The research study involved extensive secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the Conveyor System market. Primary sources, such as experts from related industries, automobile OEMs, and suppliers, were interviewed to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

Secondary sources for this research study include corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; whitepapers, marklines, and the OICA (International Organization of Motor Vehicle Manufacturers); certified publications; articles by recognized authors; directories; and databases. Secondary data was collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

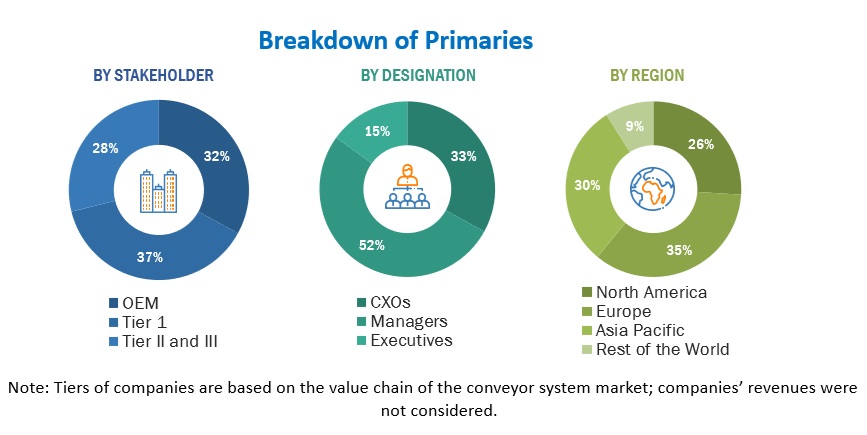

Extensive primary research was conducted after understanding the Conveyor System market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side (vehicle manufacturers, country-level government associations, and trade associations) and the supply side (Conveyor System and buses manufacturers, component providers, and system integrators). The regions considered for the research include North America, Europe, the Asia Pacific, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in this report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, led to the findings described in this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the volume and value of the Conveyor System market and other submarkets, as mentioned below.

-

Secondary research was done to identify key players in the Conveyor System market. Their global market share was determined through primary and secondary research.

-

The research methodology included studying the annual and quarterly financial reports & regulatory filings of major market players and interviews with industry experts for detailed market insights.

-

All major penetration rates, percentage shares, splits, and breakdowns for the Conveyor System market across end users were determined using secondary sources and verified through primary sources.

-

All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

-

The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

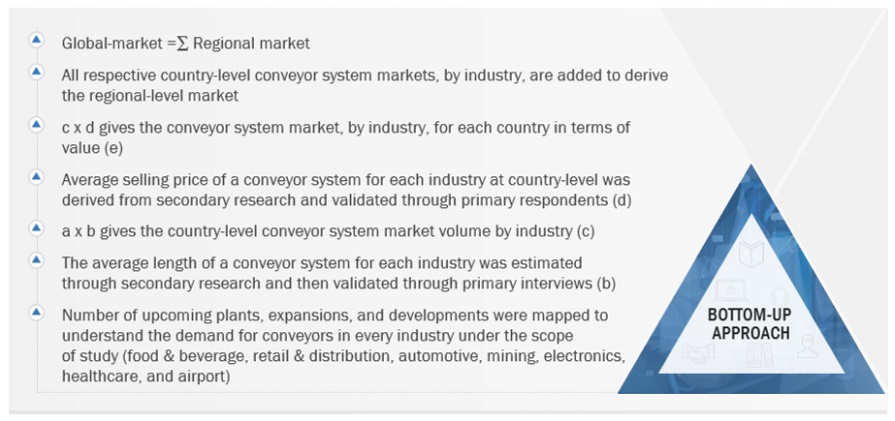

Conveyor System market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

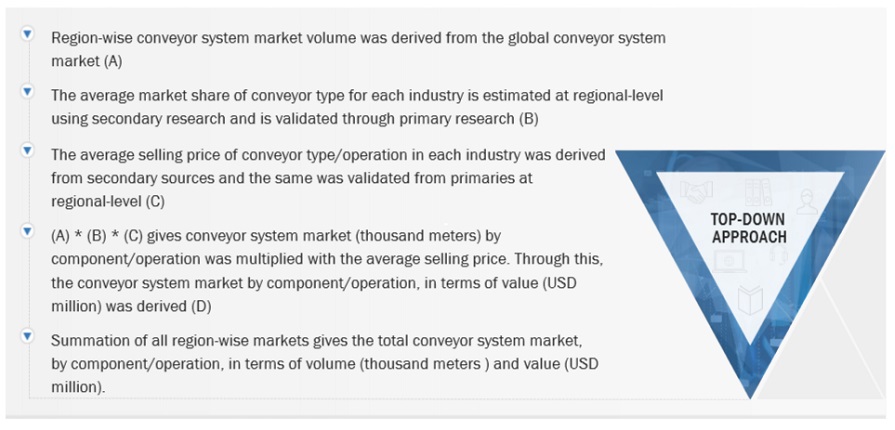

Conveyor System market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size through bottom-up approach, the conveyor system market was split into several segments and subsegments. Where applicable, the data triangulation procedure was employed to complete the overall market engineering process and arrive at the exact market value for key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Market Definition

Conveyor System market: Britannica defines a conveyor as any device that provides mechanized movement of material, such as in a factory; it is used principally in industrial applications and on large farms, as well as in warehousing and freight handling for moving raw materials. Conveyors may be only a few inches in length, or they may be integrated systems several miles long.

Key Stakeholders

-

Automation System Manufacturers

-

Automotive Ancillary Players

-

Automotive OEMs

-

Conveyor Original Equipment Manufacturers (OEMs)

-

Conveyor System Component Manufacturers

-

Conveyor System Cybersecurity Providers

-

Electronics Companies

-

Food & Beverage Companies

-

Industrial Machinery Insurance Providers

-

Legal and Regulatory Authorities

-

Mining Companies

-

Raw Material Suppliers

-

Sensor Manufacturers

-

Software Providers

-

Traders, Distributors, and Suppliers

Report Objectives

-

To define, segment, analyze, and forecast the conveyor system market, in terms of volume (thousand meters) and value (USD million) between 2024 and 2030 based on:

-

To segment and forecast the market size, by type (roller, pallet, overhead, tri-planar, bucket, floor, cable, crescent, and other types)

-

To segment and forecast the market size, by operation (manual, automatic, and semi-automatic)

-

To segment and forecast the market size, by component (aluminum profile, driving unit, extremity unit, and other components)

-

To segment and forecast the market size for the airport industry, by type (belt, tri-planar, crescent, and other types)

-

To segment and forecast the market size for the retail & distribution industry, by type (belt, roller, pallet, and other types)

-

To segment and forecast the market size for the automotive industry, by type (overhead, floor, roller, and other types)

-

To segment and forecast the market size for the mining industry, by type (belt, cable, bucket, and other types)

-

To segment and forecast the market size for the electronics industry, by type (belt, roller, and other types)

-

To segment and forecast the market size for the food & beverage industry, by sub-industry (meat & poultry, dairy, and other types)

-

To segment and forecast the mining conveyor system market size, by application (open-pit mining and underground mining)

-

To segment and forecast the mining conveyor system market size, by technology (drive, gearless, and automated)

-

To segment and forecast the market size, by region (Asia Pacific, Europe, North America, and Rest of the World)

-

To provide detailed information about the factors influencing the market growth (drivers, challenges, restraints, and opportunities)

-

To strategically analyze the market, considering individual growth trends, prospects, and contributions to the total market

-

To study the following factors with respect to the market:

-

Supply Chain Analysis

-

Ecosystem Analysis

-

Technology Analysis

-

Pricing Analysis

-

Trade Data

-

Case Study Analysis

-

Patent Analysis

-

Impact of Generative AI

-

Regulatory Landscape

-

Key Stakeholders and Buying Criteria

-

Key Conferences and Events

-

To determine the following with respect to the market:

-

Market Share Analysis

-

To analyze the competitive landscape and prepare a competitive leadership mapping/market quadrant for the global players operating in the conveyor system market

-

To analyze recent developments, alliances, joint ventures, mergers & acquisitions, product launches, and other activities carried out by key participants in the conveyor system market

AVAILABLE CUSTOMIZATIONS

With the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs.

RETAIL INDUSTRY CONVEYOR SYSTEM MARKET, BY TYPE (AT COUNTRY LEVEL)

Note: The segment would be further segmented by region

Company profiles

-

Additional company profiles (up to five)

Amey

Nov, 2019

I am tryin to understand our market and specifically a maintenance and services market around conveyor belts..

Amey

Nov, 2019

I found the TOC to be exhaustive enough, however I would like to know Few more points, -Can you customize the reports and what will be the cost of customization. - What will be the turnaround time for complete ready report and customized report - Do you provide cost driver analysis as the TOC does not specifically mention about the same - Supplier profiling in this industry - Would need a sample report .

Amey

Nov, 2019

We are interested in fire resistant conveyer belts. Best known for mining. We are looking for trends in this area. Also what are FR requirements of other conveyer belt types.

Amey

Nov, 2019

Hi, I work for a strategy consultancy based in London that works heavily in the industrial space. I would like to purchase the report on the conveying systems, and would like to see a sample before making the decision to buy. .

Amey

Nov, 2019

Looking for Australia specific info ONLY. Also, what is the full list of industries covered? We are most interested in mining, materials handling and heavy industry. Based on this can you advise if report can be customised..

Amey

Nov, 2019

I am interested in the total market share of the companies listed in the report. Also interested in the market size of each conveyor type (i.e., Roller, Belt, Pallet, etc.) automation, mobile robotic, robotic, material handling, logistic, conveyors, automotive, production equipment, AGV, etc..

Amey

Nov, 2019

I want to see the contents on Global forecast, US market forecast and the competition section from your report. I would appreciate your help. Certainly we may ended up buying the complete report if it is satisfactory .

Amey

Nov, 2019

Interested in belt conveyors for mining and industry at large. Would like to have an idea of the installed base and owners or contacts if possible. .

Amey

Nov, 2019

I have a client researching conveyor market technology and sizing the market for vacuum conveyors in particular. Thank you very much. John.

Amey

Nov, 2019

I am only interested in the conveyor belts market in Brazil. I need to understand which information on this specific market you can provide us with (market size per industry segment, competitive landscape, products etc.). Lastly, is there any possibility to purchase the Brazilian portion only?.

Amey

Nov, 2019

I just wanted to ask if there are production units available in this report or only market data in Sales/ Revenues. Specific interest would also be the share of conveyors which is driven electrically, for example, electric motors. Thanks a lot for a short feedback..

Amey

Nov, 2019

I would like to know if the report contains anything specifically about the categories of conveyor systems used by the mining industry, as well as if there is any specific information on the Brazilian market within the "Americas" section of the report..