The study involved four major activities for estimating the current size of the global ammonia market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of ammonia through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the ammonia market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

The market for the companies offering ammonia is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources such as Business Standard, Bloomberg, World Bank, and Factiva were referred to, to identify and collect information for this study on the ammonia market. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of ammonia vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the ammonia market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of ammonia offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

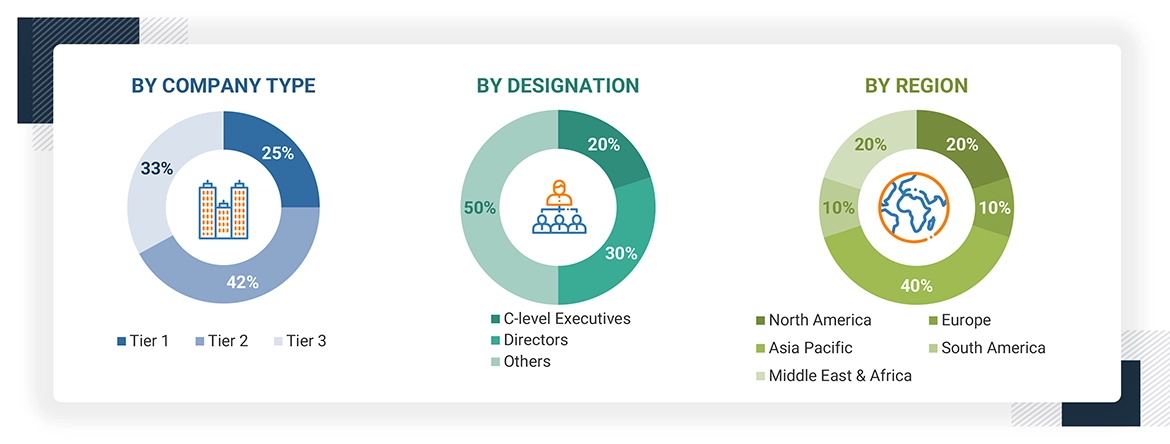

Following is the breakdown of primary respondents—

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the ammonia market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Ammonia is a gas composed of nitrogen and hydrogen. It is a colorless and toxic gas with a distinctive, unpleasant odor. Naturally, ammonia is produced by bacteria and the decomposition of plants and animals, and it can be found in water, soil, and air. In the laboratory, ammonia can be liquefied and is used in a range of products, including medicines, fertilizers, and household cleaning agents. Ammonia is a crucial precursor in the synthesis of various chemicals, such as urea and nitric acid, which are vital for numerous industrial applications. Its broad utility and effectiveness make it an essential chemical across many industries. Ammonia is utilized as a refrigerant gas, in water purification, fertilizers, medicines, household, industrial, and the production of plastics, explosives, fabrics, pesticides, dyes, and other chemicals.

Stakeholders

-

Ammonia Manufacturers

-

Ammonia Suppliers

-

Chemical Manufacturers

-

Logistics and Distribution Companies

-

Research & Development Entities

-

Industry Associations and Regulatory Bodies

-

End Users

Report Objectives

-

To estimate and forecast the ammonia market, in terms of value and volume

-

To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

-

To define, describe, and forecast the market size, based on types, sales channel, end-use industry, and region

-

To forecast the market size along with segments and submarkets, in key regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America along with their key countries

-

To strategically analyze micro markets, for individual growth trends, prospects, and their contribution to the total market

-

To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

-

To strategically profile key players and comprehensively analyze their market shares and core competencies

-

To analyze competitive developments, such as acquisition, agreements, expansions and partnerships in the ammonia market

Growth opportunities and latent adjacency in Ammonia Market