Cabin Management System Market Size, Share & Trends, 2025 to 2029

Cabin Management System Market by Solution (Cabin Management Unit and Servers, Crew & Passenger Control Units, Network & Connectivity, Audio/Video System Units, Cabin Management Software), Aircraft Type, End User - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The cabin management system (CMS) market was estimated at USD 1.39 billion in 2024 and is projected to reach USD 1.88 billion by 2029 at a CAGR of 6.2%.

KEY TAKEAWAYS

- North America accounted for a 46.0% share of the cabin management system market in 2024.

- By aircraft type, the narrow-body aircraft segment is expected to register the highest CAGR of 7.2%.

- By solution, the cabin management software segment is projected to grow at the fastest rate from 2024 to 2029.

- By end user, the linefit segment is expected to dominate the market.

- RTX, Honeywell Inc., and Airbus were identified as some of the star players in the cabin management system market, given their strong market share and product footprint.

- TQ Group and Performance Software Corporation, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The cabin management system (CMS) market growth is propelled by various factors, including growing business & private air travel, increasing aircraft production & fleet expansion, advancements in smart cabin technologies, and a growing focus on passenger experience. Airlines are increasingly concentrating on cabin customization solutions through the adoption of next-generation cabin management technologies.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Impact on consumers business in the cabin management system (CMS) market stems from a rapid shift toward software-defined, IP-based architectures that enable wireless control, real-time personalization, and seamless integration of lighting, IFE, connectivity, and environmental systems. Open platforms, modular hardware, and faster upgrade cycles allow operators to tailor cabin experiences by mission or customer tier, while cybersecurity, data privacy, and energy efficiency are becoming key buying criteria.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing Business & Private Air travel

-

Advancements in Smart Cabin Technologies

Level

-

Cybersecurity & Data Privacy Concerns

-

High Initial Costs & Installation Complexity

Level

-

Growing need for Upgradable & Modular CMS Designs

-

Increasing adoption of Wireless & Touchless Technologies

Level

-

Limited Standardization Across Aircraft Models & Airline fleets

-

Complex Integration with Legacy Systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing Business & Private Air travel

The expansion of business aviation and premium air travel is a major driver of the Cabin Management Systems (CMS) market, as passengers increasingly demand advanced, high-tech, and personalized in-flight experiences. The rise in corporate travel, the surge in high-net-worth individuals opting for private jets, and the growth of premium airline services have all fueled the need for sophisticated CMS that enhance comfort, convenience, and luxury.

Restraint: High Initial Costs & Installation Complexity

The high initial cost and installation complexity of Cabin Management Systems (CMS) act as significant restraints in their widespread adoption, particularly for cost-sensitive airlines and operators. Advanced CMS solutions integrate AI, IoT, high-resolution touchscreens, biometric authentication, wireless connectivity, and automated cabin controls, requiring substantial investment in hardware, software, and system integration.

Opportunity: Increasing adoption of Wireless & Touchless Technologies

The growing adoption of wireless and touchless technologies presents a major opportunity for the Cabin Management Systems (CMS) market, driven by the demand for seamless connectivity, enhanced hygiene, and futuristic passenger experiences. As airlines, business jet operators, and private aircraft manufacturers seek to modernize their cabins, wireless control interfaces, gesture recognition, and voice-activated systems are becoming integral to next-generation CMS solutions.

Challenge: Limited Standardization Across Aircraft Models & Airline fleets

One of the key challenges in the Cabin Management Systems (CMS) market is the lack of standardization across different aircraft models and airline fleets. Unlike avionics and propulsion systems, which follow stringent regulatory standards, CMS designs, architectures, and functionalities vary significantly between commercial airlines, business jets, and private aircraft manufacturers. This inconsistency complicates system integration, increases costs, and slows adoption.

Cabin Management System Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Advanced cabin control and environmental monitoring systems for commercial fleets. | Enhances passenger comfort and operational reliability with integrated sensing. |

|

Connected cabin platforms with automated lighting, entertainment, and air quality control. | Improves passenger experience while reducing maintenance and power consumption. |

|

Cabin upgrades, IFE/CMS retrofit solutions for airlines and VIP aircraft. | Extends fleet lifecycle and supports customized premium cabin layouts. |

|

Integrated CMS in new-build aircraft aligned with digital cabin ecosystems. | Drives seamless connectivity and data analytics for efficiency and service innovation. |

|

Modular cabin control units and lighting solutions for OEM and retrofit markets. | Enables lightweight, scalable configurations that reduce cost and support future upgrades. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Manufacturers and suppliers of cabin management systems, along with end users such as airlines and business jet operators, form the core stakeholders of the CMS market ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cabin Management System (CMS) Market, By Aircraft Type

Based on aircraft type, the business jets segment is expected to account for the largest share of the cabin management system market during the forecast period due to the increasing demand for luxury, customization, and sophisticated cabin technologies. With the increasing demand for private travel by corporate executives, high-net-worth individuals, and government officials, the demand for advanced CMS solutions on business jets has increased.

Cabin Management System (CMS) Market, By Solution

In 2024, control panels and interfaces dominated the cabin management system (CMS) market, driven by rising demand for intuitive touch, wireless, and voice-enabled controls that elevate passenger experience. Airlines and business jet operators are prioritizing solutions that support faster upgrades, seamless device integration, and improved accessibility across premium cabin layouts.

Cabin Management System (CMS) Market, By End User

The linefit segment is projected to be dominant in the cabin management system market during the forecast period due to the increasing production of commercial and business aircraft equipped with advanced cabin technology. Airlines are increasingly requiring factory-installed CMS to reduce installation costs and ease integration with installed aircraft systems.

REGION

North America to be fastest-growing region in global Cabin Management System (CMS) market during forecast period

The North American Cabin Management System (CMS) market is expected to register the highest CAGR during the forecast period, driven by the strong demand for next-generation connected cabins across commercial and business aviation. Rapid fleet modernization, premium cabin retrofits, and rising passenger expectations for smart interfaces and seamless connectivity are accelerating adoption.

Cabin Management System Market: COMPANY EVALUATION MATRIX

In the Cabin Management System (CMS) market matrix, RTX (Star) leads with a strong market share and extensive product footprint, driven by its advanced cabin systems. Astronics Corporation (Emerging Leader) is gaining visibility with its cabin systems products and services, strengthening its position through innovation and niche product offerings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.39 Billion |

| Market Forecast in 2029 (Value) | USD 1.88 Billion |

| Growth Rate | CAGR of 6.2% from 2024-2029 |

| Years Considered | 2024-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

WHAT IS IN IT FOR YOU: Cabin Management System Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Emerging Leader | Additional Company Profiles | Competitive information on targeted players to gain granular insights on direct competition |

RECENT DEVELOPMENTS

- June 2025 : Diehl Aviation (Germany) and DLR (the German Aerospace Center) announced a long-term research agreement under which Diehl will collaborate with DLR on the design and development of advanced cabin system architectures, including cabin management system technologies.

- April 2024 : ALTO Aviation (US) (a subsidiary of Heads Up Technologies) unveiled a Cadence Cabin Management System (CMS) retrofit solution tailored for Gulfstream G200 aircraft. The retrofit provides fit-compatible replacement switch panels throughout the cabin, with minor modifications required at the VIP seat and galley locations to accommodate enhanced functionalities.

- March 2024 : Materion Beryllium & Composites (a subsidiary of Materion Corporation) partnered with Liquidmetal Technologies Inc. and other Certified Liquidmetal Partners to use their alloy production technologies to provide high-quality products and support services to their customers.

Table of Contents

Methodology

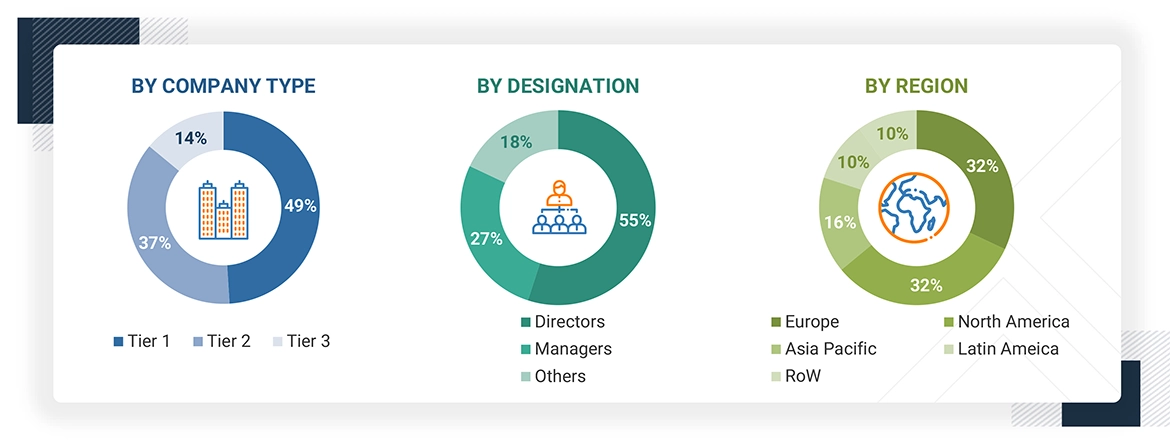

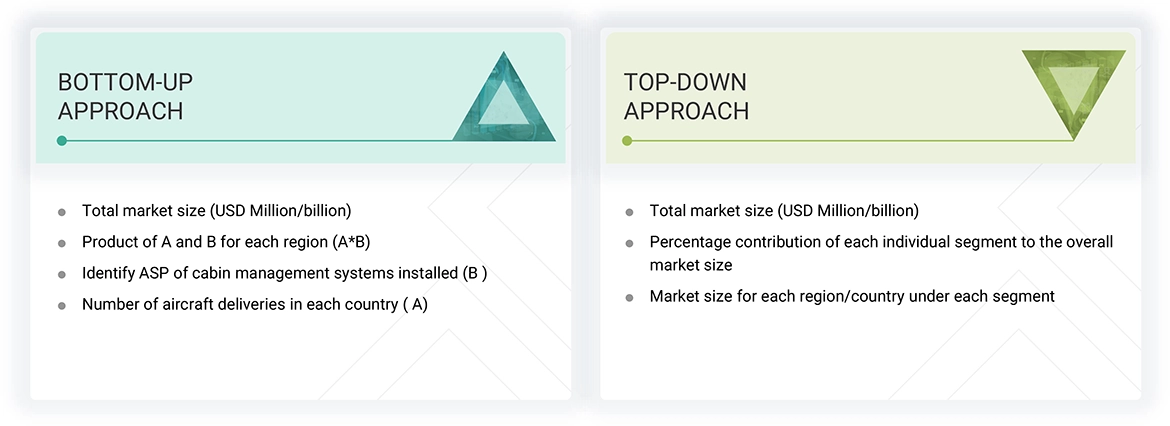

The research study conducted on the Cabin Management System market involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, and Factiva, to identify and collect relevant information. Primary sources included industry experts from the market as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this industry. In-depth interviews of various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the market as well as assess the growth prospects of the market. A deductive approach, also known as the bottom-up approach combined with the top-down approach, was used to forecast the market size of different market segments.

Secondary Research

The share of companies in the Cabin Management System market was determined based on secondary data made available through paid and unpaid sources and an analysis of the product portfolios of major companies. These companies were rated based on their performance and quality. These data points were further validated by primary sources. Secondary sources for this research study included corporate filings, such as annual reports, investor presentations, and financial statements from trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the Cabin Management System market through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across different regions. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: Tiers of companies are based on their revenue in 2023. Tier 1: company revenue greater than USD 1 billion; tier 2: company revenue between USD 100 million and USD 1 billion; and tier 3: company revenue less than USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the Cabin Management System market. The research methodology used to estimate the market size includes the following details.

Key players in the market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews with industry stakeholders such as CEOs, technical advisors, military experts, and SMEs of leading companies operating in the Cabin Management System market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the Cabin Management System market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Cabin Management System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the Cabin Management System market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the Cabin Management System market size was validated using the top-down and bottom-up approaches.

Market Definition

Cabin management systems (CMS) is an integrated solution that co-ordinates and controls of various cabin environmental functions such as temperature, lighting, galley services, wastewater, and window shades. Additionally, they include in-flight entertainment (IFE), which provides audio, video, interfaces to personal electronic devices, access to media content storage (audio & video files), satellite TV, moving map equipment, and access to long-range satellite communications and internet connectivity.

Key Stakeholders

- Cabin Management System Manufacturers

- Aircraft Manufacturers

- MRO Providers

- Technology Support Providers

- Related Research Bodies

- Cabin Management System Integrators

- Airline Operator

Report Objectives

- To define, describe, segment, and forecast the size of the Cabin Management System market based on aircraft type, solution, end user, and region.

- To forecast sizes of various segments of the market with respect to six major regions, namely, North America, Europe, Asia Pacific, Middle East, Latin America and Africa, along with major countries in each of these regions.

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market across the globe.

- To identify industry trends, market trends, and technology trends that are currently prevailing in the market.

- To provide an overview of the regulatory landscape with respect to Cabin Management System regulations across regions.

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders by identifying key market trends.

- To profile key market players and comprehensively analyze their market shares and core competencies.

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, product launches, contracts, and partnerships, adopted by leading market players.

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market.

- To provide a detailed competitive landscape of the market, along with market ranking analysis, market share analysis, and revenue analysis of key players.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Regional Analysis

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

- 4K OLED Displays

- AI-Powered Cabin Monitoring

- Li-Fi (Light Fidelity) Technology

- Over-The-Air (Ota) Software Update Technology

- IoT (Internet of Things) Sensors

- Haptic Feedback & Smart Touch Surfaces

- Growing business and private air travel

- Growing aircraft production and fleet expansion

- Advancements in smart cabin technologies

- Increasing focus on passenger experience

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Cabin Management System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Cabin Management System Market