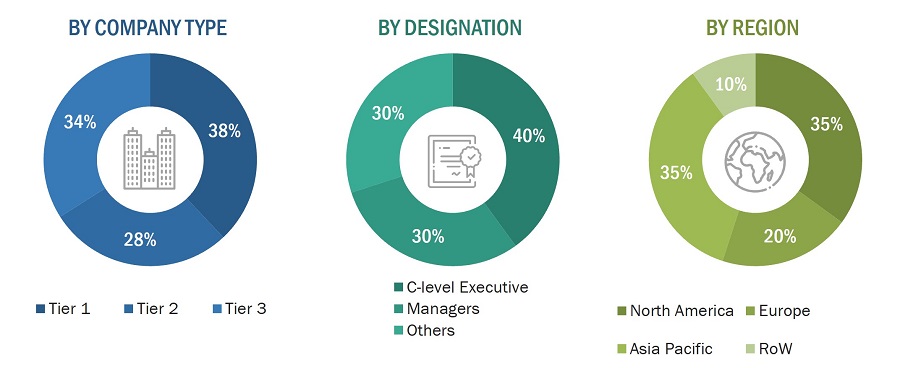

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the co-packaged optics market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the co-packaged optics market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the co-packaged optics market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research:

In the secondary research process, various secondary sources were referred to for identifying and collecting information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers; co-packaged optics products-related journals; certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, key players, market classification and segmentation as per industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and key executives from major companies in the co-packaged optics market.

After going through market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

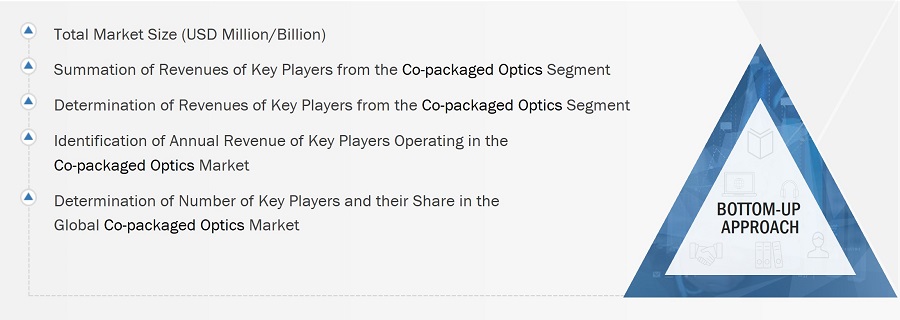

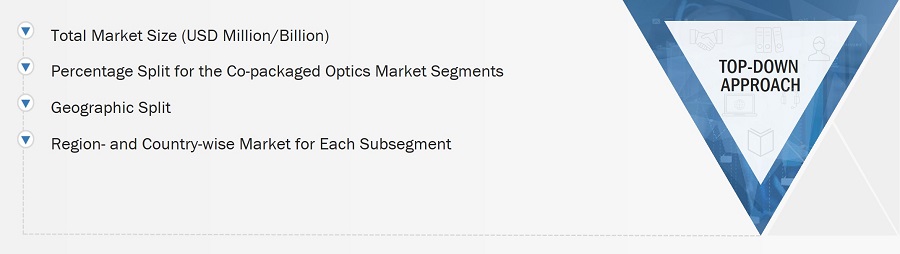

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the co-packaged optics market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Co-packaged optics market: Bottom-up Approach

Co-packaged optics market: Top-down Approach

Data Triangulation

After arriving at the overall size of the co-packaged optics market from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using top-down and bottom-up approaches.

Market Definition

Co-packaged optics (CPO) is a technology that combines optical transceivers directly with electronic chips or application-specific integrated circuits (ASICs) within a single package. By integrating optical and electronic components, CPO creates a more compact and efficient data transmission and processing solution. In CPO, optical components such as lasers, modulators, and photodetectors are integrated with electronic components like ASICs or processing units in close proximity within the same package. The close integration of optical and electronic components in CPO can result in lower latency in data transmission, making it ideal for applications that require real-time processing, such as financial trading platforms or 5G networks.

Key Stakeholders

-

Component and material providers

-

Semiconductor foundries

-

Silicon photonics platform developers

-

Silicon photonics product manufacturers and suppliers

-

Assembly and testing vendors

-

Original equipment manufacturers

-

Research organizations and consulting companies

-

Technology investors

-

Associations, alliances, and organizations related to silicon photonics

-

Analysts and strategic business planners

-

End users

Report Objectives

-

To define, describe, and forecast the co-packaged optics market based on data rates, components, applications, and regions.

-

To forecast the sizes of various segments with respect to four major regions—

North America, Europe, Asia Pacific, and RoW

-

To provide a detailed analysis of the co-packaged optics supply chain

-

To analyze the impact of the recession on co-packaged optics market

-

To strategically analyze the micromarkets1 with respect to individual growth trends and prospects and their contributions to the total market

-

To understand competitive developments such as expansions, agreements, partnerships, acquisitions, product developments, and research and development (R&D)

-

To analyze the opportunities for market players and provide details of the competitive landscape of the market

-

To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios

-

To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with a detailed market competitive landscape

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product analysis

-

Detailed analysis and profiling of additional market players

The following customization options are available for the report:

-

Market sizing and forecast for additional countries

-

Additional five companies profiling

Growth opportunities and latent adjacency in Co-Packaged Optics Market