The study involved four major activities in estimating the current market size of the composite AI market. Extensive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the composite AI market.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, Composite AI spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, verticals, and regions, and key developments from both markets- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and Composite AI expertise; related key executives from Composite AI solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using composite AI solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of Composite AI solutions and services, which would impact the overall Composite AI market.

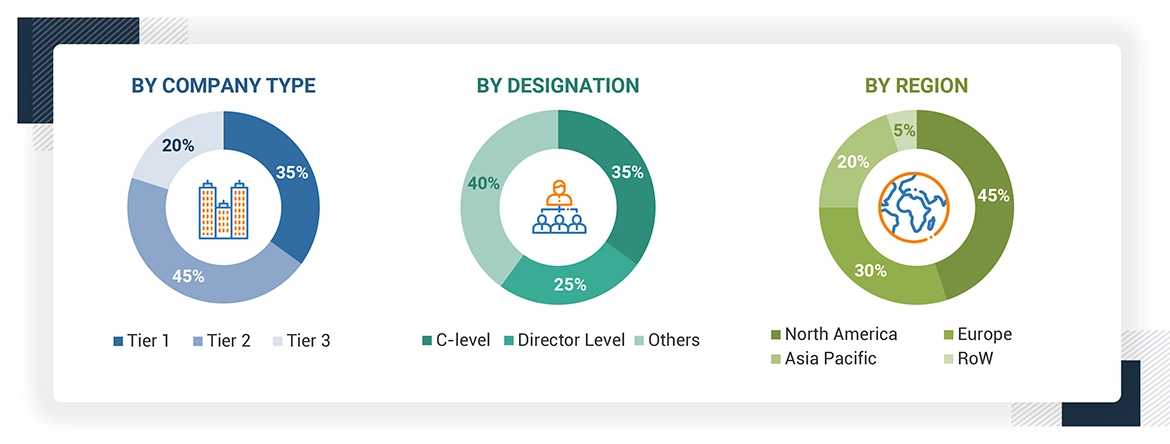

Note: Tier 1 companies comprise an overall annual revenue of >USD 10 billion; tier 2 companies’ revenue ranges between USD 1 and 10 billion; and tier 3 companies’ revenue ranges between USD 500 million–USD 1 billion

*ROW include Middle East & Africa, and Latin America

*Others include sales managers, marketing managers, and product managers Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the composite AI market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the composite AI market. The bottom-up approach was used to arrive at the overall market size of the global composite AI market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the market were identified through extensive secondary research.

-

The market size, in terms of value, was determined through primary and secondary research processes.

-

All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Composite AI Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to BlackSwan Technologies, Composite AI is a breakthrough approach combining multiple AI techniques to interpret data more deeply and efficiently solve a wider range of business problems. The techniques applied may include knowledge graphs, natural language processing (NLP), contextual analysis, machine learning (ML), deep learning, and other methods. Composite AI is most effective when integrated into a complete enterprise software platform incorporating insight-driven alerts and workflows, data visualization and situational dashboards, organizational policies, and privacy protections.

Key Stakeholders

-

Composite AI vendors

-

Composite AI hardware vendors

-

Composite AI service vendors

-

Managed service providers

-

Support and maintenance service providers

-

System Integrators (SIs)/migration service providers

-

Value-Added Resellers (VARs) and distributors

-

Distributors and Value-added Resellers (VARs)

-

System Integrators (SIs)

-

Independent Software Vendors (ISV)

-

Third-party providers

-

Technology providers

Report Objectives

-

To define, describe, and predict the composite AI market by offering (Hardware, Software, and services), technique, application, vertical, and region

-

To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

-

To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

-

To forecast the market size of segments concerning five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

-

To profile key players and comprehensively analyze their market rankings and core competencies

-

To analyze competitive developments in the composite AI market, such as partnerships, new product launches, and mergers and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

-

Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

-

Further breakup of the North American Composite AI market

-

Further breakup of the European Composite AI market

-

Further breakup of the Asia Pacific Composite AI market

-

Further breakup of the Latin American Composite AI market

-

Further breakup of the Middle East & Africa Composite AI market

Company information

-

Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Composite AI Market