Black Masterbatch Market

Black Masterbatch Market by Carrier Resin (Polypropylene, Linear Low-Density Polyethylene, Low-Density Polyethylene, High-Density Polyethylene, Polyethylene Terephthalate, Polyvinyl Chloride, Polystyrene, Polyamide), End-use Industry (Automotive, Packaging, Infrastructure, Electrical & Electronics, Consumer Goods, Agriculture, Fibers, and Other End-use Industries), by Type (Standard Black Masterbatch, High Jetness Black Masterbatch, UV-Resistant Black Masterbatch, Conductive Black Masterbatch, and Recycled Polymer Compatible Black Masterbatch), and Region - Global Forecasts to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

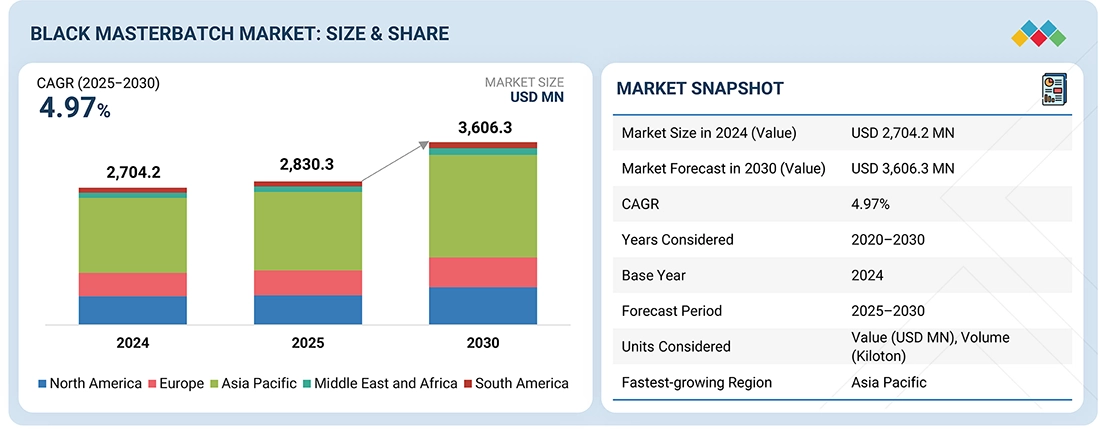

The black masterbatch market is projected to reach USD 3,606.3 million in 2030 from USD 2,830.3 million in 2025, at a CAGR of 4.97% from 2025 to 2030. The growth of the black masterbatch market is primarily driven by the demand from the automotive industry, where automakers are increasingly focused on lightweighting, recyclability, and material efficiency to meet stringent environmental targets. This shift is creating opportunities for the global black masterbatch market.

KEY TAKEAWAYS

-

BY CARRIER RESINThe global black masterbatch market's third-fastest-growing carrier resin segment is polyethylene terephthalate (PET), which is expected to grow at a compound annual growth rate (CAGR) of 5.16% during the forecast period. PET's exceptional strength, transparency, and recyclability have led to its increasing use in consumer goods, packaging, and textiles. Its adoption is further aided by the growing need for sustainable and lightweight packaging options, particularly in food and beverage applications. PET's compatibility with black masterbatch ensures superior surface finish, UV resistance, and aesthetic appeal in end-use products.

-

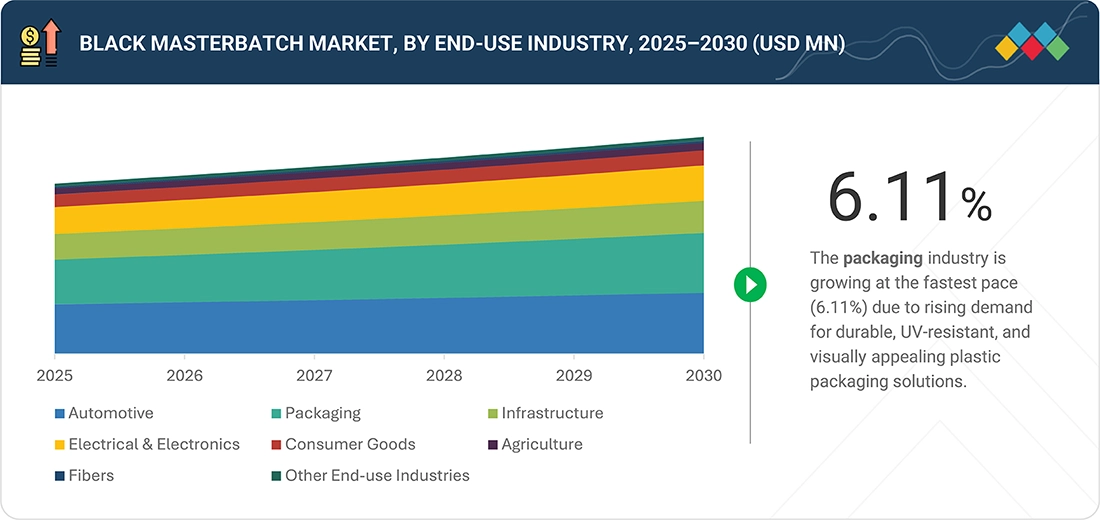

BY END-USE INDUSTRYThe infrastructure industry is the fourth-fastest-growing segment in the global black masterbatch market, with a CAGR of 4.50% during the forecast period. This growth comes from increasing construction activities, rapid urbanization, and rising investment in public and industrial infrastructure projects. Black masterbatch is widely used in construction materials such as pipes, cables, films, and sheets due to its UV stability, durability, and weather resistance. Furthermore, the demand for sustainable and long-lasting materials in infrastructure development boosts their use, especially in water management systems, road construction, and building components.

-

BY REGIONWith a compound annual growth rate (CAGR) of 4.83% over the course of the forecast period, North America is anticipated to be the second-fastest-growing region in the global black masterbatch market. Strong demand from the automotive, packaging, and construction sectors—where black masterbatch is utilized for UV protection, color stability, and surface enhancement—is the main driver of the growth. Regional growth is further reinforced by the growing use of high-performance and sustainable materials as well as sophisticated manufacturing capabilities in the United States and Canada. Furthermore, continued advancements in technology and recycling programs are facilitating the expansion of applications.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Cabot Corporation launched a new product REPLASBLAK black masterbatch which leverages 45% ISCC PLUS mass balance certified material made from mechanically recycled polymer. The solution is suitable for compounding applications in the automotive industry and Blend Colours expanded black masterbatch production capacity by 6,000 MTPA at its Hyderabad facilities, part of a phased 15,000 MTPA expansion for the masterbatch production through organic growth with new machinery and infrastructure investments.

Black masterbatch is a concentrated formulation primarily made of carbon black pigment, typically containing 30–50% carbon black. It is frequently applied to polymer-based materials to give them a deep black coloration, increased durability, and UV resistance. Black masterbatch is crucial for enhancing the functional performance and aesthetic appeal of products across various industries, including consumer goods, packaging, and automotive sectors. Polypropylene (PP), low-density polyethylene (LDPE), linear low-density polyethylene (LLDPE), high-density polyethylene (HDPE), polyvinyl chloride (PVC), polyethylene terephthalate (PET), polystyrene (PS), and polyurethane (PUR) are among the polymers with which it is compatible.

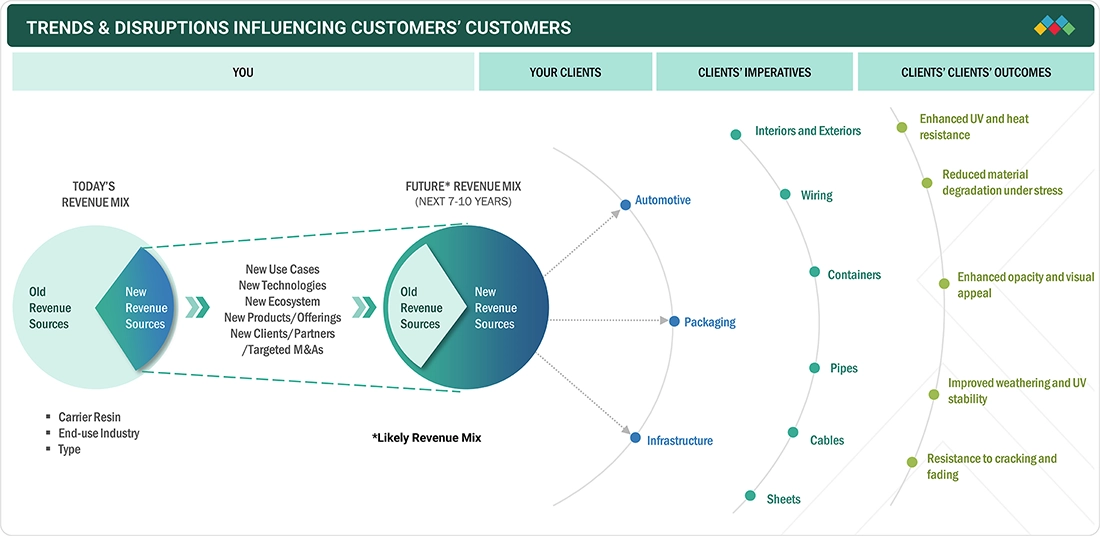

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The black masterbatch market is witnessing several trends and disruptions that are reshaping customer operations and strategic decisions. Rising sustainability concerns are prompting converters and end-use industries to shift toward recyclable and bio-based masterbatch solutions, reducing environmental impact. Volatility in raw material prices, especially carbon black and polymer resins, continues to pressure production costs and profit margins. Increasing regulations on carbon emissions and the use of certain additives are compelling manufacturers to innovate cleaner, non-toxic formulations. Digitalization across the plastics industry—through process automation, data-driven quality control, and supply chain tracking—is enhancing efficiency but also requiring technological investments. Changing consumer preferences for high-performance and aesthetically appealing plastic products are pushing customers to collaborate closely with masterbatch producers for customized and value-added solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Government Regulations and Policies Promoting Sustainable Materials

-

Infrastructure Development and Urbanization

Level

-

Volatility in Raw Material Prices and Supply Chain Disruptions

-

Rising Environmental and Regulatory Compliance Burdens

Level

-

Expansion in Semiconductor and Electronics Industries

-

Rising Demand in 3D Printing and Additive Manufacturing

Level

-

Intense Price-Based Competition in Global Market

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Government regulations and policies promoting sustainable materials

Governmental regulations and policies promoting sustainable materials have emerged as a significant driver for the global black masterbatch market. With growing environmental concerns, governments worldwide are implementing stringent frameworks to reduce plastic waste, enhance recyclability, and promote the use of eco-friendly materials in manufacturing. Regulations such as the European Union’s Circular Economy Action Plan and the EU Green Deal emphasize the integration of recycled content and the phase out of single use plastics. In US, the Environmental Protection Agency’s (EPA) National Recycling Strategy supports innovations that improve the sustainability of plastic production and waste management. In China, initiatives like the Plastic Pollution Control Plan and the Made in China 2025 strategy encourage the use of high-performance, recyclable polymers. In India, the Ministry of Environment, Forest and Climate Change (MoEFCC) has implemented several initiatives to promote the use of eco-friendly materials. For instance, the Plastic Waste Management Rules, 2016, amended in 2021, emphasize the extended producer responsibility (EPR) for plastic waste management. These rules mandate producers to take responsibility for the collection and recycling of plastic waste, encouraging the use of recyclable and sustainable materials in production processes. As per the rules, producers are required to establish systems for the collection and recycling of plastic waste, thereby promoting the use of sustainable materials in manufacturing.

Restraint: Volatility in raw material prices and supply chain disruptions

The black masterbatch market is highly sensitive to fluctuations in the prices of key raw materials such as carbon black, polymer resins, and specialty additives. Volatility in crude oil prices directly impacts the cost of polymer resins, which constitute a significant portion of black masterbatch formulations. Sudden spikes in raw material costs can erode profit margins, forcing manufacturers to either absorb the increased expenses or pass them on to end-users, potentially affecting demand. Supply chain disruptions, including delays in the transportation of raw materials, port congestions, and geopolitical tensions, further exacerbate the challenge. The COVID-19 pandemic highlighted the vulnerabilities of global supply chains, leading to temporary shortages and increased lead times for essential inputs. Additionally, carbon black, a primary pigment in black masterbatches, is often sourced from limited producers, making the market prone to supply bottlenecks. These factors compel manufacturers to adopt strategic inventory management, diversify suppliers, and explore alternative raw materials to maintain production continuity. Overall, the combined impact of raw material price volatility and supply chain disruptions poses a critical restraint on market growth, influencing pricing strategies, production planning, and competitiveness.

Opportunity: Expansion in semiconductor and electronics industries

The global semiconductor and electronics sectors are experiencing robust growth, driven by advancements in consumer electronics, electric vehicles, and renewable energy technologies. This expansion presents a significant opportunity for the black masterbatch market, particularly in applications rhat require materials offeringequiring materials that offer both functional and aesthetic benefits. Black maused in the production of electronic components, includingelectrotnic components such as casings, connectors, and insulation materials. Their ability to provide consistent coloration, UV resistance, and electrical conductivity makes them ideal for enhancing the performance and durability of electronic products. For instance, conductive black masterbatches are employed in wires and cables to prevent static electricity buildup and improve safety. The demand for black masterbatches in the semiconductor industry is also on the rise, driven by the need for materials that can withstand high temperatures and provide effective electromagnetic shielding. These properties are crucial in thsuch asnufacturing of components like semiconductor housings and heat sinks, where maintaining performance under thermal stress is essential. As the electronics industry continues to evolve, the need for specialized materials that can meet stringent performance criteria is becoming more pronounced. Black masterbatches, with their customizable properties, offer a versatile solution to meet these demands, positioning manufacturers to capitalize on the growing opportunities in this sector.

Challenge: Intense price-based competition in the global market

The global masterbatch market is facing a significant challenge due to intense price based competition. The industry comprises numerous regional manufacturers and small-scale compounders that often compete aggressively on pricing rather than technological differentiation. This high degree of competition puts consistent pressure on profit margins, especially in developing markets where end users are highly price sensitive. While large players invest heavily in advanced formulations, sustainable black pigments, and automation to enhance product quality, smaller companies often undercut prices with low-cost alternatives. This dilutes market value growth and limits the premiumization potential of innovative, high-performance grades. Additionally, regional variations in quality standards and lack of strict product benchmarking make it difficult for global suppliers to maintain brand consistency and command higher prices. The oversupply scenario in certain regions, coupled with fluctuating demand across packaging, construction, and consumer goods, further intensifies competitive rivalry. As a result, even well-established players must constantly balance between cost optimization and innovation-led differentiation to retain their market share. This sustained pricing pressure and commoditization risk remain among the most strategic challenges for long-term profitability in the black masterbatch industry.

Black Masterbatch Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses black masterbatch in automotive interior and exterior plastic components | Enhances UV resistance, surface finish, and part durability |

|

Applies in rigid and flexible packaging for personal care products | Improves opacity, brand aesthetics, and recyclability of packaging |

|

Utilizes in appliance casings, cables, and connectors | Provides uniform coloration, electrical insulation, and thermal stability |

|

Uses in food-grade packaging films and containers | Ensures color consistency, product protection, and regulatory compliance |

|

Incorporates in agricultural equipment parts and irrigation pipes | Enhances weather resistance, strength, and long-term UV protection |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The black masterbatch market ecosystem includes raw material suppliers, manufacturers, and end-users. The key raw materials are carbon black, carrier resins, and additives. Major supplying companies like Birla Carbon, Cabot, SABIC, and Dow keep quality and supplies stable in the marketplace. A number of downstream industries-for example, packaging, automotive, infrastructure, agriculture, and consumer goods-create demand. Amcor, Toyota, and BASF are some of the players that use black masterbatches for improving UV protection and durability. This integrated ecosystem encourages innovation, sustainability, and performance optimization down the value chain.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Black Masterbatch Market, By Carrier Resin

Polypropylene (PP) holds the largest share in the global black masterbatch market due to its excellent balance of mechanical strength, chemical resistance, and cost-effectiveness. It exhibits good compatibility with pigments and other additives, enabling superior dispersion, and is used across various applications, including the manufacture of automotive components, packaging films, fibers, and consumer products. PP-based masterbatches enhance UV resistance, durability, and processability for industries that require high performance and long-lasting properties. Growing demand for lightweight and recyclable plastics further strengthens the demand for PP carrier resins. Its versatility across injection molding, extrusion, and film applications continues to place polypropylene in the most preferred and commercially dominant position among carrier resins for the black masterbatch market.

Black Masterbatch Market, By End-use Industry

The packaging industry accounts for the second-largest share in the global black masterbatch market, driven by increased demand for the premium aesthetic appearance, durability, and UV resistance of packaging materials. Black masterbatches have wide applications in films, containers, bottles, and rigid packaging, ensuring the material's appearance and providing opacity and light protection. The current growth in plastic packaging materials across the food & beverages, personal care, and consumer goods sectors creates a surge in demand for black masterbatches. Additionally, the increasing trend of using sustainable packaging, including recyclable and lightweight plastics, has increased demand for black masterbatches formulated with various environmentally friendly carrier resins. They can be used cost-effectively in manufacturing due to their high color efficiency and compatibility with a wide range of polymers, ensuring consistent product quality. The rapid growth of e-commerce and flexible packaging further makes the packaging sector continue as one of the major revenue-generating streams for the global black masterbatch market.

REGION

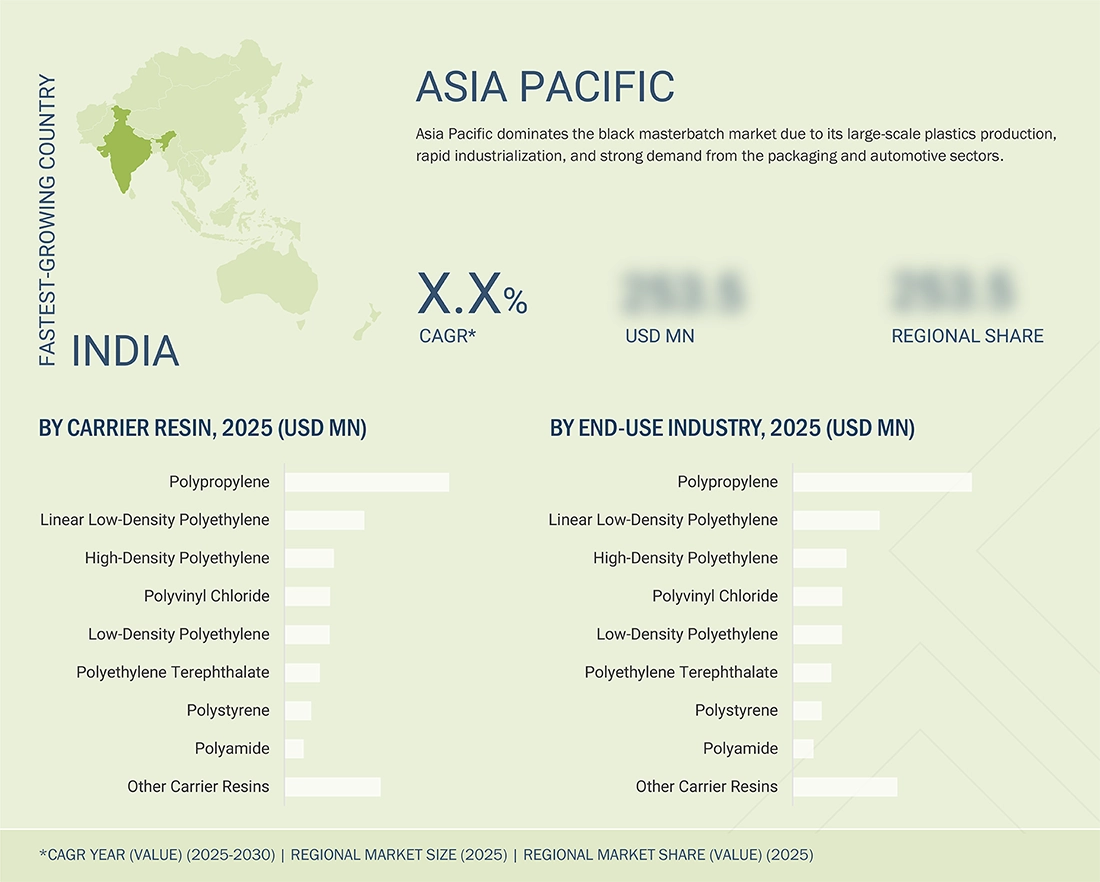

Asia Pacific to be largest region in global black masterbatch market during forecast period

Asia Pacific dominates the black masterbatch market due to high industrialization, increasing manufacturing capacity, and strong demand for plastic products in various end-use industries. China, India, Japan, and South Korea are among the major production and consumption centers, with a strong presence of polymer producers and converters. The packaging, automotive, and construction industries are driving demand for black masterbatches due to their UV protection, color consistency, and material durability enhancement properties. Rapid urbanization and infrastructure development in these countries further drive the consumption of black masterbatch in pipes, cables, and films. Low-cost raw materials and labor also provide an incentive for large-scale production, enabling regional players to price their products competitively. Growing interest in investments in sustainable, high-performance polymer solutions encourages innovation and expands local production. Overall, these factors together make the Asia Pacific region the leading and fastest-growing region in the global black masterbatch market.

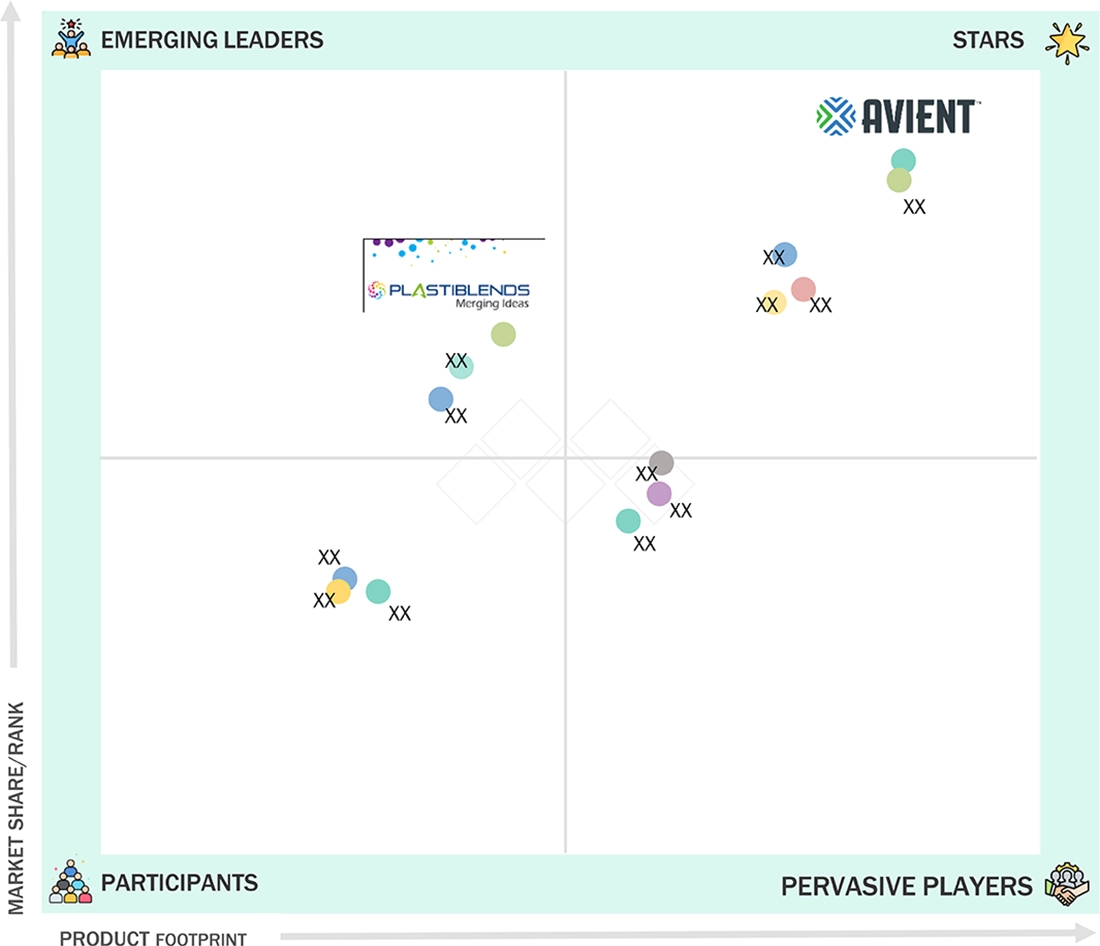

Black Masterbatch Market: COMPANY EVALUATION MATRIX

In the black masterbatch market matrix, Avient Corporation (Star) leads with a strong market share and an extensive product footprint, enabling it to serve the most regions in the world. Plastiblends (Emerging Leader) is gaining visibility with its solutions in the black masterbatch market, maintaining its position through innovation and niche product offerings. While Avient Corporation dominates through scale and a diverse portfolio, Plastiblends shows significant potential to move into the leaders’ quadrant as demand for black masterbatch continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2,704.2 Million |

| Market Forecast in 2030 (Value) | USD 3,606.3 Million |

| Growth Rate | CAGR of 4.97% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

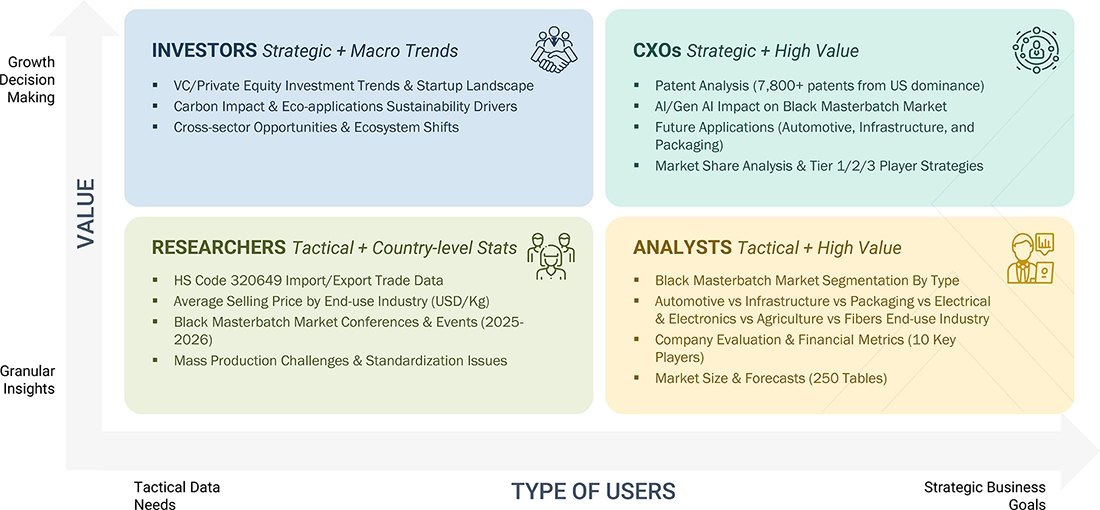

WHAT IS IN IT FOR YOU: Black Masterbatch Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Asia Pacific-based black masterbatch manufacturer |

|

|

| Europe-based black masterbatch manufacturer |

|

|

RECENT DEVELOPMENTS

- May 2024 : Cabot Corporation launched a black masterbatch series, Replasblak. It leverages 45% ISCC PLUS mass balance certified material made from mechanically recycled polymer. The solution is suitable for use in compounding applications within the automotive industry.

- March 2024 : LyondellBasell integrated KARO 5.0 technology at its Akron facility, accelerating masterbatch development for oriented films with enhanced testing capabilities and faster market delivery.

- January 2024 : Black Swan and Hubron partnered to commercialize graphene-enhanced black masterbatch, combining Hubron’s global masterbatch expertise with Black Swan’s graphene technology for automotive, construction, consumer goods, packaging, and industrial applications.

- January 2023 : Blend Colours expanded its black masterbatch production capacity by 6,000 MTPA at its Hyderabad facilities, part of a phased 15,000 MTPA expansion for masterbatch production through organic growth, including new machinery and infrastructure investments.

Table of Contents

Methodology

The study involved four major activities in estimating the market size for black masterbatches. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Following this, market breakdown and data triangulation procedures were employed to determine the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold-standard and silver-standard websites, such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research, which involved conducting extensive interviews with key officials, including CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The black masterbatch market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by key opinion leaders in various applications for the black masterbatch market. The supply side is characterized by advancements in technology and diverse industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

The following is a breakdown of the primary respondents:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/2024, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Avient Corporation | Senior Manager | |

| Ampacet Corporation | Innovation Manager | |

| LyondellBasell Industries Holdings B.V. | Vice-President | |

| Cabot Corporation | Production Supervisor | |

| Plastiblends | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the black masterbatch market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Black masterbatch market: Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes explained above, the market was divided into several segments and subsegments. To complete the overall market engineering process and determine the exact statistics for each market segment and subsegment, data triangulation and market breakdown procedures were employed, as applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the black masterbatch industry.

Market Definition

According to the Polymer Technology Dictionary, black masterbatch is a concentrated mixture primarily composed of carbon black pigment, typically comprising 30-50% carbon black content. It serves as a key additive in imparting deep black coloration, UV protection, and enhanced durability to polymer-based products. Black masterbatch has extensive applications across various industries, including automotive, packaging, and consumer goods, where it enhances both the aesthetic and functional properties of materials. It is compatible with a wide range of polymers, including polypropylene (PP), low-density polyethylene (LDPE), linear low-density polyethylene (LLDPE), high-density polyethylene (HDPE), polyvinyl chloride (PVC), polyethylene terephthalate (PET), polystyrene (PS), and polyurethane (PUR).

Stakeholders

- Black masterbatch manufacturers

- Black masterbatch distributors

- Raw material suppliers

- Government and research organizations

- Investment banks and private equity firms

Report Objectives

- To analyze and forecast the size of the global black masterbatch market in terms of value and volume

- To provide detailed information about the important drivers, restraints, challenges, and opportunities influencing market growth

- To define, describe, and segment the market based on carrier resin, end-use industry, type, and region

- To forecast the size of the market segments based on regions such as Asia Pacific, North America, Europe, the Middle East & Africa, and South America

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contributions to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansions, partnerships & collaborations, mergers & acquisitions, agreements, and product launches in the market

- To strategically profile the key companies and comprehensively analyze their core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Black Masterbatch Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Black Masterbatch Market