Application Modernization Services Market

Application Modernization Services Market by Service Type (Cloud Application Migration, Application Re-Platforming, Post Modernization), Application Type (Legacy, Cloud-hosted, Cloud-native) - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

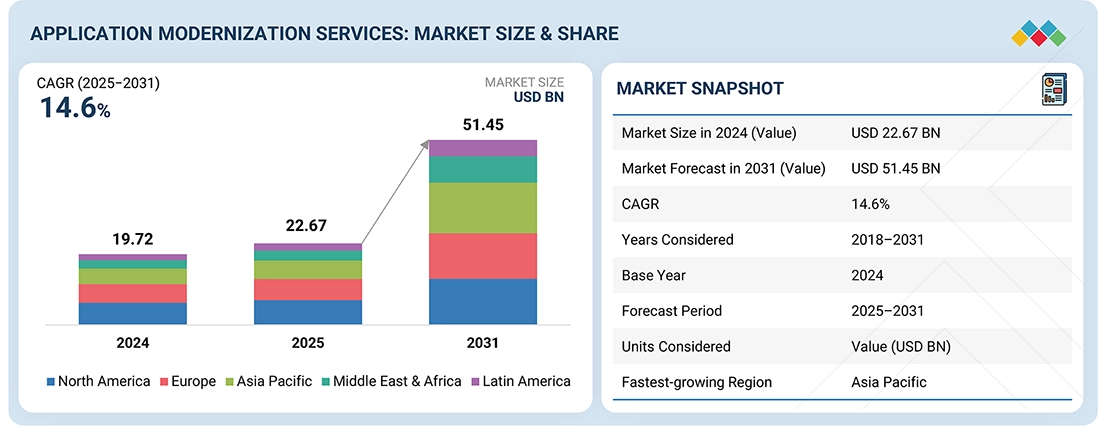

The application modernization services market, valued at USD 22.67 billion in 2024, is projected to reach USD 51.45 billion by 2031, growing at a robust CAGR of 14.6%. This market encompasses services designed to upgrade legacy applications to modern, agile, and cloud-based environments, thereby enhancing operational efficiency, scalability, and user experience. The growth is driven by increasing digital transformation initiatives, rising cloud adoption, and the need to improve business agility and cost efficiency. Asia Pacific is expected to be the fastest-growing region during the forecast period, supported by rapid technological advancements, expanding IT infrastructure, and growing demand from enterprises seeking to modernize their core applications.

KEY TAKEAWAYS

-

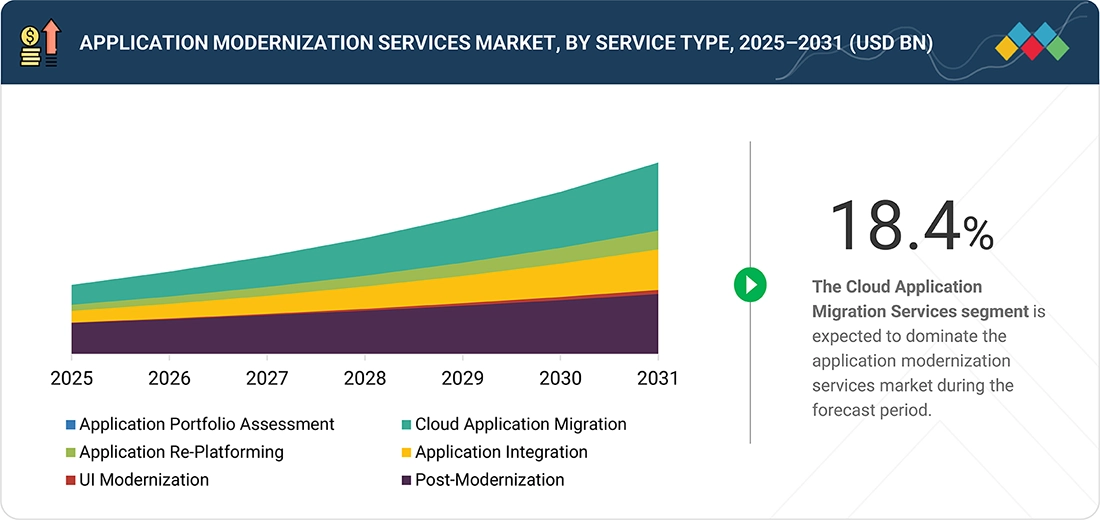

BY SERVICE TYPECloud application migration dominates the service segment as organizations increasingly seek to move their legacy on-premises applications to cloud environments. This shift enables businesses to enhance scalability, reduce infrastructure and operational costs, and leverage modern cloud-native features, ultimately facilitating faster innovation and more agile IT operations.

-

BY APPLICATION TYPECloud-hosted applications hold the largest market share as they provide businesses with flexible, scalable, and easily manageable solutions. These applications simplify integration with modern platforms, reduce maintenance overhead, and accelerate digital transformation initiatives, making them the preferred choice across industries undergoing modernization.

-

BY VERTICALThe telecom vertical is a major adopter of application modernization services due to the need to upgrade legacy IT systems and network infrastructure to support next-generation technologies such as 5G, IoT, and digital customer services. Modernized applications help telecom operators enhance service delivery, operational efficiency, and customer experience.

-

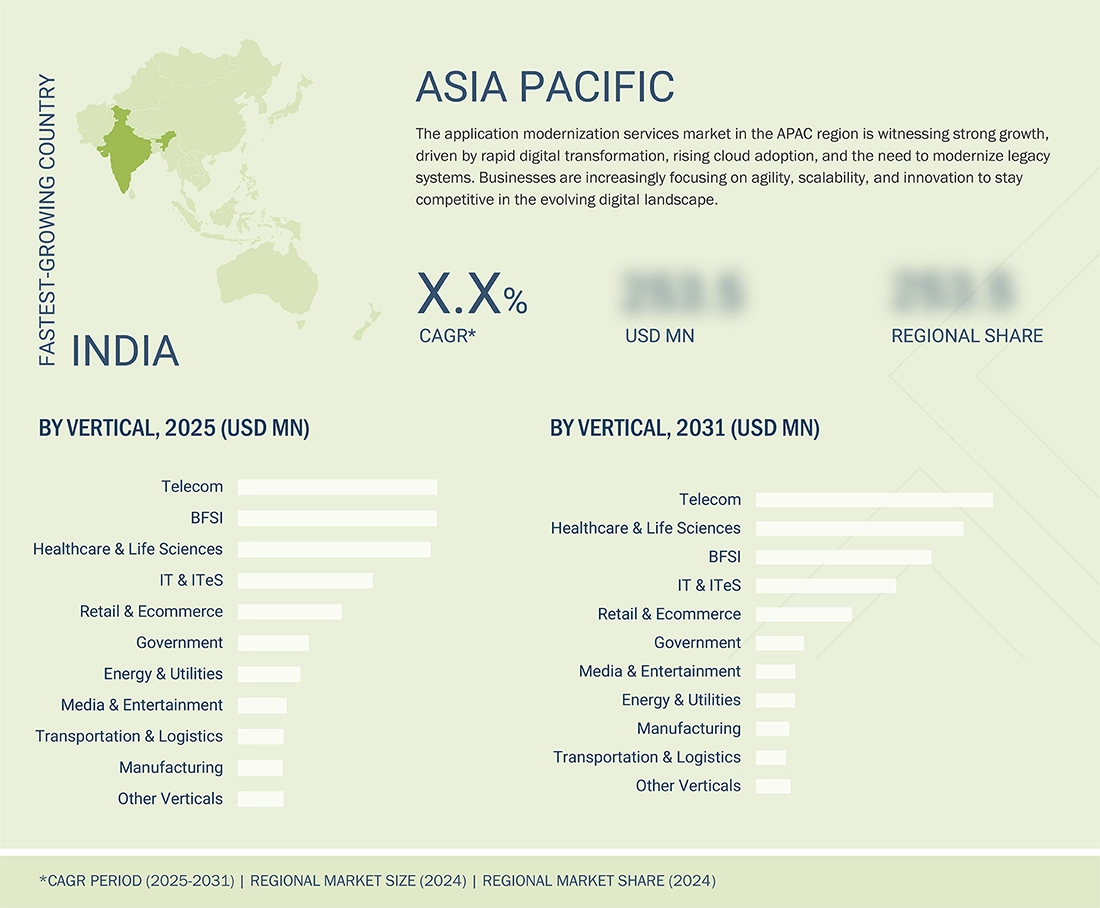

BY REGIONAsia Pacific is projected to grow at the highest CAGR of 18.3% during the forecast period. The application modernization services market in APAC is growing rapidly due to accelerated digital transformation, increasing cloud adoption, and strong government and enterprise investments in modern IT infrastructure.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships, collaborations, and investments. For instance, in August 2025, NTT DATA partnered with Google Cloud to accelerate cloud-native and AI-driven application modernization across enterprises, combining NTT DATA’s transformation expertise with Google Cloud’s advanced analytics and multicloud capabilities.

Within the application modernization services market, key segments, including service type, application type, and industry vertical, each play a vital role in driving overall growth and adoption. Among these, application portfolio assessment, legacy applications, and the BFSI sector have emerged as the leading contributors to market share, reflecting strong demand from enterprises for efficiency, scalability, and innovation.

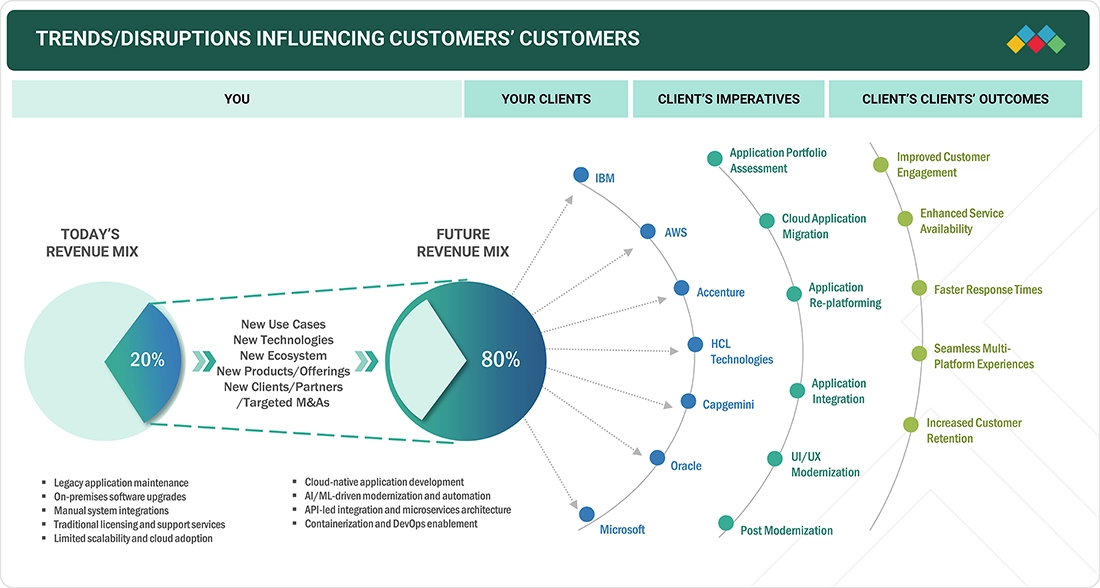

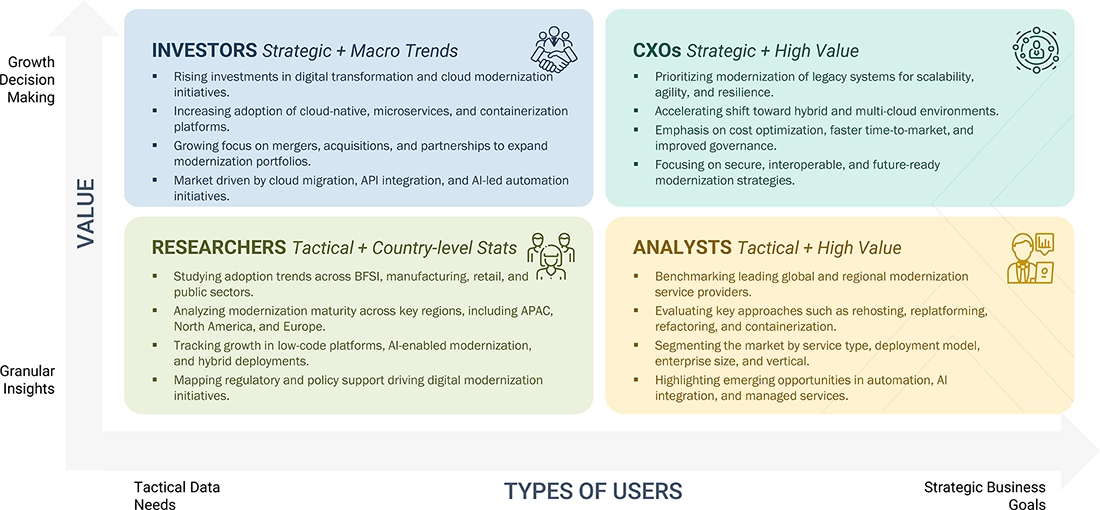

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The application modernization services market is experiencing a shift in revenue mix from traditional to modern approaches, where 20% of today’s revenue is derived from legacy application maintenance, on-premise software upgrades, manual system integrations, and traditional licensing and support services, which offer limited scalability and cloud adoption. The future revenue mix of 80% will be driven by new use cases, technologies, ecosystems, products, clients, partners, and targeted mergers and acquisitions (M&As), emphasizing cloud-native application development, AI/ML-driven modernization, API-based integration, microservices architecture, containerization, and DevOps enablement. Major players such as IBM, AWS, Accenture, HCL Technologies, Capgemini, Oracle, and Microsoft are helping clients with key imperatives like application portfolio assessment, cloud migration, application re-platforming, integration, UI/UX modernization, and post-modernization, resulting in improved customer engagement, enhanced service availability, faster response times, seamless multi-platform experiences, and increased customer retention.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising digital transformation initiatives

-

Rapid technological advancements

Level

-

High costs and complexity

-

Legacy system dependencies

Level

-

Emerging markets and SMEs

-

Evolution of open standards for software development

Level

-

Vendor lock-in and platform dependencies

-

Managing technical debt

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising digital transformation initiatives

The global push for digital transformation is fueling the demand for application modernization services. Organizations seek to upgrade from outdated legacy systems to agile, scalable, and efficient modern architectures, including microservices, containerization, and cloud-native platforms. These modern systems enable faster time-to-market, real-time data processing, and more dynamic responses to market changes. Ford’s partnership with Google Cloud aims to modernize its entire IT landscape, leveraging cloud-based solutions to support data-driven decision-making. This digital shift is critical for enterprises looking to maintain competitive advantages, leading to a significant increase in modernization projects. The need to optimize business processes, reduce technical debt, and leverage advanced technologies like AI and IoT further accelerates the demand for application modernization. As more companies realize the strategic importance of digital transformation, the application modernization services market is expected to grow at a substantial rate.

Restraint: High costs and complexity

One of the most significant restraints for application modernization services is the high cost and complexity involved in upgrading legacy systems. The modernization process often requires a substantial financial investment, as well as extensive technical expertise to redesign or rearchitect old applications. A company like Macy’s might face millions of dollars in upfront costs to modernize its legacy e-commerce infrastructure. The complexity of refactoring or re-engineering critical business applications can also delay modernization efforts, particularly for large organizations with deeply entrenched legacy systems. Smaller companies with limited IT budgets are more likely to delay modernization, preferring to maintain their legacy systems despite the long-term operational inefficiencies. The high costs associated with modernization can act as a significant deterrent for organizations, limiting the overall growth of the application modernization services market.

Opportunity: Emerging markets and SMEs

Emerging markets, especially in regions such as Asia Pacific and Latin America, offer significant growth opportunities for application modernization services. The rapid expansion of IT infrastructure in countries like India, Brazil, and Indonesia has created a fertile environment for modernization efforts. Additionally, small and medium-sized enterprises (SMEs) in these regions are increasingly adopting cloud solutions and seeking cost-effective modernization services to enhance operational efficiency. Indian SMEs are leveraging modernization to integrate digital payment systems and e-commerce platforms, thereby enhancing their operational efficiency and competitiveness. As emerging economies continue to digitalize, the demand for modernization services is expected to rise, creating lucrative opportunities for service providers to expand their offerings in these regions.

Challenge: Vendor lock-in and platform dependencies

Enterprises that have built their IT infrastructure around specific vendors or platforms often face significant challenges related to vendor lock-in when modernizing their applications. For instance, organizations that rely on Oracle-based systems may find it difficult and costly to migrate to alternative platforms without extensive re-engineering. Vendor lock-in limits flexibility and can increase the overall cost of modernization, as companies are forced to remain dependent on a single vendor’s technology stack. This challenge complicates modernization efforts and may discourage enterprises from pursuing modernization projects, especially when it involves a significant overhaul of mission-critical applications.

Application modernization services market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Microsoft enables application modernization through Azure App Service, Azure Kubernetes Service (AKS), and Azure DevOps, helping enterprises migrate legacy systems to cloud-native and microservices-based architectures. | This approach reduces infrastructure and maintenance costs, enhances scalability and security, and accelerates deployment cycles through automation and continuous integration pipelines. |

|

AWS facilitates modernization using AWS Lambda, Amazon ECS/EKS, and Migration Hub, allowing organizations to refactor traditional applications into serverless or microservices environments while integrating AI and analytics for optimization. | It improves operational efficiency through serverless computing, ensures scalability for dynamic workloads, and enables faster innovation by leveraging AI-driven insights and automation tools. |

|

IBM modernizes legacy systems through IBM Cloud, Red Hat OpenShift, and IBM Consulting, with a focus on containerization, API-led integration, and hybrid cloud transformation. | This enables seamless workload flexibility across hybrid environments, improves business continuity for mission-critical systems, and boosts productivity through AI-powered automation and open-source platforms. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of application modernization services encompasses a diverse range of components, including cloud service providers, consulting firms, technology vendors, and system integrators, all collaborating to facilitate the transformation of legacy systems into agile, cloud-ready applications. This ecosystem encompasses various service types: cloud migration, application re-platforming, and managed services. Each participant contributes unique expertise and resources, leveraging technologies such as AI, automation, and DevOps practices to optimize the modernization process and enhance application performance. As organizations increasingly prioritize digital transformation, the application modernization ecosystem plays a crucial role in enabling businesses to remain competitive, reduce technical debt, and harness the full potential of modern technologies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Application Modernization Services Market, By Service Type

The application modernization services market by service type is projected to grow significantly from 2025 to 2031, with all segments, such as application portfolio assessment, application re-platforming, UI modernization, application integration, and post-modernization, expected to expand steadily. Among these, cloud application migration services are expected to dominate the market, with a strong growth rate of 18.4%, driven by the increasing adoption of cloud technologies by enterprises seeking greater scalability, flexibility, and efficiency in their operations.

REGION

North America is estimated to account for the largest market share during the forecast period

The application modernization services market in the Asia Pacific region is witnessing robust growth, recording a CAGR of 18.3%, fueled by rapid digital transformation initiatives, widespread cloud adoption, and the growing need to modernize aging legacy systems. Organizations across the region are increasingly focusing on enhancing agility, scalability, and operational efficiency to keep pace with technological advancements and evolving customer demands. The region’s dynamic digital ecosystem, supported by government initiatives and investments in IT infrastructure, is further accelerating modernization efforts. Among all countries in the region, India stands out as the fastest-growing market, driven by a strong technology sector, increasing cloud investments, and a thriving digital economy.

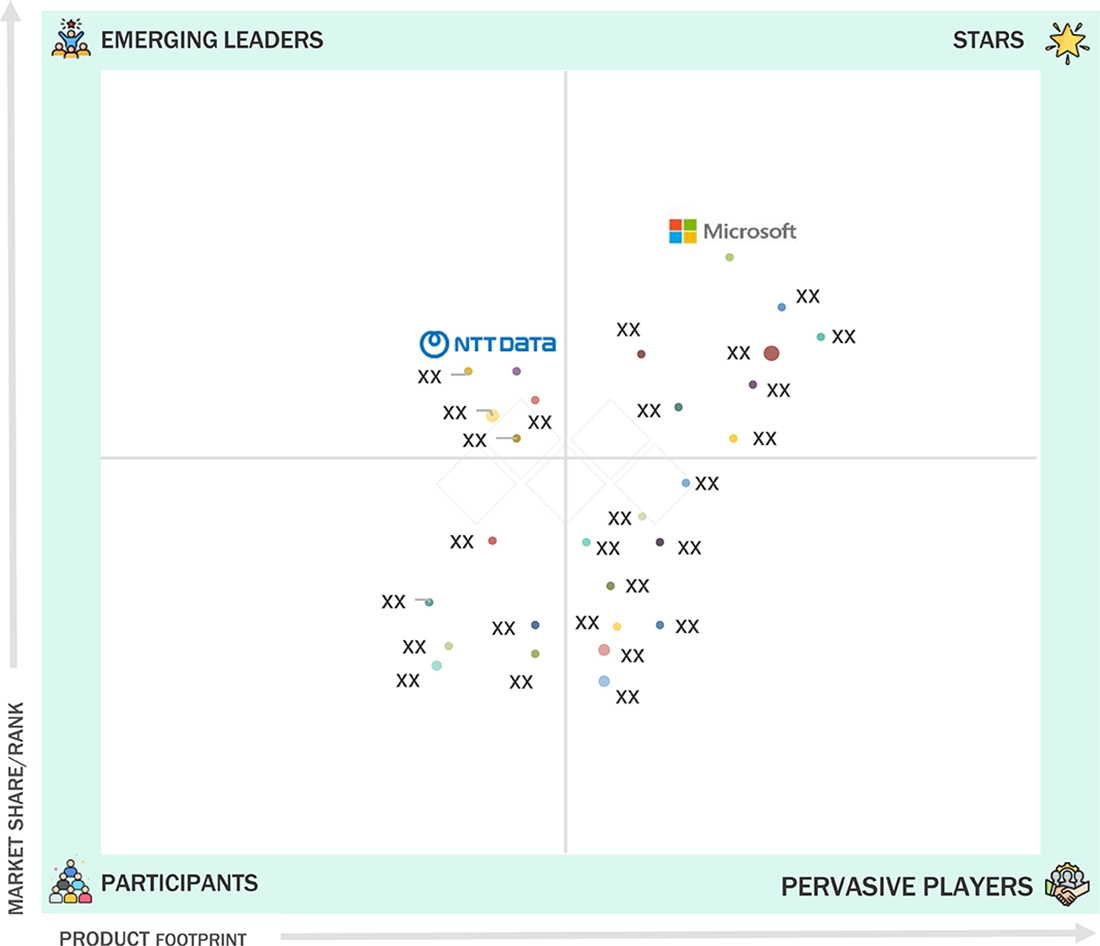

Application modernization services market: COMPANY EVALUATION MATRIX

The company evaluation matrix for the application modernization services market categorizes industry players based on their market share and product footprint, positioning them into four quadrants: Stars, Emerging Leaders, Pervasive Players, and Participants. Companies in the “Stars” quadrant, such as Microsoft, demonstrate strong market presence and a broad product portfolio, reflecting leadership and innovation in modernization services. The “Emerging Leaders” quadrant, featuring firms such as NTT Data, includes companies that are rapidly expanding their capabilities and market influence through technological advancements and strategic initiatives. “Pervasive Players” maintain a solid market presence with consistent offerings, while “Participants” represent firms with niche or developing footprints aiming to strengthen their competitiveness. This matrix provides a visual overview of how companies are positioned in terms of growth, innovation, and overall influence within the global application modernization services landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 22.67 Billion |

| Revenue Forecast in 2031 | USD 51.45 Billion |

| Growth Rate | CAGR of 14.6% from 2025 to 2031 |

| Actual data | 2018–2031 |

| Base year | 2024 |

| Forecast period | 2025–2031 |

| Units considered | Value (USD) Million/Billion |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Application modernization services market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (US) |

|

|

| Company Information | Detailed analysis and profiling of additional market players (up to 5) |

|

RECENT DEVELOPMENTS

- October 2025 : Accenture and AWS expanded their collaboration to deliver AI-powered cloud modernization services for public-sector and defense organizations, combining Accenture’s industry expertise with AWS’s advanced infrastructure and cloud capabilities.

- January 2025 : HCLTech and Microsoft expanded their strategic partnership to modernize contact centers using generative AI and cloud solutions, integrating Nuance Enterprise Professional Services into HCLTech’s modernization portfolio.

- November 2024 : Kyndryl and Microsoft launched new mainframe application modernization services on Microsoft Cloud, leveraging Azure, Copilot, and DevOps tools to migrate mission-critical workloads to modern architectures.

- April 2024 : TCS and AWS have established a multi-year strategic agreement to accelerate large-scale cloud transformations through the use of generative AI, cloud-native architectures, and full-stack application modernization initiatives.

- January 2024 : IBM completed the acquisition of application modernization assets from Advanced to strengthen its hybrid cloud and AI transformation capabilities, enhancing mainframe modernization and enterprise cloud migration services.

Table of Contents

Methodology

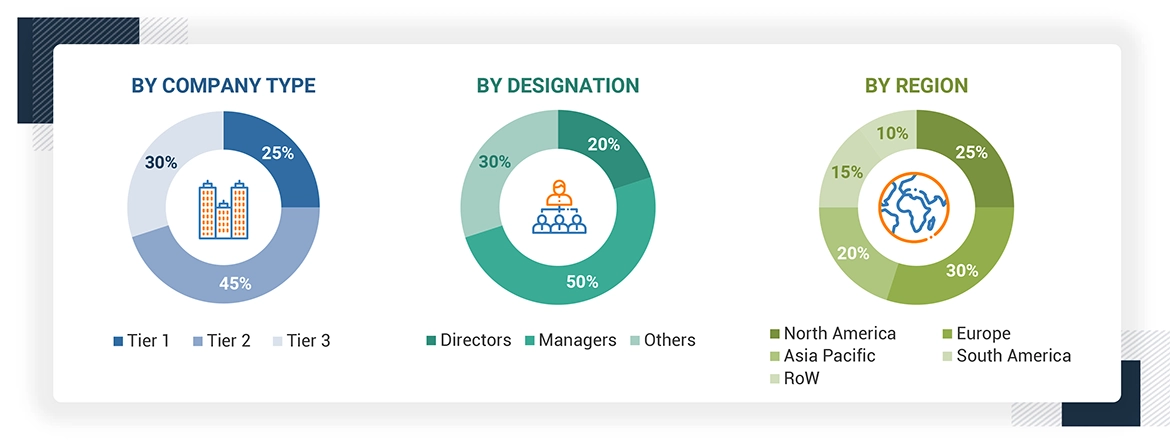

This research study extensively utilized secondary sources, directories, and databases, including Dun & Bradstreet (D&B), Hoovers, and Bloomberg Businessweek, to identify and collect information relevant to a technical, market-oriented, and commercial study of the application modernization services market. The primary sources have primarily consisted of industry experts from core and related industries, as well as preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and associations, such as the Application Modernization Services associations/forums, the Cloud Native Computing Foundation (CNCF), and the Open Mainframe Project, were also referenced. Secondary research was employed to gather key information on industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the application modernization services market. The primary sources from the demand side included application modernization services end users, consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

Others include sales managers, marketing managers, and product managers.

Note: Tier 1 companies’ revenue is more than USD 1 billion; Tier 2 companies ‘revenue ranges between USD 500 million to 1 billion;

and Tier 3 companies’ revenue ranges between USD 100 million and USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the application modernization services market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of application modernization services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the application modernization services market. These methods were extensively used to estimate the size of various market segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through a combination of primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Application Modernization Services Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size, the application modernization services market was segmented into several categories and subcategories. A data triangulation procedure was employed to complete the overall market engineering process and derive the exact statistics for all segments and subsegments, as applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. In addition to data triangulation and market breakdown, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Application modernization is the process of modernizing legacy applications by rehosting, re-platforming, rearchitecting, and migrating them to the cloud, utilizing the latest technologies and frameworks to ensure compatibility and facilitate upgrades in response to technological advancements. It enables organizations to achieve developer efficiency, scalability, and alignment of applications with current business needs.

VMware defines application modernization, also known as legacy modernization or legacy application modernization, as the practice of updating older software for newer computing approaches, including newer languages, frameworks, and infrastructure platforms.

Cognizant defines application modernization as the process of updating legacy applications to scalable, cloud-native app environments using modern technology stacks. This process allows applications to meet modern user expectations as they evolve.

Stakeholders

- Application Modernization Service Providers

- Cloud Service Providers (CSPs)

- Independent Software Vendors (ISVs)

- System Integrators

- Enterprises/Businesses

- Technology Consultants

- Regulatory Bodies

- Cloud-native Development Communities

- Managed Service Providers (MSPs)

- DevOps Teams

- Data Security Providers

- Open-source Software Communities

- API Management Solution Providers

- Infrastructure Vendors

- AI and Automation Solution Providers

- Network and Connectivity Providers

- Middleware and Integration Tool Vendors

- Platform-as-a-Service (PaaS) Providers

Report Objectives

- To determine, segment, and forecast the application modernization services market based on service type (application portfolio assessment, cloud application migration, application re-platforming, application integration, UI/UX modernization, and post-modernization), application type, vertical, and region in terms of value

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments, and perform a value chain analysis of the market landscape

- To strategically analyze the macro and micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and R&D activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

What is the current size of the Application Modernization Services market?

The global Application Modernization Services market is expected to grow from USD 22.67 billion in 2024 and is projected to reach USD 51.45 billion in 2031, at a CAGR of 14.6% during the forecast period.

Who are the top key players in the Application Modernization Services market?

Global players dominate the Application Modernization Services industry and comprise several regional players, including Oracle (US), IBM (US), Microsoft (US), AWS (US), HCL Tech (US), Accenture (Ireland), and ATOS (France).

What are the trends in the Application Modernization Services market?

Trends in the application modernization services market include cloud-native adoption, increasing use of microservices and containerization, integration of AI and automation, rise of low-code/no-code development, and a growing shift toward hybrid and multi-cloud environments.

Which are the most prominent factors driving the Application Modernization Services market?

Cloud migration, digital transformation, adoption of microservices and DevOps, rising security and compliance needs, and the demand for cost reduction and operational efficiency are driving the application modernization services market.

What are the challenges faced by Application Modernization Service providers globally?

Complex legacy migration, talent shortage, high modernization costs, security and compliance risks, and integration issues.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Application Modernization Services Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Application Modernization Services Market