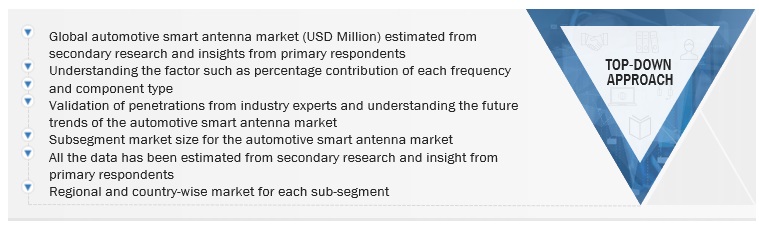

Various secondary sources, directories, and databases have been used to identify and collect information for an extensive automotive smart antenna market study. The study involved four main activities in estimating the current size of the market: secondary research, validation through primary research, assumptions, and market analysis. Exhaustive secondary research was carried out to collect information on the market, such as the antenna type and the upcoming technologies and trends. The next step was to validate these findings, assumptions, and market analysis with industry experts across the value chain through primary research. The top-down approach was employed to estimate the complete market size for different segments considered in this study.

Secondary Research

In the secondary research process, various secondary sources have been used to identify and collect information useful for an extensive commercial study of the automotive smart antenna market. Secondary sources include company annual reports/presentations, press releases, industry association publications [such as publications on vehicle sales, EEA (European Energy Agency), IEA (International Energy Agency), ACEA (European Automobile Manufacturers Association), T&E (Transport and Environment), country-level automotive associations and trade organizations, and the US Department of Transportation (DOT)], Automotive smart antenna related magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles. Additionally, secondary research has been carried out to understand the average cost of automotive smart antennas equipped in each vehicle type and the historical sales of vehicles.

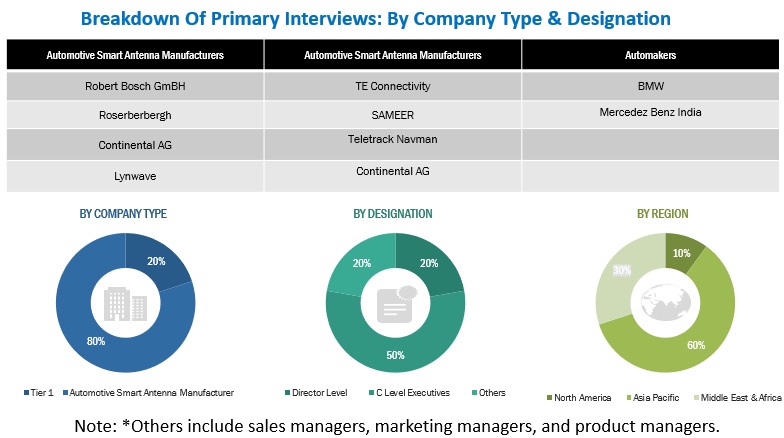

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as research and development experts, CEOs, CTOs, COOS, vice presidents, marketing directors, technology and innovation directors, and related key executives from different key companies operating in the automotive smart antenna market.

After the complete market engineering, which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation, extensive primary research has been conducted to gather information and verify and validate the critical numbers arrived at. Primary research has also been conducted to identify and validate the segmentation, industry trends, key players, competitive landscape, and market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. Extensive qualitative and quantitative analysis has been performed on the complete market engineering process to list key information/insights throughout the report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter expert’s opinions, has led us to the findings described in this report's remainder.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

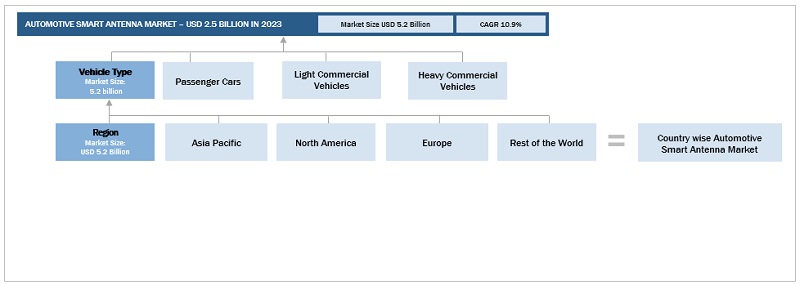

A detailed market estimation approach was followed to estimate and validate the value of the automotive smart antenna market and other dependent submarkets, as mentioned below:

-

Key players in the market were identified through secondary research, and their global market shares were determined through primary and secondary research.

-

The research methodology included the study of annual and quarterly financial reports, regulatory filings of major market players (public), and interviews with industry experts for detailed market insights.

-

All industry-level penetration rates, percentage shares, splits, and breakdowns for the market were determined using secondary sources and verified through primary sources.

-

All key macro indicators affecting the revenue growth of the market segments and sub-segments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

-

The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

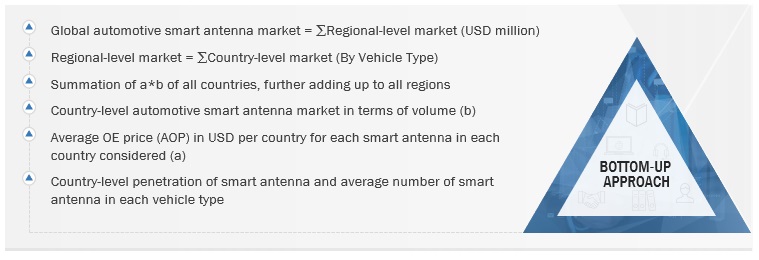

Automotive Smart Antenna Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Smart Antenna Market: Top-Down Approach

-

The top-down approach has been used to estimate and validate the size of the market, by frequency. The market share of each technology was derived at the regional level through secondary research & insights from industry experts. Further, the market was segmented based on market share for each frequency type at a regional level. A similar approach is used in EVs type, Type, and component type segments.

Top-Down Approach Automotive Smart Antenna Market For Frequency At The Regional Level

Bottom-Up Approach Automotivesmart Antenna By Type At Regional Level

Data Triangulation

The market was split into several segments and sub-segments after arriving at the overall market size—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment. The data was triangulated by studying various factors and trends.

Market Definition

Smart antennas utilize sophisticated signal processing techniques to improve V2V communication performance. They can dynamically adjust the radiation pattern towards the intended receiver, optimizing signal strength while minimizing interference. The adaptive beamforming features of smart antennas facilitate precise communication, particularly in challenging scenarios characterized by obstacles or signal fading. Its features include 4G (LTE)/5G, GPS, passive key entry, tire pressure monitoring system (TPMS), in-build Wi-Fi system, radio/FM, digital audio broadcasting and C-V2X. These features are used for high-speed data transfer, e-call, telematics systems, navigation systems, and to increase vehicle safety.

Stakeholders

-

Automotive smart antenna manufacturers

-

Automotive electronic component and software suppliers

-

Automotive original equipment manufacturers (OEMs)

-

Government regulatory bodies

-

Telecommunication companies

-

Automotive testing and certification services

-

Automotive aftermarket suppliers

-

Fleet management companies

-

Satellite communication providers

-

Insurance companies

-

Cybersecurity firms

Report Objectives

-

To define, describe, and forecast the automotive smart antenna market, in terms of value

(USD million), based on the following segments:

-

Vehicle Type ((Passenger Car, Light Commercial Vehicle (LCV), and Heavy Commercial Vehicle (HCV))

-

Frequency (High, Very High, and Ultra High)

-

Type (Shark-Fin Antenna and Fixed Mast Antenna)

-

Component Type ((Transceiver, Electronic Control Unit (ECU), and Others (Connector, Wire Harness, and Digital Bus))

-

Sales Channel (OEMs and Aftermarket) (qualitative data only)

-

Electric Vehicle (EV) Type (Battery Electric Vehicle (BEV), Plug-in Hybrid Vehicle (PHEV), and Fuel-cell Electric Vehicle (FCEV))

-

Region ((Asia Pacific, Europe, North America, and Rest of the World (RoW))

-

To understand the market dynamics (Drivers, Restraints, Opportunities, and Challenges) and conduct Patent Analysis, Pricing Analysis, Recession Impact, Key Buying Criteria, Trade Analysis, Technology Analysis, ASP Analysis, Trades and Conferences, Case Study Analysis, Supply Chain Analysis, Regulatory Analysis, Key Conference and Events, and Ecosystem Mapping

-

To understand the dynamics of the market players and distinguish them into stars, emerging leaders, pervasive players, and participants according to their product portfolio strength and business strategies.

-

To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

-

To analyze recent developments, such as partnerships, supply agreements, joint ventures/mergers and acquisitions, geographic expansions, and product developments of key players in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

Automotive Smart Antenna Market, By Frequency And Country

-

Asia Pacific

-

North America

-

Europe

-

RoW

Note:- We can cover countries like US, Canada, and Mexico from North America; Germany, France, Italy, Spain, and UK from Europe; China, India, Japan, and South Korea from Asia Pacific region; and Brazil and Iran from Rest of the World.

Automotive Smart Antenna Market, By Type And Country

-

Asia Pacific

-

North America

-

Europe

-

RoW

Note:- We can cover countries like US, Canada, and Mexico from North America; Germany, France, Italy, Spain, and UK from Europe; China, India, Japan, and South Korea from Asia Pacific region; and Brazil and Iran from Rest of the World.

Detailed Analysis And Profiling Of Additional Market Players (Up To 3)

Growth opportunities and latent adjacency in Automotive Smart Antenna Market