Coil Coatings Market

Coil Coatings Market by Type (Polyester, Fluropolymer, and Others), Application (Steel & Aluminum), End-use Industry (Building & Construction, Automotive, and Other End-use Industries), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

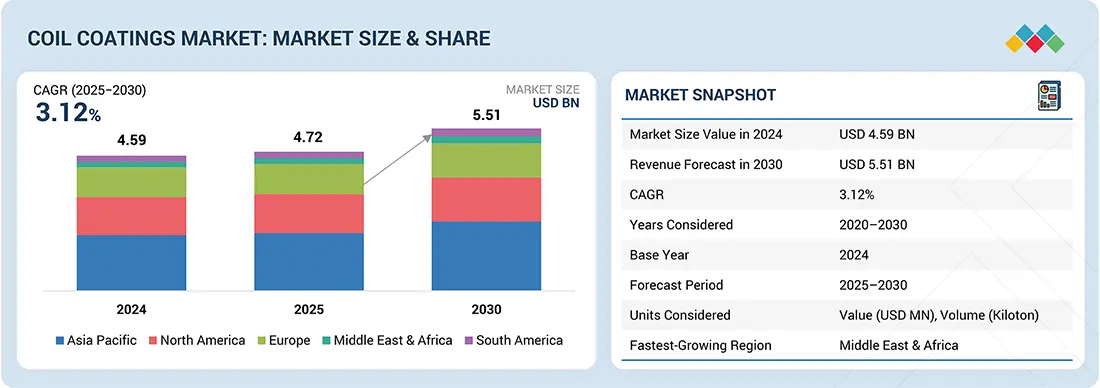

The coil coatings market is projected to reach 5,508.9 million in 2030 from 4,724.6 million in 2025 at a CAGR of 3.12%. The market refers to the continuous, automated process of applying an organic coating onto rolled metal strips, typically steel or aluminum, which involves pretreatment, coating (either side or multiple layers), and curing. This pre-coated metal, often called pre-painted metal, delivers a durable, corrosion-resistant, and uniform surface finish, improving both aesthetics and longevity in end-use manufacturing. The growth of coil coatings market is primarily driven by the rising demand for durable, corrosion-resistant, and aesthetically enhanced metal products across construction, automotive, and appliance industries globally.

KEY TAKEAWAYS

-

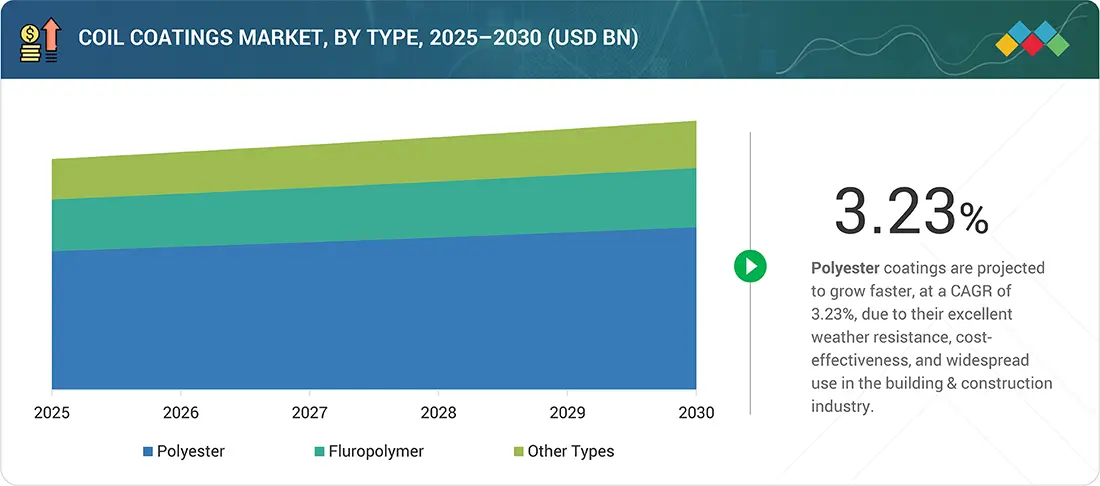

BY TYPEThe polyester segment is projected to grow faster due to the excellent weather and corrosion resistance, cost-effectiveness, versatility, and widespread adoption of polyester across building & construction and appliance industries.

-

BY APPLICATIONThe aluminum segment is expected to grow faster due to its lightweight, corrosion-resistant properties, excellent durability, and increasing use in construction, and automotive applications, driving higher adoption of coil-coated aluminum globally.

-

BY END-USE INDUSTRIESThe automotive end-use industry is growing faster due to rising vehicle production, increasing demand for lightweight and corrosion-resistant materials, and the use of coil coatings to enhance durability, aesthetics, and performance.

-

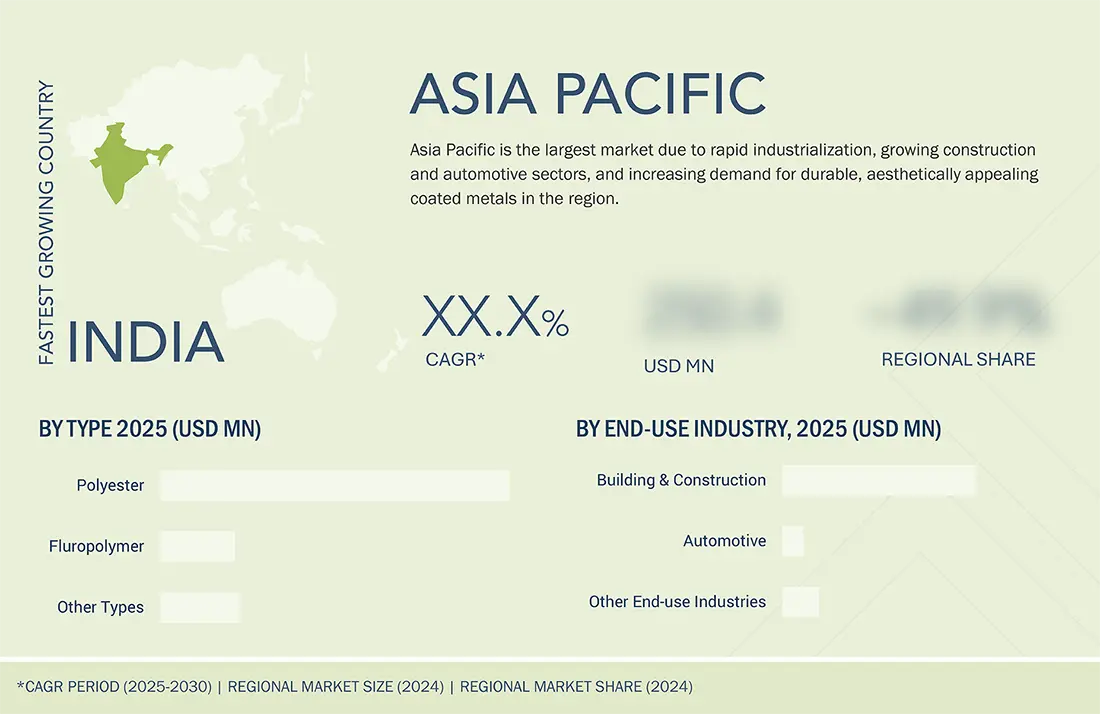

BY REGIONAsia Pacific is the largest market globally due to rapid industrialization, expanding construction and automotive sectors, rising infrastructure development, and increasing adoption of coil-coated metals for durable, high-performance applications.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including expansions, collaborations, acquisitions, and investments. For instance, The Sherwin-Williams Company acquired Shingels, S.A., a Barcelona-based paints and coatings manufacturer specializing in aluminum coil coating and industrial applications across Europe.

The market for coil coatings is expected to grow at a steady pace and the growth is stimulated by the growing demand for pre-painted metals, providing durability, corrosion resistance, and conformance with rigorous building and product performance requirements. Coil coatings are crucial for extending the life of metal substrates, improving aesthetics, and guaranteeing weatherability over widely different environmental conditions. Important end-use markets like building & construction, automotive, appliances, and others are driving market growth, with pre-coated materials being increasingly used for cost-effectiveness and long-term performance. Moreover, coating producers are pushing the boundaries with next-generation coil coating solutions to provide enhanced functionality, sustainability, and compliance with changing regulatory paradigms. Improvements in energy-saving “cool roof” coatings, low-VOC and green formulations, and specialized finishes are becoming more popular. High rates of urbanization, modernization of the infrastructure, and the increasing needs of the light-weight and durable materials in manufacturing applications of the automotive industry and appliances are also contributing to the rising adoption. Increased focus on sustainability, occupant safety, and lifecycle performance is encouraging industries to use high-performance coil coatings, thus promising robust growth prospects in emerging manufacturing economies across the globe.

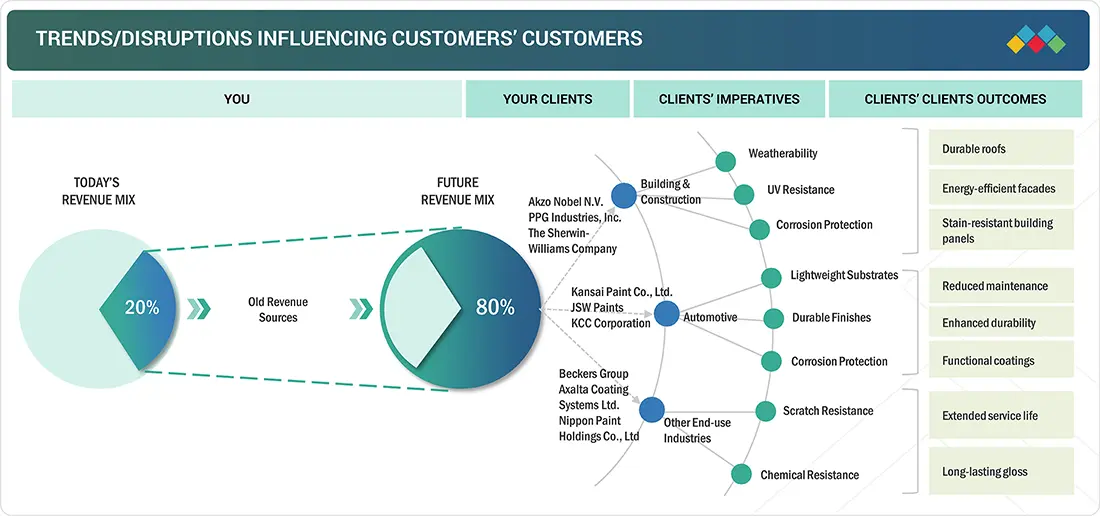

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The megatrends, including material transformation, will influence a company’s revenue in the future. Coil coatings were traditionally used for standard protection and appearance in construction and appliances. However, in recent years, there has been increasing demand from industries such as automotive, industrial equipment, and infrastructure for coatings with advanced features like superior UV resistance, corrosion protection, energy efficiency, and self-cleaning capabilities. End users now expect coil coatings to provide durability and meet environmental and regulatory standards, such as low-VOC formulations and recyclability. As consumer preferences and technology evolve, the market landscape is also shifting. Many leading companies have heavily invested in R&D to develop the ideal products that satisfy all customer needs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising adoption of pre-painted aluminum sheets in automotive sector

-

Expansion of modern infrastructure projects

Level

-

Volatility in raw material supply chains

-

High capital investment in coil coating lines

Level

-

Rising adoption in solar industry

-

Growing preference for green buildings

Level

-

Failure in adapting to extreme climatic conditions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising adoption of pre-painted aluminum sheets in automotive sector

The key driver of the coil coatings market is the expanding use of pre-painted aluminum sheets in automotive applications, as car manufacturers seek to use lightweight materials to comply with tough fuel consumption targets and federal regulations on emissions. Durable body panels and structures, with their lightweight, inherently corrosion-resistant aluminum, combined with high-performance coil coatings, deliver long-lasting protection and aesthetic. This incorporation contributes to both enhanced durability and general aesthetic value of vehicles and eliminates the necessity to take vehicles through the extra process of painting. Excellent weatherability of high-performance coil coatings can mean the difference between long- and mid-term vehicle quality in diverse environments. As consumers grow increasingly demanding in terms of delivering increased performance and attractiveness, manufacturers of automobiles have begun capitalizing on these coating systems, as they can provide durable finishes that can resist wear and exposure to harsh environments and keep their appearance premium. In addition, using pre-painted aluminum enables manufacturers to optimize their own operations by eliminating the product’s painting process, reducing labor and energy expenses, and hastening assembly line performance.

Restraint: Volatility in raw material supply chains

Among the biggest threats that the coil coatings industry is facing is fluctuation in the raw materials supply chains, which has a direct effect on the production itself and the profit. Coil coatings are highly dependent on vital materials, including resins, pigments, solvents, and basic metals like aluminum and steel. Any change in the availability or the cost of these raw materials throws the manufacturing economics off balance, adding to escalated cost pressure on manufacturers to either absorb or transfer the escalation to the products or processors. Other external factors like geopolitical tensions, natural calamities, trade restrictions, or logistics bottlenecks tend to compound these supply-side issues, leading to uncertainty in supply and pricing. This volatility makes operational risks more vulnerable for manufacturers. The problems of production delays due to shortages in raw materials or disrupted logistics can result in failure to meet delivery obligations, bad relations with end users, and the loss of competitiveness in price-sensitive markets. Moreover, due to times of shortage, businesses may have to use substitutes that are more expensive or of lower quality, which will negatively impact the margins and performance. There is also the added dimension of sourcing pedagogically certified materials as the rules of sustainability become increasingly stricter.

Opportunity: Rising adoption in solar industry

Another significant expansion potential of the coil coatings market is the rising popularity of solar panels due to the global commitment toward renewable energy and efforts to achieve decarbonization commitments. Governments, corporations, and utilities are speeding up the deployment of solar to residential, commercial, and large-scale projects broadly, putting rising pressure on the need to source durable and reliable materials. Coated aluminum and metals, including sheets, are emerging as structural support elements in panel frames, mounting and support structures, and components, due to the lightweight, durability, and long life of aluminum. The coil coatings maximize the functionality of such materials as they ensure substantial protection against adverse environmental factors, such as UV radiation, moisture, extreme temperature, and pollution. Ensuring structural integrity and extending service life, they are less costly in the long term, as well as increasing the overall efficiency of solar installations. In addition, sophisticated coil coating with functional add-ons, like thermo management and anti-reflection, could also enable them to become part of the renewable industry’s sustainability agenda.

Challenge: Adapting coil coatings to extreme climate conditions

The major pressure in the coil coatings market has been the need to adjust the product to the extreme climatic conditions, which significantly increase technical and operational complexities. Coil coatings are used more frequently in applications that may experience high UV radiation, torrential rainfall, high humidity, large temperature fluctuations, and a corrosive coastal environment. Such extreme environments aggravate problems of fading, chalking, cracking, and corrosion to the point where the manufacturers can no longer guarantee a uniform performance, durability, and aesthetic. The producers have to overcome these problems by formulating sophisticated formulas using superior-level resins, special pigments, and functional additives. Although resistance to weathering and environmental stress is enhanced by these innovations, they also create an added cost burden on production, result in longer development cycles, and an added supply chain burden of specialty raw materials. In addition, global suppliers have the challenge of targeting coatings production to match regional temperatures and climates.

Coil Coatings Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Pre-coated steel for roofing sheets and cladding | Enhanced corrosion resistance and durability, reducing maintenance costs |

|

Coil-coated steel for roofing and façade systems | Color stability and corrosion resistance, improving aesthetic appeal and structural longevity |

|

Coil-coated steel for vehicle body panels | Improved paint adhesion, corrosion resistance, and aesthetics |

|

Coil-coated steel for truck and bus body panels | Enhanced corrosion protection and surface quality, reducing maintenance |

|

Coil-coated steel for air conditioning units and duct systems | Enhanced weather resistance and thermal efficiency, increasing system lifespan |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The coil coatings market ecosystem involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, and end users. The raw material suppliers provide the key inputs required for resin production, which further enables the manufacturers to develop coil coatings using specialized technologies. The distributors and suppliers are the ones who establish contact between the manufacturing companies and end users to concentrate on the supply chain, increasing operational efficiency and profitability

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Coil Coatings Market, by Type

Polyester was the most dominant segment of the global coil coatings market due to its well-balanced combination of cost-effectiveness, performance, and application flexibility. Polyester coatings are very common in roofing, wall cladding, appliances, and general industrial products that require durability, anti-withdrawal corrosion resistance, and attractive finishing at a reasonable competitive price. This has made polyester the most preferred volume consumption material in the construction and washing machine industries, where reliability combined with affordable material is requisite to the operation process. One of the main reasons behind polyester’s dominance is its versatility. The category includes a range of formulations, namely, baseline polyesters designed to operate in a general-purpose manner as well as silicon-modified polyesters (SMPs), which allow them to perform well in harsh environments and are more weatherable. This flexibility allows polyester coatings to address both the mid-market and premium market with a strong value block versus even more expensive coatings like fluoropolymers.

Coil Coatings Market, by Application

The steel segment is expected to hold the largest share in the coil coatings market. The major driver for this dominance is steel’s extensive use across key industries, including construction, automotive, appliances, and transportation. Coil coatings enhance steel’s properties by providing superior corrosion resistance, improved durability, and an attractive finish, making it ideal for applications such as roofing, cladding, panels, and automotive body parts. Moreover, the availability of cost-effective pre-painted steel solutions, along with the growing demand for long-lasting, low-maintenance, and aesthetically appealing metal products, further fuels the adoption of coated steel. Furthermore, the growth of the segment also expands from increasing urbanization, infrastructure development, and industrial expansion in emerging markets, which continue to drive steady demand for coated steel products globally.

Coil Coatings Market, by End-use Industry

The building & construction industry held the largest share in the global coil coatings market, in terms of value, in 2024. Due to the durability, corrosion resistance, and cosmetic flexibility, coil coatings are widely used in insulated panels, facades, roofing, wall cladding, and ceilings. As urbanization and infrastructure development progress rapidly around the world, especially in high-growth economies such as Asia Pacific, the industry increasingly relies on coil-coated products for both residential and commercial applications. One of the primary drivers for this dominance is the performance benefit coil coatings provide over regular paints and finishes. Pre-painted metals are more resistant to weather; they extend the life of a product and help lower the costs of maintenance as they are more suited to the requirements of modern building work, in which significant durability is expected. Moreover, coil coatings’ visual appearance allows broader design freedom with access to an expansive selection of color combinations, surfaces, and textures to meet architectural and consumer demands.

REGION

Asia Pacific is expected to be the largest market for coil coatings during forecast period.

Asia Pacific is expected to be the largest market for coil coatings during the forecast period, supported by rapid urbanization, large-scale infrastructure projects, and the strong presence of manufacturing hubs across the region. Countries like China, India, and those in Southeast Asia are witnessing significant growth in their construction industry, both in residential and commercial sectors. This has led to a high demand for pre-painted metals used in roofing, cladding, facades, and structural applications. The ongoing industrialization in the region, along with investments in modern housing and smart cities, is further driving the increased use of coil coatings, which are recognized as a cost-effective and durable solution. Asia Pacific is also a major hub for automotive and home appliance manufacturing. Coil-coated aluminum and steel are commonly used in vehicle and home appliances and other industrial products that require durability, corrosion resistance, and versatility of surface treatments to achieve desired aesthetics. In addition, easy access to raw materials, cheap manufacturing units, and favorable government policies provide a positive environment for coil coating.

Coil Coatings Market: COMPANY EVALUATION MATRIX

In the coil coatings market matrix, Akzo Nobel N.V. (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across industries. Nippon Paint Holdings Co., Ltd (Emerging Leader) is gaining traction due to its diversified product portfolio, continuous investment in R&D, and focus on high-performance and specialty solutions. While Akzo Nobel N.V. dominates with scale, Nippon Paint Holdings Co., Ltd shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 4,588.2 MN |

| Revenue Forecast in 2030 | USD 5,508.9 MN |

| Growth Rate | CAGR of 3.12% from 2025−2030 |

| Actual Data | 2020−2030 |

| Base Year | 2024 |

| Forecast Period | 2025−2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | • By Type: Polyester, Fluoropolymer, and Other Types • By Application: Steel, and Aluminum • By End-use Industry: Building & Construction, Automotive, and Other End-use Industries |

| Regional Scope | Asia Pacific, North America, Europe, South America, and Middle East & Africa |

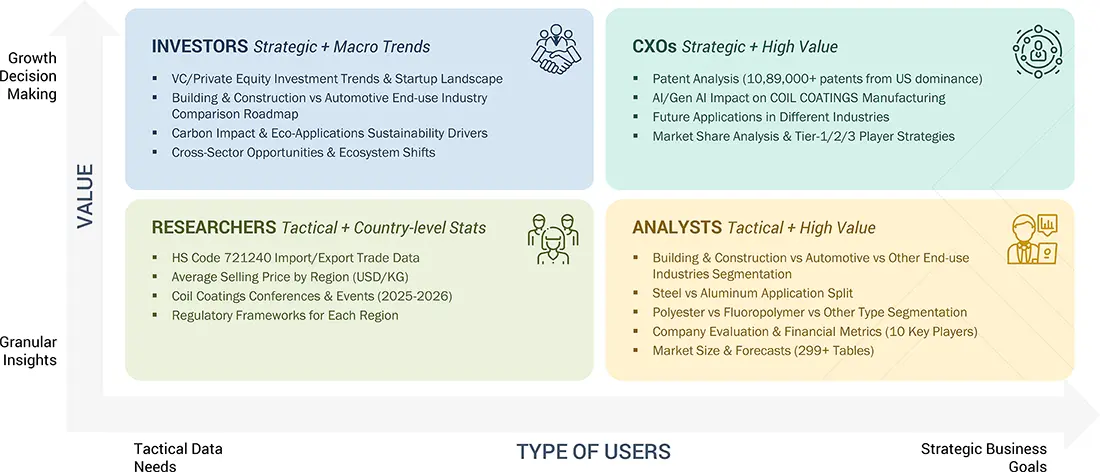

WHAT IS IN IT FOR YOU: Coil Coatings Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe -based Coil Coatings Manufacturer | • Detailed Europe based company profiles of competitors (financials, product portfolio) • Customer landscape mapping by end-use sector • Partnership ecosystem analysis | • Identify interconnections and supply chain blind spots • Detect customer migration trends across industries • Highlight untapped customer clusters for market entry |

| Asia Pacific-Based Coil Coatings Manufacturer | • Global & regional production capacity benchmarking • Customer base profiling across the application industries | • Strengthen forward integration strategy • Identify high-demand customers for long-term supply contracts • Assess supply-demand gaps for competitive advantage |

RECENT DEVELOPMENTS

- May 2025 : PPG Industries, Inc. launched the DuraNEXT line of energy-curable coil coatings, including EB- and UV-curable backers, primers, basecoats, and clearcoats. These coatings cure instantly at ambient temperatures, eliminating the need for thermal ovens and solvents, which reduces energy use, water consumption, CO2 emissions, and VOC output.

- March 2025 : The Sherwin-Williams Company acquired Shingels, S.A., a Barcelona-based paints and coatings manufacturer specializing in aluminum coil coating and industrial applications across Europe.

- October 2024 : Beckers Group opened FutureLab in the UK, a state-of-the-art Sustainable Innovation Center designed to accelerate the development of next-generation sustainable coil coatings. The facility doubles the capacity of its long-term development team and features advanced equipment to progress UV/EB curing technologies.

- January 2024 : Beckers Group and ArcelorMittal formed a strategic partnership to introduce the first commercial electron-beam (EB) cured coil coating solutions for building and construction steels.

- May 2003 : Nippon Paints Holdings Co., Ltd. expanded its coatings production into Vietnam to capitalize on the country’s rapidly growing shipbuilding and repair sector, which is now a government priority and set to become one of Asia’s largest hubs.

Table of Contents

Methodology

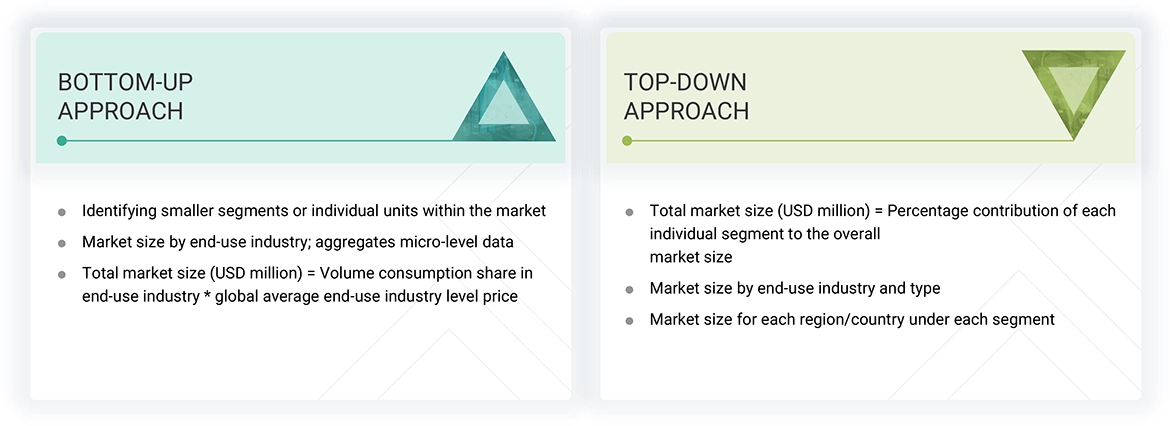

The study involved four major activities in estimating the market size for the coil coatings market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The coil coatings market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by key opinion leaders in various applications for the coil coatings market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2024, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Akzo Nobel N.V. | Senior Manager | |

| Axalta Coating Systems Ltd. | Innovation Manager | |

| PPG Industries, Inc. | Vice President | |

| Beckers Group | Production Supervisor | |

| Kansai Paint Co., Ltd. | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the coil coatings market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The supply chain of the industry has been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the coil coatings industry.

Market Definition

According to the European Coil Coating Association (ECCA), the coil coatings market refers to the continuous, automated process of applying an organic coating onto rolled metal strips, typically steel or aluminum, which involves pretreatment, coating (either side or multiple layers), and curing. This pre-coated metal, often called pre-painted metal, delivers a durable, corrosion-resistant, and uniform surface finish, improving both aesthetics and longevity in end-use manufacturing.

Stakeholders

- Coil Coating Manufacturers

- Coil Coating Distributors

- Raw Material Suppliers

- Government and Research Organizations

- Investment Banks and Private Equity Firms

Report Objectives

- To analyze and forecast the size of the global coil coatings market in terms of value and volume

- To provide detailed information about the important drivers, restraints, challenges, and opportunities influencing market growth

- To define, describe, and segment the market based on type, application, end-use industry, and region

- To forecast the size of the market segments based on regions such as Asia Pacific, North America, Western Europe, Central & Eastern Europe, the Middle East & Africa, and South America

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contributions to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansions, partnerships, collaborations, mergers & acquisitions, agreements, and product launches in the market

- To strategically profile the key companies and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Who are the major players in the coil coatings market?

Major players include Akzo Nobel N.V. (Netherlands), Axalta Coating Systems Ltd. (US), PPG Industries, Inc. (US), The Sherwin-Williams Company (US), Beckers Group (Germany), Nippon Paint Holdings Co., Ltd. (Japan), Kansai Paint Co., Ltd. (Japan), KCC Corporation (South Korea), JSW Paints (India), and Yung Chi Paint & Varnish Manufacturing Co., Ltd. (Taiwan).

What are the drivers and opportunities for the coil coatings market?

Key drivers include rising adoption of pre-painted aluminum sheets in the automotive sector, expansion of modern infrastructure projects, and the shift toward lightweight materials in appliances. Growth opportunities are expected from the increasing use of solar panels and the rising preference for green buildings.

Which strategies are the key players focusing upon in the coil coatings market?

Top players are focusing on product launches, partnerships, mergers and acquisitions, and expansions to strengthen their global presence.

What is the expected growth rate of the coil coatings market between 2025 and 2030?

The market is projected to grow at a CAGR of 3.12% in terms of value during the forecast period.

Which major factors are expected to restrain the growth of the coil coatings market during the forecast period?

Volatility in raw material supply chains and the high capital investment required for coil coating lines are expected to restrain market growth.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Coil Coatings Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Coil Coatings Market