Gas Chromatography Market by Instrument (Systems, Detectors), Accessories and Consumables (Columns, Column Accessories, Pressure Regulators, Gas Generators), End User (Oil & Gas Industry, Environmental Agencies, Pharma & Biotech) and Region - Global Forecast to 2025

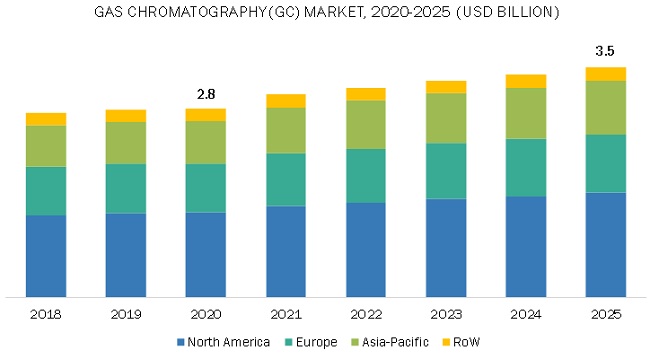

The size of global gas chromatography market in terms of revenue was estimated to be worth $2.8 billion in 2020 and is poised to reach $3.5 billion by 2025, growing at a CAGR of 4.1% from 2020 to 2025. The research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The growth in this market is driven by rising food safety concerns, and growing use of chromatography tests in the drug approval process coupled with greater utilization for hyphenated chromatology systems in industrial research & manufacturing processes.

Adoption of GC systems in the gas chromatography industry is expected to increase during the forecast period.

The systems segment of the gas chromatography market is expected to account for the highest growth due to factors such increased capability to analyze complex compounds.

The columns segment of the gas chromatography industry will grow at the highest rate during the forecast period.

On the basis of accessories and consumables, the gas chromatography market is divided into columns, columns accessories, autosampler accessories, flow management accessories, consumables & accessories, fittings & tubing, pressure regulators, gas generators, and other accessories. The columns segment is estimated to account for the largest share in the global gas chromatography market. The large share of this segment can primarily be attributed to factors such as improved gas chromatography columns for the petroleum industry.

Oil and Gas is expected to rise in the forecast period in the end user segment of the gas chromatography industry.

The Oil and Gas industry is growing at a CAGR of 4.1% in the end user gas chromatography market. The growth is mainly attributed to increasing crude & shale oil production and improved gas chromatography columns for the petroleum industry

Asia-Pacific Region of the gas chromatography industry is projected to witness the highest growth rate during the forecast period

Asia Pacific is projected to have the highest growth rate during the forecast period. The high growth rate of the region can be attributed to factors such as extensive sales of generics in Japan and the growth in the pharma and biotech sectors in India and China.

The gas chromatography market is well established due to dominance of prominent market players such as Agilent Technologies, Inc. (US), Thermo Fisher Scientific, Inc. (US), Shimadzu Corporation (Japan), PerkinElmer, Inc. (US), Restek Corporation (US), Dani Instruments S.P.A. (Italy), Chromatotec (France), Merck KGAA (Germany), Leco Corporation (US), Scion Instruments (US), Phenomenex (US), GL Sciences(Japan), OI Analytical (US), Valco Company Instruments Inc.(US), Centurion Scientific (India), SRI Instruments (US), Skyray Instruments(US), E ChromTech Co. Ltd. (Taiwan), Trajan Scientific (Australia), and Falcon Analytical (US).

Scope of the Gas Chromatography Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$2.8 billion |

|

Projected Revenue Size by 2025 |

$3.5 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 4.1% |

|

Market Driver |

Growing importance of chromatography tests in the drug approval process |

|

Market Opportunity |

Growing demand for chromatography instruments in emerging markets |

The research report categorizes the gas chromatography market to forecast revenue and analyze trends in each of the following submarkets:

By Instruments

- Systems

- Detectors

- Autosamplers

- Fraction Collectors

By Accessories and Consumables

- Columns

- Columns Accessories

- Autosampler Accessories

- Flow Management Accessories

- Consumables & Accessories

- Fittings & Tubing

- Pressure Regulators

- Gas Generators

- Other Accessories

By End User

- Oil & Gas Industry

- Environmental Agencies

- Food & Beverage Industry

- Pharma & Biotech

- Academic & Government research Institutes

- Cosmetics Industry

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments of Gas Chromatography Industry:

- In 2019, Agilent launched the 990 Micro GC System. The system is designed to monitor calorific valuation and odorant levels in natural gas. It is a compact and rugged system that may be used in laboratories

- In 2018, The University of Duisburg Essen collaborated with Agilent to utilize its gas and liquid chromatography systems and a variety of its mass spectrometry instruments to conduct improved research studies.

- In 2018, PerkinElmer acquired Shanghai Spectrum Instruments Co., Ltd. This acquisition will allow PerkinElmer to expand its customer base for analytical instruments in China.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global gas chromatography market?

The global gas chromatography market boasts a total revenue value of $3.5 billion by 2025.

What is the estimated growth rate (CAGR) of the global gas chromatography market?

The global gas chromatography market has an estimated compound annual growth rate (CAGR) of 4.1% and a revenue size in the region of $2.8 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENT

1 INTRODUCTION (Page No. - 15)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 18)

2.1 RESEARCH DATA

2.2 RESEARCH METHODOLOGY STEPS

2.2.1 SECONDARY DATA

2.2.1.1 Secondary sources

2.2.2 PRIMARY RESEARCH

2.2.2.1 Primary sources

2.2.2.2 Key insights from primary sources

2.2.3 MARKET SIZE ESTIMATION METHODOLOGY

2.2.4 REVENUE MAPPING-BASED MARKET ESTIMATION

2.3 MARKET DATA ESTIMATION AND TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 26)

4 PREMIUM INSIGHTS (Page No. - 29)

4.1 GLOBAL GAS CHROMATOGRAPHY MARKET

4.2 GEOGRAPHIC ANALYSIS: GAS CHROMATOGRAPHY MARKET BY REGION

4.3 GAS CHROMATOGRAPHY MARKET BY INSTRUMENT

4.4 GAS CHROMATOGRAPHY MARKET BY ACCESSORIES & CONSUMABLES

4.5 GAS CHROMATOGRAPHY MARKET BY END-USER INDUSTRY

5 MARKET OVERVIEW (Page No. - 32)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing crude & shale oil production

5.2.1.2 Collaborations between chromatography instrument manufacturers and research laboratories/academic institutes

5.2.1.3 Rising adoption of GC-MS

5.2.1.4 Development of policies and initiatives to reduce environmental pollution levels

5.2.1.5 Growing food safety concerns

5.2.1.6 Growing importance of chromatography tests in the drug approval process

5.2.2 RESTRAINTS

5.2.2.1 High cost of gas chromatography equipment

5.2.2.2 Geopolitical issues prevailing in some countries

5.2.3 OPPORTUNITIES

5.2.3.1 Improved gas chromatography columns for the petroleum industry

5.2.3.2 Growing proteomics market

5.2.3.3 Growing demand for chromatography instruments in emerging markets

5.2.4 CHALLENGES

5.2.4.1 Dearth of skilled professionals

5.3 IMPACT OF COVID-19 ON THE GAS CHROMATOGRAPHY MARKET

6 GAS CHROMATOGRAPHY MARKET BY INSTRUMENT (Page No. - 40)

6.1 INTRODUCTION

6.2 SYSTEMS

6.3 DETECTORS

6.3.1 FLAME IONIZATION DETECTOR (FID)

6.3.2 THERMAL CONDUCTIVITY DETECTORS (TCD)

6.3.3 MASS SPECTROMETRY (MS) DETECTORS

6.3.4 OTHER DETECTORS

6.3.4.1 Nitrogen phosphorous detector (NPD)

6.3.4.2 Electron capture detector (ECD)

6.3.4.3 Photoionization detector (PID)

6.3.4.4 Flame photometric detector (FPD)

6.4 AUTOSAMPLERS

6.5 FRACTION COLLECTORS

7 GAS CHROMATOGRAPHY MARKET BY ACCESSORIES & CONSUMABLES (Page No. - 49)

7.1 INTRODUCTION

7.2 COLUMNS

7.2.1 PACKED COLUMNS

7.2.2 CAPILLARY COLUMN

7.3 COLUMN ACCESSORIES

7.4 AUTOSAMPLER ACCESSORIES

7.5 FLOW MANAGEMENT ACCESSORIES

7.6 FITTINGS AND TUBING

7.7 PRESSURE REGULATORS

7.8 GAS GENERATORS

7.9 OTHER ACCESSORIES

8 GAS CHROMATOGRAPHY MARKET BY END-USER INDUSTRY (Page No. - 57)

8.1 INTRODUCTION

8.2 OIL & GAS

8.3 ENVIRONMENTAL AGENCIES

8.4 FOOD AND BEVERAGES

8.5 PHARMACEUTICAL & BIOTECHNOLOGY

8.6 OTHERS

8.6.1 ACADEMIC & GOVERNMENT RESEARCH INSTITUTES

8.6.2 COSMETICS

9 GAS CHROMATOGRAPHY MARKET BY REGION (Page No. - 64)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.1.1 US accounted for the largest share of the North American market

9.2.2 CANADA

9.2.2.1 Growth of food and agricultural sectors to drive the Canadian market

9.3 EUROPE

9.3.1 GERMANY

9.3.1.1 Increased R&D to drive the German market

9.3.2 UK

9.3.2.1 Growth in research funding by government and funding agencies to drive the UK market

9.3.3 FRANCE

9.3.3.1 Strong perfume industry and pharma establishment to drive the French market

9.3.4 ITALY

9.3.4.1 Growth in biotechnology and pharmaceutical industries to drive the Italian market

9.3.5 SPAIN

9.3.5.1 Growth in the food agriculture and biotechnology industries will drive the Spanish market

9.3.6 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 JAPAN

9.4.1.1 Rising production of generics and improved grants for research will drive the Japanese market

9.4.2 CHINA

9.4.2.1 Growth in the biotechnology sector to drive the Chinese market

9.4.3 INDIA

9.4.3.1 Growing pharmaceutical sector to drive the Indian market

9.4.4 REST OF ASIA PACIFIC (ROAPAC)

9.5 REST OF THE WORLD

9.5.1 MIDDLE EAST AND AFRICA

9.5.1.1 Rising healthcare expenditure and improved laws to tackle counterfeit medicines to drive market growth

9.5.2 LATIN AMERICA

9.5.2.1 Growth in the biotechnology & pharmaceutical industries to drive the market

10 COMPETITIVE LANDSCAPE (Page No. - 111)

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

10.3 REVENUE ANALYSIS OF TOP THREE PLAYERS 2019

10.4 KEY MARKET DEVELOPMENTS

10.4.1 PRODUCT LAUNCHES

10.4.2 AGREEMENTS PARTNERSHIPS & COLLABORATIONS

10.4.3 ACQUISITIONS

10.4.4 EXPANSIONS

11 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 116)

11.1 OVERVIEW

11.2 COMPANY EVALUATION MATRIX DEFINITION AND METHODOLOGY

11.2.1 MARKET SHARES OF PLAYERS 2019

11.2.2 PRODUCT FOOTPRINT

11.2.3 STAR

11.2.4 EMERGING LEADERS

11.2.5 EMERGING COMPANIES

11.2.6 PERVASIVE

11.3 COMPANY PROFILES

(Business Overview Products Offered Recent Developments MnM View)*

11.3.1 AGILENT TECHNOLOGIES INC.

11.3.2 MNM VIEW

11.3.3 THERMO FISHER SCIENTIFIC INC.

11.3.4 SHIMADZU CORPORATION

11.3.5 PERKINELMER INC.

11.3.6 PRODUCTS OFFERED

11.3.7 RESTEK CORPORATION

11.3.8 DANI INSTRUMENTS

11.3.9 MERCK KGAA

11.3.10 LECO CORPORATION

11.3.11 SCION INSTRUMENTS

11.3.12 FALCON ANALYTICAL SYSTEM AND TECHNOLOGIES

11.3.13 CHROMATOTEC

11.3.14 PHENOMENEX

11.3.15 GL SCIENCES

11.3.16 OI ANALYTICAL

11.3.17 VALCO INSTRUMENTS COMPANY INC. (VICI)

11.3.18 CENTURION SCIENTIFIC

11.3.19 SRI INSTRUMENTS

11.3.20 SKYRAY INSTRUMENTS

11.3.22 E-CHROM TECH CO. LTD.

11.3.23 TRAJAN SCIENTIFIC

*Business Overview Products Offered Recent Developments MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 160)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

LIST OF TABLES (124 TABLES)

TABLE 1 STRINGENT REGULATIONS IN ENVIRONMENTAL TESTING

TABLE 2 GAS CHROMATOGRAPHY MARKET BY INSTRUMENT 2018–2025 (USD MILLION)

TABLE 3 GC SYSTEMS MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 4 ATTRIBUTES AND PERFORMANCE SPECIFICATIONS OF DIFFERENT GC DETECTORS

TABLE 5 GC DETECTORS MARKET BY TYPE 2018–2025 (USD MILLION)

TABLE 6 GC DETECTORS MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 7 GC FID MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 8 GC TCD MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 9 GC MS DETECTORS MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 10 GC OTHER DETECTORS MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 11 GC AUTOSAMPLERS MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 12 GC FRACTION COLLECTORS MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 13 GAS CHROMATOGRAPHY BY ACCESSORIES & CONSUMABLES 2018–2025 (USD MILLION)

TABLE 14 GC COLUMNS MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 15 GC COLUMNS ACCESSORIES MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 16 GC AUTOSAMPLER MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 17 GC FLOW MANAGEMENT MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 18 GC FITTINGS AND TUBING MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 19 GC PRESSURE REGULATORS MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 20 GC GAS GENERATORS MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 21 GC OTHER ACCESSORIES MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 22 GC END-USER INDUSTRY MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 23 GC OIL AND GAS MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 24 GC ENVIRONMENTAL AGENCIES MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 25 GC FOOD AND BEVERAGES MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 26 PHARMACEUTICAL EXPORT DATA FROM INDIA AND CHINA

TABLE 27 GC PHARMA AND BIOTECHNOLOGY MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 28 GC ACADEMICS AND GOVERNMENT RESEARCH INSTITUTES MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 29 GC COSMETICS MARKET BY REGION 2018–2025 (USD MILLION)

TABLE 30 GAS CHROMATOGRAPHY INDUSTRY BY REGION 2018–2025 (USD MILLION)

TABLE 31 NORTH AMERICA: GAS CHROMATOGRAPHY MARKET BY COUNTRY 2018–2025 (USD MILLION)

TABLE 32 NORTH AMERICA: GC INSTRUMENT MARKET 2018–2025 (USD MILLION)

TABLE 33 NORTH AMERICA: GC DETECTOR MARKET 2018–2025 (USD MILLION)

TABLE 34 NORTH AMERICA: GC ACCESSORIES & CONSUMABLES MARKET 2018–2025 (USD MILLION)

TABLE 35 NORTH AMERICA: GC END-USER INDUSTRY MARKET 2018–2025 (USD MILLION)

TABLE 36 US: GAS CHROMATOGRAPHY INDUSTRY BY PRODUCT 2018–2025 (USD MILLION)

TABLE 37 US: GC INSTRUMENT MARKET 2018–2025 (USD MILLION)

TABLE 38 US: GC DETECTOR MARKET 2018–2025 (USD MILLION)

TABLE 39 US: GC ACCESSORIES & CONSUMABLES MARKET 2018–2025 (USD MILLION)

TABLE 40 US: GC END-USER INDUSTRY MARKET 2018–2025 (USD MILLION)

TABLE 41 CANADA: GAS CHROMATOGRAPHY MARKET BY PRODUCT 2018–2025 (USD MILLION)

TABLE 42 CANADA: GC INSTRUMENT MARKET 2018–2025 (USD MILLION)

TABLE 43 CANADA: GC DETECTOR MARKET 2018–2025 (USD MILLION)

TABLE 44 CANADA: GC ACCESSORIES & CONSUMABLES MARKET 2018–2025 (USD MILLION)

TABLE 45 CANADA: GC END-USER INDUSTRY MARKET 2018–2025 (USD MILLION)

TABLE 46 EUROPE: GAS CHROMATOGRAPHY INDUSTRY BY COUNTRY 2018–2025 (USD MILLION)

TABLE 47 EUROPE: GC INSTRUMENT MARKET 2018–2025 (USD MILLION)

TABLE 48 EUROPE: GC DETECTOR MARKET 2018–2025 (USD MILLION)

TABLE 49 EUROPE: GC ACCESSORIES & CONSUMABLES MARKET 2018–2025 (USD MILLION)

TABLE 50 EUROPE: GC END-USER INDUSTRY MARKET 2018–2025 (USD MILLION)

TABLE 51 GERMANY: GAS CHROMATOGRAPHY MARKET BY PRODUCT 2018–2025 (USD MILLION)

TABLE 52 GERMANY: GC INSTRUMENT MARKET 2018–2025 (USD MILLION)

TABLE 53 GERMANY: GC DETECTOR MARKET 2018–2025 (USD MILLION)

TABLE 54 GERMANY: GC ACCESSORIES & CONSUMABLES MARKET 2018–2025 (USD MILLION)

TABLE 55 GERMANY: GC END-USER INDUSTRY MARKET 2018–2025 (USD MILLION)

TABLE 56 UK: GAS CHROMATOGRAPHY INDUSTRY BY PRODUCT 2018–2025 (USD MILLION)

TABLE 57 UK: GC INSTRUMENT MARKET 2018–2025 (USD MILLION)

TABLE 58 UK: GC DETECTOR MARKET 2018–2025 (USD MILLION)

TABLE 59 UK: GC ACCESSORIES & CONSUMABLES MARKET 2018–2025 (USD MILLION)

TABLE 60 UK: GC END-USER INDUSTRY MARKET 2018–2025 (USD MILLION)

TABLE 61 FRANCE: GAS CHROMATOGRAPHY INDUSTRY BY PRODUCT 2018–2025 (USD MILLION)

TABLE 62 FRANCE: GC INSTRUMENT MARKET 2018–2025 (USD MILLION)

TABLE 63 FRANCE: GC DETECTOR MARKET 2018–2025 (USD MILLION)

TABLE 64 FRANCE: GC ACCESSORIES & CONSUMABLES MARKET 2018–2025 (USD MILLION)

TABLE 65 FRANCE: GC END-USER INDUSTRY MARKET 2018–2025 (USD MILLION)

TABLE 66 ITALY: GAS CHROMATOGRAPHY MARKET BY PRODUCT 2018–2025 (USD MILLION)

TABLE 67 ITALY: GC INSTRUMENT MARKET 2018–2025 (USD MILLION)

TABLE 68 ITALY: GC DETECTOR MARKET 2018–2025 (USD MILLION)

TABLE 69 ITALY: GC ACCESSORIES & CONSUMABLES MARKET 2018–2025 (USD MILLION)

TABLE 70 ITALY: GC END-USER INDUSTRY MARKET 2018–2025 (USD MILLION)

TABLE 71 SPAIN: GAS CHROMATOGRAPHY INDUSTRY BY PRODUCT 2018–2025 (USD MILLION)

TABLE 72 SPAIN: GC INSTRUMENT MARKET 2018–2025 (USD MILLION)

TABLE 73 SPAIN: GC DETECTOR MARKET 2018–2025 (USD MILLION)

TABLE 74 SPAIN: GC ACCESSORIES & CONSUMABLES MARKET 2018–2025 (USD MILLION)

TABLE 75 SPAIN: GC END-USER INDUSTRY MARKET 2018–2025 (USD MILLION)

TABLE 76 ROE: GAS CHROMATOGRAPHY INDUSTRY BY PRODUCT 2018–2025 (USD MILLION)

TABLE 77 ROE: GC INSTRUMENT MARKET 2018–2025 (USD MILLION)

TABLE 78 ROE: GC DETECTOR MARKET 2018–2025 (USD MILLION)

TABLE 79 ROE: GC ACCESSORIES & CONSUMABLES MARKET 2018–2025 (USD MILLION)

TABLE 80 ROE: GC END-USER INDUSTRY MARKET 2018–2025 (USD MILLION)

TABLE 81 APAC: GAS CHROMATOGRAPHY INDUSTRY BY COUNTRY 2018–2025 (USD MILLION)

TABLE 82 APAC: GC INSTRUMENT MARKET 2018–2025 (USD MILLION)

TABLE 83 APAC: GC DETECTOR MARKET 2018–2025 (USD MILLION)

TABLE 84 APAC: GC ACCESSORIES & CONSUMABLES MARKET 2018–2025 (USD MILLION)

TABLE 85 APAC: GC END-USER INDUSTRY MARKET 2018–2025 (USD MILLION)

TABLE 86 JAPAN: GAS CHROMATOGRAPHY MARKET BY PRODUCT 2018–2025 (USD MILLION)

TABLE 87 JAPAN: GC INSTRUMENT MARKET 2018–2025 (USD MILLION)

TABLE 88 JAPAN: GC DETECTOR MARKET 2018–2025 (USD MILLION)

TABLE 89 JAPAN: GC ACCESSORIES & CONSUMABLES MARKET 2018–2025 (USD MILLION)

TABLE 90 JAPAN: GC END-USER INDUSTRY MARKET 2018–2025 (USD MILLION)

TABLE 91 CHINA: GAS CHROMATOGRAPHY INDUSTRY BY PRODUCT 2018–2025 (USD MILLION)

TABLE 92 CHINA: GC INSTRUMENT MARKET 2018–2025 (USD MILLION)

TABLE 93 CHINA: GC DETECTOR MARKET 2018–2025 (USD MILLION)

TABLE 94 CHINA: GC ACCESSORIES & CONSUMABLES MARKET 2018–2025 (USD MILLION)

TABLE 95 CHINA: GC END-USER INDUSTRY MARKET 2018–2025 (USD MILLION)

TABLE 96 INDIA: GAS CHROMATOGRAPHY MARKET BY PRODUCT 2018–2025 (USD MILLION)

TABLE 97 INDIA: GC INSTRUMENT MARKET 2018–2025 (USD MILLION)

TABLE 98 INDIA: GC DETECTOR MARKET 2018–2025 (USD MILLION)

TABLE 99 INDIA: GC ACCESSORIES & CONSUMABLES MARKET 2018–2025 (USD MILLION)

TABLE 100 INDIA: GC END-USER INDUSTRY MARKET 2018–2025 (USD MILLION)

TABLE 101 ROAPAC: GAS CHROMATOGRAPHY INDUSTRY BY PRODUCT 2018–2025 (USD MILLION)

TABLE 102 ROAPAC: GC INSTRUMENT MARKET 2018–2025 (USD MILLION)

TABLE 103 ROAPAC: GC DETECTOR MARKET 2018–2025 (USD MILLION)

TABLE 104 ROAPAC: GC ACCESSORIES & CONSUMABLES MARKET 2018–2025 (USD MILLION)

TABLE 105 ROAPAC: GC END-USER INDUSTRY MARKET 2018–2025 (USD MILLION)

TABLE 106 ROW: GAS CHROMATOGRAPHY INDUSTRY BY COUNTRY 2018–2025 (USD MILLION)

TABLE 107 ROW: GC MARKET BY INSTRUMENT 2018–2025 (USD MILLION)

TABLE 108 ROW: GC MARKET BY DETECTOR 2018–2025 (USD MILLION)

TABLE 109 ROW: GC MARKET BY ACCESSORIES AND CONSUMABLES 2018–2025 (USD MILLION)

TABLE 110 ROW: GC MARKET END-USER INDUSTRY 2018–2025 (USD MILLION)

TABLE 111 MIDDLE EAST AND AFRICA: GAS CHROMATOGRAPHY MARKET BY PRODUCT 2018–2025 (USD MILLION)

TABLE 112 MIDDLE EAST AND AFRICA: GAS CHROMATOGRAPHY INDUSTRY BY INSTRUMENT 2018–2025 (USD MILLION)

TABLE 113 MIDDLE EAST AND AFRICA: GC MARKET BY DETECTOR 2018–2025 (USD MILLION)

TABLE 114 MIDDLE EAST AND AFRICA: GC MARKET BY ACCESSORIES & CONSUMABLES 2018–2025 (USD MILLION)

TABLE 115 MIDDLE EAST AND AFRICA: GC MARKET BY END-USER INDUSTRY 2018–2025 (USD MILLION)

TABLE 116 LATIN AMERICA: GAS CHROMATOGRAPHY INDUSTRY BY PRODUCT 2018–2025 (USD MILLION)

TABLE 117 LATIN AMERICA: GC MARKET BY INSTRUMENT 2018–2025 (USD MILLION)

TABLE 118 LATIN AMERICA: GC MARKET BY DETECTOR 2018–2025 (USD MILLION)

TABLE 119 LATIN AMERICA: GC MARKET BY ACCESSORIES & CONSUMABLES 2018–2025 (USD MILLION)

TABLE 120 LATIN AMERICA: GC MARKET BY END-USER INDUSTRY 2018–2025 (USD MILLION)

TABLE 121 PRODUCT LAUNCHES 2017–2019

TABLE 122 AGREEMENTS PARTNERSHIPS & COLLABORATIONS (2017–2019)

TABLE 123 ACQUISITIONS 2017–2019

TABLE 124 EXPANSIONS 2017–2020

LIST OF FIGURES (27 FIGURES)

FIGURE 1 RESEARCH METHODOLOGY: GC MARKET

FIGURE 2 RESEARCH DESIGN

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY CATEGORY DESIGNATION AND REGION

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

FIGURE 5 DATA TRIANGULATION METHODOLOGY

FIGURE 6 GAS CHROMATOGRAPHY MARKET BY INSTRUMENT 2020 VS. 2025 (USD MILLION)

FIGURE 7 GAS CHROMATOGRAPHY INDUSTRY BY ACCESSORIES AND CONSUMABLES 2020 VS. 2025 (USD MILLION)

FIGURE 8 GAS CHROMATOGRAPHY INDUSTRY BY END USERS 2020 VS. 2025 (USD MILLION)

FIGURE 9 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL GAS CHROMATOGRAPHY MARKET IN 2020

FIGURE 10 GROWING PRODUCTION OF CRUDE AND SHALE OIL TO DRIVE THE MARKET

FIGURE 11 NORTH AMERICA TO WITNESS HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

FIGURE 12 SYSTEMS SEGMENT TO HOLD THE LARGEST SHARE 2020 VS. 2025

FIGURE 13 COLUMNS SEGMENT TO HOLD THE LARGEST SHARE 2020 VS. 2025

FIGURE 14 OIL & GAS SEGMENT TO HOLD THE LARGEST SHARE 2020 VS. 2025

FIGURE 15 GAS CHROMATOGRAPHY MARKET: DRIVERS RESTRAINTS OPPORTUNITIES AND CHALLENGES

FIGURE 16 NORTH AMERICA: GAS CHROMATOGRAPHY MARKET SNAPSHOT

FIGURE 17 ASIA PACIFIC: GAS CHROMATOGRAPHY MARKET SNAPSHOT

FIGURE 18 MARKET EVALUATION FRAMEWORK SAW A RISE IN (DEVELOPMENTS) IN 2017- 2018

FIGURE 19 AGILENT DOMINATED THE GAS CHROMATOGRAPHY INDUSTRY IN 2019

FIGURE 20 KEY DEVELOPMENTS BY PROMINENT MARKET PLAYERS IN THE GC MARKET

FIGURE 21 AGILENT DOMINATED IN THE GAS CHROMATOGRAPHY MARKET IN 2019

FIGURE 22 COMPANY EVALUATION MATRIX 2019

FIGURE 23 AGILENT TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 24 THERMOFISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

FIGURE 25 SHIMADZU CORPORATION COMPANY SNAPSHOT

FIGURE 26 PERKINELMER INC.: COMPANY SNAPSHOT

FIGURE 27 MERCK KGAA: COMPANY SNAPSHOT

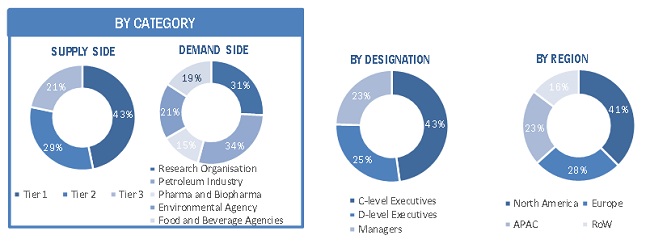

The global gas chromatography (GC) market study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape, key market dynamics, and key strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the GC market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the GC market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by product, type, application, end user, and region).

Data Triangulation

After arriving at the market size, the GC market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments.

Objectives of the Study

- To define, describe, and forecast the global gas chromatography market on the basis of instruments, accessories and consumables, end-user industries, and regions

- To provide detailed information regarding the major factors (such as drivers, restraints, growth opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically analyze the market structure and profile the key players of the gas chromatography market and comprehensively analyze their core competencies

- To forecast the size of the market segments with respect to four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To track and analyze competitive developments such as new product launches, expansions, acquisitions, partnerships, and contracts

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the ROE GC market into the Middle East and Africa and Latin America.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Gas Chromatography Market