The research study involved 4 major activities in estimating the size of the battery TIC market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In secondary research, various secondary sources have been referred to for obtaining the information that was needed for the study. Various secondary sources that were used for the research include, corporate filings such as annual reports, press releases, investor presentations, and financial statements, trade, business, and professional associations, whitepapers, journals, certified publications, and articles from recognized authors and databases.

In the battery TIC market report, the top-down as well as the bottom-up approaches have been used for the estimation of the global market size, along with several other dependent submarkets. The major players in the market were identified with the help of extensive secondary research and their presence in the market was determined using secondary and primary research. All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

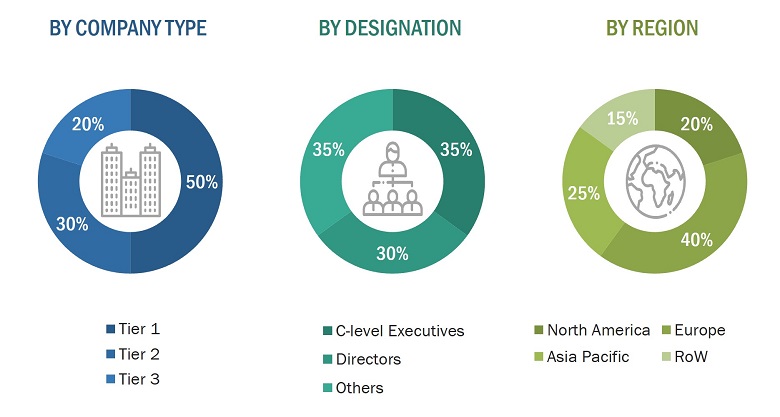

Extensive primary research has been conducted after understanding the battery testing, inspection, and certification market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions— North America, Europe, Asia Pacific, and the Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

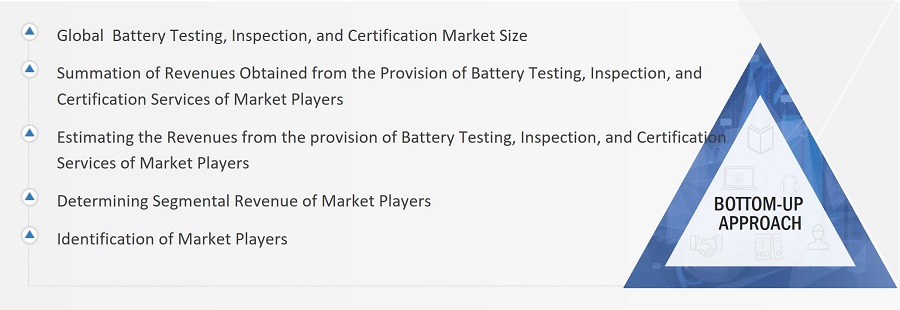

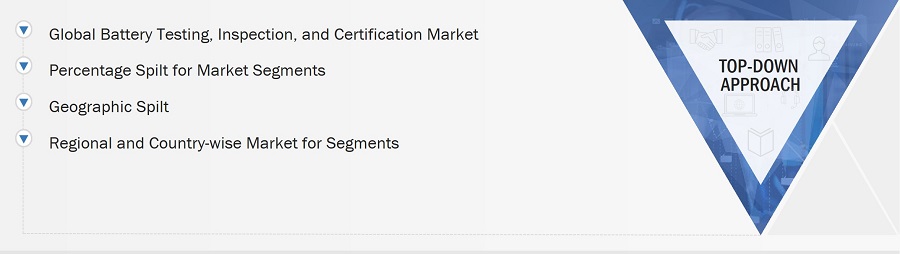

In the market engineering process, both top-down and bottom-up approaches along with data triangulation methods have been used to estimate and validate the size of the battery testing, inspection, and certification market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

-

Identifying top-line investments and spending in the ecosystem and considering segment-level splits and major market developments

-

Identifying different stakeholders in the battery testing, inspection, and certification market that influence the entire market, along with participants across the supply chain

-

Analyzing major providers of TIC service providers for battery products, as well as studying their service portfolios

-

Analyzing trends related to the adoption of battery TIC services

-

Tracking recent and upcoming market developments, including investments, R&D activities, product launches, collaborations, mergers and acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

-

Carrying out multiple discussions with key opinion leaders to identify the adoption trends of battery testing, inspection, and certification services in different applications

-

Segmenting the overall market into various other market segments

-

Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After arriving at the overall market size through the market size estimation process explained in the earlier section, the overall battery testing, inspection, and certification market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

The Battery Testing, Inspection, and Certification (TIC) Market encompasses the range of services and processes involved in evaluating and verifying the performance, safety, and compliance of battery products. This market involves rigorous testing against factors such as electrical performance, safety standards, environmental impact, and lifecycle of batteries, among others. These are important services in the achievement of batteries that are regulatory standard-compliant and benchmarked against industry standards to ensure that they are safe for their reliable performance in applications such as EV, consumer electronics, and ESS.

The TIC market acts as a promoter in technological innovation and consumer safety. TIC services are made use of to provide complete testing and certification so that the growth of the battery industry occurs sustainably. With their accredited and testing-based TIC services, the TIC providers help innovation by battery manufacturers about product development while adhering to strict safety and performance standards. It is therefore expected that the role of robust TIC services will become even more pronounced with surging demand for batteries, especially from rapidly growing electric vehicle (EV) and energy storage systenESS markets, throughout the overall growth and reliability in battery market.

Key Stakeholders

-

Suppliers of Raw Materials and Manufacturing Equipment

-

Battery Manufacturers

-

Battery Testing, Inspection, and Certification Service Providers

-

End-Product Manufacturers

-

Battery Technology Developers

-

Research and Development Organizations

-

Standard Organizations, Forums, and Associations

-

Regulatory Bodies and Government Agencies

-

Governments, financial institutions, and investment communities

-

Analysts and strategic business planners

The main objectives of this study are as follows:

-

To define, describe, and forecast the battery testing, inspection, and certification (TIC) market by standard and certification type, battery type, application, service type, and region, in terms of value

-

To describe and forecast the market size for various segments with respect to four main regions: North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

-

To forecast the market size for lithium-ion batteries, by application, in terms of capacity

-

To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the battery testing, inspection, and certification market

-

To study the complete supply chain and related industry segments for the battery TIC market

-

To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

-

To provide ecosystem analysis, trade analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s five forces analysis, key stakeholders and buying criteria, key conferences and events, regulatory bodies, government agencies, and regulations pertaining to the market under study

-

To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the market

-

To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for the market leaders

-

To analyze competitive developments such as service launches, collaborations, mergers and acquisitions, agreements, partnerships, and expansion activities carried out by players in the battery testing, inspection, and certification market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

-

Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

Company Information:

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Battery Testing, Inspection, and Certification Market