Autonomous Emergency Braking (AEB) System Market by Key Technology (Camera, Fusion, LiDAR and Radar), Vehicle Type, Operating Speed, Application, Level of Automation Driving, Component (Actuators, Audible Buzzers) and Region - Global Forecast to 2025

The autonomous emergency braking system (AEB) market is projected to reach USD 55.31 Billion by 2025, at a CAGR of 22.23% from 2020 to 2025. The base year for AEB system market study is 2016 and market has been projected up to 2025. Government mandates in Europe and US to bring down the increasing number of accidents and rising safety concerns shall be the major drivers for the growth of market.

Objectives of the Report

- To define, segment, and analyze the autonomous emergency braking (AEB) systems market

- To analyze and forecast the AEB systems market in terms of volume (‘000 units) and value (USD million) for the period 2016 to 2025

- To analyze regional markets for growth trends, prospects, and their contribution towards the entire AEB systems market

- To profile key players and analyze their market share and core competencies

The bottom-up approach has been used to estimate the market size of autonomous emergency braking (AEB) systems. To determine the market size, in terms of volume and vehicle type, the vehicle production numbers have been multiplied by the penetration level of autonomous emergency braking (AEB) systems obtained at country level. Thus, the market in terms of volume for different countries is obtained. This is further multiplied with the average OE price (AOP) to obtain the market size in terms of value for each country.

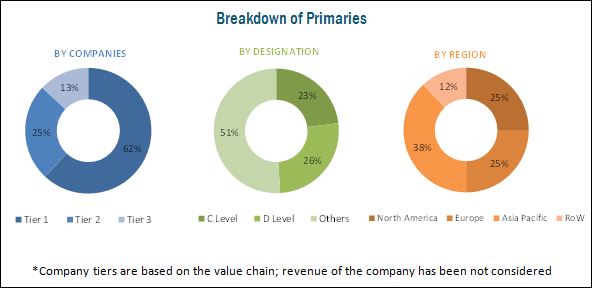

The secondary sources referred for this research study include automotive industry organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Several primary interviews have been conducted with market experts from both the demand (OEM) and supply (autonomous emergency braking system suppliers and distributors) sides across four major regions, namely, North America, Europe, Asia Pacific, and RoW (Latin America, the Middle East, and Africa).

To know about the assumptions considered for the study, download the pdf brochure

The autonomous emergency braking (AEB) system market comprises many leading players such as Robert Bosch GmbH (Germany), Continental AG (Germany), Denso Corporation (Japan), ZF Friedrichshafen AG (Germany), Hyundai Mobis Co., Ltd. (South Korea), Aisin Seiki Co., Ltd. (Japan), Valeo S.A. (France), Delphi Automotive PLC (UK), Paccar Inc. (DAF) (US), Autoliv, Inc. (Sweden), Infineon Technologies AG (Germany), Knorr-Bremse AG (Germany), Mando Corporation (South Korea), Analog Devices, Inc. (US), Wabco Holdings, Inc. (US) and others.

Target Audience

- Autonomous emergency braking (AEB) system manufacturers

- Distributors and suppliers of autonomous emergency braking systems

- Automotive braking system component manufacturers

- Automotive OEMs

- Industry associations and experts

- Lidar and radar sensor manufacturers and suppliers

Scope of the Report

Market, By Vehicle Type

Market, By Key Technology

Market, By Operating Speed

Market, By Application

Market, By Level of Automation Driving

Market, By Component

Market, By Region

-

- PV

- CV

- Camera

- Fusion

- LiDAR

- Radar

- High Speed-Inter Urban AEB Systems

- Low Speed-City AEB Systems

- Pedestrian-VRU (Vulnerable Road Users) AEB Systems

- Forward Emergency Braking

- Reverse Emergency Braking

- Multi-directional Braking

- Autonomous Passenger Car

- Semi-Autonomous Passenger Car

- Actuators

- Audible Buzzers

- Controllers

- Sensors

- Visual Indicators

- Asia Pacific (China, Japan, South Korea, India, Rest of Asia Pacific)

- Europe (Germany, France, Italy, UK, Rest of Europe)

- North America (US, Mexico, and Canada)

- Rest of the World (Brazil, Russia, and South Africa)

Available Customizations

- Market sizing in terms of Value, for AEB System Market by Level of Automation Driving

- Market sizing in terms of Volume and Value, for AEB System Market by End Market

- Market sizing in terms of Volume and Value, for AEB System Market by Electric Vehicle (EV) type

- Profiling of additional market players (Up to 3)

The autonomous emergency braking (AEB) system market is projected to be worth USD 55.31 Billion by 2025, growing at a CAGR of 22.23% from 2020 to 2025. The rising number of accidents and growing safety concerns and the increasing government mandates regarding vehicle safety and security shall be the major factor for growth of this market.

Passenger Vehicles (PV) are projected to lead the market of autonomous emergency braking (AEB) system by vehicle type, in terms of value. Higher safety concerns among passenger car users and larger volume of passenger vehicles versus commercial vehicles have led to this growth.

Low Speed-City AEB systems shall lead the AEB system market by operating speed. This can mainly be attributed to the high vehicle density and accidents in city-like road conditions compared with those in inter-urban road conditions.

Forward Emergency Braking AEB system segment is projected to contain the highest share of AEB systems on the basis of application for 2025. Majority of vehicle crashes take place in a forward direction, also the vehicle speed while moving in a forward direction and intensity of crash is higher.

Semi-autonomous passenger cars segment is expected to have the largest share in AEB system market by the level of automation driving. Higher volume of semi-autonomous passenger cars compared to autonomous passenger cars shall be the driver for the growth of this segment.

For the autonomous emergency braking (AEB) system market by component, actuators are projected to lead the market in terms of value. The primary reason the number of actuators required per vehicle being higher than other components and more expensive pricing.

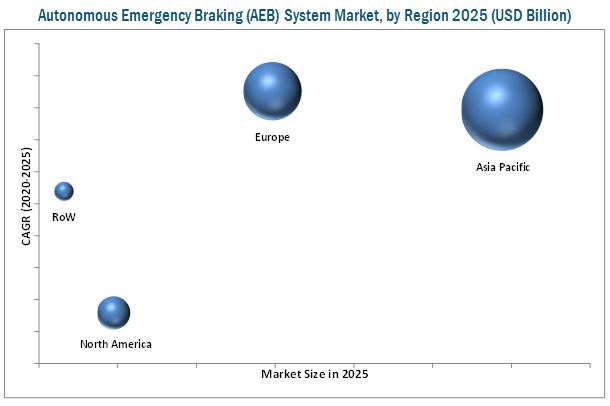

Asia Pacific region is projected to contain the largest share for AEB systems market by region. Presence of technologically advanced and economically developed countries such as Japan and South Korea, tremendous vehicle production in developing economies like China, and rising consumer disposable income are the major reasons for growth of market in this region.

Consumer sentiment and lack of functional clarity may act as the major restraint that shall hamper the growth of autonomous emergency braking (AEB) system market. Consumer perception is extremely important as it helps in building the overall opinion of the product among consumers. Consumers are generally more conscious and may not be willing to opt for new product that have a control over passenger safety. For example, in 2016, Tesla’s Model S with Autopilot system faced a severe crash resulting in the death of one person. The car was equipped with various features such as AEB, lane departure warning, and others. Such incidents reduce the credibility of such systems and may raise questions on the reliability of these systems towards passenger safety.

Continental AG (Germany), Valeo S.A. (France), Autoliv, Inc. (Sweden), Infineon Technologies AG (Germany), Knorr-Bremse AG (Germany) are some of the leading players in autonomous emergency braking (AEB) system market. Continental AG has a widespread network of manufacturing facilities spread across the globe and strong technological capabilities leading towards a wide range of diversified product portfolio. The company focuses on acquisitions and agreements to sustain its market share in autonomous emergency braking system market. The organization also signed an agreement with Allgemeiner Deutscher Automobil-Club (ADAC e.V.) (Germany) to increase awareness among the vehicle drivers about safety by providing sessions and undertaking campaigns.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Autonomous Emergency Braking (AEB) System Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand-Side Analysis

2.4.2.1 Increase in Number of Self-Driving Cars

2.4.3 Supply-Side Analysis

2.4.3.1 Government Mandates Have Led the Automotive OEMS to Provide Autonomous Emergency Braking Systems in Their Vehicles

2.5 Market Size Estimation

2.5.1 Bottom-Up Approach

2.5.2 Top-Down Approach

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 39)

4.1 Attractive Opportunities in Autonomous Emergency Braking (AEB) System Market

4.2 AEB SystemsMarket, By Key Technology

4.3 AEB System Market, By Operating Speed

4.4 AEB System Market, By Level of Automation Driving

4.5 AEB System Market, By Application

4.6 AEB System Market, By Component

4.7 AEB System Market, By Vehicle Type

4.8 AEB System Market, By Region

5 Autonomous Emergency Braking (AEB) System Market Overview (Page No. - 46)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Government Mandates in European Countries & the US and Rising Safety Concerns

5.2.1.2 Increased Consumer Spending Power

5.2.2 Restraints

5.2.2.1 Consumer Sentiment and Lack of Functional Clarity

5.2.3 Opportunities

5.2.3.1 Rising Accidents in Emerging Economies Shall Lead to Increase in Safety Regulations

5.2.3.2 Growth in the Number of Semi-Autonomous Cars

5.2.4 Challenges

5.2.4.1 Failure of AEB Systems to Recognize Danger

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Technological Overview (Page No. - 57)

6.1 Introduction

6.2 Major Technologies in Autonomous Emergency Braking (AEB) System Market

7 Autonomous Emergency Braking (AEB) System Market, By Key Technology (Page No. - 59)

7.1 Introduction

7.2 Camera-Based Market, By Region

7.3 Fusion-Based AEB System Market, By Region

7.4 Light Detection and Ranging (LiDAR)-Based Market, By Region

7.5 Radio Detection and Ranging (RaDAR)-Based AEB System Market, By Region

8 Market, By Application (Page No. - 67)

8.1 Introduction

8.2 Forward Emergency Braking System

8.3 Multi-Directional Emergency Braking System

8.4 Reverse Emergency Braking System

9 Autonomous Emergency Braking (AEB) System Market, By Operating Speed (Page No. - 73)

9.1 Introduction

9.2 High Speed Inter-Urban Market, By Region

9.3 Low Speed–City AEB System, By Region

9.4 Pedestrian/Vulnerable Road Users AEB System, By Region

10 Market, By Component (Page No. - 79)

10.1 Introduction

10.2 Actuators: Autonomous Emergency Braking (AEB) System, By Region

10.3 Audible Buzzers: AEB System Market, By Region

10.4 Controllers: AEB System Market, By Region

10.5 Sensors: AEB System Market, By Region

10.6 Visual Indicators: AEB System Market, By Region

11 Market, By Level of Automation Driving (Page No. - 88)

11.1 Introduction

11.2 Autonomous Passenger Car AEB System Market

11.3 Semi-Autonomous Passenger Car AEB System Market

12 Market, By Region (Page No. - 93)

12.1 Introduction

12.2 Asia Pacific

12.2.1 China: Market

12.2.2 India: AEB System Market

12.2.3 Japan: AEB System Market

12.2.4 South Korea: AEB System Market

12.2.5 Rest of Asia Pacific: AEB System Market

12.3 Europe

12.3.1 France: AEB System Market

12.3.2 Germany: AEB System Market

12.3.3 Italy: AEB System Market

12.3.4 UK: AEB System Market

12.3.5 Rest of Europe: AEB System Market

12.4 North America

12.4.1 Canada: AEB System Market

12.4.2 Mexico: AEB System Market

12.4.3 US: AEB System Market

12.5 Rest of the World (RoW)

12.5.1 Brazil: AEB System Market

12.5.2 Russia: AEB System Market

12.5.3 South Africa: AEB System Market

13 Competitive Landscape (Page No. - 119)

13.1 Autonomous Emergency Braking (AEB) System Market Ranking

14 Company Profiles (Page No. - 121)

(Company Overview, Strength of Product Portfolio, Product Offerings, Business Strategy Excellence, Recent Developments)*

14.1 Introduction

14.2 Robert Bosch GmbH

14.3 Continental AG

14.4 Denso Corporation

14.5 ZF Friedrichshafen AG

14.6 Hyundai Mobis Co., Ltd.

14.7 Aisin Seiki Co., Ltd.

14.8 Valeo S.A.

14.9 Delphi Automotive PLC

14.10 Paccar Inc.

14.11 Texas Instruments Incorporated

14.12 Autoliv, Inc.

14.13 Knorr-Bremse AG

14.14 Mando Corporation

14.15 Analog Devices, Inc.

14.16 Wabco Holdings, Inc.

*Details on Company Overview, Strength of Product Portfolio, Product Offerings, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 167)

15.1 Key Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.5.1 Company Information

15.6 Related Reports

15.7 Author Details

List of Tables (85 Tables)

Table 1 Average American Dollar Exchange Rates (Per 1 USD)

Table 2 Porter’s Five Forces Analysis

Table 3 Autonomous Emergency Braking (AEB) System Market, By Key Technology, 2016–2025 (’000 Units)

Table 4 Market, By Key Technology, 2016–2025 (USD Million)

Table 5 Camera-Based Market, By Region, 2016–2025 (’000 Units)

Table 6 Camera-Based AEB System Market, By Region, 2016–2025 (USD Million)

Table 7 Fusion-Based AEB System Market, By Region, 2016–2025 (’000 Units)

Table 8 Fusion-Based AEB System Market, By Region, 2016–2025 (USD Million)

Table 9 Light Detection and Ranging (LiDAR)-Based Market, By Region, 2016–2025 (’000 Units)

Table 10 Light Detection and Ranging (LiDAR)-Based AEB System Market, By Region, 2016–2025 (USD Million)

Table 11 Radio Detection and Ranging (RaDAR)-Based Autonomous Emergency Braking (AEB) System Market, By Region, 2016–2025 (’000 Units)

Table 12 Radio Detection and Ranging (RaDAR)-Based AEB System Market, By Region, 2016–2025 (USD Million)

Table 13 AEB System Market, By Application, 2016–2025 (’000 Units)

Table 14 AEB System Market, By Application, 2016–2025 (USD Million)

Table 15 Forward Emergency Braking System Market, By Region, 2016–2025 (’000 Units)

Table 16 Forward Emergency Braking System Market, By Region, 2016–2025 (USD Million)

Table 17 Multi-Directional Emergency Braking System Market, By Region, 2016–2025 (’000 Units)

Table 18 Multi-Directional Emergency Braking System Market, By Region, 2016–2025 (USD Million)

Table 19 Reverse Emergency Braking System Market, By Region, 2016–2025 (’000 Units)

Table 20 Reverse Emergency Braking System Market, By Region, 2016–2025 (USD Million)

Table 21 AEB System Market, By Operating Speed, 2016–2025 (’000 Units)

Table 22 AEB System Market, By Operating Speed, 2016–2025 (USD Million)

Table 23 High Speed Inter-Urban AEB System Market, By Region, 2016–2025 (’000 Units)

Table 24 High Speed Inter-Urban AEB System Market, By Region, 2016–2025 (USD Million)

Table 25 Low Speed–City Autonomous Emergency Braking System Market, By Region, 2016–2025 (’000 Units)

Table 26 Low Speed–City AEB System Market, By Region, 2016–2025 (USD Million)

Table 27 Pedestrian-Vulnerable Road Users AEB System Market, By Region, 2016–2025 (’000 Units)

Table 28 Pedestrian–Vulnerable Road Users AEB System Market, By Region, 2016–2025 (USD Million)

Table 29 Market, By Component, 2016–2025 (’000 Units)

Table 30 Market, By Component, 2016–2025 (USD Million)

Table 31 Actuators: Market, By Region, 2016–2025 (’000 Units)

Table 32 Actuators: AEB System Market, By Region, 2016–2025 (USD Million)

Table 33 Audible Buzzers: Market, By Region, 2016–2025 (’000 Units)

Table 34 Audible Buzzers: AEB System Market, By Region, 2016–2025 (USD Million)

Table 35 Controllers: Market, By Region, 2016–2025 (’000 Units)

Table 36 Controllers: AEB System Market, By Region, 2016–2025 (USD Million)

Table 37 Sensors: Market, By Region, 2016–2025 (’000 Units)

Table 38 Sensors: AEB System Market, By Region, 2016–2025 (USD Million)

Table 39 Visual Indicators: Autonomous Emergency Braking (AEB) System Market, By Region, 2016–2025 (’000 Units)

Table 40 Visual Indicators: AEB System Market, By Region, 2016–2025 (USD Million)

Table 41 Market, By Level of Automation Driving, 2016–2025 (’000 Units)

Table 42 Autonomous Passenger Car Autonomous Emergency Braking System Market, By Region, 2016–2025 (’000 Units)

Table 43 Semi-Autonomous Passenger Car AEB System Market, By Region, 2016–2025 (’000 Units)

Table 44 Market, By Region, 2016–2025 (’000 Units)

Table 45 Autonomous Emergency Braking (AEB) System Market, By Region, 2016–2025 (USD Million)

Table 46 Asia Pacific: Market, By Country, 2016–2025 (’000 Units)

Table 47 Asia Pacific: AEB System Market, By Country, 2016–2025 (USD Million)

Table 48 China: AEB System Market, By Vehicle Type, 2016–2025 (’000 Units)

Table 49 China: AEB System Market, By Vehicle Type, 2016–2025 (USD Million)

Table 50 India: AEB System Market, By Vehicle Type, 2016–2025 (’000 Units)

Table 51 India: AEB System Market, By Vehicle Type, 2016–2025 (USD Million)

Table 52 Japan: AEB System Market, By Vehicle Type, 2016–2025 (’000 Units)

Table 53 Japan: AEB System Market, By Vehicle Type, 2016–2025 (USD Million)

Table 54 South Korea: AEB System Market, By Vehicle Type, 2016–2025 (’000 Units)

Table 55 South Korea: AEB System Market, By Vehicle Type, 2016–2025 (USD Million)

Table 56 Rest of Asia Pacific: Market, By Vehicle Type, 2016–2025 (’000 Units)

Table 57 Rest of Asia Pacific: AEB System Market, By Vehicle Type, 2016–2025 (USD Million)

Table 58 Europe: Market, By Country, 2016–2025 (’000 Units)

Table 59 Europe: AEB System Market, By Country, 2016–2025 (USD Million)

Table 60 France: AEB System Market, By Vehicle Type, 2016–2025 (’000 Units)

Table 61 France: AEB System Market, By Vehicle Type, 2016–2025 (USD Million)

Table 62 Germany: AEB System Market, By Vehicle Type, 2016–2025 (’000 Units)

Table 63 Germany: AEB System Market, By Vehicle Type, 2016–2025 (USD Million)

Table 64 Italy: AEB System Market, By Vehicle Type, 2016–2025 (’000 Units)

Table 65 Italy: AEB System Market, By Vehicle Type, 2016–2025 (USD Million)

Table 66 UK: AEB System Market, By Vehicle Type, 2016–2025 (’000 Units)

Table 67 UK: AEB System Market, By Vehicle Type, 2016–2025 (USD Million)

Table 68 Rest of Europe: AEB System Market, By Vehicle Type, 2016–2025 (’000 Units)

Table 69 Rest of Europe: AEB System Market, By Vehicle Type, 2016–2025 (USD Million)

Table 70 North America: Market, By Country, 2016–2025 (’000 Units)

Table 71 North America: AEB System Market, By Country, 2016–2025 (USD Million)

Table 72 Canada: AEB System Market, By Vehicle Type, 2016–2025 (’000 Units)

Table 73 Canada: AEB System Market, By Vehicle Type, 2016–2025 (USD Million)

Table 74 Mexico: AEB System Market, By Vehicle Type, 2016–2025 (’000 Units)

Table 75 Mexico: AEB System Market, By Vehicle Type, 2016–2025 (USD Million)

Table 76 US: AEB System Market, By Vehicle Type, 2016–2025 (’000 Units)

Table 77 US: AEB System Market, By Vehicle Type, 2016–2025 (USD Million)

Table 78 Rest of the World (RoW): Autonomous Emergency Braking (AEB) System Market, By Country, 2016–2025 (’000 Units)

Table 79 Rest of the World (RoW): AEB System Market, By Country, 2016–2025 (USD Million)

Table 80 Brazil: AEB System Market, By Vehicle Type, 2016–2025 (’000 Units)

Table 81 Brazil: AEB System Market, By Vehicle Type, 2016–2025 (USD Million)

Table 82 Russia: AEB System Market, By Vehicle Type, 2016–2025 (’000 Units)

Table 83 Russia: AEB System Market, By Vehicle Type, 2016–2025 (USD Million)

Table 84 South Africa: AEB System Market, By Vehicle Type, 2016–2025 (’000 Units)

Table 85 South Africa: AEB System Market, By Vehicle Type, 2016–2025 (USD Million)

List of Figures (55 Figures)

Figure 1 Autonomous Emergency Braking (AEB) System Market: Segmentations Covered

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews:

Figure 5 AEB System Market, By Type: Bottom-Up Approach

Figure 6 AEB System Market, By Type: Top Down Approach

Figure 7 AEB System Market, By Region, 2020 vs 2025

Figure 8 AEB System Market, By Key Technology, 2020 vs 2025

Figure 9 AEB System Market, By Vehicle Type, 2020 vs 2025

Figure 10 AEB System Market, By Application, 2020 vs 2025

Figure 11 AEB System Market, By Component, 2020 vs 2025

Figure 12 AEB System Market, By Operating Speed, 2020 vs 2025

Figure 13 Government Mandates in Europe & US and Rising Safety Concerns Among Consumers Shall Lead to the Growth of the Autonomous Emergency Braking (AEB) Market From 2020 to 2025

Figure 14 RaDAR-Based Autonomous Emergency Braking (AEB) System is Expected to Have the Largest Market Size in 2020

Figure 15 Low Speed-City AEB Systems is Expected to Have the Largest Market Size, 2020 vs 2025 (‘000 Units)

Figure 16 Autonomous Emergency Braking (AEB) Systems in the Semi-Autonomous Passenger Car Segment is Expected to Have the Largest Market Size, 2020 vs 2025 (‘000 Units)

Figure 17 Forward Emergency Braking System is Expected to Have the Largest Market Size, 2020 vs 2025 (‘000 Units)

Figure 18 Visual Indicators for Autonomous Emergency Braking (AEB) System is Expected to Have the Largest Market Size, 2020 vs 2025 (‘000 Units)

Figure 19 Passenger Vehicles for Autonomous Emergency Braking (AEB) System is Expected to Have the Largest Market Size, 2020 vs 2025 (‘000 Units)

Figure 20 Asia-Pacific is Expected to Hold the Largest Market Share, 2020 vs 2025

Figure 21 Autonomous Emergency Braking (AEB) System : Market Dynamics

Figure 22 Road Accident Fatality Rates, Per 1,00,000 Population, 2015

Figure 23 Growth in the Number of Semi-Autonomous Cars

Figure 24 Porter’s Five Forces Analysis: Presence of Established Global Players Increases the Degree of Competition

Figure 25 Low Impact of Threat of New Entrants on the Market

Figure 26 Threat of Substitutes has A High Impact on the Autonomous Emergency Braking (AEB) System Market

Figure 27 Medium Impact of Bargaining Power of Suppliers on the AEB System Market

Figure 28 Bargaining Power of Buyers has A High Impact on the AEB System Market

Figure 29 Intensity of Competitive Rivalry to Have A High Impact on the AEB System Market

Figure 30 Technological Evolution of Autonomous Emergency Braking (AEB) Systems

Figure 31 AEB System Market, By Key Technology, 2020 vs 2025, Market Size (000’ Units)

Figure 32 AEB System Market, By Application Market (000’ Units)

Figure 33 AEB System Market, By Operating Speed, 2020 vs 2025 (000’ Units)

Figure 34 AEB System Market, By Component, 2020 vs 2025

Figure 35 AEB System Market, By Level of Automation Driving, (000’ Units)

Figure 36 AEB System Market, By Region, 2020 (USD Million)

Figure 37 Asia Pacific: AEB System Market Snapshot

Figure 38 Europe: AEB System Market Snapshot

Figure 39 North America: AEB System Market Snapshot

Figure 40 Rest of the World (RoW): AEB System Market Snapshot

Figure 41 Robert Bosch GmbH: Company Snapshot

Figure 42 Continental AG: Company Snapshot

Figure 43 Denso Corporation: Company Snapshot

Figure 44 ZF Friedrichshafen AG: Company Snapshot

Figure 45 Hyundai Mobis Co., Ltd.: Company Snapshot

Figure 46 Aisin Seiki Co., Ltd.: Company Snapshot

Figure 47 Valeo S.A.: Company Snapshot

Figure 48 Delphi Automotive PLC: Company Snapshot

Figure 49 Paccar Inc.: Company Snapshot

Figure 50 Texas Instruments Incorporated: Company Snapshot

Figure 51 Autoliv, Inc.: Company Snapshot

Figure 52 Knorr-Bremse AG: Company Snapshot

Figure 53 Mando Corporation: Company Snapshot

Figure 54 Analog Devices, Inc.: Company Snapshot

Figure 55 Wabco Holdings, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Autonomous Emergency Braking (AEB) System Market