The research study involved extensive use of secondary sources such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases to identify and collect information on the charging as a service market. In-depth interviews were conducted with various primary sources—experts from related industries, automobile OEMs, CPMs, CPOs, and service providers—to obtain and verify critical information, as well as assess the growth prospects and market estimations.

Secondary Research

Secondary research has identified key players in the charging as a service market. Primary research interviews have been conducted with key opinion leaders in the automotive industry, such as CEOs, directors, industry experts, and other executives, to validate revenues. The size of the market, in terms of value for various regions, was derived using forecasting techniques based on the demand for charging as a service and market trends.

Primary Research

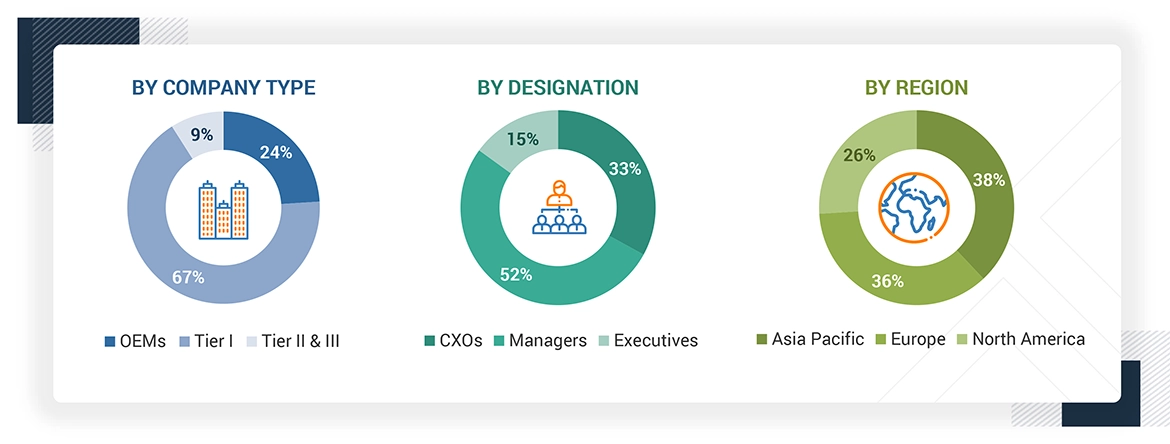

Extensive primary research was conducted after understanding the scenario of the Charging as a service through secondary research. Several primary interviews were conducted with market experts from both the demand (charging point operators) and supply (charging point manufacturers, fleet operators, and other utility providers) across three major regions: North America, Europe and Asia Pacific. Approximately 52% and 48% of primary interviews were conducted from the demand and supply sides. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in this report.

After interacting with industry experts, brief sessions with highly experienced independent consultants were also conducted to reinforce the findings from primaries. This and the in-house subject-matter experts’ opinions led to the findings described in the remainder of this report.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches were used to estimate and validate the size of the global charging as a service market. In these approaches, the vehicle production statistics for each charger type and end use were considered. The bottom-up and top-down approaches were used to estimate and validate the size of the global market. In these approaches, EV charging station cost statistics at a country level were considered:

Charging as a Service Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size of the global market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedure were employed to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments, wherever applicable. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Market Definition

Charging as a Service (CaaS) is a business model where EV charging infrastructure and energy management services are offered on a subscription or pay-per-use basis, eliminating the need for end-users to invest in and maintain their own charging systems. This model is particularly advantageous for charging point operators, fleet operators, municipalities, and businesses seeking cost-effective electrification without high upfront capital expenditure. By outsourcing installation, maintenance, and energy optimization to specialized providers, CaaS ensures operational efficiency while enabling seamless integration with renewable energy sources and grid management strategies.

Stakeholders

-

To analyze and forecast the charging as a service market in terms of value (USD million) from 2025 to 2035.

-

To segment the charging as a service market by Charger Type, End Use, Fleet Service Type, and Region.

-

To provide detailed information about the factors influencing market growth (drivers, challenges, restraints, and opportunities)

-

To strategically analyze the market for individual growth trends, prospects, and contributions to the total market

-

To strategically profile the key players and comprehensively analyze their market share and core competencies.

Report Objectives

-

American Society of Mechanical Engineers (ASME)

-

Associations, Forums, and Alliances related to EV Charging Stations

-

Automobile OEMs

-

Charging Infrastructure Providers

-

Charging Service Providers

-

Chassis and Suspension Suppliers

-

Electric Utilities and Grid Operators

-

Energy Storage Companies

-

EV Charging Network Operators

-

EV Component Manufacturers

-

EV Distributors and Retailers

-

Fleet Operators

-

Government Agencies and Organizations

-

Oil & Gas Companies

-

Research and Development Institutions

-

Utility Companies

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

-

Further breakdown of the Charging as a Service market, by level of charging, at the country-level (for countries covered in the report)

-

Further breakdown of the Charging as a Service market, by Revenue Model, at the country-level (for countries covered in the report)

Company Information

-

Profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Charging as a Service Market