Bullet Train/High-Speed Rail Market by Speed in Km/H (200–299, 300–399, Above 400), Track Length, Technology, Application, Propulsion (Electric & Dual), Component (Axle, Transformer, Traction Motor, Traction System), and Region - Global Forecast to 2025

[172 Pages Report] The bullet train/high-speed rail market, in terms of volume, is projected to grow at a CAGR of 5.54% from 2018 to 2025. The market was valued at 3,261 Units in 2017 and is projected to reach 5,287 Units by 2025. In this study, 2017 has been considered the base year, and 2018–2025 is the forecast period, for estimating the market size of the market.

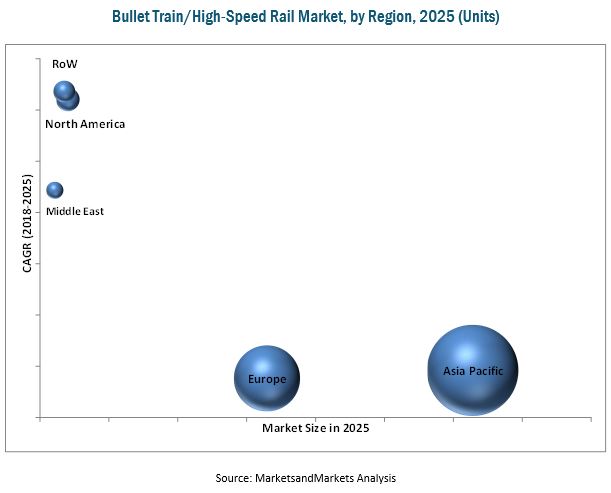

The bullet train/high-speed rail market report studies the market and forecasts its market size, by volume, based on propulsion (diesel, electric, and dual power), speed (200–299 km/h, 300–399 km/h, 400–499 km/h, and above 500 km/h), application (passenger and freight), technology (wheel-on rail and maglev), components (axle, wheelset, transformer, converter, traction system, traction motor, and pantograph). The increasing demand for high-speed rail project for efficient transportation and setting up of new HSR lines are expected to drive the market in Asia Pacific. The Asia Pacific region is estimated to lead the market, in terms of volume, in 2018. The European region is estimated to be the second largest market for bullet train/high-speed rail, due to technological advancements related to operations of trains in the region.

The research methodology used in the report involves various secondary sources such as International Union of Railways (UIC), Union of European Railway Industries (UNIFE), Japan Association of Rolling Stock Industries (JARI), Union of Industries of Railway Equipment (UIRE), and Brazilian Association of the Railroad Suppliers (ABIFER), including paid databases and directories. Experts from related industries and suppliers have been interviewed to understand the future trends of the bullet train/high-speed rail market. The bottom-up approach has been used to estimate and validate the size of the global market. The market size, by volume, is derived by identifying the country-wise operational train volumes and analyzing the demand trends.

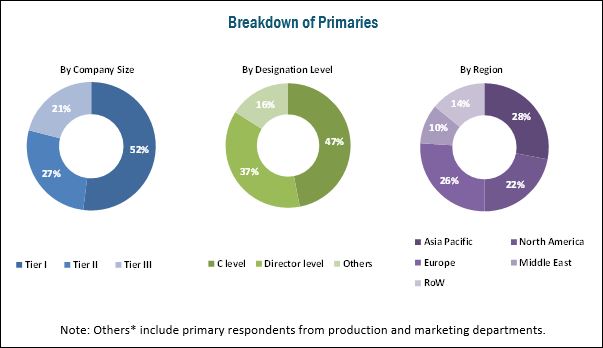

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the bullet train/high-speed rail industry consists of manufacturers such as Bombardier (Canada), Alstom (France), Siemens (Germany), and Hitachi (Japan); research institutes such as the Japan Association of Rolling Stock Industries (JARI), International Railway Journal (IRJ), Union of Industries of Railway Equipment (UIRE), and Union of European Railway Industries (UNIFE).

Target Audience

- Manufacturers of bullet train/high-speed rail

- Dealers and distributors of bullet train/high-speed rail

- Power supply dealers

- Raw materials suppliers

- Rail Industry organizations/associations

- Infrastructure providers for railway lines

- Investment firms

- Equity research firms

- Private equity firms

Scope of the Report

By Propulsion

By Speed

By Application

By Technology

By Component

By Track Length

By Region

-

- Diesel

- Electric

- Dual Power

- 200–299 km/h

- 300–399 km/h

- 400–499 km/h

- Above 500 km/h

- Passenger

- Freight

- Wheel on Rail

- Maglev

- Axle

- Wheelset

- Converter

- Transformer

- Traction Motor

- Traction System

- Pantograph

- China

- Japan

- South Korea

- Turkey

- France

- Germany

- Italy

- Spain

- UK

- US

- Asia-Pacific

- Europe

- North America

- RoW

- Middle East

Available Customizations

MarketsandMarkets offers the following customizations for this market:

- Detailed analysis and profiling of additional regions

- Detailed analysis and profiling of additional market players (up to 3)

Increasing demand for Mass Rapid transit and need to reduce traffic congestion and journey time is likely to boost the growth of the bullet train/high-speed rail market, demand close to 5,287 units by 2025

The increasing use of mass rapid transit such as a high-speed train network would help to reduce traffic congestion and journey time. It would accentuate the need for developing the infrastructure of the city to modify and lay new tracks for high-speed train lines. Therefore, the high-speed train market would grow during the forecast period.

Countries such as Japan, China, Germany, France, and Spain have successfully installed a high-speed train network that has revolutionized the transportation in the region. For instance, the high-speed train line between the Chinese cities Xi'an and Chongqing has reduced the journey time from 9.5 hours to 5.5 hours.

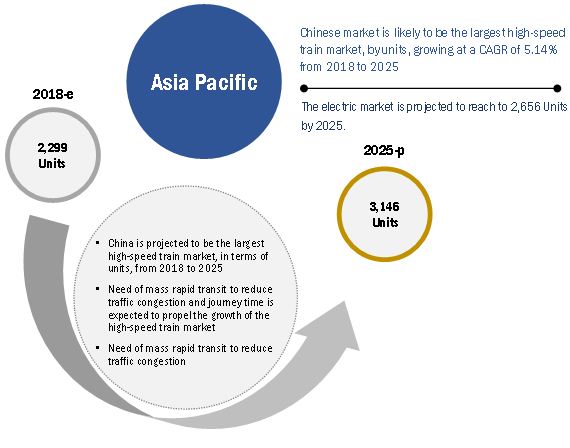

The Asia Pacific region is estimated to dominate the high-speed train market during the forecast period, followed by Europe and North America. The Asia Pacific market is dominated by developing countries such as China and Japan, which have seen the rapid growth of high-speed train lines in recent years.

High-speed train manufacturers are making investments to expand to new geographies. For instance, Alstom manufactured HSR S100, a high-speed line in Spain that connects Madrid and Castellon. Also, Bombardier delivered 850 high-speed trains worldwide, including the TGV in France, AVE in Spain, ICE in Germany, ETR in Italy, and CRH1 in China.

The high-speed train market is dominated by a few globally established players such as Bombardier (Canada), Alstom (France), Siemens (Germany), and Hitachi (Japan).

Market Dynamics

Drivers

- Need to reduce traffic congestion and journey time

- Rise in demand for energy efficient transport

Restraints

- High capital investment and operating costs of high-speed rail network

Opportunities

- Inclination of emerging countries towards high-speed train for rapid transit

- Increasing demand for comfort in transportation

Challenges

- Difficulties in acquiring land for high-speed train infrastructure

Critical Questions:

- Does Land acquisition process is a hurdle in growth path for high speed rail? How are the industry players addressing this challenge?

- By when the high-speed rail technology will gain paced for freight transport?

- Why maglev train technology couldn’t manage to perceive incremental growth?

The bullet train/high-speed rail market is estimated to be 3,626 Units in 2018 and is projected to reach 5,287 by 2025, at a CAGR of 5.54% from 2018 to 2025. The key growth driver for the market is the rising need for mass public transit to reduce traffic congestion and journey time.

The electric propulsion segment is estimated to be the largest as well as the fastest growing market segment in 2018. The segment is anticipated to grow at a rapid pace due to its energy-efficient operation with high operating speed for high-speed trains. Also, the government authorities of various countries are encouraging energy-efficient transporting modes which in turn boosting the growth of the electric propulsion segment of the market.

The segment, by speed, in the range of 300–399 km/h for bullet train/high-speed rail is estimated to be the largest as well as the fastest growing bullet train/high-speed rail market, by volume, during the forecast period. This growth is attributed to the inclination of railway authorities of numerous countries to enhance the speed of high-speed train fleet to improve rail transit modes. Also, expansion of HSR lines is fueling the demand for enhancing the speed of bullet trains by passengers to reduce the journey time.

By technology, the wheel on rail segment is estimated to be the largest market, by volume, during the forecast period. The rising demand for rapid mass transit to reduce traffic congestion is majorly responsible for the estimated growth of the wheel on rail technology. However, the maglev technology is projected to record the fastest growth in the coming years for the market. The high adoption rate of the maglev technology in the market is estimated to make it the fastest growing segment.

The bullet train/high-speed rail market for the passenger segment is anticipated to show the largest growth during the forecast period. The increasing ridership for high-speed rail is expected to propel the growth of the passenger segment in the market. The freight segment is estimated to account for the fastest growth during the forecast period due to the consistent technological advancements in the market.

Axle and wheelset components of bullet train/high-speed rail, by component, are likely to witness the fastest growth as well as largest share in the market. These components are installed in large numbers in a bullet train/high-speed rail making it the leading component in terms of growth.

The Asia Pacific region is projected to be the largest bullet train/high-speed rail market by 2025. The need for rapid mass transit to reduce the traffic congestion and journey time is the principal driving factor governing the growth in this region. The large HSR line infrastructure in countries such as China and Japan is expected to put the Asia Pacific region at the leading position in 2018 as well. The rising demand for energy-efficient transport coupled with the demand for luxury in transportation are the factors boosting the growth of the market in the European region.

The key factor restraining the growth of the bullet train/high-speed rail market is the high capital investment and operating costs of the high-speed rail network. In addition to this, the acquisition of land is a crucial factor offering a challenge to the growth of the market. The market is dominated by a few global players and comprises several regional players. Some of the key manufacturers operating in the market are Bombardier (Canada), Alstom (France), Siemens (Germany), Hitachi (Japan), and ABB (Switzerland).

Need of mass passenger transit to reduce traffic congestion and journey time are the prime factors for the growth of bullet train/high-speed train market

Axle

The axle is the significant component of high-speed rail architecture. The entire train car is mounted over the pair of axles. Therefore, the axles of high-speed trains address heavier loading and high-speed. In case of freight transport, the load on axles increases drastically and requires heavy maintenance and replacement. Thus, the manufacturers of high-speed train manufacturers need to design axles with high tensile strength and prevent fatigue. The axles for high-speed train are estimated to grow at a CAGR of 6.81%.

Wheel Set

Wheel set is one of the prime components of the bogie frame of bullet trains/high-speed trains. The suspension system is linked to the wheel set including springs or rubbers and further this suspension system is linked to the bogie of the vehicle body. The assembly of wheel set comprises two wheels fitted on to an axle. The mobility of the wheel set is driven through the flange of the wheel. The wheel set plays a crucial role in providing adhesion for transferring the tractive force from the wheels in high-speed trains. Wheel sets are projected to grow at a CAGR of 6.81% to reach an estimated 192,465 units by 2025.

Transformer

Transformers for bullet trains/high-speed trains are used either for traction power supply or substation distribution. Transformers need to operate at a high temperature for supplying power to the traction system. Transformers are subjected to high distortion and strong overloads. The basic operation of transformers in the traction system is to transfer electrical energy at low voltage to the motor. Transformers are projected to grow at a CAGR of 6.81%.

Converter

Bullet trains/high-speed trains require high electric energy for their operation. Thus, they require converters for exchanging power between the rail system and the grid. Power electronic converters are principally used in high-speed trains. Converters need to operate at fluctuating voltage applications of high-speed trains. Converters are the link between transformers and the power source. The principal motive of the converter is to provide appropriate voltage wave patterns to motors to control their speed. Auxiliary converters are used to supply power for onboard applications of high-speed trains. Converters are projected to grow at a CAGR of 6.81%.

Traction Motor

A traction motor is used to power the driving wheels of bullet trains/high-speed trains. A traction motor is the most custom component in the high-speed train market. The manufacturing of traction motors is specifically engineered which impacts their ease of maintenance. Every bullet train manufacturer has a specific technology that needs traction motors as per the compatibility of the train architecture. Thus, traction motor manufacturers supply the components with advanced electrical design, energy efficiency and proper performance/weight ratio. Traction motors are projected to grow at a CAGR of 6.81%.

Traction System

Traction system of bullet trains/high-speed trains comprises components such as transformers, motors, converters, and generators. The principal function of the traction system is to offer tractive force to the driving wheels of bullet trains/high-speed trains. The traction chain initiates through generators which generate electrical energy and supply to motors which subsequently drive the wheel of bullet trains/high-speed trains. In this entire process, the transformers and converters are used to transfer electrical energy at low voltage and appropriate voltage pattern. Traction systems are projected to grow at a CAGR of 5.29%.

Pantograph

A pantograph is a four-linkage mechanism mounted over the roof of bullet trains/high-speed trains. The function of a pantograph is to accumulate power through connecting with the overhead wire. The pantograph is defined as the current collector that subsequently generates power for the operation of bullet trains/high-speed trains. Thus, the pantograph is an electric transmission system that is suspended to connect the catenary wire. The structure of a pantograph is spring loaded to allow the free play of overhead wires. Pantographs are projected to grow at a CAGR of 5.29%.

Critical Questions:

- Does electrification of Bullet Train/High-Speed Rail would impact the growth of various rail components?

- Does hyperloop technology pose a threat to the Bullet Train/High-Speed Rail Market?

- Does North America likely to adopt high speed rail/bullet rail as an efficient mode of transportation like Asia Pacific and Europe?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Bullet Train/High-Speed Rail Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Demand-Side Analysis

2.4.1.1 Infrastructure: Rail Network

2.4.1.2 Globalization Resulted in Increasing Demand for High-Speed Rail

2.4.2 Supply Side Analysis

2.4.2.1 Technological Advancement

2.5 Bullet Train/High-Speed Rail Market Breakdown & Data Triangulation

2.6 Market Size Estimation

2.6.1 Bottom-Up Approach

2.6.2 Top-Down Approach

2.7 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in the Bullet Train/High-Speed Rail Market

4.2 Market Share, By Country

4.3 Market, By Propulsion

4.4 Market, By Speed

4.5 Market, By Technology

4.6 Market, By Application

4.7 Bullet Train/High-Speed Rail Market for Automotive, By Region

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 High-Speed Rail Network, By Country

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Need to Reduce Traffic Congestion and Journey Time

5.3.1.2 Rise in Demand for Energy Efficient Transport

5.3.2 Restraints

5.3.2.1 High Capital Investment and Operating Costs of High-Speed Rail Network

5.3.3 Opportunities

5.3.3.1 Inclination of Emerging Countries Towards High-Speed Train for Rapid Transit

5.3.3.2 Increasing Demand for Comfort in Transportation

5.3.4 Challenges

5.3.4.1 Difficulties in Acquiring Land for High-Speed Train Infrastructure

5.4 Macro Indicator Analysis

5.4.1 Introduction

5.4.1.1 Need for Rapid Mass Transit Through Energy Efficient Transport

5.4.1.2 GDP (USD Billion)

5.4.1.3 GNI Per Capita, Atlas Method (USD)

5.4.1.4 GDP Per Capita PPP (USD)

5.4.2 Macro Indicators Influencing the Bullet Train/High-Speed Rail Market for Top 3 Countries

5.4.2.1 China

5.4.2.2 France

5.4.2.3 Japan

6 Technology Overview (Page No. - 49)

6.1 Hyperloop - the Future of Transportation

6.2 Articulated and Non-Articulated Train

6.3 Tilting and Non-Tilting Train

6.4 Autonomous Train

7 Bullet Train/ High-Speed Rail Market, By Application (Page No. - 51)

7.1 Introduction

7.2 Passenger

7.3 Freight

8 Bullet Train/High-Speed Rail Market, By Component (Page No. - 56)

8.1 Introduction

8.2 Axle

8.3 Wheel Set

8.4 Transformer

8.5 Converter

8.6 Traction Motor

8.7 Traction System

8.8 Pantograph

9 Bullet Train/High-Speed Rail Market, By Propulsion (Page No. - 67)

9.1 Introduction

9.2 Diesel

9.3 Electric

9.4 Dual

10 Bullet Train/High-Speed Rail Market, By Speed (Page No. - 73)

10.1 Introduction

10.2 200–299 km/h

10.3 300–399 km/h

10.4 400–499 km/h

10.5 Above 500 km/h

11 Bullet Train/High-Speed Rail Market, By Technology (Page No. - 81)

11.1 Introduction

11.2 Wheel on Rail

11.3 Maglev

12 Bullet Train/High-Speed Rail Market, By Track Length (Page No. - 86)

12.1 Introduction

12.2 China

12.2.1 Operational High-Speed Rail in China

12.2.2 Under Construction High-Speed Rail Lines in China

12.3 Japan

12.3.1 Operational High-Speed Rail in Japan

12.3.2 Under Construction High-Speed Rail Lines in Japan

12.4 South Korea

12.4.1 Operational High-Speed Rail in South Korea

12.4.2 Under Construction High-Speed Rail Lines in South Korea

12.4.3 Long Term Plan High-Speed Rail Lines in South Korea

12.5 Turkey

12.5.1 Operational High-Speed Rail in Turkey

12.5.2 Under Construction High-Speed Rail Lines in Turkey

12.5.3 Long Term Plan for High-Speed Rail Lines in Turkey

12.6 France

12.6.1 Operational High-Speed Rail in France

12.6.2 Under Construction High-Speed Rail Train Lines in France

12.6.3 Long Term Plan for High-Speed Rail Lines in France

12.7 Germany

12.7.1 Operational High-Speed Rail in Germany

12.7.2 Under Construction High-Speed Rail Lines in Germany

12.7.3 Long Term Plan for High-Speed Rail Lines in Germany

12.8 Italy

12.8.1 Operational High-Speed Rail in Italy

12.8.2 Under Construction High-Speed Rail Lines in Italy

12.8.3 Long Term Plan for High-Speed Rail Lines in Italy

12.9 Spain

12.9.1 Operational High-Speed Rail in Spain

12.9.2 Under Construction High-Speed Rail Lines in Spain

12.9.3 Long Term Plan for High-Speed Rail Lines in Spain

12.10 UK

12.10.1 Operational High-Speed Rail in the Uk

12.10.2 Long Term Plan for High-Speed Rail Lines in the Uk

12.11 US

12.11.1 Operational High-Speed Rail in the Us

12.11.2 Under Construction High-Speed Rail Lines in the Us

12.11.3 Long Term Plan for High-Speed Rail Lines in the Us

13 Bullet Train/High-Speed Rail Market, By Region (Page No. - 98)

13.1 Introduction

13.2 Asia Pacific

13.2.1 China

13.2.2 India

13.2.3 Japan

13.2.4 South Korea

13.2.5 Turkey

13.2.6 Australia

13.3 Europe

13.3.1 Germany

13.3.2 France

13.3.3 Italy

13.3.4 Spain

13.3.5 UK

13.4 North America

13.4.1 Canada

13.4.2 Mexico

13.4.3 US

13.5 Rest of the World

13.5.1 Brazil

13.5.2 Russia

13.6 Middle East

13.6.1 Saudi Arabia

13.6.2 Egypt

14 Competitive Landscape (Page No. - 126)

14.1 Overview

14.2 Bullet Train/High-Speed Rail Market Ranking Analysis

14.3 Competitive Scenario

14.3.1 New Product Developments

14.3.2 Mergers & Acquisitions

14.3.3 Partnerships/Supply Contracts/Collaborations/Joint Ventures/License Agreements

14.3.4 Expansions

15 Company Profiles (Page No. - 131)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

15.1 Bombardier

15.2 Alstom

15.3 Siemens

15.4 Hitachi

15.5 ABB

15.6 CRRC

15.7 Talgo

15.8 Kawasaki

15.9 Toshiba

15.10 Mitsubishi

15.11 CAF

15.12 Strukton

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 165)

16.1 Key Insights of Industry Experts

16.2 Discussion Guide

16.3 Available Customizations

16.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.5 Introducing RT: Real Time Market Intelligence

16.6 Author Details

List of Tables (58 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 High-Speed Rail Market Snapshot

Table 3 Operational High-Speed Rail Network - Spain

Table 4 Operational High-Speed Rail Network – France

Table 5 Operational High-Speed Rail Network – Japan

Table 6 China: Rising GNI Per Capita is Expected to Drive the Increasing Ridership of High-Speed Train During the Forecast Period

Table 7 France: Rising GDP is Likely to Have A High Impact on High-Speed Train Sales

Table 8 Japan: Increasing GNI is Expected to Play A Crucial Role in Boosting the MARKET

Table 9 MARKET Size, By Application, 2016–2025 (Units)

Table 10 Passenger: MARKET Size, By Region, 2016–2025 (Units)

Table 11 Freight: MARKET Size, By Region, 2016–2025 (Units)

Table 12 MARKET Size, By Component, 2016–2025 (Units)

Table 13 Axle: MARKET Size, By Region, 2016–2025 (Units)

Table 14 Wheel Set: MARKET Size, By Region, 2016–2025 (Units)

Table 15 Transformer: Market Size, By Region, 2016–2025 (Units)

Table 16 Converter: Market Size, By Region, 2016–2025 (Units)

Table 17 Traction Motor: Market Size, By Region, 2016–2025 (Units)

Table 18 Traction System: Market Size, By Region, 2016–2025 (Units)

Table 19 Pantograph: Market Size, By Region, 2016–2025 (Units)

Table 20 High-Speed Rail Market Size, By Propulsion, 2016–2025 (Units)

Table 21 Diesel: High-Speed Train Market Size, By Region, 2016–2025 (Units)

Table 22 Electric: Market Size, By Region, 2016–2025 (Units)

Table 23 Dual: Market Size, By Region, 2016–2025 (Units)

Table 24 Market Size, By Speed, 2016–2025 (Units)

Table 25 200–299kmph: High-Speed Rail Market Size, By Region, 2016–2025 (Units)

Table 26 300–399 km/h: Market Size, By Region, 2016–2025 (Units)

Table 27 400–499 km/h: Market Size, By Region, 2016–2025 (Units)

Table 28 Above 500 km/h: Market Size, By Region, 2016–2025 (Units)

Table 29 Market Size, By Technology, 2016–2025 (Units)

Table 30 Wheel on Rail: Market Size, By Region, 2016–2025 (Units)

Table 31 Maglev: Market Size, By Region, 2016–2025 (Units)

Table 32 Market, By Region, 2016–2025 (Units)

Table 33 Asia Pacific: Market, By Country, 2016–2025 (Units)

Table 34 China: Market Size, By Speed, 2016–2025 (Units)

Table 35 India: Market Size, By Speed, 2016–2025 (Units)

Table 36 Japan: Market Size, By Speed, 2016–2025 (Units)

Table 37 South Korea: Market Size, By Speed, 2016–2025 (Units)

Table 38 Turkey: Market Size, By Speed, 2016–2025 (Units)

Table 39 Europe: Market, By Country, 2016–2025 (Units)

Table 40 Germany: Market Size, By Speed, 2016–2025 (Units)

Table 41 France: Market Size, By Speed, 2016–2025 (Units)

Table 42 Italy: Market Size, By Speed, 2016–2025 (Units)

Table 43 Spain: Market Size, By Speed, 2016–2025 (Units)

Table 44 UK: Market Size, By Speed, 2016–2025 (Units)

Table 45 North America: High-Speed Rail Market, By Country, 2016–2025 (Units)

Table 46 Canada: Market Size, By Speed, 2016–2025 (Units)

Table 47 Mexico: Market Size, By Speed, 2016–2025 (Units)

Table 48 US: Market Size, By Speed, 2016–2025 (Units)

Table 49 RoW: Market, By Country, 2016–2025 (Units)

Table 50 Brazil: Market Size, By Speed, 2016–2025 (Units)

Table 51 Russia: Market Size, By Speed, 2016–2025 (Units)

Table 52 Middle East: Market, By Country, 2016–2025 (Units)

Table 53 Saudi Arabia: Market Size, By Speed, 2016–2025 (Units)

Table 54 Egypt: High-Speed Rail Market Size, By Speed, 2016–2025 (Units)

Table 55 New Product Development, 2015–2017

Table 56 Mergers & Acquisitions, 2017

Table 57 Partnerships/Supply Contracts/Collaborations/Joint Ventures/Agreements, 2017

Table 58 Expansions, 2016–2017

List of Figures (78 Figures)

Figure 1 High-Speed Rail Market: Research Design

Figure 2 Breakdown of Primary Interviews

Figure 3 High-Speed Rail Network, 2016

Figure 4 Data Triangulation

Figure 5 Market: Bottom-Up Approach

Figure 6 Market: Top-Down Approach

Figure 7 Bullet Train/High-Speed Rail Market, By Propulsion (2018 vs 2025)

Figure 8 Market, By Speed (2018 vs 2025)

Figure 9 Market, By Component (2018 vs 2025)

Figure 10 Market, By Technology (2018 vs 2025)

Figure 11 Market, By Application (2018 vs 2025)

Figure 12 Market, By Region (2018 vs 2025)

Figure 13 Need to Reduce Traffic Congestion and Journey Time is Likely to Boost the Growth of the market From 2018 to 2025

Figure 14 Russia is Estimated to Be the Fastest Growing Market for Bullet Train/High-Speed Rail From 2018 to 2025

Figure 15 Electric Propulsion Segment of Bullet Train/High-Speed Rail Market to Have the Largest Market Size By 2025

Figure 16 300 km/h to 399 km/h Speed Segment to Have the Largest Share of market, 2018 vs 2025

Figure 17 Wheel-On-Rail Segment to Have the Largest Share of market, 2018 vs 2025

Figure 18 Passenger Bullet Train/High-Speed Rail to Hold the Largest Share of market, 2018 vs 2025 (Units)

Figure 19 Asia Pacific to Be the Largest Market for Bullet Train/High-Speed Rail, 2018 vs 2025

Figure 20 High-Speed Rail: Market Dynamics

Figure 21 Carbon Dioxide & Energy Consumption From Madrid to Barcelona

Figure 22 High-Speed Train Rail, By Application, 2018 vs 2025 (Units)

Figure 23 Passenger: Market, By Region, 2018 vs 2025 (Units)

Figure 24 Freight: Market, By Region, 2018 vs 2025 (Units)

Figure 25 High-Speed Rail Market, By Component, 2018 vs 2025 (Units)

Figure 26 Axle: Market, By Region, 2018 vs 2025 (Units)

Figure 27 Wheel Set: Market, By Region, 2018 vs 2025 (Units)

Figure 28 Transformer: Market, By Region, 2018 vs 2025 (Units)

Figure 29 Converter: Market, By Region, 2018 vs 2025 (Units)

Figure 30 Traction Motor: Market, By Region, 2018 vs 2025 (Units)

Figure 31 Traction System: Market, By Region, 2018 vs 2025 (Units)

Figure 32 Pantograph: Market, By Region, 2018 vs 2025 (Units)

Figure 33 High-Speed Rail Market, By Propulsion, 2018 vs 2025 (Units)

Figure 34 Diesel: Market, By Region, 2018 vs 2025 (Units)

Figure 35 Electric: Market, By Region, 2018 vs 2025 (Units)

Figure 36 Dual: Market, By Region, 2018 vs 2025 (Units)

Figure 37 High-Speed Rail Market, By Speed, 2018 vs 2025 (Units)

Figure 38 200–299 km/h: Market, By Region, 2018 vs 2025 (Units)

Figure 39 300–399 km/h: Market, By Region, 2018 vs 2025 (Units)

Figure 40 400–499 km/h: Market, By Speed, 2018 vs 2025 (Units)

Figure 41 Above 500 km/h: Market, By Region, 2018 vs 2025 (Units)

Figure 42 Market, By Technology, 2018 vs 2025 (Units)

Figure 43 Wheel on Rail: Market, By Region, 2018 vs 2025 (Units)

Figure 44 Russia is Estimated to Be the Fastest-Growing Market for High-Speed Rail During the Forecast Period (2018–2025)

Figure 45 Asia Pacific: Market Snapshot

Figure 46 China: Market, By Speed, 2018 vs 2025 (Units)

Figure 47 Japan: Market, By Speed, 2018 vs 2025 (Units)

Figure 48 South Korea: Market, By Speed, 2018 vs 2025 (Units)

Figure 49 Europe: High-Speed Rail Market Snapshot

Figure 50 Germany: Market, By Speed, 2018 vs 2025 (Units)

Figure 51 France: Market, By Speed, 2018 vs 2025 (Units)

Figure 52 Italy: Market, By Speed, 2018 vs 2025 (Units)

Figure 53 Spain: Market, By Speed, 2018 vs 2025 (Units)

Figure 54 North America: Market, By Country, 2018–2025 (Units)

Figure 55 US: Market, By Speed, 2018 vs 2025 (Units)

Figure 56 RoW: Market, 2018 vs 2025 (Units)

Figure 57 Russia: Market, By Speed, 2018 vs 2025 (Units)

Figure 58 Middle East: Market, 2018 vs 2025 (Units)

Figure 59 Saudi Arabia: Market, By Speed, 2018 vs 2025 (Units)

Figure 60 Key Developments By Leading Players in the Bullet Train/ High-Speed Rail Market, 2015–2018

Figure 61 Bullet Train/High-Speed Rail Market Ranking: 2017

Figure 62 Company Snapshot: Bombardier

Figure 63 Bombardier: SWOT Analysis

Figure 64 Company Snapshot: Alstom

Figure 65 Alstom: SWOT Analysis

Figure 66 Company Snapshot: Siemens

Figure 67 Siemens: SWOT Analysis

Figure 68 Company Snapshot: Hitachi

Figure 69 Hitachi: SWOT Analysis

Figure 70 Company Snapshot: ABB

Figure 71 ABB: SWOT Analysis

Figure 72 Company Snapshot: CRRC

Figure 73 Company Snapshot: Talgo

Figure 74 Company Snapshot: Kawasaki

Figure 75 Company Snapshot: Toshiba

Figure 76 Company Snapshot: Mitsubishi

Figure 77 Company Snapshot: CAF

Figure 78 Company Snapshot: Strukton

Growth opportunities and latent adjacency in Bullet Train/High-Speed Rail Market