The study involves four major activities for estimating the size of the building twin market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the building twin market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data has been collected and analyzed to determine the overall market size estimations, further validated by primary research.

Primary Research

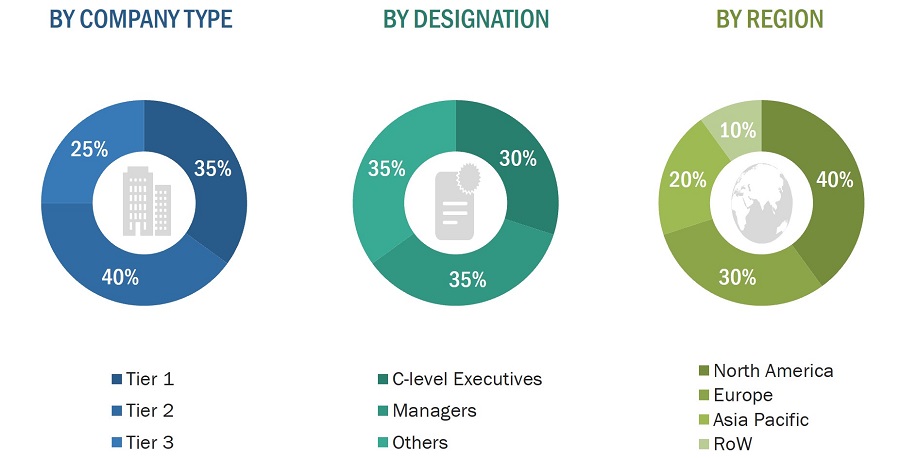

In the primary research process, several sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. Several primary interviews have been conducted with market experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and the Rest of the World. This primary data has been collected through questionnaires, emails, and telephonic interviews. Approximately 60% of the primary interviews have been conducted with the demand side and 40% with the supply side. This primary data has been collected mainly through telephonic interviews, which accounted for 80% of the total primary interviews. Additionally, questionnaires and emails were used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the building twin market and other dependent submarkets listed in this report.

-

The key players in the industry and markets have been identified through extensive secondary research.

-

Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Building Twin Market Size: Bottom-Up Approach

Global Building Twin Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

Building twin, or digital twin for buildings, is a virtual representation of a physical building or facility that integrates real-time data from sensors, IoT devices, and other sources. This digital replica enables comprehensive monitoring, analysis, and management of the building's operations and performance throughout its lifecycle. Building twin technology allows stakeholders such as facility managers, engineers, and designers to simulate scenarios, optimize energy usage, predict maintenance needs, and enhance operational efficiency. By leveraging advanced analytics and simulation capabilities, building twins support informed decision-making, improve sustainability efforts, and streamline building management practices effectively.

Key Stakeholders

-

Government bodies and policymakers

-

Industry organizations, forums, alliances, and associations

-

Market research and consulting firms

-

Raw material suppliers and distributors

-

Research institutes and organizations

-

Analysts and strategic business planners

-

End users of building twins

Study Objectives:

-

To define, describe, and forecast the building twin market size by offering, application, and end user, in terms of value

-

To describe and forecast the size of the building twin market across four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World, along with their respective country-level market sizes, in terms of value

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market growth

-

To provide a detailed overview of the process flow of the building twin market

-

To strategically analyze micromarkets1 for individual growth trends, prospects, and contributions to the overall market size

-

To study the complete value chain of the building twin market

-

To analyze opportunities for stakeholders by identifying high-growth segments of the building twin market

-

To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2

-

To analyze competitive developments, such as product launches, deals (mergers, acquisitions, partnerships, collaborations, agreements, contracts, and investments), and others (expansions) in the building twin market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

-

Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

-

Detailed analysis and profiling of 25 market players

Growth opportunities and latent adjacency in Building Twin Market