Railway Wiring Harness Market by Application (HVAC, Lighting, Traction System, Infotainment), Material, Train (Metro/Monorail, Light Rail, HRS), Component (Wire, Connector), Voltage (High, Low), Cable, Wire length,End Use and Region - Global Forecast to 2026

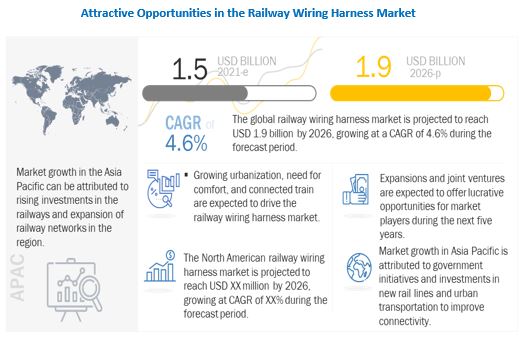

[274 Pages Report] The global railway wiring harness market size was valued at USD 1.5 Billion in 2021 and is expected to reach USD 1.9 Billion by 2026, at a CAGR of 4.6% during the forecast period. The increasing number of projects such as light rail and metro in various regions are expected to drive the market for railway wiring harness. Electrification of existing track length is expected to drive the market. Various governments plan to electrify existing railway networks. For instance, the Indian Railways completed the electrification of 40,000 km of which, 18,605 km was completed during the period from 2014 to 2020. A target has been set to complete the electrification of an additional 7,000 km by 2021. India plans to electrify all broad-gauge networks by 2023. Spain has proposed a 36% increase in suburban investments in its railway budget for 2021 presented in October 2020. All this is supporting the growth of railway wiring harness demand across various countries.

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics:

Driver: Growing Railway Related Projects

Rapid urbanization and continuous economic growth across the world are leading to increased investments in the rail and transit sector to improve the quality of public transport. Governments of different countries in the Asia Pacific region, such as China, Singapore, Malaysia, and Thailand, are carrying out new rail projects and upgrading and expanding their existing rail infrastructures to improve their overall rail connectivity. The adoption of high-speed rail (HSR) transport is increasing heavily since the ridership in the HSR-operated countries is increasing to experience enhanced transporting modes. According to the International Union of Railways (UIC), the global HSR line will grow at a faster rate and is expected to reach up to more than 41,000 km by 2025. For example, China is constructing a high-speed rail network with a distance of 420 km between Nanchang and Guangzhou opened in 2019. These rail projects increase the requirement of wiring used in the manufacturing of locomotives and coaches, which is expected to directly drive the railway wiring harness market.

According to the census report 2020, the US median household income level increased by 6.8% in 2019 compared to 2018. Rising income levels have increased the demand for personal mobility and led to a rise in road traffic in major cities across the globe. However, road congestion has increased and led to an increase in travel time in urban areas owing to the insufficient road network infrastructure. In 2019, the average time spent driving in traffic congestion in major urban areas across the globe was 102 hours, and 21% was during peak time. Urban planners and local governments are merging rapid transit networks and tramways with the existing city infrastructure to alleviate this situation. Commuters are also seeking eco-friendly, reliable, and cost-effective means of transportation. Developed nations such as Germany, France, and the UK are promoting the use of rapid transit systems to reduce traffic congestion. India, China, Egypt, Brazil, and the Gulf countries have increased investments for the development of metros due to the ever-growing urban population in these countries. For example, 462.67 km metro rail was under construction in more than fifteen cities in India in 2020. China planned an investment of USD 4.8 billion for 16 metro lines for a total length of 304.6 km and five railway projects for 132.1 km in 2020. Developed countries are also planning to increase their rail networks, which is expected to drive the railway wiring harness market. For example, in 2020, Germany and Deutsche Bahn planned to invest USD 94.6 billion to improve the railway network and meet the demands of increasing passenger traffic by 2030. Thus, with a consistent rise in rail projects worldwide, the demand for rail components such as wiring harness is expected to witness growth during the forecast period.

Various countries are also adopting automated rail systems for metros. Automated rails require an advanced wiring system for carrying the data inside the train and also for train data transmission and the connecting infrastructure. Several projects are carried out globally to enhance railway technologies and connectivity. For example, the government of Malaysia is carrying out the expansion of a mass transit system in Kuala Lumpur. As a part of this project, the construction of the 40 km underground Circle Line was initiated in 2017. The full-scale construction of the Light Rail Transit (LRT) line 3 is set to start by 2019. Increasing number of tube rail projects is also driving the market for railway wiring harness. For example, Siemens bagged a contract worth USD 2 million from London Railways to build new London tube trains as a part of its extension. Thus, increased rail budget allocations and the rise in the number of projects to develop new and upgrade existing rail infrastructures are expected to propel the growth of the railway wiring harness market across the globe.

Restraint: Environmental Challenge For Wiring Harness

The corrosion caused in electrical wiring systems due to environmental changes has been a major issue. Corrosion can degrade the voltage and current flow, which a sensor could interpret as a system fault. The fault can lead to the malfunction of safety systems like computer-based train control and positive train control. Rail manufacturers bundle wiring harnesses tightly to standardize the manufacturing process. This, however, results in wearing out of wires as well as creates chances of fire. Most trains run in an open environment, which is susceptible to changes in weather conditions. Water leakages wear out wires and can cause corrosion of wires internally leading to malfunctions of various systems of a train. Wiring harness corrosion can thus be a major restraint for the railway wiring harness market.

Additionally, each wiring system between two or more bogies are connected through modules such as terminals and connectors, and these are exposed directly to the open environment. Though these connecters and terminals are designed to withstand corrosion, being exposed to an open environment subjects them to rust and other such deterioration.

Opportunity: Growing Trend of Driverless Trains

Developed countries have initiated plans for the advancement of driverless train networks, which is expected to propel the growth of the transportation sector. Countries such as China, India, South Korea, the US, the UK, Mexico, Brazil, and South Africa are planning to revolutionize their rail networks with the introduction of driverless trains. Rail manufacturers are expanding geographically by investing in infrastructure for the manufacture of driverless trains. Developed regions like North America and Europe are improving the safety and security of railways by retrofitting trains and replacing existing systems with advanced systems. These retrofitting and deployment of new driverless trains require an extensive amount of wiring, which creates a huge opportunity for the growth of the railway wiring harness market. For example, in the European region, a new initiative known as the fourth railway package has been undertaken to create a single European rail area with structural and technical reforms. The initiative aims at providing high levels of safety, interoperability, and reliability to the European rail network. These developments are expected to boost the market for the railway wiring harness. In 2018, the International Association of Public Transport (UITP) Observatory of Automated Metros, the body commissioned to disseminate and share knowledge about automated metro lines, announced that driverless metros across the world have surpassed a total of 1,000km. The opening of the Pujiang Line in Shanghai, China helped achieved this milestone, and there is 63 fully automated operation (FAO) lines in 42 cities across 19 countries in the world. Asia and Europe contribute 75% of the kilometers of fully automated metro lines, while Europe is expected to host 26% of the growth expected over the next decade, mainly in conversion projects. In May 2020, the German Federal Ministry of Economics presented Alstom with the "Innovation Prize for Regulatory Sandboxes"*, related to a planned test project to implement Automatic Train Operation (ATO) in daily passenger operation of regional trains. The project will begin in 2021 together with the Regional Association of the greater area of Braunschweig, the German Aerospace Center (DLR), and the Technical University of Berlin (TU Berlin).

Challenge: Fluctuating Prices of Copper

Copper is used in multiple industries such as infrastructure and electricity. Hence, the cost of copper keeps fluctuating. These fluctuations tend to increase due to the supply and demand gap. The demand for copper is extensive, which primarily governs its global pricing. With the growing economies, the demand for copper is anticipated to increase, thereby inflating the prices worldwide. The railway industry procures a large quantity of copper to manufacture wiring harness for trains. Various factors are considered while manufacturing wiring harness, which controls the pricing of the wiring harness. These factors include price of material, transport cost, and labor cost. Manufacturing of wiring harnesses is labor-intensive. It depends on skilled labor, which incurs the highest cost in the manufacturing process. All these factors result in rising inputs cost and raw material prices. Manufacturers of wiring harness have to deal with the fluctuating prices of the metal to produce the harness for the railway industry. However, a few railway wiring harness manufacturers have started using aluminum because it is lightweight and cheaper. However, it is used in comparatively lesser amounts than copper and is yet to get widely accepted by manufacturers.

Infotainment railway wiring harness segment by application is expected to be the fastest-growing segment during the forecast period

The infotainment segment of the market is projected to grow at the highest during the forecast period. The rising demand for advanced technology infotainment systems such as automatic passenger info board, voice assistant, etc. is expected to drive the global railway wiring harness market.

The infotainment system is capable to simultaneously receive and analyze the real-time piece of information referring to rail connections, business news, while fluently integrating to the train onboard displays individually each train equipped with the GPS system. With such growth in electronics systems on board, the demand for wiring harness would increase significantly over the forecast period.

In 2021, PIS (Passenger Information System) company in Europe contacted Lanner to come up with rail computer to function as the onboard display control system. Once the integration with the whole train system is established, the PIS will work as an onboard unit behind digital signage to deliver audio-visual content for trains passing through Mont Blanc between France and Italy. On the other hand, the on-board PIS will be linked with display devices like LED sign and client LCD infotainment in each passenger car through serial or USB interface for real-time playback diagnosis.

Passenger information solutions, based on innovative technologies, are constantly developing to the benefit of passengers providing them with a relaxing journey and real-time information. Onboard displays show relevant trip information such as travel speed, arrival time and transfer information. The latest solutions combine this type of information with entertainment while presenting the latest news, weather forecasts, sports information, as well as financial news. Growing demand for real-time information is driving the growth of railway wiring harness market for infotainment application.

Asia Pacific market is projected to hold the largest share, in terms of volume, by 2026

Asia Pacific is home to emerging economies such as China and India, along with developed countries such as Japan. It is the second-largest market for the rail industry. The emerging countries in Asia Pacific are expected to experience significant growth, primarily in urban rail and mainline infrastructure construction markets. The industrial growth in the region can be attributed to urbanization in countries such as China and India. Most of the population in these developing countries is dependent on the public transport system for their commute.

Urbanization in emerging countries in this region is growing at an unprecedented rate and is expected to enhance the demand for public transport, such as rail networks. The increasing concern for safety is expected to boost the demand for railway wiring harness. Many countries in the region are also increasing the comfort systems in trains by introducing HVAC system in normal trains too, which increases the demand for the wiring harness. In 2021, After Economy AC, Indian Railways announced to roll out new air-conditioned general second-class coach. Rapid Urbanization in Asia Pacific countries, such as China and India, has intensified the need for the expansion of the existing rail infrastructure and construction of new railway projects, especially for urban transport. For instance, in 2020, Guangzhou Metro Corp opened an extension of Line 8 from Cultural Park on the west side of the city centre to Jiaoxin in Baiyun District to the north on November 26, adding 16·3 km and 11 stations. These projects are expected to drive the railway wiring harness market in the region.

Many countries across the Asia Pacific region witnessing strong growth in urban rail transport. In 2021, The European Investment Bank (EIB) has signed a USD 182 million finance contract with the Indian Government for the Pune Metro Rail project’s second portion in Maharashtra through a virtual signing ceremony. This project is expected to offer urban mobility to a large population, including the working class. The Maharashtra Metro Rail Corporation will work on this project as the implementing agency. This has created a business opportunity for the railway wiring harness market as these trains carry various advanced systems that require more wiring. In 2021, Over 25 cities to have metro rail networks in coming years. India plans to invest around USD 142 million during the next 5 years towards the improvement of suburban rails, metro rails, locomotives and railway wiring harness, manufacturing and maintenance, signaling and electric works, and dedicated freight lines in the country. These developments and investments are driving the market for railway wiring harness in the Asia Pacific.

Key players in the Asia pacific region include Hitachi Ltd.(Japan), Samvardhana Motherson International Limited(India), Furukawa Electric Co.(Japan), Taihan Wire Co, Ltd(South Korea), LS Cables & Systems(South Korea), KEI Industries(India), CMI(India), Gaon Cable(South Korea), and Jiangnan Group(China).

Key Market Players:

The major players in the global railway wiring harness market include Hitachi Ltd. (Japan), Prysmian Group (Italy), TE Connectivity (Switzerland), Leoni (Germany), and Nexans (France).

Scope of the report

|

Report Metric |

Details |

|

Market Revenue in 2021 |

USD 1.5 billion |

|

Estimated Value by 2026 |

USD 1.9 billion |

|

Growth Rate |

Poised to grow at a CAGR of 4.6% |

|

Market Segmentation |

Train type, application, component, cable type, voltage, Wire Length, end use and Region |

|

Market Driver |

Growing Railway Related Projects |

|

Market Opportunity |

Growing Trend of Driverless Trains |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

This research report categorizes the railway wiring harness market based on train type, application, component, cable type, voltage, material type, wire length, end use, and region

By Train Type

- Metro/Monorail

- Light Rail

- High-Speed Rail/Bullet Train

By Application

- HVAC

- Lighting

- Brake

- Traction System

- Engine

- Infotainment

- Others

By Component

- Wire

- Connector

- Terminal

- Others

By Cable Type

- Power Cable

- Transmission Cable

- Jumper Cable

- Others

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

By Material Type

- Copper

- Aluminum

- Others

By Wire Length

- Less Than 5 Feet

- Less than 15 Feet

- More Than 15 Feet

By End Use

- OEM

- Aftermarket

By Region

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of APAC

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Spain

- UK

- Rest of Europe

-

Middle East and Africa

- UAE

- Egypt

- Others

-

RoW

- Brazil

- Russia

Recent Developments

- In March 2021, Nexans extended its long-term partnership with RATP (the state-owned operator of the Paris public transport systems) by winning a two-year contract to supply specialized railway cables and logistics services to upgrade the fire-safety, reliability and performance of the city’s metro and tram networks. The contract will see a total of around 4,800 km of Nexans cables installed in tunnels as well as on-board rolling stock across the Île-de-France region, including the prestigious Grand Paris Express project.

- In December 2020, Hitachi Cable America (HCA) a leading manufacturer of Premise, Fiber Optic, and Specialty cables has announced the addition of a new partnership with Power Experts Group in Canada effective January 1st, 2021.

- In July 2020, Leoni, global solution provider for power and data management in the automotive, railway and other industries, developed two new cables for the industrial data transmission standard Single Pair Ethernet (SPE), which can be used in drag chain and torsion applications. This makes Leoni the first cable manufacturer in the world to bring these cables to market.

- In March 2020, TE Connectivity Ltd., a global industrial technology company with leading positions in connectivity and sensing solutions, completed its public takeover of First Sensor AG. TE now holds 71.87% shares of First Sensor. In combining the First Sensor and TE portfolios, TE will be able to offer an even broader product base, including innovative, market-leading sensors, connectors and systems plus best-in-class capabilities, that supports the growth strategy of TE's sensors business and TE Connectivity as a whole. First Sensor provides market expansion opportunity with optical sensing applications for industrial, heavy truck and auto applications.

- In May 2019, Furukawa Electric has announced a new technology to regenerate single-use plastics and wastepaper into high-strength reinforced plastics using a unique single process. Collected post-consumer plastic is often mixed with paper and various types of plastic, resulting in low mechanical strength, and is unsuitable for material recycling. Due to this, the majority of the collected plastic waste worldwide is incinerated, land-filled, or rejected. Our new technology now makes it possible to regenerate single-use plastics into higher strength reinforced plastics, using only plastic waste and wastepaper.

Frequently Asked Questions (FAQ):

How big is the railway wiring harness market?

The global railway wiring harness market was valued at USD 1.5 Billion in 2021 and is expected to reach USD 1.9 Billion by 2026, at a CAGR of 4.6% during the forecast period.

What are the new market trends impacting the growth of the railway wiring harness market?

Developed countries have initiated plans for the advancement of driverless train networks, which is expected to propel the growth of the transportation sector. Countries such as China, India, South Korea, the US, the UK, Mexico, Brazil, and South Africa are planning to revolutionize their rail networks with the introduction of driverless trains. Rail manufacturers are expanding geographically by investing in infrastructure for the manufacture of driverless trains. Developed regions like North America and Europe are improving the safety and security of railways by retrofitting trains and replacing existing systems with advanced systems.

Which countries are considered in the region segment?

The report covers market sizing for countries such as India, China, Japan, South Korea, France, Germany, Spain, UK, US, Canada, Mexico, UAE, Egypt, South Africa, Brazil and Russia. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS FOR RAILWAY WIRING HARNESS MARKET

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 2 CURRENCY EXCHANGE RATES (USD)

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

FIGURE 2 RESEARCH METHODOLOGY MODEL

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES

2.2.2 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

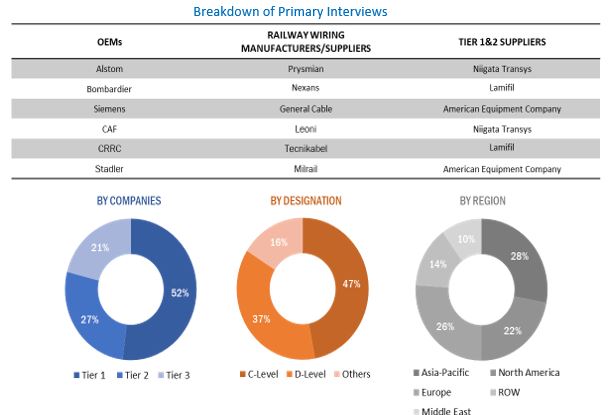

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS:

2.3.1 PRIMARY PARTICIPANTS

2.4 MARKET ESTIMATION METHODOLOGY

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.4.1 BOTTOM-UP APPROACH

2.4.2 BOTTOM-UP APPROACH: RAILWAY WIRING HARNESS MARKET

2.4.3 TOP-DOWN APPROACH: MARKET

FIGURE 5 MARKET: RESEARCH DESIGN AND METHODOLOGY

2.4.4 DEMAND-SIDE APPROACH

FIGURE 6 MARKET: RESEARCH METHODOLOGY ILLUSTRATION OF TE CONNECTIVITY REVENUE ESTIMATION

2.4.5 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY-SIDE

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

FIGURE 8 FACTOR ANALYSIS

2.6 RESEARCH ASSUMPTIONS

2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 9 RAILWAY POWER CABLE MARKET: MARKET DYNAMICS

FIGURE 10 RAILWAY WIRING HARNESS MARKET, BY REGION, 2021–2026

FIGURE 11 LIGHT RAIL SEGMENT PROJECTED TO LEAD THE MARKET FROM 2021 TO 2026

FIGURE 12 ASIA PACIFIC EXPECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 13 IMPACT OF COVID-19 ON MARKET, 2021–2026

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN THE TRAIN WIRING MARKET

FIGURE 14 INCREASING RAPID TRANSIT RAIL NETWORK PROJECTS EXPECTED TO BOOST THE GROWTH OF THE RAILWAY WIRING HARNESS MARKET

4.2 MARKET, BY REGION

FIGURE 15 ASIA PACIFIC IS ESTIMATED TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2021

4.3 MARKET, BY CABLE TYPE

FIGURE 16 POWER CABLE SEGMENT PROJECTED LEAD THE MARKET, 2021 VS. 2026 (USD MILLION)

4.4 MARKET, BY VOLTAGE

FIGURE 17 THE HIGH VOLTAGE SEGMENT IS EXPECTED TO BE THE LARGEST SEGMENT OF THE MARKET FROM 2021 TO 2026

4.5 MARKET, BY MATERIAL

FIGURE 18 THE COPPER SEGMENT IS PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.6 MARKET, BY APPLICATION

FIGURE 19 THE TRACTION SYSTEM SEGMENT PROJECTED TO BE THE LARGEST SEGMENT OF THE MARKET, 2021 VS. 2026 (USD MILLION)

4.7 MARKET, BY TRAIN TYPE

FIGURE 20 THE LIGHT RAIL SEGMENT PROJECTED TO BE THE LARGEST SEGMENT OF THEMARKET DURING FORECAST PERIOD

4.8 MARKET, BY COMPONENT

FIGURE 21 THE WIRE SEGMENT IS PROJECTED TO DOMINATE THE MARKET FROM 2021 TO 2026

4.9 MARKET, BY WIRE LENGTH

FIGURE 22 LESS THAN 5 FEET IS PROJECTED TO BE THE LARGEST SEGMENT OF THE MARKET FROM 2021 TO 2026

4.1 MARKET, BY REGION

FIGURE 23 APAC IS EXPECTED TO BE THE LARGEST MARKET FOR RAILWAY WIRING HARNESS DURING THE FORECAST PERIOD

5 RAILWAY WIRING HARNESS MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

TABLE 3 IMPACT OF MARKET DYNAMICS

5.2 MARKET DYNAMICS

FIGURE 24 TRAIN CABLE MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 INCREASING RAILWAY-RELATED PROJECTS

TABLE 4 WORLD’S BIGGEST ONGOING CONSTRUCTIONS: TOP TEN RAILWAY PROJECTS BY COST

5.2.1.2 Increasing demand for safety and security concerns

TABLE 5 ADVANTAGES OF CONNECTED RAILS

5.2.1.3 Rising smart city projects

TABLE 6 TOP GROWING SMART CITIES/COUNTRIES

5.2.2 RESTRAINTS

5.2.2.1 Environmental challenge for wiring harness

5.2.3 OPPORTUNITIES

5.2.3.1 Growing trend of driverless trains

TABLE 7 AUTOMATED RAILWAY NETWORK

5.2.3.2 Development of energy-efficient wiring system

5.2.4 CHALLENGES

5.2.4.1 Fluctuating prices of copper

FIGURE 25 FLUCTUATION IN COPPER PRICE

5.2.4.2 Durability issues

5.2.4.3 Lack of proper railway infrastructure

5.3 PORTER’S FIVE FORCES

FIGURE 26 PORTER’S FIVE FORCES: MARKET

TABLE 8 MARKET: IMPACT OF PORTERS 5 FORCES

5.3.1 COMPETITIVE RIVALRY

5.3.1.1 A large number of players in the market leads to medium competition in the railway wiring harness market

5.3.2 THREAT OF NEW ENTRANTS

5.3.2.1 Stringent government regulations offer hindrance in entering the market

5.3.3 THREAT OF SUBSTITUTES

5.3.3.1 Availability of limited or no substitutes makes the threat low

5.3.4 BARGAINING POWER OF BUYERS

5.3.4.1 Specific buyer requirement and a large number of suppliers makes the bargaining power of buyers high

5.3.5 BARGAINING POWER OF SUPPLIERS

5.3.5.1 A large number of component suppliers of tier 1 companies makes the bargaining power of suppliers low

5.4 MARKET ECOSYSTEM

FIGURE 27 MARKET: ECOSYSTEM ANALYSIS

TABLE 9 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

5.5 VALUE CHAIN ANALYSIS

FIGURE 28 VALUE CHAIN ANALYSIS: RAILWAY WIRING HARNESS

5.6 AVERAGE SELLING PRICE TREND

FIGURE 29 FLUCTUATION IN COPPER PRICE

5.7 PATENT ANALYSIS

5.8 TARIFF AND REGULATORY OVERVIEW

TABLE 10 EUROPE RAILWAY STANDARDS

TABLE 11 RAILWAY STANDARDS

FIGURE 30 INDIA RAILWAY STANDARDS

TABLE 12 CHINA RAILWAY STANDARDS

5.9 CASE STUDY

5.9.1 ELECWORKS BRINGS AN ADVANCED METHOD THAT ACCELERATES AND ENHANCES THE ELECTRICAL DESIGN AT CHINA ZHUZHOU SOUTH RAILWAY INSTITUTE – WIND POWER BUSINESS UNIT 78

5.9.2 CABLE MANAGEMENT SPECIFIC STANDARD UNDER RAILWAY CATEGORY IN CHINA

5.10 IMPORT AND EXPORT DATA

FIGURE 31 US: IMPORT AND EXPORT DATA OF RAILWAYS AND TRAMWAYS, LOCOMOTIVES, RAILWAY WIRING HARNESS, AND PARTS, 2014-2020 (USD MILLION)

FIGURE 32 CHINA: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, RAILWAY WIRING HARNESS, AND PARTS, 2014-2020 (USD MILLION)

5.11 MARKET: COVID-19 IMPACT

5.11.1 IMPACT ON RAW MATERIAL SUPPLY

5.11.2 COVID-19 IMPACT ON RAILWAY WIRING HARNESS

5.12 MARKET, SCENARIOS (2021–2026)

5.12.1 MARKET, MOST LIKELY SCENARIO

TABLE 13 MARKET (MOST LIKELY), BY REGION, 2021–2026 (USD MILLION)

5.12.2 MARKET, OPTIMISTIC SCENARIO

TABLE 14 MARKET (OPTIMISTIC), BY REGION, 2021–2026 (USD MILLION)

5.12.3 MARKET, PESSIMISTIC SCENARIO

TABLE 15 MARKET (PESSIMISTIC), BY REGION, 2021–2026 (USD MILLION)

5.13 REVENUE SHIFT FOR RAILWAY WIRING HARNESS MANUFACTURERS

5.14 TECHNOLOGY ANALYSIS FOR RAILWAY

5.14.1 IOT IN RAILWAYS

5.14.2 BIG DATA ANALYTICS AND CLOUD COMPUTING IN RAILWAYS

5.14.3 CONNECTED TRAINS

5.14.3.1 Positive train control (PTC)

5.14.3.2 Communication/Computer-Based Train Control (CBTC)

5.14.3.3 Passenger information system (PIS)

5.14.4 AUTONOMOUS TRAIN

5.14.5 EUROPEAN NETWORK AND INFORMATION SECURITY AGENCY (ENISA)

5.15 TECHNOLOGY ANALYSIS FOR RAILWAY WIRING HARNESS

5.15.1 DRAG CHAIN AND TORSION RAILWAY WIRING HARNESS

5.15.2 WIRING HARNESS WITH DUAL TEMPERATURE

6 RAILWAY WIRING HARNESS MARKET, BY APPLICATION (Page No. - 87)

6.1 INTRODUCTION

FIGURE 33 MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 16 MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 17 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

6.2 OPERATIONAL DATA

TABLE 18 RAILWAY WIRING HARNESS DATA BASED ON APPLICATION

6.2.1 ASSUMPTIONS

6.2.2 RESEARCH METHODOLOGY

6.3 HVAC

6.3.1 DEVELOPMENTS IN RAILWAYS TO ENHANCE PASSENGER COMFORT WILL DRIVE THIS SEGMENT

TABLE 19 MARKET IN HVAC SYSTEMS, BY REGION, 2016–2020 (USD MILLION)

TABLE 20 MARKET IN HVAC SYSTEMS, BY REGION, 2021–2026 (USD MILLION)

6.4 LIGHTING

6.4.1 ERROR-FREE ELECTRICAL LIGHTINGS AND HARNESS DESIGN IS DRIVING THE SEGMENT

TABLE 21MARKET IN LIGHTING, BY REGION, 2016–2020 (USD MILLION)

TABLE 22 MARKET IN LIGHTING, BY REGION, 2021–2026 (USD MILLION)

6.5 BRAKES

6.5.1 ADOPTION OF ELECTRONICALLY CONTROLLED PNEUMATIC (ECP) BRAKE SYSTEMS IS DRIVING THE SEGMENT

TABLE 23 MARKET IN BRAKES, BY REGION, 2016–2020 (USD MILLION)

TABLE 24 MARKET IN BRAKES, BY REGION, 2021–2026 (USD MILLION)

6.6 TRACTION SYSTEM

6.6.1 GROWING HIGH-SPEED LINES THAT NEED ELECTRIC TRACTION IS DRIVING THE SEGMENT

TABLE 25 MARKET IN TRACTION SYSTEM, BY REGION, 2016–2020 (USD MILLION)

TABLE 26 MARKET IN TRACTION SYSTEM, BY REGION, 2021–2026 (USD MILLION)

6.7 ENGINE

6.7.1 GROWING DEMAND FOR DIESEL LOCOMOTIVES TO TRANSPORT FREIGHT IS DRIVING THE SEGMENT

TABLE 27 MARKET IN ENGINE, BY REGION, 2016–2020 (USD MILLION)

TABLE 28 MARKET IN ENGINE, BY REGION, 2021–2026 (USD MILLION)

6.8 INFOTAINMENT

6.8.1 GROWING DEMAND FOR REAL-TIME INFORMATION IS DRIVING THE SEGMENT

TABLE 29 MARKET IN INFOTAINMENT, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 MARKET IN INFOTAINMENT, BY REGION, 2021–2026 (USD MILLION)

6.9 OTHERS

6.9.1 ADVANCED LIGHTING TECHNOLOGIES IS GAINING IMPORTANCE HENCE DRIVING THE SEGMENT

TABLE 31 RWH MARKET IN OTHER APPLICATIONS, BY REGION, 2016–2020 (USD MILLION)

TABLE 32 RWH MARKET IN OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

6.1 KEY PRIMARY INSIGHTS

FIGURE 34 KEY PRIMARY INSIGHTS

7 RAILWAY WIRING HARNESS MARKET, BY CABLE TYPE (Page No. - 101)

7.1 INTRODUCTION

FIGURE 35 MARKET, BY CABLE TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 33 MARKET, BY CABLE TYPE, 2016–2020 (USD MILLION)

TABLE 34 MARKET, BY CABLE TYPE, 2021–2026 (USD MILLION)

7.2 OPERATIONAL DATA

TABLE 35 CABLE TYPES OF RAILWAY WIRING HARNESS, BY COMPANY AND MODEL

7.2.1 ASSUMPTIONS

7.2.2 RESEARCH METHODOLOGY

7.3 POWER CABLE

7.3.1 INCREASED DEMAND FOR PHONE CHARGING POINTS AND HVAC SYSTEM IS DRIVING THIS SEGMENT

TABLE 36 POWER CABLE: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 37 POWER CABLE: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.4 TRANSMISSION CABLE

7.4.1 COVERING A WIDE RANGE OF CONTROLLING COMMAND AND SIGNALING COMPONENTS DRIVES THE GROWTH OF THE SEGMENT

TABLE 38 TRANSMISSION CABLE: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 39 TRANSMISSION CABLE: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.5 JUMPER CABLE

7.5.1 THE INCREASING DEMAND FOR HVAC AND COMMUNICATION SYSTEMS FOR PASSENGERS IS DRIVING THE SEGMENT

TABLE 40 JUMPER CABLE: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 41 JUMPER CABLE: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.6 OTHERS

7.6.1 DIGITALIZATION OF RAILWAYS IS EXPECTED TO DRIVE THIS SEGMENT

TABLE 42 OTHERS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 43 OTHERS: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.7 KEY PRIMARY INSIGHTS

FIGURE 36 KEY PRIMARY INSIGHTS

8 RAILWAY WIRING HARNESS MARKET, BY COMPONENT (Page No. - 111)

8.1 INTRODUCTION

FIGURE 37 MARKET, BY COMPONENT, 2021 VS. 2026 (USD MILLION)

TABLE 44 MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 45 MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

8.2 OPERATIONAL DATA

8.2.1 AUTOMATED RAILWAY NETWORK

TABLE 46 AUTOMATED RAILWAY NETWORK

8.2.2 ASSUMPTIONS

8.2.3 RESEARCH METHODOLOGY

8.3 WIRE

8.3.1 INCREASED INVESTMENTS TO INTRODUCE ADVANCED TECHNOLOGIES IN TRAINS IS DRIVING THIS SEGMENT

TABLE 47 WIRE: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 48 WIRE: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.4 CONNECTOR

8.4.1 INCREASING ADOPTION OF ADVANCED FEATURES TO IMPROVE THE SAFETY & COMFORT IS DRIVING THE SEGMENT

TABLE 49 CONNECTOR: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 50 CONNECTOR: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.5 TERMINAL

8.5.1 TECHNOLOGICAL ADVANCED ROLLING STOCKS FUELING THE GROWTH OF THE SEGMENT

TABLE 51 TERMINAL: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 52 TERMINAL: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.6 OTHERS

8.6.1 OTHER COMPONENTS PLAY A CRUCIAL ROLE IN THE ARCHITECTURAL DESIGNING OF THE WIRING HARNESS

TABLE 53 OTHER COMPONENTS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 54 OTHER COMPONENTS: MARKET, BY REGION, 2021–2026 (USD MILLION)

9 RAILWAY WIRING HARNESS MARKET, BY MATERIAL (Page No. - 121)

9.1 INTRODUCTION

FIGURE 38 MARKET, BY MATERIAL, 2021 VS. 2026 (USD MILLION)

FIGURE 39 MARKET, BY MATERIAL, 2021 VS. 2026 (USD MILLION)

TABLE 55 MARKET SIZE, BY MATERIAL, 2016–2020 (USD MILLION)

TABLE 56 MARKET SIZE, BY MATERIAL, 2021–2026 (USD MILLION)

9.2 OPERATIONAL DATA

TABLE 57 MATERIAL TYPES USED IN RAILWAY WIRING HARNESS, BY COMPANY AND MODEL

9.2.1 ASSUMPTIONS

9.2.2 RESEARCH METHODOLOGY

9.3 COPPER

9.3.1 HIGH STRENGTH AND CONDUCTIVITY OF COPPER DRIVES THE GROWTH OF THIS SEGMENT

TABLE 58 COPPER IN RWH MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 59 COPPER IN RWH MARKET, BY REGION, 2021–2026 (USD MILLION)

9.4 ALUMINUM

9.4.1 DUCTILITY, DURABILITY, AND CORROSION-RESISTANT PROPERTIES ARE EXPECTED TO DRIVE THIS SEGMENT

TABLE 60 ALUMINUM IN RWH MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 61 ALUMINUM IN RWH MARKET, BY REGION, 2021–2026 (USD MILLION)

9.5 OTHERS

9.5.1 MIXING COMPOSITION OF MATERIALS PROVIDE BEST-IN-CLASS WIRING SYSTEMS

TABLE 62 OTHER MATERIALS IN RWH MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 63 OTHER MATERIALS IN RWH MARKET, BY REGION, 2021–2026 (USD MILLION)

9.6 KEY INDUSTRY INSIGHTS

10 RAILWAY WIRING HARNESS MARKET, BY TRAIN TYPE (Page No. - 130)

10.1 INTRODUCTION

FIGURE 40 METRO/MONORAIL SEGMENT EXPECTED TO DOMINATE THE GLOBAL MARKET DURING FORECAST PERIOD

TABLE 64 MARKET, BY TRAIN TYPE, 2016–2020 (USD MILLION)

TABLE 65 MARKET, BY TRAIN TYPE, 2021–2026 (USD MILLION)

10.2 OPERATIONAL DATA

TABLE 66 PROPOSED RAPID TRANSIT PROJECTS IN ASIA PACIFIC

10.2.1 ASSUMPTIONS

TABLE 67 ASSUMPTIONS: BY TRAIN TYPE

10.3 RESEARCH METHODOLOGY

10.4 METRO/MONORAIL

10.4.1 DEVELOPMENTS IN RAILWAY INFRASTRUCTURE AND GOVERNMENT SUPPORT ARE DRIVING THIS SEGMENT

TABLE 68 METRO/MONORAIL: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 69 METRO/MONORAIL: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.5 LIGHT RAIL

10.5.1 THE EXTENSION OF THE LIGHT RAIL LINE IS EXPECTED TO INCREASE THE DEPLOYMENT OF WIRING HARNESS IN LIGHT RAILS

TABLE 70 LIGHT RAIL: MARKET, BY REGION,2016–2020 (USD MILLION)

TABLE 71 LIGHT RAIL: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.6 HIGH-SPEED RAIL/BULLET TRAIN

10.6.1 ADVANCED DESIGN AND IMPLEMENTATION OF ENHANCED TECHNOLOGIES IN RAILWAY IS DRIVING THIS SEGMENT

TABLE 72 HIGH-SPEED RAIL/BULLET TRAIN: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 73 HIGH-SPEED RAIL/BULLET TRAIN: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.7 KEY PRIMARY INSIGHTS

FIGURE 41 KEY PRIMARY INSIGHTS

11 RAILWAY WIRING HARNESS MARKET, BY VOLTAGE (Page No. - 142)

11.1 INTRODUCTION

FIGURE 42 MARKET, BY VOLTAGE, 2021 VS. 2026 (USD MILLION)

TABLE 74 MARKET, BY VOLTAGE, 2016–2020 (USD MILLION)

TABLE 75 MARKET, BY VOLTAGE, 2021–2026 (USD MILLION)

11.2 OPERATIONAL DATA

11.2.1 HIGH-SPEED RAIL/BULLET TRAIN PROJECTS IN EUROPE

TABLE 76 HIGH-SPEED RAIL/BULLET TRAIN PROJECTS IN EUROPE REGION

11.2.2 ASSUMPTIONS

TABLE 77 ASSUMPTIONS: BY VOLTAGE

11.3 RESEARCH METHODOLOGY

11.4 LOW VOLTAGE

11.4.1 INCREASED INSTALLATION OF LOW VOLTAGE ELECTRONIC SYSTEMS IN TRAINS WILL DRIVE THIS SEGMENT

TABLE 78 LOW VOLTAGE: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 79 LOW VOLTAGE: MARKET, BY REGION, 2021–2026 (USD MILLION)

11.5 MEDIUM VOLTAGE

11.5.1 FOCUS OF RAIL OPERATORS TO MANAGE AIRFLOW IN TRAINS FOR KEEPING PASSENGERS COMFORTABLE AND SAFE IS DRIVING THE SEGMENT

TABLE 80 MEDIUM VOLTAGE: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 81 MEDIUM VOLTAGE: MARKET, BY REGION, 2021–2026 (USD MILLION)

11.6 HIGH VOLTAGE

11.6.1 GROWING USE OF ELECTRIC TRACTION SYSTEMS IS DRIVING THE SEGMENT

TABLE 82 HIGH VOLTAGE: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 83 HIGH VOLTAGE: MARKET, BY REGION, 2021–2026 (USD MILLION)

11.7 KEY PRIMARY INSIGHTS

FIGURE 43 KEY PRIMARY INSIGHTS

12 RAILWAY WIRING HARNESS MARKET, BY WIRE LENGTH (Page No. - 152)

12.1 INTRODUCTION

12.1.1 ASSUMPTIONS

12.1.2 RESEARCH METHODOLOGY

12.2 OPERATIONAL DATA

12.2.1 LIGHT RAIL PROJECTS IN ASIA PACIFIC

TABLE 84 LIGHT RAIL PROJECTS IN ASIA PACIFIC REGION

FIGURE 44 MARKET, BY WIRE LENGTH, 2021 VS. 2026 (USD MILLION)

TABLE 85 MARKET, BY WIRE LENGTH, 2016–2020 (USD MILLION)

TABLE 86 MARKET, BY WIRE LENGTH, 2021–2026 (USD MILLION)

12.3 KEY PRIMARY INSIGHTS

FIGURE 45 KEY PRIMARY INSIGHTS

13 RAILWAY WIRING HARNESS MARKET, BY END USE (Page No. - 156)

13.1 INTRODUCTION

13.2 OPERATIONAL DATA

13.2.1 HIGH-SPEED RAIL/BULLET TRAIN PROJECTS IN ASIA PACIFIC

TABLE 87 LIGHT RAIL PROJECTS IN ASIA PACIFIC

13.3 OEM

13.3.1 INCREASING DEMAND FOR HIGH-END CONNECTED TRAINS IS DRIVING THE SEGMENT

13.4 AFTERMARKET

13.4.1 INCREASING DEMAND FOR RAILWAY WIRING HARNESS MAINTAINANCE, REPAIR & OVERHAUL DRIVES THIS SEGMENT

14 RAILWAY WIRING HARNESS MARKET, BY REGION (Page No. - 159)

14.1 INTRODUCTION

FIGURE 46 MARKET, BY REGION, 2021 VS. 2026 (USD MILLION)

TABLE 88 MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 89 MARKET, BY REGION, 2021–2026 (USD MILLION)

14.2 ASIA PACIFIC

14.2.1 RAPID TRANSIT PROJECTS IN ASIA PACIFIC

TABLE 90 RAPID TRANSIT PROJECTS IN ASIA PACIFIC

14.2.2 UPCOMING LIGHT RAIL PROJECTS IN ASIA PACIFIC

TABLE 91 PROPOSED LIGHT RAIL PROJECTS IN ASIA PACIFIC

14.2.3 UPCOMING HIGH-SPEED RAIL/BULLET TRAIN PROJECTS IN ASIA PACIFIC

TABLE 92 PROPOSED LIGHT RAIL PROJECTS IN ASIA PACIFIC

FIGURE 47 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 93 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

14.2.4 CHINA

14.2.4.1 Developments in the expansions of subways/metros and rail networks are driving the market

14.2.5 INDIA

14.2.5.1 Government focus on the expansion of the electrified network is expected to boost the market

14.2.6 JAPAN

14.2.6.1 Government investments in the railway sector are expected to boost the growth of the market

14.2.7 SOUTH KOREA

14.2.7.1 Replacement of diesel locomotives with carbon-free locomotives will drive the market

14.2.8 REST OF ASIA PACIFIC

14.2.8.1 High-speed train projects expected to drive the market

14.3 EUROPE

14.3.1 METRO/MONORAIL PROJECTS IN EUROPE

TABLE 95 METRO/MONORAIL PROJECTS IN EUROPE

14.3.2 HIGH-SPEED RAIL/BULLET TRAIN PROJECTS IN EUROPE

TABLE 96 HIGH-SPEED RAIL/BULLET TRAIN PROJECTS IN EUROPE

14.3.3 RAPID TRANSIT PROJECTS IN EUROPE

TABLE 97 RAPID TRANSIT PROJECTS IN EUROPE

TABLE 98 EUROPE: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 99 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

FIGURE 48 EUROPE: MARKET, BY COUNTRY, 2021 VS. 2026 (USD MILLION)

14.3.4 FRANCE

14.3.4.1 Growing high-speed rail line is driving the market

14.3.5 GERMANY

14.3.5.1 Railway network expansion is expected to drive the market in Germany

14.3.6 SPAIN

14.3.6.1 Expansion of metro lines in the country projected to drive the market

14.3.7 UK

14.3.7.1 Increased investments for rail infrastructure expected to drive the market

14.4 NORTH AMERICA

14.4.1 METRO/MONORAIL PROJECTS IN NORTH AMERICA

TABLE 100 METRO/MONORAIL PROJECTS IN NORTH AMERICA

14.4.2 HIGH-SPEED RAIL/BULLET TRAIN PROJECTS IN NORTH AMERICA

TABLE 101 HIGH-SPEED RAIL/BULLET TRAIN PROJECTS IN NORTH AMERICA

14.4.3 RAPID TRANSIT PROJECTS IN NORTH AMERICA

TABLE 102 RAPID TRANSIT PROJECTS IN NORTH AMERICA

FIGURE 49 NORTH AMERICA: MARKET SNAPSHOT

TABLE 103 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

14.4.4 US

14.4.4.1 Introduction of private high-speed lines to drive the market

14.4.5.1 Investments by the government in the rail network expected to drive the market

14.4.6 MEXICO

14.4.6.1 Aim for green public transport by 2040 expected to drive the market

14.5 MIDDLE EAST & AFRICA (MEA)

14.5.1 METRO/MONORAIL PROJECTS IN THE MIDDLE EAST & AFRICA

TABLE 105 METRO/MONORAIL PROJECTS IN THE MIDDLE EAST & AFRICA

14.5.2 RAPID TRANSIT PROJECTS IN THE MIDDLE EAST & AFRICA

TABLE 106 RAPID TRANSIT PROJECTS IN THE MIDDLE EAST & AFRICA

TABLE 107 MEA: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 108 MEA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

14.5.3 UAE

14.5.3.1 Development projects related to rail infrastructure expected to drive the market

14.5.4 EGYPT

14.5.4.1 Increase in rail investments in the country and the demand for locomotives to drive the market

14.5.5 OTHERS

14.5.5.1 Government initiatives to develop railway infrastructure expected to drive the market

14.5.6 REST OF THE WORLD

TABLE 109 ROW: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 110 ROW: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

FIGURE 50 ROW: MARKET, BY COUNTRY, 2021 VS. 2026 (USD MILLION)

14.5.7 BRAZIL

14.5.7.1 Increased metro projects projected to drive the market in this country

14.5.8 RUSSIA

14.5.8.1 Phasing out of carriages for long-haul distance trains is expected to drive the aftermarket

15 COMPETITIVE LANDSCAPE (Page No. - 192)

15.1 OVERVIEW

FIGURE 51 KEY DEVELOPMENTS BY LEADING PLAYERS, 2017–2021

15.2 MARKET SHARE ANALYSIS FOR MARKET

TABLE 111 MARKET SHARE ANALYSIS, 2020

FIGURE 52 MARKET SHARE ANALYSIS,2020

15.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 53 TOP PUBLIC/LISTED PLAYERS DOMINATING THE RAILWAY WIRING HARNESS MARKET IN LAST 5 YEARS

15.3.1 NEW PRODUCT LAUNCHES

TABLE 112 PRODUCTS LAUNCHES, 2017–2021

15.3.2 DEALS

TABLE 113 DEALS, 2017–2021

15.3.3 OTHERS

TABLE 114 OTHERS, 2016-2021

15.4 COMPETITIVE LEADERSHIP MAPPING

15.4.1 STARS

15.4.2 EMERGING LEADERS

15.4.3 PERVASIVE

15.4.4 PARTICIPANTS

FIGURE 54 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

TABLE 115 MARKET: COMPANY FOOTPRINT, 2021

TABLE 116 MARKET: COMPANY CABLE TYPE FOOTPRINT, 2021

15.4.5 MARKET: REGIONAL FOOTPRINT, 2021

15.5 SME COMPETITIVE LEADERSHIP MAPPING

15.5.1 PROGRESSIVE COMPANIES

15.5.2 RESPONSIVE COMPANIES

15.5.3 DYNAMIC COMPANIES

15.5.4 STARTING BLOCKS

FIGURE 55 SME MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

15.6 WINNERS VS. TAIL-ENDERS

TABLE 117 WINNERS VS. TAIL-ENDERS

16 COMPANY PROFILES (Page No. - 214)

16.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

16.1.1 LEONI

TABLE 118 LEONI: BUSINESS OVERVIEW

TABLE 119 LEONI: KEY FIGURES

FIGURE 56 LEONI: COMPANY SNAPSHOT

TABLE 120 LEONI: NEW PRODUCT LAUNCHES

TABLE 121 LEONI: DEALS

TABLE 122 LEONI: OTHERS

16.1.2 HITACHI LTD.

TABLE 123 HITACHI LTD.: BUSINESS OVERVIEW

FIGURE 57 HITACHI LTD.: COMPANY SNAPSHOT

FIGURE 58 HITACHI LTD.: RAILWAY SYSTEM BUSINESS UNIT REVENUE PERCENTAGE BREAKUP

TABLE 124 HITACHI LTD.: NEW PRODUCT LAUNCHES

TABLE 125 HITACHI LTD.: DEALS

16.1.3 NEXANS

TABLE 126 NEXANS: BUSINESS OVERVIEW

TABLE 127 NEXANS: REVENUE BY BUISENSS SEGMENT

FIGURE 59 NEXANS: COMPANY SNAPSHOT

TABLE 128 NEXANS: DEALS

TABLE 129 NEXANS: OTHERS

16.1.4 TE CONNECTIVITY

TABLE 130 TE CONNECTIVITY: BUSINESS OVERVIEW

TABLE 131 TE CONNECTIVITY: NET SALES BY BUSINESS SEGMENT AS A PERCENTAGE OF TOTAL NET SALES

TABLE 132 TE CONNECTIVITY: NET SALES BY BUSINESS SEGMENT IN USD MILLION

TABLE 133 TE CONNECTIVITY: NET SALES BY REGION AS A PERCENTAGE OF TOTAL NET SALES

FIGURE 60 TE CONNECTIVITY: COMPANY SNAPSHOT

TABLE 134 TE CONNECTIVITY: NEW PRODUCT LAUNCHES

TABLE 135 TE CONNECTIVITY: DEALS

TABLE 136 TE CONNECTIVITY: OTHERS

16.1.5 PRYSMIAN GROUP

FIGURE 61 PRYSMIAN GROUP: COMPANY SNAPSHOT

16.1.6 SAMVARDHANA MOTHERSON INTERNATIONAL LIMITED

TABLE 140 SAMVARDHANA MOTHERSON INTERNATIONAL LIMITED: BUSINESS OVERVIEW

FIGURE 62 SAMVARDHANA MOTHERSON INTERNATIONAL LIMITED: GLOBAL PRESENCE

FIGURE 63 SAMVARDHANA MOTHERSON INTERNATIONAL LIMITED: COMPANY SNAPSHOT

TABLE 141 SAMVARDHANA MOTHERSON INTERNATIONAL LIMITED: DEALS

16.1.7 FURUKAWA ELECTRIC CO., LTD.

TABLE 142 FURUKAWA ELECTRIC CO., LTD.: BUSINESS OVERVIEW

FIGURE 64 FURUKAWA ELECTRIC CO., LTD.: COMPANY SNAPSHOT

TABLE 143 FURUKAWA ELECTRIC CO., LTD.: NEW PRODUCT DEVELOPMENTS

TABLE 144 FURUKAWA ELECTRIC CO., LTD.: DEALS

TABLE 145 FURUKAWA ELECTRIC CO., LTD.: OTHERS

16.1.8 TAIHAN WIRE CO, LTD.

TABLE 146 TAIHAN WIRE CO, LTD.: BUSINESS OVERVIEW

FIGURE 65 TAIHAN WIRE CO, LTD.: GLOBAL PRESENCE

FIGURE 66 TAIHAN WIRE CO, LTD.: COMPANY SNAPSHOT

TABLE 147 TAIHAN WIRE CO, LTD.: DEALS

TABLE 148 TAIHAN WIRE CO, LTD.: OTHERS

16.1.9 LS CABLE & SYSTEM LTD

TABLE 149 LS CABLE & SYSTEM LTD.: BUSINESS OVERVIEW

FIGURE 67 LS CABLE & SYSTEM LTD.: COMPANY SNAPSHOT

TABLE 150 LS CABLE & SYSTEM LTD.: NEW PRODUCT LAUNCHES

TABLE 151 LS CABLE & SYSTEM LTD.: OTHERS

16.1.10 HUBER+SUHNER

FIGURE 68 HUBER+SUHNER: COMPANY SNAPSHOT

TABLE 152 HUBER+SUHNER: NEW PRODUCT LAUNCHES

TABLE 153 HUBER+SUHNER: DEALS

TABLE 154 HUBER+SUHNER: OTHERS

16.1.11 ELCOWIRE GROUP

TABLE 155 ELCOWIRE GROUP: BUSINESS OVERVIEW

FIGURE 69 ELCOWIRE GROUP: COMPANY SNAPSHOT

TABLE 156 ELCOWIRE GROUP: NEW PRODUCT LAUNCHES

TABLE 157 ELCOWIRE GROUP: DEALS

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

16.2 OTHER PLAYERS

16.2.1 KEI INDUSTRIES

16.2.2 CMI

16.2.3 GAON CABLE

16.2.4 JIANGNAN GROUP

16.2.5 HELUKABEL

16.2.6 AQ GROUP

16.2.7 TECNIKABEL

16.2.8 IEWC

16.2.9 GPC

16.2.10 DECA CABLES

16.2.11 MILRAIL

16.2.12 UMMC

16.2.13 ALVERN CABLES

16.2.14 ADVANCED TRANSIT MANUFACTURING AND FORTITUDE INDUSTRIES, INC.

17 APPENDIX (Page No. - 265)

17.1 KEY INDUSTRY INSIGHTS

17.2 DISCUSSION GUIDE

17.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.4 AVAILABLE CUSTOMIZATIONS

17.5 RELATED REPORTS

17.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the railway wiring harness market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of rolling stocks OEMs, International Energy Agency (IEA), Federal Transit Administration (FTA), American Public Transportation Association (APTA), Regional Transportation Authority (RTA), country-level railway associations and trade organizations, and the US Department of Transportation (DOT)], rolling stocks magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, government organizations websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global railway wiring harness market.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the railway wiring harness market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand- (OEM and component manufacturers) and supply-side (railway wiring harness manufacturers and distributors) players across five major regions, namely, North America, Europe, Asia Pacific, Middle East & Africa (MEA), and the Rest of the World (Brazil and Russia). Approximately, 70% primary interviews from the demand side and 30% from the supply side were conducted. Primary data was collected through questionnaires, emails, and telephonic interviews. various departments within organizations, such as sales, operations, and administration were strived to cover, to provide a holistic viewpoint in the report. After interacting with industry participants, brief sessions with highly experienced independent consultants were conducted to reinforce the findings from primaries. This, along with the in-house subject-matter experts’ opinions, has led to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Primary participants

In-depth interviews were conducted with the target group, as listed below, to collect industry-related data, technology-related information, and validation of our analysis.

- Associations related to the railway Industry

- Government authorities

- Infrastructure providers for railway Lines

- Legal and regulatory authorities

- Rail leasing authorities

- Railway contractors

- Railway organizations

- Raw material suppliers for wiring manufacturers

- Railway wiring manufacturers

- Rolling stock manufacturers

- Traders, distributors, and suppliers of railway wiring

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the railway wiring harness market and other dependent submarkets, as mentioned below:

- Key players in the railway wiring harness were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights.

- All major penetration rates, percentage shares, splits, and breakdowns for the railway wiring harness market were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study were accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To analyze and forecast the market size of the railway wiring harness market in terms of value (USD million)

- To analyze and forecast the market size of the global market based on train type (metro/monorail, light rail, and high-speed rail/bullet train)

- To analyze and forecast the market size of the market based on application (HVAC, lighting, brake, traction system, engine, infotainment, and others)

- To analyze and forecast the market size of this market based on component (wire, connector, terminal, and others)

- To analyze and forecast the market size of the market based on cable type (power cable, transmission cable, jumper cable, and others)

- To analyze and forecast the market size of the global market based on voltage (low voltage, medium voltage, and high voltage)

- To analyze and forecast the market size of the market based on material type (copper, aluminum, and others)

- To analyze and forecast the market size of the market, based on Wire Length (less than 5 feet, less than 15 feet, more than 15 feet)

- To analyze and forecast the market size of the global market based on end use (OEM and Aftermarket)

- To define, describe, and project the market size of the market based on region (Asia Pacific, North America, Europe, the Middle East & Africa (MEA), and the Rest of the World (RoW))

- To identify the market dynamics including drivers, restraints, opportunities, and challenges, and analyze their impact on this market

- To track and analyze competitive developments such as new product launches, deals and others carried out by key industry participants to strengthen their position in the market

Railway Wiring & Its impact on Railway Wiring Harness Market

In the context of the railway industry, railway wiring and railway wiring harnesses are inextricably linked. Railway wiring is the electrical wiring system used in railways to distribute power and communication signals between train components such as the locomotive, coaches, and control systems. A railway wiring harness, on the other hand, is a pre-assembled set of wires, cables, and connectors used to connect various electrical and electronic components in a railway system. The railway wiring harness market consists of the manufacture and distribution of these pre-assembled wiring harnesses, which are used in a variety of railway applications. These harnesses are designed to meet the railway industry's specific requirements, such as high reliability, durability, and resistance to harsh environmental conditions.

The increasing use of electronics and electrical systems in modern trains is driving the demand for railway wiring harnesses. The increased adoption of advanced control systems, communication systems, and safety systems in railway systems is expected to increase demand for wiring harnesses.

As a result, the railway wiring and railway wiring harness markets are inextricably linked, with growth in one driving growth in the other. In the coming years, the development of innovative and high-performance wiring solutions for railway systems is expected to be a key driver of growth for the market.

By extending the reach of Railway Wiring services, companies are also creating new business opportunities. Companies are using these services to create new products and services and to drive their bottom line.

- Advanced Communication Systems: Railway wiring could be used to support the development of advanced communication systems, including high-speed data transmission, remote monitoring, and control systems.

- Autonomous Trains: Railway wiring could also be used to support the development of autonomous trains, which could potentially revolutionize the way trains are operated.

- Energy Efficiency: Railway wiring could be used to improve the energy efficiency of railway systems by optimizing the distribution of power and reducing energy waste.

- Condition Monitoring: Railway wiring could also be used to support the development of advanced condition monitoring systems, which could be used to detect and diagnose faults in the railway system before they cause significant disruptions.

- Smart Ticketing: Railway wiring could be used to support the development of smart ticketing systems, which could be used to improve the efficiency and convenience of ticketing for passengers.

The top players in the Railway Wiring market are Siemens AG, Alstom SA, TE Connectivity Ltd., Hitachi, Ltd., Prysmian Group, Nexans SA, Furukawa Electric Co., Ltd., NKT A/S Taihan Electric Wire Co., Ltd., HUBER+SUHNER AG.

Some of the key industries that are going to get impacted because of the growth of Railway Wiring are,

1. Automotive Industry: The automotive industry is likely to be impacted by the advancements in railway wiring technology, particularly in the area of high-speed data transmission.

2. Aerospace Industry: The aerospace industry is another sector that could potentially be impacted by railway wiring technology.

3. Construction Industry: Railway wiring solutions could be used in building automation systems to improve communication between various building components, including heating, ventilation, and air conditioning (HVAC) systems, lighting, and security systems.

4. Renewable Energy Industry: The high reliability and durability of railway wiring solutions could potentially be applied to the wiring systems used in wind turbines and solar panels to improve their performance and longevity.

Speak to our Analyst today to know more about, "Railway Wiring Market"

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Railway wiring harness Market, By Voltage, at the country-level (For countries covered in the report)

- Railway wiring harness Market, By Train Type, at the country-level (For countries covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Railway Wiring Harness Market

Which factors are majorly influencing the global growth of the Railway Wiring Harness Market?