Application Management Services Market by Service (Application Portfolio Assessment, Application Modernization, Application Maintenance and Support, and Application Managed Services), Organization Size, Vertical, and Region - Global Forecast to 2022

[126 Pages Report] The application management services market was valued at USD 8.92 billion in 2016 and projected to reach USD 27.83 billion by 2022, at a Compound Annual Growth Rate (CAGR) of 21.2% during the forecast period. The base year considered for the study is 2016, and the forecast period is 2017–2022.

Application management services are defined as sets of services that are deployed by enterprises to manage their existing applications portfolio. These services get initiated with application portfolio assessment, post which the required actions are summarized: whether the applications need to be migrated, replat formed, or integrated with new systems. Additionally, application security measures are undertaken. These services can also be outsourced to a managed service provider who has the expertise in managing enterprise application portfolios. These services facilitate business transformation through enhanced application performance, improved application optimization, increased business productivity, and better cost efficiency.

Market Dynamics

Drivers

- Increasing need for business agility and accelerated time-to-market

- Cloud computing, a major component of the application management strategy

- Emergence of BYOD and proliferation of mobile apps demand robust mobile app management services

Restraints

- Application data security is a major concern for enterprises

Opportunities

- Existence of a large number of legacy applications, offering huge revenue opportunities

- Open-source technology would pave the way for untapped possibilities

Challenges

- Application management, a time-intensive process

- Architectural and operational complexities

- High investments in application security offset the IT applications budget

Emergence of BYOD and proliferation of mobile apps demand robust mobile app management services

The enterprises have accelerated digital transformation from web-based to app-based service delivery model. The underlying tailwind is the proliferation of BYOD and smartphones. The end-users are so well-versed with the mobile devices that almost every enterprise have devised the mobile-first strategy. Enterprises have promoted the use of BYOD as these removes the device dependency and complexity the user might face while using multiple devices having different Operating Systems (OS) and different User Interfaces (UIs). Additionally, these save the device-related cost and indirectly lower the Operational Expenditure (OPEX). However, there are several issues with BYOD faced by the employees as the enterprises used to implement device wiping as a key goal in circumstances, where they feel the company data is being compromised. This resulted in huge employee dissatisfaction. The mobile device management has gained significant momentum since then. The enterprises need various functionalities such as pushing out Wi-Fi configuration and remote installation of enterprise application along with Over The Air (OTA) updates to it. With the rise of BYOD and smartphones, the enterprise application volumes are also skyrocketing. This demands the need of a robust application management process in place that can manage the enterprise apps and support the business decisions.

The following are the objectives of the study

- To determine and forecast the global application management services market by services, organization size, verticals, and regions from 2017 to 2022, and analyze various macro and microeconomic factors that affect the market growth

-

To forecast the size of the market segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA)

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total market

- To analyse opportunities in the market for stakeholders by identifying high-growth segments of the application management services market

- To profile the key market players, provide comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities in the market

The research methodology used to estimate and forecast the application management services market begins with capturing data on key vendor revenues and the market size of individual segments through secondary sources, such as industry associations and trade journals. The vendor offerings are also taken into consideration to determine market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the application management services market from the individual services technology segment. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key industry personnel, such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

The breakdown of the profiles of the primary discussion participants is depicted in the figure below:

BREAKDOWN OF PRIMARY PROFILES

To know about the assumptions considered for the study, download pdf brochure

The application management services market ecosystem includes players, such as Accenture (Republic of Ireland), Atos (France), Capgemini (France), Cognizant (US), Fujitsu (Japan), DXC (US), HCL (India), IBM (US), Wipro (India), and Tech Mahindra (India).

Major Market Developments

- In July 2017, Cognizant opened Digital Business Collaboratory, an interactive workspace in London, UK, to help organizations and businesses with digital transformation. This facility comprises multi-disciplinary teams of social scientists, design thinkers, creative technologists, engineers, and strategists, who are expected to accelerate the client’s digital transformation journey

- In March 2017, Accenture opened a Liquid Studio in Riga to help clients accelerate the innovation and software development cycles. The Liquid Studio provides clients with an open environment to transform their business using new skills, processes, technologies and ways of working

- In October 2017, CSC acquired Logicalis SMC, the Netherlands’ leading provider of technology-enabled solutions for the service management sector. This acquisition strengthens DXC’s position as one of the most experienced global integrators for ServiceNow

- In August 2017, Accenture partnered with Apple, the leading smartphone and personal computer company, to help its clients migrate and transfer their legacy applications to the modern iOS apps

Key Target Audience for Application Management Services Market

- Global application management services providers

- Professional and managed service providers

- Government and research organizations

- Information Technology (IT) companies

- Application modernization vendors

- Associations and industry bodies

- Application security vendors

- System integrators

Scope of the Application Management Services Market Report

|

Report Metrics |

Details |

|

Market size available for years |

2016–2022 |

|

Base year considered |

2016 |

|

Forecast period |

2017–2022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Service, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Accenture (Republic of Ireland), Atos (France), Capgemini (France), Cognizant (US), Fujitsu (Japan), DXC (US), HCL (India), IBM (US), Wipro (India), and Tech Mahindra (India) |

The application management services market scope comprises services used for managing enterprise applications. The phases considered include the deployment and maintenance phases, and exclude the testing and development phases.

By Service

- Application Portfolio Assessment

- Application Security

- Web Application Security

- Mobile Application Security

- Application Modernization

- Cloud Application Migration

- Application Integration

- Application replat forming

- UI Modernization

- Application Maintenance and Support

- Application Managed Services

By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Telecom and IT

- Government

- Retail and eCommerce

- Healthcare and Lifesciences

- Manufacturing

- Energy and Utilities

- Others (Media and Entertainment, Travel and Hospitality, Education, and Transport and Logistics)

By Region

- North America

- US

- Canada

- Europe

- APAC

- MEA

- Latin America

Critical questions which the report answers

- What are new key application areas which the application management services providers are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customization as per the company’s specific requirements. The following customization options are available for the report:

Geographic Analysis

- Further country-level breakdown of the European application management services market

- Further country-level breakdown of the APAC market

- Further country-level breakdown of the MEA market

- Further country-level breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

The application management services market size is expected to grow from USD 10.67 billion in 2017 to USD 27.83 billion by 2022, at a Compound Annual Growth Rate (CAGR) of 21.2%. The major drivers of the market include increasing the need for business agility, accelerated time-to-market, emergence of BYOD, and proliferation of mobile apps demanding robust mobile app management services.

The scope of the report covers the application management services market analysis by service, organization size, vertical, and region. The application modernization services segment is expected to have the largest market share during the forecast period, owing to the increased adoption of digital transformation strategies and increased need to replace the legacy applications. The application security segment is expected to grow at the highest CAGR during the forecast period, as vulnerabilities have become more complex and sophisticated, which are expected to further increase the demand for application security, to cater to the challenges posed by the threats.

The large enterprises segment is expected to have a larger application management services market share during the forecast period, owing to the need to reduce the high Capital Expenditure (CAPEX) and Operating Expenditure (OPEX). Large enterprises have dedicated in-house IT resources and larger IT budgets and therefore consider deploying a variety of application management strategies. The Small and Medium-Sized Enterprises (SMEs) segment is expected to grow at the highest rate, owing to the increase in adoption of the lift-and-shift migration strategy that results in decreased OPEX and improved business efficiency.

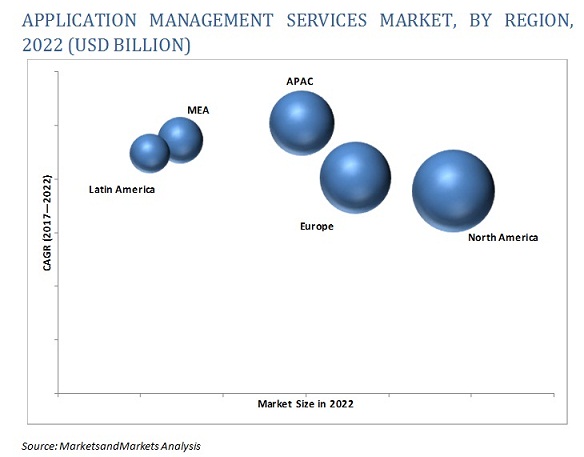

As per the geographic analysis, North America is expected to hold the largest market share, due to the presence of renown application management services providers, and stringent data security regulations and compliance. These enterprises are modernizing their legacy applications and migrating to cloud environment. Asia Pacific (APAC) is expected to witness the highest growth rate in the application management services market during the forecast period, due to the increased adoption of application management services and cloud computing. Companies in this region are migrating their core business applications to new cloud platforms to save cost.

Application management services in various industry verticals such as BFSI, Retail and eCommerce, Telecom and IT, and Healthcare and Lifesciences drive the growth of the market

Banking, Financial Services, and Insurance (BFSI)

The BFSI vertical collectively includes organizations that are into banking services, such as core banking, corporate, retail, investment banking, private banking, and cards; financial services such as payment gateways, stock broking, and mutual funds; and insurance services covering both life and general insurance policies. The risk level in the BFSI sector is always high as it deals with the critical financial data. This sector is accelerating its digital transformation strategy by implementing new technologies and modernizing its existing applications. Changes in the banking regulations and omnichannel approach to enhance customer services drive the application management services in the BFSI vertical. The BFSI vertical mainly faces regulatory compliance difficulties, challenges to attract new customers, and increase customer profitability. To address this challenge, the enterprises are emphasizing on application management solutions and services. The major part of the BFSI IT spending is utilized for the IT infrastructure maintenance and running the existing technology; to reduce this expense, the enterprises are adopting the application management services at the higher rate

Retail and ecommerce

The retail industry is going through a major transformation phase. Retailers are modernizing their brick-and-mortar stores to provide better services to their customers. Moreover, most of the retail stores are going online to increase their revenue. Retailers are adopting more innovative technologies such as cloud computing, big data analytics, digital stores, and social networks to increase their visibility and presence in the application management services market . The industry generates a huge amount of front-end and back-end data. The data is important to derive useful insights and forecast analysis. The sector is adopting the omnichannel strategy to provide a seamless experience to its customers. For this, the retailers are migrating their application landscapes toward more flexible and scalable platform to bring efficiencies and optimize their operating costs. The retail industry is dominated by the consumer experience. The focus on increasing the consumer experience, personalization, and the integration of the newer technologies such as augmented reality and virtual reality in the applications has increased which has resulted in the development of technologically advanced and remotely accessible applications. This has increased the adoption and the need for better application management services that can increase the overall efficiency and minimize the operating cost.

Telecom and IT

The telecom and IT industry is always eager to embrace digitization opportunities. This industry is modernizing its legacy applications to empower digital customer experience. Moreover, the growing number of subscribers and increasing adoption of various technologies related to the media and digital content are driving the demand for application management services across this vertical. This vertical is constantly facing the need for tailored applications to deliver a hyper-personalized experience, which has led to the requirement to learn about customer preferences in real time to reduce the churn rate and enhance customer loyalty. Furthermore, the telecom companies are migrating their legacy application to clouds and new technology platform to process and manage critical customer data. One of the major factors affecting the telecom and IT industry is the shift of focus from higher cost devices to the lower cost BYOD in the key application management services market . This has increased the need for low cost application development and management. According to a study, 53% of the IT enterprises are spending their funds to migrate the applications to the cloud, whereas 37% of the enterprises are planning to invest in developing application directly on the cloud.

Healthcare and Life Sciences

Healthcare and life sciences enterprises are embracing new methods and ways to deploy next generation technology including patient automation, application modernization, and infrastructure landscape aligned with predictive and prescriptive analytics to generate meaningful insights that facilitate decision-making and leverage IoT and smart technologies for building connected and digital health platforms. The healthcare industry has a very complex ecosystem that consists of doctors, patients, staff, administrators, and public. They require efficient technologies for different activities such as patient management, hospital resources management, doctor-patient relationship management, medical supplies management, and maintaining data for patients’ health records. Moreover, patients are demanding access to their healthcare information. Furthermore, this industry is governed by various government rules and regulations. To overcome these challenges and sustain in this competitive application management services market , the healthcare industry is upgrading and migrating its existing applications to new platforms and technologies. Modernizing existing application results in better business efficiency, robust security, and assured service levels.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry sectors for application management services?

“To speak to our analyst for a discussion on the above findings, click the Speak to Analyst tab provided above.”

The major factor that is expected to limit the growth of the application management services market is the rising concern over application data security. Business applications hold critical organizational data, they have become a prime target for hackers and cybercriminals, as they increase the risk exposure in a corporate environment. Due to increase in the security breaches targeting business applications, organizations across the world are deploying application security solutions to safeguard their web and mobile applications.

The major vendors profiled in the report include Accenture (Republic of Ireland), Atos (France), DXC (US), HCL (India), IBM (US), Capgemini (France), Cognizant (US), Fujitsu (Japan), Tech Mahindra (India), and Wipro (India). These players are increasingly undertaking partnerships and agreements, mergers and acquisitions, and product launches to develop and introduce new technologies and services in the market.

To speak to our analyst for a discussion on the above findings Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Research Assumptions and Limitations

2.3.1 Research Assumptions

2.3.2 Limitations

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 26)

4.1 Attractive Market Opportunities in the Application Management Services Market

4.2 Market By Service, 2017–2022

4.3 Market By Organization Size, 2017–2022

4.4 Market By Vertical, 2015–2022

4.5 Market By Region, 2017–2022

4.6 Market Invest Scenario, By Region, 2017-2022

5 Market Overview and Industry Trends (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Need for Business Agility and Accelerated Time-To-Market

5.2.1.2 Cloud Computing, A Major Component of the Application Management Strategy

5.2.1.3 Emergence of Byod and Proliferation of Mobile Apps Demand Robust Mobile App Management Services

5.2.2 Restraints

5.2.2.1 Application Data Security is A Major Concern for Enterprises

5.2.3 Opportunities

5.2.3.1 Existence of A Large Number of Legacy Applications, Offering Huge Revenue Opportunities

5.2.3.2 Open-Source Technology Would Pave the Way for Untapped Possibilities

5.2.4 Challenges

5.2.4.1 Application Management, A Time-Intensive Process

5.2.4.2 Architectural and Operational Complexities

5.2.4.3 High Investments in Application Security Offset the IT Applications Budget

5.3 Use Cases

6 Application Management Services Market, By Service (Page No. - 36)

6.1 Introduction

6.2 Application Portfolio Assessment

6.3 Application Modernization

6.3.1 Cloud Application Migration

6.3.2 Application Integration

6.3.3 Application Replatforming

6.3.4 User Interface Modernization

6.4 Application Security

6.4.1 Web Application Security

6.4.2 Mobile Application Security

6.5 Application Maintenance and Support

6.6 Application Managed Services

7 Application Management Services Market, By Organization Size (Page No. - 50)

7.1 Introduction

7.2 Small and Medium-Sized Enterprises

7.3 Large Enterprises

8 Market By Vertical (Page No. - 54)

8.1 Introduction

8.2 Banking, Financial Services, and Insurance

8.3 Telecom and IT

8.4 Government

8.5 Retail and Ecommerce

8.6 Healthcare and Life Sciences

8.7 Manufacturing

8.8 Energy and Utilities

8.9 Others

9 Application Management Services Market, By Region (Page No. - 63)

9.1 Introduction

9.2 North America

9.2.1 United States

9.3 Europe

9.4 Asia Pacific

9.5 Middle East and Africa

9.6 Latin America

10 Competitive Landscape (Page No. - 83)

10.1 Overview

10.2 Market Ranking Analysis

10.3 Competitive Scenario

10.3.1 New Service Launches

10.3.2 Business Expansions

10.3.3 Mergers and Acquisitions

10.3.4 Agreements, Partnerships, and Collaborations

10.3.5 Contracts

11 Company Profiles (Page No. - 88)

11.1 Accenture

(Business Overview, Solution/Service Offered, Recent Developments, SWOT Analysis, and MnM View)

11.2 ATOS

11.3 Capgemini

11.4 Cognizant

11.5 Fujitsu

11.6 DXC

11.7 HCL

11.8 IBM

11.9 Tech Mahindra

11.10 Wipro

*Details on Business Overview, Solution/Service Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 119)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customization

12.5 Related Reports

12.6 Author Details

List of Tables (68 Tables)

Table 1 United States Dollar Exchange Rate, 2014–2017

Table 2 Application Management Services Market: Use Cases

Table 3 Services: Market Size By Type, 2015–2022 (USD Million)

Table 4 Services: Market Size By Region, 2015–2022 (USD Million)

Table 5 Application Portfolio Assessment: Market Size By Region, 2015–2022 (USD Million)

Table 6 Application Modernization: Market Size By Type, 2015–2022 (USD Million)

Table 7 Application Modernization: Market Size By Region, 2015–2022 (USD Million)

Table 8 Cloud Application Migration Market Size, By Region, 2015–2022 (USD Million)

Table 9 Application Integration Market Size, By Region, 2015–2022 (USD Million)

Table 10 Application Replatforming Market Size, By Region, 2015–2022 (USD Million)

Table 11 User Interface Modernization Market Size, By Region, 2015–2022 (USD Million)

Table 12 Application Security: Application Management Services Market Size By Type, 2015–2022 (USD Million)

Table 13 Application Security: Market Size By Region, 2015–2022 (USD Million)

Table 14 Web Application Security Market Size, By Region, 2015–2022 (USD Million)

Table 15 Mobile Application Security Market Size, By Region, 2015–2022 (USD Million)

Table 16 Application Maintenance and Support: Market Size By Region, 2015–2022 (USD Million)

Table 17 Application Managed Services: Market Size By Region, 2015–2022 (USD Million)

Table 18 Application Management Services Market Size, By Organization Size, 2015–2022 (USD Million)

Table 19 Organization Size: Market Size, By Region, 2015—2022 (USD Million)

Table 20 Small and Medium-Sized Enterprises: Market Size By Region, 2015–2022 (USD Million)

Table 21 Large Enterprises: Market Size By Region, 2015–2022 (USD Million)

Table 22 Verticals: Market Size By Type, 2015–2022 (USD Million)

Table 23 Verticals: Application Management Services Market Size By Region, 2015–2022 (USD Million)

Table 24 Banking, Financial Services, and Insurance: Market Size, By Region, 2015–2022 (USD Million)

Table 25 Telecom and IT: Market Size By Region, 2015–2022 (USD Million)

Table 26 Government: Market Size By Region, 2015–2022 (USD Million)

Table 27 Retail and Ecommerce: Market Size By Region, 2015–2022 (USD Million)

Table 28 Healthcare and Life Sciences: Market Size By Region, 2015–2022 (USD Million)

Table 29 Manufacturing: Market Size By Region, 2015–2022 (USD Million)

Table 30 Energy and Utilities: Market Size By Region, 2015–2022 (USD Million)

Table 31 Others: Market Size By Region, 2015–2022 (USD Million)

Table 32 Application Management Services Market Size, By Region, 2015–2022 (USD Million)

Table 33 North America: Market Size By Country, 2015–2022 (USD Million)

Table 34 North America: Market Size By Service, 2015–2022 (USD Million)

Table 35 North America: Application Modernization Market Size, By Type, 2015–2022 (USD Million)

Table 36 North America: Application Security Market Size, By Type, 2015–2022 (USD Million)

Table 37 North America: Market Size By Organization Size, 2015–2022 (USD Million)

Table 38 North America: Application Management Services Market Size By Vertical, 2015–2022 (USD Million)

Table 39 United States: Market Size By Service, 2015–2022 (USD Million)

Table 40 United States: Application Modernization Market Size, By Type, 2015–2022 (USD Million)

Table 41 United States: Application Security Market Size, By Type, 2015–2022 (USD Million)

Table 42 United States: Market Size By Organization Size, 2015–2022 (USD Million)

Table 43 United States: Market Size By Vertical, 2015–2022 (USD Million)

Table 44 Europe: Application Management Services Market Size, By Service, 2015–2022 (USD Million)

Table 45 Europe: Application Modernization Market Size, By Type, 2015–2022 (USD Million)

Table 46 Europe: Application Security Market Size, By Type, 2015–2022 (USD Million)

Table 47 Europe: Market Size By Organization Size, 2015–2022 (USD Million)

Table 48 Europe: Market Size By Vertical, 2015–2022 (USD Million)

Table 49 Asia Pacific: Market Size, By Service, 2015–2022 (USD Million)

Table 50 Asia Pacific: Application Modernization Market Size, By Type, 2015–2022 (USD Million)

Table 51 Asia Pacific: Application Security Market Size, By Type, 2015–2022 (USD Million)

Table 52 Asia Pacific: Application Management Services Market Size By Organization Size, 2015–2022 (USD Million)

Table 53 Asia Pacific: Market Size By Vertical, 2015–2022 (USD Million)

Table 54 Middle East and Africa: Market Size By Service, 2015–2022 (USD Million)

Table 55 Middle East and Africa: Application Modernization Market Size, By Type, 2015–2022 (USD Million)

Table 56 Middle East and Africa: Application Security Market Size, By Type, 2015–2022 (USD Million)

Table 57 Middle East and Africa: Market Size By Organization Size, 2015–2022 (USD Million)

Table 58 Middle East and Africa: Market Size By Vertical, 2015–2022 (USD Million)

Table 59 Latin America: Application Management Services Market Size, By Service, 2015–2022 (USD Million)

Table 60 Latin America: Application Modernization Market Size, By Type, 2015–2022 (USD Million)

Table 61 Latin America: Application Security Market Size, By Type, 2015–2022 (USD Million)

Table 62 Latin America: Market Size By Organization Size, 2015–2022 (USD Million)

Table 63 Latin America: Market Size By Vertical, 2015–2022 (USD Million)

Table 64 New Service Launches, 2014—2016

Table 65 Business Expansions, 2016—2017

Table 66 Mergers and Acquisitions, 2017

Table 67 Agreements, Partnerships, and Collaborations, 2017

Table 68 Contracts, 2017

List of Figures (43 Figures)

Figure 1 Application Management Services Market Segmentation

Figure 2 Application Management Services Market Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Application Management Services Market, 2015–2022

Figure 7 Market Top 3 Services, and Region

Figure 8 Market By Segmentation

Figure 9 Brisk Growth of Enterprise Application Volumes is Expected to Be Driving the Growth of the Market

Figure 10 Application Modernization Segment is Estimated to Hold the Largest Market Size During the Forecast Period

Figure 11 Large Enterprises Segment is Expected to Hold the Larger Market Share During the Forecast Period

Figure 12 Banking, Financial Services, and Insurance Vertical is Expected to Lead the Market During the Forecast Period

Figure 13 North America is Expected to Hold the Largest Market Share During the Forecast Period

Figure 14 APAC is Expected to Be A Hotspot for the Market During the Forecast Period

Figure 15 Application Management Services Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Application Security Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 17 Phases of Application Portfolio Management

Figure 18 Application Modernization Process

Figure 19 Types of Application Security

Figure 20 Types of Application Managed Services

Figure 21 Large Enterprises Segment is Expected to Hold the Larger Market Size During the Forecast Period

Figure 22 Retail and Ecommerce Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 24 Asia Pacific is Expected to Be A Hotspot for the Market During the Forecast Period

Figure 25 Market North America Snapshot

Figure 26 Market Asia Pacific Snapshot

Figure 27 Key Developments By Leading Players in the Application Management Services Market, 2014–2017

Figure 28 Market Evaluation Framework

Figure 29 Accenture: Company Snapshot

Figure 30 Accenture: SWOT Analysis

Figure 31 ATOS: Company Snapshot

Figure 32 ATOS: SWOT Analysis

Figure 33 Capgemini: Company Snapshot

Figure 34 Capgemini: SWOT Analysis

Figure 35 Cognizant: Company Snapshot

Figure 36 Cognizant: SWOT Analysis

Figure 37 Fujitsu: Company Snapshot

Figure 38 Fujitsu: SWOT Analysis

Figure 39 DXC : Company Snapshot

Figure 40 HCL: Company Snapshot

Figure 41 IBM: Company Snapshot

Figure 42 Tech Mahindra: Company Snapshot

Figure 43 Wipro: Company Snapshot

Growth opportunities and latent adjacency in Application Management Services Market