Automotive Digital Cockpit Market

Automotive Digital Cockpit Market by Equipment (Front, Passenger and Rear Infotainment, HUD, Digital Instrument Cluster, Digital Center Console, Driver Monitoring System), Application, Vehicle Type, EV Type, Display Type, Display Size - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

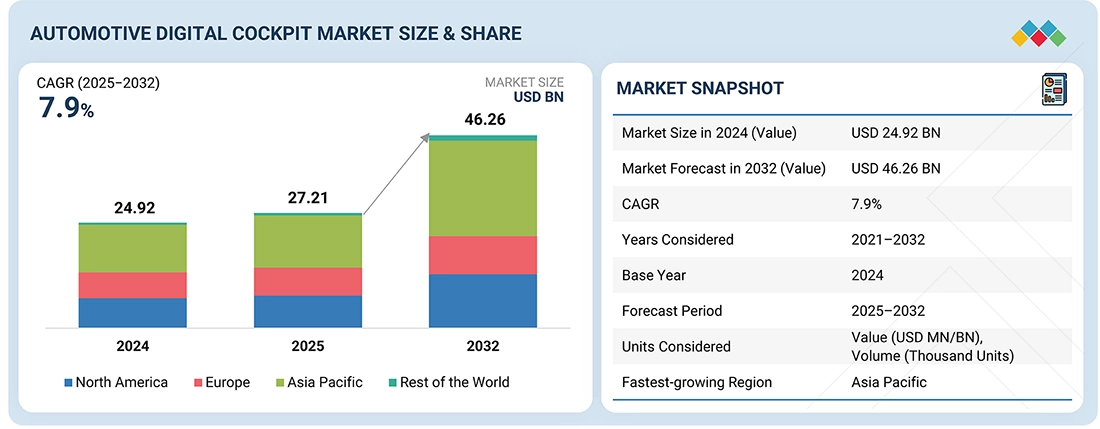

The automotive digital cockpit market is projected to grow from USD 27.21 billion in 2025 to USD 46.26 billion by 2032, supported by the rising demand for connected in-cabin experiences and advanced HMI systems. Automakers are moving toward software-driven vehicle platforms, increasing the adoption of large displays, integrated infotainment, and driver monitoring technologies. Growth in electric vehicles is accelerating the need for digital interfaces that provide energy insights and real-time vehicle information.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific accounted for a share of 44.2% of the overall market in 2025.

-

By Vehicle TypeThe passenger car segment held the largest share of 89.9% of the automotive digital cockpit market in 2025.

-

By EquipmentThe HUD segment is projected to register the highest CAGR of 15.6% during the forecast period.

-

By ApplicationThe driver assistance & monitoring segment is projected to record the highest CAGR of 13.7% during the forecast period.

-

By Display SizeThe 5-10" display segment accounted for 62.8% of the automotive digital cockpit market in 2025.

-

By Display TypeThe TFT-LCD display segment accounted for 40.8% of the automotive digital cockpit market in 2025.

-

EV TypeThe BEV segment is expected to be the fastest-growing EV type with a CAGR of 16.3% during the forecast period.

-

Competitive Landscape- Key PlayersContinental AG, Robert Bosch GmbH, Denso Corporation, Visteon Corporation, and HARMAN International are identified as major players in the market given their strong product portfolios and extensive global presence.

Automotive digital cockpit suppliers are expanding portfolios as vehicle makers shift to connected, software-driven cabin architectures. Companies are investing in larger display systems, centralized compute platforms, and integrated HMI to support safer interfaces and richer personalization. Stronger semiconductor partnerships and in-house cockpit software development are becoming core priorities. Growing EV production and higher demand for in-cabin data, driver monitoring, and seamless infotainment integration are steering product strategies as players compete on processing capability, user experience, and scalable cockpit domains.

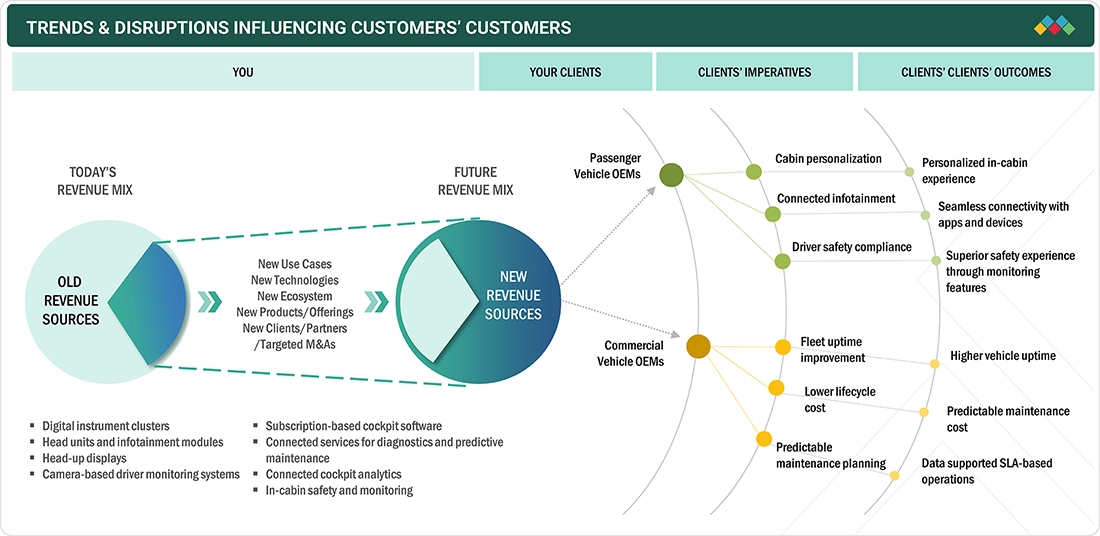

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Automotive digital cockpit demand is shifting revenue toward connected and software-driven platforms as OEMs standardize larger displays, centralized computing, and integrated infotainment systems. Companies are prioritizing cockpit solutions that enhance personalization, reduce driver workload, and support continuous feature updates through cloud connectivity. The future revenue mix is being shaped by strong uptake of EVs, growth in domain controllers, and rising adoption of AI-based driver monitoring across passenger and commercial vehicles. As OEMs pursue smart cabin strategies, suppliers are moving toward advanced HMI technologies, multiscreen layouts, and connected cockpit analytics that improve safety and deliver richer in-cabin experiences.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing consumer demand for premium in-cabin experiences

-

Rising shift toward software-defined vehicles

Level

-

High cost of advanced cockpit electronics

-

Semiconductor and display supply vulnerabilities affecting cockpit system production

Level

-

Growth in multimodal HMI, AR visualization, and interior sensing systems

-

Increasing adoption of highway driving assist technology

Level

-

Increasing cybersecurity, data governance, and OTA coordination pressures

-

Managing OTA complexity across distributed cockpit and vehicle compute units

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing consumer demand for premium in-cabin experiences

Growing preference for high-quality displays, connected infotainment, and personalized interfaces is increasing the adoption of digital cockpits across passenger and commercial vehicles. Automakers are integrating advanced clusters, infotainment units, and monitoring features to meet user expectations and differentiate models.

Restraint: High cost of advanced cockpit electronics

The high cost of displays, domain controllers, sensors, and cockpit software hinders adoption in cost-sensitive vehicle segments. Investment requirements for compute platforms and integration add financial pressure for automakers and limit deployment in budget models.

Opportunity: Growth in multimodal HMI, AR visualization, and interior sensing systems

Advancements in voice, touch, gesture control, AR overlays, and driver monitoring are opening new revenue streams for suppliers. These technologies support safety, navigation, and in-cabin comfort, creating strong opportunities for cockpit upgrades across new vehicle launches.

Challenge: Increasing cybersecurity, data governance, and OTA coordination pressures

Growth in connected cockpit functions increases cybersecurity demands. Automakers must secure vehicle data, manage updates, and coordinate software across multiple components. These requirements increase operational complexity and add cost to cockpit development cycles.

AUTOMOTIVE DIGITAL COCKPIT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops cockpit domain controllers, integrated display platforms, and scalable HMI solutions that support connected infotainment, digital clusters, and driver monitoring across passenger and commercial vehicles | Improves system consolidation, reduces electronic complexity, and supports faster deployment of advanced cockpit features for global automakers |

|

Provides high-performance infotainment systems, cloud-linked cockpit software, driver monitoring technologies, and centralized compute units tailored for software-driven vehicles | Enhances safety, improves user experience, and supports continuous feature upgrades through secure connectivity and software management |

|

Offers cockpit electronics, instrument clusters, HUD systems, and integrated HMI platforms designed for electric and hybrid vehicles requiring energy insights and efficient control interfaces | Supports efficient EV operations, improves visibility of vehicle status, and strengthens real-time decision making for drivers |

|

Specializes in digital clusters, large display modules, cockpit domain controllers, and AI-enabled interfaces optimized for unified multiscreen layouts in modern vehicles | Boosts cabin digitalization, improves processing speed for graphics output, and enhances brand differentiation for automakers |

|

Provides connected infotainment platforms, premium audio-integrated cockpits, voice assistant technologies, and cloud-based services that power immersive in-cabin experiences | Strengthens consumer engagement, supports personalized content delivery, and improves integration of connected services across vehicle models |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

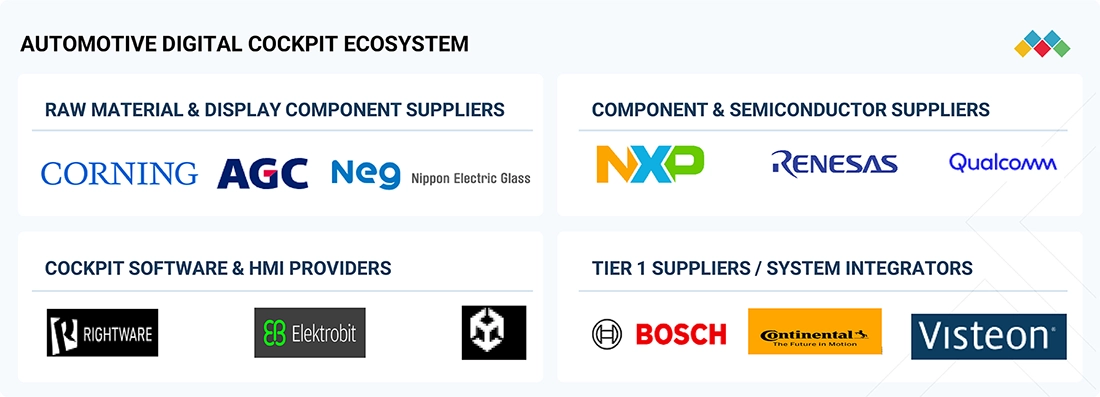

MARKET ECOSYSTEM

The automotive digital cockpit ecosystem comprises raw material suppliers, semiconductor companies, software providers, and Tier 1 integrators. that deliver complete cockpit platforms to global automakers. Display glass makers, chip suppliers, and HMI software firms support the development of high-performance infotainment units, clusters, HUDs, and monitoring systems. Tier 1 players such as Continental AG, Robert Bosch GmbH, and Visteon Corporation integrate hardware, software, and connectivity to meet OEM requirements across passenger and commercial vehicles. Collaboration across these groups strengthens system reliability, accelerates cockpit upgrades, and enables scalable deployment of next-generation in-cabin technologies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Automotive Digital Cockpit Market, By Equipment

The infotainment unit segment is expected to hold the largest market share, supported by the rising integration of connected services, navigation, and media functions across vehicle platforms. Automakers are prioritizing intuitive interfaces and seamless smartphone connectivity, strengthening demand for advanced infotainment systems. Improvements in processing power and software capabilities are reinforcing the segment’s dominance.

Automotive Digital Cockpit Market, By Display Size

The 5–10" segment is expected to account for the largest market share as it remains the preferred size for clusters and mid-range infotainment displays. Its balance of cost, visibility, and dashboard compatibility supports broad adoption across passenger and commercial vehicles. Continued upgrades in display brightness, touch performance, and graphics quality are reinforcing demand.

Automotive Digital Cockpit Market, By EV Type

The BEV segment is expected to record the strongest growth, driven by the increasing EV production and the need for energy monitoring, charging insights, and connected cockpit functions. BEVs rely heavily on digital interfaces to communicate range, performance, and vehicle health, accelerating the adoption of integrated cockpit systems.

Automotive Digital Cockpit Market, By Application

The driver assistance & monitoring segment is projected to register the fastest growth due to the rising focus on in-cabin safety, driver attention monitoring, and regulatory expectations. Automakers are integrating camera-based systems, alerts, and predictive insights to improve safety compliance, strengthening adoption across new vehicle programs.

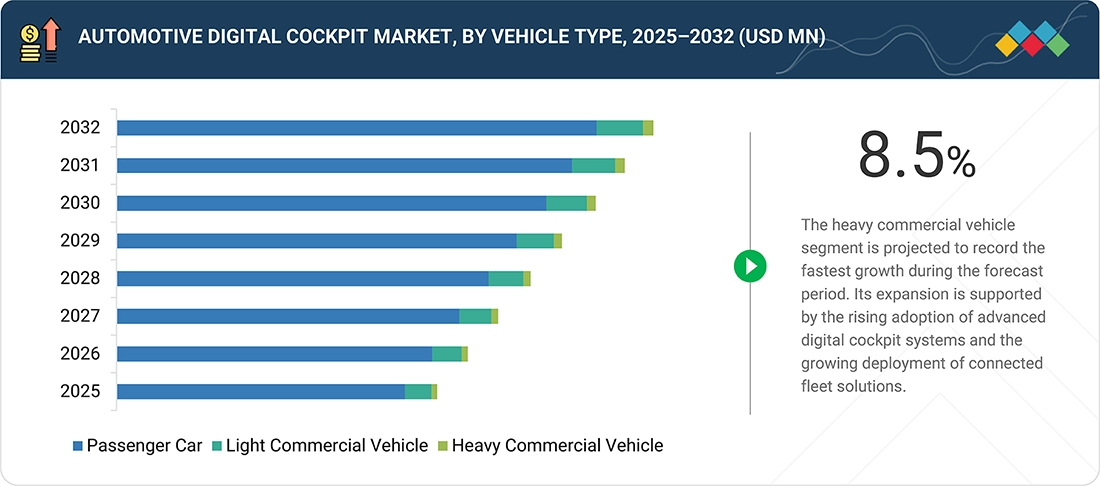

Automotive Digital Cockpit Market, By Vehicle Type

The passenger car segment is expected to continue to drive the largest adoption of digital cockpit systems as automakers prioritize connected infotainment, advanced clusters, and safety monitoring features. Growing focus on personalized cabin experiences and seamless device integration is strengthening demand across new model launches.

Automotive Digital Cockpit Market, By Display Type

The TFT-LCD display segment is expected to continue to hold the largest market share as automakers favor cost-efficient, reliable, and scalable display technologies that support multi-screen cockpit layouts and high-clarity infotainment interfaces.

REGION

Asia Pacific to grow at fastest rate in global automotive digital cockpit market during forecast period

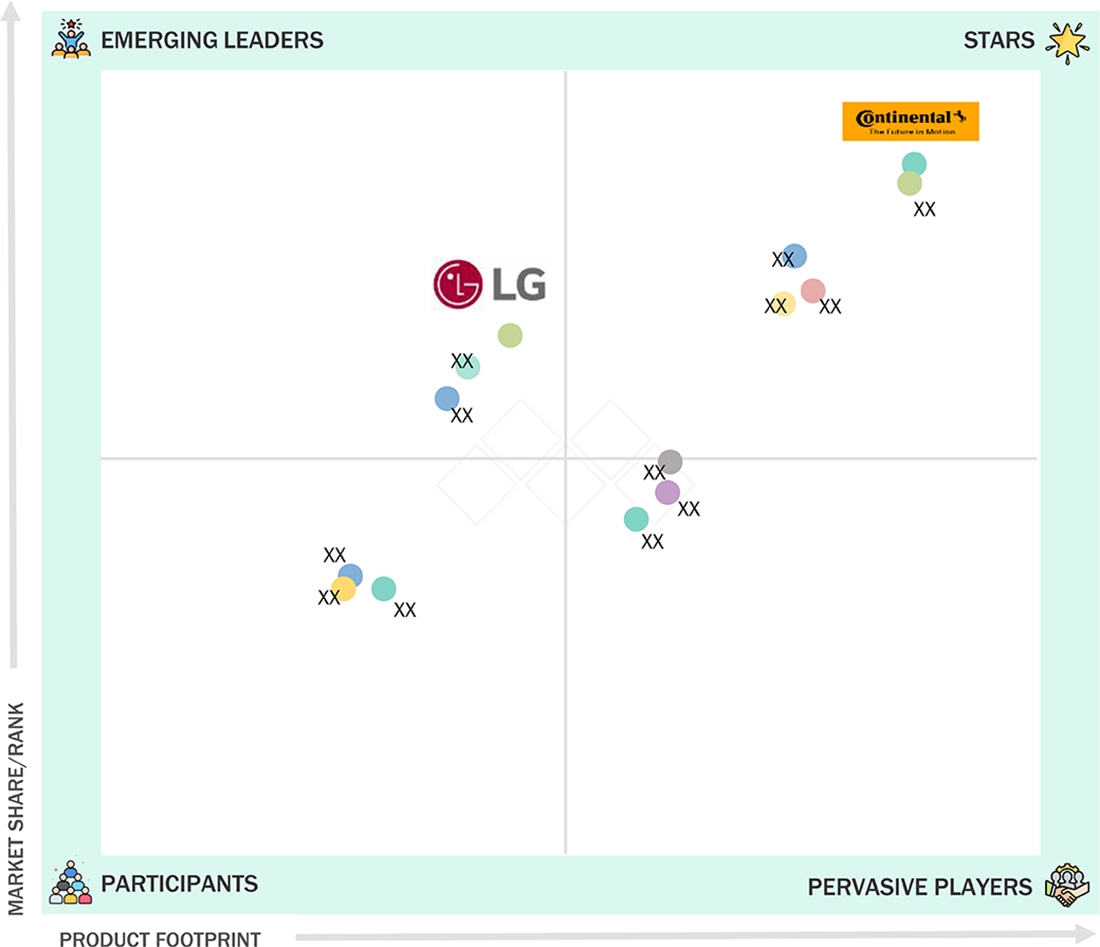

AUTOMOTIVE DIGITAL COCKPIT MARKET: COMPANY EVALUATION MATRIX

Continental AG is a Star player with a strong lineup in infotainment, digital clusters, and cockpit compute systems, supported by deep OEM engagements. LG Electronics is positioned as an Emerging Leader as it expands its cockpit displays and HMI capabilities across global programs. Both companies are strengthening their roles through steady technology upgrades and closer collaboration with automakers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Continental AG

- Robert Bosch GmbH

- DENSO CORPORATION

- Visteon Corporation

- HARMAN International

- Panasonic Holdings Corporation

- Aptiv PLC

- LG Electronics Inc.

- Valeo SA

- Magna International Inc.

- Marelli Holdings

- Pioneer Corporation

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 27.1 Billion |

| Revenue Forecast in 2032 | USD 46.26 Billion |

| Growth Rate | CAGR of 7.9% from 2025 to 2032 |

| Actual Data | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Volume (Thousand Units) and Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, and Rest of the World |

WHAT IS IN IT FOR YOU: AUTOMOTIVE DIGITAL COCKPIT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Passenger Vehicle OEM (Asia Pacific) | Assessment of cockpit digitization strategy, benchmarking of infotainment, clusters, HUDs, and driver monitoring features, and evaluation of semiconductor and display sourcing readiness | Enabled cockpit platform roadmap alignment, improved supplier selection, and supported transition toward software defined cockpit architectures |

| Commercial Vehicle OEM (Europe) | Optimization study for multi-display layouts, evaluation of connected services for fleet monitoring, assessment of domain controller integration, and cost benefit analysis for cockpit upgrades | Strengthened digital cockpit planning, improved feature allocation across trims, and enabled adoption of centralized compute platforms |

| EV Manufacturer (US) | Mapping cockpit requirements for BEVs, evaluation of energy visualization interfaces, benchmarking of in-cabin personalization features, and analysis of OTA capability readiness | Identified priority user experience elements, refined feature development pipeline, and improved clarity on cockpit software investments |

| Semiconductor Supplier (Japan) | Study of compute, graphics, and connectivity requirements by vehicle class, assessment of OEM platform roadmaps, and mapping opportunities across infotainment, ADAS, and cockpit controllers | Supported next-generation chipset positioning, guided product planning, and strengthened OEM engagement strategies |

| Investment Firm (North America) | Segmentation of leading cockpit system suppliers, financial analysis of display and HMI ecosystems, and evaluation of high growth opportunities in software-defined vehicles | Enabled informed investment decisions, highlighted high momentum cockpit technologies, and improved understanding of long-term value creation |

RECENT DEVELOPMENTS

- October 2025 : Robert Bosch GmbH launched real operation of an Iveco fuel-cell electric truck at its Nuremberg plant, featuring a 200 kW Bosch FCPM, 70 kg hydrogen storage at 700 bar for up to 800 km range, 400 kW system output, and annual coverage of 12,000 km to reduce CO2 emissions while gathering data for future Compact 190/300 modules .

- September 2025 : Continental unveiled a compact 3D HUD under the AUMOVIO brand that replaces conventional projection mirrors with an advanced 3D display. The design reduces installation space by up to 50 percent and improves depth perception and field of view for augmented reality content.

- September 2025 : HARMAN International completed the USD 350 million acquisition of Sound United, integrating brands like Bowers & Wilkins, Denon, Marantz, and Polk Audio. Sound United will operate as a standalone unit within HARMAN, expanding HARMAN’s premium audio portfolio and strengthening its market leadership in home, auto, and personal audio.?

- July 2025 : Robert Bosch GmbH launched the new system-on-chip family for radar sensors, integrating key components for high computing power, advanced object recognition, and RF CMOS technology, enabling cost-effective and reliable ADAS functions in vehicles.

- April 2025 : DENSO and Horizon Robotics partnered to co develop assisted driving solutions that combine Horizon’s Journey processing hardware with DENSO’s ADAS engineering and vehicle integration capabilities, enabling high performance and cost efficient assisted driving functions.

Table of Contents

Methodology

The research study involves four major steps in estimating the automotive digital cockpit market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings, assumptions, and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. After this, the market breakdown and data triangulation approaches have been adopted to estimate the market sizes of segments and subsegments.

Secondary Research

The secondary sources referred to the automotive digital cockpit market as directly dependent on vehicle production. Vehicle production volume is derived through secondary sources such as automotive sector organizations (Organisation Internationale des Constructeurs d'Automobiles (OICA), publications from government sources [such as country-level automotive associations and organizations, Organisation for Economic Co-operation and Development (OECD), World Bank, CDC, and Eurostat]; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, paid repository. Historical production data has been collected and analyzed, and the industry trend has been considered to arrive at the forecast, which has been further validated by primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side include various industry experts, such as CXOs, Vice Presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders have also been interviewed.

Primary interviews have been conducted to gather insights such as vehicle production forecast, automotive digital cockpit market forecast, future technology trends, and upcoming technologies in the market. Data triangulation of all these points has been done with the information gathered from secondary research as well as model mapping. Stakeholders from the demand and supply sides have been interviewed to understand their views on the aforementioned points.

Primary interviews have been conducted with market experts from both the demand (OEMs) and supply (automotive digital cockpit solution and service providers) sides across four major regions: North America, Europe, the Asia Pacific, and the Rest of the World. Approximately 20% and 80% of primary interviews have been conducted from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report.

After successful interaction with industry experts, brief sessions have been conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject-matter experts’ opinions, has led to the findings described in the report. The breakdown of primary respondents is as follows:

Note: Others in the designation include sales, marketing, and product managers. Others in the company type include infotainment, component, and technology providers. Company tiers are based on the value chain; the revenue of the company is not considered.

OEMs are automotive digital cockpit providers, while Tier I are suppliers of automotive digital cockpit systems and components.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach has been followed to estimate and validate the value of the automotive digital cockpit market and other dependent submarkets, as mentioned below.

- Key players in the market have been identified through secondary research, and their global market ranking has been determined through primary and secondary research.

- The research methodology includes a study of annual and quarterly financial reports and regulatory filings of major market players (public), as well as interviews with industry experts for detailed market insights.

- All vehicle-level penetration rates, percentage shares, splits, and breakdowns for the market have been determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain validated and verified quantitative and qualitative data.

- The gathered market data has been consolidated, enhanced with detailed inputs, analyzed, and presented in this report.

Automotive Digital Cockpit Market : Top-Down and Bottom-Up Approach

Data Triangulation

After deriving the overall size of the automotive digital cockpit market through the established market estimation process, the total market has been segmented into multiple equipment types, vehicle types, electric vehicle types, display types, and display sizes. Market breakdown and data triangulation methods have been applied to validate the distribution of value and volume across all subsegments. The triangulation process incorporates secondary research, primary interviews with OEMs and Tier 1 suppliers, and validation through top-down and bottom-up approaches. These steps ensured accuracy in segment-level statistics and strengthened confidence in the final market estimates.

Market Definition

Automotive digital cockpits comprise integrated electronic interfaces that enhance driver information, connectivity, safety, and in-cabin experience. They include digital instrument clusters, infotainment units, passenger displays, head-up displays, camera-based driver monitoring systems, and other cockpit electronics. These systems consolidate vehicle data, navigation, entertainment, and driver assistance functions to improve situational awareness and personalization.

Key Stakeholders

- Automotive digital cockpit manufacturers

- Parts and component suppliers

- Automotive OEMS

- R&D department

- Automotive association and regulatory bodies

- Infotainment service providers

- Fleet owners

- Telecom companies

Report Objectives

- To define, describe, and forecast the automotive digital cockpit market by equipment, electric vehicle (EV) type, vehicle type, display type, display size, and application in terms of value and volume

- To describe and forecast the size of the automotive digital cockpit market, by four regions: North America, Europe, the Asia Pacific, and the Rest of the World (RoW), along with their respective countries, in terms of value and volume

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies

- To analyze competitive developments, such as product launches, acquisitions, agreements, and partnerships, in the market

- To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, impact of 2025 US tariffs, key conferences and events, and regulations pertaining to the market under study

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Automotive Digital Cockpit Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Automotive Digital Cockpit Market