Blockchain Security Market

Blockchain Security Market by Solution (Key Management, Smart Contract Security, Penetration Testing, IAM, and Audits), Services (Development & Integration, Technology Advisory & Consulting, Incident and Response) - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The blockchain security market is projected to reach USD 37.42 billion by 2029 from USD 3.01 billion in 2024, at a CAGR of 65.5% from 2024 to 2029. The blockchain security market is expanding as decentralized applications, digital assets, and cross-chain ecosystems introduce new attack surfaces. Organizations are prioritizing smart contract audits, threat monitoring, and secure infrastructure to prevent exploits and ensure protocol integrity. AI-driven analysis, zero-knowledge cryptography, and automated vulnerability detection enhance trust, compliance, and resilience, driving demand for scalable, end-to-end security solutions across rapidly growing Web3 and enterprise blockchain environments.

KEY TAKEAWAYS

-

BY REGIONThe North America blockchain security market will dominate in terms of market share in 2024.

-

BY SOLUTIONBy solution, smart contract security segment is expected to dominate the market in terms of market share in the forecast period.

-

BY SERVICEBy service, technology advisory and consulting segment will grow faster with the highest CAGR.

-

BY DEPLOYMENT MODEBy deployment mode, cloud segment is projected to grow at the fastest rate from 2024 to 2029.

-

BY ORGANIZATION SIZE TYPEBy organization size, SMEs segment is expected to register a highest CAGR.

-

BY VERTICALBy vertical, banking and financial services segment will dominate the market in terms of market size during the forecast period.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSIBM, Thales and AWS were identified as Star players in the blockchain security market (global) as they offer offering strong cryptographic solutions, advanced key management, and secure cloud infrastructures. Their global reach, AI-driven security capabilities, and ecosystem partnerships enable scalable, compliant, and resilient blockchain protection.

-

COMPETITIVE LANDSCAPE - STARTUPSChainalysis, Bitfury, and Consensys have distinguished themselves as leading startups and SMEs in the blockchain security market by delivering agile, cost-effective, and highly specialized security solutions. Their offerings span on-chain analytics, secure infrastructure, smart contract protection, and compliance-focused tools that help organizations strengthen trust, detect threats, and achieve scalable, resilient blockchain operations.

The blockchain security market is experiencing rapid growth, driven by expanding Web3 ecosystems, rising cyber threats, and increasing reliance on decentralized applications and digital assets. As enterprises and institutions adopt blockchain for finance, supply chain, and governance, the need for smart contract auditing, secure key management, and cross-chain protection is accelerating. Growth is further fueled by AI-driven threat analytics, regulatory compliance demands, automation, and rising investments in resilient, zero-trust-aligned blockchain security infrastructures.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The blockchain security market is shifting from traditional offerings such as blockchain security solutions and compliance services toward more advanced, technology-driven capabilities. Future revenue growth will stem from solutions integrating post-quantum cryptography, AI/ML-based threat detection, decentralized security protocols, privacy-enhancing technologies, secure enclaves, and HSMs. Key sectors including transport, agriculture, manufacturing and supply chain, energy and utilities, healthcare, life sciences, BFSI, and others are prioritizing scalable security, smart contract interoperability, privacy compliance, post-quantum resilience, and energy-efficient protection.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising cybersecurity threats and breaches

-

Growing adoption of blockchain technology

Level

-

High implementation costs and budgetary constraints

-

Scalability and integration problems

Level

-

Integration with emerging technologies

-

Growing demand for third-party security audits

Level

-

Interoperability and regulatory uncertainty

-

Skill gap and shortage of qualified professionals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising cybersecurity threats and breaches

Rising cybersecurity threats and high-impact breaches across decentralized networks are accelerating demand in the blockchain security market. Frequent smart contract exploits, bridge hacks, and private key compromises are pushing organizations to prioritize advanced auditing, continuous on-chain monitoring, and secure key management. As attackers adopt more sophisticated techniques, enterprises and protocols are investing in AI-driven threat detection, automated vulnerability analysis, and resilient zero-trust blockchain architectures to safeguard assets, ensure protocol integrity, and maintain trust across expanding Web3 ecosystems.

Restraint: High implementation costs and budgetary constraints

High implementation costs and budgetary constraints act as significant restraints in the blockchain security market. Many organizations face challenges in allocating funds for advanced security solutions, including smart contract audits, secure key management, and continuous threat monitoring. The complexity of integrating specialized tools, along with the need for skilled professionals, further increases expenses. As a result, smaller enterprises often delay or limit security investments, slowing broader adoption of comprehensive blockchain protection measures.

Opportunity: Integration with emerging technologies

The integration of emerging technologies presents a major opportunity in the blockchain security market. Advancements in AI, zero-knowledge proofs, quantum-resistant cryptography, and automated code analysis enhance the ability to detect vulnerabilities, predict attacks, and secure decentralized systems. Combining blockchain with technologies like IoT, federated learning, and confidential computing expands use cases while strengthening trust and privacy. These integrations enable more scalable, intelligent, and resilient security frameworks across rapidly evolving digital ecosystems.

Challenge: Interoperability and regulatory uncertainty

Interoperability and regulatory uncertainty remain major challenges in the blockchain security market. As cross-chain transactions and multi-network ecosystems grow, inconsistent standards create vulnerabilities and complicate secure data exchange. At the same time, evolving global regulations around digital assets, privacy, and compliance create ambiguity for enterprises and developers. This lack of clarity slows adoption, increases compliance risks, and makes it difficult to design unified, future-proof blockchain security frameworks across jurisdictions.

BLOCKCHAIN SECURITY MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of Chainalysis Compliance and Investigation Suite for real-time blockchain transaction monitoring and AML enforcement at LINE Xenesis. | Improved security, ensured regulatory compliance, faster threat response, and strengthened user trust. |

|

Mata Capital used Consensys Codefi to tokenize real estate, digitizing registries and automating compliance. | Lower costs, improved transparency, broader investor access, and increased liquidity through simplified secondary-market trading |

|

CertiK audited Kraken, uncovering critical deposit vulnerabilities enabling artificial balances and potential financial loss risks. | Improved industry understanding of ethical hacking and strengthened security standards through clearer disclosure practices adoption. |

|

ScienceSoft conducted black- and gray-box penetration testing to identify vulnerabilities in a US fintech company’s blockchain software and IT infrastructure. | Strengthened security posture through remediation guidance, reduced cyber-attack risks, and improved protection of customer data and assets. |

|

Accubits built a Hyperledger Fabric–based P2P platform for IDG to enable secure, confidential global business deal sourcing and transactions. | Greater security and confidentiality, faster deal processing, reduced costs, expanded global reach, and improved user experience through vetted, relevant opportunities. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The blockchain security market ecosystem encompasses smart contract security, decentralized IAM, penetration testing, on-chain monitoring, and end-to-end audit and compliance services. These components collectively protect digital assets, maintain protocol integrity, and secure multi-chain interactions. Key stakeholders including banking and financial services, retail and eCommerce, government, agriculture, and food sectors are driving adoption. The ecosystem focuses on enhancing trust, reducing vulnerabilities, ensuring regulatory compliance, and enabling secure, scalable blockchain deployments across critical industries.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Blockchain Security Market, By Solution

The smart contract security segment is expected to hold the largest market share in 2024 in the blockchain security market, driven by the surge in decentralized applications, DeFi platforms, and tokenized ecosystems. With increasing vulnerabilities, exploits, and cross-chain risks, organizations are prioritizing rigorous code audits, formal verification, automated vulnerability detection, and continuous monitoring. Smart contract security solutions help enterprises and developers prevent financial losses, strengthen protocol integrity, and ensure trust and compliance across rapidly expanding blockchain networks.

Blockchain Security Market, By Service

The technology advisory and consulting segment is expected to hold a significant market share in 2024 in the blockchain security market, driven by increasing demand for expert guidance on secure blockchain deployment, risk assessment, and compliance alignment. As enterprises adopt decentralized solutions and navigate complex regulatory landscapes, consulting services provide critical support in architecture design, security audits, threat modeling, and governance frameworks. These services help organizations enhance resilience, reduce vulnerabilities, and implement scalable, trusted blockchain security strategies.

Blockchain Security Market, By Deployment Mode

The cloud deployment mode is expected to hold a significant market share in 2024 in the blockchain security market, driven by the growing need for scalable, flexible, and cost-efficient security infrastructures. As organizations increasingly adopt decentralized applications and digital asset platforms, cloud-based security solutions enable faster deployment, real-time threat monitoring, and seamless integration with existing systems. This model supports continuous updates, enhanced analytics, and improved resilience, making it a preferred choice for enterprises seeking robust blockchain protection.

Blockchain Security Market, By Organization Size

The large enterprises segment is expected to hold the largest market share in 2024 in the blockchain security market, driven by their extensive adoption of decentralized applications, digital assets, and cross-chain solutions. These organizations require robust security frameworks, including smart contract audits, secure key management, and continuous threat monitoring, to protect high-value assets. Large enterprises leverage advanced AI-driven analytics, compliance tools, and scalable blockchain security solutions to ensure resilience, trust, and regulatory adherence across complex, multi-network environments.

Blockchain Security Market , By Vertical

The banking and financial services vertical is expected to hold the largest market share in 2024 in the blockchain security market, driven by the rapid adoption of digital assets, DeFi platforms, and cross-border payment solutions. Financial institutions are prioritizing smart contract audits, secure key management, and continuous threat monitoring to safeguard high-value transactions and sensitive data. Advanced blockchain security solutions help banks and financial organizations ensure regulatory compliance, strengthen trust, and mitigate risks across complex decentralized ecosystems.

REGION

Asia Pacific to be fastest-growing region in global blockchain security market during forecast period

The Asia Pacific blockchain security market is poised to record strong growth during the forecast period, driven by rapid adoption of digital assets, expanding blockchain deployments, and increasing focus on securing decentralized ecosystems. Rising cyberattacks, smart contract exploits, and cross-chain vulnerabilities are accelerating investment in advanced blockchain security solutions. Organizations across the region are adopting secure key management, smart contract audits, on-chain analytics, and AI-driven threat detection. These technologies strengthen trust, ensure regulatory compliance, and protect critical blockchain-based systems as enterprises and governments scale their digital infrastructure.

BLOCKCHAIN SECURITY MARKET: COMPANY EVALUATION MATRIX

In the blockchain security market matrix, IBM (Star) leads with its strong global presence, advanced cryptographic capabilities, and comprehensive blockchain security portfolio spanning smart contract protection, secure key management, and enterprise-grade threat monitoring. ScienceSoft (Emerging Leader) is rapidly progressing with its specialized blockchain security services, including auditing, penetration testing, and tailored risk mitigation strategies. While IBM leads through scale, innovation, and deep enterprise integration, ScienceSoft is well-positioned to move into the leaders’ quadrant as it expands its high-value, security-focused blockchain offerings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- IBM (US)

- Amazon Web Services (AWS) (US)

- Thales (France)

- Oracle Corporation (US)

- Infosys (India)

- Infineon Technologies (Germany)

- Kudelski Security (Switzerland)

- ScienceSoft (US)

- Kaspersky Lab (Switzerland)

- Aujas Cybersecurity (US)

- Chainalysis (US)

- CertiK (US)

- Consensys (US)

- Bitfury Group Limited (Netherlands)

- LeewayHertz (India)

- Fortanix (US)

- Ultimaco (Germany)

- Hacken (Estonia)

- Bit Sentinel (Romania)

- Astra IT Inc (India)

- Kaleido Inc (US)

- Microminder Cybersecurity (UK)

- Arridae Infosec (India)

- OVHcloud (France)

- CryptoSec (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 1.82 Billion |

| Market Forecast in 2029 (Value) | USD 37.42 Billion |

| Growth Rate | CAGR of 65.5% from 2024-2029 |

| Years Considered | 2021-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: BLOCKCHAIN SECURITY MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| A large European infrastructure provider sought a focused understanding of the blockchain infrastructure landscape to benchmark competitors and identify product, capability, and market opportunities. | Conducted an end-to-end assessment of global blockchain infrastructure providers, including provider mapping (cloud hyperscalers, node/validator service providers), competitive and technical benchmarking (performance, security, interoperability, deployment models), commercial comparison (pricing, SLAs, support), gap/opportunity analysis, and strategic recommendations for product, partnership, and GTM priorities. | Provided clear visibility into competitive positioning, high-value capability gaps, and emerging opportunities. Enabled prioritization of product enhancements, partnership targets, and GTM focus areas to strengthen the provider’s Web3 and blockchain infrastructure strategy. |

RECENT DEVELOPMENTS

- August 2024 : Infosys collaborated with VMware to launch a blockchain-based Vital Records Management Solution. The solution makes use of VMware Blockchain for Ethereum in verifying vital records such as birth certificates and marriage certificates. This blockchain assures the immutability and transparency of such records and thereby makes public sector services more secure and efficient.

- August 2024 : Haven1 and AWS announced a partnership to strengthen blockchain security by making AWS one of the first validators for the Haven1 Proof-of-Authority blockchain. With the collaboration, the use of AWS's advanced security tools such as AWS Secrets Manager, Amazon GuardDuty, and AWS Key Management Service (KMS) is done to secure the network and support Web3 innovations.

- August 2022 : VMware partnered with Infosys to enhance blockchain security solutions by developing VMware Blockchain for Ethereum. The collaboration aims to improve enterprise-grade privacy and governance features, strengthening blockchain security in managing sensitive records and reducing fraud

- March 2021 : Oracle Database 21c added a blockchain table feature to its flagship database for product enhancement. It adds blockchain technology for a ledger of immutable transactions to ensure data integrity and security. The functionality brings an added layer of security to Oracle's rich database features, including enhanced data integrity, regulatory compliance, and SQL-based querying against blockchain-stored data.

- January 2021 : IBM advanced its blockchain technology by contributing to Hyperledger and developing solutions like IBM Food Trust and TradeLens, which enhance security, transparency, and trust in data-sharing across industries such as supply chain management and finance.

Table of Contents

Methodology

The study involved major activities in estimating the current market size for the Blockchain Security market. Exhaustive secondary research was done to collect information on the Blockchain Security industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Blockchain Security market.

Secondary Research

The market for the companies offering Blockchain Security solutions is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of Blockchain Security vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

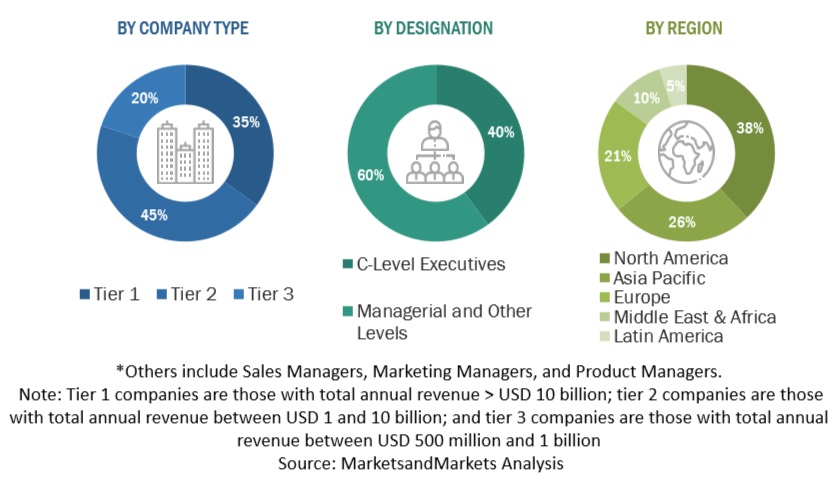

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Blockchain Security market.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of Blockchain Security solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in the report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global blockchain security market and estimate the size of various other dependent sub-segments in the overall blockchain security market. The research methodology used to estimate the market size includes the following details: key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. The entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives.

All percentage splits and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters affecting the market are covered in the research study and have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

INFOGRAPHIC DEPICTING BOTTOM-UP AND TOP-DOWN APPROACHES

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Blockchain security involves applying a blend of cybersecurity strategies, tools, and best practices to minimize risks and prevent malicious attacks. It involves securing the underlying infrastructure, maintaining the integrity and confidentiality of transactions, preventing unauthorized access, and protecting smart contracts.

Key Stakeholders

- Information Technology (IT) Professionals

- Government Agencies

- Investors and Venture Capitalists

- Small and Medium-Sized Enterprises (SMEs) and Large Enterprises

- Managed and Professional Service Providers

- Blockchain Security Vendors

- Security Infrastructure Providers

- Consultants/Consultancies/Advisory Firms

- System Integrators

- Third-Party Providers

- Value-added Resellers (VARs)

- Business Analysts

- Financial Services Firms

Report Objectives

- To define, describe, and forecast the Blockchain Security market based on solution, services, deployment mode, organization size, vertical, and region.

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the Blockchain Security market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the Blockchain Security market

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the Blockchain Security market and comprehensively analyze their market size and core competencies.

- To track and analyze competitive developments, such as product enhancements and new product launches, acquisitions, and partnerships and collaborations, in the Blockchain Security market globally.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Blockchain Security Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Blockchain Security Market