Color Masterbatch Market by Type (Standard Color, Tailor-made Color, Specialty Color), Carrier Resin (PE, PP, PS) and End-use Industry (Packaging, Building & Construction, Consumer Goods, Automotive, Agriculture) - Global Trends & Forecasts to 2021

[149 Pages Report] The market size of color masterbatch was USD 3.46 billion in 2015 and is projected to reach USD 4.75 billion by 2021, registering a CAGR of 5.6% between 2016 and 2021. Masterbatch helps impart colors and/or certain properties to raw polymer in the manufacture of plastics. It is an efficient and clean method of adding colorant with or without additives to polymer resin at the factory site. In this report, 2015 is considered as the base year and forecast period is between 2016 and 2021.

Market Dynamics

Drivers

- Increasing use of plastics in automotive industry

- Most preferred coloring method

- Growth in Asia-Pacific and South America region

Restraints

- Cost competitiveness of color matching

- Technological advancements leading to introduction of universal carrier resins

Increasing use of plastics in automotive industry

Plastics, especially engineered plastics, possess superior mechanical, physical, thermal, and electrical properties than that of metals. Engineering plastics are widely used in automotive application for various components such as steering wheel, airbags, seat belts, bumpers, and dashboards. Continuous innovation and demand for lightweight materials in several end-use industries is encouraging the replacement of metals with plastics. In the automotive industry, the need for replacing metals with plastics to reduce the overall weight of vehicles is increasing. It is estimated that for every 10% reduction in weight of vehicles, fuel efficiency can be increased by 7.0%8.0%. In addition, plastics offer better design, safety characteristics, and environmental sustainability than that of metals. Automotive and airplane manufacturers utilize lightweight plastics such as PP and polycarbonate for windows, hood, and interior applications.

The objectives of this study are:

- To analyze and forecast the market size of color masterbatch, in terms of value and volume

- To define, describe, and segment the global color masterbatch market by type, carrier resin, and end-use industry

- To forecast the sizes of the market segments based on regionsAsia-Pacific, Europe, North America, the Middle East & Africa, and South America

- To provide detailed information regarding the important factors (drivers, restraints, and opportunities) influencing the growth of the market

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansions, mergers & acquisitions, collaboration, and new product developments in the global color masterbatch market

- To strategically profile key players and comprehensively analyze their core competencies

Research Methodology:

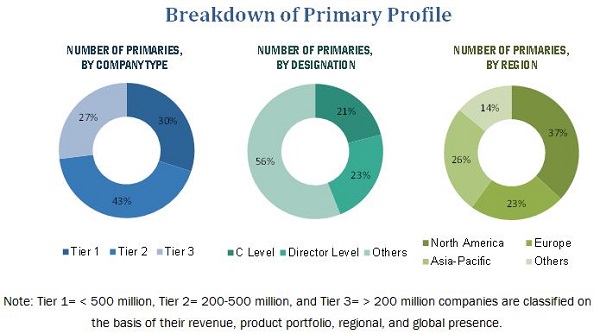

This research study involves the extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg BusinessWeek, and Factiva) to identify and collect information useful for this technical, market-oriented, and commercial study of the color masterbatch market. The primary sources mainly include several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the industrys supply chain. After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure below illustrates the breakdown of the primary interviews based on company type, designation, and region conducted during the research study:

To know about the assumptions considered for the study, download the pdf brochure

The value chain of color masterbatch starts with the procurement of raw materials suppliers. The key components of any type of masterbatch are polymers, dispersants, and carrier resins. The raw materials are chemically synthesized to form a typical concentrate, which is then compounded by color masterbatch producers. Compounding is a two-stage process; gathering ingredients and then mixing them together by applying heat and shear stress to produce a homogenized pellet. Compounders improve the properties of thermoplastic polymers by incorporating additives in molten state. The top compounders of color masterbatch include RTP Company (U.S.) and Astra Polymers (Saudi Arabia). A great amount of effort and expertise is required to manufacture raw materials suitable for different end-use industries. The major end-use industries where these color masterbatch is used include packaging, building & construction, consumer goods, automotive, agriculture, automotive, and others.

Major Market Developments

- In April 2016, A. Schulman, Inc. expanded its color masterbatch plant in Jiangsu, China. The new plant helped the company in producing color additives and tap the Chinese and neighboring markets.

- In February 2016, Clariant AG (Switzerland) planned to invest USD 54 million to expand the production capacity of color and additive masterbatches in Europe, Asia-Pacific, and North America. The expansion helped the company to cater to the demand of high temperature plastics and masterbatches.

- In December 2015, Ampacet Corporation acquired Oceania Plastic. The acquisition helped the company to facilitate distribution of plastic raw material in both Australia and New Zealand.

- In May 2016, Ampacet Corporation launched a new product, ReptyleFx masterbatch. The new product helped to create unique customizable colors and surface textures in plastic films.

Target Audiences:

- Color masterbatch manufacturers

- Color masterbatch suppliers

- Government and research organizations

- Color masterbatch traders, distributors, and suppliers

- Investment banks and private equity firms

- Raw material suppliers

- Service providers

- End users such as automotive, packaging, consumer good, and other companies

Scope of the Report:

This report categorizes the global market of color masterbatch on the basis of type, carrier resin, end-use industry, and region.

Color Masterbatch Market, by Type:

- Standard Color

- Specialty Color

- Tailor-made color

Color Masterbatch Market, by Carrier resin:

- Polyethylene

- Polypropylene

- Polystyrene

- Others

Color Masterbatch Market, by Carrier resin:, by End-use Industry:

- Packaging

- Automotive

- Consumer Goods

- Building & Construction

- Agriculture

- Others

Color Masterbatch Market, by Region:

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia & Newzealand

- Taiwan

- Europe

- Germany

- France

- Italy

- Benelux

- Spain

- UK

- North America

- US

- Canada

- Mexico

- Middle East & Africa

- Saudi Arabia

- Iran

- South America

- Brazil

- Argentina

Critical questions which the report answers

- What are new product color masterbatch companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options (not limited to) are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country, additional end-use industry, and/or type

Country Information

- Additional country information (up to 3)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

The market size of color masterbatch is projected to reach USD 4.75 billion by 2021, registering a CAGR of 5.6% between 2016 and 2021. The rapid growth in the packaging industry in Asia-Pacific is a key driver of the color masterbatch market.

Color masterbatch is used to color the plastics products. Reliance of end-use industries on color for their marketing and branding strategies drives the color masterbatch market. It is extensively used in packaging, building & construction, automotive, consumer goods, agriculture, and other end-use industries. Color masterbatch possesses mechanical strength, thermal resistance, and friction & anti-wear properties when a significant amount of pigment is added to it.

On the basis of type, standard color is the largest segment of the color masterbatch market. Standard color are used in a wide range of applications due to its mechanical, heat resistance, and weather resistance properties. Some of the applications of standard color masterbatch are packaging sheets & films, plastic bottles & containers, and cables & wire.

On the basis of carrier resin, PE is the largest segment of the color masterbatch market. PE is a major carrier resin used to manufacture color masterbatch. It is used to impart specific resin properties to processed polymers. Polyethylene products are mostly used in various end-use applications, such as packaging bags, general plastic films, medical packaging, mulch films, green house & tunnel films, and pipes.

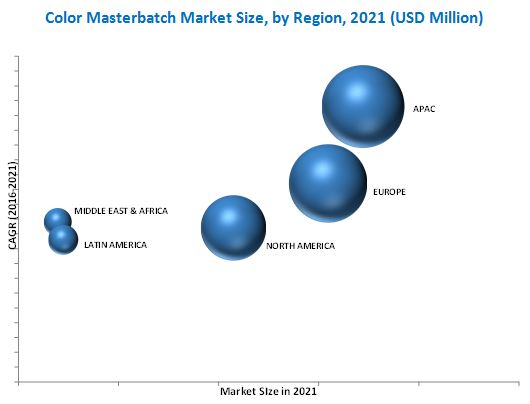

On the basis of region, Asia-Pacific is the largest market for color masterbatch. The growing packaging industry coupled with the increased demand from retail industry drives the market of color masterbatch in the region. End-use industries are witnessing a high growth in developing nations such as India, Indonesia, and Brazil due to the growing economies. Europe is projected to be the second fastest-growing market between 2016 and 2021. This growth is attributed to the rising packaging and automotive sector in the region.

Packaging, consumer goods, and building & construction applications to drive the growth of color masterbatch market

Packaging

Packaging is a crucial process for protection and transportation of goods. Packaging is widely used for goods utilized at the retail, industrial, and institutional levels. The increase in handling and transport of goods due to globalization, liberalization, changing consumer lifestyles, and economic development has led to the increase in demand for better protection and handling of goods. The availability of a wide variety of plastics and their adherence to regulatory standards make them the most extensively used material for packaging. Plastics can be molded, extruded, and blown and cast into films, sheets, foams, and pellets. They also help provide better aesthetic appeal to the packaging, as they offer ease of providing the required color, shape, size, utility, printing, weight, protection, and others. The growth in use of plastics in the packing industry is driving the demand for color masterbatch. The growing importance of color in marketing and branding activities is further fueling growth of the color masterbatch market. The demand for standard color, specialty color, and tailor-made color is very high in the packaging industry.

Consumer Goods

Thermoplastic materials such as PS, PP, PVC, and HDPE are extruded and molded for producing various consumer goods. Consumer goods comprise a number of applications such as electronics, stationary, toys, kitchenware, footwear, safety gear, cosmetic articles, and household products. Consumer goods based on plastics, utilize large volume of color masterbatch for enhancing their properties and aesthetic appeal. Color masterbatch is widely used for manufacturing goods in this segment.

Building and Construction

Plastics are widely used in the construction industry for both interior and exterior applications such as domes, roofing, flooring, storage containers, insulation, windows, pipes, cables, fixtures, panels, and railings. Plastics utilized in the building & construction industry are PVC, PU, PS, PE, PP, composites, and others. They also provide enhanced aesthetics, durability, performance, and cost savings. It is estimated that a years energy savings from the use of plastics in the building & construction industry is adequate to meet the average annual energy needs of, approximately, five million households in North America. With increased emphasis on cost saving and enhanced sustainability, the use of plastics in this application is projected to increase, thus driving the demand for color masterbatch.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming product type of color masterbatch?

The major factor restraining the growth of the color masterbatch market. The stringent government regulations against the use of environmental polluting products are estimated to hamper the growth of the color masterbatch market. An opportunity for the growth of this market is the use of innovative technology to reduce the environmental issues.

Some of the key players of the color masterbatch market are A. Schulman, Inc. (U.S.), Clariant AG (Switzerland), Polyone Corporation (U.S.), Plastiblends India Ltd. (India), and Plastika Kritis S.A. (Greece), and others. These players compete with each other with respect to prices, and offer wide range of products to meet the market requirements.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitation

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Significant Opportunities in Color Masterbatch Market (20162021)

4.2 Color Masterbatch Market Growth, By Region (20162021)

4.3 Color Masterbatch Market Share in Asia-Pacific, 2015

4.4 Color Masterbatch Market Attractiveness

4.5 Color Masterbatch Market Size, By End-Use Industries, 2015

4.6 Color Masterbatch Market Size: Developed vs Developing Nations

4.7 Lifecycle Analysis, By Region

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Use of Plastics as A Substitute for Conventional Materials

5.3.1.2 Most Preferred Coloring Method

5.3.1.3 Growth in Asia-Pacific and South America Region

5.3.2 Restraints

5.3.2.1 Cost Competitiveness of Color Matching

5.3.2.2 Low-Quality and Cheaper Product Offerings

5.3.3 Opportunities

5.3.3.1 Technological Advancements Leading to Introduction of Universal Carrier Resins

5.4 Revenue Pocket Matrix

6 Industry Trends (Page No. - 46)

6.1 Supply Chain Analysis

6.1.1 Masterbatch Producer

6.1.2 Compounder

6.1.3 Polymer Producer

6.1.4 Integrated Polymer Manufacturer & Converter

6.1.5 Integrated Polymer Manufacturer & Compounder

6.1.6 Integrated Masterbatch Producer & Compounder

6.1.7 Integrated Masterbatch Producer, Compounder, & Converter

6.2 Porters Five Forces Analysis

6.2.1 Threat of Substitutes

6.2.2 Bargaining Power of Suppliers

6.2.3 Bargaining Power of Buyers

6.2.4 Threat of New Entrants

6.2.5 Intensity of Competitive Rivalry

6.3 Economic Indicators

6.3.1 Industry Outlook

6.3.1.1 Packaging

6.3.1.2 Automotive

6.3.1.3 Construction

7 Color Masterbatch Market, By Type (Page No. - 54)

7.1 Introduction

7.1.1 Standard Color Masterbatch

7.1.2 Specialty Color Masterbatch

7.1.2.1 Metallic Masterbatch

7.1.2.2 Pearlescent Masterbatch

7.1.2.3 Fluorescent Masterbatch

7.1.2.4 Phosphorescent Masterbatch

7.1.3 Tailor-Made Color

8 Color Masterbatch Market, By Carrier Resin (Page No. - 58)

8.1 Introduction

8.2 Polyethylene

8.2.1 Lldpe

8.2.2 Ldpe

8.2.3 Hdpe

8.3 Polypropylene

8.4 Polystyrene

8.5 Others

9 Color Masterbatch Market, By End-Use Industry (Page No. - 63)

9.1 Introduction

9.2 Packaging

9.3 Building & Construction

9.4 Consumer Goods

9.5 Automotive

9.6 Agriculture

9.7 Others

10 Color Masterbatch Market, By Region (Page No. - 68)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Australia & New Zealand

10.2.6 Taiwan

10.2.7 Rest of Asia-Pacific

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 Italy

10.3.4 Benelux

10.3.5 Spain

10.3.6 U.K.

10.3.7 Rest of Europe

10.4 North America

10.4.1 U.S.

10.4.2 Canada

10.4.3 Mexico

10.5 South America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South America

10.6 Middle East & Africa

10.6.1 Saudi Arabia

10.6.2 Iran

10.6.3 Rest of Middle East & Africa

11 Competitive Landscape (Page No. - 110)

11.1 Overview

11.2 Competitive Benchmarking

11.2.1 Product Portfolio Mapping

11.2.2 Regional Players Mapping

11.3 Market Share Analysis

11.4 Competitive Situations and Trends

11.4.1 Expansions

11.4.2 Mergers & Acquisitions

11.4.3 New Product Launches

11.4.4 Collaborations

12 Company Profiles (Page No. - 119)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Clariant AG

12.2 A. Schulman, Inc.

12.3 Polyone Corporation

12.4 Plastika Kritis S.A.

12.5 Plastiblends India Ltd.

12.6 Ampacet Corporation

12.7 Oneil Color & Compounding

12.8 Penn Color, Inc.

12.9 RTP Company

12.10 Tosaf Group

12.11 Other Market Players

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 142)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (84 Tables)

Table 1 Color Masterbatch Market, By Type

Table 2 Color Masterbatch Market, By Carrier Resin

Table 3 Color Masterbatch Market, By End-Use Industry

Table 4 Color Masterbatch Market Size, By Type, 20142021 (Kiloton)

Table 5 Color Masterbatch Market Size, By Type, 20142021 (USD Million)

Table 6 Color Masterbatch and Carrier Resin Mapping

Table 7 Color Masterbatch Market Size, By Carrier Resin, 20142021 (Kiloton)

Table 8 Color Masterbatch Market Size, By Carrier Resin, 20142021 (USD Million)

Table 9 Color Masterbatch Market: Breakdown of End-Use Industry

Table 10 Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 11 Color Masterbatch Market Size, By End-Use Industry, 20142021 (USD Million)

Table 12 Color Masterbatch Market Size, By Region, 20142021 (Kiloton)

Table 13 Color Masterbatch Market Size, By Region, 20142021 (USD Million)

Table 14 Asia-Pacific: Color Masterbatch Market Size, By Country, 20142021 (Kiloton)

Table 15 Asia-Pacific: Market Size, By Country, 20142021 (USD Million)

Table 16 Asia-Pacific: Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 17 Asia-Pacific: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 18 China: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 19 China: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 20 India: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 21 India: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 22 Japan: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 23 Japan: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 24 South Korea: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 25 South Korea: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 26 Australia & New Zealand: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 27 Australia & New Zealand: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 28 Taiwan: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 29 Taiwan: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 30 Rest of Asia-Pacific: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 31 Rest of Asia-Pacific: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 32 Europe: Color Masterbatch Market Size, By Country, 20142021 (Kiloton)

Table 33 Europe: Market Size, By Country, 20142021 (USD Million)

Table 34 Europe: Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 35 Europe: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 36 Germany: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 37 Germany: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 38 France: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 39 France: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 40 Italy: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 41 Italy: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 42 Benelux: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 43 Benelux: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 44 Spain: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 45 Spain: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 46 U.K.: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 47 U.K.: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 48 Rest of Europe: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 49 Rest of Europe: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 50 North America: Color Masterbatch Market Size, By Country, 20142021 (Kiloton)

Table 51 North America: Market Size, By Country, 20142021 (USD Million)

Table 52 North America: Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 53 North America: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 54 U.S.: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 55 U.S.: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 56 Canada: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 57 Canada: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 58 Mexico: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 59 Mexico: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 60 South America: Color Masterbatch Market Size, By Country, 20142021 (Kiloton)

Table 61 South America: Market Size, By Country, 20142021 (USD Million)

Table 62 South America: Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 63 South America: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 64 Brazil: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 65 Brazil: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 66 Argentina: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 67 Argentina: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 68 Rest of South America: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 69 Rest of South America: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 70 Middle East & Africa: Color Masterbatch Market Size, By Country, 20142021 (Kiloton)

Table 71 Middle East & Africa: Market Size, By Country, 20142021 (USD Million)

Table 72 Middle East & Africa: Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 73 Middle East & Africa: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 74 Saudi Arabia: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 75 Saudi Arabia: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 76 Iran: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 77 Iran: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 78 Rest of Middle East & Africa: Color Masterbatch Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 79 Rest of Middle East & Africa: Market Size, By End-Use Industry, 20142021 (USD Million)

Table 80 Brand Influence on the Color Masterbatch Market

Table 81 Expansions, 20122016

Table 82 Mergers & Acquisitions, 20122016

Table 83 New Product Launches, 20122016

Table 84 Collaborations, 20122016

List of Figures (49 Figures)

Figure 1 Color Masterbatch Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Color Masterbatch Market: Data Triangulation

Figure 5 Standard Color to Dominate Color Masterbatch Market Between 2016 and 2021

Figure 6 PS to Register the Highest CAGR Between 2016 and 2021

Figure 7 Packaging Industry to Dominate the Color Masterbatch Market in 2016

Figure 8 Asia-Pacific to Be the Fastest Growing Market Between 2016 and 2021

Figure 9 Color Masterbatch Market to Witness Moderate Growth Between 2016 and 2021

Figure 10 Asia-Pacific Color Masterbatch Market to Grow at the Highest Rate Between 2016 and 2021

Figure 11 China Accounted for the Largest Color Masterbatch Market Share in Asia-Pacific, 2015

Figure 12 Asia-Pacific to Be the Fastest-Growing Market of Color Masterbatch Between 2016 and 2021

Figure 13 Asia Pacific Accounted for the Largest Share Across All End-User Industries in 2015

Figure 14 China and India to Emerge as Lucrative Markets Between 2016 and 2021

Figure 15 Asia-Pacific Color Masterbatch Market to Register High Growth During Forecast Period

Figure 16 Color Masterbatch Market, By Region

Figure 17 Overview of the Forces Governing the Color Masterbatch Market

Figure 18 GDP Growth Rate: Year-Over-Year Percentage Change

Figure 19 Revenue Pocket Matrix of Color Masterbatch, By Color Type

Figure 20 Supply Chain Analysis for Color Masterbatch

Figure 21 Porters Five Forces Analysis

Figure 22 Global Packaging Industry, By Region, 2014

Figure 23 Global Packaging Industry, By End User, 2014

Figure 24 Gross Domestic Product (GDP) vs Commercial Vehicle Production

Figure 25 Construction Industry Growth Rate, 2014

Figure 26 Standard Color Masterbatch Segment to Witness Significant Growth

Figure 27 High-Visual Appearance Shades of Specialty Color Masterbatch

Figure 28 PS Segment to Witness the Highest Growth During the Forecast Period

Figure 29 Packaging Segment to Be the Largest End-Use Industry for Color Masterbatch During the Forecast Period

Figure 30 Regional Snapshot (20162021): China and India are Emerging as Strategic Locations

Figure 31 India to Be the Fastest-Growing Color Masterbatch Market Between 2016 and 2021

Figure 32 Asia-Pacific Market Snapshot: Packaging Industry to Dominate the Color Masterbatch Market

Figure 33 Color Masterbatch Market in Europe Snapshot: Germany to Dominate the Market During the Forecast Period

Figure 34 North American Market Snapshot: U.S. to Register High Growth During the Forecast Period

Figure 35 Brazil to Dominate the Color Masterbatch Market in South America Between 2016 and 2021

Figure 36 Saudi Arabia to Register the Highest Growth During the Forecast Period

Figure 37 Companies Adopted Expansions as the Key Growth Strategy

Figure 38 Regional Player Mapping

Figure 39 Clariant AG Holds the Maximum Share of Masterbatch Market Among the Top 5 Companies, 2015

Figure 40 Clariant AG: Company Snapshot

Figure 41 Clariant AG: SWOT Analysis

Figure 42 A. Schulman, Inc.: Company Snapshot

Figure 43 A. Schulman, Inc.: SWOT Analysis

Figure 44 Polyone Corporation: Company Snapshot

Figure 45 Polyone Corporation: SWOT Analysis

Figure 46 Plastika Kritis S.A.: Company Snapshot

Figure 47 Plastika Kritis S.A.: SWOT Analysis

Figure 48 Plastiblends India Ltd.: Company Snapshot

Figure 49 Plastiblends India Ltd.: SWOT Analysis

Growth opportunities and latent adjacency in Color Masterbatch Market