2

RESEARCH METHODOLOGY

47

5

MARKET OVERVIEW

Telehealth and data-driven solutions revolutionize healthcare amid interoperability and cost challenges.

75

5.2.1.1

INCREASING FOCUS ON TELEHEALTH & REMOTE PATIENT MONITORING

5.2.1.2

FAVORABLE GOVERNMENT INITIATIVES FOR ADOPTION OF IT SOLUTIONS

5.2.1.3

GROWING NEED TO CURB HEALTHCARE SPENDING

5.2.1.4

INCREASING ADOPTION OF EHR

5.2.1.5

GROWING FOCUS ON DATA-DRIVEN DECISION-MAKING

5.2.2.1

INTEROPERABILITY ISSUES ASSOCIATED WITH INFORMATION SYSTEMS

5.2.2.2

HIGH DEPLOYMENT COSTS

5.2.2.3

RESISTANCE FROM CONVENTIONAL HEALTHCARE PROVIDERS

5.2.3.1

GRADUAL SHIFT TOWARD OUTPATIENT CARE ENVIRONMENTS

5.2.3.2

POTENTIAL BENEFITS OF REAL-WORLD EVIDENCE

5.2.3.3

DEVELOPMENT OF MHEALTH TOOLS

5.2.3.4

EMERGENCE OF PRECISION MEDICINE AND UTILIZATION OF OMICS DATA SETS

5.2.3.5

EMPHASIS ON VALUE-BASED MEDICINE

5.2.3.6

UPTAKE OF VIRTUAL CLINICAL & NURSING ASSISTANTS

5.2.3.7

HIGH-GROWTH POTENTIAL OF EMERGING ECONOMIES

5.2.4.1

SHORTAGE OF SKILLED IT PROFESSIONALS

5.2.4.2

DATA SECURITY CONCERNS

5.2.4.3

COMPLEXITIES ASSOCIATED WITH BIG DATA IN HEALTHCARE

5.3

TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.4.1

INTEROPERABILITY & INTEGRATED CARE MODELS

5.4.2

CLOUD-BASED SOLUTIONS

5.4.3

BIG DATA IN HEALTHCARE

5.7.1.1

PREDICTIVE ANALYTICS

5.7.1.2

ARTIFICIAL INTELLIGENCE & MACHINE LEARNING

5.7.1.3

VIRTUAL ASSISTANTS & CHATBOTS

5.7.1.4

AUGMENTED & VIRTUAL REALITY

5.7.2

COMPLEMENTARY TECHNOLOGIES

5.7.2.1

REAL-WORLD EVIDENCE DATA

5.7.2.3

DIGITAL HEALTH PLATFORMS

5.7.2.4

CLINICAL DATA WAREHOUSING & BIG DATA ANALYTICS

5.7.2.5

DIGITAL PATHOLOGY

5.7.3

ADJACENT TECHNOLOGIES

5.7.3.2

BLOCKCHAIN TECHNOLOGY

5.7.3.4

GENOMICS & PRECISION MEDICINE PLATFORMS

5.8.1

REGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONS

5.8.2

REGULATORY SCENARIO

5.8.2.4

MIDDLE EAST & AFRICA

5.9.1

INDICATIVE PRICE OF CLINICAL INFORMATICS SOLUTIONS, BY FUNCTION (2023)

5.9.1.1

AVERAGE SELLING PRICE OF EHR SOLUTIONS, BY KEY PLAYER (2023)

5.9.1.2

INDICATIVE PRICE OF EHR SOLUTIONS, BY COMPONENT (2023)

5.9.1.3

INDICATIVE PRICE OF CLINICAL DECISION SUPPORT SYSTEMS, BY PRODUCT (2023)

5.9.1.4

INDICATIVE PRICE OF HCIT INTEGRATION SOLUTIONS, BY COMPONENT (2023)

5.9.2

INDICATIVE PRICE OF CLINICAL INFORMATICS SOLUTIONS, BY REGION (2023)

5.10

PORTER’S FIVE FORCES ANALYSIS

5.10.1

INTENSITY OF COMPETITIVE RIVALRY

5.10.2

BARGAINING POWER OF BUYERS

5.10.3

THREAT OF SUBSTITUTES

5.10.4

THREAT OF NEW ENTRANTS

5.10.5

BARGAINING POWER OF SUPPLIERS

5.11

KEY STAKEHOLDERS AND BUYING CRITERIA

5.11.1

KEY STAKEHOLDERS IN BUYING PROCESS

5.11.2

KEY BUYING CRITERIA

5.12.1

PATENT PUBLICATION TRENDS

5.12.2

JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR CLINICAL INFORMATICS

5.12.3

LEADING PATENTS IN CLINICAL INFORMATICS MARKET

5.13.2

END-USER EXPECTATIONS

5.14

KEY CONFERENCES & EVENTS, 2024–2025

5.15.1

TRANSFORMING CLINICAL INFORMATICS AT CORNWALL COMMUNITY HOSPITAL

5.15.2

GRANGER MEDICAL CLINIC’S FOCUS ON GAINING EFFICIENT HEALTHCARE OPERATIONS

5.15.3

IMPROVEMENTS IN IMAGING EFFICIENCY BY OVERCOMING REPORTING & VISUALIZATION BARRIERS

5.16

INVESTMENT & FUNDING SCENARIO

5.18

IMPACT OF AI/GEN AI IN CLINICAL INFORMATICS MARKET

5.18.2

CASE STUDIES OF AI/GENERATIVE AI IMPLEMENTATION

5.18.2.1

CASE STUDY 1: ENHANCING DIAGNOSTIC ACCURACY WITH AI SOLUTIONS AT PRINCESS ALEXANDRA HOSPITAL

5.18.2.2

CASE STUDY 2: LEVERAGING AI FOR PROACTIVE INFECTION PREVENTION IN HOSPITAL

5.18.3

IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

5.18.3.1

HEALTHCARE IT MARKET

5.18.3.2

CLINICAL DECISION SUPPORT SYSTEM MARKET

5.18.3.3

TELEHEALTH & TELEMEDICINE MARKET

5.18.3.4

AMBULATORY EHR MARKET

5.18.4

USER READINESS & IMPACT ASSESSMENT

5.18.4.2

IMPACT ASSESSMENT

6

CLINICAL INFORMATICS MARKET, BY FUNCTION

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 35 Data Tables

145

6.2

ELECTRONIC HEALTH RECORDS

6.2.1

NEED FOR INTEGRATED HEALTHCARE SYSTEMS TO FUEL UPTAKE

6.3

PRACTICE MANAGEMENT SYSTEMS

6.3.1

DIGITAL SHIFT IN MEDICAL PRACTICE MANAGEMENT TO SUPPORT ADOPTION IN HEALTHCARE ORGANIZATIONS

6.4

CLINICAL WORKFLOW MANAGEMENT SYSTEMS

6.4.1

WORKFLOW AUTOMATION SOLUTIONS

6.4.1.1

PATIENT FLOW MANAGEMENT SOLUTIONS

6.4.1.2

CLINICIAN & STAFF SCHEDULING SOLUTIONS

6.4.2

CLINICAL COMMUNICATION & COLLABORATION SOLUTIONS

6.4.2.1

ADVANTAGES IN DECISION-MAKING AND PROCESS EXPEDIENCY TO DRIVE MARKET

6.5

DIAGNOSTIC & IMAGING SOLUTIONS

6.5.1

MEDICAL IMAGE ANALYSIS SOFTWARE

6.5.1.1

ROBUST GROWTH OF 3D MEDICAL IMAGING SYSTEMS AND DIGITIZATION OF MEASUREMENT VALUES TO SUPPORT SEGMENT GROWTH

6.5.2.1

FAVORABLE GOVERNMENT INITIATIVES TO MODERNIZE IMAGING FACILITIES TO SPUR SEGMENT GROWTH

6.5.3

RADIOLOGY INFORMATION SYSTEMS

6.5.3.1

FOCUS ON HEALTHCARE DIGITIZATION AND RISING DEMAND FOR EFFICIENT WORKFLOW OPTIMIZATION IN HEALTHCARE FACILITIES TO DRIVE SEGMENT

6.5.4

LABORATORY INFORMATION SYSTEMS

6.5.4.1

RISING DEMAND FOR ACCURATE AND EFFICIENT LAB TEST RESULTS TO FUEL MARKET GROWTH

6.6

CLINICAL DECISION SUPPORT SYSTEMS

6.6.1

SUPPORT IN DEVELOPING BETTER TREATMENT PLANS TO DRIVE ADOPTION

6.7

MEDICATION MANAGEMENT SYSTEMS

6.7.1

EPRESCRIBING SOLUTIONS

6.7.1.1

ABILITY TO LINK AND SEARCH PATIENT RECORDS AND EASY ACCESS TO PATIENT INFORMATION TO BOOST MARKET GROWTH

6.7.2

COMPUTERIZED PHYSICIAN ORDER ENTRY SYSTEMS

6.7.2.1

NEED FOR MINIMIZING PRESCRIPTION AND DRUG ADMINISTRATION ERRORS TO DRIVE SEGMENT

6.7.3

PHARMACY INFORMATION SYSTEMS

6.7.3.1

PHARMACY INFORMATION SYSTEMS TO REDUCE MEDICATION DISPENSING ERROR RATES AND ENSURE EFFICIENT INVENTORY CONTROL

6.8

SPECIALTY INFORMATION MANAGEMENT SOLUTIONS

6.8.1

ONCOLOGY INFORMATION SYSTEMS

6.8.1.1

RISE IN CANCER PREVALENCE AND TECHNOLOGICAL ADVANCEMENTS IN ONCOLOGY TREATMENTS TO SUPPORT MARKET GROWTH

6.8.2

CARDIOVASCULAR INFORMATION SYSTEMS

6.8.2.1

INCREASING INCIDENCE OF CARDIOVASCULAR DISEASES TO PROPEL MARKET GROWTH

6.8.3

OTHER SPECIALITY INFORMATION MANAGEMENT SOLUTIONS

6.9

TELEHEALTH & TELEMEDICINE SOLUTIONS

6.9.1

SHORTAGE OF HEALTHCARE WORKFORCE AND NEED FOR REMOTE PATIENT MONITORING TO ACCELERATE ADOPTION

6.10

INFECTION SURVEILLANCE SOLUTIONS

6.10.1

INCREASING PREVALENCE OF HOSPITAL-ACQUIRED INFECTIONS TO AID MARKET GROWTH

6.11

PATIENT PORTALS & ENGAGEMENT SOLUTIONS

6.11.1

BETTER PERSONALIZED MEDICATION PLANS AND STREAMLINED FOLLOW-UP CARE TO SUPPORT MARKET GROWTH

6.12

POPULATION HEALTH MANAGEMENT SOLUTIONS

6.12.1

POPULATION HEALTH MANAGEMENT SOLUTIONS TO REDUCE READMISSIONS AND TRACK CARE ACROSS MULTIPLE SPECIALTIES

6.13

DATA ANALYTICS & REPORTING SOLUTIONS

6.13.1

NEED FOR ENHANCED PATIENT CARE AND STREAMLINED OPERATIONS TO FUEL UPTAKE

6.14

MOBILE HEALTH APPLICATIONS

6.14.1

RISING PREFERENCE FOR SELF-CARE MANAGEMENT TO BOOST MARKET GROWTH

6.15

HCIT INTEGRATION & INTEROPERABILITY SYSTEMS

6.15.1

NEED TO REPLACE OUTDATED MEDICAL TECHNOLOGY AND REDUCE HEALTHCARE COSTS TO PROPEL MARKET GROWTH

7

CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 4 Data Tables

181

7.2.1

POTENTIAL SCALABILITY AND COST-EFFECTIVENESS TO DRIVE MARKET

7.3.1

GROWING DEMAND FOR SECURITY, CONTROL, AND COMPLIANCE NEEDS TO DRIVE MARKET

7.4.1

RISING ADOPTION OF HYBRID CLOUD MODELS TO ENHANCE INNOVATION, SCALABILITY, AND DATA SECURITY

8

CLINICAL INFORMATICS MARKET, BY COMPONENT

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 8 Data Tables

187

8.2.1

STANDALONE SOFTWARE

8.2.1.1

RISING FOCUS ON DATA MANAGEMENT EFFICIENCY TO DRIVE MARKET

8.2.2

INTEGRATED SOFTWARE

8.2.2.1

ABILITY TO CREATE COHESIVE UNIFICATION AMONG MULTIPLE PLATFORMS TO FUEL UPTAKE

8.3.1

RISING REQUIREMENT FOR CONSULTING & IMPLEMENTATION SERVICES TO DRIVE MARKET

9

CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 10 Data Tables

197

9.2.1

RISING ADOPTION OF ELECTRONIC MEDICAL RECORDS TO DRIVE MARKET

9.3.1

ADVANCES IN AI-ENHANCED DIAGNOSTIC IMAGING AND DECISION SUPPORT TO PROPEL DEMAND

9.4.1

CHALLENGES IN TREATING AND RESEARCHING NEUROLOGICAL DISORDERS TO DRIVE ADOPTION

9.5.1

ADVANCES IN IMAGING SOLUTIONS FOR RESPIRATORY DIAGNOSTICS TO PROPEL MARKET

9.6.1

POTENTIAL FOR ENHANCING DETECTION AND PERSONALIZED THERAPEUTICS TO PROPEL ADOPTION

9.7.1

RISING INCIDENCE OF DIABETES AND LIVER DISEASES TO DRIVE DEMAND

9.8.1

NEED TO MANAGE AND REDUCE SPREAD OF INFECTIOUS DISEASES TO SUPPORT MARKET GROWTH

9.9

OTHER THERAPEUTIC AREAS

10

CLINICAL INFORMATICS MARKET, BY END USER

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 8 Data Tables

210

10.2.1

IMPROVEMENTS IN HEALTHCARE INFRASTRUCTURE FOR DIGITAL INFORMATICS TO DRIVE MARKET

10.3

AMBULATORY SURGERY CENTERS, AMBULATORY CARE CENTERS, AND OTHER OUTPATIENT SETTINGS

10.3.1

ADVANTAGES OF COST-EFFICIENCY AND RAPID TURNAROUND TIMES TO PROPEL MARKET

10.4

SPECIALTY CARE CENTERS

10.4.1

INCREASING FOCUS ON PERSONALIZED THERAPEUTICS TO SUPPORT MARKET GROWTH

10.5

HOME HEALTHCARE, LONG-TERM CARE, AND ASSISTED LIVING FACILITIES

10.5.1

GROWING FOCUS ON TELEHEALTH TO FUEL UPTAKE

10.6

DIAGNOSTIC & IMAGING CENTERS

10.6.1

INCREASING UPTAKE OF ADVANCED IMAGING DIAGNOSTICS INTEGRATED WITH AI SOLUTIONS TO BOOST DEMAND

10.7.1

RISING REQUIREMENT FOR ELECTRONIC HEALTH RECORDS TO SUPPORT MARKET GROWTH

11

CLINICAL INFORMATICS MARKET, BY REGION

Comprehensive coverage of 8 Regions with country-level deep-dive of 12 Countries | 248 Data Tables.

221

11.2.1

MACROECONOMIC OUTLOOK FOR NORTH AMERICA

11.2.2.1

VAST HEALTHCARE INFRASTRUCTURE, REFORMS, AND ADVANCEMENTS IN DIGITAL INNOVATION TO ENSURE STRONG MARKET SHARE

11.2.3.1

GOVERNMENT INVESTMENT IN HEALTH INFRASTRUCTURE AND ADOPTION OF DIGITAL SOLUTIONS SUCH AS EHRS

11.3.1

MACROECONOMIC OUTLOOK FOR EUROPE

11.3.2.1

GROWING DIGITALIZATION OF HEALTHCARE INFRASTRUCTURE TO DRIVE MARKET

11.3.3.1

FAVORABLE GOVERNMENT INITIATIVES TO DRIVE MARKET

11.3.4.1

STRONG GOVERNMENT SUPPORT AND DIGITALIZATION TO PROPEL MARKET GROWTH

11.3.5.1

INCREASING FOCUS ON OPTIMIZING HEALTHCARE RESOURCES TO ACCELERATE GROWTH

11.3.6.1

RISING AGING POPULATION AND GROWING DEMAND FOR HEALTHCARE TO SUPPORT ADOPTION

11.4.1

MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

11.4.2.1

WELL-ESTABLISHED HEALTHCARE INFRASTRUCTURE AND RAPIDLY EVOLVING MOBILE HEALTHCARE SECTOR TO DRIVE GROWTH

11.4.3.1

ESTABLISHED HEALTHCARE REFORMS FOR EMR SOLUTIONS TO DRIVE MARKET

11.4.4.1

GROWING ADOPTION OF EHR SOLUTIONS TO FUEL UPTAKE

11.4.5

REST OF ASIA PACIFIC

11.5.1

MACROECONOMIC OUTLOOK FOR LATIN AMERICA

11.5.2.1

BRAZIL TO DOMINATE CLINICAL INFORMATICS MARKET IN LATIN AMERICA

11.5.3.1

RISING FOCUS ON DIGITAL HEALTH TO BOOST MARKET GROWTH

11.5.4

REST OF LATIN AMERICA

11.6

MIDDLE EAST & AFRICA

11.6.1

INCREASING INVESTMENTS IN MODERNIZING HEALTHCARE SYSTEMS TO BOOST MARKET GROWTH

11.6.2

MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

11.6.3.1

RISING HEALTHCARE INVESTMENTS TO FUEL UPTAKE

11.6.4

REST OF MIDDLE EAST & AFRICA

12

COMPETITIVE LANDSCAPE

Discover strategic advantages and market positioning of key clinical informatics players and startups.

353

12.2

KEY PLAYER STRATEGIES/RIGHT TO WIN

12.2.1

OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN CLINICAL INFORMATICS MARKET

12.3

REVENUE ANALYSIS, 2019–2023

12.4

MARKET SHARE ANALYSIS, 2023

12.5

COMPANY VALUATION AND FINANCIAL METRICS

12.6

BRAND/SOFTWARE COMPARISON

12.7

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

12.7.5

COMPANY FOOTPRINT: KEY PLAYERS, 2023

12.7.5.1

COMPANY FOOTPRINT

12.7.5.2

REGION FOOTPRINT

12.7.5.3

FUNCTION FOOTPRINT

12.7.5.4

COMPONENT FOOTPRINT

12.7.5.5

DEPLOYMENT MODEL FOOTPRINT

12.7.5.6

END-USER FOOTPRINT

12.8

COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

12.8.1

PROGRESSIVE COMPANIES

12.8.2

RESPONSIVE COMPANIES

12.8.5

COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

12.8.5.1

DETAILED LIST OF KEY STARTUPS/SMES

12.8.5.2

COMPETITIVE BENCHMARKING OF STARTUPS/SMES

12.9

COMPETITIVE SCENARIO

12.9.1

PRODUCT LAUNCHES/APPROVALS/UPGRADES

12.9.4

OTHER DEVELOPMENTS

13

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

387

13.1.1

UNITEDHEALTH GROUP

13.1.1.1

BUSINESS OVERVIEW

13.1.1.2

PRODUCTS OFFERED

13.1.1.3

RECENT DEVELOPMENTS

13.1.3

EPIC SYSTEMS CORPORATION

13.1.4

KONINKLIJKE PHILIPS N.V.

13.1.5

MCKESSON CORPORATION

13.1.8

EXLSERVICE HOLDINGS, INC.

13.1.10

MEDICAL INFORMATION TECHNOLOGY, INC.

13.1.11

SIEMENS HEALTHINEERS AG

13.1.15

ATHENAHEALTH, INC.

13.1.17

NVIDIA CORPORATION

13.1.19

NXGN MANAGEMENT, LLC

13.1.20

INTERSYSTEMS CORPORATION

13.1.23

SAS INSTITUTE INC.

13.2.2

PRACTICE FUSION, INC.

13.2.3

MEDEANALYTICS, INC.

13.2.7

SURGICAL INFORMATION SYSTEMS

13.2.9

MEMORA HEALTH INC.

13.2.10

MEDIVIEW XR, INC.

14.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3

CUSTOMIZATION OPTIONS

TABLE 1

CLINICAL INFORMATICS MARKET: INCLUSIONS & EXCLUSIONS

TABLE 2

EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

TABLE 3

CLINICAL INFORMATICS MARKET: FACTOR ANALYSIS

TABLE 4

CLINICAL INFORMATICS MARKET: MARKET SIZING ASSUMPTIONS

TABLE 5

CLINICAL INFORMATICS MARKET: RISK ASSESSMENT

TABLE 6

CLINICAL INFORMATICS MARKET: IMPACT ANALYSIS

TABLE 7

RECENT DEVELOPMENTS FOR TELEHEALTH EXPANSION, JANUARY 2024–DECEMBER 2024

TABLE 8

RECENT DEVELOPMENTS FOR VIRTUAL CLINICAL & NURSING ASSISTANTS, JANUARY 2023–DECEMBER 2024

TABLE 9

TOP 30 HEALTHCARE DATA BREACHES IN US (2011−2024)

TABLE 10

CLINICAL INFORMATICS MARKET: ROLE IN ECOSYSTEM

TABLE 11

NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12

EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13

ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14

LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15

MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16

REGULATORY SCENARIO OF NORTH AMERICA

TABLE 17

REGULATORY SCENARIO OF EUROPE

TABLE 18

REGULATORY SCENARIO OF ASIA PACIFIC

TABLE 19

REGULATORY SCENARIO OF MIDDLE EAST & AFRICA

TABLE 20

REGULATORY SCENARIO OF LATIN AMERICA

TABLE 21

INDICATIVE PRICE OF EHR SOLUTIONS, BY COMPONENT (2023)

TABLE 22

INDICATIVE PRICE OF CLINICAL DECISION SUPPORT SYSTEMS, BY PRODUCT (2023)

TABLE 23

INDICATIVE PRICE OF HCIT INTEGRATION SOLUTIONS, BY COMPONENT (2023)

TABLE 24

INDICATIVE PRICE OF CLINICAL INFORMATICS SOLUTIONS, BY REGION (2023)

TABLE 25

CLINICAL INFORMATICS MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 26

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE END USERS (%)

TABLE 27

KEY BUYING CRITERIA FOR TOP THREE END USERS

TABLE 28

JURISDICTION ANALYSIS OF TOP APPLICANT COUNTRIES FOR CLINICAL INFORMATICS

TABLE 29

CLINICAL INFORMATICS MARKET: LIST OF PATENTS/PATENT APPLICATIONS

TABLE 30

UNMET NEEDS IN CLINICAL INFORMATICS MARKET

TABLE 31

END-USER EXPECTATIONS IN CLINICAL INFORMATICS MARKET

TABLE 32

CLINICAL INFORMATICS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

TABLE 33

CASE STUDY 1: TRANSFORMING CLINICAL INFORMATICS AT CORNWALL COMMUNITY HOSPITAL

TABLE 34

CASE STUDY 2: GRANGER MEDICAL CLINIC’S FOCUS ON GAINING EFFICIENT HEALTHCARE OPERATIONS

TABLE 35

CASE STUDY 3: IMPROVEMENTS OF IMAGING EFFICIENCY BY OVERCOMING REPORTING & VISUALIZATION BARRIERS

TABLE 36

CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 37

CLINICAL INFORMATICS MARKET FOR ELECTRONIC HEALTH RECORDS, BY REGION, 2022–2030 (USD MILLION)

TABLE 38

CLINICAL INFORMATICS MARKET FOR PRACTICE MANAGEMENT SYSTEMS, BY REGION, 2022–2030 (USD MILLION)

TABLE 39

CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 40

CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY REGION, 2022–2030 (USD MILLION)

TABLE 41

WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 42

WORKFLOW AUTOMATION SOLUTIONS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 43

PATIENT FLOW MANAGEMENT SOLUTIONS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 44

CLINICIAN & STAFF SCHEDULING SOLUTIONS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 45

CLINICAL COMMUNICATION & COLLABORATION SOLUTIONS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 46

CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 47

CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY REGION, 2022–2030 (USD MILLION)

TABLE 48

MEDICAL IMAGE ANALYSIS SOFTWARE MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 49

PACS & VNA MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 50

RADIOLOGY INFORMATION SYSTEMS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 51

LABORATORY INFORMATION SYSTEMS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 52

CLINICAL INFORMATICS MARKET FOR CLINICAL DECISION SUPPORT SYSTEMS, BY REGION, 2022–2030 (USD MILLION)

TABLE 53

CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 54

CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY REGION, 2022–2030 (USD MILLION)

TABLE 55

EPRESCRIBING SOLUTIONS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 56

COMPUTERIZED PHYSICIAN ORDER ENTRY SYSTEMS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 57

PHARMACY INFORMATION SYSTEMS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 58

CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 59

CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY REGION, 2022–2030 (USD MILLION)

TABLE 60

ONCOLOGY INFORMATION SYSTEMS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 61

CARDIOVASCULAR INFORMATION SYSTEMS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 62

OTHER SPECIALTY INFORMATION MANAGEMENT SOLUTIONS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 63

CLINICAL INFORMATICS MARKET FOR TELEHEALTH & TELEMEDICINE SOLUTIONS, BY REGION, 2022–2030 (USD MILLION)

TABLE 64

CLINICAL INFORMATICS MARKET FOR INFECTION SURVEILLANCE SOLUTIONS, BY REGION, 2022–2030 (USD MILLION)

TABLE 65

CLINICAL INFORMATICS MARKET FOR PATIENT PORTALS & ENGAGEMENT SOLUTIONS, BY REGION, 2022–2030 (USD MILLION)

TABLE 66

CLINICAL INFORMATICS MARKET FOR POPULATION HEALTH MANAGEMENT SOLUTIONS, BY REGION, 2022–2030 (USD MILLION)

TABLE 67

CLINICAL INFORMATICS MARKET FOR DATA ANALYTICS & REPORTING SOLUTIONS, BY REGION, 2022–2030 (USD MILLION)

TABLE 68

CLINICAL INFORMATICS MARKET FOR MOBILE HEALTH APPLICATIONS, BY REGION, 2022–2030 (USD MILLION)

TABLE 69

CLINICAL INFORMATICS MARKET FOR HCIT INTEGRATION & INTEROPERABILITY SYSTEMS, BY REGION, 2022–2030 (USD MILLION)

TABLE 70

CLINICAL INFORMATICS MARKET FOR OTHER FUNCTIONS, BY REGION, 2022–2030 (USD MILLION)

TABLE 71

CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 72

CLOUD-BASED CLINICAL INFORMATICS SOLUTIONS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 73

ON-PREMISE CLINICAL INFORMATICS SOLUTIONS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 74

HYBRID CLINICAL INFORMATICS SOLUTIONS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 75

CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 76

CLINICAL INFORMATICS SOFTWARE OFFERED BY KEY MARKET PLAYERS

TABLE 77

CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 78

CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY REGION, 2022–2030 (USD MILLION)

TABLE 79

CLINICAL INFORMATICS MARKET FOR STANDALONE SOFTWARE, BY REGION, 2022–2030 (USD MILLION)

TABLE 80

CLINICAL INFORMATICS MARKET FOR INTEGRATED SOFTWARE, BY REGION, 2022–2030 (USD MILLION)

TABLE 81

SERVICES OFFERED BY KEY MARKET PLAYERS

TABLE 82

CLINICAL INFORMATICS MARKET FOR SERVICES, BY REGION, 2022–2030 (USD MILLION)

TABLE 83

CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 84

INDICATIVE LIST OF COMPANIES OFFERING ONCOLOGY CLINICAL INFORMATICS SOLUTIONS

TABLE 85

CLINICAL INFORMATICS MARKET FOR ONCOLOGY, BY REGION, 2022–2030 (USD MILLION)

TABLE 86

CLINICAL INFORMATICS MARKET FOR CARDIOLOGY, BY REGION, 2022–2030 (USD MILLION)

TABLE 87

CLINICAL INFORMATICS MARKET FOR NEUROLOGY, BY REGION, 2022–2030 (USD MILLION)

TABLE 88

CLINICAL INFORMATICS MARKET FOR RESPIRATORY DISEASES, BY REGION, 2022–2030 (USD MILLION)

TABLE 89

CLINICAL INFORMATICS MARKET FOR IMMUNOLOGY, BY REGION, 2022–2030 (USD MILLION)

TABLE 90

CLINICAL INFORMATICS MARKET FOR METABOLIC DISORDERS, BY REGION, 2022–2030 (USD MILLION)

TABLE 91

CLINICAL INFORMATICS MARKET FOR INFECTIOUS DISEASES, BY REGION, 2022–2030 (USD MILLION)

TABLE 92

CLINICAL INFORMATICS MARKET FOR OTHER THERAPEUTIC AREAS, BY REGION, 2022–2030 (USD MILLION)

TABLE 93

CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 94

CLINICAL INFORMATICS MARKET FOR HOSPITALS, BY REGION, 2022–2030 (USD MILLION)

TABLE 95

CLINICAL INFORMATICS MARKET FOR ASCS, ACCS, AND OTHER OUTPATIENT SETTINGS, BY REGION, 2022–2030 (USD MILLION)

TABLE 96

CLINICAL INFORMATICS MARKET FOR SPECIALTY CARE CENTERS, BY REGION, 2022–2030 (USD MILLION)

TABLE 97

CLINICAL INFORMATICS MARKET FOR HOME HEALTHCARE, LONG-TERM CARE, AND ASSISTED LIVING FACILITIES, BY REGION, 2022–2030 (USD MILLION)

TABLE 98

CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING CENTERS, BY REGION, 2022–2030 (USD MILLION)

TABLE 99

CLINICAL INFORMATICS MARKET FOR PHARMACIES, BY REGION, 2022–2030 (USD MILLION)

TABLE 100

CLINICAL INFORMATICS MARKET FOR OTHER END USERS, BY REGION, 2022–2030 (USD MILLION)

TABLE 101

CLINICAL INFORMATICS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 102

NORTH AMERICA: CLINICAL INFORMATICS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 103

NORTH AMERICA: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 104

NORTH AMERICA: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 105

NORTH AMERICA: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 106

NORTH AMERICA: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 107

NORTH AMERICA: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 108

NORTH AMERICA: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 109

NORTH AMERICA: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 110

NORTH AMERICA: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 111

NORTH AMERICA: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 112

NORTH AMERICA: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 113

NORTH AMERICA: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 114

US: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 115

US: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 116

US: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 117

US: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 118

US: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 119

US: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 120

US: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 121

US: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 122

US: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 123

US: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 124

US: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 125

CANADA: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 126

CANADA: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 127

CANADA: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 128

CANADA: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 129

CANADA: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 130

CANADA: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 131

CANADA: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 132

CANADA: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 133

CANADA: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 134

CANADA: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 135

CANADA: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 136

EUROPE: CLINICAL INFORMATICS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 137

EUROPE: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 138

EUROPE: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 139

EUROPE: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 140

EUROPE: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 141

EUROPE: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 142

EUROPE: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 143

EUROPE: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 144

EUROPE: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 145

EUROPE: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 146

EUROPE: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 147

EUROPE: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 148

UK: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 149

UK: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 150

UK: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 151

UK: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 152

UK: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 153

UK: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 154

UK: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 155

UK: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 156

UK: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 157

UK: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 158

UK: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 159

GERMANY: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 160

GERMANY: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 161

GERMANY: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 162

GERMANY: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 163

GERMANY: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 164

GERMANY: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 165

GERMANY: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 166

GERMANY: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 167

GERMANY: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 168

GERMANY: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 169

GERMANY: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 170

FRANCE: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 171

FRANCE: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 172

FRANCE: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 173

FRANCE: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 174

FRANCE: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 175

FRANCE: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 176

FRANCE: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 177

FRANCE: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 178

FRANCE: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 179

FRANCE: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 180

FRANCE: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 181

ITALY: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 182

ITALY: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 183

ITALY: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 184

ITALY: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 185

ITALY: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 186

ITALY: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 187

ITALY: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 188

ITALY: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 189

ITALY: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 190

ITALY: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 191

ITALY: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 192

SPAIN: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 193

SPAIN: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 194

SPAIN: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 195

SPAIN: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 196

SPAIN: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 197

SPAIN: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 198

SPAIN: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 199

SPAIN: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE 2022–2030 (USD MILLION)

TABLE 200

SPAIN: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 201

SPAIN: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 202

SPAIN: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 203

REST OF EUROPE: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 204

REST OF EUROPE: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 205

REST OF EUROPE: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 206

REST OF EUROPE: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 207

REST OF EUROPE: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 208

REST OF EUROPE: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 209

REST OF EUROPE: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 210

REST OF EUROPE: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 211

REST OF EUROPE: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 212

REST OF EUROPE: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 213

REST OF EUROPE: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 214

ASIA PACIFIC: CLINICAL INFORMATICS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 215

ASIA PACIFIC: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 216

ASIA PACIFIC: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 217

ASIA PACIFIC: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 218

ASIA PACIFIC: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 219

ASIA PACIFIC: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 220

ASIA PACIFIC: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 221

ASIA PACIFIC: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 222

ASIA PACIFIC: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 223

ASIA PACIFIC: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 224

ASIA PACIFIC: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 225

ASIA PACIFIC: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 226

JAPAN: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 227

JAPAN: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 228

JAPAN: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 229

JAPAN: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 230

JAPAN: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 231

JAPAN: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 232

JAPAN: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 233

JAPAN: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 234

JAPAN: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 235

JAPAN: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 236

JAPAN: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 237

CHINA: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 238

CHINA: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 239

CHINA: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 240

CHINA: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 241

CHINA: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 242

CHINA: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 243

CHINA: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 244

CHINA: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 245

CHINA: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 246

CHINA: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 247

CHINA: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 248

INDIA: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 249

INDIA: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 250

INDIA: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 251

INDIA: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 252

INDIA: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 253

INDIA: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 254

INDIA: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 255

INDIA: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 256

INDIA: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 257

INDIA: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 258

INDIA: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 259

REST OF ASIA PACIFIC: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 260

REST OF ASIA PACIFIC: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 261

REST OF ASIA PACIFIC: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 262

REST OF ASIA PACIFIC: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 263

REST OF ASIA PACIFIC: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 264

REST OF ASIA PACIFIC: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 265

REST OF ASIA PACIFIC: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 266

REST OF ASIA PACIFIC: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 267

REST OF ASIA PACIFIC: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 268

REST OF ASIA PACIFIC: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 269

REST OF ASIA PACIFIC: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 270

LATIN AMERICA: CLINICAL INFORMATICS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 271

LATIN AMERICA: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 272

LATIN AMERICA: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 273

LATIN AMERICA: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 274

LATIN AMERICA: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 275

LATIN AMERICA: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 276

LATIN AMERICA: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 277

LATIN AMERICA: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 278

LATIN AMERICA: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 279

LATIN AMERICA: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 280

LATIN AMERICA: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 281

LATIN AMERICA: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 282

BRAZIL: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 283

BRAZIL: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 284

BRAZIL: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 285

BRAZIL: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 286

BRAZIL: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 287

BRAZIL: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 288

BRAZIL: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 289

BRAZIL: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 290

BRAZIL: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 291

BRAZIL: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 292

BRAZIL: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 293

MEXICO: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 294

MEXICO: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 295

MEXICO: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 296

MEXICO: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 297

MEXICO: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 298

MEXICO: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 299

MEXICO: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 300

MEXICO: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 301

MEXICO: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 302

MEXICO: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 303

MEXICO: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 304

REST OF LATIN AMERICA: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 305

REST OF LATIN AMERICA: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 306

REST OF LATIN AMERICA: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 307

REST OF LATIN AMERICA: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 308

REST OF LATIN AMERICA: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 309

REST OF LATIN AMERICA: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 310

REST OF LATIN AMERICA: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 311

REST OF LATIN AMERICA: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 312

REST OF LATIN AMERICA: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 313

REST OF LATIN AMERICA: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 314

REST OF LATIN AMERICA: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 315

MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 316

MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 317

MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 318

MIDDLE EAST & AFRICA: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 319

MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 320

MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 321

MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 322

MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 323

MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 324

MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 325

MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 326

MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 327

GCC COUNTRIES: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 328

GCC COUNTRIES: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 329

GCC COUNTRIES: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 330

GCC COUNTRIES: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 331

GCC COUNTRIES: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 332

GCC COUNTRIES: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 333

GCC COUNTRIES: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 334

GCC COUNTRIES: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 335

GCC COUNTRIES: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 336

GCC COUNTRIES: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 337

GCC COUNTRIES: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 338

REST OF THE MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET, BY FUNCTION, 2022–2030 (USD MILLION)

TABLE 339

REST OF THE MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET FOR CLINICAL WORKFLOW MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 340

REST OF THE MIDDLE EAST & AFRICA: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 341

REST OF THE MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET FOR DIAGNOSTIC & IMAGING SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 342

REST OF THE MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 343

REST OF THE MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET FOR SPECIALTY INFORMATION MANAGEMENT SOLUTIONS, BY TYPE, 2022–2030 (USD MILLION)

TABLE 344

REST OF THE MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

TABLE 345

REST OF THE MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET FOR SOFTWARE, BY TYPE, 2022–2030 (USD MILLION)

TABLE 346

REST OF THE MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2022–2030 (USD MILLION)

TABLE 347

REST OF THE MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2022–2030 (USD MILLION)

TABLE 348

REST OF THE MIDDLE EAST & AFRICA: CLINICAL INFORMATICS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 349

OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN CLINICAL INFORMATICS MARKET, JANUARY 2021–DECEMBER 2024

TABLE 350

CLINICAL INFORMATICS MARKET: DEGREE OF COMPETITION

TABLE 351

CLINICAL INFORMATICS MARKET: REGIONAL FOOTPRINT, 2023

TABLE 352

CLINICAL INFORMATICS MARKET: FUNCTION FOOTPRINT, 2023 (1/5)

TABLE 353

CLINICAL INFORMATICS MARKET: FUNCTION FOOTPRINT, 2023 (2/5)

TABLE 354

CLINICAL INFORMATICS MARKET: FUNCTION FOOTPRINT (3/5)

TABLE 355

CLINICAL INFORMATICS MARKET: FUNCTION FOOTPRINT (4/5)

TABLE 356

CLINICAL INFORMATICS MARKET: FUNCTION FOOTPRINT (5/5)

TABLE 357

CLINICAL INFORMATICS MARKET: COMPONENT FOOTPRINT, 2023

TABLE 358

CLINICAL INFORMATICS MARKET: DEPLOYMENT MODEL FOOTPRINT, 2023

TABLE 359

CLINICAL INFORMATICS MARKET: END-USER FOOTPRINT, 2023

TABLE 360

CLINICAL INFORMATICS MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

TABLE 361

CLINICAL INFORMATICS MARKET: COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS, BY REGION

TABLE 362

CLINICAL INFORMATICS MARKET: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 363

CLINICAL INFORMATICS MARKET: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 364

CLINICAL INFORMATICS MARKET: EXPANSIONS, JANUARY 2021–DECEMBER 2024

TABLE 365

CLINICAL INFORMATICS MARKET: OTHER DEVELOPMENTS, JANUARY 2021–DECEMBER 2024

TABLE 366

UNITEDHEALTH GROUP: COMPANY OVERVIEW

TABLE 367

UNITEDHEALTH GROUP: PRODUCTS OFFERED

TABLE 368

UNITEDHEALTH GROUP: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 369

UNITEDHEALTH GROUP: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 370

ORACLE: COMPANY OVERVIEW

TABLE 371

ORACLE: PRODUCTS OFFERED

TABLE 372

ORACLE: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 373

ORACLE: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 374

ORACLE: CONTRACTS, JANUARY 2021–DECEMBER 2024

TABLE 375

EPIC SYSTEMS CORPORATION: COMPANY OVERVIEW

TABLE 376

EPIC SYSTEMS CORPORATION: PRODUCTS OFFERED

TABLE 377

EPIC SYSTEMS CORPORATION: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 378

EPIC SYSTEMS CORPORATION: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 379

EPIC SYSTEMS CORPORATION: CONTRACTS, JANUARY 2021–DECEMBER 2024

TABLE 380

KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

TABLE 381

KONINKLIJKE PHILIPS N.V.: PRODUCTS OFFERED

TABLE 382

KONINKLIJKE PHILIPS N.V.: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 383

KONINKLIJKE PHILIPS N.V.: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 384

MCKESSON CORPORATION: COMPANY OVERVIEW

TABLE 385

MCKESSON CORPORATION: PRODUCTS OFFERED

TABLE 386

MCKESSON CORPORATION: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 387

MCKESSON CORPORATION: EXPANSIONS, JANUARY 2021–DECEMBER 2024

TABLE 388

GE HEALTHCARE: COMPANY OVERVIEW

TABLE 389

GE HEALTHCARE: PRODUCTS OFFERED

TABLE 390

GE HEALTHCARE: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 391

GE HEALTHCARE: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 392

COGNIZANT: COMPANY OVERVIEW

TABLE 393

COGNIZANT: PRODUCTS OFFERED

TABLE 394

COGNIZANT: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 395

COGNIZANT: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 396

EXLSERVICE HOLDINGS, INC.: COMPANY OVERVIEW

TABLE 397

EXLSERVICE HOLDINGS, INC.: PRODUCTS OFFERED

TABLE 398

EXLSERVICE HOLDINGS, INC.: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 399

ECLINICALWORKS: COMPANY OVERVIEW

TABLE 400

ECLINICALWORKS: PRODUCTS OFFERED

TABLE 401

ECLINICALWORKS: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 402

ECLINICALWORKS: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 403

MEDICAL INFORMATION TECHNOLOGY, INC.: COMPANY OVERVIEW

TABLE 404

MEDICAL INFORMATION TECHNOLOGY, INC.: PRODUCTS OFFERED

TABLE 405

MEDICAL INFORMATION TECHNOLOGY, INC.: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 406

MEDICAL INFORMATION TECHNOLOGY, INC.: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 407

MEDICAL INFORMATION TECHNOLOGY, INC.: CONTRACTS, JANUARY 2021–DECEMBER 2024

TABLE 408

MEDICAL INFORMATION TECHNOLOGY, INC.: OTHER DEVELOPMENTS, JANUARY 2021–MARCH 2024

TABLE 409

SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

TABLE 410

SIEMENS HEALTHINEERS AG: PRODUCTS OFFERED

TABLE 411

SIEMENS HEALTHINEERS AG: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 412

SIEMENS HEALTHINEERS AG: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 413

TRUBRIDGE: COMPANY OVERVIEW

TABLE 414

TRUBRIDGE: PRODUCTS OFFERED

TABLE 415

TRUBRIDGE: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 416

TRUBRIDGE: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 417

TRUBRIDGE: OTHER DEVELOPMENTS, JANUARY 2021–DECEMBER 2024

TABLE 418

VERADIGM LLC: COMPANY OVERVIEW

TABLE 419

VERADIGM LLC: PRODUCTS OFFERED

TABLE 420

VERADIGM LLC: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 421

ADVANCEDMD, INC.: COMPANY OVERVIEW

TABLE 422

ADVANCEDMD, INC.: PRODUCTS OFFERED

TABLE 423

ADVANCEDMD, INC.: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 424

ADVANCEDMD, INC.: OTHER DEVELOPMENTS, JANUARY 2021–DECEMBER 2024

TABLE 425

ATHENAHEALTH, INC.: COMPANY OVERVIEW

TABLE 426

ATHENAHEALTH, INC.: PRODUCTS OFFERED

TABLE 427

ATHENAHEALTH, INC.: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 428

ATHENAHEALTH, INC.: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 429

ATHENAHEALTH, INC.: CONTRACTS, JANUARY 2021–DECEMBER 2024

TABLE 430

MERATIVE: COMPANY OVERVIEW

TABLE 431

MERATIVE: PRODUCTS OFFERED

TABLE 432

MERATIVE: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 433

MERATIVE: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 434

MERATIVE: OTHER DEVELOPMENTS, JANUARY 2021–DECEMBER 2024

TABLE 435

NVIDIA CORPORATION: COMPANY OVERVIEW

TABLE 436

NVIDIA CORPORATION: PRODUCTS OFFERED

TABLE 437

NVIDIA CORPORATION: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–NOVEMBER 2024

TABLE 438

NVIDIA CORPORATION: DEALS, JANUARY 2021–NOVEMBER 2024

TABLE 439

AGFA HEALTHCARE: COMPANY OVERVIEW

TABLE 440

AGFA HEALTHCARE: PRODUCTS OFFERED

TABLE 441

AGFA HEALTHCARE: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 442

AGFA HEALTHCARE: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 443

NXGN MANAGEMENT, LLC: COMPANY OVERVIEW

TABLE 444

NXGN MANAGEMENT, LLC: PRODUCTS OFFERED

TABLE 445

NXGN MANAGEMENT, LLC: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 446

NXGN MANAGEMENT, LLC.: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 447

NXGN MANAGEMENT, LLC: EXPANSIONS, JANUARY 2021–DECEMBER 2024

TABLE 448

NXGN MANAGEMENT, LLC.: CONTRACTS, JANUARY 2021–DECEMBER 2024

TABLE 449

INTERSYSTEMS CORPORATION: COMPANY OVERVIEW

TABLE 450

INTERSYSTEMS CORPORATION: PRODUCTS OFFERED

TABLE 451

INTERSYSTEMS CORPORATION: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 452

INTERSYSTEMS CORPORATION: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 453

DEDALUS S.P.A.: COMPANY OVERVIEW

TABLE 454

DEDALUS S.P.A.: PRODUCTS OFFERED

TABLE 455

DEDALUS S.P.A.: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 456

IQVIA INC.: COMPANY OVERVIEW

TABLE 457

IQVIA INC.: PRODUCTS OFFERED

TABLE 458

IQVIA INC.: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 459

SAS INSTITUTE INC.: COMPANY OVERVIEW

TABLE 460

SAS INSTITUTE INC.: PRODUCTS OFFERED

TABLE 461

SAS INSTITUTE INC.: PRODUCT LAUNCHES/APPROVALS/UPGRADES, JANUARY 2021–DECEMBER 2024

TABLE 462

SAS INSTITUTE INC.: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 463

WIPRO: COMPANY OVERVIEW

TABLE 464

WIPRO: PRODUCTS OFFERED

TABLE 465

WIPRO: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 466

HEALTH CATALYST: COMPANY OVERVIEW

TABLE 467

HEALTH CATALYST: PRODUCTS OFFERED

TABLE 468

HEALTH CATALYST: DEALS, JANUARY 2021–DECEMBER 2024

TABLE 469

TEMPUS: COMPANY OVERVIEW

TABLE 470

PRACTICE FUSION, INC.: COMPANY OVERVIEW

TABLE 471

MEDEANALYTICS, INC.: COMPANY OVERVIEW

TABLE 472

MEDECISION: COMPANY OVERVIEW

TABLE 473

CHARTIS: COMPANY OVERVIEW

TABLE 474

ALLARA HEALTH: COMPANY OVERVIEW

TABLE 475

SURGICAL INFORMATION SYSTEMS: COMPANY OVERVIEW

TABLE 476

ANUMANA, INC.: COMPANY OVERVIEW

TABLE 477

MEMORA HEALTH INC.: COMPANY OVERVIEW

TABLE 478

MEDIVIEW XR, INC.: COMPANY OVERVIEW

FIGURE 1

CLINICAL INFORMATICS MARKET: SEGMENTS CONSIDERED & GEOGRAPHICAL SPREAD

FIGURE 2

CLINICAL INFORMATICS MARKET: YEARS CONSIDERED

FIGURE 3

CLINICAL INFORMATICS MARKET: RESEARCH DESIGN

FIGURE 4

CLINICAL INFORMATICS MARKET: KEY DATA FROM SECONDARY SOURCES

FIGURE 5

CLINICAL INFORMATICS MARKET: KEY SOURCES FOR PRIMARY DATA

FIGURE 6

CLINICAL INFORMATICS MARKET: KEY DATA FROM PRIMARY SOURCES

FIGURE 7

CLINICAL INFORMATICS MARKET: KEY INDUSTRY INSIGHTS

FIGURE 8

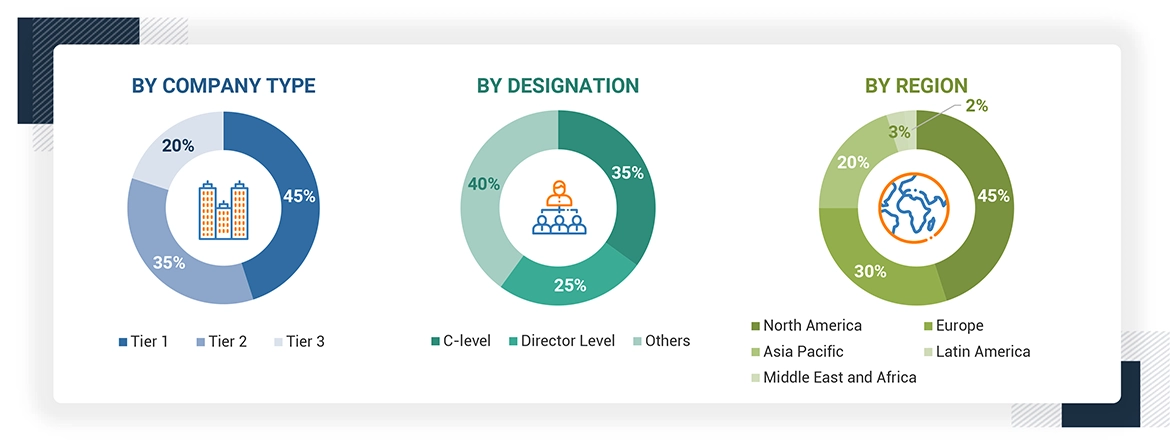

BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 9

RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

FIGURE 10

CLINICAL INFORMATICS MARKET: SUPPLY-SIDE MARKET ESTIMATION

FIGURE 11

CLINICAL INFORMATICS MARKET: REVENUE ESTIMATION APPROACH

FIGURE 12

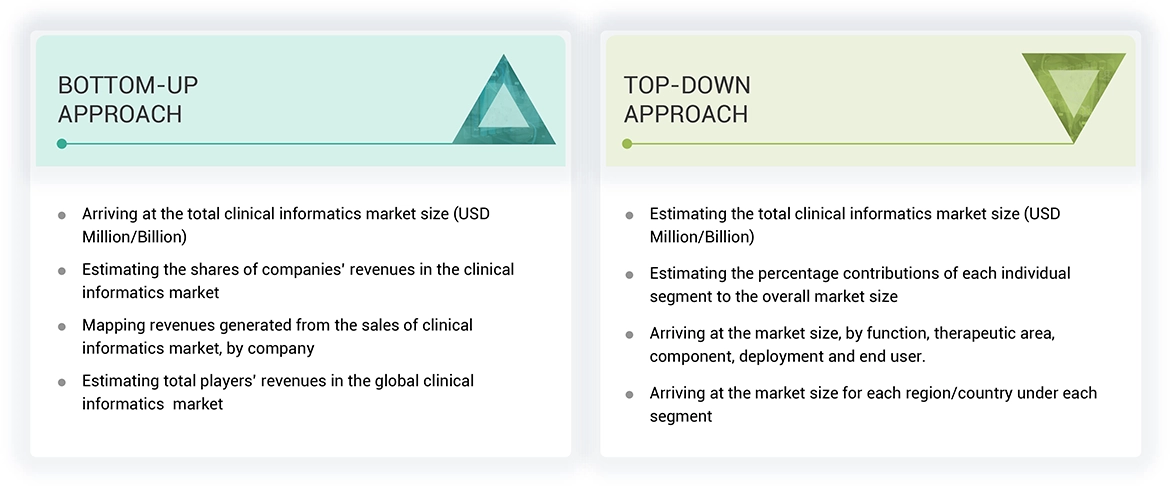

BOTTOM-UP APPROACH: END-USER SPENDING ON CLINICAL INFORMATICS

FIGURE 13

CLINICAL INFORMATICS MARKET: TOP-DOWN APPROACH

FIGURE 14

CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2024–2030)

FIGURE 15

CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 16

CLINICAL INFORMATICS MARKET: DATA TRIANGULATION

FIGURE 17

CLINICAL INFORMATICS MARKET, BY FUNCTION, 2024 VS. 2030 (USD MILLION)

FIGURE 18

CLINICAL INFORMATICS MARKET, BY THERAPEUTIC AREA, 2024 VS. 2030 (USD MILLION)

FIGURE 19

CLINICAL INFORMATICS MARKET, BY COMPONENT, 2024 VS. 2030 (USD MILLION)

FIGURE 20

CLINICAL INFORMATICS MARKET, BY DEPLOYMENT MODEL, 2024 VS. 2030 (USD MILLION)

FIGURE 21

CLINICAL INFORMATICS MARKET, BY END USER, 2024 VS. 2030 (USD MILLION)

FIGURE 22

CLINICAL INFORMATICS MARKET: REGIONAL SNAPSHOT

FIGURE 23

FOCUS ON REDUCING HEALTHCARE COSTS AND IMPROVING DATA STANDARDIZATION TO DRIVE MARKET

FIGURE 24

US AND HOSPITALS SEGMENTS ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

FIGURE 25

CHINA TO REGISTER HIGHEST CAGR DURING STUDY PERIOD

FIGURE 26

EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES FROM 2024 TO 2030

FIGURE 27

CLINICAL INFORMATICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 28

HEALTH EXPENDITURE AS SHARE OF GDP, 2022

FIGURE 29

US: HOSPITAL & PHYSICIAN ADOPTION OF EHR, 2008–2021

FIGURE 30

US: MEDICARE-CERTIFIED ASCS, BY STATE (AS OF SEPTEMBER 2024)

FIGURE 31

WORLD POPULATION COVERAGE, BY MOBILE NETWORK TYPE (2015−2023)

FIGURE 32

WORLD POPULATION COVERAGE FOR MOBILE NETWORK TYPE, BY REGION (2023)

FIGURE 33

APPROVAL OF PERSONALIZED MEDICINES BY US FDA, 2015–2023

FIGURE 34

US: HEALTHCARE SECURITY BREACHES OF 500+ RECORDS, 2009–2024

FIGURE 35

US: MEDIAN HEALTHCARE DATA BREACH SIZE, 2009–2024

FIGURE 36

INDIVIDUALS AFFECTED BY HEALTHCARE SECURITY BREACHES IN US, 2009–2023

FIGURE 37

REVENUE SHIFT IN CLINICAL INFORMATICS MARKET

FIGURE 38

CLINICAL INFORMATICS MARKET: ECOSYSTEM ANALYSIS

FIGURE 39

CLINICAL INFORMATICS MARKET: VALUE CHAIN ANALYSIS (2023)

FIGURE 40

AVERAGE SELLING PRICE TREND OF KEY PLAYERS FOR EHR (2023)

FIGURE 41

CLINICAL INFORMATICS MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 42

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

FIGURE 43

KEY BUYING CRITERIA FOR TOP THREE END USERS

FIGURE 44

PATENT PUBLICATION TRENDS IN CLINICAL INFORMATICS MARKET, 2015–2024

FIGURE 45

JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR “CLINICAL INFORMATICS” PATENTS (JANUARY 2015–NOVEMBER 2024)

FIGURE 46

LEADING PATENTS IN CLINICAL INFORMATICS MARKET (JANUARY 2015–NOVEMBER 2024)

FIGURE 48

MARKET POTENTIAL OF AI/GENERATIVE AI CLINICAL INFORMATICS ACROSS INDUSTRIES

FIGURE 49

US: NEW CANCER CASES, 2024

FIGURE 50

NORTH AMERICA: CLINICAL INFORMATICS MARKET SNAPSHOT

FIGURE 51

EUROPE: CLINICAL INFORMATICS MARKET SNAPSHOT

FIGURE 52

ASIA PACIFIC: CLINICAL INFORMATICS MARKET SNAPSHOT

FIGURE 53

REVENUE ANALYSIS OF KEY PLAYERS IN CLINICAL INFORMATICS MARKET, 2019–2023 (USD MILLION)

FIGURE 54

MARKET SHARE ANALYSIS OF KEY PLAYERS IN CLINICAL INFORMATICS MARKET, 2023

FIGURE 55

EV/EBITDA OF KEY VENDORS, 2024

FIGURE 56

YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND A 5-YEAR STOCK BETA OF CLINICAL INFORMATICS VENDORS, 2024

FIGURE 57

CLINICAL INFORMATICS MARKET: BRAND/SOFTWARE COMPARATIVE ANALYSIS

FIGURE 58

CLINICAL INFORMATICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

FIGURE 59

CLINICAL INFORMATICS MARKET: COMPANY FOOTPRINT, 2023

FIGURE 60

CLINICAL INFORMATICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

FIGURE 61

UNITEDHEALTH GROUP: COMPANY SNAPSHOT (2023)

FIGURE 62

ORACLE: COMPANY SNAPSHOT (2023)

FIGURE 63

KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2023)

FIGURE 64

MCKESSON CORPORATION: COMPANY SNAPSHOT (2023)

FIGURE 65

GE HEALTHCARE: COMPANY SNAPSHOT (2023)

FIGURE 66

COGNIZANT: COMPANY SNAPSHOT (2023)

FIGURE 67

EXLSERVICE HOLDINGS, INC.: COMPANY SNAPSHOT (2023)

FIGURE 68

SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2023)

FIGURE 69

TRUBRIDGE: COMPANY SNAPSHOT (2023)

FIGURE 70

VERADIGM LLC: COMPANY SNAPSHOT (2021)

FIGURE 71

NVIDIA CORPORATION: COMPANY SNAPSHOT (2023)

FIGURE 72

IQVIA INC.: COMPANY SNAPSHOT (2023)

FIGURE 73

WIPRO: COMPANY SNAPSHOT (2023)

FIGURE 74

HEALTH CATALYST: COMPANY SNAPSHOT (2023)

Growth opportunities and latent adjacency in Clinical Informatics Market