintain oral health. Increasing wealth in APAC countries is leading to higher spending on healthcare, including dental care.

Dental 3D Printing Market: COMPANY EVALUATION MATRIX

In the Dental 3D Printing market matrix, Formlabs Company (Star) leads with scale, extensive distribution, and a broad solutions portfolio. Prodway Group (Emerging Leader) is gaining momentum with innovative products and technologies. While Formlabs Company dominates through reach, Prodway Group innovation positions it for rapid growth toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.04 Billion |

| Market Forecast in 2030 (Value) | USD 10.06 Billion |

| Growth Rate | CAGR of 20.5% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Product & Services: Services, Materials and Equipment By Technology: VAT photopolymerization (VPP), fused deposition modeling, selective laser sintering, polyjet printing, and other technologies. By Application: Temporary Crowns & Bridges, Final Crowns & Bridges, Dental Models, Surgical Guides, Removable Partial Frameworks, Models For Clear Aligners, Partial Dentures, Complete Dentures, And Other Applications. By End User: Dental Laboratories, Dental Hospitals & Clinics, And Dental Academic & Research Institutes. By Region |

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Dental 3D Printing Market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- July 2024 : Stratasys (US and Israel) launched the DentaJet XL, the latest addition to the DentaJet series.

- December 2023 : Align Technology received product approval from the US Food and Drug Administration (FDA) for the commercial availability of Align’s Invisalign Palatal Expander System in the US.

- January 2024 : Stratasys (US and Israel) entered into an agreement with Desktop Metal (US) to not approve the terms of the previously announced merger with Desktop Metal, Inc. Consequently, they have terminated the Merger Agreement.

Table of Contents

Methodology

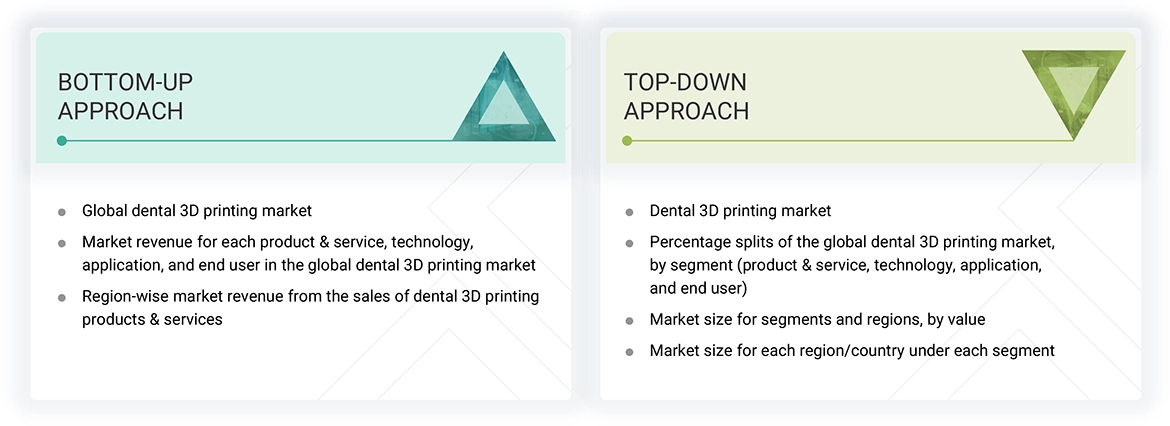

The study comprised four key activities aimed at estimating the current size of the dental 3D printing market. First, extensive secondary research was conducted to gather information on the market, including related and parent markets. The next step involved validating these findings, assumptions, and market size estimates through primary research with industry experts across the value chain. We employed both top-down and bottom-up approaches to arrive at a comprehensive estimate of the overall market size. Finally, we utilized market breakdown and data triangulation techniques to determine the sizes of segments and subsegments within the market.

Secondary Research

The secondary research process involved extensive use of various secondary sources, including directories, databases like Bloomberg Business, Factiva, and D&B Hoovers, as well as white papers, annual reports, company house documents, investor presentations, and SEC filings. This research was conducted to gather information valuable for a comprehensive, technical, market-oriented, and commercial study of the dental 3D printing market. It also helped obtain critical insights about key players in the industry, market classification, and segmentation based on current industry trends, down to the finest details. Additionally, a database of leading industry players was created through this secondary research.

Primary Research

In the primary research process, we interviewed various sources from both the supply and demand sides to gather qualitative and quantitative information for this report. On the supply side, we interviewed industry experts, including CEOs, vice presidents, marketing & sales directors, technology & innovation directors, and other key executives from prominent companies and organizations involved in the dental 3D printing market. For the demand side, we engaged with industry experts, purchase and sales managers, doctors, and personnel from research organizations. This primary research was essential to validate market segmentation, identify key players in the industry, and gather insights on important industry trends and market dynamics.

A breakdown of the primary respondents for the dental 3D printing market is provided below:

Note 1: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 2: Others include sales, marketing, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the dental 3D printing market includes the following details.

The market sizing was undertaken from the global side.

Country-level Analysis: The size of the dental 3D printing market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products and services in the overall dental 3D printing market was obtained from secondary data and validated by primary participants to arrive at the total dental 3D printing market. Primary participants further validated the numbers.

Geographic Market Assessment (By Region & Country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated by industry experts who were contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall dental 3D printing market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Dental 3D printing is a groundbreaking technology that uses additive manufacturing techniques to produce customized dental restorations, prosthetics, and appliances directly from digital models. This innovation allows dental practices to bypass traditional molds and lengthy lab work. Instead, intricate crowns, bridges, and even surgical guides can be printed on-demand right within the dental office itself.

Stakeholders

- Senior Management

- Finance Department

- Procurement Department

- Dental Hospitals & Clinics

- Dental Laboratories

- Dental Academic & Research Institutes

- Trade Associations and Industry Bodies

- Regulatory Bodies and Government Agencies

- Business Research and Consulting Service Providers

- Market Research and Consulting Firms

- Venture Capitalists and Investors

Report Objectives

- To define, describe, segment, analyze, and forecast the global dental 3D printing market by product & service, technology, application, end user, and region

- To provide detailed information about the factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets concerning individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the dental 3D printing market in North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa, and GCC countries

- To profile the key players in the dental 3D printing market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as agreements, collaborations, and partnerships; expansions; acquisitions; and product launches & approvals in the dental 3D printing market

Frequently Asked Questions (FAQ)

Which is the largest segment of the dental 3D printing market, by product & service?

Services are the largest segment of the dental 3D printing market based on product & service. Many service providers offer expertise in selecting the right biocompatible materials for specific dental applications.

Which is the largest segment of the dental 3D printing market, by technology?

Based on technology, VAT photopolymerization is the largest segment of the dental 3D printing market. Its layer-by-layer process offers high accuracy and resolution, enabling precise prints with exceptional detail and smooth surface finishes.

Which segments have been included in this report?

This report has the following main segments:

- By Product & Service

- By Technology

- By Application

- By End User

- By Region

Which country/region occupies the largest share of the dental 3D printing market globally?

In 2024, North America held the largest share of the dental 3D printing market. This is due to several factors, such as advanced healthcare infrastructure, rising technological advancements, and the growing number of oral diseases in the region.

Who are the top industry players in the global dental 3D printing market?

The top market players in the global dental 3D printing market are Stratasys (US and Israel), 3D Systems, Inc. (US), Desktop Metal, Inc. (US), DWS S.r.l. (Italy), Align Technology, Inc. (US), Formlabs (US), and Asiga (Australia).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Dental 3D Printing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Dental 3D Printing Market