Chip Antenna Market by Product Type (Dielectric Chip and LTCC Chip), Application Type (WLAN/WiFi, Bluetooth/BLE, Dual Band/Multi-Band, and GPS/GNSS), End-User Industry (Automotive, Healthcare, and Industrial & Retail) - Global Forecast to 2022

The chip antenna market was valued at USD 1.28 Billion in 2015 and is expected to be worth USD 2.99 Billion by 2022 The base year used for this study is 2015, and the forecast period is between 2016 and 2022. This report provides a detailed analysis of the market on the basis of product, application, end-user industry, and geography. A chip antenna is a compact antenna that is used for transmitting and receiving radio frequency signals in different wireless applications, including Bluetooth/Bluetooth Low Energy (BLE), dual band & multi-band, global positioning system (GPS)/global navigation satellite system (GNSS), and WLAN/WiFi.

The chip antenna market is expected to be worth USD 2.99 Billion by 2022, growing at a CAGR of 13.1% between 2016 and 2022. A key factor driving the growth of this market is the increasing demand for chip antennas for IoT applications such as smart homes, smart grids, industrial internet, and connected cars.

The dielectric chip antenna segment is estimated to hold the largest share in the chip antenna market, by product type. The demand for dielectric chip antennas is mainly attributed to the growing demand for compact antennas that operate at multiple frequency ranges and help reduce space in devices such as smartphones and wearables devices and others.

In terms of wireless applications, the Bluetooth segment is estimated to account for the largest share in the chip antenna market, as Bluetooth technology is widely used for short-range wireless communication in consumer electronic devices such as headsets, smartphones, wearables, and gaming consoles. The growing demand for these consumer electronic devices is propelling the growth of the market for Bluetooth applications.

The smart home /smart grid end-user industry segment of the chip antenna market is expected to grow at the highest CAGR between 2016 and 2022.The growing adoption of IoT systems in the smart home application for which wireless technologies, such as Bluetooth, WLAN, are used to connect different IOT devices is contributing to the growth of this segment.

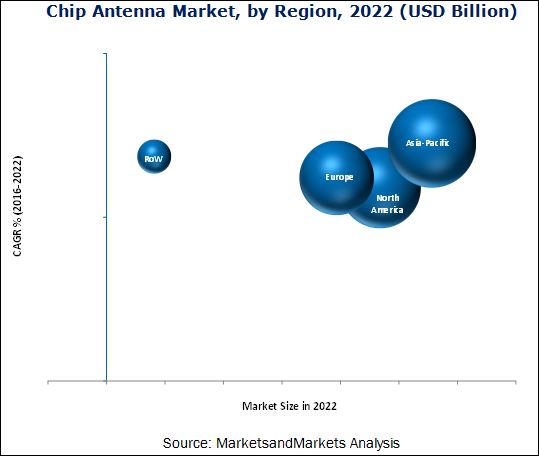

With regard to geography, APAC held the largest market share, and is expected to grow at the highest CAGR during the forecast period. The high demand for consumer electronics and automobiles from countries such as China, India, Japan, and South Korea is driving the chip antenna market in the APAC region.

However, the performance variance of chip antenna when used in different devices for same wireless applications such as Bluetooth, WLAN/WIFI, and others is limiting the growth of the global market.

Yageo Corporation (Taiwan) is one of the frontrunners in the market. The company is a leading global provider of passive components and services. It offers a broad range of products, such as resistors, capacitors, and wireless components. The company predominantly focuses on its core business and improving its product mix by developing new products using its strong research and development capabilities. Yageo has adopted the strategies of new product development and launch to expand its presence in the chip antenna market. For instance, the company launched two small, multi-band antennas—ANT5320LL14R1516A and ANT8010LL05R1516A for the GPS/GLONAS for applications such as navigation, tracking, and tracing.

The companies that are profiled in the report are Johanson Technology, Inc. (U.S.), Mitsubishi Materials (Japan), Yageo Corporation (Taiwan), Vishay Intertechnology, Inc. (U.S.)., Fractus S.A. (Spain), Antenova M2M (U.K.), Taoglas (Ireland), Linx Technologies (U.S.), Fractus Antenna S.L. (Spain), Pulse Electronics (U.S.), Inpaq Technology Co., Ltd. (Taiwan), and Partron Co., Ltd. (South Korea).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

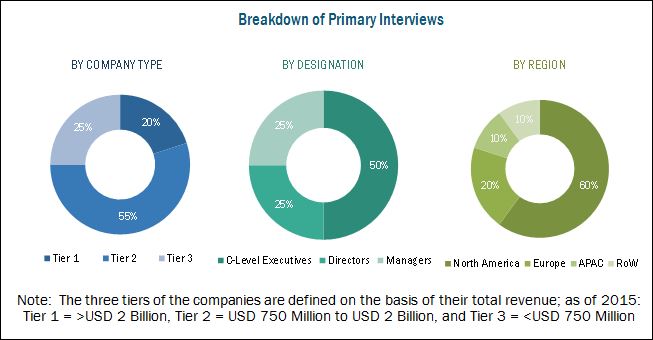

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Chip Antenna Market, 2013–2022 (USD Million)

4.2 Market, By Application

4.3 Market, By Geography

4.4 Consumer Electronics End-User Industry to Dominate the Asia-Pacific Market in 2015

4.5 Asia-Pacific Market Expected to Grow at the Highest CAGR During the Forecast Period (2016-2022)

4.6 Chip Antenna Market, By End-User Industry

4.7 Market, By Region

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Chip Antenna Market, By Product Type

5.2.2 Market, By Application

5.2.3 Market, By End-Use Industry

5.2.4 Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Low Cost of Smd Chip Antennas as Compare to Conventional Antennas

5.3.1.2 Demand for Chip Antenna in IoT Applications

5.3.1.3 Growing Trend of Miniaturization in Consumer Electronics

5.3.2 Restraints

5.3.2.1 High Initial Development Cost of Ceramic Chip Antenna

5.3.2.2 Variable Performance Efficiency and Limited Range of Chip Antenna

5.3.2.3 Lack in Operability and Compatibility Between Supplier and Odm

5.3.3 Opportunities

5.3.3.1 Industry 4.0 Will Provide Potential Growth Opportunity for Chip Antennas in the Near Future

5.3.3.2 Opportunity for Chip Antenna in Low Power Wide Area Network (Lpwan) Application

5.3.4 Challenge

5.3.4.1 Lack of Uniformity & Consistency in Chip Antennas and Variance in Various Operating Frequencies for Different Applications Across the World

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Value Chain Analysis (2015)

6.3 Key Industry Trends

6.4 Porter’s Five Forces Analysis

6.4.1 Intensity of Competitive Rivalry

6.4.2 Threat of Substitutes

6.4.3 Threat of New Entrants

6.4.4 Bargaining Power of Suppliers

6.4.5 Bargaining Power of Buyers

7 Chip Antenna Market, By Product Type (Page No. - 51)

7.1 Introduction

7.2 Dielectric Chip Antenna

7.3 LTCC

8 Chip Antenna Market, By Application Type (Page No. - 56)

8.1 Introduction

8.2 Wlan/Wifi

8.3 Bluetooth /BLE

8.4 Dual Band / Multi-Band

8.5 GPS / GNSS

9 Chip Antenna Market, By End-User Industry (Page No. - 68)

9.1 Introduction

9.2 Consumer Electronics

9.3 Automotive

9.4 Smart Home / Smart Grid

9.5 Healthcare

9.6 Industrial & Retail

9.7 Other

10 Geographic Analysis (Page No. - 86)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe

10.4 APAC

10.4.1 China

10.4.2 Japan

10.4.3 South Korea

10.4.4 Rest of Asia-Pacific

10.5 Rest of the World

10.5.1 Latin America

10.5.2 Middle East

10.5.3 Africa

11 Competitive Landscape (Page No. - 105)

11.1 Overview

11.2 Chip Antenna Market: Comparative Analysis

11.3 Market Ranking Analysis: Chip Antenna Market, 2015

11.4 Competitive Situations and Trends

11.4.1 New Product Launches & New Product Devlopments

11.4.2 Expansions

11.4.3 Agreements & Partnerships

11.4.4 Acquisitions

12 Company Profiles (Page No. - 112)

(Overview, Products And Services, Financials, Strategy & Development)*

12.1 Introduction

12.2 Yageo Corporation

12.3 Vishay Intertechnology, Inc.

12.4 Johanson Technology, Inc.

12.5 Pulse Electronics

12.6 Taoglas

12.7 Mitsubishi Materials Corporation

12.8 Partron Co., Ltd.

12.9 Inpaq Technology Co., Ltd.

12.10 Antenova M2m

12.11 Fractus S.A.

12.12 Linx Technologies

12.13 Fractus Antenna S.L.

*Details On Overview, Products And Services, Financials, Strategy & Development Might Not Be Captured In Case Of Unlisted Companies.

13 Appendix (Page No. - 145)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Introducing RT: Real Time Market Intelligence

13.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.5 Available Customizations

13.6 Related Reports

List of Tables (77 Tables )

Table 1 Currency Table

Table 2 Increasing Demand for IoT Applicationsis Propelling the Growth of the Chip Antenna Market

Table 3 Variable Performance Efficiency and Limited Range Expected to Affect Growth of the Chip Antenna Market

Table 4 Communication Matrix for Low Power Wide Area Network

Table 5 Evolution of 5g Technology Will Create New Market Opportunities for Market

Table 6 Lack of Uniformity & Consistency ,Variance in Various Operating Frequencies for Different Applications Will Be A Major Challenge for the Market

Table 7 Chip Antenna Market Size, By Product Type, 2013–2022 (USD Million)

Table 8 Market Size, By Product Type, 2013–2022 (Million Units)

Table 9 Dielectric: Chip Antenna Market Size, By Application Type, 2013–2022 (USD Million)

Table 10 Dielectric: Market Size, By Application Type, 2013–2022 (Million Units)

Table 11 LTCC: Market Size, By Application Type, 2013–2022 (USD Million)

Table 12 LTCC: Market Size, By Application Type, 2013–2022 (Million Units)

Table 13 Global Chip Antenna Market Size, By Application, 2013–2022 (USD Million)

Table 14 Global Market Size, By Application, 2013–2022 ( Million Units)

Table 15 Wlan/Wi-Fi Market Size, By Product Type, 2013–2022 (USD Million)

Table 16 Wlan-/Wi-Fi Market Size, By Product Type, 2013–2022 (Million Units)

Table 17 Wlan/Wi-Fi Market Size, By End-User Industry, 2013–2022 (USD Million)

Table 18 Bluetooth /BLE Market Size, By Product Type, 2013–2022 (USD Million)

Table 19 Bluetooth /BLE Market Size, By Product Type, 2013–2022 (Million Units)

Table 20 Bluetooth/BLE Market Size, By End-User Industry, 2013–2022 (USD Million)

Table 21 Dual Band / Multi-Band Chip Antenna Market Size, By Product Type, 2013–2022 (USD Million)

Table 22 Dual Band / Multi-Band Market Size, By Product Type, 2013–2022 (Million Units)

Table 23 Dual Band/Multi-Band Market Size, By End-User Industry, 2013–2022 (USD Million)

Table 24 GPS / GNSS Chip Antenna Market Size, By Product Type, 2013–2022 (USD Million)

Table 25 GPS / GNSS Market Size, By Product Type, 2013–2022 (Million Units)

Table 26 GPS/GNSS Market Size, By End-User Industry, 2013–2022(USD Million)

Table 27 Chip Antenna Market Size, By End-User Industry, 2013–2022 (USD Million)

Table 28 Consumer Electronics: Chip Antenna Market Size, By Application, 2013–2022 (USD Million)

Table 29 North America: Market for Consumer Electronics, By Country, 2013–2022 (USD Million)

Table 30 Europe: Market for Consumer Electronics, By Country, 2013–2022 (USD Million)

Table 31 APAC: Market for Consumer Electronics, By Country, 2013–2022 (USD Million)

Table 32 RoW: Market for Consumer Electronics, By Country, 2013–2022 (USD Million)

Table 33 Automotive: Chip Antenna Market Size, By Application, 2013–2022 (USD Million)

Table 34 North America: Market for Automotive, By Country, 2013–2022 (USD Million)

Table 35 Europe: Market for Automotive, By Country, 2013–2022 (USD Million)

Table 36 APAC: Market for Automotive, By Country, 2013–2022 (USD Million)

Table 37 RoW: Market for Automotive, By Country, 2013–2022 (USD Million)

Table 38 Smart Home/Smart Grid: Chip Antenna Market Size, By Application, 2013–2022 (USD Million)

Table 39 North America: Market for Smart Home/Smart Grid, By Country, 2013–2022 (USD Million)

Table 40 Europe: Market for Smart Home/Smart Grid, By Country, 2013–2022 (USD Million)

Table 41 APAC: Market for Smart Home/Smart Grid, By Country, 2013–2022 (USD Million)

Table 42 RoW: Market for Smart Home/Smart Grid, By Country, 2013–2022 (USD Million)

Table 43 Healthcare: Chip Antenna Market Size, By Application, 2013–2022 (USD Million)

Table 44 North America: Market for Healthcare, By Country, 2013–2022 (USD Million)

Table 45 Europe: Market for Healthcare, By Country, 2013–2022 (USD Million)

Table 46 APAC: Market for Healthcare, By Country, 2013–2022 (USD Million)

Table 47 RoW: Market for Healthcare, By Country, 2013–2022 (USD Million)

Table 48 Industrial & Retail: Market Size, By Application, 2013–2022 (USD Million)

Table 49 North America: Market for Industrial & Retail, By Country, 2013–2022 (USD Million)

Table 50 Europe: Market for Industrial & Retail, By Country, 2013–2022 (USD Million)

Table 51 APAC: Market for Industrial & Retail, By Country, 2013–2022 (USD Million)

Table 52 RoW: Market for Industrial & Retail, By Country, 2013–2022 (USD Million)

Table 53 Others: Market Size, By Application, 2013–2022 (USD Million)

Table 54 North America: Market for Other, By Country, 2013–2022 (USD Million)

Table 55 Europe: Market for Other, By Country, 2013–2022 (USD Million)

Table 56 APAC: Market for Other, By Country, 2013–2022 (USD Million)

Table 57 RoW: Market for Other, By Country, 2013–2022 (USD Million)

Table 58 Chip Antenna Market Size, By Region, 2013–2022 (USD Million)

Table 59 U.S.: Market, By End-User Industry, 2013–2022 (USD Million)

Table 60 Canada: Market, By End-User Industry, 2013–2022 (USD Million)

Table 61 Mexico: Market, By End-User Industry, 2013–2022 (USD Million)

Table 62 U.K.: Market, By End-User Industry, 2013–2022 (USD Million)

Table 63 Germany: Market, By End-User Industry, 2013–2022 (USD Million)

Table 64 France: Market, By End-User Industry, 2013–2022 (USD Million)

Table 65 Rest of Europe: Market, By End-User Industry, 2013–2022 (USD Million)

Table 66 China: Market, By End-User Industry, 2013–2022 (USD Million)

Table 67 Japan: Market, By End-User Industry, 2013–2022 (USD Million)

Table 68 South Korea: Market, By End-User Industry, 2013–2022 (USD Million)

Table 69 Rest of Asia-Pacific: Market, By End-User Industry, 2013–2022 (USD Million)

Table 70 Latin America: Market, By End-User Industry, 2013–2022 (USD Million)

Table 71 Middle East: Market, By End-User Industry, 2013–2022 (USD Million)

Table 72 Africa: Market, By End-User Industry, 2013–2022 (USD Million)

Table 73 Chip Antenna Market Ranking, 2015

Table 74 New Product Launches & New Product Devlopments, 2013–2016

Table 75 Expansions, 2013–2015

Table 76 Agreements & Partnerships, 2013–2015

Table 77 Acquisitions, 2014–2015

List of Figures (50 Figures)

Figure 1 Market Segmentation

Figure 2 Chip Antenna Market: Research Design

Figure 3 Data Triangulation

Figure 4 Process Flow of Market Size Estimation

Figure 5 Dielectric Chip Antennas to Hold the Largest Market Share in 2015

Figure 6 Dual Band/Multi-Band Segment is Expected to Grow at the Highest CAGR Between (2016-2022)

Figure 7 Consumer Electronics Market Expected to Hold the Largest Market Size During the Forecast Period (2016-2022)

Figure 8 Chip Antenna Market, By Geography, 2015

Figure 9 Demand From the Consumer Electronics & Automotive Sectors is Driving the Chip Antenna Market Between (2016-2022)

Figure 10 Dual Band/Multi-Band Segment is Expected to Grow at the Highest CAGR During the Forecast Period (2016-2022)

Figure 11 Asia-Pacific Held the Largest Share of the Market in 2015

Figure 12 China Held the Largest Share in the Asia-Pacific Market (2015)

Figure 13 Asia-Pacific Held the Largest Share in the Market in 2015

Figure 14 Consumer Electronics End-User Industry Dominated the Market in 2015

Figure 15 Asia-Pacific Market to Grow at the Highest CAGR During the Forecast Period (2016-2022)

Figure 16 Segmentation, By Geography

Figure 17 Increasing Demand for Chip Antennas for IoT Applications are the Key Factor Driving the Market

Figure 18 IoT Chip Market, 2014– 2022, (USD Million)

Figure 19 Value Chain Analysis: Major Value is Added During Component Development and Device Integration Phase

Figure 20 Key Industry Trends: Growing Demand for Compact Size Antenna

Figure 21 Porter’s Five Forces Analysis, 2015

Figure 22 Intensity of Competitive Rivalry Had A High Impact on the Chip Antenna Market in 2015

Figure 23 Threat of Substitutes Had Medium Impact on Market in 2015

Figure 24 Threat of New Entrants Had Medium Impact on Market in 2015

Figure 25 Bargaining Power of Suppliers Had Medium Impact on Market in 2015

Figure 26 Bargaining Power of Buyers Had High Impact on Market in 2015

Figure 27 Market for Dual Band/ Multi-Band Applications is Expected to Grow at Highest CAGR From 2016 to 2022

Figure 28 Consumer Electronics End-Use Segment Dominated the Wlan/WiFi Market in 2016

Figure 29 Bluetooth Enabled Device Shipment (Billion Units) From 2012 to 2018

Figure 30 Consumer Electronics End-User Segment Dominated the GPS Chip Antenna in 2016

Figure 31 Chip Antenna Market: Geographic Snapshot, 2016–2022

Figure 32 North American Market Snapshot: Demand Would Be Driven By the Growth in the Consumer Electronics Sector

Figure 33 Asia-Pacific Market Snapshot: Demand Would Be Driven By the Growth in the Consumer Electronics & Automotive Sectors

Figure 34 During the Forecast Period Players Adopted New Product Launches as the Key Strategy

Figure 35 Battle for Market Share: Companies Adopt New Product Launches as the Key Strategy

Figure 36 Market Evolution Framework: Various New Product Launches Fueled the Growth of the Market Between 2014 and 2016

Figure 37 Geographic Revenue Mix of the Top 3 Market Players

Figure 38 Yageo Corporation: Company Snapshot

Figure 39 Yageo Corporation: SWOT Analysis

Figure 40 Vishay Intertechnology, Inc.: Company Snapshot

Figure 41 Vishay Intertechnology, Inc.: SWOT Analysis

Figure 42 Johanson Technology, Inc.: SWOT Analysis

Figure 43 Pulse Electronics: Company Snapshot

Figure 44 Mitsubishi Materials Corporation: Company Snapshot

Figure 45 Mitsubishi Materials Corporation: SWOT Analysis

Figure 46 Partron Co., Ltd.: Company Snapshot

Figure 47 Partron Co., Ltd.: SWOT Analysis

Figure 48 Inpaq Technology Co., Ltd.: Company Snapshot

Figure 49 Inpaq Technology Co., Ltd.: SWOT Analysis

Figure 50 Antenova M2m: SWOT Analysis

The top-down and bottom-up approaches have been used in the study to estimate the size of the chip antenna market. The research methodology includes the study of annual and financial reports of top players, presentations, press releases, journals, and paid databases, and interviews with industry experts. Additionally, the average revenue generated by companies according to the region was used to arrive at the overall market size. This overall market size was used in the top-down procedure to estimate the sizes of other individual markets via percentage splits from secondary and primary research.

To know about the assumptions considered for the study, download the pdf brochure

The chip antenna ecosystem comprises antenna manufacturers such as Johanson Technology, Inc. (U.S.), Yageo Corporation (Taiwan), Vishay Intertechnology, Inc. (U.S.)., Fractus S.A. (Spain), Antenova M2M (U.K.), and Taoglas (Ireland), dielectric material suppliers, distributors, and system integrators such as Samsung C&T Corporation (South Korea) and Apple (U.S.) that integrate chip antennas and sell them to end-users according to their unique business requirements.

Target Audience:

- Chip antenna designers and manufacturers

- Research organizations and consulting companies

- Associations, forums, and alliances related to chip antenna

- Investors

- Start-up companies

- Raw material suppliers

- Government and other regulatory bodies

- Market research and consulting firms

Chip antenna Market Scope:

By Product Type

- LTCC Chip Antenna

- Dielectric Chip Antenna

By Application Type

- WLAN/WiFi

- Bluetooth/BLE

- Dual Band/Multi-Band

- GPS/GNSS

By End-User Industry

- Automotive

- Healthcare

- Industrial & Retail

- Smart Grid/Smart Home

- Consumer Electronics

- Others

By Geography

-

North America

- U.S.

- Canada

- Mexico

-

Europe

- U.K.

- Germany

- France

- Others

-

APAC

- China

- Japan

- South Korea

- Others

-

RoW

- Latin America

- Middle East

- Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients’ specific needs. The following customization options are available for this report:

Geographic Analysis

Further breakdown of region/country-specific analysis

Company Information

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Chip Antenna Market