Coating Pretreatment Market by Type (Phosphate, Chromate, Chromate-Free, and Blast Clean), Metal Substrate (Steel and Aluminum), Application (Automotive & Transportation, Appliances, and Building & Construction), by Region (Asia-Pacific, Europe, North America, Middle East & Africa, and South America) - Global Forecasts to 2021

Coating Pretreatment Market size is estimated to grow USD 3.83 Billion by 2021, at a CAGR of 5.76%.

The coating pretreatment industry is witnessing high growth because of increasing applications, growing demand for powder coatings, and its rising demand in developing countries. Coatings pretreatment are largely used in the automotive & transportation applications. Rapid growth of the coating pretreatment market is driven by increasing demand from its end-use industries. The report covered the market by type such as phosphate, chromate, chromate free, and blast clean; market by metal substrate such as steel and aluminum; and the market by applications such as automotive & transportation, building & construction, and appliances.

Years considered for this report:

2014 – Historical Year

2015 – Base Year

2016 – Estimated Year

2021 – Projected Year

Objectives of the study

- To define, describe, and forecast the global coating pretreatment market on the basis of type, substrate, application, and region

- To provide detailed information regarding major factors influencing the market growth—drivers, restraints, opportunities, and industry-specific challenges

- To strategically analyze micromarketswith regard to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for key players and details of the competitive landscape for the market leaders

- To forecast the size of the market segments, in terms of value, with regard to five main regions (along with countries), namely, North America, Europe, Asia-Pacific, South America, and the Middle East & Africa

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, and expansions in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Research Methodology

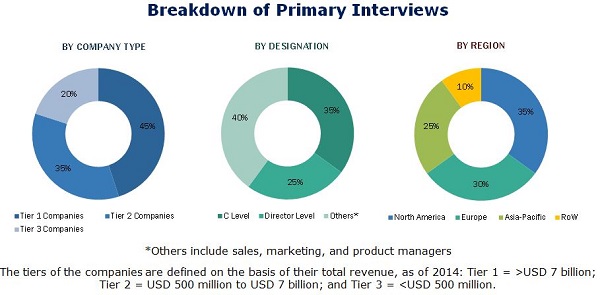

This study aims to estimate the market size of coating pretreatment for 2016 and project its demand by 2021. It also provides a detailed qualitative and quantitative analysis of the coating pretreatment market. Various secondary sources such as directories, industry journals, and databases have been used to identify and collect information useful for this extensive commercial study of the market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess prospects of the market.

To know about the assumptions considered for the study, download the pdf brochure

The coating pretreatment value chain includes raw material suppliers, coating pretreatment manufacturers, and end users. Maximum value addition is done during the manufacturing stage of coating pretreatment. The major companies involved in the value chain of coating pretreatment market are Chemetall GmbH (Germany), Henkel AG & Co. KGaA (Germany), PPG Industries (U.S.), Nihon Parkerizing Co., Ltd. (Japan), Nippon Paint Co., Ltd. (Japan) and others.

Target Audience:

- Manufacturers of coating pretreatment

- Manufacturers of coatings, resins, additives, pigments, and other feedstock chemicals manufacturers

- Manufacturers in end-use industries, such as building & construction, automotive & transportation, and appliances

- Traders, distributors, and suppliers of coating pretreatment

- Regional manufacturers' associations and paints & coatings associations

- Government and regional agencies and research organizations

“The study answers several questions for the stakeholders, primarily, which market segments to focus on in the next two-to-five years for prioritizing efforts and investments and competitive landscape of the market”.

Scope of the Coating Pretreatment Market Report:

The coating pretreatment market has been covered in detail in this report. To provide a complete picture, the current market demand and forecasts have also been included. The coating pretreatment market is segmented as follows:

On the basis of Type:

- Phosphate

- Chromate

- Chromate free

- Blast clean

On the basis of Metal Substrate:

- Steel

- Aluminum

On the basis of Application:

- Building & Construction

- Automotive & Transportation

- Appliances

On the basis of Region:

- Europe

- North America

- Asia-Pacific

- Middle East & Africa

- South America

The market is further analyzed for key countries in each of these regions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of product portfolio of each company

Regional Analysis

- Further breakdown of the rest of Asia-Pacific coating pretreatment market into Australia, New Zealand, and others

The coating pretreatment market is estimated to reach USD 3.83 Billion by 2021, at a CAGR of over 5.76% between 2016 and 2021. The drivers identified for the market are growth in application areas, increased demand from end-use industries, and growing demand from developing nations.

Automotive & transportation is the largest application of coating pretreatment. The construction industry is driven by rising urbanization in Asia-Pacific and the Middle East & Africa, which has resulted in increased demand for residential, commercial, and industrial infrastructure. Low interest rates on housing loans are also responsible for increase in the demand for new houses, eventually driving the building & construction application of coating pretreatment.

The chromate free type of coating pretreatment is growing at the highest rate among all the types of coating pretreatment. The demand for chromate free coating pretreatment is expected to increase in the future owing to their non-VOC emission properties, thus providing high growth opportunity to the overall coating pretreatment market.

Stringent government regulations in the U.S. and Europe, especially to reduce air pollution, will trigger the need for adopting new, low-pollution coating technologies. The chromate free pretreatment coating are nowadays used as a substitute of chromate-based pretreatment due to its environmental friendly nature. It also adheres to the regulations of REACH and other institutions. It is the fastest-growing market among all types of coating pretreatment in Europe and North America. It is used for pretreatment of aluminum and light alloys. The growth is mainly attributed to its ecofriendly nature as these are based on titanium and zirconium chemistries, and they are less harmful and eco-friendly in nature.

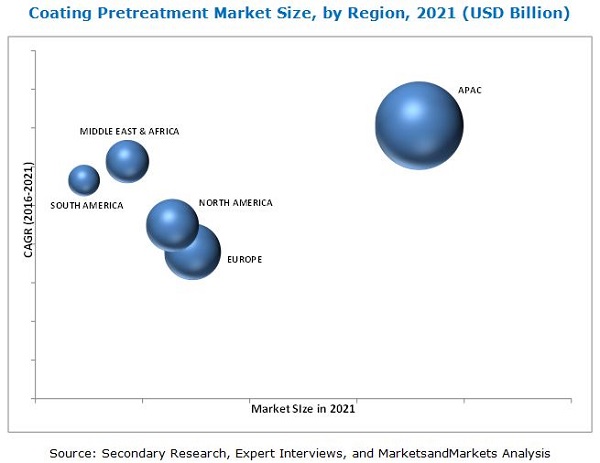

Currently, Asia-Pacific is the largest market for coating pretreatment, both in terms of volume and value, followed by Europe and North America. Countries such as the U.S., China, and Germany are the major markets of coating pretreatment. Due to the increasing demand on domestic front, rising income levels, and easy access to resources, Asia-Pacific has emerged as the leading market of coating pretreatment. South America, especially Brazil, has also emerged as a key market for coating pretreatment manufacturers. Not only is the demand for coating pretreatment expected to be strong in Brazil, but its proximity to the U.S. makes it an emerging market for setting up production facilities.

Low demand of coating pretreatment and its application industries in developed countries are restraining the growth of the coating pretreatment market.

The coating pretreatment market is highly competitive, with key market players, such as Chemetall GmbH (Germany), AkzoNobel N.V. (Netherlands), Axalata Coating System LLC (U.S.), PPG Industries (U.S.), Henkel AG & Co. KGgA (Germany), Sherwin-Williams Company (U.S.), and Nippon Paints Co. Ltd. (Japan), having a sizable share in the global market. New product launches; agreements, partnerships, and joint ventures; expansions; and mergers & acquisitions are some of the key strategies adopted by the market players to expand their global presence and product portfolio. Maximum number of market activities took place in 2015. The leading players, such as Chemetall GmbH (Germany), PPG Industries (U.S.), Nippon Paints (Japan), and Henkel AG & Co. KGgA (Germany), contributed mainly in terms of number of developments. New product launches and mergers & acquisitions are the key strategies adopted between 2013 and 2016.

Frequently Asked Questions (FAQ):

How big is the Coating Pretreatment Market ?

Coating Pretreatment Market size is estimated to grow USD 3.83 Billion by 2021, at a CAGR of 5.76%.

Who leading market players in Coating Pretreatment Market ?

The coating pretreatment market is highly competitive, with key market players, such as Chemetall GmbH (Germany), AkzoNobel N.V. (Netherlands), Axalata Coating System LLC (U.S.), PPG Industries (U.S.), Henkel AG & Co. KGgA (Germany), Sherwin-Williams Company (U.S.), and Nippon Paints Co. Ltd. (Japan), having a sizable share in the global market

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Coating Pretreatment Market

4.2 Coating Pretreatment Market: Developed vs Developing Nations

4.3 Coating Pretreatment: Life Cycle Analysis, By Region

5 Market Overview (Page No. - 38)

5.1 Introduction

5.1.1 Market Segmentation

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Growth in the Powder Coatings Market

5.2.1.2 Increasing Demand From Developing Countries Supported By the Growth in End-Use Industries

5.2.2 Restraints

5.2.2.1 Stagnant Growth in Developed Countries

5.2.2.2 Stringent Regulations on Chromate-Based Coating Pretreatment

5.2.3 Opportunities

5.2.3.1 High Growth in Emerging Economies

5.2.4 Challenges

5.2.4.1 Unstable Economic Cycle

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat 0f New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Intensity of Rivalry

7 Patent Details (Page No. - 50)

7.1 Introduction

7.2 Patent Details

8 Coating Pretreatment Market, By Metal Substrate (Page No. - 53)

8.1 Introduction

8.2 Steel

8.3 Aluminum

9 Coating Pretreatment Market, By Type (Page No. - 57)

9.1 Introduction

9.2 Phosphate

9.3 Chromate

9.4 Chromate-Free

9.5 Blast Clean

10 Coating Pretreatment Market, By Application (Page No. - 64)

10.1 Introduction

10.2 Automotive & Transportation

10.3 Appliances

10.4 Construction

11 Coating Pretreatment Market, By Region (Page No. - 71)

11.1 Introduction

11.2 Asia-Pacific

11.2.1 China

11.2.1.1 China: Macroeconomic Indicators

11.2.2 India

11.2.2.1 India: Macroeconomic Indicators

11.2.3 Japan

11.2.3.1 Japan: Macroeconomic Indicators

11.2.4 South Korea

11.2.4.1 South Korea: Macroeconomic Indicators

11.2.5 Indonesia

11.2.5.1 Indonesia: Macroeconomic Indicators

11.2.6 Thailand

11.2.6.1 Thailand: Macroeconomic Indicators

11.2.7 Malaysia

11.2.7.1 Malaysia: Macroeconomic Indicators

11.2.8 Taiwan

11.2.9 Australia

11.2.10 Others

11.3 North America

11.3.1 U.S.

11.3.1.1 U.S.: Macroeconomic Indicators

11.3.2 Mexico

11.3.2.1 Mexico: Macroeconomic Indicators

11.3.3 Canada

11.3.3.1 Canada: Macroeconomic Indicators

11.4 Europe

11.4.1 Germany

11.4.1.1 Germany: Macroeconomic Indicators

11.4.2 Spain

11.4.2.1 Spain: Macroeconomic Indicators

11.4.3 U.K.

11.4.3.1 U.K.: Macroeconomic Indicators

11.4.4 France

11.4.4.1 France: Macroeconomic Indicators

11.4.5 Italy

11.4.6 Russia

11.4.6.1 Russia: Macroeconomic Indicators

11.4.7 Turkey

11.4.7.1 Turkey: Macroeconomic Indicators

11.4.8 Others

11.5 Middle East & Africa

11.5.1 Saudi Arabia

11.5.2 Iran

11.5.3 South Africa

11.5.4 Others

11.6 South America

11.6.1 Brazil

11.6.2 Argentina

11.6.3 Others

12 Competitive Landscape (Page No. - 120)

12.1 Introduction

12.2 Maximum Developments in 2015

12.3 Growth Strategies in the Coating Pretreatment Market

12.4 Competitive Situations and Trends

12.4.1 New Product Launches

12.4.2 Mergers & Acquisitions

12.4.3 Expansions

12.4.4 Partnerships, Agreements, and Joint Ventures

12.5 Competitive Benchmarking

12.6 Market Share Analysis

13 Company Profiles (Page No. - 127)

(Overview, Financial*, Products & Services, Strategy, and Developments)

13.1 Chemetall GmbH

13.2 Henkel AG & Co. KGAA

13.3 PPG Industries

13.4 Nihon Parkerizing Co., Ltd.

13.5 Nippon Paint Co., Ltd.

13.6 3M Company

13.7 Akzonobel N.V.

13.8 The Sherwin-Williams Company

13.9 Axalta Coating Systems LLC

13.10 Kansai Paint Co. Ltd.

*Details Might Not Be Captured in Case of Unlisted Companies

14 Appendix (Page No. - 145)

14.1 Insights From Industry Experts

14.2 Discussion Guide

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.5 Available Customizations

14.6 Related Reports

List of Tables (147 Tables)

Table 1 Coating Pretreatment: Industry Snapshot

Table 2 Market Segmentation, By Metal Substrate

Table 3 Market Segmentation, By Type

Table 4 Market Segmentation, By Application

Table 5 Global Coating Pretreatment Market Size, By Metal Substrate, 2014–2021 (Kiloton)

Table 6 Global Coating Pretreatment Market Size, By Metal Substrate, 2014–2021 (USD Million)

Table 7 Coating Pretreatment Market Size in Steel Substrates, By Region, 2014–2021 (Kiloton)

Table 8 Coating Pretreatment Market Size in Steel Substrates, By Region, 2014–2021 (USD Million)

Table 9 Coating Pretreatment Market Size in Aluminum Substrates, By Region, 2014–2021 (Kiloton)

Table 10 Coating Pretreatment Market Size in Aluminum Substrates, By Region, 2014–2021 (USD Million)

Table 11 Compatibility Between Coating Pretreatment Type and Metal Substrate

Table 12 Global Coating Pretreatment Market Size, By Type, 2014–2021 (Kiloton)

Table 13 Global Coating Pretreatment Market Size, By Type, 2014–2021 (USD Million)

Table 14 Phosphate Coating Pretreatment Market Size, By Region, 2014–2021 (Kiloton)

Table 15 Phosphate Coating Pretreatment Market Size, By Region, 2014–2021 (USD Million)

Table 16 Chromate Coating Pretreatment Market Size, By Region, 2014–2021 (Kiloton)

Table 17 Chromate Coating Pretreatment Market Size, By Region, 2014–2021 (USD Million)

Table 18 Chromate-Free Coating Pretreatment Market Size, By Region, 2014–2021 (Kiloton)

Table 19 Chromate-Free Coating Pretreatment Market Size, By Region, 2014–2021 (USD Million)

Table 20 Blast Clean Coating Pretreatment Market Size, By Region, 2014–2021 (Kiloton)

Table 21 Blast Clean Coating Pretreatment Market Size, By Region, 2014–2021 (USD Million)

Table 22 Global Coating Pretreatment Market Size, By Application, 2014–2021 (Kiloton)

Table 23 Global Coating Pretreatment Market Size, By Application, 2014–2021 (USD Million)

Table 24 Coating Pretreatment Market Size for Automotive & Transportation, By Region, 2014–2021 (Kiloton)

Table 25 Coating Pretreatment Market Size for Automotive & Transportation, By Region, 2014–2021 (USD Million)

Table 26 Coating Pretreatment Market Size for Appliances, By Region, 2014–2021 (Kiloton)

Table 27 Coating Pretreatment Market Size for Appliances, By Region, 2014–2021 (USD Million)

Table 28 Coating Pretreatment Market Size for Construction, By Region, 2014–2021 (Kiloton)

Table 29 Coating Pretreatment Market Size for Construction, By Region 2014–2021 (USD Million)

Table 30 Coating Pretreatment Market Size, By Region, 2014–2021 (Kiloton)

Table 31 Coating Pretreatment Market Size, By Region, 2014–2021 (USD Million)

Table 32 Asia-Pacific: Coating Pretreatment Market Size, By Country, 2014–2021 (Kiloton)

Table 33 Asia-Pacific: Coating Pretreatment Market Size, By Country, 2014–2021 (USD Million)

Table 34 Asia-Pacific: Coating Pretreatment Market Size, By Type, 2014–2021 (Kiloton)

Table 35 Asia-Pacific: Coating Pretreatment Market Size, By Type, 2014–2021 (USD Million)

Table 36 Asia-Pacific: Coating Pretreatment Market Size, By Metal Substrate, 2014–2021 (Kiloton)

Table 37 Asia-Pacific: Coating Pretreatment Market Size, By Metal Substrate, 2014–2021 (USD Million)

Table 38 Asia-Pacific: Coating Pretreatment Market Size, By Application, 2014–2021 (Kiloton)

Table 39 Asia-Pacific: Coating Pretreatment Market Size, By Application, 2014–2021 (USD Million)

Table 40 China: Macroeconomic Indicators

Table 41 China: Coating Pretreatment Market Size, By Application, 2014–2021 (Kiloton)

Table 42 China: Coating Pretreatment Market Size, By Application, 2014–2021 (USD Million)

Table 43 India: Macroeconomic Indicators

Table 44 India: Coating Pretreatment Market Size, By Application, 2014–2021 (Kiloton)

Table 45 India: Coating Pretreatment Market Size, By Application, 2014–2021 (USD Million)

Table 46 Japan: Macroeconomic Indicators

Table 47 Japan: Coating Pretreatment Market Size, By Application, 2014–2021 (Kiloton)

Table 48 Japan: Coating Pretreatment Market Size, By Application, 2014–2021 (USD Million)

Table 49 South Korea: Macroeconomic Indicators

Table 50 South Korea: Coating Pretreatment Market Size, By Application, 2014–2021 (Kiloton)

Table 51 South Korea: Coating Pretreatment Market Size, By Application, 2014–2021 (USD Million)

Table 52 Indonesia: Macroeconomic Indicators

Table 53 Indonesia: Coating Pretreatment Market Size, By Application, 2014–2021 (Kiloton)

Table 54 Indonesia: Coating Pretreatment Market Size, By Application, 2014–2021 (USD Million)

Table 55 Thailand: Macroeconomic Indicators

Table 56 Thailand: Coating Pretreatment Market Size, By Application, 2014–2021 (Kiloton)

Table 57 Thailand: Coating Pretreatment Market Size, By Application, 2014–2021 (USD Million)

Table 58 Malaysia: Macroeconomic Indicators

Table 59 Malaysia: Coating Pretreatment Market Size, By Application, 2014–2021 (Kiloton)

Table 60 Malaysia: Coating Pretreatment Market Size, By Application, 2014–2021 (USD Million)

Table 61 Taiwan: Coating Pretreatment Market Size, By Application, 2014–2021 (Kiloton)

Table 62 Taiwan: Coating Pretreatment Market Size, By Application, 2014–2021 (USD Million)

Table 63 Australia: Coating Pretreatment Market Size, By Application, 2014–2021 (Kiloton)

Table 64 Australia: Coating Pretreatment Market Size, By Application, 2014–2021 (USD Million)

Table 65 Others: Coating Pretreatment Market Size, By Application, 2014–2021 (Kiloton)

Table 66 Others: Coatings Market Size, By Application, 2014–2021 (USD Million)

Table 67 North America: Coating Pretreatment Market Size, By Country, 2014–2021 (Kiloton)

Table 68 North America: Coating Pretreatment Market Size, By Country, 2014–2021

Table 69 North America: Coating Pretreatment Market Size, By Type, 2014–2021 (Kiloton)

Table 70 North America: Coating Pretreatment Market Size, By Type, 2014–2021 (USD Million)

Table 71 North America: Coating Pretreatment Market Size, By Metal Substrate, 2014–2021 (Kiloton)

Table 72 North America: Coating Pretreatment Market Size, By Metal Substrate, 2014–2021 (USD Million)

Table 73 North America: Coating Pretreatment Market Size, By Application, 2014–2021 (Kiloton)

Table 74 North America: Coating Pretreatment Market Size, By Application, 2014–2021 (USD Million)

Table 75 U.S.: Macroeconomic Indicators

Table 76 U.S.: Coating Pretreatment Market Size, By Application, 2014–2021 (Kiloton)

Table 77 U.S.: Coating Pretreatment Market Size, By Application, 2014–2021 (USD Million)

Table 78 Mexico: Macroeconomic Indicators

Table 79 Mexico: Coating Pretreatment Market Size, By Application, 2014–2021 (Kiloton)

Table 80 Mexico: Coating Pretreatment Market Size, By Application, 2014–2021 (USD Million)

Table 81 Canada: Macroeconomic Indicators

Table 82 Canada: Coating Pretreatment Market Size, By Application, 2014–2021 (Kiloton)

Table 83 Canada: Coating Pretreatment Market Size, By Application, 2014–2021 (USD Million)

Table 84 Europe: Coating Pretreatment Market Size, By Country, 2014–2021 (Kiloton)

Table 85 Europe: Coating Pretreatment Market Size, By Country, 2014–2021 (USD Million)

Table 86 Europe: Coating Pretreatment Market Size, By Type, 2014–2021 (Kiloton)

Table 87 Europe: Coating Pretreatment Market Size, By Technology, 2014–2021 (USD Million)

Table 88 Europe: Coating Pretreatment Market Size, By Metal Substrate, 2014–2021 (Kiloton)

Table 89 Europe: Coating Pretreatment Market Size, By Metal Substrate, 2014–2021 (USD Million)

Table 90 Europe: Coating Pretreatment Market Size, By Application, 2014–2021 (Kiloton)

Table 91 Europe: Coating Pretreatment Market Size, By Application, 2014–2021 (USD Million)

Table 92 Germany: Macroeconomic Indicators

Table 93 Germany: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 94 Germany: Coating Pretreatment Market Size, By Application, 2014-2021 (USD Million)

Table 95 Spain: Macroeconomic Indicators

Table 96 Spain: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 97 Spain: Coating Pretreatment Market Size, By Application, 2014-2021 (USD Million)

Table 98 U.K.: Macroeconomic Indicators

Table 99 U.K.: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 100 U.K.: Coating Pretreatment Market Size, By Application, 2014-2021 (USD Million)

Table 101 France: Macroeconomic Indicators

Table 102 France: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 103 France: Coating Pretreatment Market Size, By Application, 2014-2021 (USD Million)

Table 104 Italy: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 105 Italy: Coating Pretreatment Market Size, By Application, 2014-2021 (USD Million)

Table 106 Russia: Macroeconomic Indicators

Table 107 Russia: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 108 Russia: Coating Pretreatment Market Size, By Application, 2014-2021 (USD Million)

Table 109 Turkey: Macroeconomic Indicators

Table 110 Turkey: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 111 Turkey: Coating Pretreatment Market Size, By Application, 2014-2021 (USD Million)

Table 112 Others: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 113 Others: Coating Pretreatment Market Size, By Application, 2014-2021 (USD Million)

Table 114 Middle East & Africa: Coating Pretreatment Market Size, By Country, 2014-2021 (Kiloton)

Table 115 Middle East & Africa: Coating Pretreatment Market Size, By Country, 2014-2021 (USD Million)

Table 116 Middle East& Africa: Coating Pretreatment Market Size, By Type, 2014-2021 (Kiloton)

Table 117 Middle East & Africa: Coating Pretreatment Market Size, By Type, 2014-2021 (USD Million)

Table 118 Middle East& Africa: Coating Pretreatment Market Size, By Metal Substrate, 2014-2021 (Kiloton)

Table 119 Middle East & Africa: Coating Pretreatment Market Size, By Metal Substrate, 2014-2021 (USD Million)

Table 120 Middle East & Africa: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 121 Middle East & Africa: Coating Pretreatment Market Size, By Application, 2014-2021 (USD Million)

Table 122 Saudi Arabia: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 123 Saudi Arabia: Coating Pretreatment Market Size, By Application, 2014-2021 (USD Million)

Table 124 Iran: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 125 Iran: Coating Pretreatment Market Size, By Application, 2014-2021 (USD Million)

Table 126 South Africa: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 127 South Africa: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 128 Others: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 129 Others: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 130 South America: Coating Pretreatment Market Size, By Country, 2014-2021 (Kiloton)

Table 131 South America: Coating Pretreatment Market Size, By Country, 2014-2021 (USD Million)

Table 132 South America: Coating Pretreatment Market Size, By Type, 2014-2021 (Kiloton)

Table 133 South America: Coating Pretreatment Market Size, By Type, 2014-2021 (USD Million)

Table 134 South America: Coating Pretreatment Market Size, By Metal Substrate, 2014-2021 (Kiloton)

Table 135 South America: Coating Pretreatment Market Size, By Metal Substrate, 2014-2021 (USD Million)

Table 136 South America: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 137 South America: Coating Pretreatment Market Size, By Application, 2014-2021 (USD Million)

Table 138 Brazil: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 139 Brazil: Coating Pretreatment Market Size, By Application, 2014-2021 (USD Million)

Table 140 Argentina: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 141 Argentina: Coating Pretreatment Market Size, By Application, 2014-2021 (USD Million)

Table 142 Others: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 143 Others: Coating Pretreatment Market Size, By Application, 2014-2021 (Kiloton)

Table 144 New Product Launches, 2013–2016

Table 145 Mergers & Acquisitions, 2013–2016

Table 146 Expansions, 2013–2016

Table 147 Partnerships, Agreements, and Joint Ventures, 2013–2016

List of Figures (45 Figures)

Figure 1 Coating Pretreatment Market Segmentation

Figure 2 Coating Pretreatment: Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 Coating Pretreatment in Appliances Applications to Grow at the Highest Rate Between 2016 and 2021

Figure 8 Asia-Pacific to Witness the Highest Growth During the Forecast Period, 2016–2021 (USD Million)

Figure 9 Coating Pretreatment Market to Record High Growth Between 2016 and 2021

Figure 10 Coating Pretreatment in Appliances Applications to Register the Highest CAGR Between 2016 and 2021

Figure 11 China Accounted for A Major Share in the Asia-Pacific Coating Pretreatment Market in 2015

Figure 12 Asia-Pacific to Register the Highest CAGR in the Coating Pretreatment Market Between 2016 and 2021

Figure 13 The Market in Developing Countries to Grow Faster Than in Developed Countries

Figure 14 Coating Pretreatment Market to Witness High Growth Between 2016 and 2021 in Asia-Pacific and Middle East & Africa

Figure 15 Drivers, Restrains, Opportunities, and Challenges in the Coating Pretreatment Market

Figure 16 High Investment in Infrastructure Development in Emerging Countries By 2017

Figure 17 Overview of Supply Chain of the Coating Pretreatment Industry

Figure 18 Porter’s Five Forces Analysis of the Coating Pretreatment Market

Figure 19 Europe Accounted for the Highest Number of Patents Filed Between 2014 and 2015

Figure 20 PPG Industries Had the Highest Number of Patents Between 2014 and 2015

Figure 21 Chromate-Free Pretreatment to Register the Highest Growth Between 2016 and 2021

Figure 22 Global Coating Pretreatment Market, By Application, 2016 vs 2021 (USD Million)

Figure 23 Regional Snapshot (2016–2021): Fastest-Growing Markets are Emerging as New Hot Spots

Figure 24 China and Japan: Major Markets for Coating Pretreatment in Asia-Pacific

Figure 25 U.S., the Largest Market for Coating Pretreatment in North America

Figure 26 Germany, the Largest Market for Coating Pretreatment in Europe

Figure 27 Companies Adopted New Product Launches and Mergers & Acquisitions as Their Key Growth Strategies Between 2013 and May 2016

Figure 28 Coating Pretreatment Market Had Maximum Developments in 2015

Figure 29 New Product Launches and Mergers & Acquisitions—Most Widely Adopted Growth Strategies Between 2013 and May 2016

Figure 30 PPG Industries and Chemetall Have Diversified Product Portfolios for Coating Pretreatment Products

Figure 31 Chemetall Was the Leading Player in the Coating Pretreatment Market in 2015

Figure 32 Chemetall: SWOT Analysis

Figure 33 Henkel AG & Co. KGAA: Company Snapshot

Figure 34 Henkel AG & Co. KGAA: SWOT Analysis

Figure 35 PPG Industries: Company Snapshot

Figure 36 PPG Industries: SWOT Analysis

Figure 37 Nihon Parkerizing Co., Ltd.: Company Snapshot

Figure 38 Nihon Parkerizing Co., Ltd.: SWOT Analysis

Figure 39 Nippon Paint Co., Ltd.: Company Snapshot

Figure 40 Nippon Paint Co., Ltd.: SWOT Analysis

Figure 41 3M Company: Company Snapshot

Figure 42 Akzonobel N.V.: Company Snapshot

Figure 43 The Sherwin-Williams Company: Company Snapshot

Figure 44 Axalta Coating Systems LLC: Company Snapshot

Figure 45 Kansai Paint Co. Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Coating Pretreatment Market

Chromate-free coating pretreatment is nowadays used as a substitute to chromate-based pre-treatment. These coatings are based on titanium and zirconium chemistries and are less harmful and ecofriendly than chromate-based pretreatment. Chromate-free pretreatment also adheres to the regulations of REACH and other institutions. It is the fastest growing segment among all types of coating pretreatment in Europe and North America. It is used for the pretreatment of aluminum and light alloys. The global chromate-free coating pretreatment market is forecasted to be 385.5 Kiloton by 2021 for Automotive & Transportation (includes aerospace), appliances, building & construction applications. We would be to happy to hear/like to have a quick call and understand if you have more queries on this. Please feel free to email sales@marketsandmarkets.com / Call us on +1-888-600-6441

I am researching the volume usage of non-chrome coatings pretreatments for automotive and aerospace markets out to 2020Any help would be a big help.