Crane and Hoist Market Size, Share & Trends

Crane and Hoist Market by Mobile Cranes (Lattice Boom, Telescopic Boom, Crawler, Rough Terrain, All-Terrain, Truck-Loader), Fixed Cranes (Industrial, Tower, Ship-to-Shore), Operation (Hydraulic, Electric), Hoist Type, Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

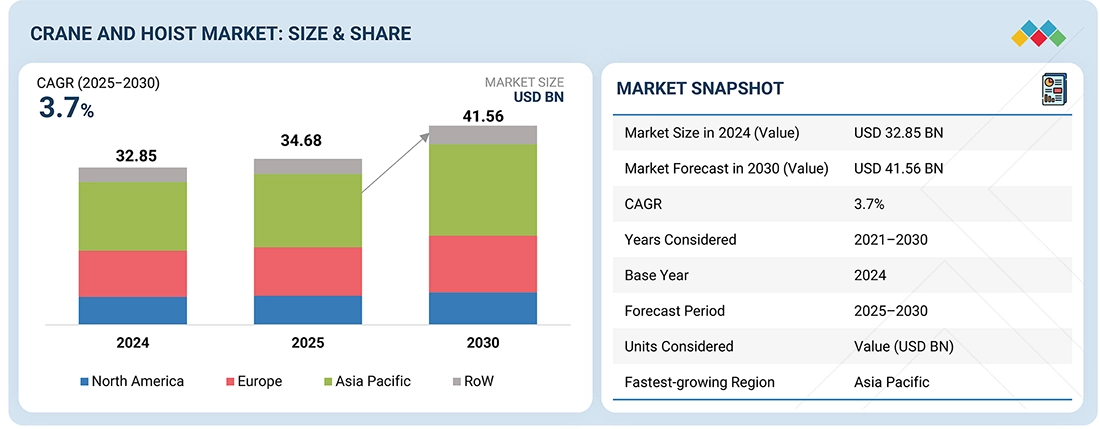

The crane and hoist market is projected to reach USD 41.56 billion by 2030 from USD 34.68 billion in 2025, at a CAGR of 3.7% from 2025 to 2030. The growth of the crane and hoist market is driven by increasing demand from the construction, mining, and shipping industries, supported by rising infrastructure development, expanding material handling requirements, and modernization of port and industrial facilities worldwide.

KEY TAKEAWAYS

- The Asia Pacific crane and hoist market accounted for a 43.6% revenue share in 2024.

- By Crane type, the mobile crane segment is expected to register the highest CAGR of 4.1%.

- By Hoist type, the wire rope segment is projected to grow at the fastest rate from 2025 to 2030.

- By Industry, the construction segment will grow the fastest during the forecast period.

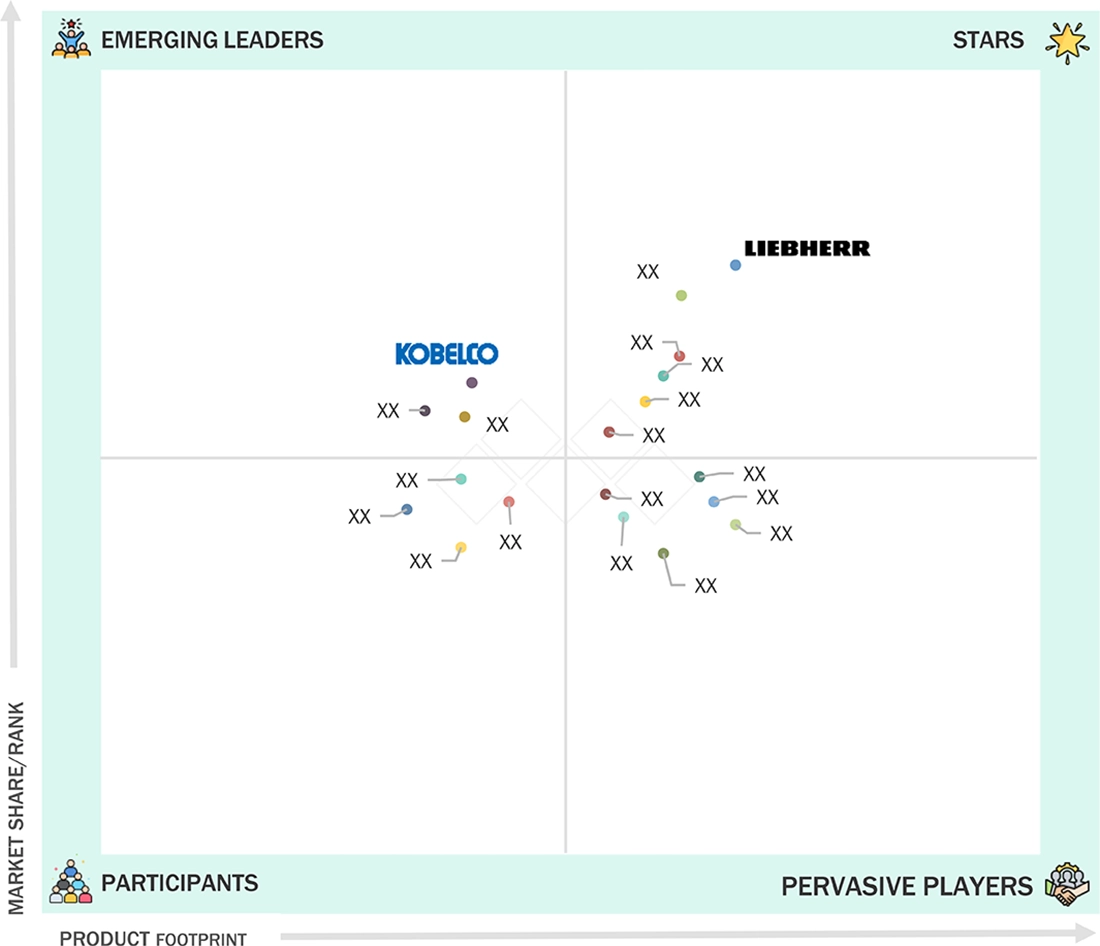

- Companies Liebherr, Konecranes, and Zoomlion Heavy Industry Science & Technology Co., Ltd. were identified as some of the star players in the crane and hoist market (global), given their strong market share and product footprint.

- Companies Verlinde and CHENG DAY MACHINERY WORKS CO., LTD., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The crane and hoist market is experiencing steady growth, driven by the rising need for efficient, safe, and automated lifting solutions across multiple industries. Advancements in IoT connectivity, AI-based control systems, and remote monitoring are enhancing equipment reliability and operational visibility. Additionally, product innovations, digital lifting technologies, and smart maintenance solutions are transforming market dynamics, supporting the transition toward intelligent, connected, and energy-efficient material handling environments.

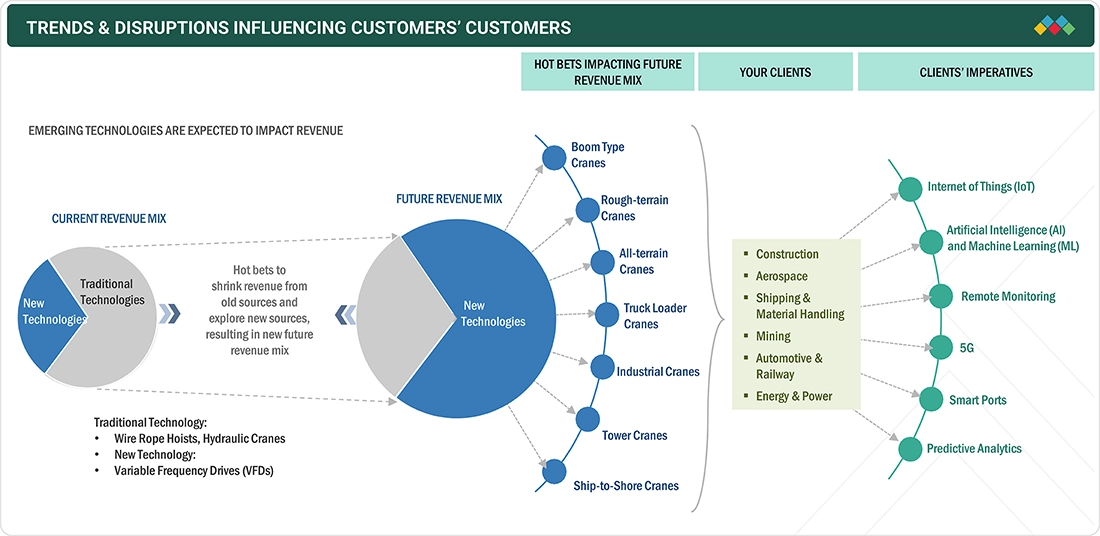

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ businesses in the crane and hoist market is being reshaped by the shift from traditional lifting systems to technology-driven, intelligent solutions. Advancements such as IoT, AI, remote monitoring, 5G, and predictive analytics are transforming operations across construction, aerospace, shipping & material handling, mining, automotive & railway, and energy & power industries. This digital shift is fueling demand for smart, connected, and energy-efficient cranes, enhancing safety, precision, and productivity while reducing downtime.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing emphasis on infrastructure development

-

Increasing need for advanced material handling solutions to support mining operations

Level

-

High cost of manufacturing and maintenance

Level

-

Rapid expansion of e-commerce and retail sectors in Southeast Asia

-

Integration of smart technologies into cranes and hoists

Level

-

Shortage of skilled crane technicians and operators

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing emphasis on infrastructure development

The construction industry relies on cranes and hoists for safely lifting and transporting heavy materials such as steel beams, concrete, and machinery, ensuring efficient project execution. Rising infrastructure investments and urban development across the US, India, China, and Europe are fueling demand for advanced lifting solutions. Tower and mobile cranes play a vital role in high-rise construction and ground-level operations, supporting faster project timelines, improved safety, and enhanced productivity amid the global surge in construction activities.

Restraint: High cost of manufacturing and maintenance

The manufacturing of cranes involves advanced metal fabrication, precision engineering, and strict quality control to ensure safety and durability. Key components include hoists, trolleys, bridges, and structural frames. However, high production and maintenance costs make market entry challenging for SMEs. Regular inspections, lubrication, and testing of load indicators, brakes, gears, and wire ropes are vital for operational reliability. These demanding maintenance and compliance standards significantly raise operational expenses, limiting new entrants in the global crane and hoist industry.

Opportunity: Integration of smart technologies into cranes and hoists

The integration of smart technologies is revolutionizing cranes and hoists across manufacturing, construction, and logistics sectors. Features like IoT sensors, AI analytics, predictive maintenance, and remote monitoring enhance safety, precision, and energy efficiency. Smart cranes—equipped with anti-sway systems, torque control, and VFDs—enable real-time diagnostics and automation, reducing downtime and operational risks. Companies such as Arnikon (Turkey) are advancing these solutions, supporting the Industry 4.0 shift toward intelligent, data-driven, and sustainable material handling systems.

Challenge: Shortage of skilled crane technicians and operators

A significant challenge in the crane and hoist market is the limited availability of skilled labor capable of handling increasingly complex lifting systems. As cranes become more advanced with automation, sensors, and digital controls, the need for technically trained operators and maintenance experts has intensified. Insufficient expertise can lead to installation errors, safety risks, and higher downtime. Moreover, continuous technological upgrades require ongoing training, making workforce development a critical barrier to efficient and safe crane operations worldwide.

Crane and Hoist Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Terex provided RT and tower cranes for Bechtel’s oil & gas construction projects in Saudi Arabia and the UAE. | Enhanced lifting efficiency in large-scale infrastructure work. |

|

Konecranes installed 150 crane and hoist systems at Jaguar Land Rover’s Engine Manufacturing Centre in the UK, including jib and workstation cranes with CLX electric chain hoists for improved precision and efficiency. | Improved lifting efficiency and precision in engine assembly operations. |

|

FPS Food Processing Solutions installs Norelco cranes to support production across multiple bays. | Improves efficiency, safety, and handling of heavy stainless-steel parts. |

|

Demag supplied DH hoist units for the Albbruck-Dogern hydroelectric power plant (Germany) to handle dam beams and turbine components. | Enabled safe, reliable, and precise lifting in power operations. |

|

Kito Corporation provided electric chain hoists to Mitsubishi Heavy Industries (Japan) for precision lifting in aircraft assembly lines. | Ensured vibration-free lifting and assembly accuracy. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

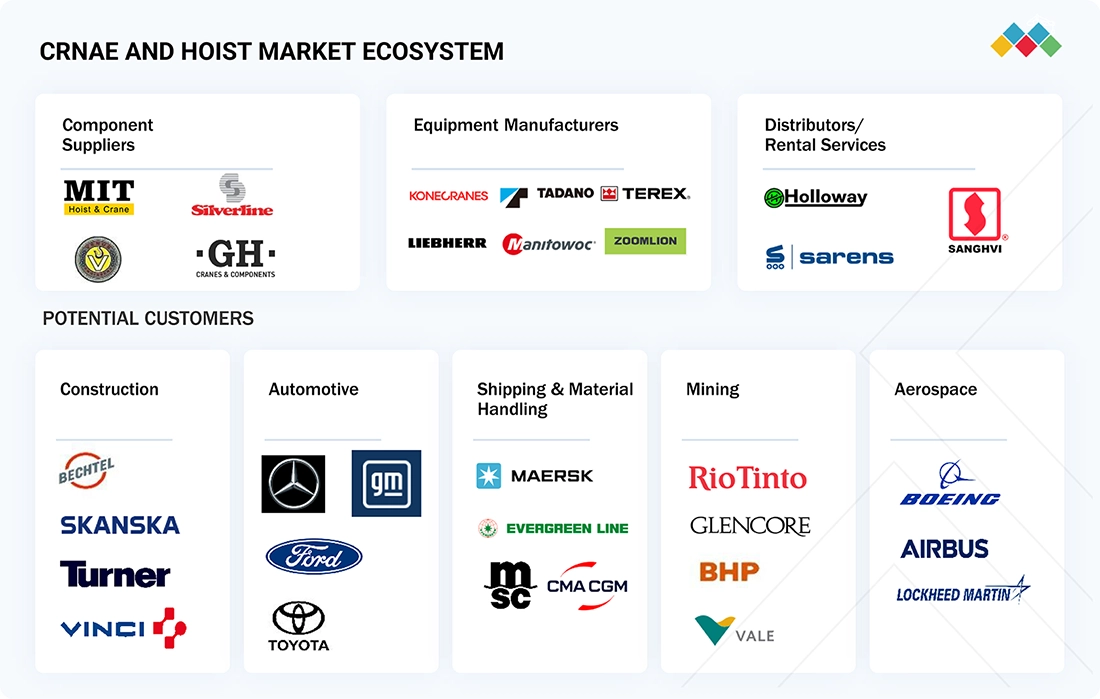

MARKET ECOSYSTEM

The crane and hoist market ecosystem consists of component suppliers (MIT Hoist & Crane, GH Cranes & Components, Silverline), equipment manufacturers (Konecranes, Tadano, Terex, Liebherr, Zoomlion, Manitowoc), and distributors/rental service providers (Holloway, Sarens, Sanghvi). Component suppliers provide essential mechanical and electrical parts, while equipment manufacturers design and produce advanced lifting systems. Distributors and rental firms ensure product availability and operational support. Key end users in construction, automotive, shipping & material handling, mining, and aerospace sectors drive market growth through rising demand for safe, efficient, and high-performance lifting solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Crane and Hoist Market

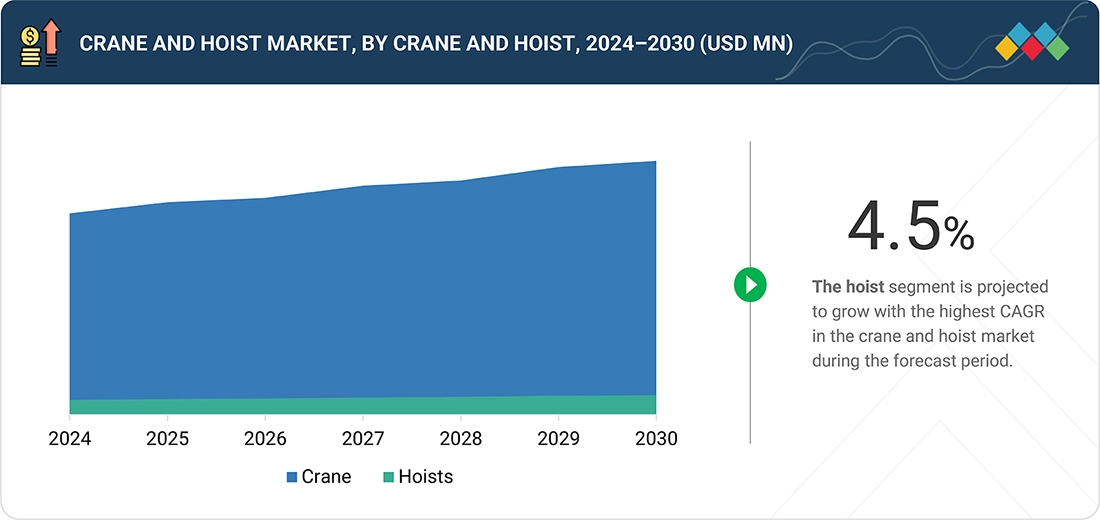

As of 2024, cranes account for the larger share of the crane and hoist market, driven by their extensive use across industries such as construction, shipping, material handling, and automotive. Known for their versatility in lifting heavy loads, transporting materials, and performing complex operations both indoors and outdoors, cranes continue to gain traction. The integration of automation, IoT connectivity, and remote-control technologies enhances their precision, efficiency, and safety, further solidifying their dominance over hoists, which remain primarily suited for limited indoor vertical lifting applications.

Crane Market, By Type

As of 2024, the mobile crane segment holds a dominant share of the crane market, driven by its high mobility, fast setup, and operational flexibility across industries such as construction, mining, aerospace, and shipping & material handling. Mobile cranes enable quick assembly and efficient load movement over long distances, making them ideal for time-sensitive projects. In contrast, fixed cranes are primarily used in automotive, railway, and port operations, where long-term lifting is required within confined spaces. However, their longer replacement cycle results in relatively slower market growth.

Crane Market, By Operation

As of 2024, the hydraulic segment leads the crane market, driven by strong adoption across construction, manufacturing, and material handling industries. Hydraulic systems provide high lifting capacity, superior energy efficiency, and independence from continuous power sources, making them ideal for heavy-duty operations. The use of telescopic hydraulic cylinders, which retract to a fraction of their length, enhances efficiency in confined spaces such as warehouses and assembly lines. In contrast, electric cranes, suited for light-duty applications, exhibit slower growth due to their limited load-handling capabilities in heavy industrial environments.

Crane and Hoist Market, By Industry

As of 2024, the construction industry is projected to witness the highest CAGR in the crane and hoist market, driven by increasing infrastructure development, urbanization, and large-scale building projects. Cranes play a crucial role in lifting, positioning, and transporting heavy materials across diverse site conditions. Their versatility and efficiency make them indispensable for material handling, assembly, and on-site logistics. Ongoing expansion of residential, commercial, and industrial infrastructure continues to fuel strong demand for advanced crane systems in the construction sector.

REGION

Asia Pacific to be fastest-growing region in global crane and hoist market during forecast period

Asia Pacific is expected to dominate the crane and hoist market during the forecast period, driven by rapid urbanization, infrastructure development, and industrial expansion. Strong construction activity in China, India, Japan, and Southeast Asia, supported by projects like smart cities and transport networks, fuels demand. Additionally, thriving manufacturing, automotive, energy, and shipping sectors further strengthen the region’s leading position in crane and hoist adoption.

Crane and Hoist Market: COMPANY EVALUATION MATRIX

In the crane and hoist market matrix, Liebherr (Star) leads with a comprehensive range of advanced lifting solutions, offering superior load capacity, precision control, and digital integration for applications across construction, mining, and shipping industries. Kobelco (Emerging Leader) is rapidly strengthening its position by delivering innovative, energy-efficient, and compact crane systems designed for modern construction and industrial environments, aligning with the growing demand for smart and sustainable lifting solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 32.85 Billion |

| Market Forecast in 2030 (Value) | USD 41.56 Billion |

| Growth Rate | CAGR of 3.7% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

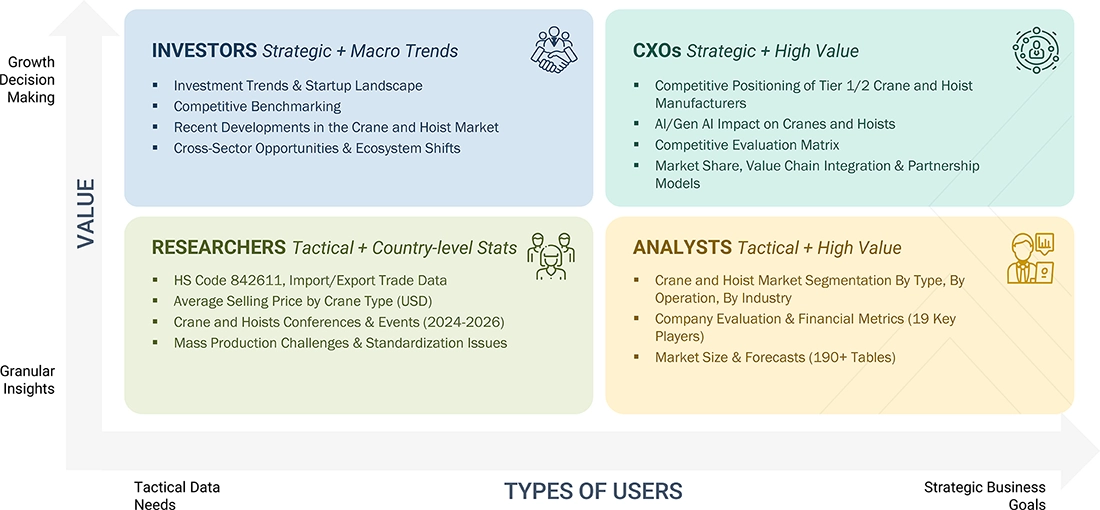

WHAT IS IN IT FOR YOU: Crane and Hoist Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Profiling of key market participants with details on product portfolio, market share, technological advancements, and strategic collaborations across crane and hoist categories. | Enables benchmarking of competitive positioning and assessment of innovation and automation strategies. |

| Regional Market Entry Strategy | Country- and region-specific insights covering infrastructure projects, investment trends, and regulatory frameworks driving crane and hoist adoption. | Supports informed regional expansion and strategic planning in high-growth construction and industrial markets. |

| Application-Specific Opportunity Assessment | Evaluation of adoption trends across construction, automotive, aerospace, shipping & material handling, mining, and energy sectors. | Helps identify high-demand applications and prioritize product development and market focus. |

| Technology Adoption by Industry | Insights into the integration of smart, IoT-enabled, and automated crane and hoist systems for enhanced safety, efficiency, and predictive maintenance. | Guides R&D planning, technology upgrades, and differentiation through digital transformation. |

| Pricing & Margin Benchmarking | Analysis of crane and hoist pricing by type (mobile, fixed, hydraulic, electric), lifting capacity, and end-user segment across OEM and rental channels. | Supports pricing optimization, profitability improvement, and strategic channel management. |

RECENT DEVELOPMENTS

- April 2025 : The Manitowoc Company, Inc. unveiled the Grove GMK5250L-2 prototype at Bauma 2025. This 250-ton, 5-axle crane features a new design, updated cabs, and advanced control systems. It includes CCS 2.0 with MAXbase 2.0 for faster setup and flexible outrigger positioning. Enhanced safety tech and user-centric features were added based on customer feedback as part of its VOC program.

- April 2025 : Konecranes acquired POLIPASTOS INSTALACIONES MEG, SL (PIMEG), a Spanish company specializing in crane sales and services in Catalonia. This acquisition strengthens Konecranes’ footprint in Catalonia and Spain, enhancing its local service network. It brings in a skilled team with strong market knowledge and supports the expansion of Konecranes’ maintenance and equipment services in the region.

- March 2025 : Tadano Ltd. launched a compact AC 5.250L-2 all-terrain crane with a 229.7-foot boom, designed for urban jobsites. It offers high capacity with easy mobility.

- October 2024 : Liebherr introduced the world’s first fully electric LTC 1050-3.1E mobile crane. It uses conventional and electric motors, combining high performance with zero emissions. This dual-motor setup sets a new standard for sustainable lifting.

Table of Contents

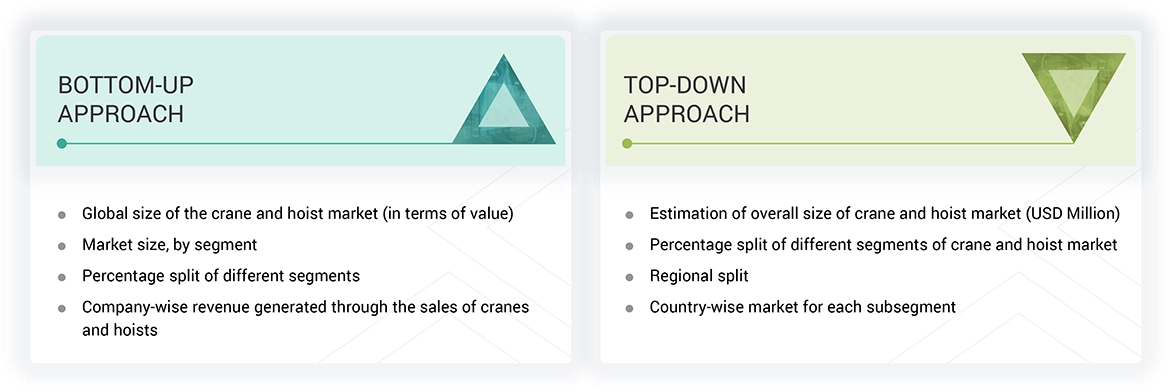

Methodology

This study involved four major activities in estimating the crane and hoist market size. Exhaustive secondary research has been conducted to collect information on the crane and hoist market. In the next step, these findings, assumptions, and sizing have been validated with industry experts across the value chain through primary research. The top-down and bottom-up approaches have been employed to estimate the complete market size. The market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process for identifying and collecting information necessary for the crane and hoist market study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, transformer associations (such as Industrial Supply Association (ISA), Associated Wire Rope Fabricators (AWRF), Specialty Carriers and Riggers Association (SCRA), Crane Manufacturers Association of America (CMAA), Electrification & Controls Manufacturers Association (ECMA), and certified publications; articles from recognized authors; directories; and databases.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts, such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the crane and hoist market. The following is the breakdown of primary respondents:

Note: The three tiers of the companies are defined based on their total revenue as of 2024; Tier 1 = >USD 3 billion, Tier 2 = USD 1 billion to USD 3 billion, and Tier 3 = USD 1 billion. Others include Managers, Engineers, and Researchers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the overall crane and hoist market and the market based on segments. The research methodology used to estimate the market size is given below:

- Extensive secondary research has identified key players operating in the crane and hoist market.

- The industry’s supply/value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Crane and Hoist Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall expected crane and hoist market size—using the estimation processes explained above—the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both the demand and supply sides of the crane and hoist market.

Market Definition

A crane is a large, complex machine engineered to lift and move heavy loads vertically and horizontally. It consists of several key components, including a hoist, trolley, boom, and a hook suspended by cables or chains. Cranes are integral to various industrial applications, including construction sites, manufacturing facilities, and ports, where they efficiently handle and transport heavy materials. Unlike cranes, hoists are simpler lifting devices primarily designed for vertical applications. Typically, hoists operate through a motorized or manual system that employs a drum or pulley mechanism to wind a chain or wire rope. They are often paired with a trolley or mounted on a beam, allowing for limited horizontal maneuverability along a predetermined path. Hoists are prevalent in warehouses, workshops, and construction environments, where they are used for precisely lifting, positioning, and securing heavy loads.

Key Stakeholders

- Distributors of cranes and hoists

- Government bodies, venture capitalists, and private equity firms

- Manufacturers of crane and hoist components such as hydraulic pumps, chains, pulleys, motors, and power units

- Crane and hoist designers and manufacturers

- Process industries and power industry associations

- Research organizations and consulting companies

- System integrators

- Technology consultants

- Value-added resellers

Report Objectives

- To describe and forecast the crane and hoist market, in terms of value, based on type, operation, and industry

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To describe the two types of mobile crane booms: lattice booms and telescopic booms

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To provide a comprehensive overview of the crane and hoist value chain and ecosystem

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players, comprehensively analyze their market positions in terms of ranking and core competencies, and provide a detailed competitive landscape of the market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of 25 market players

Key Questions Addressed by the Report

Which crane type is likely to dominate the crane and hoist market during the forecast period?

The mobile crane segment is expected to dominate the market during the forecast period.

Who are the top players in the crane and hoist market?

The top players operating in the crane and hoist market include Konecranes (Finland), Liebherr (Switzerland), Tadano Ltd. (Japan), The Manitowoc Company, Inc. (US), and Zoomlion Heavy Industry Science & Technology Co., Ltd. (China).

Which region has the highest potential in the crane and hoist market?

The Asia Pacific market is expected to be the fastest-growing market during the forecast period.

Which major countries are considered in the Asia Pacific region?

The report primarily analyzes China, Australia, Japan, India, and Rest of Asia Pacific countries (mainly Malaysia, Singapore, Taiwan, and New Zealand).

Which are the major industries where crane and hoist machines are used?

Cranes and hoists are used extensively in construction, shipping and material handling, automotive and railway, aerospace, mining, energy, and power.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Crane and Hoist Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Crane and Hoist Market