This research study involved the extensive use of both primary and secondary sources. It involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research:

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, white papers, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the Chromatography reagents market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research:

In the primary research process, various supply side and demand side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the Chromatography reagents market. Primary sources from the demand side included researchers, lab technicians, reagent suppliers, purchase managers etc, and stakeholders in corporate & government bodies.

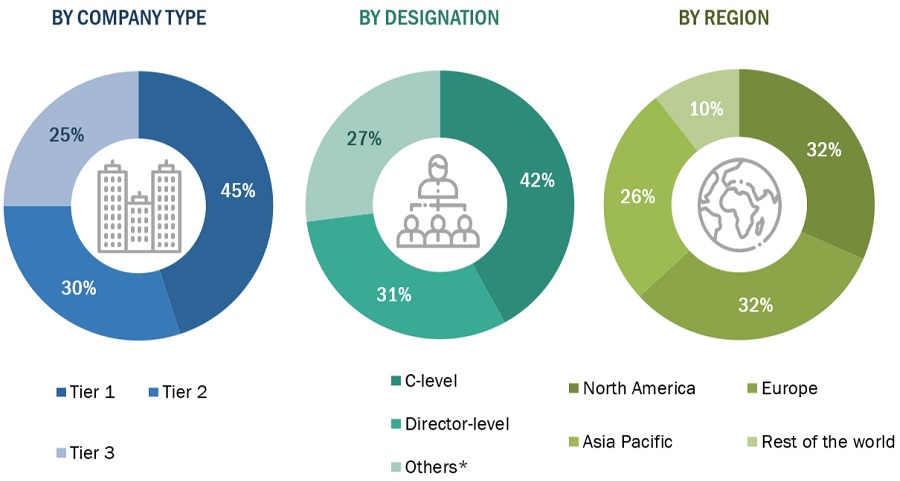

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

The total size of the Chromatography reagents was arrived at after data triangulation through the two approaches mentioned below. After the completion of each approach, the weighted average of these approaches was taken based on the level of assumptions used in each approach.

Data Triangulation:

The size of the Chromatography reagents was estimated through segmental extrapolation using the bottom-up approach. The methodology used is as given below:

-

Shares of leading players in the Chromatography reagents market were gathered from secondary sources to the extent available. In some instances, shares of Chromatography reagents have been ascertained after a detailed analysis of various parameters, including product portfolios, market positioning, selling price, and geographic reach & strength.

-

Individual shares or revenue estimates were validated through interviews with experts.

The total revenue in the Chromatography reagents was determined by extrapolating the Market share data of major companies.

Global Chromatography reagents market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Definition:

Chromatography Reagents:

Chromatography is a biophysical technique that separates, identifies, and/or purifies the components of a mixture for qualitative and quantitative analysis. Chromatography reagents are essential chemicals used in chromatographic processes to separate and analyze complex mixtures of compounds. They enable accurate qualitative and quantitative analyses across various industries, including pharmaceuticals, biotechnology, environmental testing, food and beverage, and forensic science.

Key Stakeholders:

-

Chromatography reagent manufacturers

-

Third-party chromatography reagent suppliers

-

Reagent raw material suppliers

-

Pharmaceutical, biopharmaceutical, and biotechnology companies

-

Food and beverage industry

-

Environment protection and forensic institutes

-

Clinicians, researchers, hospitals, and pharmaceutical research laboratories

-

Research institutes and academic centers

-

Government bodies/municipal corporations

-

Contract research organizations (CROs)

-

Business research and consulting service providers

-

Forensic laboratories

-

Diagnostic laboratories

-

Research institutes and laboratories

-

Academic centers

-

Product manufacturers, distributors, and suppliers

-

Venture capitalists and other government funding organizations

Objectives of the Study:

-

To define, describe, segment, and forecast the chromatography reagents market based on type, technology, separation mechanism, end user, and region

-

To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges), key industry trends, regulatory landscape, and pricing trends of major reagent categories at a regional level

-

To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall chromatography reagents market

-

To analyze the opportunities in the global chromatography reagents market for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the revenue of market segments with respect to five major regions: North America (US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), the Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (GCC Countries and Rest of Middle East & Africa)

-

To profile the key players and comprehensively analyze their market shares and core competencies2

-

To benchmark players within the market using a proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

-

To track and analyze competitive developments such as product launches, agreements & partnerships, mergers & acquisitions, and research activities in the chromatography reagents market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information:

-

Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis:

-

Further breakdown of the Rest of Europe Chromatography reagents market into Denmark, Norway, and others

-

Further breakdown of the Rest of Asia Pacific Chromatography reagents market into Vietnam, New Zealand, and others

Growth opportunities and latent adjacency in Chromatography Reagents Market