Autonomous Luxury Vehicle Market by Body Type (Sedan/Hatchback & SUV), End User (Personal Mobility & Car Sharing), Fuel Type (BEV, Hybrid, ICE, & FCEV), Component (Radar, LiDAR, & Biometric Sensors) and Region - Global Forecast to 2030

The autonomous luxury vehicle market size was valued at 27,906 Units by 2025 and is projected to reach 126,774 Units by 2030, growing at a CAGR of 35.35% from 2025 to 2030. The autonomous luxury vehicle market analyzes and forecasts the market size, in terms of volume, for the market. The report segments the market and forecasts its size, by volume, on the basis of region, fuel type, body type, and end-user. The market size, in terms of value, is projected for the component segments only. The report also provides a detailed analysis of various forces acting in the market such as drivers, restraints, opportunities, and challenges. It strategically profiles the key players and comprehensively analyzes their core competencies. It also tracks and analyzes competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants.

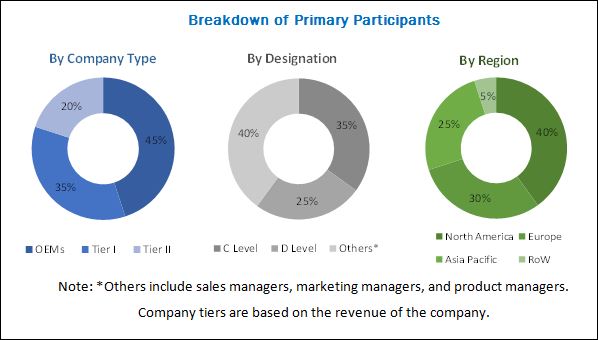

The research methodology used in the report involves various secondary sources such as China Association of Automobile Manufacturers (CAAM), European Automobile Manufacturers Association (EAMA), Japan Automobile Manufacturers Association (JAMA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA). Experts from OEMs and suppliers have been interviewed to understand the future trends in the market. The top-down approach has been used to estimate and validate the size of the global autonomous luxury vehicle market. The market size, by volume, is derived by identifying the region-wise production volumes and analyzing the demand trends. The same approach has been followed to estimate the size of the market by component, in terms of value and volume. The average number of components per vehicle has been considered for calculating the market volume. The average selling price (ASP) of each component is multiplied by its volume, which gives the market size of components for autonomous luxury vehicles, in terms of value.

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the autonomous luxury vehicle market consists of OEMs such as Daimler (Germany), BMW (Germany), Tesla (US), and Audi (Germany). The report also discusses tier I suppliers such as Robert Bosch (Germany), Continental (Germany), Denso (Japan), and Delphi (UK).

Target Audience

- Automobile manufacturers

- Distributors and suppliers of automotive safety systems

- Industry associations and automotive experts

- LiDAR and Radar manufacturers

- Automotive component manufacturers

- Autonomous vehicle software providers

- Cab service providers

- Tier 1, Tier 2, and Tier 3 suppliers

Scope of the Report

Market By Body Type

Market Fuel Type

Component Type

End User

Market Region

-

- Sedan/Hatchback

- SUV

- Battery Electric Vehicle (BEV)

- Hybrid (HEV & PHEV)

- Internal Combustion Engine (ICE) Vehicle

- Fuel Cell Electric Vehicle (FCEV)

- Biometric Sensors

- Radar Sensors

- LiDAR Sensors

- Ultrasonic Sensors

- Camera Unit

- Car Sharing

- Personal Mobility

- Asia Pacific

- Europe

- North America

- Rest of the World

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional countries (up to 3)

- Detailed analysis and profiling of additional market players (up to 3)

- Detailed analysis of component types by country wise.

The autonomous luxury vehicle market, in terms of volume, is projected to grow at a CAGR of 35.35% from 2025 to 2030. The market is projected to be 27,906 Units in 2025 and is projected to reach 126,774 Units by 2030. The rising concerns about vehicle safety and security have accentuated the need for the development of autonomous vehicles. Factors such as an increase in disposable income, the rise in purchasing power, and changing buyer preferences have fueled the market for luxury and premium cars, which in turn is expected to drive the market.

The autonomous luxury vehicle market has been segmented by body type, component type, fuel type, end-user type, and region. The market has been segmented, by body type, into sedan/hatchback and SUV. SUV is projected to be the fastest growing segment of the market, by body type. Continuously increasing sales of luxury SUVs will drive the market growth of this segment. Also, the continuous increase in the preference for SUVs and off-road driving practices are expected to contribute to the growth of the autonomous SUV vehicle market for luxury segment.

The autonomous luxury vehicle market has been segmented, by fuel type, into battery electric vehicle (BEV), hybrid (HEV & PHEV), internal combustion engine (ICE), and fuel cell electric vehicle (FCEV). BEV is estimated to be the fastest growing segment of the market, by fuel type. Research and development for an innovative battery source, OEM initiatives, favorable government regulations, and zero emission advantage would drive the growth of BEV autonomous luxury vehicles.

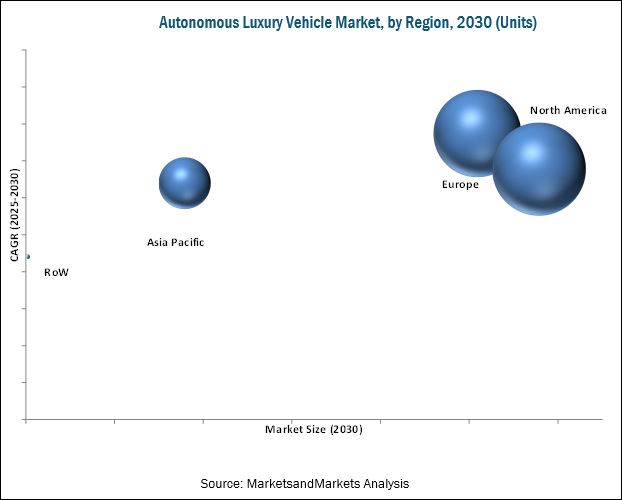

North America is projected to dominate the market, by volume, in 2025. The large customer base and high disposable income of end-users in the region have fueled the demand for high-end vehicles, which in turn has resulted in increasing R&D innovations by local and international automotive OEMs. Sustainable government regulations, increasing demand for luxury vehicles, rising purchasing power, and concerns of increasing number of road accidents are the key factors that will drive the market in this region.

The lack of infrastructure is the key restraint for the growth of autonomous luxury vehicles. The market requires basic infrastructure such as well-organized roads, lane marking, and availability of GPS for effective functioning. The lack of infrastructure in developing countries could make it difficult to achieve a common platform for autonomous luxury vehicles.

BMW (Germany) is a leading manufacturer of luxury cars. The group comprises brands such as BMW (Germany), MINI (UK), and Rolls-Royce (UK). The company’ strategy has shifted from manufacturing premium automobiles to providing premium mobility and mobility services. Along with its partners, BMW is working on standards, platforms, and a backend for the future of automated driving. BMW has collaborated with Intel (US) and Mobileye (Israel) to develop a new series of fully automated prototype vehicles. The company has developed products such as DriveNow, ReachNow, ParkNow, and ChargeNow for mobility services that would be used for autonomous vehicle segments.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Autonomous Luxury Vehicle Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.1.2 Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Sampling Techniques & Data Collection Methods

2.1.2.2 Primary Participants

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increasing Traffic Congestion Due to Rising Urbanization Around the Globe

2.2.2.2 Impact of Disposable Income on Vehicle Sales

2.2.2.3 Growth in Luxury Vehicle Sales

2.2.2.4 Need for Safety and Security

2.2.3 Supply-Side Analysis

2.2.3.1 Technological Advancements in Autonomous Vehicles

2.3 Autonomous Luxury Vehicle Market Size Estimation

2.4 Data Triangulation

2.5 Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 36)

4.1 Introduction

4.2 Attractive Opportunities in the Market

4.3 Autonomous Luxury Vehicle Market, By Region, 2025–2030

4.4 Market, By Body Type, 2025–2030

4.5 Market, By Fuel Type, 2025–2030

4.6 Market, By End-User, 2025–2030

4.7 Market, By Component, 2025–2030

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Autonomous Luxury Vehicle Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth in Connected Vehicle Technology and Dynamic Mobility Application

5.2.1.2 Need for Safe, Productive and Efficient Driving Experience

5.2.1.3 Integration of Technology in Vehicles

5.2.2 Restraints

5.2.2.1 Consumer Acceptance to Automation

5.2.2.2 Cyber Security and Safety Concerns

5.2.2.3 Non-Availability of Required Infrastructure in Developing Countries

5.2.3 Opportunities

5.2.3.1 Autonomous Luxury Cars as A Car Shared Service

5.2.3.2 Robotic Assistance

5.2.4 Challenges

5.2.4.1 Mutual Interference Between LiDAR Scanners

5.2.4.2 Environment Constraints Pose A Challenge for Autonomous Luxury Vehicles

5.2.4.3 Crowd Navigation

5.2.4.4 Undefined Legal Responsibility

5.3 Government Regulations for Autonomous Vehicles, By Country

5.4 Autonomous Luxury VehiclesMarket Regional Growth Factor Roadmap

5.5 Macro-Indicator Analysis

5.5.1 Introduction

5.5.2 Premium Vehicle Sales as A Percentage of Total Sales

5.5.3 GDP (USD Billion)

5.5.4 GNI Per Capita, Atlas Method (USD)

5.5.5 GDP Per Capita Ppp (USD)

5.5.6 Macro Indicators Influencing the Market for Top 3 Countries

5.5.6.1 US

5.5.6.2 Germany

5.5.6.3 UK

6 Technology Overview (Page No. - 55)

6.1 Artificial Intelligence

6.2 Smart Seats

6.3 Mobile Payment Systems

7 Autonomous Luxury Vehicle Market, By Body Type (Page No. - 58)

7.1 Introduction

7.2 Sedan/Hatchback

7.3 SUV (Sport Utility Vehicle)

8 Autonomous Luxury Vehicle Market, By Fuel Type (Page No. - 68)

8.1 Introduction

8.2 Battery Electric Vehicle (BEV)

8.3 Hybrid Vehicle (HEV & PHEV)

8.4 Internal Combustion Engine (ICE)

8.5 Fuel Cell Electric Vehicle (FCEV)

9 Autonomous Luxury Vehicle Market, By Component (Page No. - 75)

9.1 Introduction

9.2 Biometric Sensors

9.3 Camera Unit

9.4 LiDAR Sensors

9.5 Radar Sensors

9.6 Ultrasonic Sensors

10 Autonomous Luxury Vehicle Market, Future Trends & Scenario (2023–2030) (Page No. - 86)

10.1 Introduction

10.2 Market - Optimistic Scenario

10.3 Market – Most Likely Scenario

10.4 Market - Pessimistic Scenario

11 Autonomous Luxury Vehicle Market, Future Trends & Scenario for Car Sharing (Page No. - 91)

11.1 Introduction

11.2 Autonomous Luxury Vehicle Car Sharing Segment - Optimistic Scenario

11.3 Autonomous Luxury Vehicle Car Sharing Segment – Most Likely Scenario

11.4 Autonomous Luxury Vehicle Car Sharing Segment – Pessimistic Scenario

12 Autonomous Luxury Vehicle Market, By End-User (Page No. - 95)

12.1 Introduction

12.2 Personal Mobility

12.3 Car Sharing

13 Autonomous Luxury Vehicle Market, By Region (Page No. - 101)

13.1 Introduction

13.2 Asia Pacific

13.2.1 China

13.2.2 Japan

13.2.3 South Korea

13.3 Europe

13.3.1 France

13.3.2 Germany

13.3.3 Italy

13.3.4 Spain

13.3.5 UK

13.4 North America

13.4.1 US

13.4.2 Mexico

13.4.3 Canada

13.5 RoW

13.5.1 Brazil

13.5.2 Russia

14 Competitive Landscape (Page No. - 113)

14.1 Autonomous Luxury Vehicle Market Ranking Analysis: Market

14.2 Competitive Situation & Trends

14.3 New Product Development

14.4 Supply Contracts

14.5 Expansions

14.6 Merger & Acquisition and Joint Venture

15 Company Profiles (Page No. - 119)

(Business Overview, Product Offerings & Business Strategies, Key Insights, Recent Developments, MnM View)*

15.1 Original Equipment Manufacturers

15.1.1 Daimler

15.1.2 Audi

15.1.3 BMW

15.1.4 NIO

15.1.5 Porsche

15.1.6 Tesla

15.1.7 BYD

15.1.8 Changan Automobile

15.1.9 Saic Motor Corporation

15.1.10 Baidu

15.1.11 Baic Motor

15.1.12 Waymo

15.2 Tier 1 Suppliers

15.2.1 Robert Bosch

15.2.2 Continental

15.2.3 Denso

15.2.4 Delphi Automotive

15.2.5 Infineon Technologies

15.2.6 NXP Semiconductors

15.2.7 Valeo

15.2.8 Texas Instruments

15.2.9 ZF Friedrichshafen

15.2.10 Magna International

15.2.11 Cisco Systems

15.2.12 Renesas Electronics

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 165)

16.1 Key Insights of Industry Experts

16.2 Discussion Guide

16.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.4 Available Customizations

16.5 Related Reports

16.6 Author Details

List of Tables (65 Tables)

Table 1 Currency Exchange Rates (W.R.T USD)

Table 2 Automotive Application Features Related to Safety, Comfort, and Assistance

Table 3 Automated Driving Initiatives By Automakers

Table 4 Autonomous Luxury Vehicle Market, By Body Type, 2023–2030 (Units)

Table 5 Asia Pacific: Autonomous Luxury Vehicle Market, By Body Type, 2023–2030 (Units)

Table 6 China: Market, By Body Type, 2023–2030 (Units)

Table 7 Japan: Market, By Body Type, 2023–2030 (Units)

Table 8 South Korea: Market, By Body Type, 2023–2030 (Units)

Table 9 Europe: Autonomous Luxury Vehicle Market, By Body Type, 2023–2030 (Units)

Table 10 France: Market, By Body Type, 2023–2030 (Units)

Table 11 Germany: Market, By Body Type, 2023–2030 (Units)

Table 12 Italy: Market, By Body Type, 2023–2030 (Units)

Table 13 Spain: Market, By Body Type, 2023–2030 (Units)

Table 14 UK: Autonomous Luxury Vehicle Market, By Body Type, 2023–2030 (Units)

Table 15 North America: Autonomous Luxury Vehicle Market, By Body Type, 2023–2030 (Units)

Table 16 Canada: Market, By Body Type, 2023–2030 (Units)

Table 17 Mexico: Market, By Body Type, 2023–2030 (Units)

Table 18 US: Market, By Body Type, 2023–2030 (Units)

Table 19 Brazil: Market Size, By Body Type, 2023–2030 (Units)

Table 20 Russia: Autonomous Luxury Vehicle Market, By Body Type, 2023–2030 (Units)

Table 21 RoW: Market, By Body Type, 2023–2030 (Units)

Table 22 Market, By Fuel Type, 2023–2030 (Units)

Table 23 Battery Electric Vehicle: Market, By Region, 2023–2030 (Units)

Table 24 Hybrid Electric Vehicle: Market, By Region, 2023–2030 (Units)

Table 25 Internal Combustion Engine: Market, By Region, 2023–2030 (Units)

Table 26 Fuel Cell Electric Vehicle: Market, By Region, 2023–2030 (Units)

Table 27 Technological Superiority of Sensors in Automotive Applications

Table 28 Autonomous Luxury Vehicle Market Size, By Component, 2023–2030 (Units)

Table 29 Market Size, By Component, 2023–2030 (USD Thousand)

Table 30 Biometric Sensors: Autonomous Luxury Vehicle Market Size, By Region, 2023–2030 (Units)

Table 31 Biometric Sensors: Market Size, By Region, 2023–2030 (USD Thousand)

Table 32 Camera Unit: Market Size, By Region, 2023–2030 (Units)

Table 33 Camera Units: Market Size, By Region, 2023–2030 (USD Thousand)

Table 34 LiDAR Sensors: Market Size, By Region, 2023–2030 (Units)

Table 35 LiDAR Sensors: Market Size, By Region, 2023–2030 (USD Thousand)

Table 36 Radar Sensors: Market Size, By Region, 2023–2030 (Units)

Table 37 Radar Sensors: Market Size, By Region, 2023–2030 (USD Thousand)

Table 38 Ultrasonic Sensors: Market Size, By Region, 2023–2030 (Units)

Table 39 Ultrasonic Sensors: Market Size, By Region, 2023–2030 (USD Thousand)

Table 40 Autonomous Luxury Vehicle Market (Optimistic), By Region 2023–2030 (Units)

Table 41 Market (Most Likely), By Region 2023–2030 (Units)

Table 42 Market (Pessimistic), By Region 2023–2030 (Units)

Table 43 Car Sharing: Market (Optimistic), By Region 2023–2030 (Units)

Table 44 Car Sharing: Market (Most Likely), By Region 2023–2030 (Units)

Table 45 Car Sharing: Market (Pessimistic), By Region 2023–2030 (Units)

Table 46 Global Market, By End-User, 2023–2030 (Units)

Table 47 Oem Investment in Mobility Services

Table 48 Asia Pacific: Market, By End-User, 2023–2030 (Units)

Table 49 Europe: Market, By End-User, 2023–2030 (Units)

Table 50 North America: Market, By End-User, 2023–2030 (Units)

Table 51 RoW: Autonomous Luxury Vehicle Market, By End-User, 2023–2030 (Units)

Table 52 Global Market, By Region, 2023–2030 (Units)

Table 53 Asia Pacific: Market, By Country, 2023–2030 (Units)

Table 54 Asia Pacific: Market, By Fuel Type, 2023–2030 (Units)

Table 55 Europe: Autonomous Luxury Vehicle Market, By Country, 2023–2030 (Units)

Table 56 Europe: Market, By Fuel Type, 2023–2030 (Units)

Table 57 North America: Autonomous Luxury Vehicle Market, By Country, 2023–2030 (Units)

Table 58 North America: Market, By Fuel Type, 2023–2030 (Units)

Table 59 RoW: Market, By Country, 2023–2030 (Units)

Table 60 RoW: Market, By Fuel Type, 2023–2030 (Units)

Table 61 Market Ranking: 2016

Table 62 New Product Development, 2016–2017

Table 63 Supply Contracts/Joint Ventures/Collaborations/Partnerships, 2017

Table 64 Expansions, 2014–2017

Table 65 Mergers & Acquisitions, 2015–2017

List of Figures (65 Figures)

Figure 1 Research Design

Figure 2 Research Methodology Model

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Average Traffic Congestion, 2015

Figure 5 Urban Population, 2000 vs 2016

Figure 6 Autonomous Luxury Vehicle Market Size Estimation Methodology: Top-Down Approach

Figure 7 Autonomous Luxury Vehicle Market, By End-User: Top-Down Approach

Figure 8 Key Countries of Market: US is Projected to Be the Largest Market, 2025–2030 (Units)

Figure 9 Market, By Component: LiDAR is Projected to Be the Largest Market, in Terms of Value (2025–2030)

Figure 10 Autonomous Luxury Vehicle Market Outlook, By Region: Europe is Projected to Register the Highest Market Growth, in Terms of Volume (2025–2030)

Figure 11 Autonomous Luxury Vehicle Market Outlook, By Body Type: Sedan/Hatchback Segment to Dominate the Market, in Terms of Volume (2025–2030)

Figure 12 Market Outlook, By Fuel Type: BEV Segment to Lead the Market, in Terms of Volume (2025–2030)

Figure 13 Market Outlook, By End-User: Car Sharing to Lead the Market, in Terms of Volume (2025–2030)

Figure 14 Growing Opportunities in Market, 2025–2030

Figure 15 North America is Projected to Hold the Largest Market Share, 2025–2030

Figure 16 Sedan/Hatchback Segment Projected to Hold the Largest Market Share, 2025–2030

Figure 17 BEV to Hold the Largest Autonomous Luxury Vehicle Market Share, 2025–2030

Figure 18 Car Sharing to Hold the Largest Market Share, 2025–2030

Figure 19 Ultrasonic Sensors to Hold the Largest Market Share, 2025–2030

Figure 20 Autonomous Luxuey Vehicle Market: Market Dynamics

Figure 21 Road Traffic Death Rates, Per 1,00,000 Population, 2015

Figure 22 World’s Petroleum Consumption, Quad Btu, 1980-2014

Figure 23 Consumers’ Preference for Shared Self Driving Taxi

Figure 24 LiDAR Integration in Vehicle

Figure 25 US: Rising GNI Per Capita Expected to Drive the Market for Autonomous Luxury Vehicles During the Forecast Period

Figure 26 Germany: Domestic Demand Expected to Drive the Market

Figure 27 UK: Increasing Luxury Vehicle Production is Expected to Drive the Market

Figure 28 Autonomous Luxury Vehicle Market, By Body Type, 2025 vs 2030 (Units)

Figure 29 Autonomous Luxury Vehicle Market, By Fuel Type, 2025 vs 2030 (Units)

Figure 30 Market, By Component, 2025 vs 2030 (USD Thousand)

Figure 31 Banned Countries for Private and Commercial Use of Radar Detectors and Sensors

Figure 32 Global Market, Future Trends & Scenario (2023—2030)

Figure 33 Autonomous Luxury Vehicle Market (Optimistic), By Region, 2025 vs 2030 (Units)

Figure 34 Market (Most Likely), By Region 2025 vs 2030 (Units)

Figure 35 Autonomous Luxury Vehicles Market (Pessimistic), By Region 2025 vs 2030 (Units)

Figure 36 Global Market, By Future Trends & Scenario, By Car Sharing (2023—2030)

Figure 37 Market, By End-User, 2025 vs 2030 (Units)

Figure 38 Europe to Be the Fastest Growing Region for Autonomous Luxury Vehicles During the Forecast Period (2025–2030)

Figure 39 China to Account for the Largest Market Share in the Asia Pacific Region for Autonomous Luxury Vehicle, 2025 vs 2030

Figure 40 Europe: Autonomous Luxury Vehicle Market Snapshot

Figure 41 North America: Market Snapshot

Figure 42 Companies Adopted New Development as the Key Growth Strategy From 2014 to 2017

Figure 43 Battle for Market Share: New Product Development Was the Key Strategy

Figure 44 Daimler: Company Snapshot

Figure 45 Audi: Company Snapshot

Figure 46 BMW: Company Snapshot

Figure 47 Porsche: Company Snapshot

Figure 48 Tesla: Company Snapshot

Figure 49 BYD: Company Snapshot

Figure 50 Changan Automobile: Company Snapshot

Figure 51 Saic Motor Corporation: Company Snapshot

Figure 52 Baidu: Company Snapshot

Figure 53 Baic Motor: Company Snapshot

Figure 54 Robert Bosch: Company Snapshot

Figure 55 Continental: Company Snapshot

Figure 56 Denso: Company Snapshot

Figure 57 Delphi Automotive: Company Snapshot

Figure 58 Infineon Technologies: Company Snapshot

Figure 59 NXP Semiconductors: Company Snapshot

Figure 60 Valeo: Company Snapshot

Figure 61 Texas Instruments: Company Snapshot

Figure 62 ZF Friedrichshafen: Company Snapshot

Figure 63 Magna International: Company Snapshot

Figure 64 Cisco Systems: Company Snapshot

Figure 65 Renesas Electronics: Company Snapshot

Growth opportunities and latent adjacency in Autonomous Luxury Vehicle Market