Automotive RADAR Market Size, Share, Forecast, Report

Automotive Radar Market by Range (Short Range, Medium Range, Long Range), Vehicle Type (PC, LCV, HCV), Frequency (2X-GHz and 7X-GHz), EV Type (BEV, PHEV, FCEV, HEV), Mounting (In-cabin, Exterior), Application, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The automotive radar market is projected to reach USD 22.83 billion by 2032, growing at a CAGR of 23.0% from USD 5.36 billion in 2025. This growth is mainly driven by OEMs adopting 4D imaging radar to support L2 and higher ADAS functions in vehicles. Regulatory mandates are also speeding up adoption: Europe’s GSR II requires Automatic Emergency Braking (AEB), Lane-Keeping Assistance, and pedestrian/cyclist detection. China’s CNCAP emphasizes AEB and Blind Spot Detection; in the US, NHTSA is requiring AEB and forward-collision warning in all new vehicles. These rules are pushing radar into the mainstream as a key safety feature. The interior radar sector is gaining popularity for occupant sensing and in-cabin safety applications. Advances in radar technology, combined with stricter safety regulations worldwide, set the stage for substantial growth in the coming years.

KEY TAKEAWAYS

-

BY VEHICLE TYPEPassenger cars are poised to lead the automotive radar market as consumers seek safer, smarter, and more convenient driving experiences. As ADAS features such as collision avoidance, adaptive cruise control, and automated parking transition from premium vehicles to the mass market, passenger vehicles present a significant growth opportunity for radar suppliers.

-

BY RANGELong-range radar is central to automotive systems and is experiencing increasing demand as vehicles adopt advanced ADAS features like highway pilot, adaptive cruise control, automated lane change, and collision avoidance. Its significance is driven by the need for reliable detection in all weather and lighting conditions, growing regulatory emphasis on safety, and the drive toward higher levels of vehicle autonomy.

-

BY FREQUENCYThe 77 GHz radar frequency leads the market because of its high resolution and long detection range, making it perfect for advanced driver assistance systems in passenger cars. Lower-frequency bands like 24 GHz are still important for short-range uses, but the industry is gradually moving toward higher frequencies to enable more precise, faster, and reliable object detection, which is crucial for safety and autonomous driving features.

-

BY EV TYPEBEVs are becoming the fastest adopters of automotive radar as manufacturers integrate advanced driver-assistance and autonomous features to differentiate their offerings. Radar is especially attractive in EVs because it is highly reliable in poor weather and low-light conditions, while also being more power-efficient than camera or LiDAR systems — a crucial factor given EVs’ sensitivity to battery consumption. Among radar types, 77 GHz long-range radar is most widely used in BEVs, supporting functions like adaptive cruise control, collision avoidance, and highway autopilot.

-

BY REGIONNorth America’s automotive radar market is expanding rapidly, driven by three main factors: increased use in commercial fleets to enhance safety and reduce costs, quick advancements in 77 GHz and 4D imaging radar through strong partnerships between tech companies and automakers, and regulatory requirements from NHTSA and IIHS for collision avoidance and AEB in new vehicles. These combined elements establish radar as a vital and growing component in the region.

The automotive radar market is expanding rapidly, fueled by advancements in radar technology, increasing demand for ADAS, and strict safety regulations. In Europe, Germany takes the lead with strong R&D and compliance with Euro NCAP and UNECE standards, promoting the adoption of high-frequency radar. Radar plays a key role in the shift from Level 2 driver assistance to higher levels of autonomy, providing reliable performance in poor visibility and supporting sensor fusion. Adoption trends vary across segments, with EVs incorporating radar for advanced software features, while commercial vehicles focus on safety and fleet efficiency.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The automotive radar market is rapidly shifting from basic to advanced systems, driven by AI, sensor fusion, and 4D imaging technologies. Automakers and fleet operators demand smarter, long-range, and durable radar solutions to enable collision avoidance, asset security, and autonomous driving readiness. This shift is forcing suppliers to innovate, build new partnerships, and expand offerings to stay competitive in a fast-evolving mobility ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Surging demand for ADAS and technological advancements to drive growth

-

•Increasing reliance on Doppler frequency shift technology

Level

-

•Inability to distinguish multiple targets

-

•Varying weather conditions affecting radar performance and reliability

Level

-

Growing adoption of 4D imaging radar for enhanced safety, autonomy, and cost-effective sensor fusion in next-gen vehicles

-

•Unlocking new business models and smart mobility solutions with automotive radar technology models

Level

-

•Competition from substitute technologies

-

•Fluctuating raw material prices and supply chain disruptions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing reliance on Doppler frequency shift technology

The Doppler frequency shift is a key factor enabling advances in the automotive radar industry, especially for next-generation ADAS and autonomous driving features. By measuring the frequency change between emitted and reflected radar signals, automotive radar systems can precisely assess the relative speed of objects around the vehicle, such as other cars, cyclists, and pedestrians, allowing for real-time, dynamic, and predictive responses.

Restraint: Varying weather conditions affecting radar performance and reliability

The automotive radar market faces significant challenges due to weather-dependent reliability issues. Conditions like heavy rain, snow, and fog introduce signal noise and scatter radar waves, degrading obstacle detection and distance accuracy. Manufacturers are now enhancing radar resilience through advanced sensor fusion with LiDAR and cameras, rigorous testing, and evolving standards to ensure consistent performance across diverse climates, thereby mitigating safety risks and meeting stricter regulatory demands.

Opportunity: Growing adoption of 4D imaging radar for enhanced safety, autonomy, and cost-effective sensor fusion in next-gen vehicles

4D imaging radar is opening up new frontiers in the automotive radar market, particularly through its integration into ADAS and automated driving platforms, with recent developments underscoring its growing strategic importance. This adoption signals not only the radar's commercial readiness but also its role in reducing dependence on LiDAR for cost-sensitive applications. As OEMs push toward sensor fusion strategies to balance safety, performance, and cost, 4D imaging radar is gaining traction as a scalable, high-resolution, all-weather alternative that bridges the gap between traditional radar and LiDAR, making it a cornerstone of upcoming automotive platforms in both premium and mass-market segments..

Challenge: Competition from substitute technologies

The automotive radar market faces increasing competition from alternative technologies such as LiDAR and advanced vision-based systems, which are gaining popularity due to rapid technological advances and falling costs. This trend pressures radar manufacturers to stand out with innovations like 4D imaging radar or radar-on-chip designs as automakers balance the trade-offs between redundancy, resolution, and cost across different sensor types.

Automotive Radar Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

0.1m-precision imaging radar for Euro NCAP pedestrian auto-braking, front cross-traffic alert in dense urban settings | Reliable detection in all weather and lighting, robust ADAS, supports L2+ automation and urban safety |

|

360° surround radar with adaptive cruise, emergency braking, and lane change assist for highway pilot | High-resolution object tracking, Euro NCAP/Level 3 readiness, large-scale autonomous mobility deployment |

|

Millimeter-wave radar enabling rapid pre-crash intervention in hybrid vehicles; forward tracking for Toyota Safety Sense and Mazda i-ACTIVSENSE | Extended detection range, fast response, lower cost for advanced Japanese/Asian OEM platforms |

|

Gen-4 4D mmWave radar for multi-lane auto lane change; ML-based cut-in detection; OTA-swappable upgradability | HD perception, high scalability, flexible fleet deployment, precise multi-object detection HD perception, high scalability, flexible fleet deployment, precise multi-object detection |

|

Custom radars for blind spot and cross-traffic alert; in-cabin life and presence detection; optimized for park assist | OEM-customizable, reliable ADAS/interior compliance, seamless seatbelt and occupant monitoring |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Radar system manufacturers such as Continental, Bosch, and Valeo provide automotive radar to OEMs such as BMW, Ford, Toyota, Mercedes-Benz, GM, Tesla, and Volkswagen for L2 and above vehicles. Tech aggregators such as Arbe, Vayyar, and Spartan also support in the ecosystem, providing features such as adaptive cruise control, automatic emergency braking, blind spot detection, forward collision warning system, intelligent parking assistance, cross-traffic alert, and lane departure warning system.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AUTOMOTIVE RADAR MARKET, BY VEHICLE TYPE

Passenger cars are leading in RADAR adoption as high production volumes make it feasible for automakers to scale multi-RADAR integration across models. This segment is also the primary focus of regulatory safety mandates and NCAP assessments, pushing manufacturers to embed 77 GHz systems that enable functions like AEB, ACC, and blind spot detection, making RADAR a standard rather than optional feature.

AUTOMOTIVE RADAR MARKET, BY FREQUENCY

7X-GHz RADAR systems are dominating the market due to their longer detection range, higher resolution, and ability to support advanced functions like highway pilot and cross-traffic detection, along with regulatory phase-out of 24 GHz systems in key regions.

Automotive radar market, by range

Long-range radar is projected to be the fastest-growing segment due to its capability to detect vehicles and obstacles at greater distances, enabling adaptive cruise control, highway assist, and collision avoidance in high-speed driving conditions. In addition, regulatory mandates in markets such as the US and Europe that require advanced safety features like automatic emergency braking and forward collision warning are accelerating the adoption of long-range radar systems.

Automotive radar market, By EV Type

BEVs are set to dominate the radar market as they adopt ADAS and autonomous features faster than conventional vehicles. Radar is favored in EVs because it is reliable in all weather, energy-efficient compared to cameras and LiDAR, and critical for functions like adaptive cruise control, lane change assist, and automated parking. 77 GHz long-range radar leads adoption, offering the precision and range needed for higher autonomy.

AUTOMOTIVE RADAR market, by mounting

Front-mounted radar dominates the market due to its essential role in forward-looking ADAS functions like automatic emergency braking and adaptive cruise control, while corner-mounted radar is growing rapidly by providing 360-degree coverage for blind spot detection, lane change assist, and cross-traffic alerts. Roof-mounted radar is also gaining traction in premium and semi-autonomous vehicles for extended range and environment mapping, supporting high-level automated driving functions.

Automotive radar market, By Application

The automotive radar market is driven by applications that enhance vehicle safety and automation. Adaptive cruise control and automatic emergency braking are boosting demand as they require precise long- and mid-range detection. Blind spot detection and lane departure warning systems are increasing radar adoption for side and corner coverage. Forward collision warning systems, intelligent parking assist, and cross-traffic alert are further supporting growth by relying on accurate, real-time object detection in complex driving environments.

REGION

North America is projected to be the fastest growing market in the global Automotive RADAR market during the forecast period

North America is likely to grow fastest in the automotive radar market because leading automakers are shifting to 4D imaging radar for higher-resolution object detection, driven by US regulatory pressure to reduce pedestrian and cyclist fatalities and the Insurance Institute for Highway Safety’s stricter criteria for advanced crash prevention systems.

Automotive Radar Market: COMPANY EVALUATION MATRIX

In the automotive radar market, Robert Bosch GmbH stands out as the star performer, consistently leading with advanced radar technologies, high-resolution imaging, and wide partnerships with global OEMs. Bosch's focus on AI-powered object detection and integration with autonomous driving platforms solidifies its leadership role. Meanwhile, Valeo is in the Emerging Leaders segment, quickly expanding its radar product lineup, securing new ADAS and EV contracts, and investing in next-generation applications for both mainstream and premium vehicles.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 5.36 Billion |

| Revenue Forecast in 2032 | USD 22.83 Billion |

| Growth Rate | CAGR of 23.0% from 2025-2032 |

| Actual data | 2021-2032 |

| Base year | 2024 |

| Forecast period | 2025-2032 |

| Units considered | Volume (Thousand Units), Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Europe, North America, and the Rest of the World |

WHAT IS IN IT FOR YOU: Automotive Radar Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global OEM (US) | Competitive benchmarking of radar suppliers (Bosch, Continental, Aptiv, Denso, Valeo) Assessment of radar module integration with L2+ and L3 autonomous driving packages Regional regulatory analysis (Euro NCAP, NHTSA standards, GSR II adoption timelines) |

|

| Radar Technology Startup (Asia/US/EU) |

|

|

| Tier-1 Supplier (Europe/Asia) |

|

|

| Fleet/Shared Mobility Operator (US/Global) | Cost-benefit analysis of radar-supported driver assistance in commercial and robotaxi fleets MaaS fleet benchmarking for radar-integrated safety solutions |

|

| Smart City Authority (Middle East) |

|

|

RECENT DEVELOPMENTS

- May 2025 : Bosch launched a new generation RADAR that uses “RF CMOS technology,” which enables the efficient integration of high-frequency and digital circuits on a single chip. The structure size of the transistors of only 22 nanometers makes the chip particularly powerful and efficient despite its small footprint. Bosch is the first Tier-1 supplier to introduce this technology in serial production.

- January 2025 : Bosch introduced a new generation RADAR that uses “RF CMOS technology,” enabling efficient integration of high-frequency and digital circuits on a single chip. The transistor structure size of only 22 nanometers makes the chip especially powerful and efficient despite its small footprint. Bosch is the first Tier-1 supplier to adopt this technology in mass production.

- October 2024 : Valeo and HERE Technologies (HERE), the leading location data and technology platform, showcased for the first time a new version of Valeo’s Smart Safety 360 (VSS 360) system that integrates a Navigation on Pilot (NOP) function. With its state-of-the-art parking and driving features, it provides full coverage for a safe and relaxed driving journey. The smart front camera is at the center of the architecture and can be connected with up to 6 cameras, 5 radars, 12 ultrasonic sensors, and the associated software.

- September 2024 : At IAA Transportation 2024, ZF announced the deployment of the new version of ZF’s Advanced Driving Assistance System, OnGuardMAX, and the modular brake platform, mBSP XBS, for the European market. The latest version of OnGuardMAX combines upgraded radar and camera technologies with an improved image processing module to enhance vehicle and driver safety.

- November 2023 : NXP Semiconductors announced the launch of TrimensionTM NCJ29D6, a fully integrated automotive single-chip Ultra-Wideband (UWB) family combining next-generation secure and precise real-time localization with short-range radar to address multiple use cases with a single system, including secure car access, child presence detection, intrusion alert, gesture recognition and more. Integrated by major automotive OEMs, devices from this family are expected to be on the road in model year 2025 vehicles.

- January 2023 : Ficosa Internacional SA announced that it is expanding its in-cabin monitoring (ICM) solutions by developing advanced driver monitoring system (DMS) and occupant monitoring system (OMS) solutions for premium automotive customers.

Table of Contents

Methodology

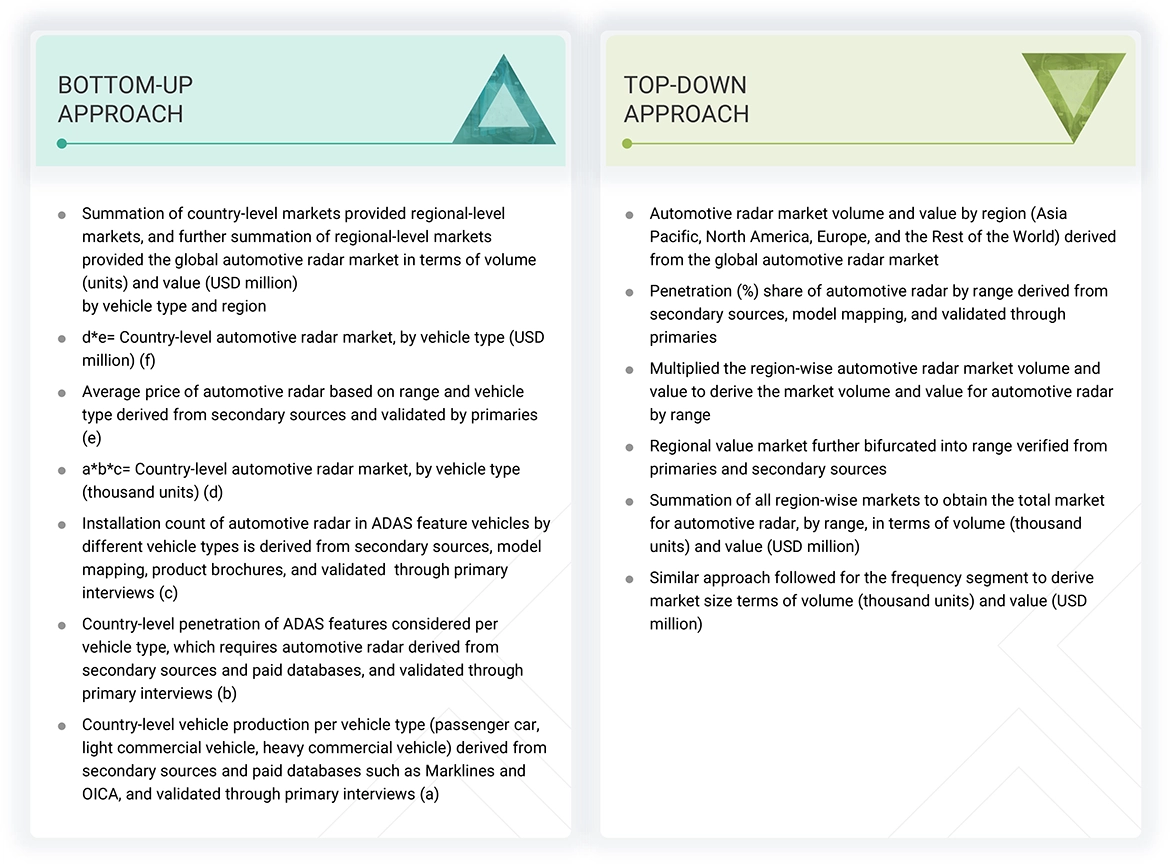

The study involved four major activities in estimating the current size of the automotive radar market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step involved validating these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized authors. Secondary research was mainly used to obtain key information about the value chain of the industry, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market and application perspectives.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the automotive radar market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply side participants across four regions: North America, Europe, Asia Pacific, and the Rest of the World. Approximately 65% and 35% of the primary interviews were conducted from the supply and demand sides, respectively. Primary data was collected through questionnaires, e-mails, and telephonic interviews. While canvassing primaries, various departments within organizations, including sales, operations, and administration, were covered to provide a holistic viewpoint in the report.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the opinions/insights of in-house subject matter experts, led to the findings delineated in the rest of this report.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to analyze and validate the value and volume of the automotive radar market and other dependent submarkets:

- Key players in the automotive radar market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology includes the study of the annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights.

- All major penetration rates, percentage shares, splits, and breakdowns for the automotive radar market were determined using secondary sources and model mapping and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

Automotive Radar Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand and supply-side participants.

Market Definition

The word radar is an acronym derived from ‘radio detection and ranging.’ It is a device or an electronic system that detects and tracks objects at certain distances. A radar can detect any change within its covered range with the help of radio energy traveling at the speed of light. Whenever an object travels through the observed range, short bursts of radio energy are transmitted, reflected off a target or an object, and returned as an echo. The form of the electromagnetic signal radiated by the radar depends on the type of information required for the target.

According to Renesas Electronics Corporation, radar is a well-known technology that relies on sending and receiving electromagnetic waves to measure, detect, and locate obstacles in the environment. Radar is specially indicated for automotive applications, as vehicles are good reflectors for electromagnetic waves, and thus, their distance, position, and velocity can be determined accurately.

The automotive radar sensor is an object-detection device that uses radio waves to determine the range, altitude, direction, and speed of objects within the range of the vehicle. It provides long to short-range functionality, allowing automotive systems to monitor the environment around the vehicle to help prevent crashes. It can be used to detect, search, and track pedestrians, obstacles, motor vehicles, and terrain. The automotive radar is applicable for blind spot detection, adaptive cruise control, lane change assist, and crash avoidance, among others.

Stakeholders

- ADAS Integrators

- ADAS/Occupant Safety Solution Suppliers

- American Automobile Association (AAA)

- Automobile Original Equipment Manufacturers (OEMs)

- Automotive radar Manufacturers

- Automotive radar Component Manufacturers

- Automotive Software and Platform Providers

- Autonomous Driving Platform Providers

- Brazilian Association of Automotive Vehicle Manufacturers

- Comité des Constructeurs Français d'Automobiles (CCFA)

- China Association of Automobile Manufacturers (CAAM)

- Canadian Automobile Association

- Canadian Automobile Dealers Association (CADA)

- EV and EV Component Manufacturers

- Government & Research Organizations

- Japan Automobile Manufacturers Association (JAMA)

- Korea Automobile Manufacturers Association (KAMA)

- National Highway Traffic Safety Administration (NHTSA)

- Vehicle Safety Regulatory Bodies

- Verband der Automobilindustrie (VDA)

Report Objectives

- To segment and forecast the automotive radar market in terms of volume (thousand units) and value (USD Million)

- To define, describe, and forecast the market based on vehicle type, range, frequency, EV type, application, mounting, and region

-

To analyze regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market by vehicle type (passenger car, light commercial vehicle, heavy commercial vehicle)

- To segment and forecast the market by range (short-range radar, medium-range radar, long-range radar)

- To segment and forecast the market by frequency (2X-GHz and 7X-GHz)

- To segment and forecast the market by EV type (BEV, PHEV, FCEV, HEV)

- To segment and forecast the market by mounting (in-cabin and exterior).

- To provide qualitative insights on the market based on application [adaptive cruise control (ACC), autonomous emergency braking (AEB), blind spot detection (BSD), forward collision warning system (FCWS), intelligent parking assistance (IPA), cross traffic alert (CTA), lane departure warning system (LDW) and traffic jam assist (TJA)]

- To forecast the market by region [North America, Europe, Asia Pacific, and the Rest of the World (RoW)]

- To analyze technological developments impacting the market

- To provide detailed information about the major factors influencing market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market, considering individual growth trends, prospects, and contributions to the total market

-

To study the following concerning the market

- Supply chain analysis

- Ecosystem analysis

- Technology analysis

- HS code

- Case study analysis

- Patent analysis

- Regulatory landscape

- Key stakeholders and buying criteria

- Key conferences and events

- Impact of Generative AI

-

To estimate the following with respect to the market:

-

Pricing Analysis

- By Range

- By Region

- Market Share Analysis

-

Pricing Analysis

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze the impact of the recession on the market

- To track and analyze competitive developments, such as deals, product developments, and expansions, carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with the company’s specific needs.

Company Information

- Profiling of Additional Market Players (Up To 5)

Automotive Radar Market, By Range, at Country Level

Automotive Radar Market, By Frequency, at Country Level

Key Questions Addressed by the Report

What is the current size of the automotive radar market by value?

The current size of the automotive radar market is estimated to be USD 5.36 billion in 2025.

Who are the winners in the automotive radar market?

The automotive radar market is dominated by established players such as Robert Bosch GmbH (Germany), Continental AG (Germany), Aptiv (Ireland), Denso Corporation (Japan), and NXP Semiconductors (Netherlands). These companies have introduced products and formed strategic alliances to enhance their position in the market.

Which region will have the fastest-growing market for automotive radar market?

North America is expected to grow at a higher CAGR in the automotive radar market during the forecast period due to increasing demand for ADAS, rising adoption of autonomous driving technologies, and strong regulatory support for vehicle safety. The presence of major automotive OEMs and radar technology providers, coupled with growing investments in R&D and innovation, further accelerates market expansion. Additionally, consumer preference for high-end vehicles equipped with radar-based features like adaptive cruise control and collision avoidance systems is driving regional market growth.

What are the new trends impacting the growth of the automotive radar market?

The key trends impacting the growth of the automotive radar market are increased adoption of ADAS, shift towards 77 GHz and 79 GHz radar systems, enhanced signal processing, and AI, which are some of the trends in the automotive radar market.

Which countries are covered in the Asia Pacific region for the automotive radar market?

The countries covered in the report for the automotive radar market are China, Japan, South Korea, India, Thailand, Indonesia, and the Rest of Asia Pacific (Taiwan and Singapore).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Automotive Radar Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Automotive Radar Market