Compact Construction Equipment Market

Compact Construction Equipment Market by Type (Excavator, Loader, Skid Steer, Track Loader, Compactor, Telehandler), Propulsion, Power Output, Engine Capacity, Function, Electric Construction Equipment, Battery Chemistry, & Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global compact construction equipment market is projected to grow from USD 39.62 billion in 2025 to USD 56.21 billion by 2032 at a CAGR of 5.1%. The compact construction equipment market is experiencing steady growth as construction operators increasingly prefer cost-efficient and versatile machinery for urban redevelopment and small-scale infrastructure projects. Also, compared to full-sized equipment, the lower leasing and transportation costs of these compact machines make them particularly appealing to rental operators and small to mid-sized contractors.

KEY TAKEAWAYS

-

BY ENGINE CAPACITYThe demand for compact construction equipment with 2–3.5 L engine capacity is growing due to its optimal balance of power, fuel efficiency, and compliance with emission norms such as EU Stage V and U.S. Tier 4. These engines are robust enough for urban and light construction tasks while avoiding the high costs and complex after-treatment systems of larger engines. Leading OEMs like Doosan Bobcat, SANY, and Kubota are increasingly focusing on this range to serve medium-scale construction and infrastructure projects, especially in North America .

-

BY POWER OUTPUTThe 61–100 HP segment of compact construction equipment is increasingly favored for high-capacity excavation, material handling, and lifting operations due to its enhanced payload and operational efficiency. In this range, equipment such as mini excavators, skid steer loaders, compact track loaders, backhoe loaders, and telehandlers is driving market demand. Leading manufacturers, including Caterpillar, Hitachi, Deere, and Volvo, are focusing on this segment, with North America expected to dominate the market in 2025

-

BY EQUIPMENT TYPEThe mini excavators segment is driving the compact construction equipment market with its heavy-load capability and suitability for confined urban projects. Electric and hybrid models offer low-emission, quiet, and sustainable operations, boosting residential and small-scale construction adoption. Similarly, the demand for Backhoe loaders is increasing, driven by the functionality and suitability for urban and rural construction projects, particularly in cost-sensitive emerging economies.

-

ELECTRIC & HYDROGEN COMPACT CONSTRUCTION EQUIPMENT MARKET, BY EQUIPMENT TYPEThe electric compact loaders segment is gaining traction in the global electric construction equipment market due to rising environmental awareness, stringent emission norms, and demand for quiet, low-vibration operation. Models such as Doosan Bobcat’s T7X & S7X and AB Volvo’s L25 Electric wheel loader demonstrate high efficiency, zero emissions, and improved site agility. With urban infrastructure development and rapid urbanization in the Asia Pacific, particularly in China and India, adopting electric skid steers, compact track loaders, and wheel loaders is expected to accelerate, driving growth in sustainable and energy-efficient compact construction solutions.

-

BY REGIONThe North American compact construction equipment market is driven by residential construction projects, creating strong demand for compact track loaders and mini excavators. Leading OEMs such as Caterpillar (US) and Bobcat (US) are leveraging joint ventures, supply contracts, and M&A strategies to expand product offerings for residential and small-scale commercial projects. The combination of technological innovation, government infrastructure investment, and growing demand for efficiency in confined job sites makes North America a key growth hub for compact construction equipment.

-

COMPETITIVE LANDSCAPEThe compact construction equipment market is led by globally established players, such as Caterpillar (US), Doosan Bobcat (South Korea), JCB (UK), CNH Industrial (UK), and Kubota Corporation (Japan). These companies adopted strategies, such as expansion strategies, collaborations, partnerships, and mergers & acquisitions, to gain traction in the compact construction equipment market.

Advancements in hydraulic efficiency, telematics, and modular attachments are supporting the compact construction equipment market, enabling machines like mini excavators and compact track loaders to perform multiple tasks efficiently while reducing the total cost of ownership. However, high upfront costs of electric equipment and limited operator expertise remain key challenges for market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The compact construction equipment market is undergoing rapid transformation, driven by technological advancements, evolving customer expectations, and sustainability demands. Key trends include electrification, telematics integration, and automation, which are reshaping how compact loaders, mini excavators, and other equipment operate. At the same time, disruptions such as rising material costs, labor shortages, and the shift toward eco-friendly solutions are challenging traditional business models. Manufacturers and component suppliers are now required to innovate, enhance efficiency, and deliver customized solutions to stay competitive in this dynamic market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid urbanization in residential and commercial sectors

-

Rising costs and shortage of skilled labor

Level

-

Stringent international trade policies and events

Level

-

Advancements in hydrogen-propelled compact equipment

-

Enhancements in autonomous compact construction equipment

Level

-

•Supply chain issues for biodiesel and hydrogen fuels

-

•Battery-related issues in electric compact construction equipment

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid urbanization to fuel the demand for compact construction equipment in the residential and commercial sectors

Rapid urbanization, particularly in developing countries, drives strong demand for compact construction equipment that can operate efficiently in tight urban spaces. With the UN projecting that 68% of the global population will live in cities by 2050, the need for infrastructure, residential, and commercial projects is surging. Compact machinery such as mini excavators, compact track loaders, skid steer loaders, and compactors is increasingly deployed to meet this demand. Asia is a key growth region, with India enabling 100% FDI in township development and launching the PM Awas Yojana Urban 2.0 (USD 120.16 Bn) to support housing for 10 million urban families, Japan seeing real estate investments of USD 10.2 Bn in 2023 (up 12.3% YoY), and China implementing pilot schemes to boost private real estate investments. These factors underscore strong future growth prospects for the compact construction equipment market.

Restraint: Stringent regulations and geopolitical issues

Strict international trade regulations and geopolitical tensions restrain the growth of the compact construction equipment market. Governments are increasingly introducing rules and standards that complicate global trade; for instance, the European Commission’s revised Construction Products Regulation (Regulation 3110/2024), effective January 2025 with full enforcement by January 2026, aims to enhance sustainability, digitalization, and standardization in the construction sector, impacting equipment trade in Europe. Additionally, geopolitical issues, such as ongoing US–China trade tensions and tariffs on Chinese construction equipment imports, increase costs, create trade uncertainties, discourage investments, and constrain opportunities for manufacturers reliant on global supply chains.

Opportunity: Advancements in hydrogen-propelled compact construction equipment

Advancements in hydrogen ICE-powered compact construction equipment present a significant growth opportunity for market players as the industry shifts toward sustainable practices. Leading OEMs like JCB have introduced hydrogen combustion engines in models such as the 3DX backhoe loader, while other manufacturers are pursuing collaborations and developments to strengthen their market position. Global initiatives, including India’s National Hydrogen Mission, the US National Clean Hydrogen Strategy, the EU Hydrogen Strategy, China Hydrogen Alliance, and Japan’s Hydrogen Basic Strategy, are driving the adoption of hydrogen as an alternative fuel. Hydrogen-powered equipment addresses practical challenges in remote construction sites lacking electric charging infrastructure and supports global sustainability goals, positioning the market for significant growth in the coming years.

Challenge: Battery-related issues in electric compact construction equipment

Electric compact construction equipment faces significant challenges due to battery limitations, including inadequate capacity, frequent recharging, and long charging times, which restrict operational hours and increase machine downtime. These issues disrupt project timelines and have reinforced the preference for diesel-powered machinery, which offers more reliable performance. Additionally, limited space in compact equipment constrains the use of larger batteries needed to extend operational time, forcing manufacturers to balance battery size with performance. These constraints present ongoing challenges in achieving optimal functionality and efficiency for electric compact construction equipment.

Compact Construction Equipment Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of high-strength steel and advanced alloys in excavator booms and chassis. | Increased load capacity, improved durability, and extended service intervals. |

|

Lightweight titanium and aluminum components in hydraulic systems. | Reduced machine weight, improved fuel efficiency, and enhanced maneuverability. |

|

Use of carbon fiber composites in loader arms and structural panels. | 15-20% weight reduction, improved fuel efficiency, and reduced maintenance costs. |

|

Advanced wear-resistant steels in digging buckets and attachments. | Longer lifespan, lower replacement costs, improved operational reliability. |

|

Use of polymer-metal hybrid composites in compact excavator components. | Lower overall machine weight, vibration damping, and enhanced operator comfort. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The compact construction equipment market ecosystem comprises component suppliers, assembly lines, distribution & services, rental service components, and end users. The ecosystem consists of component suppliers who supply engines and drivetrains, as well as specialized suppliers for construction equipment. These components are assembled at the second level of the ecosystem. This stage brings together components for the assembly and fabrication of construction equipment. At the distribution and service level, the dealer sells construction equipment independently without the intervention of the OEM. OEMs directly deal with construction companies for sales. Rental services include construction equipment manufacturers who undertake sales of new equipment and rental services, and the end user completes the ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Compact Construction Equipment Market, By Engine Capacity

Compact construction equipment with an engine capacity of above 3.5 L is used in backhoe loaders, mini excavators, and telehandlers. These equipment types are best-suited for heavy applications like material hoisting and large-scale excavation projects, as they have better payload, excavation, and material handling capacities. Caterpillar (US), Case (Italy), and Komatsu (Japan) offer compact construction equipment featuring these engines. North America is projected to account for the largest share in this market segment due to the rise in construction expenditure and growing urbanization.

Compact Construction Equipment Market, By Equipment Type

Asia Pacific is projected to be the fastest-growing segment for backhoe loaders during the forecast period. The segment's progress can be attributed to increased public and private investments driving the growth of the construction industry. Initiatives, such as the “Smart City” programs in India, are anticipated to further boost construction activities in Tier II cities. These construction activities are expected to impact the sales of backhoe loaders significantly.

Compact Construction Equipment Market, By Function

Asia Pacific is projected to dominate the excavation segment due to ongoing investments in the construction industry. In 2024, Japan invested ~USD 48 billion in building construction, and Indonesia spent USD 649 million on infrastructure development through the “Indonesia Infrastructure and Finance Compact.” These investments have created a demand for mini excavators in the Asia Pacific.

Compact Construction Equipment Market, By Power Output

61 – 100 HP is the dominant segment in the compact construction equipment market by power output. These category engines are primarily equipped in equipment such as Mini excavators, Compact track loaders, Telehandlers, and Backhoe loaders, which contribute to ~50% of the global compact equipment market. Correspondingly, North America and the Asia Pacific have substantial sales for this category of equipment. Asia Pacific has a high demand for excavators, whereas North America leads the global market for compact track loaders. Additionally, these categories of equipment strike a right balance between operational output and efficiency, which further propels the growth of the segment.

Compact Construction Equipment Market, By Propulsion Type

Diesel dominates the compact equipment ICE segment, accounting for nearly 99% of the market, due to high power output, strong torque, and long engine life. Well-developed diesel infrastructure ensures fast refueling and easy availability. Users are cautious about CNG/ LNG/RNG because of limited infrastructure and uncertain performance. Currently, the Asia Pacific has the highest demand for diesel-propelled equipment due to the presence of emerging economies such as India and Indonesia. However, CNG, LNG, and RNG have notable demand in Latin America due to incentives and lower fuel costs.

Electric & Hydrogen Compact Construction Equipment Market, By Equipment Type

Electric-propelled equipment is gaining traction in Europe and North America. The European region currently has the highest adoption of electric-propelled equipment, particularly for electric mini excavators. Major players such as Kubota Corporation (Japan) and Volvo Construction Equipment (Sweden) have launched a range of electric mini excavators focusing on the European market. These players offer mini excavators ranging from 20HP to 80-100 HP models, serving a wide range of customers. Hydrogen-propelled compact equipment is also expected to enter commercial markets in the coming 2-3 years. JCB (UK) has already launched a backhoe loader powered by a 74HP hydrogen ICE. Additionally, JCB has also secured full EU type-approval for its hydrogen combustion engine for use in off-highway equipment under Regulation (EU) 2016/1628, certifying it to EU Stage V emissions norms. Unlike electric propulsion, hydrogen engines offer zero tailpipe CO2 emissions while delivering diesel-like performance without the challenges of battery weight, charging downtime, or rare-material dependence.

Electric Construction Equipment Market, By Battery Chemistry

Many OEMs are transitioning to use LFP batteries over lithium nickel manganese cobalt (NMC). The market for LFP batteries is estimated to be the largest in the Asia Pacific compared to Europe and North America due to their cost-effectiveness compared to NMC, long-cycle life, and high thermal stability.

REGION

During the forecast period, North America is expected to be the largest region in the global compact construction equipment market.

North America remains the largest market for compact construction equipment, driven by strong residential development, infrastructure upgrades, and the widespread use of compact track loaders, telehandlers, mini excavators, and compactors for versatile job site applications. Compact track loaders dominate the regional market due to their suitability for landscaping, roadwork, and utility projects. Meanwhile, telehandlers are the fastest-growing equipment type, supported by increasing use in material handling, logistics yards, and urban redevelopment. Both local OEMs like Caterpillar, Deere & Company, and Bobcat, and foreign players such as Volvo CE and Kubota are expanding production and introducing high-performance, low-emission models to strengthen their market presence. Electrification is gaining traction, with electric mini excavators leading adoption amid growing sustainability goals and stricter emission regulations. To meet surging demand, Doosan Bobcat is investing USD 300 million in a new compact loader manufacturing facility in Mexico, slated to open in 2026, aimed at reinforcing its dominance in the North American compact equipment market.

Compact Construction Equipment Market: COMPANY EVALUATION MATRIX

The figure illustrates the competitive landscape of the global compact construction equipment market, positioning key players based on their market share and product footprint. In the compact construction equipment market matrix, Doosan Bobcat (US) (Star) leads with a strong market presence and a broad product portfolio. This reinforces the company's position as a leader and ability to meet evolving market demands for efficient and compact equipment, enhancing its brand recognition and customer trust.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 39.62 BILLION |

| Market Size Forecast in 2032 | USD 56.22 BILLION |

| Growth Rate | 5.10% |

| Actual data | 2021 – 2032 |

| Base year | 2024 |

| Forecast period | 2032 |

| Units considered | USD MILLION AND UNITS |

| Report Coverage | Revenue forecast, Global Market Shares, Competitive Landscape, Driving factors, Trends & Disruption, OEM Analysis, and others |

| Segments Covered |

|

| Regions Covered | Asia, Europe, North America, the Middle East, and the Rest of the World |

WHAT IS IN IT FOR YOU: Compact Construction Equipment Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Compact Construction Equipment Market, By End-Use Industry | Additional segment by end use industry, such as construction, mining, oil & gas, manufacturing, and others, is delivered. | Providing detailed insights into market demand and trends for each equipment type, helping optimize product portfolio and investment focus. |

RECENT DEVELOPMENTS

- January 2025 : Kubota Corporation launched three new models of compact construction equipment, including two mini excavators and one compact track loader

- October 2024 : JCB India launched the JCB NXT 215 LC Fuel Master Tracked Excavator.

- July 2024 : Deere & Company launched a 326 P-Tier Telescopic Compact Wheel Loader. The equipment provides enhanced operator confidence and effortless operation efficiency.

- June 2024 : Deere & Company launched five new P-Tier Skid Steer Loader (SSL) and Compact Track Loader (CTL) models, including 330 and 334 P-Tier Skid Steer Loaders.

- March 2024 : New Holland Construction Equipment launched three compact wheel loader models: the W60C, W70C, and W80C LR.

- Decemebr 2023 : In Europe, Kubota Corporation launched the KX038-4e electric mini excavator.

Table of Contents

Methodology

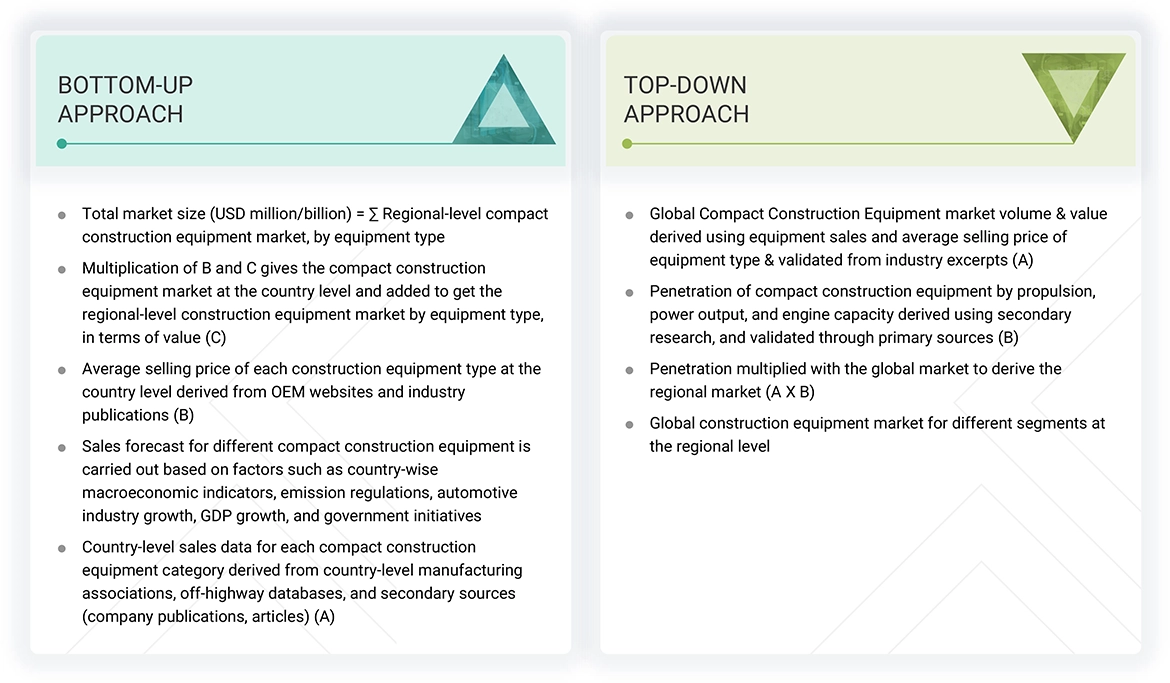

The study encompassed four primary tasks to determine the present and future scope of the compact construction equipment market. Initially, extensive secondary research was conducted to gather data on the market, its related sectors, and overarching industries. Subsequently, primary research involving industry experts across the value chain corroborated and validated these findings and assumptions. The complete market size was estimated by using both top-down and bottom-up methodology. Following this, a market breakdown and data triangulation approach were utilized to determine the size of specific segments and subsegments within the market.

Secondary Research

The secondary sources referred to the company's annual reports/presentations, industry association publications, directories, technical handbooks, World Economic Outlook, technical articles, and databases, which were used to identify and collect information for an extensive study of the compact construction equipment market. The secondary sources used while estimating the market sizing are the Association of Equipment Manufacturers, the Committee for European Construction Equipment (CECE), corporate filings (such as annual reports, investor presentations, and financial statements), and off-highway associations. Secondary data was collected and analyzed to determine the overall market size, further validated through primary research. The primary sources—experts from related industries, OEMs, and component suppliers—were interviewed to obtain and verify critical information and assess prospects and market estimations. Historical sales data has been collected and analyzed, and the industry trend is considered to arrive at the forecast, which is further validated by primary research.

Primary Research

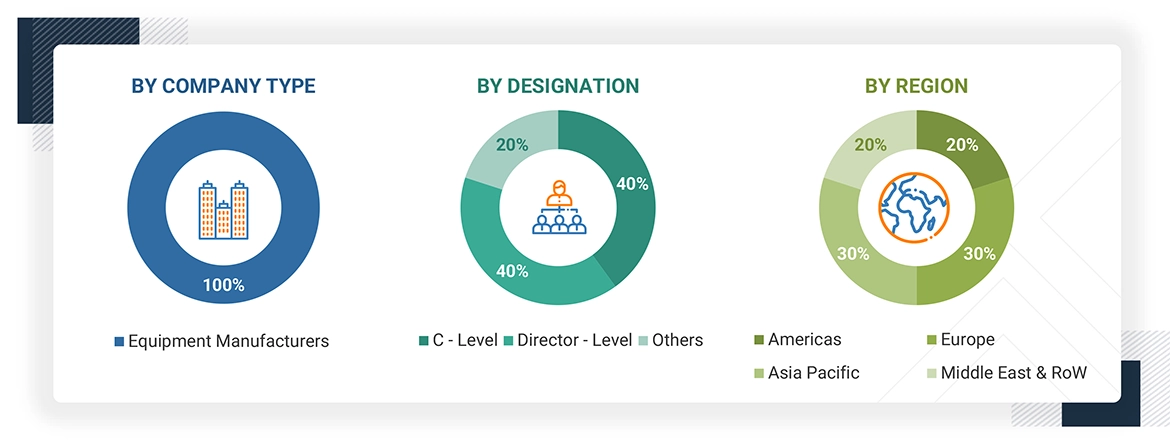

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as sizing estimates on the compact construction equipment market and forecast, future technology trends, and upcoming technologies in the compact construction equipment market. Data triangulation of all these points was done using the information gathered from secondary research and model mapping. Stakeholders from the demand and supply sides have been interviewed to understand their views on the abovementioned points.

Note: Other designations include sales, marketing, and product managers.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

As mentioned below, a detailed market estimation approach was followed to estimate and validate the value of the compact construction equipment market and other dependent submarkets.

The bottom-up approach was used to estimate and validate the compact construction equipment market size. The compact construction equipment market size, by equipment and country, was derived by mapping the historical sales of different equipment at the country level. These data points were largely fetched from the country-level associations, off-highway databases, and OEM data excerpts. The market size, by value, was derived by multiplying the equipment-wise average selling price with the respective equipment volume calculated in units. Each country/region's total volume and value of each country/ region are then summed up to reveal the total volume of the global compact construction equipment market for each type. The data was validated through primary interviews with industry experts. The compact construction equipment market is further segmented into power output, engine capacity, propulsion, and electric equipment. The penetration of different segments was derived from secondary research and primary interviews.

The gathered market data was consolidated, enhanced with detailed inputs, analyzed, and presented in this report.

Compact Construction Equipment Market : Top-Down and Bottom-Up Approach

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Market Definition

Compact Construction equipment is machinery that performs specific construction or demolition functions. These equipment are portable/semi-permanent and are primarily used for excavation, loading, lifting and, hoisting and compaction applications. It is also used in other applications such as infrastructure, residential, commercial, and industrial buildings.

The equipment considered in the study have been selected based on power output, all under 120 HP.

Stakeholders

- Construction Equipment manufacturers

- Consulting companies (Road, Building & Infrastructure)

- Tier 1 companies (component suppliers)

- Battery, motor, and other electric construction equipment part suppliers

- Equipment service providers

- Off-Vehicle Safety Regulatory Bodies

- Government and research institutions

- Off-highway associations

Report Objectives

-

To define, describe, and forecast the Compact Construction Equipment market in terms of value (USD million) and volume (units) based on the following segments:

- By Equipment Type (Backhoe Loaders, Compact Track Loaders, Mini Excavators, Skid-Steer Loaders, Wheeled Excavators, Wheeled Loaders <80 HP, Compactors and Telehandlers)

- By Propulsion Type (Diesel, CNG/LNG/RNG, Hydrogen)

- By Power Output (<30HP, 31-60HP, 61-100HP)

- By Engine Capacity (Up to 2L, 2-3.5L, Above 3.5L)

- By Function (Excavation, Loading, Lifting & Hoisting and Compaction)

- Electric Construction Equipment Market, By Equipment Category (Electric Excavators, Electric Loaders, Electric Telehandlers, Electric Compactors)

- Electric Compact Construction Equipment Market, By Battery Chemistry (Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt Oxide, Others)

- Compact construction Equipment Market, Global Shipment by OEM (Doosan Bobcat, Caterpillar, Hitachi Construction Equipment, CNH Industrial, Hyundai Construction Equipment Co., Ltd, JCB, Deere & Company, Komatsu, Kubota Corporation, AB Volvo, Wacker Neuson SE, Kobelco)

- By Region (Asia Pacific, Europe, North America, The Middle East, and the Rest of the World)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the market share of leading players operating in the compact construction equipment market and evaluate the company evaluation quadrant.

- To strategically analyze key player strategies and company revenue analysis

-

To study the following with respect to the market

- Trends and Disruptions Impacting Customers' Businesses

- Market Ecosystem

- Supply Chain Analysis

- Patent Analysis

- Regulatory Landscape

- Case Study Analysis

- Key Conferences and Events

- Investment and Funding Scenario

- Pricing Analysis

- OEM Analysis

- OEM Strategies

- To analyze recent developments, including supply contracts, new product launches, expansions, and mergers & acquisitions undertaken by key industry participants in the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Compact Construction Equipment Market, By End-Use Industry

- Construction& Infrastructure

- Mining

- Oil & Gas

- Manufacturing

- Others

Electric Compact Construction Equipment Market, By Country

- China

- India

- Japan

- Indonesia

- US

- Canada

- Mexico

- Germany

- UK

- France

- Italy

- Spain

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Compact Construction Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Compact Construction Equipment Market