The study used four major activities to estimate the market size of the automotive speaker. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the size of the automotive speaker market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. Various secondary sources have been referred to in the secondary research process for identifying and collecting information for this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, certified publications, and articles by recognized authors; websites; directories; and databases. Secondary research has mainly been used to obtain key information about the value chain of the automotive speaker market, key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated through primary research. The secondary research referred to for this research study involves the International Organization of Motor Vehicle Manufacturers (OICA), Federation of Automobile Dealers Associations (FADA), Society of Automotive Engineers India (SAEINDIA), Santa Clarita Auto Sound, Inc., AudioMotive, Department of Business & Trade. Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect valuable information for a technical, market-oriented, and commercial study of the automotive speaker market. Vendor offerings have been taken into consideration to determine market segmentation.

Primary Research

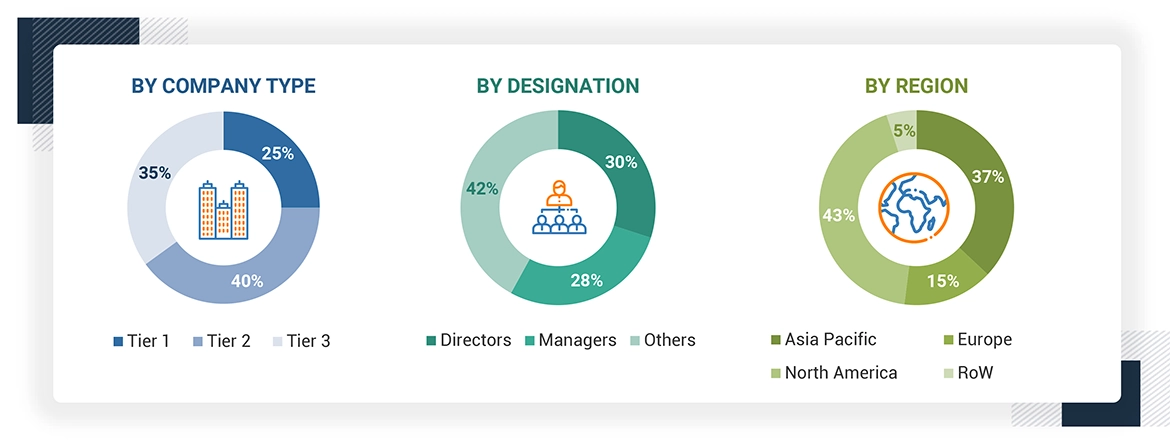

In the primary research, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include the key industry participants, subject-matter experts (SMEs), and C-level executives and consultants from various key companies and organizations in the automotive speaker ecosystem. After the complete market engineering (including calculations for the market statistics, the market breakdown, the market size estimations, the market forecasting, and the data triangulation), extensive primary research has been conducted to verify and validate the critical market numbers obtained. Extensive qualitative and quantitative analyses have been performed during the market engineering process to list key information/insights throughout the report. Extensive primary research has been conducted after understanding the automotive speaker market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand and supply-side players across key regions: North America, Europe, Asia Pacific, and the Rest of the World (Middle East, Africa, and South America). Various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts’ opinions have led us to the findings described in the remainder of this report.

Note: The three tiers of the companies are defined based on their total revenue in 2023: Tier 1 - revenue greater than or equal to USD 1

billion; Tier 2 - revenue between USD 100 million and USD 1 billion; and Tier 3 revenue less than or equal to USD 100 million. Other

designations include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To estimate and validate the size of the automotive speaker market and its submarkets, both top-down and bottom-up approaches were utilized. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying top players' annual and financial reports and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering products in the WCM market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of product type, deployment mode, architecture, and end user. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Automotive Speaker Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the automotive speaker market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both top-down and bottom-up approaches.

Market Definition

The automotive speaker market includes the development, distribution, and installation of audio systems specifically made for vehicles like passenger cars, commercial vehicles, and electric vehicles (EVs). These speakers vary from standard to high-quality systems to meet diverse consumer preferences for in-car audio. Designed for vehicle conditions, these speakers provide clear sound despite vibrations, temperature shifts, and varying speeds. Increasing demand for premium audio and advances in sound technology are driving growth in this market. Automakers and aftermarket providers are collaborating with audio technology companies to offer various speaker types, including coaxial, component, and subwoofer speakers, that cater to distinct vehicle segments and consumer preferences. With the rise in electric and hybrid vehicles, the market is witnessing new growth opportunities as manufacturers prioritize advanced audio features that enhance the driving experience.

Stakeholders

-

Raw material providers

-

OEMs (Original Equipment Manufacturers)

-

Aftermarket Distributors and Retailers

-

Integrators and solution providers

-

Professional services/solution providers

-

Research institutions and organizations

Report Objectives

-

To estimate and forecast the size of the Automotive Speaker Market in terms of value based on type, vehicle type, installation location, sales channel, and region.

-

To analyze the influence of electric vehicles on speaker system requirements and design.

-

To analyze different speaker types and their adoption rates across various vehicle segments.

-

To describe and forecast the market size, in terms of value, for four major regions-North America, Europe, Asia Pacific, and Rest of the World (RoW).

-

To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the market growth.

-

To provide a detailed overview of the Automotive Speaker value chain.

-

To strategically analyze micro markets regarding individual market trends, growth prospects, and contributions to the total market.

-

To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with a detailed competitive landscape for the market leaders.

-

To analyze major growth strategies such as product launches/developments, and acquisitions adopted by the key market players to enhance their market position.

-

To analyze the impact of the macroeconomic factors impacting the automotive speaker market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players (up to 5)

-

Additional country-level analysis of the automotive speaker market

Product Analysis

-

Product matrix, which provides a detailed comparison of the product portfolio of each company in the automotive speaker market.

Growth opportunities and latent adjacency in Automotive Speaker Market