The study involved four major activities in estimating the current market size of the autonomous train market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications such as The European Rail Industry (UNIFE), International Union of Railways, Federal Railroad Administration, Association of American Railroads, International Association of Railway Operation Research etc., railway magazine articles, directories, technical handbooks, world economic outlook, trade websites, technical articles, and databases (Marklines, Factiva etc.) have been used to identify and collect for an extensive commercial study of the global autonomous train market.

Primary Research

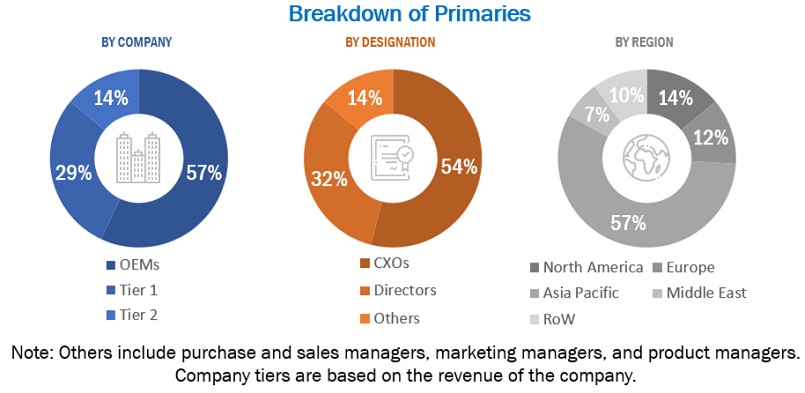

Extensive primary research has been conducted after acquiring an understanding of this market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across major regions, namely, Asia Pacific, Europe, North America, Middle East & Africa and Rest of the World. Approximately 30% and 70% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

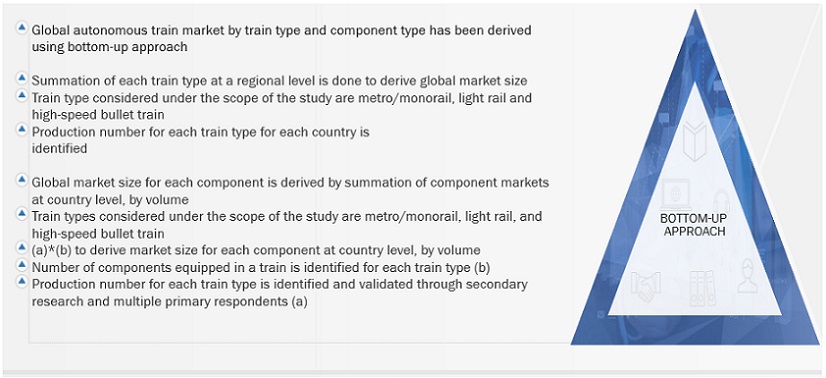

Global autonomous train market by train type & component has been derived using bottom-up approach. To derive global market size, summation of each train type, component type is studied at a regional level. Production numbers are identified and validated through secondary research and multiple primary respondents.

To know about the assumptions considered for the study, Request for Free Sample Report

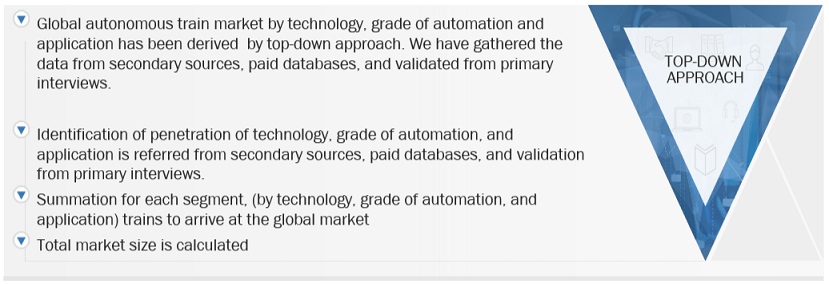

The top-down approach was used to estimate and validate the total market size. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

Key players in the autonomous train market were identified through secondary research, and their market shares were determined through primary and secondary research

-

The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights

-

All major penetration rates, percentage shares, splits, and breakdowns for the autonomous train market were determined using secondary sources and verified through primary sources

-

All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data

-

The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The autonomous train market is the market for trains that have the ability to operate without human intervention. This includes trains that can automatically start, stop, and navigate tracks, as well as detect and avoid obstacles. The market is a relatively new market, but it is expected to grow rapidly in the coming years, driven by factors such as increasing urbanization, rising labor costs, and the need for improved safety and efficiency in the rail industry.

List of Key Stakeholders

-

Government Authorities related to Railway Infrastructure Services

-

Independent Software Vendors

-

Independent Technology/Solution Providers

-

National Railway Governing Authorities/Regulators/Bodies

-

Rail Infrastructure Hardware and Device Suppliers

-

Rail Manufacturers/OEMs

-

Rail Transportation Technology Solution Providers

-

Railway Associations

-

Railway Management Companies (private/public)

-

Railway Operations Management Service Providers

-

Railway Operations Management Solution Vendors

-

Railway Operators Signaling Vendors

-

Transportation Research Authorities, NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

-

Legal and Regulatory Authorities

-

Manufacturers of Rail Components

-

Rail Leasing Authorities

-

Rail Service Providers

-

Railway Contractors

-

Railway Industry Associations

-

Railways Organizations/Associations

-

Raw Material Suppliers for Autonomous Trains

-

Traders, Distributors, and Suppliers of Autonomous Trains

Report Objectives

-

To analyze and forecast the size of the autonomous train market, in terms of volume (units/thousand units), from 2024 to 2030

-

To analyze and forecast the size of the market, in terms of volume (units), based on the grade of automation (grade of automation 1, grade of automation 2, grade of automation 3, and grade of automation 4) from 2024 to 2030

-

To analyze and forecast the size of the market, in terms of value

(USD billion/million), based on technology (Automatic Train Control (ATC), Communication-based Train Control (CBTC), Positive Train Control (PTC), and European Railway Traffic Management System (ERTMS) from 2024 to 2030

-

To analyze and forecast the size of the market, in terms of volume (units) and USD billion, based on train type (metro/monorail, light rail, and high-speed rail/bullet train) from 2024 to 2030

-

To analyze and forecast the size of the market, in terms of volume (units), based on component (tachometer, doppler, accelerometer, sensor, camera, antenna, odometer, radar, lidar) from 2024 to 2030

-

To analyze and forecast the size of the market, in terms of volume (units), based on application (passenger and freight) from 2024 to 2030

-

To qualitatively analyze market, in terms of GoA 4 systems for different regions.

-

To identify the market dynamics, including drivers, restraints, opportunities, and challenges, and analyze their impact on the market.

-

To define, describe, and project the size of the market, in terms of volume (units), based on region (Asia Pacific, Europe, North America, the Middle East & Africa, and Rest of the World (RoW)) from 2024 to 2030

-

To analyze the competitive leadership map for the key players operating in the market based on their business strategies from 2019-2023.

-

To track and analyze competitive developments such as, new product developments, deals and other industry-related activities carried out by the key players to strengthen their position in the autonomous train market.

-

To analyze the opportunities offered by various segments of the market to its stakeholders

-

To analyze and forecast the trends and orientation for autonomous train in the global rail industry

-

To track and analyze competitive developments such as new product development, deals, and other industry activities carried out by key industry participants

-

To analyze opportunities for stakeholders and the competitive landscape for market leaders

-

To strategically profile key players and comprehensively analyze their respective market share and core competencies

-

To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

-

To strategically analyze the market with respect to individual growth trends, prospects, and contributions to the total market

Available Customizations

MarketsandMarkets offers the following customizations for this market:

-

Autonomous train market, additional components

-

Profiling of additional market players (Up to 3)

Growth opportunities and latent adjacency in Autonomous Train Market